The global synthetic fiber rope market, driven by increasing demand across marine, offshore, and construction sectors, is projected to grow at a CAGR of 5.2% from 2023 to 2030, according to Grand View Research. With rising maritime activities, deep-sea exploration, and infrastructure development, high-performance halyard ropes—known for their strength, UV resistance, and low stretch—are becoming critical components in both commercial and recreational sailing. As the marine textiles segment expands, particularly within the Asia Pacific and North American regions, manufacturers are investing in advanced materials like Dyneema®, Technora®, and high-modulus polyethylene (HMPE) to meet evolving performance standards. This growing demand has intensified competition among leading rope producers, pushing innovation in durability, elasticity, and load capacity. Based on production scale, material technology adoption, and global distribution, the following eight companies have emerged as key manufacturers of premium halyard ropes shaping the modern marine industry.

Top 8 Halyard Rope Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Halyard rope manufacturer (polyester, polyamide, polyethylene)

Domain Est. 2004

Website: promotress.fr

Key Highlights: Promotress is a French manufacturer of braided halyard ropes in polypropylene, polyester, or polyamide, for sailing, sport, automotive, outdoor……

#2 Halyards

Domain Est. 2014

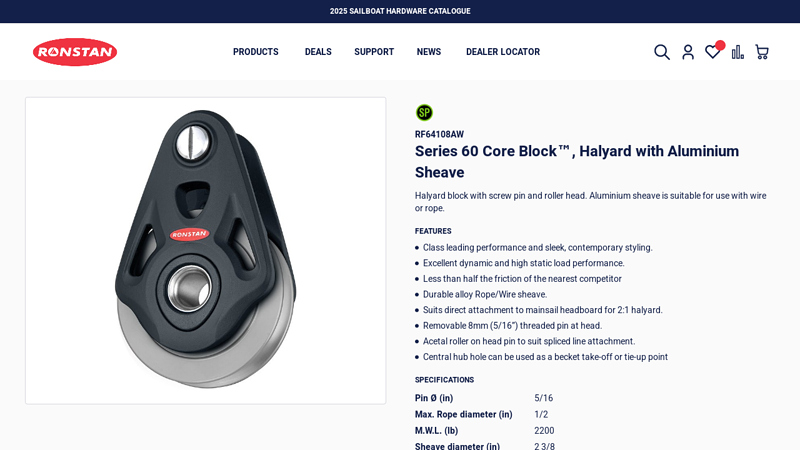

#3 Series 60 Core Block™, Halyard with Aluminium Sheave

Domain Est. 1997

Website: ronstan.com

Key Highlights: In stock Free delivery over $75Series 60 Core Block™, Halyard with Aluminium Sheave. Halyard block with screw pin and roller head. Aluminium sheave is suitable for use with wire or…

#4

Domain Est. 1997

Website: neropes.com

Key Highlights: Our Products: Grand Prix Racing Performance, Dinghy & One Design Racing Performance, Cruising, traditional rigging, mega yacht rigging, anchoring and docking….

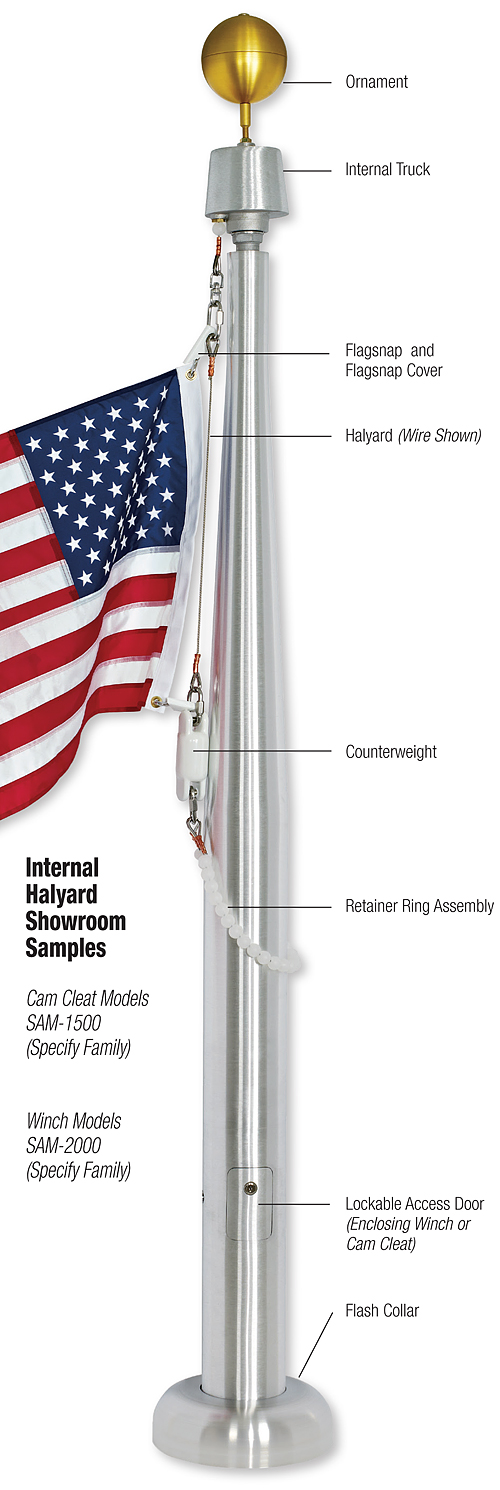

#5 Halyard Rope Cut to Length

Domain Est. 1999

Website: flagstoreusa.com

Key Highlights: In stock $7.98 delivery1/4″ white halyard rope should be twice the height of your flagpole (cut to length per feet). Non-wire center – recommended for any use….

#6 Premiumropes

Domain Est. 2011

Website: premiumropes.com

Key Highlights: Free delivery over €200 14-day returnsThe best place to buy ropes and rigging for your sailing boat. Ropes and steel wire ropes for industry and architecture. We ship worldwide….

#7 Robline ropes

Domain Est. 2018

Website: roblineropes.com

Key Highlights: From halyards to sheets and dock lines to tow ropes, we provide the essential lines for sailing, powerboating, and kitesurfing, including main sheets, jib ……

#8 Ropes and Rigging Halyards

Domain Est. 2021

Website: roosterusa.com

Key Highlights: Free delivery over $100 30-day returnsRooster stocks a wide range of sailing halyards and you can scroll down to view the different products we have listed below….

Expert Sourcing Insights for Halyard Rope

H2: 2026 Market Trends Forecast for Halyard Rope

As the maritime, offshore, and renewable energy sectors evolve, the market for halyard ropes—critical components used primarily in sailing rigging and offshore lifting operations—is expected to undergo significant transformation by 2026. Driven by technological innovation, sustainability demands, and shifting industry needs, several key trends are shaping the future of the halyard rope market.

-

Increased Demand from Offshore Wind Energy

The rapid global expansion of offshore wind farms is one of the primary drivers influencing halyard rope demand. Halyard ropes are used in wind turbine maintenance operations, particularly in personnel and equipment transfer via rope access techniques. With countries like the UK, Germany, China, and the U.S. accelerating offshore wind deployment, the need for high-performance, durable halyard ropes is projected to grow substantially through 2026. This growth is expected to favor ropes with high tensile strength, UV resistance, and low elongation. -

Shift Toward High-Performance Synthetic Fibers

Traditional nylon and polyester ropes are being increasingly replaced by advanced synthetic fibers such as Dyneema®, Aramid (e.g., Kevlar®), and high-modulus polyethylene (HMPE). These materials offer superior strength-to-weight ratios, improved abrasion resistance, and longer service life—critical attributes for both marine and industrial applications. By 2026, manufacturers like Samson, Marlow Ropes, and Yale Cordage are anticipated to dominate market share by offering engineered halyard solutions tailored for extreme environments. -

Sustainability and Circular Economy Pressures

Environmental regulations and corporate sustainability goals are pushing manufacturers to develop recyclable or bio-based rope alternatives. While fully biodegradable halyard ropes remain technologically challenging, efforts are underway to improve end-of-life recyclability and reduce microplastic shedding. By 2026, leading suppliers are expected to introduce eco-certified product lines, supported by lifecycle assessments and take-back programs, to meet ESG (Environmental, Social, and Governance) standards. -

Smart Ropes and IoT Integration

Innovations in embedded sensor technology are paving the way for “smart halyard ropes” capable of monitoring load, wear, temperature, and structural integrity in real time. Particularly in offshore and industrial safety applications, this trend toward predictive maintenance is expected to gain traction by 2026. Integration with IoT platforms will allow operators to reduce downtime, prevent catastrophic failures, and extend rope lifespan—adding value beyond traditional performance metrics. -

Regional Market Diversification

While Europe and North America remain core markets due to mature maritime and renewable sectors, Asia-Pacific—especially China, South Korea, and India—is emerging as a high-growth region. Expanding shipbuilding industries, coastal infrastructure projects, and rising recreational boating activities are fueling regional demand. Localized production and strategic partnerships with Asian rope manufacturers are anticipated to be key strategies for global players by 2026. -

Regulatory and Safety Standards Evolution

As safety standards in offshore and marine operations tighten (e.g., ISO 21809, OCIMF guidelines), compliance with rigorous testing and certification becomes essential. By 2026, halyard ropes will likely require more comprehensive documentation, traceability, and third-party validation. This regulatory landscape will favor established brands with robust quality assurance systems.

Conclusion

The halyard rope market in 2026 will be defined by technological sophistication, environmental responsibility, and diversification across industrial applications. Companies that invest in material innovation, digital integration, and sustainable practices will be best positioned to capture growth, particularly in high-value sectors such as offshore wind and commercial marine operations. As demand shifts from basic functionality to performance intelligence and lifecycle sustainability, the halyard rope industry is poised for a transformative phase in the mid-2020s.

Common Pitfalls Sourcing Halyard Rope: Quality and Intellectual Property Issues

Sourcing halyard rope for marine or industrial applications can present significant challenges, particularly concerning quality consistency and intellectual property (IP) protection. Overlooking these aspects can lead to performance failures, safety risks, and legal complications.

Poor Material Quality and Inconsistent Performance

One of the most frequent pitfalls is receiving halyard rope that fails to meet specified performance standards. Low-cost suppliers may use subpar fibers such as recycled or off-spec UHMWPE (e.g., Dyneema®) or polyester, resulting in reduced strength, accelerated UV degradation, and poor resistance to creep. Additionally, inadequate jacketing or poor braid construction can lead to internal core slippage, splice failure, and shortened service life. Buyers often discover these deficiencies only after the rope is installed and under load, potentially endangering vessel operations.

Misrepresentation of Fiber Content and Brand Authenticity

Many suppliers falsely claim their halyard rope uses high-performance fibers like Dyneema® SK78 or Technora® without providing verifiable proof. Some products are labeled as “Dyneema®-equivalent” or “high-modulus polyethylene” without certification or traceability. This misrepresentation not only undermines performance expectations but may also void equipment warranties. Without access to mill test reports or chain-of-custody documentation, buyers risk purchasing counterfeit or downgraded materials.

Infringement of Patented Rope Constructions

High-performance halyard ropes often incorporate patented designs related to core-jacket interaction, braiding patterns, or end-fitting integration. Sourcing from manufacturers who replicate these designs without licensing exposes the buyer to intellectual property infringement risks. If the rope design violates an existing patent—such as those held by major rope manufacturers like Samson, New England Ropes, or Colligo—customs authorities may seize shipments, or the end user could face legal claims, especially in regulated markets like the EU or U.S.

Lack of Traceability and Compliance Documentation

Reputable halyard ropes come with traceability tags, batch numbers, and compliance certifications (e.g., ISO, DNV-GL, or EC1 certification for marine use). Many low-cost suppliers, particularly from regions with weak IP enforcement, do not provide these documents. This absence makes it difficult to verify quality, initiate recalls, or prove compliance in case of accidents or insurance claims, increasing liability for the buyer.

Inadequate Testing and Quality Control Procedures

Suppliers may claim their halyards meet certain break strength or elongation standards but lack in-house or third-party testing to back those claims. Without standardized quality control—such as load testing, elongation checks, or abrasion resistance evaluations—there is no assurance that every batch performs consistently. This variability can compromise safety, especially in critical sailing or lifting applications.

Conclusion

To avoid these pitfalls, buyers should conduct thorough due diligence, request material certifications, verify IP compliance, and prioritize suppliers with transparent manufacturing practices and a track record of quality. Engaging third-party inspection services and specifying IP-safe designs in procurement contracts can further mitigate risks.

Logistics & Compliance Guide for Halyard Rope

This guide outlines the essential logistics and compliance considerations for the handling, transportation, storage, and regulatory adherence related to halyard ropes used in marine, sailing, and industrial applications. Proper management ensures product integrity, safety, and legal compliance.

Product Classification and Specifications

Halyard ropes are high-performance synthetic lines primarily used to raise and lower sails on vessels. They are typically constructed from materials such as Dyneema®, Spectra®, or high-modulus polyester, offering high strength-to-weight ratios and low stretch. Accurate product classification—by material, diameter, breaking strength, and construction (e.g., 12-strand, braided core)—is critical for correct handling, labeling, and regulatory compliance.

Packaging and Labeling Requirements

Halyard ropes must be packaged to prevent tangling, abrasion, and environmental exposure. Standard packaging includes cardboard spools, sealed plastic wraps, or labeled reels. Each package must be clearly labeled with:

– Product name and model number

– Material composition

– Diameter and length

– Minimum breaking load (MBL)

– Manufacturer details and batch/lot number

– Compliance markings (e.g., ISO, CE where applicable)

– Handling symbols (e.g., “Do Not Drop,” “Keep Dry”)

Labels must be durable and legible under transport and storage conditions.

Storage Conditions

To maintain performance and longevity, halyard ropes must be stored in:

– Dry, temperature-controlled environments (recommended 10°C–25°C / 50°F–77°F)

– Areas free from direct sunlight and UV exposure

– Clean spaces away from chemicals, oils, and sharp objects

– Off the floor using pallets or shelves to prevent moisture absorption

Avoid prolonged compression or tight coiling during storage to prevent permanent deformation.

Transportation Guidelines

When shipping halyard ropes, ensure:

– Use of secure, weather-resistant containers or palletized loads

– Protection from moisture, extreme temperatures, and physical impact

– Compliance with freight carrier requirements for dimension and weight

– Use of non-abrasive strapping and dunnage to prevent damage

– Proper orientation (e.g., upright reels) to avoid crushing

For international shipments, ensure adherence to Incoterms® and carrier-specific packaging standards.

Import/Export Compliance

Halyard ropes may be subject to import/export regulations depending on destination and material composition. Key considerations include:

– Accurate HS (Harmonized System) code classification (e.g., 5607.50 for synthetic fiber ropes)

– Compliance with local customs documentation (commercial invoice, packing list, certificate of origin)

– Adherence to trade restrictions or sanctions

– Potential need for export licenses for high-performance fibers (e.g., Dyneema® may be subject to dual-use regulations in certain jurisdictions)

Verify country-specific requirements through official customs authorities or a licensed customs broker.

Safety and Regulatory Standards

Halyard ropes used in commercial or safety-critical applications must comply with relevant standards, such as:

– ISO 21809 (fibrous ropes)

– EN 13414 (steel wire and synthetic ropes for lifting)

– ABYC (American Boat & Yacht Council) standards for marine applications

– OSHA and local workplace safety regulations for industrial use

Maintain documentation of third-party testing, certifications, and material safety data sheets (MSDS/SDS) where applicable.

Environmental and Disposal Compliance

End-of-life halyard ropes, particularly those containing high-performance synthetics, must be disposed of in accordance with local environmental regulations. Avoid landfill disposal when possible. Explore recycling programs for Dyneema® or polyester ropes through manufacturer take-back initiatives or certified recyclers. Document disposal methods to ensure traceability and regulatory compliance.

Quality Assurance and Traceability

Implement a traceability system that records:

– Batch or lot numbers

– Manufacturing date and location

– Test results and compliance documentation

– Distribution history

This supports rapid recall management and demonstrates regulatory due diligence.

Training and Handling Procedures

Personnel involved in handling, storing, or transporting halyard ropes should be trained in:

– Safe lifting and handling techniques

– Proper unspooling and coiling methods

– Identification of damage or wear

– Emergency response for damaged packaging or exposure

Regular audits of logistics practices help maintain compliance and product quality.

Conclusion

Effective logistics and compliance management for halyard ropes ensures product reliability, safety, and legal adherence throughout the supply chain. By following this guide, organizations can mitigate risks, maintain customer trust, and operate efficiently in global markets.

Conclusion for Sourcing Halyard Rope:

After evaluating various options for sourcing halyard rope, it is clear that selecting the right supplier and product involves balancing performance, durability, cost, and technical specifications. Key factors such as rope material (e.g., high-modulus fibers like Dyneema or polyester for strength and low stretch), diameter, construction (braided vs. double braid), UV and abrasion resistance, and compatibility with existing rigging systems are critical to ensuring optimal sail handling and long-term reliability.

Sourcing from reputable marine rope manufacturers or specialized sailing chandleries ensures product quality, traceability, and access to technical support. While cost-effective alternatives may be available, compromising on quality can lead to reduced performance, safety risks, and higher long-term maintenance costs. Therefore, the recommended approach is to source high-quality halyard rope from trusted suppliers offering proven marine-grade products, supported by warranties and positive user feedback, to ensure durability, safety, and improved sailing efficiency.