The global heat transfer equipment market is experiencing robust growth, driven by rising demand across industries such as oil & gas, power generation, chemical processing, and HVAC. According to Mordor Intelligence, the market was valued at USD 19.7 billion in 2023 and is projected to grow at a CAGR of over 6.2% through 2029. Increasing emphasis on energy efficiency, coupled with technological advancements in heat exchanger design and materials, continues to fuel adoption. Additionally, expanding industrialization in emerging economies and regulatory mandates for carbon emission reduction are accelerating investments in high-performance thermal systems. As competition intensifies and innovation becomes a key differentiator, a select group of manufacturers lead the market in terms of product breadth, R&D capabilities, and global reach. Based on market presence, revenue scale, and technological impact, the following nine companies represent the forefront of the heat transfer equipment industry in 2024.

Top 9 Heat Transfer Equipment Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

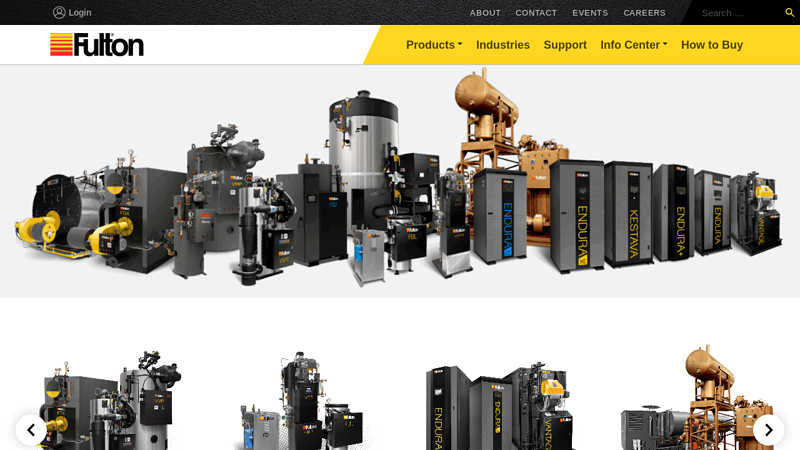

#1 Fulton: High

Domain Est. 1996

Website: fulton.com

Key Highlights: We research, engineer, manufacture, and support premier heat transfer equipment for a wide range of commercial and industrial applications….

#2 Heat Transfer Equipment Company

Domain Est. 2001

Website: heatexchangermanufacturers.com

Key Highlights: Heat Transfer Equipment Company is a leading manufacturer and provider of heat exchangers and comprehensive thermal management solutions….

#3 Thermal Solutions Manufacturing

Domain Est. 2012

Website: thermalsolutionsmfg.com

Key Highlights: TSM Champ is the leading manufacturer of innovative heat exchangers, oil coolers, fuel and power steering oil coolers in the marine engine industry. Learn how ……

#4 Graham Manufacturing

Domain Est. 1996

Website: graham-mfg.com

Key Highlights: Graham is a leading designer and builder of vacuum and heat transfer equipment for engineering process industries world-wide….

#5 API Heat Transfer

Domain Est. 1997

Website: apiheattransfer.com

Key Highlights: API Heat Transfer is a worldwide leader in high-performance heat transfer solutions, ready to meet any challenge, anywhere around the globe….

#6 Heat Transfer Equipment Company (HTE)

Domain Est. 1998

Website: htequip.com

Key Highlights: HTE has the expertise to thermally and mechanically design and guarantee shell and tube heat exchanger equipment from customer supplied process data and ……

#7 Heat Transfer Equipment Company

Domain Est. 2001

Website: htecompany.com

Key Highlights: We offer an extensive range of top-tier commercial products, including Boilers, Water Heaters, Heat Pumps, Pumps, Rainwater/Grey-Water Reclamation Systems….

#8 Alfa Laval

Domain Est. 2002

Website: alfalaval.us

Key Highlights: Alfa Laval is a global leader in the design and manufacture of fluid handling equipment, epitomizing innovation, efficiency and reliability….

#9 Reimagining Heat Transfer

Domain Est. 2016

Website: xrgtechnologies.com

Key Highlights: XRG Technologies is an innovative engineering and procurement firm focused on fired and unfired heat transfer equipment for the refining, petrochemical, and ……

Expert Sourcing Insights for Heat Transfer Equipment

2026 Market Trends for Heat Transfer Equipment

The global heat transfer equipment market is poised for significant transformation by 2026, driven by a confluence of technological innovation, stringent environmental regulations, and evolving industrial demands. Key trends shaping the landscape include the accelerated adoption of advanced materials, the integration of digitalization and Industry 4.0, a strong push towards energy efficiency and sustainability, and growing demand from emerging applications.

Rising Demand for Advanced Materials and Compact Designs

Manufacturers are increasingly shifting towards high-performance materials such as titanium, super duplex stainless steels, and composite alloys to enhance corrosion resistance, thermal efficiency, and longevity—particularly in harsh operating environments like offshore oil & gas and chemical processing. Simultaneously, the need for space optimization and reduced footprint is fueling demand for compact heat exchangers, including plate-and-frame, printed circuit, and microchannel designs. These technologies offer higher surface-area-to-volume ratios, translating into improved thermal performance and lower material usage, aligning with sustainability goals.

Digitalization and Predictive Maintenance Integration

By 2026, digital transformation will be central to the heat transfer equipment sector. The integration of IoT sensors, AI-driven analytics, and digital twins enables real-time performance monitoring, predictive maintenance, and operational optimization. Smart heat exchangers equipped with condition-monitoring systems can detect fouling, leaks, or inefficiencies before failures occur, minimizing downtime and extending equipment life. This shift toward data-driven operations enhances reliability and reduces total cost of ownership, especially in critical industries such as power generation and petrochemicals.

Focus on Energy Efficiency and Decarbonization

With global pressure to reduce carbon emissions, industries are prioritizing energy-efficient heat transfer solutions to comply with regulations like the EU Green Deal and U.S. Clean Air Act amendments. Waste heat recovery systems, heat pumps, and regenerative heat exchangers are gaining traction as companies seek to capture and reuse thermal energy. The push for decarbonization is also accelerating the deployment of heat exchangers in renewable energy applications, including concentrated solar power (CSP), geothermal plants, and green hydrogen production facilities.

Growth in Emerging Applications and Regional Markets

Beyond traditional sectors like oil & gas and power, new growth frontiers are emerging. The expanding data center industry requires advanced liquid cooling systems, driving demand for precision heat transfer solutions. Similarly, the rise of electric vehicles (EVs) is increasing the need for battery thermal management systems, creating opportunities for compact and efficient heat exchangers. Regionally, Asia-Pacific—led by China, India, and Southeast Asia—is expected to dominate market growth due to rapid industrialization, infrastructure development, and government investments in clean energy.

In summary, the 2026 heat transfer equipment market will be defined by innovation in materials and design, digital integration, sustainability imperatives, and diversification into high-growth sectors. Companies that align with these trends through R&D investment and strategic partnerships will be best positioned to capture market share in this evolving landscape.

Common Pitfalls Sourcing Heat Transfer Equipment (Quality, IP)

Poor Quality Control and Material Verification

One of the most prevalent risks when sourcing heat transfer equipment—such as heat exchangers, boilers, or cooling systems—is inadequate quality assurance. Suppliers, particularly in lower-cost regions, may use substandard materials or cut corners during fabrication to reduce costs. This can lead to premature failures, safety hazards, and unplanned downtime. Key issues include:

– Use of non-certified or counterfeit materials (e.g., incorrect alloy grades)

– Inadequate welding practices not conforming to ASME, PED, or other relevant codes

– Insufficient testing (e.g., pressure testing, NDT) or falsified inspection reports

Without rigorous supplier vetting, factory acceptance tests (FAT), and third-party inspection, buyers risk receiving equipment that fails to meet operational or regulatory standards.

Intellectual Property (IP) Risks and Technology Leakage

Sourcing heat transfer equipment often involves sharing sensitive engineering specifications, performance data, or proprietary designs, particularly for custom or high-efficiency systems. This exposes companies to significant IP risks:

– Reverse Engineering: Suppliers may analyze provided designs to replicate or sell similar equipment to competitors.

– Unauthorized Replication: Especially in regions with weaker IP enforcement, there is a risk that designs are used beyond the agreed scope or produced for other clients without consent.

– Lack of IP Clauses in Contracts: Failure to include clear terms on ownership, confidentiality, and usage rights in procurement agreements can leave buyers vulnerable.

To mitigate these risks, companies should enforce strict NDAs, conduct due diligence on suppliers’ IP practices, and ensure contracts explicitly define IP ownership and data handling protocols.

Logistics & Compliance Guide for Heat Transfer Equipment

This guide outlines key logistics considerations and regulatory compliance requirements for the safe and efficient handling, transport, and operation of heat transfer equipment such as heat exchangers, boilers, chillers, and thermal fluid systems.

Regulatory Compliance Overview

Ensure adherence to all applicable local, national, and international regulations governing the design, installation, operation, and transportation of heat transfer equipment. Key regulatory frameworks include:

– Pressure Equipment Directive (PED) 2014/68/EU (for equipment in Europe)

– ASME Boiler and Pressure Vessel Code (BPVC) (widely adopted in North America and globally)

– OSHA Standards (e.g., 29 CFR 1910.106 for flammable liquids, 1910.169 for compressed air systems)

– EPA Regulations (e.g., Clean Air Act, Risk Management Program under 40 CFR Part 68)

– DOT (Department of Transportation) Regulations (49 CFR) for hazardous materials transport

– REACH and RoHS (for material composition, especially in EU markets)

Documentation including CE markings, ASME stamps, Material Test Reports (MTRs), and conformity assessments must be maintained and readily accessible.

Transportation & Handling Requirements

Proper handling and transportation are critical to prevent damage and ensure safety:

– Packaging: Secure equipment using crating, protective covers, and desiccants to prevent moisture ingress and physical damage. Anchor all components, especially tube bundles and internal parts.

– Lifting Procedures: Use only designated lifting points specified by the manufacturer. Employ slings and rigging rated for the equipment’s weight and center of gravity. Never lift by piping connections or instrumentation.

– Load Securing: During transit, secure equipment to trailers or containers using straps, chains, or braces to prevent shifting. Comply with load securement standards per DOT or ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road).

– Environmental Protection: Shield equipment from rain, snow, and extreme temperatures during transit and storage. Avoid prolonged exposure to corrosive environments.

Hazardous Materials & Fluid Management

Many heat transfer systems use hazardous fluids (e.g., thermal oils, refrigerants, steam, glycols):

– Classification & Labeling: Classify fluids according to GHS (Globally Harmonized System). Ensure all containers are properly labeled with hazard symbols, signal words, and precautionary statements.

– Transport Documentation: Prepare Safety Data Sheets (SDS), shipping manifests, and emergency response information. For hazardous materials, use proper DOT/IMDG/ICAO hazard class labels and UN numbers.

– Spill Prevention & Response: Equip transport vehicles and storage areas with secondary containment and spill kits. Train personnel in spill response procedures. Report significant spills per local environmental regulations.

Import/Export Compliance

Cross-border shipments require attention to customs and trade regulations:

– Customs Documentation: Provide accurate commercial invoices, packing lists, certificates of origin, and import/export licenses where required.

– Tariff Classification: Classify equipment correctly under the Harmonized System (HS) code (e.g., 8419.89 for other heat exchangers).

– Sanctions & Embargoes: Screen all parties against OFAC, EU, and UN sanctions lists. Verify end-use and end-user compliance, especially for dual-use technologies.

– Product Certification: Confirm that equipment meets destination country standards (e.g., CRN in Canada, PESO in India, GOST in Russia).

Installation & Commissioning Compliance

Ensure safe and compliant installation and startup:

– Permits: Obtain necessary permits for pressure systems, emissions, and electrical connections prior to installation.

– Qualified Personnel: Installation and commissioning must be performed by certified technicians or engineers familiar with applicable codes (e.g., ASME, NFPA, local building codes).

– Inspection & Testing: Conduct hydrostatic or pneumatic pressure tests as per design code requirements. Document all test results and inspections.

– Operational Documentation: Provide operators with Operation & Maintenance (O&M) manuals, P&ID diagrams, and compliance certificates.

Maintenance & Operational Safety

Ongoing compliance depends on proper maintenance and operational controls:

– Scheduled Inspections: Follow manufacturer-recommended inspection intervals for pressure vessels, tubes, seals, and safety valves.

– Recordkeeping: Maintain logs of maintenance, repairs, pressure relief valve certifications, and fluid analyses.

– Training: Train operators on emergency shutdown procedures, leak response, and lockout/tagout (LOTO) protocols.

– Environmental Monitoring: Monitor emissions (e.g., VOCs, NOx) and effluent discharges to ensure compliance with environmental permits.

Decommissioning & Disposal

End-of-life equipment and fluids must be managed responsibly:

– System Depressurization & Draining: Safely drain and decontaminate all fluids before dismantling.

– Hazardous Waste Handling: Dispose of used thermal fluids, refrigerants, and contaminated components as hazardous waste per RCRA (in the US) or equivalent regulations.

– Recycling: Recycle metals (e.g., copper, stainless steel) through certified recyclers. Follow WEEE directives for electronic components.

– Documentation: Retain decommissioning records, waste manifests, and disposal certificates for audit purposes.

Adhering to this guide ensures the safe, legal, and efficient lifecycle management of heat transfer equipment across global operations.

In conclusion, sourcing heat transfer equipment requires a strategic approach that balances performance, efficiency, cost, and reliability. Careful evaluation of technical specifications, material compatibility, operating conditions, and lifecycle costs is essential to ensure optimal selection. Partnering with reputable suppliers who offer proven engineering expertise, quality certifications, and responsive support enhances long-term operational success. Additionally, considering energy efficiency and sustainability supports both environmental goals and reduced operational expenses. Ultimately, a well-informed sourcing decision contributes significantly to the safety, productivity, and competitiveness of industrial processes.