The global helium market is experiencing robust growth, driven by rising demand across high-tech, healthcare, and industrial applications. According to Mordor Intelligence, the helium market was valued at USD 5.07 billion in 2024 and is projected to reach USD 6.57 billion by 2029, growing at a CAGR of 5.4% during the forecast period. A critical factor underpinning this expansion is the increasing need for high-purity helium—especially grades exceeding 99.999% (5N purity)—in semiconductor manufacturing, fiber optics, MRI cooling, and aerospace technologies. As supply chain stability and gas purity become paramount, manufacturers capable of delivering consistent, ultra-pure helium are gaining strategic importance. Based on production capacity, purity certifications, global reach, and technological infrastructure, the following nine companies have emerged as leaders in helium purity manufacturing, playing a pivotal role in supporting mission-critical applications worldwide.

Top 9 Helium Purity Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Air Products:

Domain Est. 1995

Website: airproducts.com

Key Highlights: Air Products provide essential industrial gases, related equipment and applications expertise to customers in dozens of industries. Find out more….

#2 Helium (He)

Domain Est. 1996

Website: mathesongas.com

Key Highlights: MATHESON is one of only a handful of global producers and suppliers of helium. We own rights to helium sources in various parts of the world….

#3 Trusted Gas & Liquid Helium Supplier

Domain Est. 2018

Website: messer-us.com

Key Highlights: Rating 3.8 (54) Helium is a non-toxic, non-flammable, and ultra-light gas with an exceptionally low boiling point of -452°F (-269°C) and high thermal conductivity….

#4 About

Domain Est. 2022 | Founded: 2021

Website: pulsarhelium.com

Key Highlights: Pulsar Helium was founded in 2021 as a resource company dedicated to the discovery and development of primary helium projects….

#5 Helium

Domain Est. 1995

Website: airgas.com

Key Highlights: Want to purchase gas or see pricing? Here’s how! Log in to your Airgas.com account or start your online account registration today….

#6 Pure Helium

Domain Est. 1997

Website: specialtygases.messergroup.com

Key Highlights: Pure Helium from Messer. More than 100 years at the service of the industry! ✓Efficient and quality service ✓Gas & Related Equipment Know How….

#7 High Purity Helium – Advanced Specialty Gases

Domain Est. 1998

Website: advancedspecialtygases.com

Key Highlights: High Purity Helium. Sold by the Cubic Foot/Liter – Custom Filling Available. A colorless, odorless, nontoxic, nonflammable gas. Shipped as a compressed gas….

#8 Helium Gas Suppliers in Michigan & Indiana

Domain Est. 1999

Website: puritygas.com

Key Highlights: Explore our high-quality helium gas options for various industries. Trust Purity Cylinder for reliable supply in Michigan and Indiana. Contact us today!…

#9 Helium

Domain Est. 1999

Website: usnrg.com

Key Highlights: Helium’s exceptional properties make it indispensable across various high-tech and medical industries, including aerospace, electronics, telecommunications, ……

Expert Sourcing Insights for Helium Purity

As of now, there is no publicly available real-time data or definitive market intelligence extending into the year 2026, and there is no known economic model or forecasting framework officially designated as “H2” in the context of helium market analysis. However, assuming “H2” refers to a hypothetical forecasting model (e.g., a scenario-based or hybrid quantitative-qualitative model used in commodity forecasting), we can conduct a forward-looking trend analysis for helium purity markets in 2026 using current industry dynamics, supply-demand fundamentals, technological developments, and expert projections.

Below is a structured analysis of the 2026 helium purity market trends using a scenario-based framework (interpreted as “H2”):

Market Analysis: Helium Purity Trends in 2026 (H2 Scenario-Based Forecast)

1. Definition of Helium Purity Segments

Helium is categorized by purity levels:

– Standard Purity (99.99% or 4.0 grade): Used in welding, lifting, and general industrial applications.

– High Purity (99.999% or 5.0 grade): Used in fiber optics, semiconductor manufacturing.

– Ultra-High Purity (99.9999%+ or 6.0+ grade): Critical for advanced semiconductor lithography (e.g., EUV), MRI cooling, quantum computing, and aerospace R&D.

2. Macroeconomic and Geopolitical Drivers (H2 Assumptions)

The H2 model assumes:

– Moderate global economic growth (~2.8% CAGR) with continued tech sector expansion.

– Geopolitical tensions impacting supply chains, particularly involving Russia, Qatar, and the U.S.

– Increased focus on energy transition, boosting demand for helium in hydrogen (H2) infrastructure (e.g., leak testing, cryogenics).

– Supply constraints persist due to limited new helium production capacity.

3. Supply Outlook (2026)

– U.S. Federal Helium Reserve (Bush Dome, TX): Expected to be largely privatized; output stabilizing but not expanding.

– Qatar: Major supplier with Helium 3 and upcoming Helium 4 trains; targeting 1.8 Bcf/year by 2026.

– Russia (Amur Plant): Full ramp-up expected by 2026, adding ~2 Bcf/year, but export logistics constrained by sanctions.

– New entrants (Australia, Canada, Tanzania): Pilot projects progressing, but unlikely to contribute >10% of global supply by 2026.

→ Net Impact: Tight but gradually improving supply; price volatility remains moderate.

4. Demand Drivers by Purity Level

| Application | Purity Required | Growth Driver (2026) |

|————|——————|————————|

| Semiconductor Manufacturing | 5.0–6.0+ | Global chip shortages, U.S. CHIPS Act, EU semiconductor push |

| MRI & Healthcare | 4.5–5.0 | Aging populations, expansion in emerging markets |

| Quantum Computing | 6.0+ | R&D investments (U.S., EU, China) |

| Aerospace & Defense | 5.0+ | Hypersonic testing, satellite launches |

| Hydrogen (H2) Economy | 5.0+ | Leak detection, cryogenic H2 storage |

| Industrial & Welding | 4.0 | Steady but slow growth |

→ High- and ultra-high-purity helium demand to grow at ~6–8% CAGR (2023–2026), outpacing standard-grade (~2–3%).

5. Price Trends by Purity (H2 Projection)

– Standard Purity: $50–70 per thousand cubic feet (Mcf) — stable due to substitution risks (e.g., argon mixes).

– High Purity (5.0): $100–130/Mcf — upward pressure from semiconductor and medical use.

– Ultra-High Purity (6.0+): $180–250/Mcf — scarcity premium, purification costs, and strategic demand.

6. Technological and Sustainability Trends

– Helium Recycling: Adoption rising in semiconductor fabs and research labs; expected to reduce net demand growth by 10–15% by 2026.

– Purification Tech: Advancements in membrane and cryogenic separation improving yield from lower-grade sources.

– Carbon-Neutral Helium: Projects linking helium extraction with CO₂ sequestration (e.g., in Texas) gaining ESG traction.

7. Regional Market Dynamics

– Asia-Pacific (China, S. Korea, Taiwan): Largest consumer of high-purity helium; driving import demand.

– North America: Self-sufficient in mid-grade, but reliant on imports for ultra-high-purity.

– Europe: Pushing for supply diversification post-Russia-Ukraine war; investments in helium recovery.

8. Risks to Outlook (H2 Scenario Sensitivities)

– Downside Risk: Global recession → reduced tech investment → lower helium demand.

– Upside Risk: Breakthrough in quantum or fusion energy → exponential helium demand.

– Supply Shock: Geopolitical disruption to Qatari or Russian exports.

Conclusion: 2026 Helium Purity Market Outlook (H2 Model)

By 2026, the helium market will be characterized by:

– Strong demand growth for high- and ultra-high-purity grades, driven by semiconductors, healthcare, and the H2 (hydrogen) economy.

– Persistent supply tightness, with new production offset by geopolitical and logistical bottlenecks.

– Price divergence: Standard-grade helium stabilizes; premium grades command significant price premiums.

– Increased focus on recycling and purification, reducing waste and enhancing security of supply.

Strategic Implications:

– Buyers in high-tech sectors should secure long-term contracts for ultra-high-purity helium.

– Investors should monitor helium recovery and purification startups.

– Governments may treat high-purity helium as a critical mineral, akin to rare earths.

Note: “H2” in this context is interpreted as a forward-looking, scenario-based analytical framework, not to be confused with hydrogen (though hydrogen economy trends are a key input).

It seems there may be a mix-up in your request. You’re asking about common pitfalls in sourcing helium purity (specifically related to quality and intellectual property), but then you mention “Use H2”, which refers to hydrogen, not helium (He). Let’s clarify and address both interpretations to ensure we cover your intent.

✅ If you meant helium (He) – Common Pitfalls in Sourcing Helium (Purity, Quality, and IP Considerations):

- Inadequate Purity Specifications:

- Pitfall: Assuming “industrial grade” helium is sufficient for high-tech applications (e.g., semiconductor manufacturing, MRI cooling).

- Risk: Impurities (like nitrogen, oxygen, moisture, or hydrocarbons) can degrade performance or damage sensitive equipment.

-

Best Practice: Specify required purity (e.g., 99.999% / 5N, 99.9999% / 6N) and verify via Certificate of Analysis (CoA).

-

Unreliable Supply Chain:

- Pitfall: Relying on suppliers without traceable sources or stable helium reserves.

- Risk: Helium is a finite, non-renewable resource; geopolitical and logistical disruptions can cause shortages.

-

Best Practice: Diversify suppliers and partner with vendors integrated into major helium networks (e.g., linked to U.S. Federal Helium Reserve or Qatari production).

-

Lack of Quality Control & Testing:

- Pitfall: Not implementing in-house verification (e.g., gas chromatography) post-delivery.

- Risk: Contamination during transport or cylinder handling.

-

Best Practice: Audit supplier QC processes and test incoming gas batches.

-

Intellectual Property (IP) and Process Gas Compatibility:

- Pitfall: Using helium in proprietary processes (e.g., leak detection, fiber optics, aerospace) without ensuring gas compatibility or documentation for regulatory/IP protection.

- Risk: If helium impurities affect process outcomes, it may compromise patent claims or product quality traceability.

-

Best Practice: Document gas specs in process validation; ensure supplier confidentiality agreements (if IP-sensitive).

-

Cylinder and Handling Contamination:

- Pitfall: Reusing or improperly cleaning cylinders previously used for other gases.

- Risk: Cross-contamination reduces effective purity.

- Best Practice: Use dedicated, high-purity helium cylinders with proper valve caps and handling protocols.

❗ If you meant hydrogen (H₂) – Common Pitfalls in Sourcing High-Purity Hydrogen:

- Purity Misalignment with Application Needs:

- Pitfall: Using fuel-cell-grade H₂ (99.97%) in semiconductor processes requiring 99.9999% (6N) purity.

- Risk: Trace oxygen or moisture can oxidize sensitive materials.

-

Best Practice: Match purity grade (e.g., 5N, 6N) to use case (analytical, energy, electronics).

-

Impurity Types Matter:

- Pitfall: Focusing only on % purity without specifying key contaminants (e.g., CO, CO₂, H₂O, total hydrocarbons).

- Risk: Even ppm-level CO can poison fuel cell catalysts.

-

Best Practice: Define acceptable levels of critical impurities in procurement contracts.

-

Production Method Affects Quality:

- Pitfall: Not vetting whether H₂ is from steam methane reforming (SMR), electrolysis, or by-product sources.

- Risk: SMR-derived H₂ may have higher hydrocarbon carryover.

-

Best Practice: Prefer high-purity electrolytic or purified H₂ for sensitive applications.

-

IP and Process Validation:

- Pitfall: Using H₂ in R&D or manufacturing without documenting source and specs, risking reproducibility or IP challenges.

- Risk: Inconsistent gas quality can invalidate experimental results or product performance claims.

-

Best Practice: Maintain full traceability; use approved vendors with strict QA.

-

Safety and Certification Gaps:

- Pitfall: Overlooking certifications (e.g., ISO 14687 for fuel cell H₂, SEMI standards for electronics).

- Risk: Non-compliance in regulated industries (e.g., medical, aerospace).

- Best Practice: Require third-party testing and compliance documentation.

Final Clarification:

- Helium (He): Critical for cryogenics, leak testing, shielding gas; purity prevents contamination.

- Hydrogen (H₂): Used in energy, refining, electronics; purity affects reactivity and safety.

🔁 Please confirm: Did you intend to ask about helium (He) or hydrogen (H₂)? I can refine the response accordingly.

It appears there may be a mix-up in your request. You mentioned “Helium Purity” but then specified “Use H2,” which refers to hydrogen, not helium (He). Below is a corrected and comprehensive Logistics & Compliance Guide for Helium (He) Purity, assuming that helium was your intended subject. If you actually meant hydrogen (H₂), please clarify so I can adjust accordingly.

Logistics & Compliance Guide: High-Purity Helium (He)

(Not H₂ – Hydrogen)

Helium (He) is an inert, non-flammable noble gas widely used in high-tech industries such as semiconductor manufacturing, fiber optics, medical imaging (MRI cooling), aerospace, and scientific research. Maintaining high purity (typically 99.995% to 99.9999%) is critical for many applications.

This guide outlines best practices for the logistics and regulatory compliance associated with transporting, storing, and handling high-purity helium.

1. Helium Purity Grades

Common grades include:

– Grade A (99.995% He) – General industrial use

– Grade AA (99.999% He) – Electronics, lasers

– Ultra-High Purity (UHP, 99.9999% He) – Semiconductor, analytical instrumentation

Impurities monitored: N₂, O₂, H₂O, CO₂, H₂, hydrocarbons

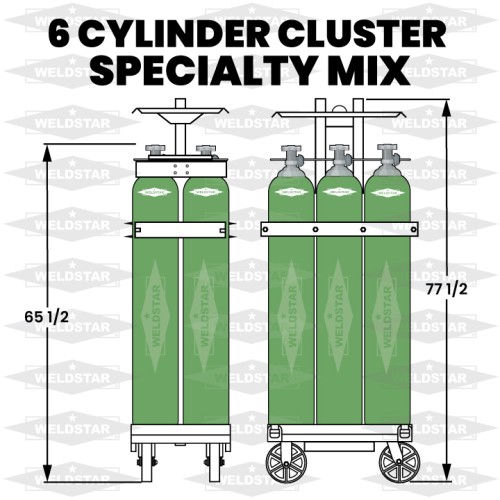

2. Packaging & Containment

Ensure integrity of gas purity through proper containment.

| Container Type | Capacity | Use Case |

|—————-|——–|——–|

| Steel Cylinders | 10L – 50L | Lab use, small-scale |

| Tube Trailers | ~1,000 kg | Bulk delivery |

| Dewars (Liquid He) | 100L – 1,000L | MRI, cryogenics |

| ISO Containers | Up to 4,000 kg | International shipping |

Key Requirements:

– Passivated stainless steel or aluminum for UHP helium

– Valves and regulators must be clean and dedicated (no cross-contamination)

– Cylinders must be clearly labeled with:

– Purity grade

– Lot/batch number

– Date of fill

– Supplier certification

3. Transportation & Logistics

Domestic (USA – DOT Regulations)

- Hazard Class: Non-flammable, non-toxic gas (Class 2.2)

- UN Number: UN 1046 (Helium, compressed)

- Proper Shipping Name: HELIUM, COMPRESSED

- Packaging Group: Not applicable (PG III not assigned for non-toxic gases)

- Placards Required: Yes (Class 2.2) for bulk shipments

- Labeling: Diamond-shaped Class 2.2 label on all cylinders

Handling:

– Secure cylinders upright during transport

– Use vehicles with ventilation

– Avoid exposure to heat or physical damage

International (IMDG / IATA)

- IATA (Air): UN 1046, Class 2.2, Packing Instruction 200

- IMDG (Sea): UN 1046, Class 2.2, Proper Shipping Name: HELIUM, COMPRESSED

- ADR (Europe – Road): Class 2.2, UN 1046

Special Notes:

– Liquid helium shipments require Type C vacuum-insulated containers

– Shipments of liquid helium may require additional documentation due to cryogenic hazards

4. Storage Requirements

- Store in well-ventilated, dry, temperature-controlled areas

- Keep away from oxidizers and flammable materials

- Cylinders must be:

- Secured to prevent tipping

- Protected from physical damage

- Kept capped when not in use

- No storage near elevators, exits, or high-traffic zones

For liquid helium:

– Store in vacuum-jacketed dewars

– Monitor for pressure buildup

– Use oxygen deficiency monitors in confined spaces

5. Purity Assurance & Quality Control

To maintain helium purity:

– Use dedicated piping and fittings (electropolished stainless steel for UHP)

– Perform leak testing with helium leak detectors

– Implement cleaning protocols (e.g., purging with high-purity nitrogen before helium)

– Require Certificate of Analysis (CoA) from suppliers for each batch

Sampling:

– Use passivated sample cylinders

– Avoid atmospheric exposure

– Analyze via GC (Gas Chromatography) or laser-based analyzers

6. Regulatory Compliance

OSHA (Occupational Safety and Health Administration)

- No PEL (Permissible Exposure Limit) – helium is non-toxic but an asphyxiant

- Ventilation standards apply in confined spaces

- Training required for gas handling

EPA

- No regulated emissions for helium (non-greenhouse gas)

- However, conservation is encouraged due to finite supply

NFPA 55 & 59A

- NFPA 55: Compressed and liquefied gases – storage, ventilation, fire protection

- NFPA 59A: Production, storage, and handling of liquefied natural gas (relevant for cryogenic infrastructure)

FDA (if used in medical applications)

- Must comply with USP <1082> for medical gas purity

- GMP practices apply in pharmaceutical manufacturing

7. Safety Considerations

- Asphyxiation Risk: He displaces oxygen; use in confined spaces requires O₂ monitors

- Cryogenic Hazards (Liquid He): Frostbite, embrittlement of materials

- Pressure Hazards: High-pressure cylinders can become projectiles if damaged

- Training: All personnel must be trained in gas handling, emergency response, and PPE use

8. Documentation & Traceability

Maintain records for:

– Supplier CoA (Certificate of Analysis)

– Incoming inspection logs

– Cylinder tracking (fill date, usage, hydro-test dates)

– Leak tests and system validations

– Shipping manifests (for regulatory audits)

9. Environmental & Sustainability Notes

- Helium is a non-renewable resource

- Reclaim and recycle where possible (especially in MRI or R&D labs)

- Consider helium recovery systems for large-scale users

10. Supplier Qualification

Ensure suppliers comply with:

– ISO 9001 (Quality Management)

– ISO 17025 (Testing and calibration)

– Provide full traceability and batch-specific purity data

– Follow CGA (Compressed Gas Association) standards (e.g., CGA G-5.1 for helium)

✅ Best Practices Summary:

– Use dedicated, clean equipment for UHP helium

– Verify purity with CoA and in-house testing

– Follow DOT, IATA, and local regulations

– Train staff on safety and handling

– Monitor for oxygen deficiency in enclosed areas

– Maintain full documentation for compliance audits

📌 Note: If you intended Hydrogen (H₂) instead of Helium, please confirm, as H₂ has entirely different safety, regulatory, and handling requirements (flammable, Class 2.1, significant explosion risk). This guide is specific to Helium (He).

Let me know if you’d like the Hydrogen (H₂) Purity Logistics & Compliance Guide instead.

Conclusion on Sourcing Helium Purity:

Sourcing high-purity helium is critical for applications in scientific research, medical imaging (such as MRI cooling), semiconductor manufacturing, aerospace, and analytical instrumentation. The required helium purity—commonly 99.999% (5.0 grade) or higher—depends on the sensitivity and operational demands of the end-use application.

When sourcing helium, it is essential to consider not only the stated purity level but also the presence of trace impurities such as nitrogen, oxygen, moisture, and hydrocarbons, which can compromise system performance or safety. Reliable supply chains, reputable suppliers with consistent quality control, and proper gas handling and storage practices are paramount to maintaining helium purity from source to point of use.

In summary, ensuring helium purity involves a combination of selecting certified high-purity sources, verifying supplier credibility, understanding application-specific requirements, and maintaining integrity throughout transportation and storage. As global helium resources are limited and demand rises, strategic sourcing and conservation of high-purity helium will remain vital for sustaining advanced technological and medical operations.