The global halide bulb market has experienced steady growth, driven by increasing demand for energy-efficient lighting across commercial, industrial, and outdoor applications. According to Grand View Research, the global high-intensity discharge (HID) lamp market, which includes metal halide bulbs, was valued at USD 1.78 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is fueled by ongoing infrastructure development, stringent energy regulations, and the gradual replacement of traditional lighting systems with high-efficiency alternatives. While LED technology continues to gain traction, metal halide lamps remain critical in high-ceiling industrial facilities, sports arenas, and outdoor lighting where high lumen output and color rendering are essential. As demand persists in niche applications, a select group of manufacturers continues to lead in innovation, production scale, and global distribution. Below are the top eight halide bulb manufacturers shaping the current landscape.

Top 8 Halide Bulb Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Metal Halide

Domain Est. 1995

Website: ushio.com

Key Highlights: Ushio America specializes in the manufacturing of high-quality, value-added LED, quartz halogen, fluorescent, metal halide and high pressure sodium ……

#2 SATCO

Domain Est. 1996

Website: satco.com

Key Highlights: A leading supplier of lighting products, with solutions for nearly every lighting market across the commercial, residential and industrial landscape….

#3 Venture’s Lamps

Domain Est. 1998

Website: hid.venturelighting.com

Key Highlights: Venture Lighting is the world’s leading designer and manufacturer of state-of-the-art metal halide lamps….

#4 Metal Halide Lamp Fixtures

Domain Est. 1999 | Founded: 2007

Website: energy.gov

Key Highlights: Manufacturers have been required to comply with the U.S. Department of Energy (DOE) energy conservation standards for metal halide lamp fixtures since 2007….

#5 Ceramic metal halide

Domain Est. 1987

Website: lighting.philips.com

Key Highlights: Philips’ CMH bulbs have excellent colour stability and produce higher colour rendition. Our new-generation Ceramic Metal Halide bulbs are used Outdoor….

#6 Quartz metal halide

Domain Est. 1996

Website: signify.com

Key Highlights: Explore product category of Quartz metal halide lights and bulbs powered by Philips’. Metal halide light is compounded between metal and halogens which can ……

#7 Metal Halide Standard

Domain Est. 1997

Website: halcolighting.com

Key Highlights: HID Standard Metal Halide BT28 Bulb Mogul Base 175W 4200K Probe Start Dimmable · HID Standard Metal Halide BT37 Bulb Mogul Base 1000W 3800K ……

#8 FAQ

Domain Est. 2024

Website: massmetalhalide.com

Key Highlights: We focus on Metal Halide (MH), a high frequency and high power lamp that has a tuneable spectrum capable of truly sunlike color temperatures. I find this to ……

Expert Sourcing Insights for Halide Bulb

H2: Projected 2026 Market Trends for Halide Bulbs

As global lighting markets continue to evolve rapidly due to technological advancements and regulatory shifts, the halide bulb segment—particularly metal halide lamps—is expected to face significant challenges and transformations by 2026. Once widely used in commercial, industrial, and outdoor lighting applications due to their high luminous efficacy and color rendering, halide bulbs are now being increasingly displaced by more energy-efficient and longer-lasting alternatives, primarily LED technology.

-

Declining Market Share

The most prominent trend shaping the 2026 halide bulb market is a steady decline in market share. According to industry forecasts, the global metal halide lamp market is projected to contract at a compound annual growth rate (CAGR) of approximately -4% to -6% between 2022 and 2026. This decline is primarily driven by the widespread adoption of LED lighting, which offers superior energy efficiency (up to 50–60% energy savings), longer lifespans (50,000+ hours vs. 6,000–15,000 for halide), and lower maintenance costs. -

Regulatory and Environmental Pressures

Governments worldwide are implementing stricter energy efficiency standards and phasing out less efficient lighting technologies. Initiatives such as the EU’s Ecodesign Directive and similar regulations in the U.S. and Asia-Pacific regions have effectively restricted or banned the sale of many halide lamp types. The 2026 market will likely reflect the full impact of these policies, further limiting new installations and replacement demand. -

Niche Applications and Legacy Systems

Despite the decline, halide bulbs are expected to maintain a presence in specific niche applications where their unique spectral output and high-intensity characteristics remain valuable. These include specialized horticultural lighting, high-bay industrial lighting in older facilities, sports stadium lighting (in regions with slower LED adoption), and certain photographic or film production uses. Additionally, maintenance of legacy systems will continue to generate limited aftermarket demand through 2026. -

Shift in Manufacturing and Supply

Manufacturers are pivoting away from halide bulb production, with major lighting companies such as Philips, GE, and Osram either discontinuing or significantly reducing their halide product lines. This shift will likely result in reduced economies of scale, higher per-unit costs, and supply chain constraints for halide bulbs by 2026. The availability of replacement parts and compatible ballasts may also diminish, accelerating the transition to LED retrofits. -

Retrofit and Conversion Opportunities

A growing trend supporting the halide-to-LED transition is the expansion of retrofit solutions. Plug-and-play LED replacements designed to work in existing halide fixtures are gaining traction, offering cost-effective upgrades without requiring full fixture replacement. This trend reduces the total cost of ownership and shortens payback periods, further eroding demand for new halide bulbs. -

Regional Variations

While mature markets (North America, Western Europe) are expected to have nearly phased out halide bulbs by 2026, some developing regions—particularly in Africa, parts of South Asia, and Latin America—may still rely on halide technology due to lower upfront costs and slower infrastructure modernization. However, even in these regions, declining LED prices and international aid programs promoting energy efficiency are expected to accelerate the transition.

Conclusion

By 2026, the halide bulb market will be a shadow of its former self, surviving primarily in legacy systems and specialized applications. The broader trajectory points to obsolescence, driven by technological superiority of LEDs, regulatory mandates, and economic incentives. Stakeholders in the lighting industry should anticipate continued contraction and plan for strategic exits, product transitions, or focused support services for remaining halide installations.

Common Pitfalls When Sourcing Halide Bulbs (Quality, IP)

Sourcing halide bulbs—particularly metal halide lamps—requires careful attention to both quality and intellectual property (IP) considerations. Overlooking these aspects can lead to performance issues, safety hazards, and legal risks. Below are key pitfalls to avoid:

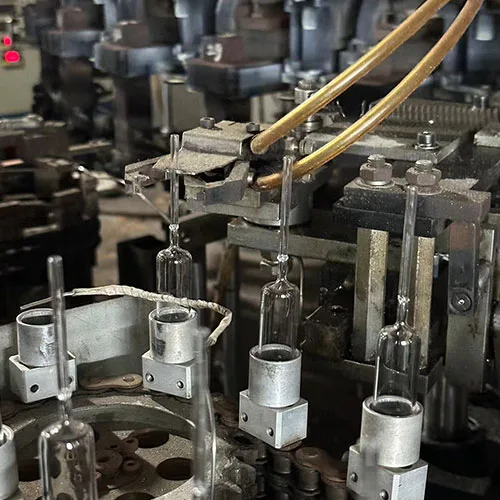

Poor Quality Components and Performance Inconsistencies

Many low-cost halide bulbs on the market use substandard materials such as inferior quartz glass, inconsistent halide salts, or poor electrode construction. These lead to shorter lifespans, color temperature shifts, reduced lumen output, and even bulb rupture. Buyers may experience batch-to-batch variability, especially when sourcing from manufacturers without rigorous quality control. Always verify certifications (e.g., UL, CE, RoHS) and request performance test reports before bulk procurement.

Misrepresentation of IP and Brand Infringement

A significant risk in sourcing halide bulbs is the sale of counterfeit or IP-infringing products. Reputable brands like Philips, Osram, and GE hold patents and trademarks on specific designs, arc tube technologies, and proprietary chemical formulations. Some suppliers falsely label generic bulbs with brand names or offer “compatible” versions that infringe on protected IP. This exposes buyers to legal liability, shipment seizures, and reputational damage. Conduct due diligence on suppliers, request IP documentation, and avoid deals that seem too good to be true.

Inaccurate IP Rating (Ingress Protection) Claims

For outdoor or industrial applications, the IP rating (e.g., IP65, IP66) is critical for dust and moisture resistance. Some suppliers exaggerate or fabricate IP ratings without proper testing. Using bulbs with falsely claimed IP ratings in harsh environments can result in premature failure, electrical hazards, or safety code violations. Ensure suppliers provide third-party test reports validating the claimed IP ratings and confirm compatibility with the intended enclosure and operating conditions.

Lack of Compliance with Regional Regulations

Halide bulbs may need to meet region-specific energy efficiency, mercury content, or disposal regulations (e.g., EU’s EcoDesign Directive, US DOE rules). Non-compliant bulbs can be barred from import or sale. Additionally, some regions are phasing out high-intensity discharge (HID) lamps like metal halide in favor of LED alternatives. Sourcing outdated or non-compliant technology can lead to inventory obsolescence and financial loss.

Inadequate Thermal and Electrical Specifications

Poorly engineered halide bulbs may not operate correctly with existing ballasts or fixtures, leading to flickering, reduced efficiency, or safety risks. Mismatched wattage, voltage tolerances, or thermal management can cause overheating. Always cross-check technical specifications with existing systems and confirm compatibility with control gear.

Avoiding these pitfalls requires working with trusted suppliers, demanding verifiable documentation, and staying informed about technological and regulatory trends in lighting.

Logistics & Compliance Guide for Halide Bulbs

Product Classification and Regulatory Overview

Halide bulbs, also known as metal halide lamps, are high-intensity discharge (HID) lamps commonly used in industrial, commercial, and outdoor lighting applications. Due to their composition—containing mercury and other hazardous materials—these bulbs are subject to various international and domestic regulations governing their transportation, handling, disposal, and labeling.

Hazard Classification for Transport

Halide bulbs are classified as hazardous materials under most transportation regulations due to their mercury content. Key classifications include:

– UN Number: UN 3506 (Lamps, electrical, containing mercury)

– Hazard Class: Class 8 (Corrosive Substances) or Class 9 (Miscellaneous Dangerous Goods), depending on jurisdiction

– Packing Group: II (Medium danger)

Always consult the most recent edition of the IATA DGR (air), IMDG Code (sea), or ADR (road) for region-specific requirements.

Packaging Requirements

To ensure safe transport and regulatory compliance:

– Use original manufacturer packaging or equivalent tested packaging designed for hazardous lamps.

– Packaging must be leakproof, crush-resistant, and capable of containing mercury in case of breakage.

– Individual bulbs should be wrapped in shock-absorbent material and secured to prevent movement.

– Outer packaging must display required hazard labels (e.g., Class 9 Miscellaneous label) and handling instructions.

Labeling and Documentation

Proper labeling and documentation are mandatory:

– Outer packaging must display:

– Proper shipping name: “Lamps, electrical, containing mercury”

– UN 3506

– Hazard labels (Class 9, and Class 8 if applicable)

– Orientation arrows (if required)

– Shipping documents (e.g., dangerous goods declaration, air waybill, or bill of lading) must include:

– Full description with UN number and hazard class

– Quantity and packaging details

– Emergency contact information

– Shipper and consignee details complying with local and international regulations

Storage and Handling Guidelines

During storage and handling:

– Store in a cool, dry, well-ventilated area away from direct sunlight and incompatible materials.

– Handle with care to avoid breakage; wear protective gloves and eyewear when necessary.

– Keep packaging upright and avoid stacking heavy items on top.

– Do not disassemble or modify bulbs during transit or storage.

Import/Export Compliance

International shipments require attention to:

– Customs documentation, including commercial invoice and packing list

– Compliance with destination country regulations (e.g., RoHS, REACH in the EU)

– Notification to customs authorities if required (e.g., EPA notification for U.S. imports)

– Valid Material Safety Data Sheet (MSDS/SDS) provided to importers and carriers

Environmental and Disposal Compliance

Halide bulbs are regulated under WEEE (Waste Electrical and Electronic Equipment) and similar recycling laws:

– Do not dispose of in regular trash; must be recycled through certified hazardous waste handlers.

– End-of-life bulbs must be managed in accordance with local environmental regulations (e.g., EPA in the U.S., Environment Agency in the UK).

– Maintain records of recycling and disposal for audit purposes.

Carrier and Mode-Specific Regulations

Different transport modes have specific rules:

– Air (IATA): Strict limits on quantity per package; approval from airline required.

– Sea (IMDG): Must comply with stowage and segregation rules; declaration in the Dangerous Goods List.

– Road (ADR): Drivers must have ADR training; vehicles may require placarding.

Always verify carrier-specific policies, as some may refuse mercury-containing lamps.

Training and Certification

Personnel involved in shipping halide bulbs must:

– Complete hazardous materials training per 49 CFR (U.S.), ADR, or equivalent standards

– Retraining required every 1–2 years, depending on jurisdiction

– Maintain training records for inspection

Emergency Response Procedures

In case of breakage or spillage:

– Evacuate area and ventilate space immediately

– Do not vacuum—use mercury spill kits to collect fragments and powder

– Follow local hazardous material spill reporting requirements

– Provide SDS to emergency responders

Compliance Monitoring and Audits

Regularly:

– Audit packaging, labeling, and documentation practices

– Review regulatory updates from agencies such as IATA, IMO, DOT, and EPA

– Maintain compliance records for at least three years

Note: Regulations vary by country and can change frequently. Always consult local authorities and certified dangerous goods specialists before shipping halide bulbs.

Conclusion for Sourcing Halide Bulbs:

After evaluating various suppliers, quality standards, cost considerations, and availability, it is evident that sourcing halide bulbs requires a strategic balance between performance, reliability, and cost-efficiency. High-quality halide bulbs from reputable manufacturers ensure longer lifespan, better lumen output, and improved energy efficiency, which ultimately reduce maintenance and operational costs. It is recommended to partner with certified suppliers who comply with international standards (such as ISO, CE, or RoHS) and offer warranties and technical support. Additionally, considering alternatives like LED equivalents may provide long-term savings and sustainability benefits. In conclusion, a well-informed procurement strategy focusing on quality, supplier reliability, and total cost of ownership will ensure optimal performance and operational efficiency when sourcing halide bulbs.