The global Helicobacter pylori (H. pylori) diagnostic testing market is experiencing steady expansion, driven by rising prevalence of gastrointestinal disorders, increased awareness of early detection, and growing demand for non-invasive testing methods. According to Grand View Research, the global H. pylori testing market was valued at USD 1.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. This growth is further reinforced by Mordor Intelligence, which highlights the increasing adoption of point-of-care and rapid diagnostic kits, particularly in emerging economies. As healthcare providers prioritize early and accurate diagnosis to combat ulcers, gastritis, and gastric cancer linked to H. pylori infection, the demand for reliable, user-friendly test kits has surged. This dynamic has catalyzed innovation among manufacturers, resulting in advanced, high-sensitivity testing solutions. The following analysis explores the top eight manufacturers leading this space, evaluated on product performance, technological differentiation, regulatory compliance, and market reach.

Top 8 H Pylori Kit Test Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Helicobacter pylori

Domain Est. 1996

Website: techlab.com

Key Highlights: Complete H. pylori testing options · Stool Antigen Testing · Urea Breath Testing* · Rapid Urease Testing* ……

#2 H. Pylori

Domain Est. 1999

Website: aconlabs.com

Key Highlights: ACON Laboratories, Inc H. Pylori Rapid Test Product is Available for International Distribution Only – Not Available in the US…

#3 H.pylori Antigen Test Kit

Domain Est. 2006

Website: hipro.us

Key Highlights: Auxiliary diagnosis of H.pylori infection Home Test: CE Qualification for home test High Accuracy: above 90%Only for in-vitro diagnosis (IVD) test….

#4 PyloriTek® for H. pylori

Domain Est. 1997

Website: serim.com

Key Highlights: Serim® PyloriTek Test Kit detects urease activity in gastric biopsy specimens providing a presumptive identification of a Helicobacter pylori infection….

#5 LIAISON ® H. pylori Diagnostic Solution

Domain Est. 1997

Website: us.diasorin.com

Key Highlights: H Pylori Diagnostic Test: Diasorin provides a complete diagnostic solution for the detection of antigen and for antibodies determination for H.pylori….

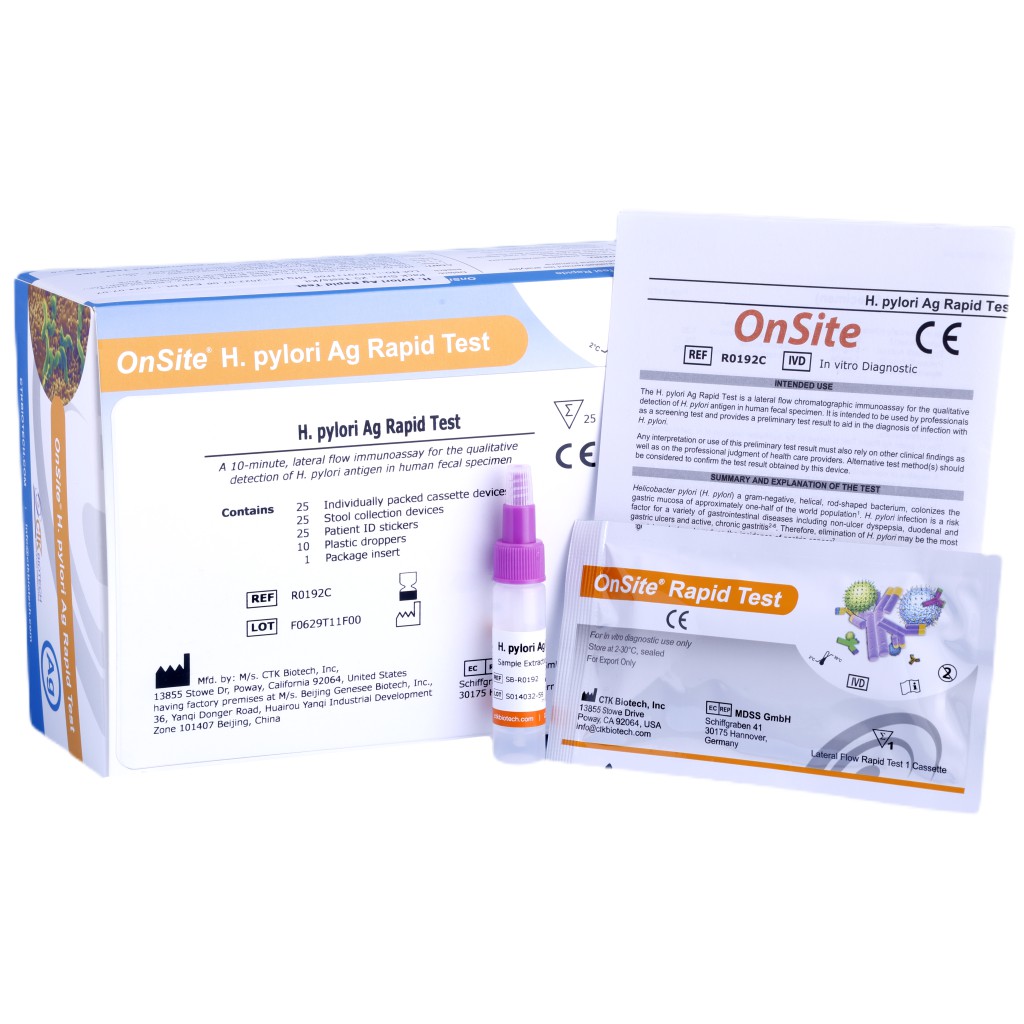

#6 OnSite® H. pylori Ag Rapid Test

Domain Est. 2000

Website: ctkbiotech.com

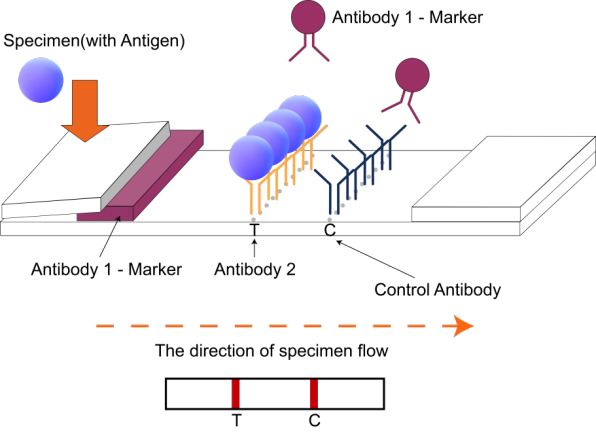

Key Highlights: The OnSite H. pylori Ag Rapid Testis a lateral flow chromatographic immunoassay for the qualitative detection of H. pylori antigen in human fecal specimens….

#7 BreathID® Hp Lab – IDkit Hp® Two

Domain Est. 2001

Website: meridianbioscience.com

Key Highlights: A non-invasive urea breath test for the detection of H. pylori and confirmation of eradication. Catalog Number: AC00063…

#8 clearview™ one step h. pylori antigen test device

Domain Est. 2020

Website: globalpointofcare.abbott

Key Highlights: A simple, rapid stool antigen test that empowers a test-and-treat strategy to test early and treat optimally before symptoms evolve to a more serious condition….

Expert Sourcing Insights for H Pylori Kit Test

H2: 2026 Market Trends for H. Pylori Test Kits

The global market for Helicobacter pylori (H. pylori) test kits is poised for significant evolution by 2026, driven by rising gastrointestinal disease prevalence, advancements in diagnostic technologies, and growing healthcare access in emerging economies. Key trends shaping the H. pylori test kit market in 2026 include:

1. Rising Prevalence of H. pylori Infections and Associated Diseases

H. pylori remains a leading cause of peptic ulcers, gastritis, and gastric cancer, with an estimated global infection rate of over 50%. Increasing awareness of the link between chronic H. pylori infection and gastric malignancies is fueling demand for early and accurate diagnosis. Public health initiatives in high-burden regions, including parts of Asia, Latin America, and Eastern Europe, are promoting widespread screening, thereby boosting test kit adoption.

2. Shift Toward Non-Invasive Diagnostic Methods

There is a strong market preference for non-invasive testing methods such as the urea breath test (UBT), stool antigen tests (SAT), and serological assays. By 2026, stool antigen and breath test kits are expected to dominate due to their high accuracy, ease of use, and avoidance of endoscopy. Innovations in point-of-care (POC) SAT kits are enhancing accessibility in primary care and low-resource settings.

3. Growth of Point-of-Care and Home Testing Solutions

The demand for rapid, decentralized testing is accelerating the development of POC and at-home H. pylori test kits. These solutions empower patients and reduce strain on healthcare systems. By 2026, several manufacturers are expected to launch FDA- or CE-approved home testing kits, supported by mobile health apps for result interpretation and physician consultation.

4. Technological Advancements and Multiplex Diagnostics

Advancements in immunoassay sensitivity, molecular diagnostics (e.g., PCR-based detection), and digital readout systems are improving test accuracy and user experience. Some next-generation kits integrate H. pylori detection with antibiotic resistance profiling (e.g., clarithromycin resistance), enabling personalized treatment plans and reducing the risk of treatment failure.

5. Expansion in Emerging Markets

Asia-Pacific, particularly China, India, and Southeast Asia, is projected to be the fastest-growing region for H. pylori test kits due to large patient pools, improving healthcare infrastructure, and government support for digestive disease programs. Local manufacturing and partnerships with global diagnostic firms are lowering costs and increasing market penetration.

6. Regulatory and Reimbursement Support

Strengthening regulatory pathways and improved reimbursement policies in key markets (e.g., U.S., EU, Japan) are facilitating the adoption of standardized H. pylori testing. Inclusion of H. pylori screening in clinical guidelines for dyspepsia and gastric cancer prevention is further driving utilization.

7. Competitive Landscape and Strategic Collaborations

The market is characterized by a mix of established players (e.g., Abbott, Biohit, SD Biosensor) and innovative startups. Strategic collaborations, mergers, and product launches are common as companies aim to expand their diagnostic portfolios. Digital integration and AI-assisted diagnostics are emerging differentiators.

In summary, the H. pylori test kit market in 2026 will be shaped by technological innovation, increased focus on early detection, and expanding access to diagnostics globally. The convergence of non-invasive testing, POC solutions, and personalized medicine is expected to redefine patient management and drive sustained market growth.

H2: Common Pitfalls When Sourcing H. Pylori Test Kits – Quality and Intellectual Property Risks

Sourcing Helicobacter pylori (H. pylori) test kits, especially from international suppliers, presents several critical challenges that can compromise diagnostic accuracy, regulatory compliance, and legal safety. Two major areas of concern are product quality and intellectual property (IP) infringement. Failing to address these pitfalls can lead to unreliable test results, regulatory penalties, reputational damage, and legal liabilities.

1. Quality-Related Pitfalls

a. Inconsistent Manufacturing Standards

Many suppliers, particularly in less-regulated markets, may not adhere to international quality standards such as ISO 13485 or Good Manufacturing Practices (GMP). This can result in batch-to-batch variability, reduced sensitivity/specificity, and false-positive or false-negative results.

b. Lack of Regulatory Approvals

Some sourced kits may lack necessary certifications such as CE marking, FDA 510(k) clearance, or local approvals (e.g., NMPA in China, ANVISA in Brazil). Using non-compliant kits can lead to legal issues and rejection by healthcare providers or regulatory bodies.

c. Poor Shelf Life and Stability

Improper storage conditions during shipping or substandard reagent formulation can degrade kit components, especially in rapid antigen or antibody-based tests. This compromises test reliability, particularly in hot or humid climates.

d. Inadequate Validation Data

Suppliers may provide limited or falsified clinical validation data. Without published peer-reviewed studies or third-party verification, it is difficult to assess the true performance (sensitivity, specificity) of the kit.

2. Intellectual Property (IP) Risks

a. Counterfeit or Copycat Products

Many low-cost H. pylori kits on the market are unauthorized copies of well-known branded tests (e.g., mimicking formats from companies like Biohit, Abbott, or Premier). These may infringe on patented assay designs, antibodies, or detection methods.

b. Use of Proprietary Reagents Without Licensing

Some kits may use patented monoclonal antibodies or unique buffer systems protected under IP law. Sourcing such kits—even unknowingly—can expose distributors or end-users to legal action for contributory infringement.

c. Unclear or Missing IP Documentation

Suppliers may not provide evidence of freedom-to-operate (FTO) or licensing agreements. This lack of transparency increases the risk of inadvertently importing or distributing IP-violating medical devices.

d. Brand Confusion and Liability

Using kits with misleading labeling or branding similar to established products can result in trademark infringement claims and undermine trust in your organization’s procurement practices.

Mitigation Strategies:

– Conduct thorough due diligence on suppliers, including audit of quality management systems.

– Require proof of regulatory certifications and clinical validation studies.

– Consult legal experts to assess IP risks, especially when sourcing from high-risk jurisdictions.

– Work with reputable distributors or directly with original equipment manufacturers (OEMs).

– Include IP indemnification clauses in procurement contracts.

By proactively addressing quality and IP pitfalls, organizations can ensure the reliability, legality, and safety of H. pylori test kits in their diagnostic workflows.

H2: Logistics & Compliance Guide for H. Pylori Test Kit

This guide outlines the essential logistics and compliance considerations for the distribution, handling, and use of H. Pylori test kits. Adherence ensures product integrity, regulatory approval, and patient safety.

H2: 1. Regulatory Classification & Approval

- Determine Classification: Identify the specific regulatory pathway (e.g., FDA 510(k) clearance, CE Marking under IVDR, Health Canada license, local country registration). Classification depends on test technology (antigen, antibody, molecular, urea breath test components) and intended use (screening, diagnosis, treatment monitoring).

- Maintain Documentation: Ensure current regulatory approvals (licenses, certificates) are valid and accessible for all target markets. Track renewal dates.

- Labeling Compliance: Labels (primary container, secondary packaging, instructions) must strictly adhere to regulatory requirements (e.g., FDA 21 CFR Part 809, EU IVDR Annex I, local language requirements). Include:

- Unique Device Identifier (UDI) – Mandatory in US, EU, and many regions.

- Intended Use/Indications for Use.

- Contraindications, Warnings, Precautions.

- Storage conditions.

- Lot number and Expiry Date.

- Manufacturer and Authorized Representative details.

- Performance characteristics (sensitivity, specificity).

- QR codes linking to Instructions for Use (IFU).

H2: 2. Storage & Stability

- Define Conditions: Strictly follow manufacturer-specified storage requirements (e.g., 2°C to 8°C for refrigerated kits, 15°C to 30°C for ambient kits, protection from light, freezing avoidance). Document these in the IFU.

- Temperature Monitoring: Implement continuous temperature monitoring during storage and transit using calibrated data loggers. Set alarms for excursions.

- Stability Data: Rely on validated stability data to define shelf life. Ensure kits are distributed and used within their expiry dates. Monitor for signs of degradation (e.g., reagent discoloration, test line artifacts).

- Cold Chain Management (if applicable): For refrigerated kits, utilize validated cold chain packaging (insulated shippers, phase change materials) and qualified transport partners. Validate packaging performance.

H2: 3. Transportation & Distribution

- Qualified Carriers: Use carriers experienced in medical device/pharmaceutical logistics with proven cold chain capabilities if required.

- Packaging Validation: Validate packaging for transit duration, temperature extremes, and physical shock/vibration. Include desiccants if moisture-sensitive.

- Shipping Documentation: Ensure all shipments include: Commercial Invoice, Packing List, Certificate of Analysis (CoA) / Certificate of Conformity (CoC), Regulatory Certificates (e.g., CE, FDA), and completed customs forms.

- Track & Trace: Implement systems to track shipments in real-time (e.g., GPS, barcode scanning) from origin to final destination.

- Import/Export Compliance: Comply with all import/export regulations (e.g., FDA Prior Notice, EU Export Certificates, CITES if applicable, local customs duties/taxes). Obtain necessary permits.

H2: 4. Supply Chain & Inventory Management

- Traceability: Implement robust systems (e.g., ERP, inventory software) to track kits by Lot/Batch Number and UDI from manufacture to point of use or patient level (as required by regulations).

- First-Expired, First-Out (FEFO): Enforce strict FEFO protocols in warehouses and distribution centers.

- Stock Control: Maintain optimal inventory levels to prevent stockouts while minimizing expiry losses. Monitor demand patterns.

- Supplier Qualification: Ensure all suppliers (components, packaging, logistics) are qualified and audited per Quality Management System (QMS) requirements (e.g., ISO 13485).

H2: 5. Quality Management System (QMS)

- ISO 13485 Certification: Implement and maintain a QMS certified to ISO 13485, covering design, manufacturing, storage, distribution, and post-market surveillance.

- Document Control: Maintain controlled versions of all procedures (SOPs), records, and regulatory documents.

- Training: Provide comprehensive training for all personnel involved in logistics and handling on procedures, regulations, and GxP principles.

- Audits: Conduct regular internal audits and facilitate external audits (regulatory, customer, notified bodies).

H2: 6. Post-Market Surveillance (PMS) & Vigilance

- Complaint Handling: Establish a formal process to receive, investigate, and record customer complaints related to product quality, performance, or suspected adverse events.

- Field Safety Corrective Actions (FSCAs): Have procedures for implementing recalls, field corrections, or safety alerts if necessary. Notify relevant regulatory authorities promptly (e.g., FDA MedWatch, EU Vigilance system).

- Periodic Safety Update Reports (PSURs): Submit required PSURs to regulators, summarizing safety and performance data.

- Market Surveillance: Monitor market feedback and emerging safety signals.

H2: 7. End-of-Life & Waste Disposal

- Expired/Recalled Kits: Segregate and quarantine expired or recalled kits. Follow regulatory procedures for destruction and documentation.

- User Waste: Provide clear disposal instructions in the IFU (e.g., biohazard if patient samples involved, general waste for test cassettes/strips if no biohazard). Comply with local biohazardous waste regulations.

Key Compliance Frameworks: FDA (QSR 21 CFR 820, UDI Rule), EU IVDR (Regulation (EU) 2017/746), ISO 13485:2016, ISO 14971 (Risk Management), local country regulations.

Disclaimer: This guide provides general principles. Specific requirements vary significantly by jurisdiction, test kit type, and intended use. Always consult the latest regulations and your Notified Body/competent authority.

Conclusion for Sourcing H. Pylori Test Kits:

The sourcing of H. pylori test kits is a critical step in ensuring accurate, timely, and cost-effective diagnosis of Helicobacter pylori infection, a major cause of gastritis, peptic ulcers, and gastric cancer. After evaluating various suppliers, kit types (such as antigen/antibody rapid tests, urea breath test components, and stool antigen kits), and regulatory compliance standards, it is evident that selecting high-quality, CE-certified or FDA-approved test kits from reputable manufacturers is essential for reliable clinical outcomes.

Key factors to consider when sourcing include test accuracy, ease of use, shelf life, storage requirements, cost-efficiency, and availability of technical support. Additionally, partnerships with suppliers offering consistent supply chain reliability and scalability are crucial, especially for large healthcare providers or public health programs.

In conclusion, strategic sourcing of H. pylori test kits—balancing quality, regulatory compliance, and cost—will enhance diagnostic capabilities, support early intervention, and ultimately improve patient management and gastrointestinal health outcomes.