The global hardwood lumber market continues to experience steady expansion, driven by rising demand in construction, furniture, and flooring industries. According to a 2023 report by Grand View Research, the global lumber market size was valued at USD 225.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. A significant segment of this demand is attributed to hardwood dimensional lumber, particularly the widely used 2x4s, which are integral to residential framing, DIY projects, and commercial builds. Fueled by sustainability trends and advancements in engineered wood products, North American and European manufacturers are leading innovation in quality, grading standards, and supply chain efficiency. As demand for durable, renewable building materials increases, identifying the top hardwood 2×4 manufacturers becomes critical for contractors, retailers, and procurement professionals seeking reliable, high-performance supply partners.

Top 10 Hardwood 2X4 Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Rex Lumber Company

Domain Est. 1998

Website: rexlumber.com

Key Highlights: Rex Lumber Company is one of the largest wholesale tropical and domestic hardwood distributors and custom moulding manufacturers on the Eastern Seaboard….

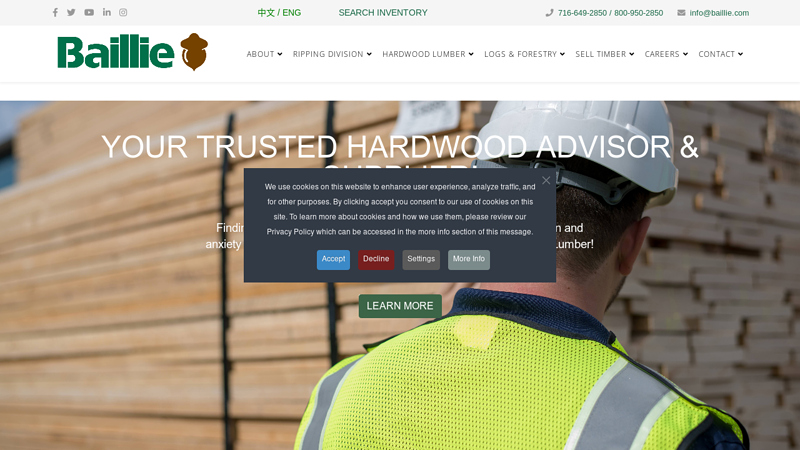

#2 North American Hardwood Lumber from Baillie

Domain Est. 1996

Website: baillie.com

Key Highlights: Quality hardwood lumber provided by Baillie Lumber Co. We work hard to provide hardwood lumber solutions that help your business succeed….

#3 84 Lumber: Lumber Yard

Domain Est. 1996

Website: 84lumber.com

Key Highlights: 84 Lumber is an industry leader in building supplies, manufactured components, and services for single- and multifamily residences and commercial buildings….

#4 Midwest Hardwood Company

Domain Est. 1998

Website: midwesthardwood.com

Key Highlights: Midwest Hardwood has a full gallery of professionally photographed packs of lumber. Packs are available to view in a variety of species and grades….

#5 Hardwoods Specialty Products

Domain Est. 1999

Website: hardwoods-inc.com

Key Highlights: Hardwoods is the recognized premier distributor of decorative architectural building products in North America. This includes an unmatched, integrated ……

#6 Lumber Yard

Domain Est. 2002

Website: peachstatelumber.com

Key Highlights: Located at 4000 Moon Station Rd NW Kennesaw, GA 30144, Peach State Lumber Products Inc specializes in lumber, hardwood products, softwoods and exotic wood….

#7 Hardwood Sparks, NV

Domain Est. 2002 | Founded: 1983

Website: mastercrafthardwood.com

Key Highlights: Your go-to source for hardwood, plywood, and custom moldings. Our family’s been serving the local community since 1983, providing premium lumber products….

#8 Baird Brothers Fine Hardwoods

Domain Est. 2002

Website: bairdbrothers.com

Key Highlights: Baird Brothers natural hardwood and accent parts, whether custom-designed or standard favorites, from timeless classics to the latest design trends….

#9

Domain Est. 2006

Website: clarkshardwood.com

Key Highlights: Leading Hardwood, Softwood & Trailer Decking supplier in greater Houston and beyond. At Clark’s Hardwood Lumber, we don’t just sell wood—we help you build ……

#10 General Hardwood Company

Domain Est. 2007

Website: generalhardwood.com

Key Highlights: We distribute domestic and imported hardwood, lumber, and plywood. our services. a history of. family, quality, & proficiency….

Expert Sourcing Insights for Hardwood 2X4

H2: Projected 2026 Market Trends for Hardwood 2×4 Lumber

As the construction, woodworking, and DIY sectors continue to evolve, the market for hardwood 2×4 lumber is expected to experience notable shifts by 2026. Driven by sustainability demands, supply chain dynamics, and changing consumer preferences, the following trends are anticipated to shape the hardwood 2×4 sector:

-

Increased Demand for Sustainable and Certified Hardwood

Environmental consciousness is projected to remain a dominant force in 2026. Consumers and builders are increasingly favoring hardwood sourced from responsibly managed forests, particularly those certified by organizations such as the Forest Stewardship Council (FSC) or the Sustainable Forestry Initiative (SFI). This trend will likely push suppliers to prioritize traceability and eco-friendly harvesting practices, increasing the premium on certified hardwood 2x4s. -

Rising Prices Due to Supply Constraints

Hardwood species such as oak, maple, and walnut grow more slowly than softwoods like pine, leading to tighter supply conditions. Combined with ongoing challenges in timber harvesting (e.g., labor shortages, regulatory restrictions, and climate-related disruptions), the availability of dimensionally standardized hardwood 2x4s is expected to remain limited. This constrained supply, coupled with steady demand in specialty construction and high-end furniture, will likely drive prices upward through 2026. -

Growth in Niche and Value-Added Applications

While softwood dominates structural framing, hardwood 2x4s are increasingly being used in non-structural, high-value applications such as exposed beams, interior framing for aesthetic finishes, custom cabinetry, and artisanal furniture. The trend toward luxury home builds and biophilic design will amplify demand for visually appealing, durable hardwood components, supporting a shift from commodity to specialty product positioning. -

Technological Advancements in Processing and Efficiency

Sawmills and distributors are investing in advanced kiln-drying, grading automation, and optimized cutting techniques to reduce waste and improve yield from hardwood logs. These innovations will help mitigate cost pressures and improve consistency in hardwood 2×4 dimensions and quality—critical factors for professional builders and precision-oriented industries. -

Regional Market Divergence

North America and Western Europe are expected to remain the primary markets for hardwood 2x4s, driven by robust residential remodeling and custom homebuilding sectors. In contrast, emerging markets may rely more on imported or substitute materials due to cost and availability. Regional supply chains will play a crucial role, with localized sourcing gaining favor to reduce transportation emissions and lead times. -

Competition from Engineered and Alternative Materials

While solid hardwood retains strong appeal for its natural beauty and durability, engineered wood products (e.g., laminated veneer lumber, cross-laminated timber) and composites may encroach on traditional hardwood applications. However, for visible architectural elements where authenticity matters, solid hardwood 2x4s are likely to maintain a competitive edge.

Conclusion:

By 2026, the hardwood 2×4 market will likely reflect a premium, specialized segment of the lumber industry—characterized by sustainability-driven sourcing, price volatility, and growth in high-end applications. Stakeholders who invest in certification, supply chain resilience, and value-added processing will be best positioned to capitalize on these evolving trends.

H2: Common Pitfalls When Sourcing Hardwood 2x4s (Quality and IP Concerns)

Sourcing hardwood 2x4s for construction or woodworking projects can present several challenges, particularly regarding material quality and intellectual property (IP) considerations in design applications. Below are key pitfalls to avoid:

1. Inconsistent Material Quality

Hardwood species vary significantly in density, grain pattern, and moisture content. Buyers often assume uniformity similar to softwood lumber, but hardwood 2x4s may exhibit warping, twisting, or checking if not properly dried. Sourcing from suppliers without proper kiln-drying certifications increases the risk of using unstable material that may degrade over time.

2. Misidentification of Species

Some suppliers may mislabel or substitute lower-grade hardwoods (e.g., poplar passed off as oak or maple). This not only affects structural integrity and aesthetics but can also violate project specifications. Always request species verification and consider third-party wood testing when authenticity is critical.

3. Lack of Grading Standards Compliance

Unlike softwoods, hardwoods are graded differently (e.g., NHLA standards), and not all suppliers adhere strictly to these. Purchasing “premium” grade without documentation may result in boards with excessive knots, sapwood, or other defects unsuitable for fine woodworking or visible structural applications.

4. Moisture Content Issues

Hardwood 2x4s with high moisture content can shrink, crack, or warp after installation. Ensure the lumber has been acclimated and tested to an appropriate moisture level (typically 6–8% for indoor use) to prevent long-term performance issues.

5. Intellectual Property Risks in Design Applications

When using hardwood 2x4s in custom furniture or architectural millwork, designers may inadvertently replicate patented or copyrighted designs (e.g., unique joinery systems, proprietary furniture designs). This poses IP infringement risks, especially if the final product is commercialized. Always conduct due diligence on design elements and, when necessary, consult legal counsel.

6. Sustainability and Certification Gaps

Many hardwoods come from slow-growing trees, and unethical sourcing can lead to deforestation. Failing to verify certifications like FSC (Forest Stewardship Council) or PEFC may result in reputational damage or non-compliance with green building standards (e.g., LEED).

7. Limited Availability and Long Lead Times

Hardwood 2x4s are less standardized than softwoods and may require special ordering. Delays can disrupt project timelines, especially with exotic or sustainably harvested species. Always confirm lead times and have backup material plans.

To mitigate these risks, work with reputable suppliers, request documentation (grading, moisture reports, chain-of-custody), and ensure alignment between material specs and project requirements—both structurally and legally.

H2: Logistics & Compliance Guide for Hardwood 2×4 Lumber

Transporting and processing hardwood 2×4 lumber requires strict adherence to logistics best practices and regulatory compliance to ensure product integrity, safety, and legal operation. This guide outlines key considerations for handling, shipping, documentation, and regulatory requirements specific to hardwood 2x4s.

1. Material Handling & Storage

- Moisture Control: Store lumber in a dry, well-ventilated area with moisture content ideally between 6–8% to prevent warping, checking, or mold. Use moisture meters to verify MC before shipment.

- Stacking: Use stickers (spacers) between layers for airflow. Limit stack height to prevent crushing (typically no more than 6–7 feet). Ensure even support across the entire length.

- Protection: Cover with breathable tarp or store indoors to avoid direct exposure to rain and sun. Avoid plastic wraps that trap moisture.

- Forklift Use: Use appropriate lifting slings or lumber clamps to prevent damage during handling.

2. Packaging & Unit Load

- Banding: Secure bundles with steel or composite strapping. Minimum of 3 bands per 8-foot bundle; more for longer lengths.

- Labeling: Clearly mark bundles with species, grade, dimensions (e.g., “Hard Maple – Select & Better – 2x4x8”), moisture content, and mill identification.

- Palletization: Use sturdy, ISO-compliant pallets. Max load: ~4,000 lbs per standard pallet to prevent collapse during transport.

- Dunnage: Use dunnage between layers when stacking pallets in containers or trailers to prevent crushing.

3. Transportation

- Trucking (Domestic):

- Use flatbed or dry van trailers with side rails.

- Secure loads with ratchet straps or load bars to prevent shifting.

- Comply with FMCSA weight limits (80,000 lbs gross vehicle weight on U.S. interstate).

- Container Shipping (International):

- Use 20’ or 40’ dry containers.

- Max container payload: ~28,000 kg (40’ HC).

- Ensure proper dunnage and blocking to prevent movement during transit.

- Monitor humidity to minimize moisture-related damage.

4. Regulatory Compliance

- Lacey Act (U.S.):

- Requires declaration of species and country of harvest.

- Prohibits trade in illegally sourced wood.

- Maintain chain-of-custody documentation (invoices, harvest permits, mill certifications).

- ISPM 15 (International):

- Wood packaging material (pallets, dunnage) must be heat-treated and stamped with official ISPM 15 mark.

- Kiln-dried lumber itself is not subject to ISPM 15, but packaging is.

- Customs & Duties:

- Provide accurate HS Code (e.g., 4407.29 for sawn tropical hardwood, 4407.99 for non-tropical).

- Submit commercial invoice, packing list, bill of lading, and phytosanitary certificate (if required).

- Be aware of anti-dumping or countervailing duties on certain imported hardwoods.

5. Sustainability & Certification

- FSC® or PEFC Certification: Required by many retailers and public projects.

- Maintain certification chain-of-custody (CoC) documentation.

- Label certified products accordingly.

- Carbon Footprint: Optimize shipping routes and consolidate loads to minimize emissions.

6. Quality Assurance

- Pre-Shipment Inspection:

- Verify dimensions, grade, moisture content, and absence of defects (knots, wane, splits).

- Use NHLA (National Hardwood Lumber Association) grading rules for U.S. hardwoods.

- Documentation:

- Provide mill certificate, grading report, moisture content report, and Lacey Act declaration.

7. Risk Mitigation

- Insurance: Cover cargo for damage, theft, and delays.

- Incoterms®: Clearly define responsibilities (e.g., FOB, CIF, DDP) in contracts.

- Traceability: Implement batch tracking from harvest to delivery.

By following this H2-compliant logistics and compliance framework, suppliers and distributors can ensure efficient, legal, and sustainable movement of hardwood 2×4 lumber across domestic and international markets.

In conclusion, sourcing hardwood 2×4 lumber requires careful consideration of availability, cost, project requirements, and sustainability. While hardwood 2x4s are less common than softwood options like pine or fir, they offer superior strength, durability, and aesthetic appeal for specialized applications such as fine woodworking, furniture framing, or decorative structures. Due to their limited standardization and higher price point, sourcing should involve reliable suppliers, local mills, or specialty lumberyards that can provide consistent quality and appropriate wood species such as oak, maple, or ash. Additionally, verifying moisture content and grading standards ensures optimal performance and longevity. When hardwood 2x4s are not readily available, alternatives like glue-laminating dimensional hardwood stock or custom milling may be viable solutions. Ultimately, successful sourcing balances material properties with practical constraints, ensuring the right choice for both structural integrity and design intent.