The global laser cleaning market, driven by increasing demand for eco-friendly and precision surface treatment solutions, is projected to grow at a CAGR of 11.8% from 2023 to 2028, according to Mordor Intelligence. A key segment within this expansion is handheld rust removal lasers, which are gaining traction across automotive, aerospace, and industrial maintenance sectors due to their efficiency, safety, and reduced environmental impact compared to traditional methods like sandblasting or chemical treatments. With the rising adoption of portable laser systems, manufacturers are investing heavily in compact, user-friendly designs offering high power density and real-time control. As industries prioritize sustainable operations and regulatory compliance, the demand for handheld laser rust removal equipment is expected to accelerate. This growth has led to a competitive landscape of innovators focused on performance, durability, and ease of integration. Based on market presence, technological capabilities, and product scalability, the following nine companies have emerged as leading manufacturers in the handheld rust removal laser space.

Top 9 Handheld Rust Removal Laser Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 P-laser Industrial laser cleaning

Website: p-laser.com

Key Highlights: Clean smarter with laser light. Fully cleaning rust of machine parts with the help of laser cleaning. WHY LASER CLEANING? Embrace the future of sustainable ……

#2 SFX Laser

Website: sfxlaser.com

Key Highlights: SFX Laser is a 20+ years professional laser equipment manufacturer including laser cleaning machine, laser welding machine, fiber laser engraver, ……

#3 Laser Cleaning Machine Manufacturer

Website: hantencnc.com

Key Highlights: HANTENCNC is a professional laser cleaning machine manufacturer with over 20 years of experience. We offer a wide range of laser cleaners, from 100W to 3000W….

#4 Clean Laser Systems

Website: cleanlaser.de

Key Highlights: IPG | cleanLASER has been developing and producing high-precision laser systems for cleaning and industrial surface treatment for more than 20 years….

#5 Handheld Laser Cleaning Machines

Website: ipgphotonics.com

Key Highlights: Handheld and portable laser cleaning machines designed for manual applications including rust removal, paint stripping, restoration, and more….

#6 Handheld Laser Cleaning Systems

Website: laserphotonics.com

Key Highlights: Utilize this laser cleaning machine for rust removal and coating removal, decontamination, degreasing, pre- and post-weld surface preparation, and texturing….

#7 Laser Rust Removal

Website: powerlase-limited.com

Key Highlights: Watch this super fast rust removal from carbon steel panel with the new ultra-lightweight Vulcan handheld from Powerlase. The nature of laser cleaning ……

#8 ZAC Laser Machine

Founded: 2004

Website: zaclaser.com

Key Highlights: ZAC laser is the professional manufacture since 2004 which sell many laser machines such as laser rust removal-laser cleaning machine, laser engraver-laser ……

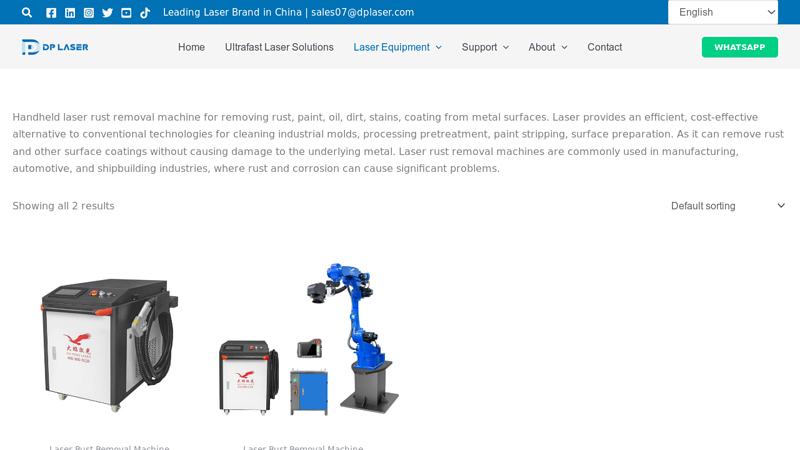

#9 Laser Rust Removal Machine

Website: dplaser.com

Key Highlights: Handheld laser rust removal machine for removing rust, paint, oil, dirt, stains, coating from metal surfaces. Laser provides an efficient, cost-effective ……

Expert Sourcing Insights for Handheld Rust Removal Laser

H2: Market Trends for Handheld Rust Removal Laser in 2026

By 2026, the global market for handheld rust removal lasers is poised for significant transformation, driven by technological advancements, expanding industrial demand, and growing environmental awareness. Key trends shaping the H2 2026 landscape include:

1. Accelerated Technological Innovation and Performance Enhancement

Laser systems are expected to feature higher average power outputs (potentially 1,500W–3,000W+), enabling faster rust removal on thicker coatings and larger surfaces. Advances in beam shaping, real-time monitoring, and AI-driven process control will improve precision, reduce operator skill requirements, and ensure consistent results. Integration with IoT for remote diagnostics and performance tracking will become standard, enhancing equipment uptime and maintenance planning.

2. Expansion into New Industrial Sectors

While the maritime and automotive industries remain core markets, broader adoption is anticipated in aerospace (for composite and aluminum surface prep), energy (oil & gas infrastructure, wind turbines), rail transport, and heritage restoration. As costs decline and usability improves, SMEs and field service contractors will increasingly adopt handheld lasers as a cost-effective alternative to abrasive blasting.

3. Growing Emphasis on Sustainability and Regulatory Compliance

With tightening environmental regulations globally, the non-chemical, waste-minimizing nature of laser rust removal will drive demand. Unlike sandblasting or chemical stripping, lasers produce minimal secondary waste (only vaporized rust particles, easily captured with filtration), eliminating hazardous runoff and disposal issues. This eco-friendly profile will be a major selling point, especially in environmentally sensitive regions.

4. Competitive Market Dynamics and Price Erosion

Increased competition from new entrants—particularly in China and Europe—will lead to price reductions and diversified product offerings. This will improve affordability and accessibility, especially for smaller operators. However, differentiation will increasingly rely on software features, durability, after-sales support, and integration capabilities (e.g., with robotic arms or automation platforms).

5. Advancement in Safety and Usability Standards

By H2 2026, improved safety protocols, ergonomic designs, and user-friendly interfaces will be standard. Expect wider adoption of integrated fume extraction systems, real-time safety sensors, and augmented reality (AR) guidance to assist operators. Certification standards (e.g., ISO, IEC) for handheld laser tools will mature, fostering greater trust and regulatory acceptance.

6. Rising Demand in Emerging Markets

Infrastructure development in Asia-Pacific, Latin America, and the Middle East will fuel demand for efficient maintenance tools. Handheld lasers offer logistical advantages in remote or hard-to-reach locations, making them attractive for offshore platforms, pipelines, and rural infrastructure projects.

In conclusion, H2 2026 will mark a pivotal phase in the maturation of the handheld rust removal laser market. The convergence of performance gains, cost reductions, and environmental imperatives will accelerate adoption across diverse industries, positioning laser-based surface preparation as a mainstream solution in industrial maintenance and restoration.

Common Pitfalls When Sourcing Handheld Rust Removal Lasers (Quality and Intellectual Property)

Sourcing handheld rust removal laser systems can offer significant advantages in terms of efficiency and precision. However, buyers—especially those new to laser cleaning technology—often encounter pitfalls related to product quality and intellectual property (IP) risks. Being aware of these challenges helps ensure a reliable, legal, and cost-effective procurement process.

Poor Build Quality and Inconsistent Performance

Many low-cost suppliers, particularly from regions with less stringent manufacturing standards, offer handheld rust removal lasers that appear technically compliant on paper but underperform in real-world applications. Common issues include overheating, unstable laser output, and premature component failure. These problems often stem from substandard materials, inadequate thermal management, and lack of rigorous quality control. Buyers may end up with devices that require frequent maintenance or fail entirely after minimal use.

Misleading Technical Specifications

Some suppliers exaggerate key performance metrics such as laser power (e.g., labeling a 50W laser as “effective 100W”), pulse frequency, or cleaning speed. These inflated claims can mislead buyers into purchasing systems that lack the power needed for industrial applications. It’s essential to verify specifications through third-party testing or independent reviews and request demo units before committing to large orders.

Lack of Safety Certifications and Compliance

Handheld laser devices must comply with international safety standards such as IEC 60825 (laser safety) and CE, FCC, or RoHS certifications. Some suppliers omit or falsify these certifications, exposing buyers to legal liability and safety risks. Always request valid certification documents and verify their authenticity through official databases or third-party inspection services.

Inadequate After-Sales Support and Warranty

Many suppliers, especially smaller or online-based manufacturers, offer limited technical support, spare parts availability, or warranty coverage. This can result in extended downtime and high repair costs. Before sourcing, evaluate the supplier’s service network, response time, and availability of local support or authorized service centers.

Intellectual Property Infringement Risks

A significant concern when sourcing from certain markets is the risk of IP violations. Some handheld laser systems may incorporate patented technologies—such as beam delivery mechanisms, control software, or ergonomic designs—without proper licensing. Purchasing such products can expose your business to legal action, import seizures, or reputational damage. Conduct due diligence by reviewing patent databases and requiring suppliers to confirm IP compliance in writing.

Insufficient Training and Documentation

Effective use of handheld laser rust removal systems requires proper training and comprehensive user manuals. Some suppliers provide minimal or poorly translated documentation, increasing the risk of improper operation and accidents. Ensure that the supplier offers detailed operational guides, safety protocols, and training materials—preferably in your local language.

Conclusion

To avoid these pitfalls, conduct thorough supplier vetting, request product demonstrations, verify certifications, and consult legal experts regarding IP concerns. Investing time upfront in due diligence can prevent costly mistakes and ensure long-term reliability and compliance.

Logistics & Compliance Guide for Handheld Rust Removal Laser

Product Classification and Regulatory Overview

Handheld rust removal lasers fall under industrial laser equipment and are subject to international and regional regulations concerning laser safety, electrical standards, and environmental compliance. Proper classification ensures adherence to shipping, import/export, and operational requirements.

Laser Safety Standards (IEC 60825-1)

These devices must comply with the IEC 60825-1 standard for laser product safety. Key requirements include:

– Laser classification (typically Class 4 for industrial rust removal lasers).

– Mandatory safety labeling with warning symbols and output specifications.

– Incorporation of safety features such as key switches, emission indicators, and emergency stop functions.

– Provision of user training materials and laser safety goggles rated for the laser’s wavelength and power.

Electrical and EMC Compliance

Handheld laser units must meet electrical safety and electromagnetic compatibility (EMC) standards in target markets:

– EU: CE marking under the Low Voltage Directive (LVD) and Electromagnetic Compatibility Directive (EMCD).

– USA: FCC Part 15 compliance for electromagnetic emissions.

– Other Regions: KC (South Korea), PSE (Japan), or CCC (China) as applicable.

Ensure power supply units are certified to local voltage and plug standards.

Transport and Shipping Regulations

Due to their laser and battery components, these devices are subject to specific shipping rules:

– Lithium Batteries: If the unit includes rechargeable lithium batteries, comply with IATA Dangerous Goods Regulations (DGR) for air transport. Batteries must be protected from short circuits and packed per UN 38.3 testing standards.

– Laser Equipment: Declare as laser devices during customs clearance. Some carriers may require additional documentation or labeling.

– Packaging: Use shock-resistant, anti-static packaging with clear hazard and handling labels.

Import/Export Documentation

Ensure all shipments include:

– Commercial invoice detailing product description, value, and Harmonized System (HS) code (e.g., 8543.70 for laser systems).

– Packing list and bill of lading/air waybill.

– Certificate of Conformity (CoC) for relevant standards (e.g., CE, FCC).

– Laser safety compliance report or test certificate.

Verify export controls; some high-power lasers may require licenses under dual-use regulations (e.g., EU Dual-Use Regulation or U.S. EAR).

Environmental and RoHS Compliance

The device must comply with environmental directives:

– EU RoHS Directive: Restricts hazardous substances such as lead, mercury, and cadmium.

– WEEE Directive: Requires take-back and recycling provisions for electronic waste.

Provide compliance declarations and ensure markings are visible on product and packaging.

User Documentation and Training

Suppliers must provide:

– Multilingual user manuals including safety instructions, operational procedures, and maintenance guidelines.

– Laser safety training modules or access to certified training programs.

– Declaration of Conformity (DoC) listing applicable standards.

– Warranty and service support information.

Country-Specific Considerations

Regulatory requirements vary by market:

– USA: FDA/CDRH registration for laser products. Submit laser product reports and comply with variance requirements if applicable.

– Canada: Health Canada laser safety compliance under the Radiation Emitting Devices Act (REDA).

– Australia: Comply with ARPANSA laser safety standards and obtain RCM marking.

– China: CCC certification may be required; local testing through CNAS-accredited labs.

Maintenance and Service Logistics

Plan for:

– Availability of spare parts and service centers in key regions.

– Calibration and safety re-certification schedules.

– Return logistics for repairs, including customs documentation for cross-border servicing.

Summary and Best Practices

To ensure smooth logistics and compliance:

1. Verify all certifications before entering a new market.

2. Partner with experienced freight forwarders familiar with laser and battery shipments.

3. Maintain up-to-date technical files and conformity documentation.

4. Train distributors and end-users on safety and regulatory requirements.

5. Monitor regulatory changes in target regions regularly.

Adhering to this guide minimizes delays, avoids penalties, and ensures safe and legal operation of handheld rust removal lasers worldwide.

Conclusion: Sourcing a Handheld Rust Removal Laser

In conclusion, sourcing a handheld laser rust removal system represents a strategic investment in efficiency, precision, and sustainability for industrial maintenance, restoration, and manufacturing operations. As traditional abrasive and chemical methods face increasing regulatory and environmental scrutiny, laser cleaning technology offers a non-contact, eco-friendly alternative that minimizes waste, reduces worker health risks, and preserves substrate integrity.

When sourcing such equipment, it is essential to evaluate key factors including laser power (typically 100W–2000W), portability, duty cycle, safety certifications, and ease of use. Selecting a reputable supplier with technical support, training, and warranty offerings ensures long-term reliability and operational success. While the initial cost may be higher than conventional tools, the long-term savings in labor, consumables, and downtime often justify the investment.

Ultimately, adopting a handheld laser for rust removal not only enhances cleaning performance but also aligns with modern demands for cleaner, smarter, and safer industrial practices. As the technology becomes more accessible and cost-effective, integrating laser rust removal into maintenance workflows positions organizations at the forefront of innovation and sustainability.