The global head pump market is experiencing robust growth, driven by increasing demand across industrial, municipal, and commercial applications such as wastewater treatment, chemical processing, and HVAC systems. According to Grand View Research, the global water pump market was valued at USD 59.03 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2030. This expansion is fueled by rising infrastructure development, stricter environmental regulations, and the growing need for efficient fluid transfer solutions. Meanwhile, Mordor Intelligence forecasts similar momentum, citing advancements in energy-efficient pump technologies and increasing automation in industrial processes as key market drivers. As demand intensifies, manufacturers are focusing on innovation, reliability, and sustainability to gain a competitive edge. Against this backdrop, the following nine head pump manufacturers have emerged as leaders, consistently delivering high-performance products and capturing significant market share worldwide.

Top 9 Head Pump Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 MWI Pumps

Domain Est. 2008

Website: mwipumps.com

Key Highlights: MWI Pumps specializes in the design, manufacturing, rental, sale and servicing of large volume axial and mixed-flow propeller water pumps….

#2 Industrial Centrifugal Pumps & Solutions

Domain Est. 2011

Website: psgdover.com

Key Highlights: Discover Griswold’s centrifugal pumps, trusted by pump manufacturers across industries for exceptional performance, proven reliability, and long service ……

#3 Grundfos USA

Domain Est. 1995

Website: grundfos.com

Key Highlights: The full range supplier of pumps and pump solutions. As a renowned pump manufacturer, Grundfos delivers efficient, reliable, and sustainable solutions all ……

#4 Solutions Driven Pump Manufacturer

Domain Est. 1997 | Founded: 1989

Website: gpmco.com

Key Highlights: Since 1989, GPM has been the premier pump manufacturer of the GPM-Eliminator, the most durable, reliable, and dependable USA-made slurry and dewatering pump….

#5 Cornell Pump Company

Domain Est. 1997

Website: cornellpump.com

Key Highlights: Cornell Pump Company in Clackamas, Oregon, is a trusted manufacturer of high-quality pumps that have been designed in the USA, manufactured in the US with ……

#6 Pump World

Domain Est. 1997

Website: pumpworld.com

Key Highlights: Free deliveryPump World provides a one-stop shop for all your pumping needs. Our extensive portfolio of top industrial, commercial, and municipal pump brands…

#7 Johnson Pump

Domain Est. 2014

Website: spxflow.com

Key Highlights: The Johnson Pump portfolio covers internal gear pumps, impeller pumps and circulation pumps. All of these items deliver strong performance and continued ……

#8 Ampco Pumps

Domain Est. 1999

Website: ampcopumps.com

Key Highlights: Ampco Pumps Company has been providing quality centrifugal pumps and positive displacement pumps worldwide for more than 70 years….

#9 Pioneer Pump

Domain Est. 1999

Website: pioneerpump.com

Key Highlights: Our pumps provide better flow, higher head, greater efficiency, and unparalleled service designed to meet your unique needs….

Expert Sourcing Insights for Head Pump

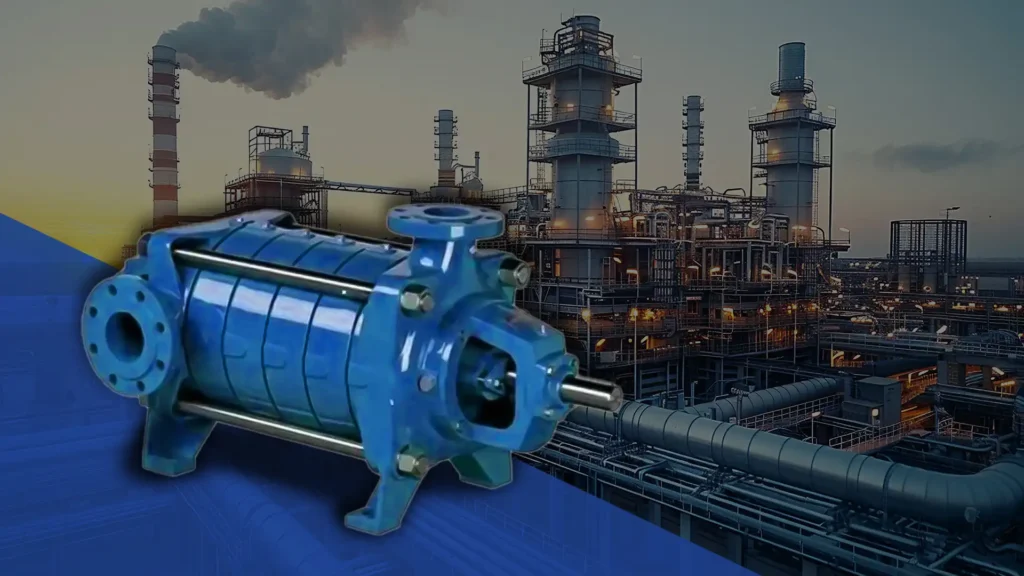

As of now, detailed and definitive market data for the year 2026 is not available, since we are still in the early stages of that year. However, based on current industry trajectories, technological advancements, and macroeconomic indicators up to 2024, we can project plausible market trends for Head Pumps (commonly used in oil & gas, chemical processing, water treatment, and industrial applications) using H2 (second half) 2026 as a forecasting window.

Projected 2026 Market Trends for Head Pumps – H2 Analysis

1. Increased Demand in Energy Transition Sectors

With global momentum toward decarbonization, H2 2026 is expected to see rising demand for head pumps in renewable energy infrastructure—particularly in hydrogen production (electrolysis), carbon capture and storage (CCS), and geothermal energy. High-pressure head pumps will be critical in hydrogen compression and CO₂ injection systems, driving innovation in materials and sealing technologies to handle corrosive or high-purity fluids.

2. Advancements in Smart Pumping Systems

By H2 2026, integration of IoT and predictive maintenance in head pumps is expected to become standard. Manufacturers will increasingly offer smart pumps equipped with real-time monitoring, remote diagnostics, and AI-driven performance optimization. This shift will improve operational efficiency, reduce downtime, and align with Industry 4.0 standards, especially in oil & gas and water treatment sectors.

3. Regional Market Shifts

– Asia-Pacific: China, India, and Southeast Asia will likely remain the fastest-growing regions for head pump demand due to expanding industrial infrastructure, urbanization, and water management projects.

– North America: Growth will be driven by shale oil operations, pipeline maintenance, and federal investments in clean water and energy infrastructure (e.g., U.S. IIJA and IRA programs).

– Europe: Stricter environmental regulations will favor high-efficiency, low-emission pump systems. Adoption of digital twins and energy-efficient pumps will rise to meet EU Green Deal targets.

4. Material and Design Innovation

To meet durability and sustainability goals, H2 2026 will likely see increased use of advanced materials such as duplex stainless steels, ceramics, and composite coatings in head pump construction. These materials improve resistance to erosion, cavitation, and chemical corrosion—especially in harsh environments like offshore drilling or chemical processing.

5. Supply Chain Resilience and Localization

Following disruptions in recent years, OEMs are expected to have restructured supply chains by H2 2026, with more regional manufacturing hubs and strategic inventory planning. This localization trend will reduce lead times and enhance responsiveness to market demands—particularly in critical sectors like power generation and wastewater treatment.

6. Regulatory and Efficiency Standards

Regulatory bodies globally are expected to enforce stricter energy efficiency standards (e.g., alignment with MEI – Minimum Energy Performance Standards). Head pumps will need to meet higher hydraulic efficiency benchmarks, prompting OEMs to redesign impellers, casings, and motor integrations.

7. Competitive Landscape

The market will likely consolidate moderately, with larger players acquiring niche technology firms specializing in digital pump controls or sustainable materials. At the same time, mid-sized regional manufacturers will focus on customization and after-sales service to compete.

Conclusion

By H2 2026, the head pump market is projected to be shaped by digitalization, sustainability, and energy transition demands. Growth will be strongest in smart, efficient, and corrosion-resistant pump systems serving renewable energy, water infrastructure, and industrial modernization. Companies that invest in R&D, digital integration, and regional supply chain agility will be best positioned to capture market share.

Note: These projections are based on current trends and may be adjusted as real-time 2026 data becomes available.

Common Pitfalls When Sourcing Head Pumps (Quality and IP)

Sourcing head pumps—especially for critical applications like medical devices, industrial systems, or precision equipment—can present significant challenges related to both quality assurance and intellectual property (IP) protection. Failing to address these aspects thoroughly can lead to product failures, legal disputes, compliance issues, and reputational damage. Below are the key pitfalls to avoid:

Quality-Related Pitfalls

1. Inadequate Supplier Vetting

Relying on suppliers without conducting thorough due diligence—such as on-site audits, quality system certifications (e.g., ISO 9001), and production capability assessments—can result in substandard components. Red flags include lack of traceability, inconsistent batch performance, or poor documentation practices.

2. Compromised Material and Component Quality

Some suppliers may cut costs by using inferior materials (e.g., low-grade seals, plastics, or motors), leading to premature failure, leakage, or reduced efficiency. Ensure specifications clearly define acceptable materials and request material certifications (e.g., RoHS, REACH).

3. Inconsistent Manufacturing Processes

Variability in assembly, calibration, or testing procedures can result in non-uniform performance across units. This is particularly dangerous in applications requiring high precision or reliability. Demand standardized work instructions and statistical process control (SPC) data.

4. Insufficient Testing and Validation

Suppliers may perform only basic functionality checks instead of rigorous life-cycle, pressure, or environmental testing. Always require documented test results (e.g., flow rate, pressure tolerance, endurance testing) aligned with your application requirements.

5. Lack of Traceability and Documentation

Poor record-keeping makes it difficult to investigate failures, perform root cause analysis, or comply with regulatory standards. Ensure each unit or batch comes with a certificate of conformance (CoC), test reports, and full traceability (e.g., lot numbers, serials).

Intellectual Property (IP) Pitfalls

1. Inadequate IP Protection in Contracts

Failing to define IP ownership clearly in sourcing agreements can result in disputes. Ensure contracts explicitly state that custom designs, modifications, or tooling developed for your pump remain your exclusive property.

2. Risk of Design or Technology Leakage

Suppliers, especially in regions with weak IP enforcement, may replicate or resell your pump designs to competitors. Use non-disclosure agreements (NDAs), limit access to sensitive information, and consider splitting manufacturing across vendors.

3. Use of Infringing Components

A supplier might integrate third-party parts (e.g., motors, controllers) that infringe on existing patents, exposing your company to legal liability. Require warranties of non-infringement and conduct IP clearance searches where possible.

4. Reverse Engineering and Unauthorized Production

Without contractual safeguards, suppliers may produce and sell identical pumps under different branding. Include strict clauses prohibiting reverse engineering and unauthorized production, with penalties for violations.

5. Insecure Handling of Digital Assets

CAD files, firmware, and control algorithms shared during development can be misused. Use secure file-sharing platforms, watermark sensitive documents, and restrict access to essential personnel only.

Conclusion

To mitigate these risks, implement a structured sourcing strategy that includes supplier qualification, stringent quality controls, clear IP agreements, and ongoing monitoring. Partnering with reputable suppliers and involving legal and technical experts early in the procurement process can safeguard both product performance and your intellectual assets.

Logistics & Compliance Guide for Head Pump

Product Overview

Head Pump is a specialized fluid transfer device designed for precise handling of liquids in industrial, commercial, or medical environments. Proper logistics and compliance management are essential to ensure product safety, regulatory adherence, and operational efficiency during transportation, storage, and deployment.

Regulatory Compliance Requirements

Head Pump must comply with relevant international and regional regulations depending on its components, materials, and intended use. Key compliance areas include:

- Transportation Regulations: Adherence to IATA (air), IMDG (sea), and ADR (road) guidelines if transporting hazardous materials or battery-powered models.

- Electrical Safety Standards: Compliance with CE (Europe), UL (USA), or other local electrical certifications if the pump includes electronic components.

- Material Restrictions: Ensure materials used meet RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) requirements.

- Medical/Pharmaceutical Use: If applicable, compliance with FDA 21 CFR Part 820 (Quality System Regulation) or ISO 13485 standards.

Documentation such as Safety Data Sheets (SDS), Certificates of Conformity (CoC), and test reports must accompany shipments when required.

Packaging & Handling Specifications

Proper packaging is critical to prevent damage and maintain compliance during transit:

- Use shock-absorbent, anti-static packaging for electronic components.

- Seal all fluid pathways to prevent leakage; use protective caps on inlets and outlets.

- Clearly label packages with orientation arrows, fragile indicators, and handling instructions.

- Include desiccants if moisture-sensitive components are present.

- Ensure packaging meets ISTA 3A or equivalent performance standards for drop and vibration testing.

Shipping & Transportation Guidelines

Follow these protocols to ensure safe and compliant shipping:

- Classify the Head Pump correctly under the UN Model Regulations (e.g., UN3481 for lithium batteries if applicable).

- Use certified carriers trained in handling industrial equipment or hazardous goods, as needed.

- Maintain temperature-controlled environments if components are sensitive to extreme heat or cold (typically 5°C to 40°C).

- Avoid stacking heavy items on packaged units; follow load distribution guidelines.

- Provide accurate shipping documentation, including commercial invoices, packing lists, and export declarations.

Import & Export Controls

International shipments of Head Pump may be subject to customs and trade regulations:

- Verify export classification under ECCN (Export Control Classification Number) or HTS codes.

- Obtain necessary export licenses for controlled technologies, especially if containing advanced sensors or software.

- Comply with destination country import requirements, including local certification, labeling, and registration.

- Maintain records of all transactions for a minimum of five years per most trade compliance standards.

Storage Conditions

To preserve functionality and compliance during warehousing:

- Store in a dry, well-ventilated area with stable temperatures (10°C to 30°C recommended).

- Keep away from direct sunlight, corrosive chemicals, and sources of electromagnetic interference.

- Elevate pallets off the floor to prevent moisture absorption and pest infestation.

- Implement FIFO (First In, First Out) inventory rotation to minimize aging of components.

Quality Assurance & Traceability

Maintain full traceability and quality control throughout the logistics chain:

- Assign unique serial numbers or batch codes to each unit.

- Record storage conditions, handling events, and inspection results in a quality management system.

- Conduct pre-shipment inspections to verify compliance with technical and safety standards.

- Retain compliance documentation for audit purposes.

Disposal & End-of-Life Management

Dispose of Head Pump units in accordance with environmental regulations:

- Recycle electronic components through certified e-waste handlers.

- Follow local regulations for disposal of plastics, metals, and any residual fluids.

- Comply with WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions.

- Provide end-users with clear disposal instructions in product manuals.

Training & Documentation

Ensure all personnel involved in logistics and handling are properly trained:

- Provide training on hazard identification, safe handling, and emergency procedures.

- Maintain up-to-date user manuals, technical specifications, and compliance certificates.

- Distribute logistics guidelines to all partners in the supply chain.

Following this guide ensures that Head Pump is transported, stored, and managed in full compliance with global standards, minimizing risk and maximizing operational reliability.

Conclusion for Sourcing a Head Pump:

In conclusion, sourcing a head pump requires a thorough evaluation of technical specifications, application requirements, quality standards, and supplier reliability. It is essential to select a pump that meets the required performance criteria—such as flow rate, pressure, efficiency, and compatibility with the fluid being handled—while also considering long-term operational costs, maintenance needs, and energy consumption. Conducting a comprehensive supplier assessment, including reviews of certifications, after-sales support, and delivery timelines, ensures a sustainable and cost-effective procurement decision. By aligning technical needs with reliable sourcing strategies, organizations can ensure optimal system performance, durability, and return on investment in their pumping solutions.