The global helical rack and pinion market is experiencing steady growth, driven by rising demand in industrial automation, material handling, and precision motion control systems. According to a report by Mordor Intelligence, the global linear motion systems market—of which rack and pinion systems are a critical component—was valued at USD 6.8 billion in 2022 and is projected to grow at a CAGR of over 6.5% through 2028. Similarly, Grand View Research highlights expanding applications in CNC machinery, robotics, and semiconductor manufacturing as key growth accelerators. As industries prioritize high-efficiency, high-precision linear motion solutions, helical rack and pinion systems stand out for their durability, accuracy, and ability to handle heavy loads. With increasing adoption in automated guided vehicles (AGVs), packaging equipment, and aerospace systems, the demand for high-performance rack and pinion manufacturers continues to rise. In this evolving landscape, the following eight manufacturers have established themselves as leaders in innovation, reliability, and technical expertise.

Top 8 Helical Rack And Pinion Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

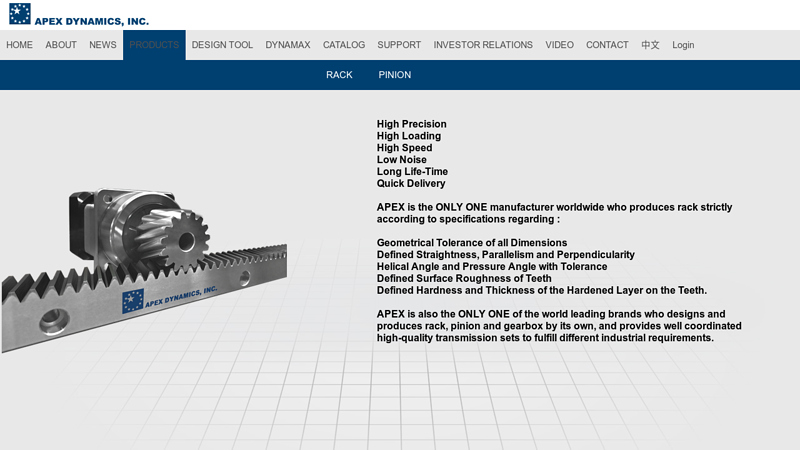

#1 Rack & Pinion

Domain Est. 2001

Website: apexdyna.com

Key Highlights: APEX is the ONLY ONE manufacturer worldwide who produces rack strictly according to specifications regarding : Geometrical Tolerance of all Dimensions…

#2 Gear Racks & Pinions

Domain Est. 2001

Website: hms-ind.com

Key Highlights: HMS is proud to be partnered with a leading Taiwan manufacturer backed with over 40 years in gear rack and pinion design! … Straight & Helical Gear Racks….

#3 KHK USA Inc

Domain Est. 2015

Website: khkgears.us

Key Highlights: Take a Virtual Tour of our Factory · Metric Spur Gears · Metric Helical Gears · Metric Internal Ring Gears · Metric Gear Racks · Circular Pitch Metric Racks & ……

#4 Linear Rack Supplier & Manufacturer

Domain Est. 2023

Website: cskmotions.com

Key Highlights: Racks can be customized to suit specific applications based on length, tooth profile (e.g., linear, helical), and mounting options….

#5 Rack and Pinion Systems

Domain Est. 1996

Website: stober.com

Key Highlights: STOBER creates versatile rack and pinion systems that fit virtually any setup. Click here to learn more about our capabilities….

#6 Helical Rack & Pinion Products

Domain Est. 1998

Website: gamweb.com

Key Highlights: GAM Rack & Pinion Products Include: Helical Gear Rack, Helical Pinions, Helical Rack and Pinion Systems, Rack and Pinion Accessories, Lubrication Systems….

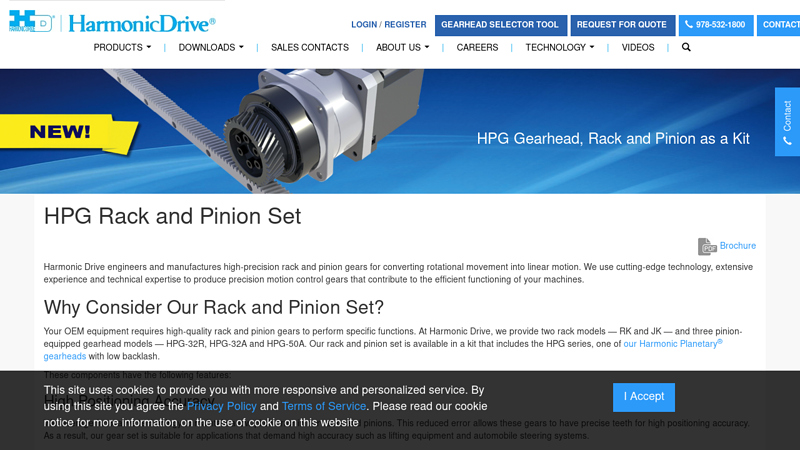

#7 HPG Rack and Pinion Set

Domain Est. 2002

Website: harmonicdrive.net

Key Highlights: Harmonic Drive engineers and manufactures high-precision rack and pinion gears for converting rotational movement into linear motion….

#8 Precision Rack and Pinion Systems

Domain Est. 2003

Website: apexdynamicsusa.com

Key Highlights: Free delivery over $99Apex Dynamics USA manufactures precision rack and pinion systems for a variety of applications, as well as smart lubrication systems for gearing ballscrew ……

Expert Sourcing Insights for Helical Rack And Pinion

H2: Projected Market Trends for Helical Rack and Pinion Systems in 2026

By 2026, the global market for helical rack and pinion systems is expected to witness steady growth, driven by increasing automation across industrial and commercial sectors, advancements in precision engineering, and rising demand in key end-use industries such as manufacturing, robotics, aerospace, and renewable energy.

One major trend shaping the market is the growing adoption of electric actuation systems in place of hydraulic or pneumatic alternatives. Helical rack and pinion systems are favored for their high load capacity, smooth torque transmission, and improved efficiency—attributes that align with the shift toward energy-efficient and low-maintenance motion control solutions. As industries strive to meet sustainability goals, these systems offer reduced energy consumption and lower environmental impact.

Additionally, the expansion of Industry 4.0 is accelerating demand for precision motion components. Helical rack and pinions are increasingly integrated into automated guided vehicles (AGVs), CNC machinery, and robotic arms, where accurate linear motion and dynamic performance are critical. This integration is expected to fuel innovation in materials (e.g., high-strength alloys and surface coatings) and modular design, enabling lighter, more durable, and customizable solutions.

Regionally, Asia-Pacific—particularly China, India, and South Korea—is anticipated to dominate market growth due to rapid industrialization, government initiatives promoting smart manufacturing, and a booming electric vehicle (EV) sector that utilizes rack and pinion systems in production automation and battery manufacturing lines.

Furthermore, the renewable energy sector, especially wind turbine pitch and yaw control systems, is emerging as a high-potential application area. The reliability and high torque density of helical rack and pinions make them ideal for harsh operating conditions in wind farms, contributing to market expansion.

However, challenges such as fluctuating raw material prices and the need for precision manufacturing capabilities may constrain smaller players. As a result, market consolidation and strategic partnerships among component manufacturers, system integrators, and automation providers are expected to rise through 2026.

In summary, the helical rack and pinion market in 2026 will be shaped by technological innovation, digital integration, and sector-specific demand, positioning it as a critical enabler of next-generation automation and industrial efficiency.

Common Pitfalls Sourcing Helical Rack and Pinion Systems

Poor Quality Materials and Manufacturing

One of the most frequent issues when sourcing helical rack and pinion systems is receiving components made from substandard materials or with inadequate heat treatment. Low-quality steel or improper hardening processes can lead to premature wear, tooth deformation, and system failure under load. Inconsistent tooth profile accuracy due to poor machining reduces meshing efficiency, increases backlash, and introduces noise and vibration.

Inadequate or Misrepresented IP (Ingress Protection) Rating

Many suppliers claim high IP ratings (e.g., IP54 or IP65) for rack and pinion systems, but these claims are often unverified or based on incomplete testing. In harsh environments—such as those with dust, moisture, or washdown conditions—a lack of true environmental sealing can allow contaminants to enter the gear interface, accelerating wear and causing jamming. It’s critical to verify IP certification through third-party testing documentation rather than relying solely on supplier assertions.

Incompatible Module or Pressure Angle Specifications

Sourcing racks and pinions with mismatched modules or pressure angles can result in improper meshing, increased stress concentrations, and reduced service life. Some suppliers may offer “compatible” parts that deviate slightly from standard dimensions, leading to integration issues in precision applications. Always confirm dimensional conformity to international standards (e.g., DIN, ISO) before procurement.

Lack of Traceability and Certification

Reputable applications—especially in aerospace, medical, and industrial automation—require material traceability and quality certifications (e.g., ISO 9001, RoHS). Sourcing from suppliers who cannot provide heat lot numbers, test reports, or compliance documentation introduces risk, particularly in regulated industries where audit trails are mandatory.

Overlooking Backlash and Preload Requirements

Some low-cost suppliers do not offer adjustable or preloaded pinion options, which are essential for high-precision motion control. Assuming standard backlash values will suffice can result in positioning inaccuracies and poor dynamic performance. Failing to specify required backlash or preload during sourcing can lead to system redesigns or performance compromises.

Insufficient Length Tolerance and Straightness

Rack segments that are not manufactured to tight linear tolerance or straightness specifications can cause uneven load distribution, binding, and accelerated wear. This is especially critical in long travel applications where multiple rack segments are joined. Poor alignment due to dimensional inaccuracies can void warranties and increase maintenance costs.

Hidden Costs from Incomplete Systems

Some suppliers quote only the rack or pinion separately, omitting essential components such as mounting hardware, lubrication systems, protective covers, or alignment tools. This leads to unexpected costs and delays during integration. Always request a complete bill of materials and confirm system readiness before finalizing a purchase.

Logistics & Compliance Guide for Helical Rack and Pinion

Packaging and Handling

Proper packaging is essential to prevent damage during transit. Helical rack and pinion components—especially precision-ground racks—must be protected from impact, moisture, and corrosion. Use wooden crates or heavy-duty corrugated boxes with internal foam or foam-lined dividers to immobilize parts. Racks should be wrapped in anti-corrosion paper (e.g., VCI paper) and sealed in moisture-resistant plastic. Pinions and mounting hardware should be individually bagged and labeled. Clearly mark packages with “Fragile,” “This Side Up,” and “Do Not Stack” as applicable.

Transportation Requirements

Transport helical rack and pinion systems via reliable freight carriers experienced in handling precision mechanical components. For long-distance or international shipping, choose climate-controlled containers to avoid condensation. Racks longer than 2 meters may require special handling and flatbed transport. Secure loads to prevent shifting. Avoid extreme temperatures and high-humidity environments during transit. Provide detailed loading/unloading instructions, including recommended lifting points and equipment (e.g., forklift or crane use).

Storage Conditions

Store racks and pinions in a dry, temperature-stable environment (10–30°C, relative humidity <60%). Keep components in original packaging until installation. Elevate packages off the floor to prevent moisture absorption. Avoid exposure to dust, chemicals, or direct sunlight. Long-term storage (>6 months) requires re-inspection of corrosion protection and periodic rotation of pinion gears to prevent brinelling.

Import/Export Compliance

Ensure all helical rack and pinion shipments comply with destination country regulations. Verify Harmonized System (HS) codes—typically 8483.40 or 8483.50 for gear components. Prepare accurate commercial invoices, packing lists, and certificates of origin. Check for export controls, especially if components are used in defense, aerospace, or high-precision automation (ITAR, EAR may apply). Use Incoterms (e.g., FOB, DDP) clearly defined in contracts.

Regulatory Standards and Certifications

Helical rack and pinion systems must meet relevant international and regional standards. Key certifications include:

– ISO 1328-1: Cylindrical gears — ISO system of flank tolerance classification

– DIN 3967: Tolerances for cylindrical gears

– CE Marking: Required for sale in the EU; demonstrates compliance with Machinery Directive 2006/42/EC

– REACH and RoHS: Ensure materials are free from restricted substances (e.g., lead, cadmium)

– UKCA Marking: Required for the UK market post-Brexit

Provide test reports, material certifications (e.g., EN 10204 3.1), and declaration of conformity with each shipment.

Documentation and Traceability

Maintain full traceability for all batch-manufactured racks and pinions. Each component should carry a unique serial or batch number linked to manufacturing records, heat treatment data, and quality inspection reports. Include user manuals, installation guides, and maintenance documentation with shipments. For regulated industries, provide a full technical file upon request.

Installation and Safety Compliance

Installation must follow manufacturer guidelines to ensure operational safety and performance. Use calibrated torque tools for fasteners. Align racks precisely to avoid premature wear. Comply with local occupational safety regulations (e.g., OSHA in the U.S., HSE in the UK). Provide safety warnings for pinch points and moving parts. Train personnel on proper handling and emergency stop procedures.

Environmental and Disposal Considerations

Dispose of packaging materials in accordance with local recycling regulations. Used racks and pinions, typically made of alloy steel, are recyclable through approved metal recovery facilities. Avoid landfill disposal. Lubricants used during operation must be handled and disposed of per environmental regulations (e.g., EPA or EU Directive 2008/98/EC).

Warranty and Post-Shipment Support

Clearly define warranty terms covering material defects and manufacturing faults (typically 12–24 months). Offer technical support for installation troubleshooting and compliance verification. Maintain a responsive logistics channel for replacement parts and returns (RMA process).

Conclusion: Sourcing Helical Rack and Pinion Systems

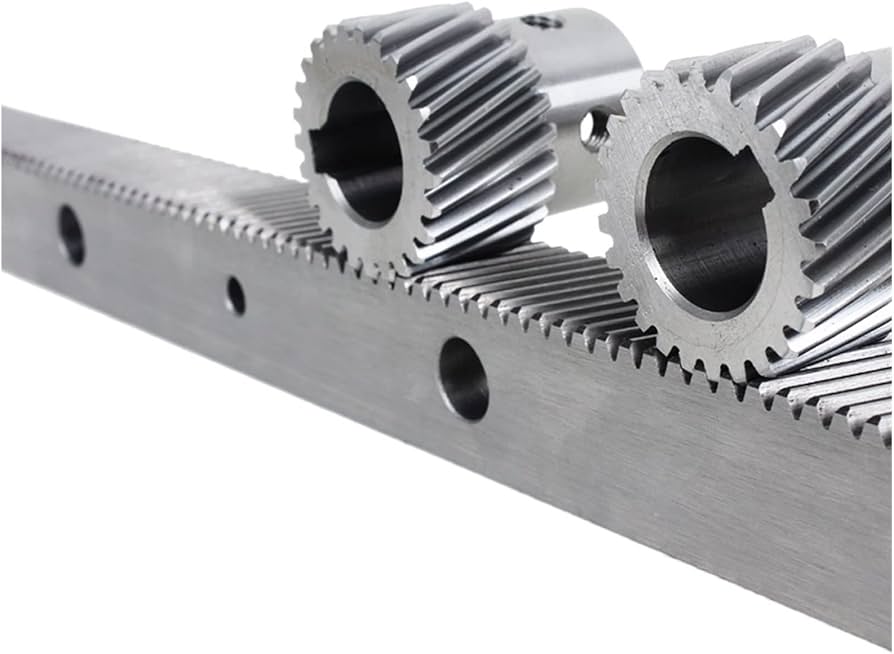

In summary, sourcing helical rack and pinion systems requires a comprehensive evaluation of technical specifications, application requirements, material quality, manufacturing precision, and supplier reliability. Helical racks offer smoother, quieter operation and higher load capacity compared to their straight-cut counterparts, making them ideal for precision applications in industries such as automation, CNC machinery, robotics, and heavy-duty industrial equipment.

When selecting a supplier, factors such as gear accuracy (e.g., DIN or AGMA standards), material grade (e.g., case-hardened steel), tooth profile optimization, and compatibility with existing drive systems should be prioritized. Additionally, considering lead time, customization capabilities, technical support, and total cost of ownership—rather than just initial price—leads to a more sustainable and efficient solution.

Ultimately, partnering with reputable manufacturers or distributors who provide certified products, rigorous quality control, and engineering support ensures optimal performance, durability, and alignment with project goals. A well-sourced helical rack and pinion system contributes significantly to the efficiency, accuracy, and longevity of motion control applications.