The global hardwood lumber market is experiencing steady expansion, driven by rising demand in construction, furniture manufacturing, and flooring industries. According to Grand View Research, the global solid wood flooring market—chiefly composed of hardwood—was valued at USD 12.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is further reinforced by Mordor Intelligence, which reports that increased urbanization and consumer preference for sustainable, durable materials are key factors boosting hardwood consumption, particularly in North America and Europe. As demand intensifies, the role of reliable hardwood distributors and manufacturers becomes critical in ensuring supply chain efficiency and product quality. Below, we spotlight the top 10 hardwood distributors and manufacturers shaping the industry through scale, innovation, and consistent delivery performance.

Top 10 Hardwood Distributors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Rex Lumber Company

Domain Est. 1998

Website: rexlumber.com

Key Highlights: Rex Lumber Company is one of the largest wholesale tropical and domestic hardwood distributors and custom moulding manufacturers on the Eastern Seaboard….

#2 Premium Hardwood Flooring

Domain Est. 2005

Website: johnsonhardwood.com

Key Highlights: Johnson Hardwood is one of the leading manufacturers of premium hardwood flooring with distribution to the United States and Canada….

#3 Hardwood Flooring

Domain Est. 1994

Website: bruce.com

Key Highlights: America has been built on Bruce hardwood flooring since 1884. Vast selection of solid and engineered hardwoods in oak, hickory, maple, and more….

#4 North American Hardwood Lumber from Baillie

Domain Est. 1996

Website: baillie.com

Key Highlights: Access to the a vast supply of imported and domestic species. Hardwood Logs, Saw logs, veneer logs we have them all available for domestic or export shipment!…

#5 Holt & Bugbee

Domain Est. 1997

Website: holtandbugbee.com

Key Highlights: Holt & Bugbee is a leading name in manufacturing and distribution of fine quality, domestic and imported hardwood and softwood lumber….

#6 Midwest Hardwood Company

Domain Est. 1998

Website: midwesthardwood.com

Key Highlights: Midwest Hardwood has a full gallery of professionally photographed packs of lumber. Packs are available to view in a variety of species and grades….

#7 Hardwoods Specialty Products

Domain Est. 1999

Website: hardwoods-inc.com

Key Highlights: Hardwoods Specialty Products has evolved into one of the largest architectural decor material suppliers in North America….

#8 National Hardwood Lumber Association

Domain Est. 1999

Website: nhla.com

Key Highlights: The National Hardwood Lumber Association (NHLA) supports the hardwood industry through membership, education, grading rules, and advocacy….

#9 Dakota Premium Hardwoods

Domain Est. 2007

Website: dakotahardwoods.com

Key Highlights: Hardwood lumber, plywood and custom cabinet products distributor for cabinetmaking, trim, furniture and woodworking industries….

#10

Domain Est. 2007

Website: allstateflooringdistributors.com

Key Highlights: All State Flooring Distributors is a wholesale distributor of Hardwood Flooring, Supplies, and other related products including, installation tools and ……

Expert Sourcing Insights for Hardwood Distributors

H2: Market Trends Shaping Hardwood Distribution in 2026

As the global economy evolves and consumer preferences shift, the hardwood distribution industry is undergoing significant transformation. By 2026, several key trends are expected to shape the market landscape for Hardwood Distributors, influencing sourcing strategies, supply chain operations, customer demands, and sustainability practices.

-

Increased Demand for Sustainable and Certified Hardwood

Environmental consciousness continues to rise among consumers and commercial buyers alike. By 2026, demand for hardwood sourced from sustainably managed forests—particularly products certified by the Forest Stewardship Council (FSC) or Programme for the Endorsement of Forest Certification (PEFC)—is projected to grow significantly. Hardwood distributors that can verify ethical sourcing and transparent supply chains will gain a competitive advantage, especially in eco-conscious markets such as North America and Western Europe. -

Resurgence in Domestic and Regional Sourcing

Geopolitical instability, trade restrictions, and post-pandemic supply chain disruptions have prompted a shift toward regionalization. By 2026, many hardwood distributors are expected to reduce reliance on overseas imports and instead strengthen partnerships with local and regional timber suppliers. In the U.S., for example, increased investment in Appalachian and Southern hardwood forests is enabling faster delivery times, lower carbon footprints, and more resilient supply chains. -

Growth in Premium and Exotic Hardwood Demand

Despite economic fluctuations, there remains strong demand for high-end hardwood species such as walnut, white oak, and exotic imports like teak and purpleheart. This trend is driven by luxury residential construction, boutique hospitality projects, and high-end furniture manufacturing. Hardwood distributors that diversify their portfolios to include rare or aesthetically unique species will be well-positioned to capture premium margins. -

Digital Transformation and E-Commerce Expansion

The hardwood distribution sector is embracing digital platforms to streamline ordering, inventory management, and customer engagement. By 2026, leading distributors are expected to offer integrated e-commerce portals with augmented reality (AR) tools for visualizing wood finishes, real-time inventory tracking, and AI-driven procurement recommendations. This digital shift improves customer experience and operational efficiency, especially for small contractors and DIY consumers. -

Labor Shortages and Automation in Processing

The wood products industry continues to face labor shortages, particularly in milling and logistics. In response, hardwood distributors are investing in automation and advanced manufacturing technologies. Automated sorting, CNC processing integration, and robotic material handling are expected to become more prevalent by 2026, improving throughput and consistency while reducing dependency on manual labor. -

Regulatory Pressures and Carbon Compliance

Environmental regulations are tightening globally, with increasing emphasis on carbon accounting, emissions reporting, and deforestation-free supply chains. By 2026, hardwood distributors will likely need to comply with stricter compliance standards, such as the EU’s Deforestation Regulation (EUDR). This will require enhanced traceability systems and digital documentation to prove the origin and legality of timber products. -

Volatility in Pricing and Supply Due to Climate Change

Climate-related events—such as prolonged droughts, wildfires, and pest infestations—are impacting hardwood yields in key producing regions. By 2026, these environmental stressors may lead to greater price volatility and supply constraints. Forward-thinking distributors are expected to adopt risk mitigation strategies, including diversified sourcing, long-term supplier contracts, and inventory buffering.

Conclusion

By 2026, the hardwood distribution market will be defined by sustainability, technology adoption, regional resilience, and adaptability. Hardwood distributors that proactively align with these trends—by investing in certification, digital infrastructure, automation, and supply chain transparency—will be best equipped to thrive in an increasingly competitive and regulated environment.

Common Pitfalls When Sourcing Hardwood Distributors (Quality & Intellectual Property)

Sourcing hardwood from distributors can streamline supply chains, but it comes with significant risks—particularly concerning material quality and intellectual property (IP) protection. Overlooking these pitfalls can lead to compromised product integrity, legal disputes, and reputational damage.

Inconsistent or Substandard Material Quality

One of the most frequent challenges is receiving hardwood that does not meet specified quality standards. Distributors may source from multiple mills with varying grading practices, leading to inconsistencies in grain, moisture content, color, and defect rates. Some may substitute lower-grade or different species without disclosure, especially when under pressure to fulfill orders. Without proper verification (e.g., third-party inspection or mill certifications), buyers risk incorporating defective wood into finished products, resulting in customer dissatisfaction and increased waste.

Misrepresentation of Wood Origin and Species

Distributors may inaccurately represent the geographic origin or botanical species of hardwood, either due to supply chain opacity or intentional mislabeling. This not only affects the aesthetic and structural performance of the wood but can also violate environmental regulations such as the Lacey Act (in the U.S.), which prohibits trade in illegally sourced timber. Buyers risk legal penalties and sustainability claims backlash if the wood is falsely advertised as “FSC-certified” or “sustainably harvested” without proper documentation.

Lack of Traceability and Chain-of-Custody Documentation

Many hardwood distributors fail to maintain robust traceability systems, making it difficult to verify the wood’s journey from forest to final product. This lack of chain-of-custody documentation undermines quality assurance efforts and complicates compliance with environmental and trade regulations. It also increases vulnerability to fraud, especially when dealing with premium or exotic hardwoods.

Intellectual Property Infringement Risks

When sourcing hardwood for custom designs or branded products, IP risks emerge if distributors or their suppliers use wood patterns, finishes, or engineered profiles protected by design patents or trademarks. Unauthorized replication of proprietary wood treatments or milling techniques can expose the buyer to infringement claims. Additionally, if a distributor supplies material used in counterfeit goods—even unknowingly—the brand owner may face legal liability and brand dilution.

Inadequate Contracts and Ambiguous Terms

Many sourcing agreements with hardwood distributors lack clear clauses on quality specifications, acceptable tolerances, IP warranties, and remedies for non-compliance. Without detailed contracts, buyers have limited recourse if delivered materials deviate from expectations or if IP conflicts arise. Ambiguity in ownership of custom tooling or design adaptations can also lead to disputes over who controls the IP for unique wood components.

Overreliance on Distributor Claims Without Verification

Buyers often accept distributor claims about quality, sustainability, or exclusivity at face value. This trust without verification—such as independent lab testing, site audits, or legal review of IP rights—can result in costly surprises. Due diligence is essential to validate both the physical attributes of the hardwood and the legal integrity of the sourcing relationship.

Conclusion

To mitigate these pitfalls, businesses should vet hardwood distributors thoroughly, demand transparent documentation, include enforceable quality and IP clauses in contracts, and conduct ongoing audits. Proactive risk management ensures both material excellence and legal compliance in hardwood sourcing.

Logistics & Compliance Guide for Hardwood Distributors

This guide outlines the essential logistics and compliance procedures for Hardwood Distributors to ensure efficient operations, regulatory adherence, and customer satisfaction. Adherence to these standards supports sustainable forestry, legal trade, and supply chain integrity.

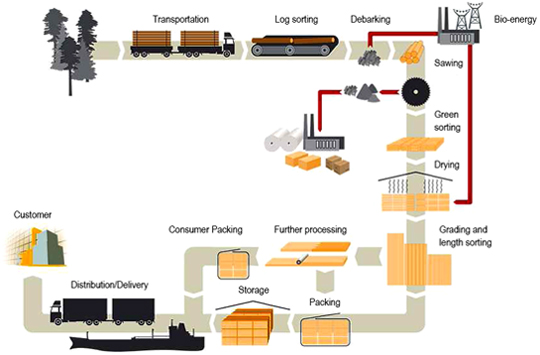

Supply Chain Management

Implement a transparent and traceable supply chain from forest to customer. Verify the origin of all hardwood materials and maintain documentation for each shipment, including supplier details, species, volume, and harvest location. Utilize a digital inventory management system to track stock levels, monitor product movement, and reduce lead times.

Sustainable Sourcing & Certification

Source hardwood exclusively from legally managed and sustainably harvested forests. Prioritize suppliers certified by recognized organizations such as the Forest Stewardship Council (FSC) or the Programme for the Endorsement of Forest Certification (PEFC). Maintain up-to-date certification records and provide chain-of-custody documentation upon request.

Import/Export Compliance

All international shipments must comply with relevant trade regulations, including the Lacey Act (USA), EU Timber Regulation (EUTR), and other local laws. Accurately complete customs documentation, including commercial invoices, bills of lading, and phytosanitary certificates where required. Conduct due diligence to confirm that timber is legally harvested and declare species using correct scientific and common names.

Transportation & Handling

Use appropriate transportation methods to prevent damage during transit. Secure loads properly and protect hardwood from moisture, sunlight, and contamination. Train staff and carriers in proper handling techniques to avoid warping, cracking, or surface defects. For long-distance or international shipments, consider climate-controlled containers when necessary.

Inventory Management & Storage

Store hardwood in dry, well-ventilated warehouse facilities with controlled humidity levels. Stack lumber using proper stickers for airflow and avoid direct ground contact. Segregate species and grades to minimize errors and expedite order fulfillment. Conduct regular inventory audits to ensure accuracy and identify potential spoilage or theft.

Regulatory Reporting & Recordkeeping

Maintain records for a minimum of five years, including purchase orders, shipping documents, certifications, compliance declarations, and audit reports. Be prepared to submit documentation to regulatory authorities upon request. Assign a compliance officer to oversee reporting obligations and stay updated on changes in trade or environmental laws.

Quality Assurance & Customer Compliance

Inspect all incoming and outgoing hardwood shipments for quality, dimensions, moisture content, and compliance with customer specifications. Provide customers with material certifications and compliance documentation as part of the delivery package. Address non-conformances promptly and implement corrective actions to prevent recurrence.

Environmental & Safety Compliance

Adhere to all local, state, and federal environmental regulations, including waste disposal, emissions, and chemical use (e.g., wood treatments). Ensure workplace safety in compliance with OSHA (or equivalent) standards, especially in sawing, handling, and storage operations. Conduct regular employee training on safety protocols and emergency procedures.

By following this guide, Hardwood Distributors will enhance operational efficiency, maintain legal compliance, support sustainable forestry, and build trust with customers and regulators.

In conclusion, sourcing hardwood distributors requires careful evaluation of several key factors including product quality, species availability, sustainability certifications, pricing, reliability, and geographic reach. Establishing relationships with reputable distributors who adhere to ethical sourcing practices and offer consistent supply chain performance is essential for long-term success. Additionally, leveraging both local and international suppliers can enhance flexibility and resilience in procurement. Conducting thorough due diligence, requesting samples, and reviewing customer feedback can help ensure the chosen distributor aligns with your project or business requirements. Ultimately, a strategic and well-informed approach to selecting hardwood distributors will support sustainable operations, maintain product integrity, and contribute to overall customer satisfaction.