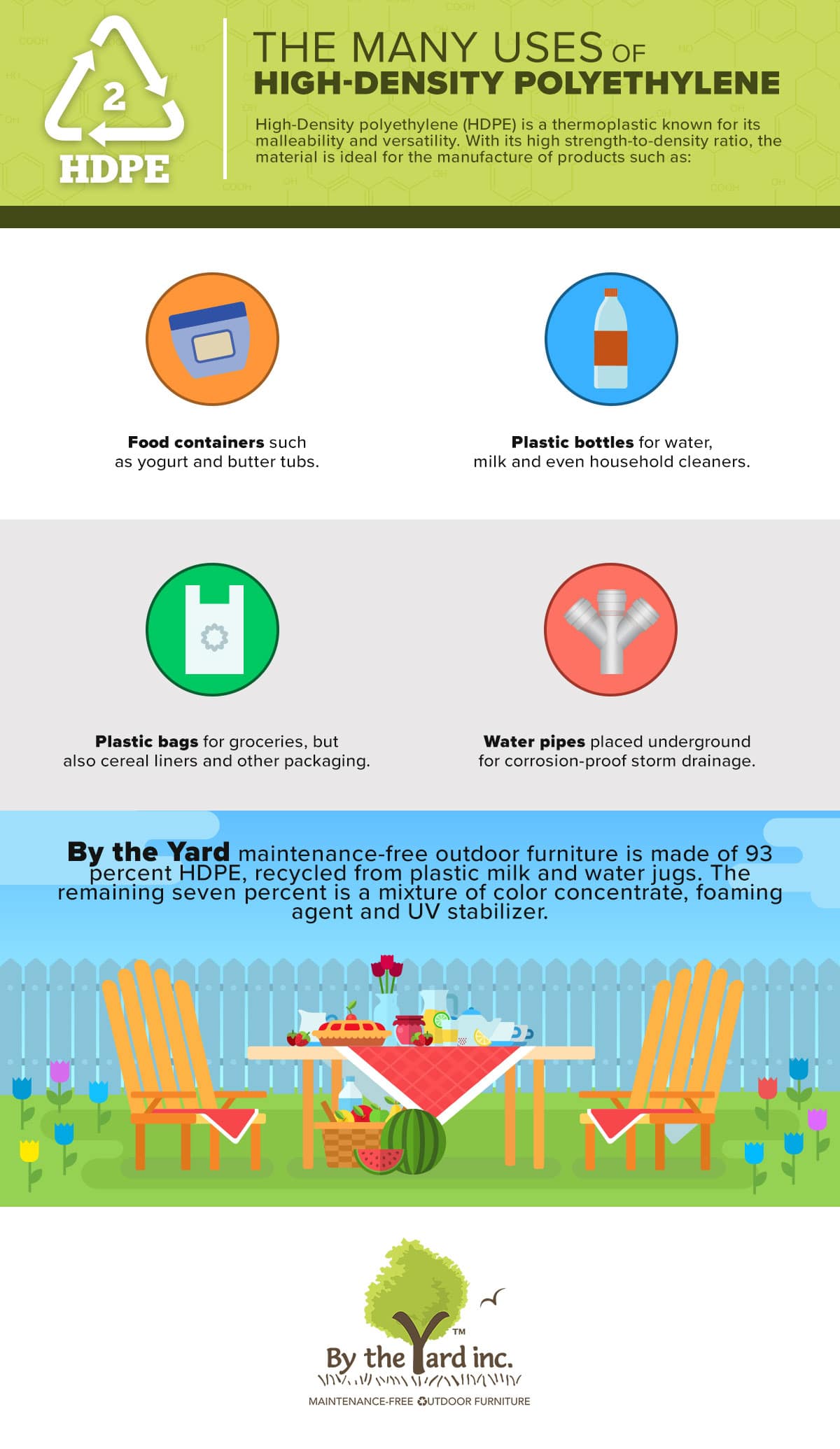

The global HDPE (High-Density Polyethylene) resin market is experiencing robust expansion, driven by rising demand across packaging, construction, automotive, and consumer goods industries. According to Grand View Research, the market was valued at USD 68.9 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. This growth is fueled by HDPE’s favorable properties—such as high strength-to-density ratio, recyclability, and resistance to moisture and chemicals—making it a preferred choice for sustainable packaging solutions and infrastructure applications. Additionally, increasing regulatory support for plastic recycling and advancements in polymer technology are further accelerating market momentum. As global production capacity expands and emerging economies boost industrial activity, the competitive landscape is led by a select group of manufacturers dominating supply, innovation, and regional reach. Below, we spotlight the top 10 HDPE resin manufacturers shaping the industry’s future through scale, sustainability initiatives, and technological leadership.

Top 10 Hdpe Resin Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 High Density Polyethylene (HDPE)

Domain Est. 1992

Website: dow.com

Key Highlights: Dow’s High Density Polyethylene (HDPE) Resins empower outstanding product performance in flexible and rigid packaging, durable goods and plastic pipes….

#2 High

Domain Est. 2018

Website: nexeoplastics.com

Key Highlights: Nexeo Plastics is a supplier of HDPE resins for thermoplastic processing from top manufacturers. Learn more about the properties and applications of ……

#3 High

Domain Est. 1997

Website: kwplastics.com

Key Highlights: KW Plastics’ high-density polyethylene (HDPE) resin comes in several varieties to meet the needs of any potential manufacturing applications….

#4 Polyethylene (PE)

Domain Est. 1998

Website: sabic.com

Key Highlights: Polyethylene (PE). Complete range of HDPE, LDPE and LLDPE, including Metallocene LLDPE, plastomers and elastomers for flexible and rigid applications….

#5 High Density Polyethylene (HDPE)

Domain Est. 1999

Website: exxonmobilchemical.com

Key Highlights: Our broad portfolio of HDPE resins provide a suite of solutions for blow molding, roto molding and injection molding. View data sheets….

#6 Polyethylene Products

Domain Est. 2000

Website: cpchem.com

Key Highlights: Chevron Phillips Chemical’s Americas Polyethylene Division produces HDPE, LDPE, LLDPE, MDPE and metallocene polyethylenes….

#7 Resources on Shell Polymers’ HDPE

Domain Est. 2002

Website: shell.us

Key Highlights: As a trusted HDPE supplier, our Shell Polymers resins are designed to withstand high processing temperatures and demanding line conditions. Our commitment to ……

#8 High

Domain Est. 2007

Website: lyondellbasell.com

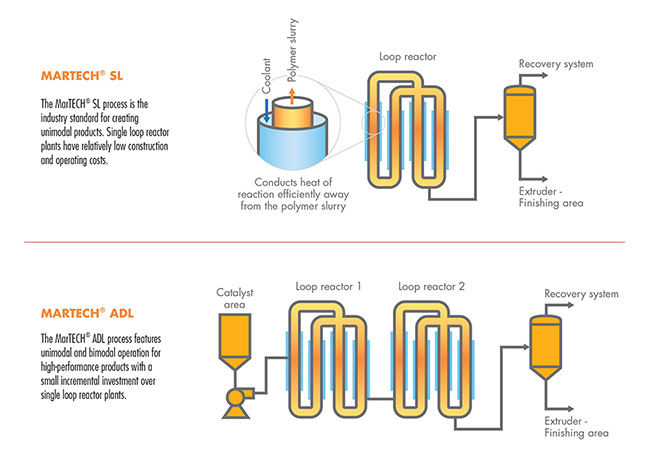

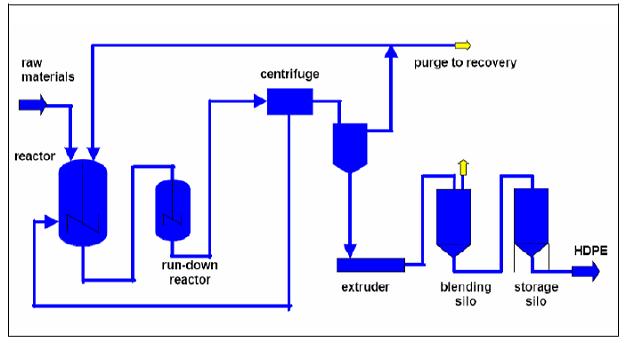

Key Highlights: High density polyethylene (HDPE) resins from LYB are thermoplastics made from the polymerization of ethylene in gas phase, slurry or solution reactors….

#9 United Poly Systems

Domain Est. 2011

Website: unitedpolysystems.com

Key Highlights: We manufacture custom HDPE pipe in the USA for the water and sewer, power & communications and oil & gas markets. Contact us for a quote now!…

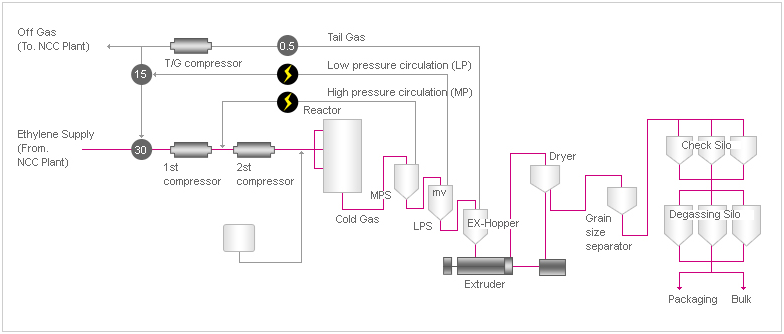

#10 Formosa Plastics

Domain Est. 2021

Website: fic-pe.com

Key Highlights: Formosa Industries Corporation offers Formolene high density polyethylene (HDPE) and linear low density polyethylene (LLDPE) resins produced on a UNIPOL swing ……

Expert Sourcing Insights for Hdpe Resin

H2: 2026 Market Trends for HDPE Resin

The global High-Density Polyethylene (HDPE) resin market is poised for significant evolution by 2026, driven by shifting industrial demands, regulatory developments, and advancements in sustainability. As a critical material in packaging, construction, automotive, and consumer goods industries, HDPE resin is adapting to a rapidly changing economic and environmental landscape. Below are the key trends expected to shape the HDPE resin market in 2026:

-

Rising Demand in Packaging Sector

The packaging industry will remain the largest consumer of HDPE resin, with ongoing growth in demand for lightweight, durable, and recyclable materials. The expansion of e-commerce and the need for sustainable packaging solutions are driving manufacturers to adopt HDPE in bottles, containers, and films. By 2026, innovations in barrier technologies and improved recyclability will enhance HDPE’s competitiveness against alternative plastics. -

Sustainability and Circular Economy Initiatives

Regulatory pressure and consumer preferences are accelerating the shift toward circular economy models. In 2026, recycled HDPE (rHDPE) is expected to account for a growing share of total HDPE consumption, particularly in Europe and North America. Extended Producer Responsibility (EPR) laws and plastic tax regulations will incentivize the use of post-consumer recycled (PCR) content, pushing resin producers to invest in advanced recycling technologies such as chemical recycling and depolymerization. -

Expansion of Recycling Infrastructure

Investments in mechanical and advanced recycling facilities are anticipated to rise globally by 2026. Governments and private enterprises are collaborating to improve collection and sorting systems, increasing the availability of high-quality feedstock for rHDPE production. This infrastructure development will help close the supply-demand gap for recycled resins and reduce reliance on virgin HDPE. -

Regional Production Shifts and Capacity Additions

The Middle East and Asia-Pacific regions are expected to lead in new HDPE production capacity expansions due to access to low-cost feedstocks and growing domestic demand. China and India will drive regional growth, while the U.S. Gulf Coast remains a key hub due to shale gas availability. However, environmental regulations in North America and Europe may constrain new virgin resin projects, favoring upgrades to existing facilities for recycled resin production. -

Technological Innovations in Resin Performance

By 2026, HDPE resin producers will increasingly focus on high-performance grades with enhanced properties such as improved UV resistance, impact strength, and processability. These advancements will open new applications in automotive lightweighting, medical devices, and durable construction materials like pipes and geomembranes. -

Price Volatility and Feedstock Dynamics

HDPE resin prices will remain sensitive to fluctuations in crude oil and natural gas prices, especially as global energy markets transition toward cleaner alternatives. Producers leveraging ethane from shale gas (particularly in the U.S.) may maintain cost advantages, while those dependent on naphtha-based feedstocks in Europe and Asia face higher input costs. -

Regulatory and Trade Landscape

Stricter environmental regulations, including bans on single-use plastics and carbon emission targets, will influence HDPE market dynamics. Trade policies related to plastic waste exports and recycled content standards will also impact global supply chains. Compliance with ESG (Environmental, Social, and Governance) criteria will become a competitive differentiator for resin suppliers.

In conclusion, the 2026 HDPE resin market will be characterized by a dual focus on growth and sustainability. While demand continues to rise—especially in emerging economies—the industry’s ability to innovate in recycling, reduce carbon footprint, and adapt to regulatory changes will determine long-term success. Companies that integrate circular principles and invest in next-generation production technologies are best positioned to lead in the evolving HDPE landscape.

Common Pitfalls Sourcing HDPE Resin: Quality and Intellectual Property (IP) Concerns

Sourcing High-Density Polyethylene (HDPE) resin is critical for manufacturers across industries like packaging, construction, and consumer goods. However, several pitfalls related to quality and intellectual property (IP) can jeopardize production, product performance, and legal compliance. Being aware of these challenges is essential for effective procurement.

Quality-Related Pitfalls

Inconsistent Material Properties

HDPE resin must meet specific mechanical, thermal, and chemical resistance standards depending on the application. A common pitfall is receiving batches with inconsistent melt flow index (MFI), density, or molecular weight distribution. This variability can lead to processing issues (e.g., uneven extrusion, poor mold filling) and compromised end-product performance (e.g., reduced strength, brittleness, or leakage in containers).

Contamination and Impurities

Contaminants such as gels, black specks, foreign particles, or cross-contaminated polymer types (e.g., LDPE or PP) are frequent quality issues. These can originate from poor manufacturing practices, inadequate filtration, or improper handling during transportation and storage. Contamination not only affects aesthetics but can also weaken structural integrity and cause failures in critical applications.

Lack of Traceability and Certification

Sourcing from suppliers who cannot provide full traceability or proper documentation (e.g., Certificates of Analysis, compliance with FDA, REACH, or ISO standards) increases risk. Without verifiable data, ensuring consistent quality and regulatory compliance becomes difficult, especially in regulated industries like food packaging or medical devices.

Counterfeit or Substandard Resin

In some markets, especially through secondary or unverified distributors, there is a risk of receiving resin that is mislabeled, regrind passed off as virgin material, or even outright counterfeit. These materials often fail to meet performance specifications and can introduce unknown additives or degraded polymers into the production process.

Intellectual Property (IP)-Related Pitfalls

Unauthorized Use of Proprietary Formulations

Some HDPE resins are developed with proprietary additives, catalyst systems, or polymer architectures protected by patents or trade secrets. Sourcing from unauthorized suppliers or using off-spec resins may result in unintentional infringement of IP rights, exposing the buyer to legal action from the original resin producer (e.g., companies like Dow, SABIC, or LyondellBasell).

Lack of Licensing for Specialty Grades

Engineered HDPE grades—such as those designed for high-pressure pipes, UV resistance, or barrier performance—often require licensing agreements for legal use. Procuring these grades without proper authorization, or from unauthorized channels, may void warranties and lead to liability if the product fails or causes downstream issues.

Ambiguous or Inadequate Supply Agreements

Contracts that fail to address IP ownership, permitted uses, and restrictions on resale or modification can create legal vulnerabilities. For example, modifying a patented resin formulation without permission—even for internal R&D—could constitute IP infringement.

Reputational and Compliance Risks

Using non-licensed or counterfeit resins not only poses legal risks but can also damage brand reputation, especially if product failures occur. Additionally, customers and regulators increasingly demand transparency in material sourcing, including proof of IP compliance and sustainability credentials.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Partner with reputable, authorized suppliers and verify their certifications.

– Require detailed specifications and batch-specific quality documentation.

– Conduct regular audits and material testing (e.g., FTIR, DSC, mechanical testing).

– Include clear IP clauses in supply contracts, specifying permitted uses and responsibilities.

– Monitor supply chains for unauthorized resellers or suspiciously low pricing.

By proactively addressing quality and IP concerns, companies can ensure reliable HDPE resin sourcing that supports product integrity, regulatory compliance, and long-term business sustainability.

Logistics & Compliance Guide for HDPE Resin

Overview of HDPE Resin

High-Density Polyethylene (HDPE) resin is a thermoplastic polymer widely used in packaging, pipes, containers, and industrial applications due to its strength, chemical resistance, and recyclability. Proper logistics and compliance handling are critical to ensure product quality, worker safety, and environmental protection.

Regulatory Compliance

International Regulations

HDPE resin is generally classified as a non-hazardous material under international transport regulations. However, compliance with the following standards is required:

– IMDG Code (International Maritime Dangerous Goods): HDPE resin in pellet form is typically not regulated as dangerous goods for sea transport. Proper packaging and documentation are still mandatory.

– IATA Dangerous Goods Regulations: For air freight, HDPE resin is usually exempt from hazardous classification, but shippers must verify classification using UN test criteria.

– ADR/RID (Road/Rail in Europe): HDPE is not classified as hazardous under ADR/RID when transported in solid pellet form. Proper labeling and load securing are required.

Regional Compliance Requirements

- United States (DOT/PHMSA): HDPE resin is not regulated as a hazardous material under 49 CFR. Standard shipping papers and packaging guidelines apply.

- European Union (REACH & CLP): HDPE resin is not classified as hazardous under CLP Regulation (EC) No 1272/2008. However, manufacturers must comply with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) obligations, including submission of Safety Data Sheets (SDS).

- China (GB Standards): Compliance with GB 13690 and other national standards for chemical classification and packaging is required. Importers must ensure customs documentation reflects accurate product codes (HS Code: 3901.10).

Safety Data Sheet (SDS) Requirements

- HDPE resin must be accompanied by a compliant SDS (in accordance with GHS standards).

- Key sections to review include:

- Section 3 (Composition): Confirms absence of hazardous additives.

- Section 7 (Handling & Storage): Recommends dry, ventilated storage away from heat and direct sunlight.

- Section 14 (Transport Information): Confirms non-hazardous classification and packaging guidelines.

- SDS must be updated every 3–5 years or when formulation changes occur.

Packaging & Handling

Recommended Packaging

- Bulk Bags (FIBCs): 500–1000 kg capacity, UV-stabilized, with inner liner to prevent moisture ingress.

- Big Bags on Pallets: Secured with stretch wrap for stability.

- Railcars and Flexitanks: For large-volume shipments; must comply with DOT or AAR standards.

- Drums or Boxes: For smaller quantities; HDPE resin is typically supplied in 25 kg bags inside cardboard boxes or 1000 lb supersacks.

Handling Best Practices

- Use mechanical handling equipment (forklifts, conveyors) to avoid manual strain.

- Prevent contamination by using clean, dry handling tools.

- Avoid dropping or puncturing bags to prevent pellet spillage and degradation.

- Minimize dust generation; use dust extraction systems if cutting or grinding is required.

Storage Guidelines

- Store in a cool, dry, well-ventilated area.

- Keep away from direct sunlight and heat sources (>40°C can cause agglomeration).

- Stack bags no higher than recommended by the manufacturer (typically 4–6 layers).

- Separate from oxidizing agents, strong acids, and flammable materials.

Transportation Considerations

Mode-Specific Requirements

- Marine Freight: Use container desiccants to prevent condensation. Ensure containers are clean and dry before loading.

- Rail Transport: Secure loads with straps or dunnage. Comply with rail carrier specifications.

- Road Transport: Cover trucks with tarpaulins or use enclosed trailers. Prevent moisture and contamination.

- Air Freight: Although non-regulated, HDPE must be packed securely to prevent shifting.

Labeling & Documentation

- Shipping Labels: Include product name, batch number, net weight, manufacturer details, and “Non-Hazardous” declaration.

- Bill of Lading (B/L): Accurately describe cargo as “HDPE Resin, Non-Hazardous, Pellets.”

- Customs Documentation: Provide HS code (e.g., 3901.10), country of origin, and commercial invoice.

Environmental & Sustainability Compliance

- HDPE is recyclable (Resin Identification Code #2). Encourage recycling and proper waste management.

- Comply with local plastic waste regulations (e.g., EU Single-Use Plastics Directive).

- Provide recyclability information in product documentation.

Emergency Procedures

- Spill Response: Sweep or vacuum spilled pellets. Avoid water runoff into drains.

- Fire Response: HDPE is combustible. Use foam, CO₂, or dry chemical extinguishers. Combustion may produce CO and VOCs—evacuate and ventilate area.

- First Aid: Generally low risk. In case of eye contact, rinse with water. If inhaled as dust, move to fresh air.

Quality Assurance & Traceability

- Maintain lot traceability from production to delivery.

- Conduct periodic checks for moisture content, particle size, and contamination.

- Use tamper-evident seals on bulk packaging.

Conclusion

HDPE resin is a safe and widely used polymer, but adherence to logistics and compliance standards ensures operational efficiency and regulatory conformity. Always verify local regulations, maintain up-to-date SDS, and implement best practices in handling, storage, and transport to protect people, products, and the environment.

Conclusion for Sourcing HDPE Resin:

Sourcing high-density polyethylene (HDPE) resin requires a strategic approach that balances quality, cost, supply chain reliability, and sustainability. As a widely used thermoplastic valued for its strength, chemical resistance, and recyclability, HDPE resin is essential across industries such as packaging, construction, and consumer goods. Effective sourcing involves evaluating suppliers based on consistent quality standards, production capacity, and compliance with regulatory and environmental requirements.

Establishing long-term partnerships with reputable suppliers helps mitigate risks related to price volatility and supply disruptions. Additionally, increasing emphasis on circular economy principles makes it imperative to consider recycled HDPE (rHDPE) options and support sustainable sourcing initiatives. Leveraging market intelligence, diversifying supply sources, and integrating sustainability goals into procurement strategies will ensure a resilient and responsible HDPE resin supply chain. Ultimately, a well-optimized sourcing strategy not only supports operational efficiency but also aligns with environmental and corporate social responsibility objectives.