The global handheld cutting laser market is experiencing robust growth, driven by rising demand for precision tools in metal fabrication, construction, and automotive repair. According to Grand View Research, the global laser cutting equipment market was valued at USD 9.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. A key contributor to this trend is the increasing adoption of portable, handheld laser systems that offer enhanced maneuverability and efficiency over traditional fixed-format machines. Mordor Intelligence further projects the laser processing equipment market to grow at a CAGR of over 6.8% during the forecast period 2023–2028, citing advancements in fiber laser technology and growing industrial automation as primary catalysts. As industries shift toward lightweight, high-precision tools, manufacturers specializing in handheld cutting lasers are emerging as critical players in modern manufacturing ecosystems. This increasing demand has led to a surge in innovation, setting the stage for the top 10 handheld cutting laser manufacturers leading the charge in performance, reliability, and technological advancement.

Top 10 Hand Held Cutting Laser Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

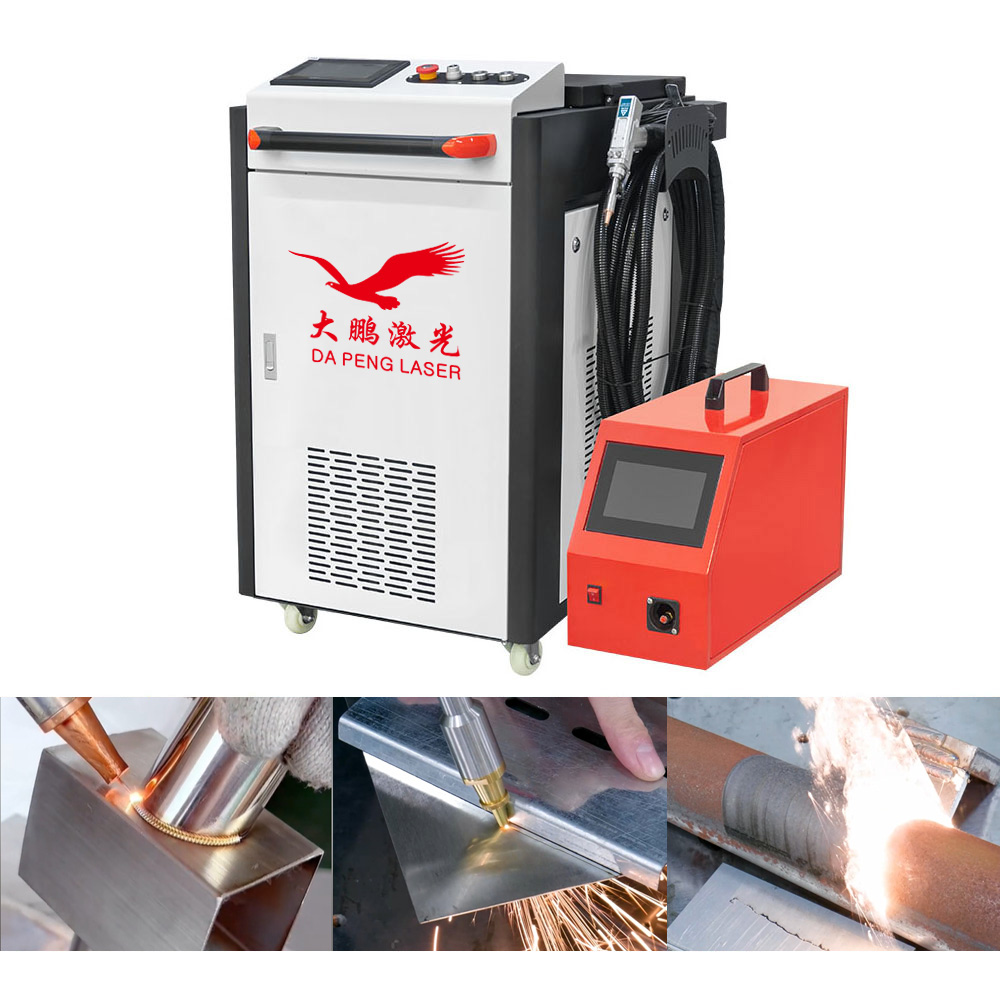

#1 Laser Machine – Laser Equipment Manufacturer

Website: dplaser.com

Key Highlights: DPLASER is a leading manufacturer & factory of industrial laser welding, laser cutting, laser marking and laser cleaning machines….

#2 Laser Photonics

Website: laserphotonics.com

Key Highlights: Laser Photonics manufactures reliable, safe, and eco-friendly Laser Cleaning, Laser Cutting, Laser Engraving, Laser Marking, and Laser Welding solutions….

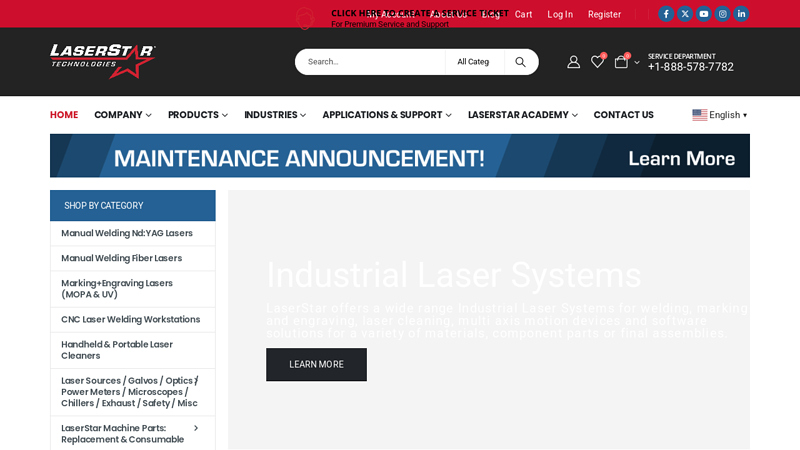

#3 LaserStar Technologies

Website: laserstar.net

Key Highlights: LaserStar Technologies designs and manufactures high-performance laser welding, marking, and cutting systems for industrial, jewelry, ……

#4 Wattsan

Website: wattsan.com

Key Highlights: Wattsan is a manufacturer of laser and cnc milling machines of European quality at affordable prices with worldwide delivery….

#5 Bodor

Website: bodor.com

Key Highlights: Bodor laser is a fiber laser cutting machine manufacturer specialized in cnc fiber laser cutting machine equipment with integrating development, production, ……

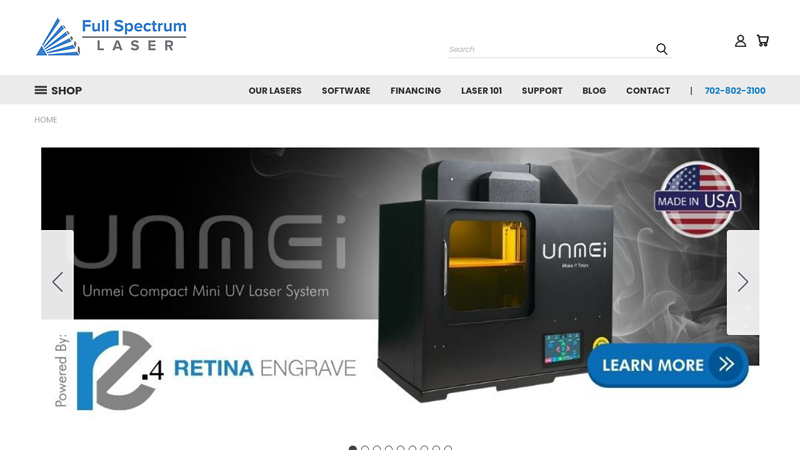

#6 Full Spectrum Laser

#7 Fiber laser cutting machine

Website: hsglaser.com

Key Highlights: HSG LASER is an international company dedicated to R&D, production, sales of laser cutting, bending, welding machines, automatic loading & unloading and ……

#8 IPG Photonics

Website: ipgphotonics.com

Key Highlights: IPG Photonics manufactures high-performance fiber lasers, amplifiers, and laser systems for diverse applications and industries. Discover your solution….

#9 Laser Solutions

Website: lincolnelectric.com

Key Highlights: Flex Lase Handheld Laser Systems. The easy-to-use Flex Lase handheld laser system puts power, speed, and precision at your fingertips. With 2kW of output power, ……

#10 Handheld Laser Welding Machine, Handheld Laser Cleaning …

Website: kaihuanlaser.com

Key Highlights: Laser pipe cutting machines deliver precise cuts for complex shapes and tight tolerances. Fast cutting speeds improve production rates and reduce material waste ……

Expert Sourcing Insights for Hand Held Cutting Laser

2026 Market Trends for Hand-Held Cutting Lasers

Rising Demand Across Heavy Industries Drives Adoption

The global market for hand-held cutting lasers is projected to experience robust growth by 2026, fueled primarily by increasing demand in key industrial sectors. Manufacturing, shipbuilding, construction, and metal fabrication are rapidly adopting hand-held laser technology due to its superior speed, precision, and operational flexibility compared to traditional cutting methods like plasma or oxy-fuel. As industries prioritize efficiency and automation, hand-held lasers offer a versatile solution for on-site and complex cutting tasks, accelerating workflow and reducing labor costs.

Technological Advancements Enhance Usability and Safety

By 2026, ongoing innovation will make hand-held cutting lasers more user-friendly, efficient, and safer. Improvements in fiber laser sources are delivering higher power outputs (up to 6kW and beyond) in compact, portable designs. Integration with smart features—such as real-time monitoring, AI-assisted path optimization, and augmented reality (AR) guidance—is streamlining operations and reducing operator error. Enhanced safety systems, including intelligent fume extraction and beam containment, are addressing regulatory concerns and expanding deployment in diverse work environments.

Cost Reductions Expand Market Accessibility

A significant trend shaping the 2026 landscape is the declining cost of laser components and systems. As fiber laser technology matures and production scales up, entry-level and mid-range hand-held lasers are becoming more affordable. This cost reduction is democratizing access, enabling small and medium-sized enterprises (SMEs) to adopt laser cutting—previously limited to large corporations. Increased competition among manufacturers is also driving value-focused innovations, further accelerating market penetration.

Sustainability and Regulatory Pressures Influence Design

Growing emphasis on environmental sustainability and stricter workplace safety regulations are pushing manufacturers to develop energy-efficient and low-emission hand-held lasers. Systems with improved energy conversion rates and integrated environmental controls will gain favor, particularly in regions with rigorous industrial standards like the EU and North America. Compliance with international safety certifications (e.g., IEC 60825) will become a key differentiator in the 2026 market.

Regional Growth Disparities and Emerging Markets

Asia-Pacific, led by China and India, will remain the fastest-growing region for hand-held cutting lasers in 2026, driven by booming infrastructure projects and manufacturing expansion. North America and Europe will see steady growth, supported by industrial modernization and reshoring initiatives. Meanwhile, emerging markets in Southeast Asia, the Middle East, and Latin America are expected to increase adoption as industrial capabilities mature and access to financing improves.

Common Pitfalls When Sourcing Hand-Held Cutting Lasers (Quality and Intellectual Property)

Sourcing hand-held cutting lasers can be a complex process, especially when balancing performance, reliability, and legal compliance. Below are key pitfalls related to quality and intellectual property (IP) that buyers should be aware of:

Quality-Related Pitfalls

1. Inadequate Power and Performance Verification

Many suppliers overstate laser power output or cutting capabilities. A common issue is advertising peak power instead of sustained operational power, leading to underperformance in real-world applications. Always request independent test reports or conduct on-site demonstrations under actual working conditions.

2. Poor Build Quality and Component Sourcing

Low-cost manufacturers may use substandard materials and components (e.g., inferior optical fibers, cooling systems, or handpieces) to reduce costs. This leads to frequent breakdowns, inconsistent cuts, and shorter machine life. Verify the origin and quality of core components such as the laser source (e.g., IPG, Raycus), collimator, and focusing head.

3. Lack of Safety and Certification Standards

Some hand-held lasers lack necessary safety certifications (e.g., CE, FDA, IEC 60825). Non-compliant units pose serious workplace hazards and may be barred from import or use in regulated markets. Ensure the product meets regional safety and laser classification standards.

4. Inconsistent Cutting Precision and Beam Quality

Poor beam mode quality (M² value) or misaligned optics result in uneven cuts, excessive dross, and reduced edge quality. Without proper quality control, units from the same batch can perform differently. Request beam profiling data and sample cut tests.

5. Insufficient After-Sales Support and Spare Parts Availability

Many suppliers, especially smaller or offshore manufacturers, offer limited technical support, training, or spare parts. This leads to prolonged downtime when maintenance is needed. Confirm service agreements, local support options, and the supplier’s track record for responsiveness.

Intellectual Property (IP) Risks

1. Use of Counterfeit or Cloned Technology

Some manufacturers replicate branded laser systems (e.g., copying IPG-based designs) without proper licensing. These units may infringe on patents or trademarks, exposing buyers to legal risks, especially in markets with strong IP enforcement like the EU or U.S.

2. Lack of Transparency in Technology Origin

Suppliers may obscure the true source of core technology. For example, claiming a “proprietary” laser source that is actually a rebranded or reverse-engineered component. Always verify technical documentation and request proof of IP ownership or licensing agreements.

3. Risk of Customs Seizures and Legal Liability

Importing equipment with suspected IP violations can lead to customs delays, confiscation, or litigation. Buyers may be held liable as “willful infringers” if they knowingly source infringing products. Conduct due diligence on the supplier’s IP compliance and request indemnification clauses in contracts.

4. Absence of Software and Firmware Licensing

Hand-held lasers often include proprietary control software. Unauthorized use or distribution of such software may violate copyright laws. Ensure the supplier provides legitimate, licensed software with update and support rights.

By carefully evaluating both quality assurance processes and IP legitimacy, buyers can mitigate risks and ensure a reliable, legally sound investment in hand-held cutting laser technology.

Logistics & Compliance Guide for Hand Held Cutting Laser

Product Classification and Regulatory Standards

Hand held cutting lasers are classified as industrial laser systems and are subject to various international and national regulations. They typically fall under machinery and laser safety standards such as IEC 60825-1 (Safety of laser products) and IEC 60204-1 (Safety of machinery – Electrical equipment). Additionally, they may be categorized under HS Code 8515.21 (“Electrode and laser cutting machines”) for customs purposes. Accurate classification ensures proper handling during import/export and compliance with destination country regulations.

Safety Certification and Documentation Requirements

Prior to shipment, hand held cutting lasers must be certified by recognized bodies depending on the target market. In the European Union, CE marking is mandatory, indicating conformity with health, safety, and environmental protection standards under the Machinery Directive (2006/42/EC) and the Low Voltage Directive (2014/35/EU). For the U.S. market, compliance with FDA/CDRH (Center for Devices and Radiological Health) regulations under 21 CFR 1040.10 is required. Documentation must include a Declaration of Conformity, technical file, user manual with safety instructions, and laser classification label.

Packaging and Transportation Guidelines

Hand held cutting lasers must be securely packaged to prevent damage and unauthorized activation during transit. Use shock-absorbent materials and rigid outer containers with clear hazard labels, including “Fragile,” “This Side Up,” and “Laser Radiation” warnings. Batteries (if included) must comply with IATA/IMDG regulations for air or sea freight, particularly if lithium-based. Shipments should avoid extreme temperatures and moisture exposure. Use UN-certified packaging for any integrated or accompanying battery systems.

Import/Export Controls and Customs Compliance

Exporters must verify if the hand held cutting laser is subject to dual-use or strategic trade controls under regulations such as the EU Dual-Use Regulation (EU) 2021/821 or the U.S. Export Administration Regulations (EAR). Some high-power laser systems may require export licenses depending on power output and end-use. Accurate commercial invoices, packing lists, and certificates of origin must accompany shipments. Harmonized System (HS) code 8515.21 should be declared, and import duties and VAT assessed based on destination country rules.

End-User Compliance and Training Obligations

End users must be trained in laser safety per ANSI Z136.1 (U.S.) or EN 60825 (Europe). Suppliers should provide comprehensive operation and safety manuals, and ensure users have appropriate personal protective equipment (PPE), including laser safety goggles rated for the specific wavelength. Installation should follow local occupational health and safety regulations. Maintain records of training and equipment maintenance to support compliance audits and liability protection.

Environmental and Disposal Regulations

At end-of-life, hand held cutting lasers must be disposed of in accordance with WEEE (Waste Electrical and Electronic Equipment) Directive 2012/19/EU in Europe or equivalent e-waste regulations elsewhere. Components such as lasers, circuit boards, and batteries may contain hazardous materials requiring special handling. Do not dispose of in regular trash. Coordinate with certified e-waste recyclers and provide users with take-back or recycling instructions.

Conclusion: Sourcing a Hand-Held Cutting Laser

In conclusion, sourcing a hand-held cutting laser requires a thorough evaluation of technical specifications, safety standards, application requirements, and supplier credibility. These advanced tools offer significant advantages in terms of portability, precision, and efficiency across industries such as metal fabrication, automotive, construction, and aerospace. However, successful integration into operations depends on selecting a system that matches the material types, thickness capabilities, and duty cycles specific to the intended use.

Key considerations include laser power output, cooling mechanisms, ergonomics, safety certifications (e.g., FDA, CE), and post-purchase support such as training, maintenance, and warranty. It is also essential to evaluate total cost of ownership—factoring in not just the initial purchase price, but also consumables, energy consumption, and downtime.

Sourcing from reputable manufacturers or authorized distributors ensures product reliability, regulatory compliance, and access to technical support. Conducting on-site demonstrations, reviewing customer testimonials, and comparing multiple quotes can further mitigate procurement risks.

Ultimately, a well-researched sourcing strategy for hand-held cutting lasers will lead to improved productivity, enhanced cutting quality, and a strong return on investment, positioning businesses at the forefront of modern industrial cutting technology.