The global GSM modem market is experiencing robust growth, driven by rising demand for wireless communication in industrial automation, remote monitoring, and IoT applications. According to Mordor Intelligence, the GSM module market was valued at USD 3.85 billion in 2023 and is projected to reach USD 6.03 billion by 2029, growing at a CAGR of approximately 7.8% during the forecast period. This expansion is fueled by increasing adoption of smart metering, automotive telematics, and mobile broadband solutions across emerging economies. As connectivity becomes a cornerstone of digital transformation, manufacturers of GSM modems are scaling innovation in low-power wide-area networks (LPWAN), multi-band support, and compact form factors. In this evolving landscape, seven leading manufacturers stand out for their technological expertise, global reach, and consistent product development—shaping the future of reliable, long-range wireless communication.

Top 7 Gsm Modem Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

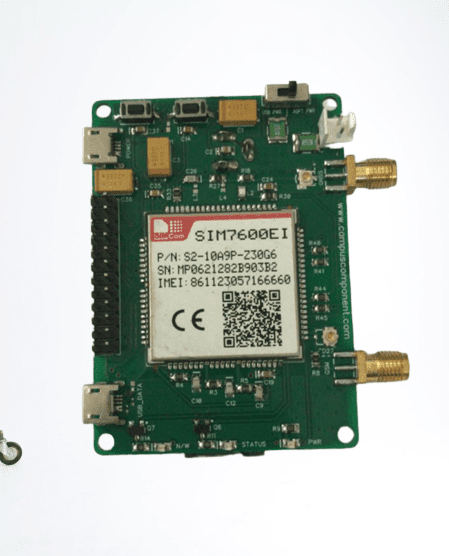

#1 SIMCom Wireless Solutions

Domain Est. 1995 | Founded: 2002

Website: simcom.com

Key Highlights: Founded in 2002, SIMCom has been committed to providing a variety of cellular wireless modules and solutions including 5G, 4G, LPWA, LTE-A, smart module, ……

#2 Sierra Wireless

Domain Est. 1995

Website: sierrawireless.com

Key Highlights: We simplify IoT with industry-leading wireless solutions: cellular modules, rugged routers, and global connectivity services to enable a smarter & more ……

#3 MediaTek

Domain Est. 2001

Website: mediatek.com

Key Highlights: MediaTek powers smarter devices with cutting-edge chipsets for smartphones, smart homes, automotive, IoT, and more. Discover innovation that connects….

#4 page

Domain Est. 2003

Website: sequans.com

Key Highlights: Sequans’ Monarch 2 GM02S module is one of the most advanced cellular IoT connectivity solutions in the market today. It can be deployed in any band worldwide, ……

#5 GSM Modem Price

Domain Est. 2004

Website: pusr.com

Key Highlights: USR IOT has produced two GSM modems includes USR-GPRS232–730 and USR-GPRS232–734. The price of USR-GPRS232–730 and USR-GPRS232–734 is under $50.00….

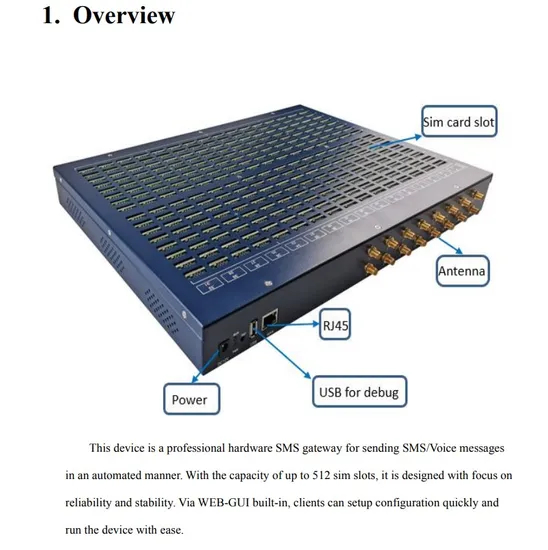

#6 GSM box

Domain Est. 2009

Website: powerknot.com

Key Highlights: The Power Knot GSM Box allows you to connect equipment that has an Ethernet port to the internet without using your own facility network….

#7 Inseego

Domain Est. 2016

Website: inseego.com

Key Highlights: Deploy. Connect. Control. All with Inseego 5G. · Get your business connected anywhere with our 5G routers, gateways, MiFi, and network management solutions….

Expert Sourcing Insights for Gsm Modem

2026 Market Trends for GSM Modems

The global GSM modem market is poised for transformative growth and evolution by 2026, driven by increasing demand for IoT connectivity, advancements in cellular technology, and the expansion of smart infrastructure across industries. Although 5G adoption is accelerating, GSM modems continue to play a pivotal role—particularly in regions with limited next-generation network coverage and in applications requiring low-cost, reliable communication solutions.

Expansion in IoT and M2M Applications

One of the primary drivers shaping the GSM modem market in 2026 is the proliferation of Internet of Things (IoT) and Machine-to-Machine (M2M) communication. Despite the emergence of LTE-M and NB-IoT, GSM remains a cost-effective solution for low-bandwidth applications such as smart metering, asset tracking, and remote monitoring in agriculture and utilities. In developing regions, where 2G and 3G networks are still widely operational, GSM modems are preferred for their reliability and broad compatibility.

Regional Network Transitions and Market Adaptation

While North America and parts of Europe are phasing out 2G and 3G networks to reallocate spectrum for 5G, many regions in Asia-Pacific, Africa, and Latin America will continue supporting GSM well into 2026. This divergence creates a dual-market dynamic: declining demand in mature markets and sustained or growing demand in emerging economies. Manufacturers are responding by producing hybrid modems capable of fallback to GSM when higher-generation networks are unavailable, ensuring uninterrupted connectivity.

Cost-Effectiveness and Legacy System Integration

GSM modems remain attractive due to their low production cost, energy efficiency, and ease of integration with legacy systems. In industrial automation, healthcare monitoring, and home security systems, many existing devices rely on GSM technology. Upgrading entire fleets to 4G/5G is often cost-prohibitive, leading businesses to extend the lifespan of GSM-based solutions. This inertia supports continued market demand through 2026, especially in sectors with long equipment cycles.

Technological Enhancements and Miniaturization

Innovation in GSM modem design is focusing on power efficiency, compact form factors, and enhanced security features. By 2026, we expect to see more GSM modems with embedded SIM (eSIM) capabilities, improved encryption standards, and support for over-the-air (OTA) updates. These advancements help bridge the gap between legacy technology and modern security and maintenance requirements.

Competitive Landscape and Vendor Strategies

Key players in the GSM modem market—including Telit, Sierra Wireless, u-blox, and Quectel—are diversifying their portfolios to include multi-mode modems that support GSM alongside LTE and 5G. This strategy ensures backward compatibility while future-proofing devices. Additionally, partnerships with telecom providers and IoT platform vendors are enabling ecosystem integration, enhancing value beyond hardware.

Conclusion

While the long-term trajectory points toward the gradual obsolescence of GSM technology, the 2026 market landscape will still reflect strong regional demand, particularly in IoT and emerging markets. The GSM modem’s role is evolving from a primary connectivity solution to a fallback or complementary technology within broader cellular ecosystems. As such, it will remain a relevant component in the global connectivity infrastructure through the mid-2020s.

Common Pitfalls When Sourcing GSM Modems (Quality, IP)

Sourcing GSM modems, especially for industrial or IoT applications, involves navigating several potential pitfalls that can impact performance, reliability, and total cost of ownership. Two critical areas where issues frequently arise are product quality and intellectual property (IP) risks. Being aware of these challenges helps in selecting reliable suppliers and avoiding costly setbacks.

Quality-Related Pitfalls

-

Inconsistent Build and Component Quality

Many low-cost GSM modems, especially from lesser-known manufacturers, use substandard components or inconsistent assembly processes. This can lead to high failure rates, poor signal reception, and reduced lifespan. Always verify component sourcing (e.g., certified chipsets from Quectel, SIMCom) and request reliability testing data such as MTBF (Mean Time Between Failures). -

Lack of Environmental and Industrial Certification

Industrial applications require modems that operate reliably under extreme temperatures, humidity, and vibration. Sourcing modems without proper certifications (e.g., IP67, MIL-STD-810, CE, FCC) can result in field failures. Ensure the product meets the necessary environmental and regulatory standards for your deployment environment. -

Firmware Instability and Poor Updates

Poorly maintained firmware can result in frequent disconnections, crashes, or incompatibilities with network providers. Avoid vendors who do not provide regular firmware updates or lack transparent changelogs. Confirm OTA (Over-The-Air) update support and long-term software maintenance commitments. -

Insufficient Carrier and Network Compatibility

Some modems claim global compatibility but lack support for key frequency bands used in specific regions. Always cross-check supported bands with your target markets and carriers. Incompatibility can lead to poor connectivity or complete service failure. -

Inadequate Technical Support and Documentation

Sourcing from vendors with limited technical documentation or unresponsive support can cause integration delays and troubleshooting difficulties. Ensure access to comprehensive datasheets, AT command guides, SDKs, and responsive engineering support.

IP-Related Pitfalls

-

Use of Counterfeit or Cloned Modules

Some suppliers rebrand or clone GSM modules without proper licensing, using counterfeit chipsets. These violate intellectual property rights and often lack reliability and security. Always source from authorized distributors or directly from reputable manufacturers to ensure genuine components. -

Risk of Infringing Patented Technologies

GSM technology involves numerous patents held by entities like Qualcomm, Ericsson, and others. Modems manufactured without proper licensing agreements may expose your business to legal action or import bans. Verify that the supplier complies with all relevant licensing requirements (e.g., through membership in licensing pools like Avanci). -

Lack of Transparency in Supply Chain

Opaque supply chains make it difficult to trace component origins and verify IP compliance. Request detailed bills of materials (BOMs) and manufacturing disclosures. Prefer vendors who offer full supply chain transparency and compliance documentation. -

Open-Source License Violations

Many modems use open-source firmware or software stacks (e.g., Linux-based). Vendors who fail to comply with licenses like GPL may expose your product to legal risks. Confirm that the supplier adheres to open-source licensing terms and provides source code when required. -

Design Copying and Lack of Differentiation

Some suppliers offer nearly identical modems with minimal differentiation, suggesting design copying rather than innovation. This not only raises IP concerns but also reduces long-term viability. Choose suppliers who invest in R&D and offer unique value, such as custom firmware or enhanced security features.

Conclusion

Avoiding these pitfalls requires due diligence in supplier evaluation, technical validation, and legal compliance. Prioritize vendors with strong reputations, certifications, transparent practices, and clear IP licensing to ensure reliable, legally sound GSM modem integration.

Logistics & Compliance Guide for GSM Modem

Overview

This guide outlines the essential logistics and compliance considerations for the import, export, distribution, and use of GSM (Global System for Mobile Communications) modems. Adhering to these guidelines ensures legal operation, minimizes supply chain risks, and supports global market access.

Regulatory Compliance

Radio Frequency (RF) Certification

GSM modems must comply with regional RF regulations due to their wireless transmission capabilities. Key certifications include:

– FCC Certification (USA): Required under Part 15 and Part 22/24/27 of the FCC rules. Modems must pass testing for RF exposure, interference, and modulation accuracy.

– CE Marking (Europe): Requires compliance with the Radio Equipment Directive (RED) 2014/53/EU, covering electromagnetic compatibility (EMC), safety, and spectrum efficiency.

– IC Certification (Canada): Industry Canada (ISED) requires licensing for radio apparatus under RSS-130 and RSS-210.

– Other Regions: Local approvals such as SRRC (China), NCC (Taiwan), KC (South Korea), and TELEC (Japan) may apply depending on the destination market.

Environmental and Safety Standards

- RoHS Compliance (Restriction of Hazardous Substances): Required in the EU, UK, China, and other regions. Ensures the modem does not contain restricted materials such as lead, mercury, or cadmium.

- REACH (EU): Addresses the registration, evaluation, and restriction of chemical substances.

- WEEE Directive (EU): Mandates proper recycling and disposal of electronic equipment.

- UL/CSA Safety Certification: Required in North America for electrical safety compliance.

Network Operator Requirements

- IMEI Registration: In many countries (e.g., India, UAE), GSM modems must have a valid IMEI (International Mobile Equipment Identity) registered with local telecom authorities.

- Carrier Approval: Some network operators require pre-approval or certification of modems before they can be connected to their networks.

Logistics Considerations

Packaging and Labeling

- Compliant Labeling: Include required regulatory marks (FCC ID, CE, ISED, etc.), operating frequency bands, input voltage, and safety warnings.

- IMEI and MAC Address Labels: Must be clearly printed on the product and packaging.

- Multilingual Documentation: User manuals and safety information should be provided in the official languages of the target market.

- ESD Protection: Use anti-static packaging to prevent damage during transit.

Import/Export Documentation

- Commercial Invoice: Must detail product description, value, quantity, and Harmonized System (HS) code.

- Packing List: Itemizes contents of each shipment.

- Certificate of Origin: May be required for customs duty determination.

- Radio Equipment Compliance Declaration: A Declaration of Conformity (DoC) signed by the manufacturer or importer, verifying compliance with local RF and safety standards.

HS Code and Tariff Classification

- Typical HS Code: 8517.62 (Transmission apparatus for wireless networks).

- Verify exact classification with local customs authorities, as rates and rules vary by country.

Shipping and Handling

- Air Transport (IATA Regulations): Lithium batteries (if integrated) must comply with IATA Dangerous Goods Regulations (DGR). Proper UN38.3 testing and packaging are required.

- Temperature and Humidity Control: Avoid exposure to extreme conditions that may damage sensitive electronics.

- Insurance: Ensure adequate coverage for high-value electronic shipments.

Market-Specific Requirements

United States

- FCC ID must be listed in the user manual and on the device.

- Compliance with Section 15.247 and 15.209 for unlicensed frequency use.

European Union

- RED compliance with technical documentation (including risk assessment) stored for 10 years.

- CE marking affixed visibly on the product.

China

- Requires SRRC certification for all radio transmission equipment.

- CCC mark may be required if the product includes AC power adapters.

India

- BIS (Bureau of Indian Standards) registration may be required.

- TEC (Telecommunication Engineering Center) certification for telecom equipment.

- IMEI registration via TEC portal mandatory.

Post-Market Compliance

- Software Updates: Ensure firmware updates do not affect certified RF parameters. Recertification may be required for significant changes.

- Field Monitoring: Track customer reports of interference or non-compliance.

- Recall Preparedness: Maintain procedures to handle product recalls due to compliance failures.

Conclusion

Successful global deployment of GSM modems requires strict adherence to regulatory standards and efficient logistics planning. Always consult local authorities or a compliance expert before shipping to new markets to avoid delays, fines, or product seizure.

Conclusion on Sourcing a GSM Modem

After evaluating various factors such as technical specifications, reliability, cost, supplier credibility, and long-term support, sourcing a GSM modem requires a strategic approach that balances performance with budgetary constraints. It is essential to select a modem that supports the required frequency bands for the target region, offers robust data connectivity (GSM/GPRS/EDGE or 3G/4G, depending on application needs), and is compatible with existing hardware and software systems.

Supplier reliability, warranty terms, availability of technical documentation, and customer support play a crucial role in ensuring smooth integration and maintenance. Prioritizing established brands or reputable manufacturers can reduce the risk of downtime and ensure firmware updates and compliance with regulatory standards.

Additionally, considering future scalability—such as support for LTE or NB-IoT—can future-proof the deployment, especially in IoT and remote monitoring applications.

In conclusion, a well-informed decision based on thorough market research, clear technical requirements, and lifecycle cost analysis will ensure the successful sourcing of a GSM modem that meets both current operational needs and future expansion goals.