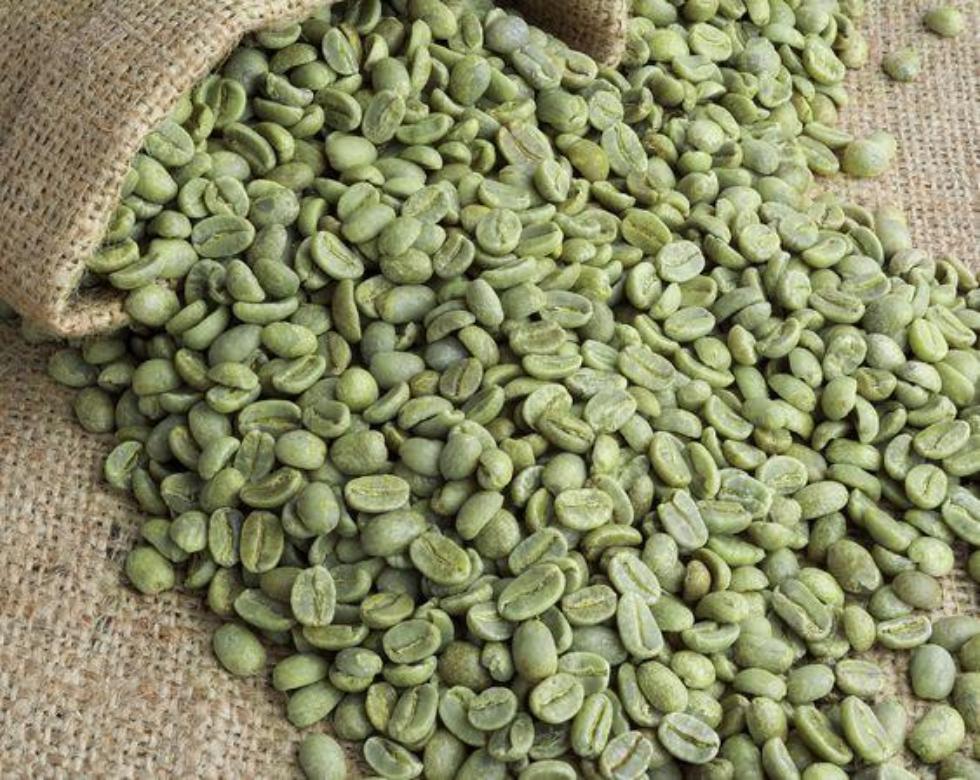

The global green coffee bean market is experiencing robust growth, driven by rising coffee consumption, increasing demand for specialty and sustainably sourced beans, and a surge in home brewing and artisanal coffee culture. According to Mordor Intelligence, the market was valued at USD 30.6 billion in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2029. This expansion is further supported by Grand View Research, which highlights the growing preference for ethically traded and organic coffee, particularly in North America and Europe. As demand intensifies, a select group of manufacturers has emerged as industry leaders, consistently delivering high-quality green coffee beans while embracing sustainable sourcing and traceability practices. These top 10 green coffee bean manufacturers not only command significant market share but also set the standard for innovation, scale, and supply chain transparency in a rapidly evolving sector.

Top 10 Green Coffee Bean Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Sustainable Harvest® Coffee Importers

Domain Est. 1996

Website: sustainableharvest.com

Key Highlights: We can find the right offering to fit your green coffee needs, from exquisite micro-lots and hard-working core blenders to special women’s coffees….

#2 Green Coffee Supplier

Domain Est. 1997

Website: ofi.com

Key Highlights: As a leading green coffee supplier, we connect coffee roasters with a vast selection of world-class green coffees. Whether you’re looking for long-established ……

#3 Green Coffee

Domain Est. 1998

Website: sweetmarias.com

Key Highlights: 5-day deliveryGreen coffee is our specialty! We source our beans directly from farmers and cooperatives we’ve built relationships with over the last 25 years….

#4 Cafe Imports

Domain Est. 1999

Website: cafeimports.com

Key Highlights: Cafe Imports are importers of fine specialty green coffees. We source the world’s best green coffee, offer free coffee education resources and material, ……

#5 Green Coffee Beans for Roasting

Domain Est. 2001

Website: sonofresco.com

Key Highlights: 7-day delivery 30-day returnsExperience the art of coffee roasting with Sonofresco. Shop green coffee beans and easy-to-use roasters made for perfect small batch results….

#6 Buy Green Coffee Beans Online

Domain Est. 2002

Website: burmancoffee.com

Key Highlights: Free delivery over $250World class super fresh Green Coffee Beans for Home Coffee Roasters. Starting at $5.99/lb. Exceptional service and value. $7.99 shipping….

#7 StoneX Specialty Coffee

Domain Est. 2003

Website: specialtycoffee.stonex.com

Key Highlights: StoneX Specialty Coffee is a specialty green coffee bean importer. We sell green coffee to roasters and coffee companies across the US and Canada….

#8 Green Coffee beans

Domain Est. 2009

Website: bodhileafcoffee.com

Key Highlights: Free delivery over $59 30-day returnsView our selection of Green Coffee Beans to choose from. We are a licensed Q – Grader that proudly performs extensive research on every batch o…

#9 Green Coffee Company

Domain Est. 2011

Website: greencoffeecompany.com

Key Highlights: We are Colombia’s Largest Coffee Grower. Vertical integration and full control of our supply chain provide our clients with traceability and unmatched quality….

#10 Genuine Origin

Domain Est. 2015

Website: genuineorigin.com

Key Highlights: Shop our selection of green coffee beans and get them shipped free to your coffee roastery. Find unroasted coffee beans from your favorite coffee origins….

Expert Sourcing Insights for Green Coffee Bean

H2: 2026 Market Trends for Green Coffee Bean

The green coffee bean market is poised for significant transformation by 2026, driven by evolving consumer preferences, sustainability demands, technological advancements, and shifting global supply dynamics. Below is an analysis of key trends expected to shape the market in this pivotal year.

1. Rising Demand for Health and Wellness Products

Green coffee beans, known for their high chlorogenic acid content and antioxidant properties, are increasingly associated with weight management and metabolic health. By 2026, growing consumer awareness and endorsement from health influencers are expected to amplify demand, particularly in North America and Europe. The nutraceutical sector is likely to incorporate green coffee extracts into dietary supplements, functional foods, and beverages, boosting market expansion.

2. Expansion of E-Commerce and Direct-to-Consumer Channels

The digitalization of retail continues to reshape how green coffee beans are marketed and sold. By 2026, e-commerce platforms, subscription models, and specialty online retailers will play a dominant role in connecting producers directly with health-conscious consumers. This trend enables transparency in sourcing, traceability, and premium branding—factors increasingly valued by modern buyers.

3. Sustainability and Ethical Sourcing as Market Differentiators

Consumers and regulatory bodies are placing greater emphasis on environmentally responsible practices. In 2026, certifications such as organic, fair trade, and carbon-neutral will be critical for market access. Producers investing in regenerative agriculture, water conservation, and deforestation-free supply chains will gain competitive advantage. Major buyers, including multinational supplement brands, are expected to enforce stricter sustainability criteria.

4. Technological Innovations in Processing and Extraction

Advancements in cold extraction, supercritical CO2 extraction, and precision drying technologies will enhance the quality and consistency of green coffee bean products. These innovations not only preserve bioactive compounds but also reduce waste and energy consumption. By 2026, adoption of AI and IoT in post-harvest processing will improve yield prediction, quality control, and logistics efficiency.

5. Geographic Shifts in Production and Consumption

While traditional producers like Brazil, Vietnam, and Colombia remain dominant, emerging regions such as East Africa (Ethiopia, Kenya) and Southeast Asia (Indonesia, Laos) are gaining traction due to unique flavor profiles and sustainable farming practices. On the demand side, Asia-Pacific—especially China and India—is projected to experience the fastest growth in green coffee consumption, fueled by rising disposable incomes and wellness trends.

6. Price Volatility and Supply Chain Resilience

Climate change, geopolitical instability, and fluctuating currency exchange rates will continue to impact green coffee bean prices. By 2026, stakeholders will prioritize supply chain diversification and long-term contracts to mitigate risks. Blockchain-enabled traceability systems may become mainstream to ensure authenticity and reduce fraud.

7. Regulatory Scrutiny and Standardization

As health claims proliferate, regulatory bodies such as the FDA and EFSA are expected to impose stricter guidelines on labeling and efficacy claims for green coffee-based products. This will drive the need for clinical validation and standardized extract formulations, potentially consolidating the market around reputable suppliers.

Conclusion

The 2026 green coffee bean market will be characterized by innovation, sustainability, and heightened consumer awareness. Companies that align with health trends, embrace technology, and prioritize ethical sourcing will be best positioned to capitalize on this growing, dynamic market.

Common Pitfalls Sourcing Green Coffee Bean (Quality, IP)

Sourcing green coffee beans presents several challenges that can significantly impact quality, consistency, and long-term supply chain integrity. Among the most critical pitfalls are those related to quality assurance and intellectual property (IP) concerns.

Quality Variability and Inconsistency

One of the foremost challenges in sourcing green coffee is maintaining consistent quality across batches. Coffee is an agricultural product influenced by numerous variables including climate, soil conditions, harvest timing, and post-harvest processing methods. Buyers often face inconsistencies in bean size, moisture content, defect levels, and cup profile—even when sourcing from the same farm or region over multiple seasons. Without rigorous quality control protocols, such as standardized sampling, cupping, and adherence to grading standards (e.g., SCA or USDA), buyers risk receiving subpar beans that fail to meet roast profiles or customer expectations.

Lack of Traceability and Verification

Traceability is essential for verifying origin claims and ensuring ethical sourcing, yet many supply chains lack transparency. Mislabeling or blending beans from different origins can obscure the true source of the coffee, making it difficult to confirm quality claims or sustainability certifications. Without proper documentation and third-party verification, buyers may inadvertently support unethical practices or receive counterfeit specialty coffees, undermining brand integrity and consumer trust.

Insufficient Post-Harvest Handling and Storage

Green coffee is a perishable commodity sensitive to moisture, temperature, and contaminants. Poor handling during drying, transportation, or storage can lead to mold development, insect infestation, or flavor degradation (e.g., musty or fermented notes). Sourcing from suppliers without proper infrastructure or quality management systems increases the risk of receiving beans with inherent defects that are not immediately visible but emerge during roasting or cupping.

Intellectual Property and Origin Misappropriation

“Intellectual property” in coffee sourcing refers to the protection of unique regional identities, varietals, and traditional production methods. A key pitfall is the misappropriation or falsification of geographic indications (GIs), such as “Kona,” “Jamaican Blue Mountain,” or “Geisha.” Unscrupulous suppliers may blend lower-grade beans with a small percentage of authentic origin coffee and market the blend as the premium product. This not only deceives buyers but also undermines the value and reputation of genuine producers who invest in quality and terroir-specific branding.

Limited Access to Verified Specialty Genetics

High-value coffee varietals such as Geisha, Pacamara, or proprietary hybrids are often protected by breeding programs or farmer cooperatives. Sourcing these beans without proper authorization can lead to legal and ethical issues, particularly if the genetics are patented or subject to benefit-sharing agreements. Buyers may unknowingly support biopiracy or violate plant variety rights when sourcing from unverified suppliers offering “exclusive” or “rare” beans without documentation of provenance.

Overreliance on Intermediaries Without Due Diligence

Many buyers source green coffee through brokers or importers without direct engagement with farms or cooperatives. While intermediaries can facilitate access, they may obscure accountability and dilute quality control. Without conducting audits, farm visits, or building direct trade relationships, buyers are vulnerable to supply chain opacity, inconsistent quality, and potential IP violations.

Avoiding these pitfalls requires a proactive sourcing strategy that emphasizes transparency, long-term partnerships, third-party verification, and respect for both quality standards and intellectual property rights in the coffee industry.

Logistics & Compliance Guide for Green Coffee Beans

Overview of Green Coffee Bean Trade

Green coffee beans, the raw, unroasted seeds of the coffee plant, are a globally traded commodity subject to complex logistics and regulatory frameworks. Efficient handling, transportation, and compliance with international standards are critical for maintaining quality and ensuring smooth cross-border trade.

Harvesting and Post-Harvest Processing

Green coffee beans must be properly harvested and processed to meet export standards. Common methods include:

- Washed (wet) processing: Beans are depulped, fermented, and washed to remove mucilage.

- Natural (dry) processing: Whole cherries are dried in the sun before hulling.

- Honey processing: A hybrid method retaining some mucilage during drying.

Proper drying is essential—moisture content should be maintained between 10–12% to prevent mold and maintain shelf life during transit.

Quality Grading and Certification

Coffee is graded based on size, density, color, and defect count. Key certification standards include:

- ** Specialty Coffee Association (SCA) Grading**: Scores above 80 points qualify as specialty grade.

- Fair Trade, Organic, Rainforest Alliance, and UTZ: Sustainability and ethical sourcing certifications required by many importers.

- Country-Specific Standards: For example, Colombia’s Café de Colombia or Ethiopia’s Ethiopian Commodity Exchange (ECX) protocols.

Exporters should maintain documentation proving compliance with these standards.

Packaging and Storage Requirements

To preserve quality during transport:

- Use jute or woven polypropylene bags (60–70 kg capacity) lined with polyethylene to reduce moisture exchange.

- Store in clean, dry, well-ventilated facilities away from strong odors and direct sunlight.

- Avoid stacking on concrete floors; use pallets or wooden platforms to prevent moisture absorption.

For premium or specialty beans, vacuum-sealed or GrainPro bags may be used to enhance shelf life.

Transportation and Logistics

Pre-Shipment Preparation

- Ensure beans are clean, graded, and moisture-tested before loading.

- Conduct pre-shipment inspections to verify quality and quantity.

- Secure phytosanitary certificates and certificate of origin.

Shipping Methods

- Containerized shipping (20′ or 40′ containers) is standard:

- Use dry-van containers for bulk transport.

- Consider reefer containers with humidity control for high-value or specialty beans in extreme climates.

- Break-bulk shipping is rare but used in some regional markets.

Transit Considerations

- Avoid temperature fluctuations and condensation (“sweating”) by ensuring proper ventilation.

- Limit exposure to moisture; use desiccants if necessary.

- Minimize handling to reduce physical damage and contamination.

Import and Export Regulations

Export Documentation

Mandatory documents typically include:

- Commercial invoice

- Packing list

- Bill of lading or air waybill

- Phytosanitary certificate

- Certificate of origin

- Fumigation certificate (if required)

- Organic or Fair Trade certification (if applicable)

Import Requirements by Region

- United States: Regulated by USDA and FDA. Requires prior notification under the Prior Notice System for Food. May require fumigation for certain origins.

- European Union: Must comply with EU Regulation (EC) No 396/2005 (pesticide residues) and Regulation (EC) No 178/2002 (food safety). Organic imports require EU organic certification.

- Canada: Managed by the Canadian Food Inspection Agency (CFIA); requires import license for some origins.

- Japan & South Korea: Require strict residue testing and often mandate fumigation.

Always verify current import requirements with the destination country’s agricultural or food safety authority.

Pest and Disease Control

Green coffee beans may carry pests such as:

- Coffee berry borer (Hypothenemus hampei)

- Coffee bean weevil (Araecerus fasciculatus)

Fumigation (e.g., with methyl bromide or phosphine) may be required, though alternatives like heat treatment or controlled atmosphere are gaining popularity due to environmental concerns.

Ensure all treatments comply with the International Standards for Phytosanitary Measures (ISPM 15) for wood packaging and ISPM 38 for consignments of green coffee.

Customs Clearance and Duties

- HS Code: 0901.11 (coffee, roasted) and 0901.21 (coffee, unroasted) are commonly used.

- Tariff rates vary by country and trade agreements (e.g., GSP, CBI, AGOA).

- Accurate declaration of volume, value, and origin is essential to avoid delays or penalties.

Engage licensed customs brokers in both origin and destination countries for efficient clearance.

Sustainability and Traceability

Increasing demand for traceability and ethical sourcing requires:

- Farm-to-port tracking systems.

- Blockchain or digital ledger technologies for transparency.

- Compliance with due diligence regulations (e.g., EU Deforestation Regulation (EUDR), which requires geolocation data for coffee plots).

Risk Management

Common risks include:

- Moisture damage during transit.

- Contamination from improper storage or adjacent cargo.

- Delays due to documentation errors or customs inspections.

Mitigation strategies:

- Purchase cargo insurance covering quality and quantity loss.

- Partner with experienced freight forwarders specializing in agricultural commodities.

- Conduct regular audits of supply chain partners.

Conclusion

Successful logistics and compliance for green coffee beans require attention to detail at every stage—from farm processing to final delivery. Adherence to international standards, proper documentation, and investment in quality preservation ensure market access and customer satisfaction in a competitive global industry.

In conclusion, sourcing green coffee bean suppliers requires a strategic approach that balances quality, sustainability, traceability, and long-term reliability. Building strong relationships with ethical and transparent suppliers ensures access to superior beans while supporting environmentally responsible and socially equitable practices throughout the supply chain. Factors such as origin, processing methods, certifications (e.g., organic, fair trade, Rainforest Alliance), and consistency in supply should all be carefully evaluated. Additionally, maintaining open communication and conducting regular quality assessments help mitigate risks and foster mutual growth. Ultimately, a well-vetted network of green coffee bean suppliers not only enhances the quality and authenticity of the final product but also strengthens brand integrity and customer trust in an increasingly conscious market.