The North American GVS (Glass, Ventilation, and Shading) manufacturing sector is experiencing robust growth, driven by rising demand for energy-efficient building solutions, stricter environmental regulations, and increased investments in smart infrastructure. According to Grand View Research, the North American smart building market—closely tied to GVS technologies—was valued at USD 22.7 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 12.8% from 2023 to 2030. This momentum is further supported by Mordor Intelligence, which reports that the North American HVAC and building automation systems market, integral to GVS integration, is expected to grow at a CAGR of over 7.5% during the same period. As building owners and developers prioritize sustainability and occupant comfort, manufacturers specializing in advanced glazing, dynamic shading, and intelligent ventilation systems are well-positioned to capitalize on this upward trajectory. Below are the top four GVS manufacturers leading innovation and market share across North America.

Top 4 Gvs North America Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 GVS Filter Technology

Domain Est. 1999

Website: gvs.com

Key Highlights: GVS produces highly technological filtration solutions with great attention to research, development and innovation of its products and processes….

#2 About GVS

Website: gvs.in.th

Key Highlights: The GVS Group is one of the world’s leading manufacturers of filter solutions for applications in the Healthcare & Life Sciences, Energy & Mobility and Health ……

#3 Inspection Detail

Domain Est. 1997

Website: osha.gov

Key Highlights: Site Address: Gvs North America 63 Community Drive Sanford, ME 04073. Mailing Address: 63 Community Drive, Sanford, ME 04073. Union Status: NonUnion….

#4 GVS

Domain Est. 2021

Website: gvs-rpb.com

Key Highlights: We create respiratory protection solutions that you make you and your team safer, so everyone can get home at the end of each day, safe, healthy….

Expert Sourcing Insights for Gvs North America

H2: Market Trends Analysis for GVS North America in 2026

As of 2026, GVS North America — a leading provider of filtration solutions for life sciences, healthcare, industrial, and environmental applications — is positioned to benefit from several converging market trends driven by technological innovation, regulatory developments, and shifting industry demands. Below is an analysis of the key trends shaping the market landscape for GVS in North America during H2 2026.

-

Growth in Life Sciences and Biopharmaceutical Filtration

The North American biopharmaceutical sector continues to expand, fueled by increased investment in mRNA therapies, personalized medicine, and biosimilars. GVS’s expertise in sterile filtration, viral removal, and single-use technologies places it at the forefront of this growth. With accelerated drug development cycles and a focus on contamination control, demand for high-efficiency, scalable filtration solutions remains strong. GVS’s proprietary Supor® and Versapor® membrane technologies are well-aligned with the industry’s need for reliable, validated filtration systems. -

Emphasis on Sustainability and Green Manufacturing

Environmental, social, and governance (ESG) goals are driving industrial and pharmaceutical manufacturers to adopt sustainable practices. In 2026, GVS has responded by enhancing its product lifecycle sustainability — introducing recyclable filter housings, reducing manufacturing waste, and offering energy-efficient filtration systems. Customers increasingly favor suppliers with transparent environmental impact data, giving GVS a competitive edge as it advances its circular economy initiatives. -

Expansion of Industrial Air Quality and HVAC Filtration

Post-pandemic awareness of indoor air quality (IAQ) persists into 2026, especially in commercial buildings, schools, and healthcare facilities. GVS’s line of high-efficiency particulate air (HEPA) and ultra-low penetration air (ULPA) filters continues to gain traction in HVAC and cleanroom applications. Additionally, stricter EPA air quality standards and ASHRAE guidelines are driving retrofits and upgrades, increasing demand for advanced filtration media — a core strength of GVS’s industrial division. -

Supply Chain Resilience and Nearshoring

Ongoing geopolitical uncertainty and supply chain disruptions have led North American manufacturers to prioritize domestic sourcing. GVS North America has invested in localized production and inventory buffering, enhancing its responsiveness to regional demand. This strategy supports clients in pharmaceutical, semiconductor, and aerospace industries seeking reliable, onshore supply chains — positioning GVS as a trusted partner in supply continuity. -

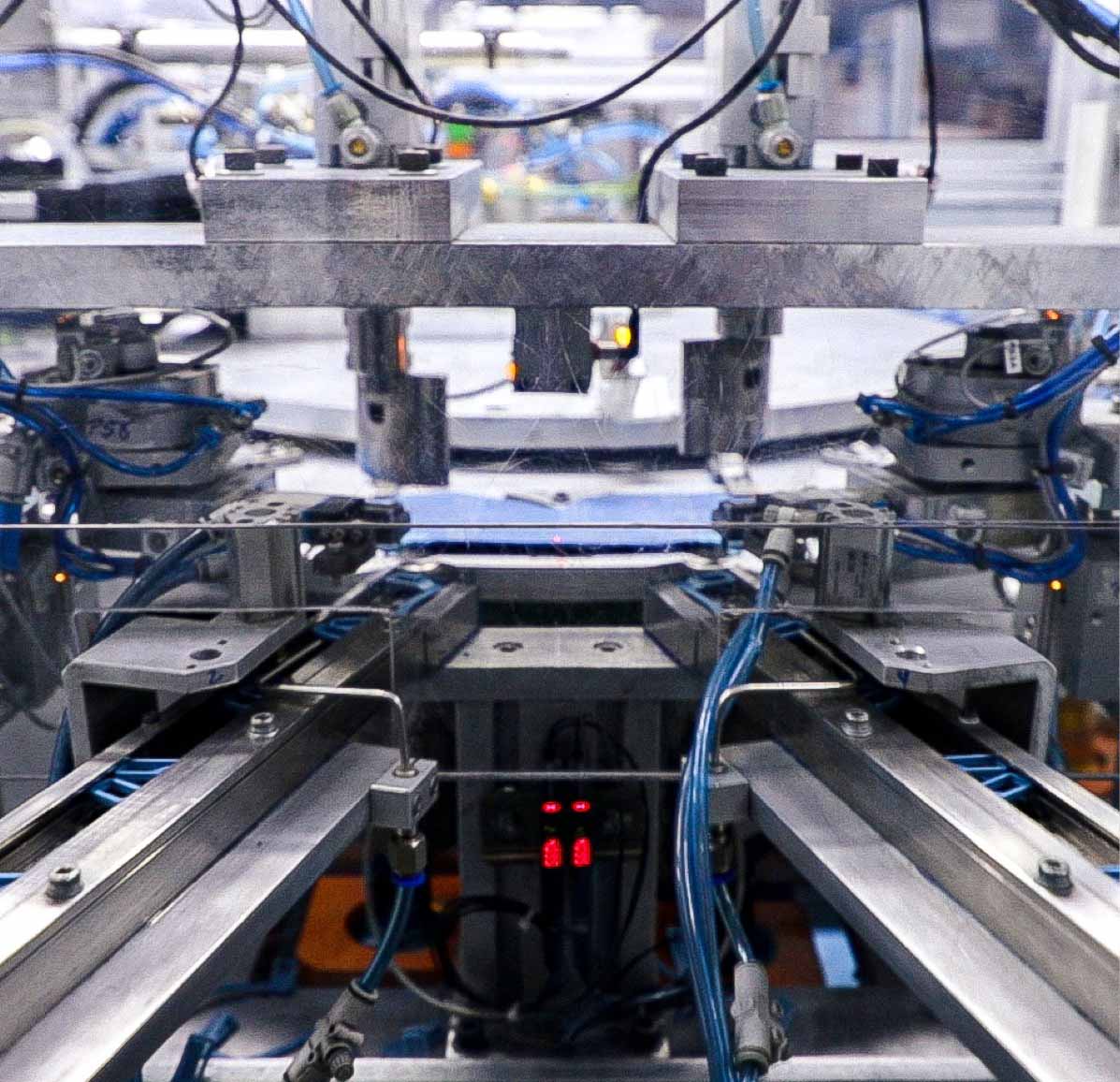

Technological Integration and Digital Filtration Monitoring

Smart manufacturing and Industry 4.0 are influencing filtration through the integration of IoT-enabled monitoring systems. In H2 2026, GVS is advancing sensor-integrated filters and predictive maintenance platforms that provide real-time performance data. These digital solutions help customers optimize filter changeouts, reduce downtime, and improve compliance — particularly attractive in highly regulated sectors. -

Competitive Landscape and Market Consolidation

The filtration market in North America remains competitive, with major players such as Pall Corporation (Danaher), MilliporeSigma (Merck), and Donaldson Company vying for market share. GVS differentiates itself through niche innovation, customer-specific engineering, and agility in product customization. However, M&A activity remains a watchpoint, as larger firms seek to consolidate capabilities in specialty filtration.

Conclusion

In H2 2026, GVS North America is well-positioned to capitalize on sustained demand across life sciences, industrial air quality, and sustainability-focused markets. By leveraging its technological expertise, reinforcing supply chain resilience, and embracing digital transformation, GVS is expected to maintain strong growth momentum. Continued investment in R&D and strategic customer partnerships will be critical to sustaining its competitive advantage in an evolving and increasingly regulated landscape.

Common Pitfalls Sourcing from GVS North America (Quality, IP)

When sourcing products or components from GVS North America, companies may encounter several critical pitfalls, particularly concerning quality assurance and intellectual property (IP) protection. Being aware of these risks is essential for maintaining supply chain integrity and safeguarding proprietary information.

Quality Consistency and Compliance Risks

One major pitfall is the assumption of uniform quality standards across all GVS North America offerings. While GVS is known for high-performance filtration solutions, variations can occur due to production site differences, raw material sourcing, or changes in manufacturing processes. Buyers may experience inconsistencies in product performance—such as filtration efficiency or durability—if not actively managing quality agreements and conducting regular audits. Additionally, failure to verify compliance with industry-specific regulations (e.g., FDA, ISO, or NIOSH standards) can lead to non-conforming shipments or regulatory setbacks, particularly in highly regulated sectors like healthcare or pharmaceuticals.

Intellectual Property Exposure

Sourcing from GVS North America may also present IP-related risks, especially when co-developing customized filtration solutions or sharing technical specifications. Without robust contractual safeguards—such as clear confidentiality agreements (NDAs), IP ownership clauses, and usage limitations—buyers risk unintentional disclosure or misappropriation of proprietary designs, formulations, or application data. Furthermore, GVS’s own patented technologies may impose usage restrictions; unauthorized modification or reverse engineering of their products could lead to legal disputes or infringement claims. Ensuring IP rights are explicitly defined in procurement contracts is crucial to avoid future liabilities.

Logistics & Compliance Guide for GVS North America

This guide outlines the essential logistics and compliance procedures for conducting business with GVS North America. Adhering to these standards ensures smooth operations, regulatory compliance, and supply chain integrity.

Transportation & Shipping Requirements

All shipments to GVS North America must comply with the following transportation standards:

– Use only approved carriers with valid insurance and compliant safety records.

– Provide advanced shipment notifications (ASNs) via EDI or GVS-approved portal at least 48 hours prior to delivery.

– Label all packages with GVS purchase order number, item numbers, quantities, and hazardous material indicators (if applicable).

– Ensure packaging is robust enough to withstand standard freight handling and environmental conditions during transit.

Import & Export Compliance

Suppliers and partners must adhere to U.S. and Canadian international trade regulations:

– Provide accurate commercial invoices, packing lists, and certificates of origin.

– Comply with U.S. Customs and Border Protection (CBP) and Canada Border Services Agency (CBSA) documentation requirements.

– Ensure all goods meet applicable HTS (Harmonized Tariff Schedule) classifications.

– Abide by Export Administration Regulations (EAR) and International Traffic in Arms Regulations (ITAR), where relevant.

– Proactively communicate any changes in country of origin or product composition.

Regulatory & Product Compliance

All products shipped to GVS North America must meet regional regulatory standards:

– Conform to FDA regulations for applicable filtration and healthcare products.

– Comply with EPA and OSHA standards for industrial and safety-related materials.

– Provide required testing certifications (e.g., ISO, NIOSH, CSA) upon request.

– Notify GVS of any product changes affecting compliance status (e.g., material substitutions, manufacturing site changes).

Warehouse & Receiving Procedures

To facilitate efficient receiving at GVS distribution centers:

– Deliver shipments during scheduled dock hours; appointments are mandatory.

– Pallets must be GMA-standard (48” x 40”), uniformly stacked, and secured with stretch wrap.

– Barcodes must be clearly visible and scannable; use GS1-128 standards where applicable.

– Non-conforming deliveries may be subject to rejection or chargebacks.

Quality & Traceability

Maintain full product traceability throughout the supply chain:

– Assign and record batch/lot numbers for all shipped items.

– Retain shipping and quality documentation for a minimum of seven years.

– Cooperate promptly with GVS in the event of a recall or quality investigation.

– Report any non-conformances or deviations immediately through the designated GVS quality portal.

Sustainability & Environmental Standards

GVS North America is committed to sustainable logistics:

– Minimize packaging waste and use recyclable materials whenever possible.

– Optimize load efficiency to reduce transportation emissions.

– Comply with local and federal environmental regulations regarding hazardous material handling and disposal.

– Participate in GVS initiatives aimed at reducing carbon footprint across the supply chain.

For questions or compliance clarifications, contact the GVS North America Logistics & Compliance Team at [email protected].

Conclusion for Sourcing GVS North America:

Sourcing GVS (Global Value Stream) components or services from North America presents a strategic advantage in terms of supply chain resilience, quality assurance, and regulatory compliance. The region’s robust manufacturing infrastructure, skilled workforce, and adherence to high environmental and labor standards support reliable and sustainable operations. Proximity to key markets reduces lead times and transportation costs, enhancing responsiveness to demand fluctuations. Additionally, favorable trade agreements and geopolitical stability further strengthen the case for North American sourcing. While cost competitiveness may vary compared to other regions, the long-term benefits—such as reduced risk, improved innovation collaboration, and enhanced supply chain transparency—make GVS sourcing in North America a viable and strategic choice for organizations prioritizing agility, quality, and supply chain integrity.