The global HDMI technology market is experiencing steady expansion, driven by increasing demand for high-definition audio and video transmission across consumer electronics, automotive, and commercial sectors. According to a 2023 report by Mordor Intelligence, the global HDMI market was valued at approximately USD 11.5 billion and is projected to grow at a CAGR of over 6.8% from 2023 to 2028. This growth is fueled by the rising adoption of 4K and 8K displays, the proliferation of smart home systems, and the integration of HDMI interfaces in gaming consoles, monitors, and automotive infotainment systems. As HDMI plates—key components in managing connectivity and cable organization—become increasingly essential in both residential and commercial AV installations, the demand for reliable, high-quality manufacturing has surged. In response, a core group of manufacturers has emerged as leaders in producing durable, standards-compliant HDMI plate solutions, combining precision engineering with scalable production. Based on market presence, product innovation, and global supply capacity, the following seven manufacturers represent the top players in the HDMI plate industry today.

Top 7 Hdmi Plate Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 HDMI

Domain Est. 1995

#2 PCS

Domain Est. 1996

#3 Single Outlet Female HDMI Wall Plate White

Domain Est. 1998

Website: startech.com

Key Highlights: In stock Free deliveryThe 19-pin HDMI wall plate eliminates cable clutter, providing you with a professional look and is backed by StarTech.com’s Lifetime ……

#4 HDMI Wall Plates

Domain Est. 2000

Website: 3starinc.com

Key Highlights: Free deliveryBuy HDMI Wall Plates at a great price or buy in bulk and save even more. We Sell WISP Networking and Infrastructure Equipment including Towers, Masts, ……

#5 Ortronics Network Infrastructure Solutions

Domain Est. 2004

Website: legrand.us

Key Highlights: Legrand Ortronics® network infrastructure solutions combine flexibility and efficiency, with superior design, to ensure that facilities operate flawlessly….

#6 HDMI Pass

Domain Est. 2014

Website: comprehensiveco.com

Key Highlights: In stock 1–2 day deliveryFeatures • Single Gang Decorative Wall Plate with matched color ABS face plate • Supports HDMI pass-through signals up to 4K@60 (4:4:4)…

#7 Basic HDMI Wall Plate Kit

Domain Est. 2015

Website: avproglobal.com

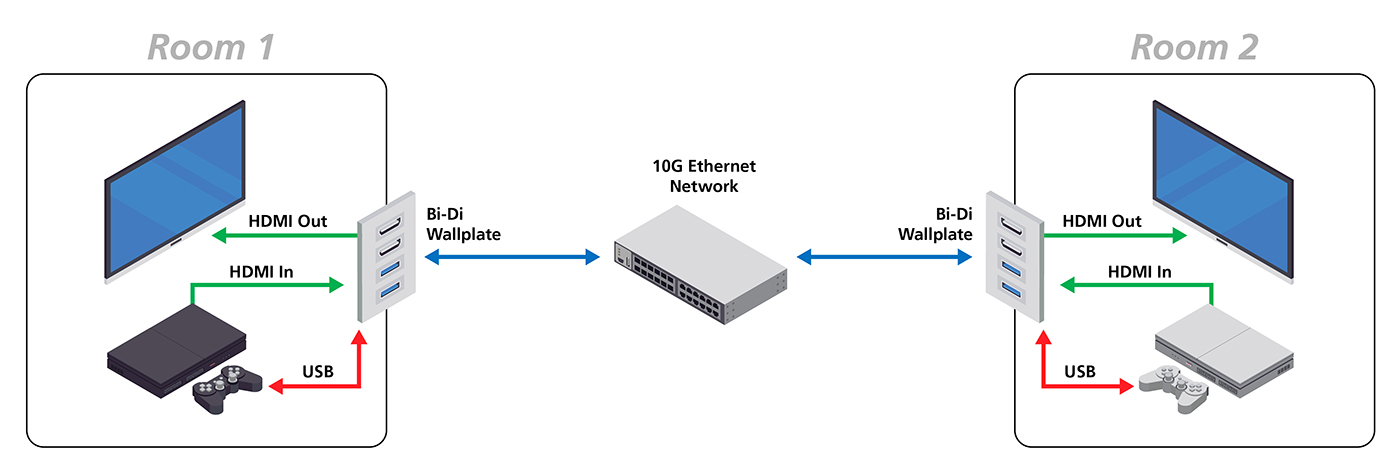

Key Highlights: This basic HDBaseT wall plate transmitter/receiver kit is a cost-effective HDMI extension product from AVPro Edge’s ConferX line. Able to handle 4k at 10.2 Gbps ……

Expert Sourcing Insights for Hdmi Plate

H2: 2026 Market Trends for HDMI Plates

The HDMI plate market is poised for significant transformation by 2026, driven by advancements in display technology, increasing demand for seamless connectivity, and the proliferation of high-bandwidth applications. As consumer electronics evolve toward higher resolutions and faster data transfer standards, HDMI plates—used to integrate HDMI ports into desks, walls, furniture, and home theaters—are adapting to meet new performance and aesthetic requirements.

A key trend shaping the 2026 landscape is the widespread adoption of HDMI 2.1 and the gradual emergence of HDMI 2.1a/b specifications. These standards support features such as 8K resolution at 60Hz, 4K at 120Hz, Dynamic HDR, and enhanced Audio Return Channel (eARC), necessitating HDMI plates that are not only compatible but also designed to minimize signal loss and electromagnetic interference. Manufacturers are responding by incorporating shielded, gold-plated connectors and low-profile designs with improved heat dissipation.

Another major driver is the growth of hybrid workspaces and smart home environments. With more people working remotely and investing in home entertainment systems, there is rising demand for clean, clutter-free setups. Wall-mounted and desk-integrated HDMI plates offer a sleek solution for managing cables and maintaining a professional appearance. By 2026, expect to see increased integration with USB-C, power delivery (PD), and even wireless transmission technologies, enabling multi-functional connectivity panels.

Sustainability is also becoming a competitive differentiator. Eco-conscious consumers and commercial clients are favoring HDMI plates made from recycled metals and plastics, with modular designs that allow for easy upgrades without full replacement. This aligns with broader electronics industry trends toward circular economy principles.

Regionally, North America and Europe lead adoption due to high penetration of 4K/8K TVs and smart homes, while the Asia-Pacific region is expected to exhibit the fastest growth, fueled by expanding middle-class demand and government-backed smart city initiatives.

In summary, the HDMI plate market in 2026 will be defined by technological compatibility with next-gen HDMI standards, aesthetic and functional integration into modern living and working spaces, and a growing emphasis on sustainability and multi-connectivity. Manufacturers who innovate in these areas will be well-positioned to capture market share in an increasingly competitive landscape.

Common Pitfalls When Sourcing HDMI Plates: Quality and Intellectual Property (IP) Concerns

When sourcing HDMI plates—whether for integration into consumer electronics, industrial equipment, or custom AV installations—businesses often encounter challenges related to product quality and intellectual property compliance. Overlooking these aspects can lead to performance issues, legal vulnerabilities, and reputational damage. Below are key pitfalls to avoid.

Poor Build Quality and Material Defects

One of the most frequent issues when sourcing HDMI plates—especially from low-cost suppliers—is substandard build quality. This can manifest in poorly machined ports, flimsy metal housings, or inadequate shielding. Low-quality materials may result in signal degradation, intermittent connections, or premature failure. Additionally, plates that lack proper EMI (electromagnetic interference) shielding can compromise signal integrity, especially in high-bandwidth applications like 4K or 8K video transmission.

Buyers should verify mechanical durability, plating thickness (e.g., gold-plated contacts), and adherence to HDMI specifications (e.g., HDMI 2.0, 2.1). Sourcing from suppliers with proven manufacturing standards (e.g., ISO-certified facilities) helps mitigate these risks.

Non-Compliance with HDMI Licensing and Specifications

HDMI technology is protected by strict licensing requirements governed by HDMI Licensing Administrator, Inc. (HDMI LA). A common pitfall is sourcing HDMI plates that are not HDMI-compliant or lack proper certification. Unauthorized or counterfeit components may not support required features like HDCP (High-bandwidth Digital Content Protection), leading to compatibility issues with certified devices.

Using non-licensed HDMI components can expose companies to legal action, product recalls, and voided warranties. Always confirm that the supplier is a licensed HDMI adopter and that the HDMI plate carries valid compliance testing (e.g., HDMI ATC certification).

Intellectual Property (IP) Infringement Risks

Sourcing HDMI plates from unverified manufacturers—particularly in regions with lax IP enforcement—can inadvertently lead to the use of infringing designs. Some suppliers may replicate patented connector layouts, shielding techniques, or mechanical designs without authorization. This exposes the buyer to potential IP litigation, especially when selling finished products in regulated markets like the U.S. or EU.

To avoid infringement, conduct due diligence on the supplier’s design origins, request proof of IP ownership or licensing, and consider third-party IP clearance searches when integrating HDMI plates into proprietary products.

Inadequate Support for Latest HDMI Standards

Another quality-related pitfall is sourcing HDMI plates that claim support for advanced standards (e.g., HDMI 2.1 with 48 Gbps bandwidth) but fail to deliver in practice. Misleading specifications are common among uncertified vendors. Plates may lack the necessary internal trace routing, impedance control, or connector integrity to handle high-speed data, resulting in dropped signals or reduced performance.

Ensure technical documentation includes verified bandwidth ratings, supported features (e.g., eARC, VRR), and test reports from accredited labs. Whenever possible, perform in-house signal integrity testing before mass integration.

Conclusion

To avoid common pitfalls in sourcing HDMI plates, prioritize quality assurance, verify HDMI licensing compliance, and assess IP risks thoroughly. Partnering with reputable, certified suppliers and demanding transparent technical validation can prevent costly setbacks and ensure reliable, legally compliant product integration.

Logistics & Compliance Guide for HDMI Plate

Product Overview and Classification

The HDMI Plate is a passive accessory designed to mount and organize HDMI connectors on desks, walls, or equipment racks. It typically consists of a metal or plastic faceplate with integrated HDMI ports, enabling clean cable management and accessibility. As a non-powered component, the HDMI Plate falls under HS Code 8536.90 (Electrical apparatus for switching or protecting electrical circuits) or 8517.70 (Other parts of telephone or telegraph apparatus), depending on regional classification practices. Confirm the precise HS code with local customs authorities to ensure accurate tariff application and avoid shipment delays.

Packaging and Labeling Requirements

Proper packaging is essential to prevent damage during transit. HDMI Plates should be individually sealed in anti-static poly bags and placed in rigid inner boxes with cushioning (e.g., foam inserts or bubble wrap). Outer shipping containers must be double-walled corrugated cardboard boxes rated for stacking, with a gross weight not exceeding 15 kg per box for ease of handling. Each package must display: product name, model number, quantity, weight, dimensions, manufacturer details, country of origin (e.g., “Made in China”), and handling symbols (e.g., “Fragile,” “This Side Up”). Barcodes compliant with GS1 standards are recommended for inventory tracking.

Import/Export Documentation

For international shipments, the following documents are required: commercial invoice, packing list, bill of lading (or air waybill), and certificate of origin. The commercial invoice must detail the transaction value, currency, Incoterms (e.g., FOB, EXW), and a clear product description. If exporting from a country with preferential trade agreements (e.g., USMCA, RCEP), a completed certificate of origin may reduce tariffs. Some destinations may require additional declarations; for example, the EU may request an Economic Operator Registration and Identification (EORI) number from the importer.

Regulatory Compliance and Certifications

HDMI Plates, while not active electronic devices, must comply with regional safety and environmental standards. In the European Union, they must comply with the RoHS (Restriction of Hazardous Substances) Directive 2011/65/EU, restricting lead, mercury, and other substances. REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) compliance is also required. In the United States, adherence to CPSC (Consumer Product Safety Commission) guidelines is advised, particularly regarding sharp edges and material safety. Although HDMI Licensing, LLC does not require certification for passive plates, avoid using the HDMI logo unless formally authorized under a trademark license agreement.

Transportation and Freight Considerations

HDMI Plates are generally non-hazardous and can be shipped via air, sea, or ground freight. For air freight, ensure packaging meets IATA standards for secure stacking and moisture resistance. For ocean freight, use moisture-absorbing desiccants inside containers to prevent corrosion, especially in tropical climates. Choose Incoterms carefully—FOB (Free On Board) transfers risk to the buyer once goods are loaded, while DDP (Delivered Duty Paid) places full responsibility on the seller, including customs clearance and duty payments. Always insure shipments for replacement value.

Customs Clearance and Duties

Customs clearance times vary by country. To expedite processing, provide accurate Harmonized System (HS) codes, complete documentation, and declare the correct value. Duties on HDMI Plates are typically low (0–5% in most markets) due to their classification as passive components. However, anti-dumping duties may apply depending on the country of manufacture and destination. Engage a licensed customs broker in the destination country to manage entries, pay duties, and resolve classification disputes. Maintain records of all shipments for at least five years for audit purposes.

End-of-Life and Environmental Responsibility

HDMI Plates contain recyclable materials such as aluminum and plastic. Comply with local waste electrical and electronic equipment (WEEE) regulations where applicable, even if exemptions exist for passive components. Provide customers with guidance on proper disposal or recycling. Implement a take-back program if required by law (e.g., in EU member states). Document environmental compliance efforts to support corporate sustainability reporting and customer inquiries.

Conclusion on Sourcing HDMI Plates

Sourcing HDMI plates requires a careful balance between functionality, compatibility, durability, and cost. After evaluating various suppliers, materials, and product specifications, it is clear that selecting the right HDMI plate involves considering key factors such as build quality (e.g., metal vs. plastic), HDMI version support (e.g., HDMI 2.0, 2.1 for 4K/8K and HDR), ease of installation, and aesthetic design to match the intended environment.

OEM and ODM suppliers from regions like China offer competitive pricing and scalable manufacturing, but due diligence is necessary to ensure compliance with HDMI Licensing Administrator standards and to avoid counterfeit or substandard products. Reputable brands and certified distributors, while often more expensive, provide assurance of performance and reliability—especially important in professional AV installations, home theaters, or commercial settings.

In conclusion, the optimal sourcing strategy involves identifying the specific technical requirements, validating supplier credibility, and prioritizing long-term reliability over upfront cost savings. By doing so, organizations can ensure seamless integration, superior signal integrity, and customer satisfaction in their HDMI connectivity solutions.