The global car care products market, driven by rising vehicle ownership and increasing consumer emphasis on vehicle aesthetics, is projected to grow at a CAGR of 4.8% from 2023 to 2028, according to Mordor Intelligence. Within this expanding segment, hand wax—a staple in both consumer and professional detailing—has seen consistent demand due to its effectiveness in enhancing paint protection and shine. As the aftermarket automotive care industry gains momentum, particularly in emerging economies, competition among manufacturers has intensified. Technological advancements in synthetic polymers and eco-friendly formulations are further reshaping product offerings. Based on market presence, innovation, product range, and global distribution, the following seven companies have emerged as leading hand wax manufacturers, shaping the future of automotive surface care.

Top 7 Hand Wax Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

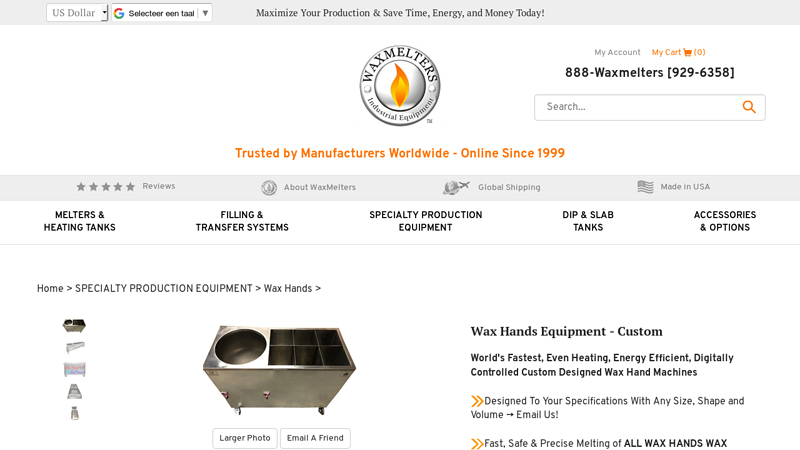

#1 Wax Hands Equipment

Domain Est. 1999

Website: waxmelters.com

Key Highlights: 20-day returnsWorld’s fastest, even heating, energy efficient, digitally controlled custom designed wax hand machines designed to your specifications with any size, shape ……

#2 Wax Hand Event Services and Machine Sales

Domain Est. 2000

Website: waxhand.com

Key Highlights: Wax Hands is fun for all ages and is 100% safe. We create customized and colorful wax molds of your hands or baby’s feet on the spot! We specialize in events ……

#3 Hands of Wax Machines

Domain Est. 2000

Website: coogarproducts.com

Key Highlights: Hands of wax machines capture any hand position to create amazing keepsakes and memorable experiences. Find the right wax hand machine for your next event!…

#4 Wax Hands

Domain Est. 2009

#5 Otter Wax

Domain Est. 2011

Website: otterwax.com

Key Highlights: Otter Wax makes all-natural, small-batch fabric and leather care products in Portland, Oregon. No petroleum, no synthetics—just effective, eco-friendly ……

#6 All

Domain Est. 2015

Website: makersofwaxgoods.com

Key Highlights: Free delivery over $50 7-day returns…

#7 Nightshift Wax Co.

Domain Est. 2015

Website: nightshiftwaxcompany.com

Key Highlights: Free delivery over $50 14-day returns100% Paraffin free. Hand-poured small batch soy candles and home fragrance made with all natural ingredients….

Expert Sourcing Insights for Hand Wax

H2: Projected Market Trends for Hand Wax in 2026

The global hand wax market is anticipated to experience steady growth by 2026, driven by increasing consumer focus on personal grooming, hygiene, and aesthetic appeal. As part of the broader personal care and beauty industry, hand wax—which includes waxes used for hand care treatments such as cuticle conditioning, skin smoothing, and professional salon applications—is evolving in response to shifting consumer preferences and technological advancements.

One of the dominant trends shaping the 2026 hand wax market is the rising demand for natural and organic formulations. Consumers are increasingly scrutinizing product ingredients, favoring hand wax products free from parabens, synthetic fragrances, and petroleum-based compounds. Brands are responding by launching plant-based, vegan, and cruelty-free wax solutions, often enriched with shea butter, beeswax, and essential oils to enhance moisturization and skin compatibility.

Another key trend is the expansion of at-home hand care products. With the continued popularity of DIY beauty routines post-pandemic, manufacturers are developing user-friendly hand wax kits that mimic professional treatments. These kits often include low-temperature waxes, ergonomic applicators, and aftercare balms, targeting convenience-seeking consumers who prioritize salon-quality results at home.

The professional salon and spa sector also remains a significant driver of demand. Estheticians are adopting advanced waxing technologies, such as microwave-safe and stripless waxes tailored for sensitive hand skin, to improve client comfort and efficiency. Additionally, the integration of hand waxing into comprehensive hand rejuvenation treatments—including exfoliation and anti-aging serums—is enhancing service value and boosting market growth.

Regionally, North America and Europe are expected to maintain strong market positions due to high beauty consciousness and established spa cultures. Meanwhile, the Asia-Pacific region is projected to witness the fastest growth, fueled by rising disposable incomes, urbanization, and growing awareness of personal grooming in countries like India, China, and South Korea.

Sustainability is also emerging as a critical factor. By 2026, eco-conscious packaging—such as recyclable containers and reduced plastic use—is becoming a competitive differentiator. Brands are investing in green supply chains and transparent labeling to appeal to environmentally aware consumers.

In summary, the 2026 hand wax market is characterized by innovation in formulation, increased accessibility through at-home solutions, and a strong emphasis on natural ingredients and sustainability. These H2 trends indicate a maturing market that aligns closely with broader shifts in consumer behavior toward wellness, convenience, and environmental responsibility.

H2. Common Pitfalls When Sourcing Hand Wax: Quality and Intellectual Property Issues

Sourcing hand wax, whether for industrial, automotive, or cosmetic applications, involves several potential pitfalls—particularly concerning product quality and intellectual property (IP) rights. Overlooking these factors can lead to supply chain disruptions, legal liabilities, and damage to brand reputation.

1. Inconsistent Product Quality

A major challenge when sourcing hand wax is ensuring consistent quality across batches. Suppliers—especially those in low-cost regions—may use substandard raw materials or vary formulations to cut costs. This can result in poor performance (e.g., inadequate protection, uneven finish, or skin irritation), leading to customer dissatisfaction and returns.

2. Lack of Transparency in Ingredients

Some suppliers may not fully disclose the composition of their hand wax, hiding the use of harmful chemicals (e.g., solvents, silicones, or allergens). This lack of transparency can lead to compliance issues with safety regulations (e.g., REACH, FDA, or EU Cosmetics Regulation) and pose health risks.

3. Misrepresentation of Natural or Organic Claims

Many buyers seek “natural” or “organic” hand waxes, but suppliers may exaggerate or falsify these claims. Without proper certifications (e.g., COSMOS, ECOCERT), such assertions can mislead consumers and expose the buyer to regulatory penalties and reputational damage.

4. Intellectual Property Infringement

Sourcing hand wax formulas from third-party manufacturers carries the risk of IP violations. Some suppliers may offer formulations that closely mimic patented or branded products, potentially exposing the buyer to legal action. Additionally, if the supplier retains ownership of the formulation, it could limit exclusivity and lead to unauthorized distribution.

5. Unprotected Custom Formulations

When developing a proprietary hand wax blend, failing to secure IP rights (e.g., through trade secrets, patents, or licensing agreements) can allow the manufacturer to replicate and sell the formula to competitors. Clear contractual agreements are essential to protect innovation and maintain market differentiation.

6. Supplier Reliability and Scalability

Low-cost suppliers may lack the infrastructure to maintain consistent quality at scale. Sudden changes in production processes or raw material sourcing can affect product stability and performance, especially during high-demand periods.

To mitigate these risks, buyers should conduct thorough due diligence—requesting material safety data sheets (MSDS), certificates of analysis (CoA), and third-party testing—while establishing strong legal agreements that address quality standards and IP ownership.

Logistics & Compliance Guide for Hand Wax

Product Classification & Regulatory Overview

Hand wax, typically a cosmetic product designed to soften and protect the skin, is subject to regulatory oversight depending on its ingredients, claims, and intended use. In most jurisdictions, including the United States (FDA), European Union (EU), and Canada (Health Canada), hand wax is classified as a cosmetic. This classification dictates labeling, ingredient disclosure, and manufacturing requirements. If the product makes therapeutic claims (e.g., “treats eczema” or “medicated”), it may be reclassified as an over-the-counter (OTC) drug, triggering additional regulatory scrutiny.

International Shipping & Transportation

When shipping hand wax globally, compliance with international transport regulations is essential. Most hand wax formulations are non-hazardous and do not require hazardous materials (hazmat) labeling under IATA, IMDG, or ADR regulations—provided they do not contain flammable solvents or pressurized components. However, formulations containing alcohol or essential oils above certain thresholds may be subject to restrictions. Always conduct a hazard classification assessment and include Safety Data Sheets (SDS) with shipments. Use leak-proof, tamper-evident packaging to prevent spills and ensure container integrity during transit.

Labeling & Packaging Requirements

All hand wax products must comply with regional labeling laws. In the EU, Regulation (EC) No 1223/2009 mandates the inclusion of: product name, nominal content, best-before date or period-after-opening symbol (if applicable), manufacturer or responsible person details, batch number, function of the product, and a full ingredient list in INCI (International Nomenclature of Cosmetic Ingredients) format. In the U.S., FDA 21 CFR Part 701 requires similar information, including ingredient declaration in descending order of predominance. Avoid unsubstantiated claims such as “dermatologist-tested” without proper substantiation.

Ingredient Compliance & Restrictions

Ensure all raw materials used in hand wax formulations comply with applicable regulations. The EU maintains a positive and negative list of permitted ingredients under Annexes IV–VI of the EU Cosmetics Regulation; substances like certain parabens, formaldehyde-releasers, and specific fragrances may be restricted or banned. In the U.S., the FDA prohibits or restricts ingredients such as chloroform and mercury compounds. Verify that all suppliers provide Certificates of Analysis (CoA) and confirm compliance with REACH (EU) and TSCA (U.S.) chemical inventories.

Manufacturing & Good Manufacturing Practices (GMP)

Manufacturing facilities producing hand wax must adhere to Good Manufacturing Practices (GMP) as defined by ISO 22716 (internationally recognized) or regional standards such as the EU’s GMP guidelines. This includes maintaining clean production environments, validating processes, conducting microbial and stability testing, and ensuring traceability through batch records. Facilities must be registered with relevant authorities (e.g., FDA facility registration in the U.S.) and undergo periodic audits.

Import/Export Documentation

For cross-border trade, compile accurate import/export documentation, including commercial invoices, packing lists, and certificates of origin. The Harmonized System (HS) code for hand wax typically falls under 3304.99 (“Beauty or make-up preparations and preparations for the care of the skin… other”). Confirm the exact code with local customs authorities, as misclassification can result in delays or penalties. In the EU, a Responsible Person (RP) must be designated to ensure market compliance and maintain a Product Information File (PIF).

Environmental & Sustainability Considerations

Increasingly, logistics and compliance must account for environmental regulations. Packaging should comply with Extended Producer Responsibility (EPR) schemes in countries such as Germany (LUCID), France (ADEME), and others. Use recyclable materials where possible and provide proper disposal instructions on packaging. Avoid microplastics (e.g., polyethylene beads), which are banned in rinse-off cosmetics in several regions and under scrutiny in leave-on products.

Product Testing & Safety Assessment

Prior to market release, hand wax must undergo safety assessment by a qualified cosmetic safety assessor (required under EU law). The assessment evaluates ingredient safety, exposure levels, and potential for irritation or sensitization. Stability testing (typically 3–6 months at elevated temperatures) and challenge testing (to ensure preservative efficacy) are critical. Retain all test reports and assessments for regulatory inspection.

Recordkeeping & Incident Reporting

Maintain comprehensive records for a minimum of 10 years post-market (EU requirement) or as per local laws. Records should include formulation data, batch records, supplier CoAs, safety assessments, and consumer complaints. In the EU, serious undesirable effects must be reported to the CPNP (Cosmetic Products Notification Portal) and relevant authorities within 15 days. In the U.S., adverse events should be documented and reported if they meet FDA reporting criteria.

Market-Specific Compliance Highlights

- United States (FDA): Register facility, list product, monitor adverse events; no pre-market approval for cosmetics.

- European Union: Notify via CPNP, appoint Responsible Person, comply with ingredient bans and labeling rules.

- Canada (Health Canada): Submit Cosmetic Notification Form (CNF), comply with Cosmetic Regulations under the Food and Drugs Act.

- UK (post-Brexit): Use the UK CPNP, designate a UK Responsible Person, follow GB cosmetic regulations.

Ensure ongoing monitoring of regulatory updates in all target markets to maintain compliance and avoid penalties or product recalls.

In conclusion, sourcing hand wax requires careful consideration of quality, sustainability, cost, and supplier reliability. It is essential to partner with reputable suppliers who adhere to industry standards and provide consistent product specifications. Evaluating factors such as ingredient transparency, packaging, certifications (e.g., organic, cruelty-free), and environmental impact ensures that the chosen hand wax meets both consumer expectations and brand values. Additionally, maintaining strong supplier relationships and conducting regular quality assessments will support long-term success and market competitiveness. Ultimately, a strategic and informed sourcing approach will help deliver a high-performing hand wax that satisfies customer needs while aligning with business objectives.