The global grease plumbing systems market is experiencing steady growth, driven by increasing industrialization, stringent environmental regulations, and rising demand for efficient wastewater management solutions. According to Grand View Research, the global grease trap market was valued at USD 1.2 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. Similarly, Mordor Intelligence forecasts consistent expansion in the sector, citing rising construction of commercial foodservice facilities and mandatory grease interceptor installations in municipal sewer regulations as key growth drivers. As compliance and sustainability become priorities, manufacturers are innovating to deliver high-efficiency, durable grease plumbing solutions. In this competitive landscape, nine companies have emerged as leaders, combining engineering excellence, global reach, and data-backed performance to set industry benchmarks.

Top 9 Grease Plumbing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Sioux Chief: Rough Plumbing Products

Domain Est. 1997

Website: siouxchief.com

Key Highlights: We are an American manufacturer. Sioux Chief believes in making our products right here in America. American manufacturing is important….

#2 Baker Commodities

Domain Est. 1997

Website: bakercommodities.com

Key Highlights: Baker Commodities, Inc. offers services in rendering, restaurant grease collection, jetting and fat and bone collection….

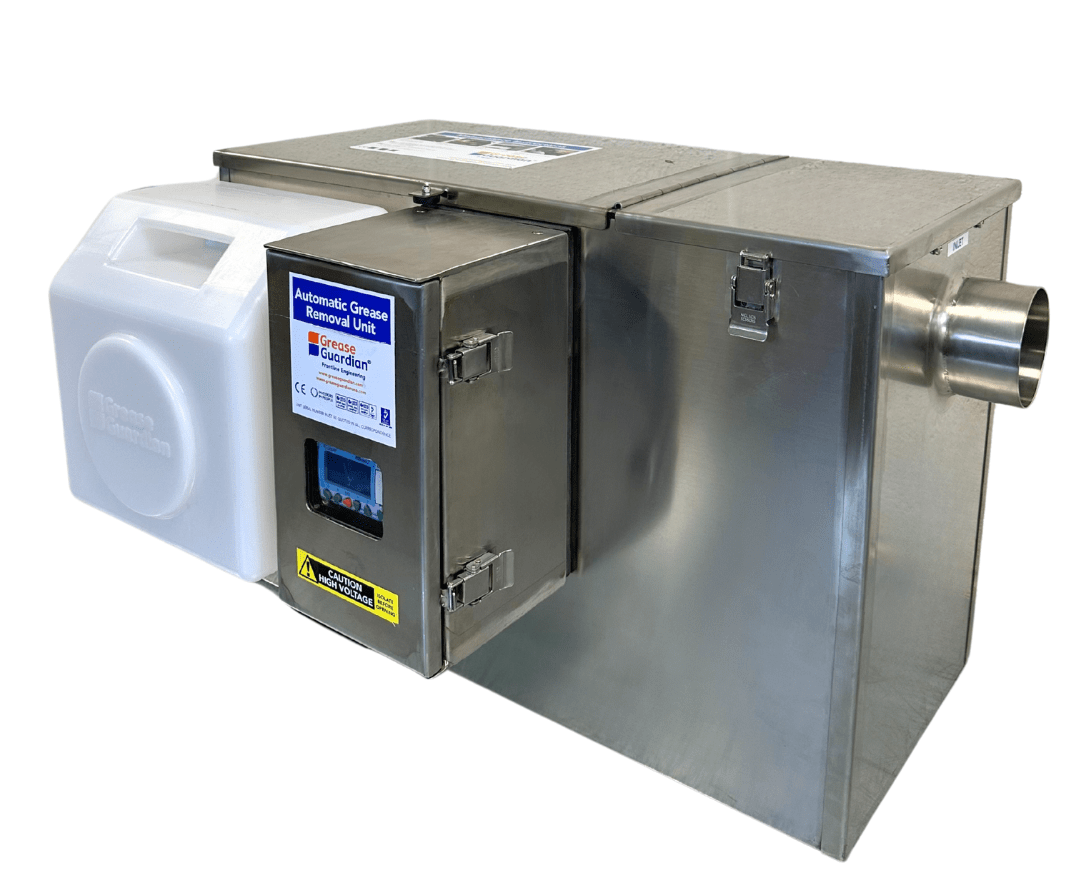

#3 Grease Guardian®

Domain Est. 2001

Website: greaseguardian.com

Key Highlights: Grease Guardian® | Sustainable Grease Management- The Leading Manufacturer of Automatic Grease Removal Devices, Under Sink Grease Traps and Grease Interceptors….

#4 Grease Interceptor

Domain Est. 1995

Website: zurn.com

Key Highlights: Grease Interceptor are manufactured with patented distributed flow pattern and corrosion resistant fiberglass material capturing FOG before it clogs pipes….

#5 Oatey

Domain Est. 1996

Website: oatey.com

Key Highlights: We’ve set the standard for quality in rough plumbing products, and we’ve innovated to help make your best work even better….

#6 Schier Products

Domain Est. 1998

Website: schierproducts.com

Key Highlights: Schier offers nine Great Basin® grease interceptor models ranging in size from 10 to 1,500 liquid gallons and 3rd-party-certified grease capacities from 70 lbs….

#7 GreaseCorp

Domain Est. 2014

Website: greasecorp.com

Key Highlights: We provide fast removal, without neglecting cleanliness and quality of service for your trap. Additionally, the headache of grease….

#8 Grease Pumping Plumbing A&P Grease Trappers, Inc Chicagoland

Domain Est. 2017 | Founded: 2006

Website: apgreasetrappers.com

Key Highlights: A&P Grease Trappers, Inc has been a trusted name in the Chicagoland area since 2006, delivering dependable grease trap cleaning and plumbing services. Our ……

#9 The Grease Company

Domain Est. 2020

Website: thegreasecompany.com

Key Highlights: #1 Commercial Kitchen Grease & Plumbing Experts. At The Grease Company, we specialize in professional grease trap cleaning, interceptor maintenance, and repairs ……

Expert Sourcing Insights for Grease Plumbing

H2: 2026 Market Trends for Grease Plumbing

As the global focus on sustainability, infrastructure modernization, and food service expansion intensifies, the grease plumbing sector—particularly systems managing grease interceptor installations, grease trap maintenance, and wastewater pre-treatment—is poised for significant evolution by 2026. Driven by regulatory changes, technological innovation, and shifting commercial kitchen dynamics, several key market trends are expected to shape the industry.

1. Stricter Environmental Regulations and Compliance Demands

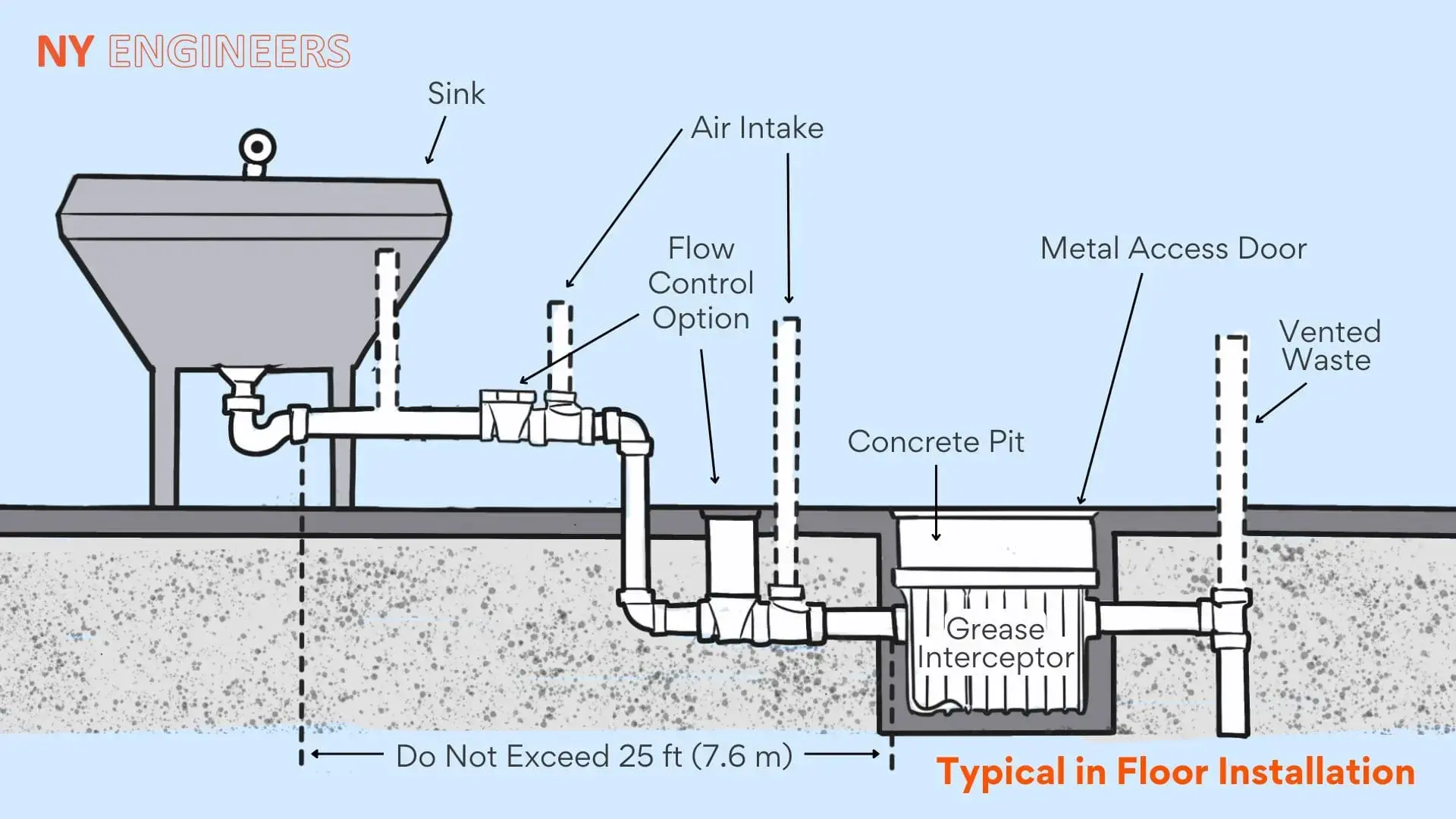

Municipalities and environmental agencies worldwide are tightening discharge standards for fats, oils, and grease (FOG) into sewer systems. By 2026, more regions are anticipated to mandate advanced grease interceptor systems—such as hydromechanical and gravity grease interceptors—alongside regular inspection and digital reporting. Compliance will drive demand for certified grease plumbing services, especially in urban centers facing sewer overflows and blockages.

2. Growth in Commercial Food Service Establishments

The continued expansion of quick-service restaurants (QSRs), food trucks, cloud kitchens, and hospitality venues is increasing the number of FOG-producing facilities. Emerging markets in Asia-Pacific and Latin America, along with urban redevelopment in North America and Europe, will fuel demand for new grease plumbing installations and retrofits, especially in mixed-use developments where space-efficient grease management is critical.

3. Adoption of Smart Grease Interception Technology

The integration of Internet of Things (IoT) sensors and remote monitoring in grease interceptors is a growing trend. By 2026, smart systems capable of measuring grease levels, water temperature, and flow rates will become more common, enabling predictive maintenance, reducing overflow risks, and lowering service costs. These technologies will appeal to facility managers seeking operational efficiency and compliance assurance.

4. Emphasis on Sustainable FOG Management and Recycling

Circular economy principles are influencing the grease plumbing sector. Rather than disposing of grease as waste, more businesses will partner with biodiesel producers and waste-to-energy firms. This shift will boost demand for plumbing systems compatible with grease recycling programs and incentivize the use of eco-friendly, biodegradable degreasers that do not disrupt wastewater treatment processes.

5. Labor Shortages and Demand for Skilled Technicians

The grease plumbing industry faces a growing skills gap, with fewer workers trained in FOG system maintenance and regulatory compliance. By 2026, companies investing in technician training, certification programs, and automated service tools will gain competitive advantages. Mobile workforce management platforms will also become standard, improving scheduling, documentation, and customer communication.

6. Consolidation and Professionalization of Service Providers

The market is expected to see increased consolidation among grease trap cleaning and plumbing service firms, driven by the need for scalability, regulatory expertise, and investment in technology. Larger, full-service providers offering integrated plumbing, maintenance, and compliance reporting will dominate urban markets, while niche operators will focus on specialized solutions for high-end hospitality or healthcare facilities.

Conclusion

By 2026, the grease plumbing market will be characterized by heightened regulation, technological integration, and sustainability imperatives. Companies that embrace innovation, ensure compliance, and adapt to evolving food service trends will be best positioned to capitalize on growth opportunities in this essential segment of wastewater infrastructure.

Common Pitfalls in Sourcing Grease Plumbing (Quality, IP)

Sourcing grease plumbing components—such as grease fittings, nipples, lines, and valves—requires careful attention to both quality and intellectual property (IP) considerations. Overlooking these aspects can lead to operational failures, safety hazards, legal risks, and reputational damage. Below are key pitfalls to avoid:

Poor Material and Build Quality

One of the most frequent issues is selecting components made from substandard materials or with poor manufacturing tolerances. Low-quality grease fittings or lines may corrode, crack, or leak under pressure, leading to equipment downtime and safety risks. Always verify that materials meet industry standards (e.g., ASTM, SAE) and are compatible with the lubricants and operating environments in use.

Inadequate Pressure and Temperature Ratings

Grease plumbing components must withstand system-specific pressure and temperature conditions. Sourcing parts without verifying these ratings can result in catastrophic failures. Ensure specifications match or exceed operational requirements, especially in heavy-duty industrial or mobile equipment applications.

Lack of Standardization and Interchangeability

Using non-standard or proprietary fittings can create long-term maintenance challenges. If replacement parts are not easily sourced or compatible with existing systems, it increases downtime and inventory costs. Prioritize components that adhere to widely accepted standards (e.g., Zerk fittings per SAE J512) to ensure interchangeability.

Counterfeit or Unlicensed Products

The market for industrial components includes counterfeit or imitation parts that mimic reputable brands. These products often lack proper testing, certifications, and IP licensing. Using such parts exposes organizations to performance risks and potential IP infringement claims. Always source from authorized distributors or directly from OEMs.

Ignoring Intellectual Property Rights

Sourcing components that replicate patented designs—such as specific fitting geometries or valve mechanisms—without proper licensing can lead to legal action. This is especially critical when sourcing from regions with weak IP enforcement. Conduct due diligence to ensure suppliers respect IP rights and can provide documentation of legal manufacturing rights.

Insufficient Documentation and Traceability

Reputable suppliers provide material certifications, test reports, and traceability data. Lack of documentation makes it difficult to verify quality or respond to audits and failures. Insist on full traceability, including batch numbers and compliance certificates, to support quality assurance processes.

Overlooking Environmental and Regulatory Compliance

Grease plumbing components may need to meet environmental standards (e.g., RoHS, REACH) or industry-specific regulations. Sourcing non-compliant parts can result in penalties or project delays. Confirm that components meet all relevant regulatory requirements for the target market.

By addressing these pitfalls proactively, organizations can ensure reliable performance, legal compliance, and long-term cost savings in their grease plumbing systems.

Logistics & Compliance Guide for Grease Plumbing

This guide outlines the essential logistics procedures and compliance requirements for Grease Plumbing to ensure efficient operations, regulatory adherence, and customer satisfaction.

Logistics Operations

Service Dispatch & Scheduling

Grease Plumbing utilizes a centralized dispatch system to assign jobs based on technician location, skill set, and service urgency. All service appointments are logged in the CRM system with real-time updates, ensuring timely arrivals and accurate customer communication.

Vehicle Fleet Management

Company vehicles are equipped with standardized plumbing tools, safety gear, and GPS tracking. Technicians are responsible for daily vehicle inspections, fuel logs, and inventory checks. Maintenance schedules are managed through a digital fleet tracking platform to minimize downtime.

Parts & Inventory Supply Chain

Plumbing parts and materials are sourced from approved vendors compliant with industry standards. Inventory is tracked in a cloud-based system, enabling automatic reordering when stock reaches predetermined thresholds. Emergency parts are stored in regional staging areas to reduce response time.

Waste Disposal & Environmental Handling

All grease, wastewater, and hazardous materials collected during service are handled in accordance with local, state, and federal environmental regulations. Waste is transported to licensed disposal facilities, with proper documentation and chain-of-custody records maintained for audit purposes.

Compliance Requirements

Licensing & Certifications

All technicians must hold valid plumbing licenses and certifications as required by the state or municipality. Continuing education records are monitored to ensure all staff maintain up-to-date credentials. Business operations are registered with relevant state and local agencies.

OSHA Safety Standards

Grease Plumbing adheres to OSHA regulations for workplace safety. Technicians are trained in hazard communication, personal protective equipment (PPE) usage, confined space entry, and safe lifting practices. Safety data sheets (SDS) are accessible on all service vehicles.

Environmental Regulations

Operations comply with the Environmental Protection Agency (EPA) and local wastewater management codes. Grease trap cleaning and disposal follow the guidelines set by the National Pollutant Discharge Elimination System (NPDES). Spill response protocols are in place for accidental releases.

Recordkeeping & Audits

All service reports, compliance certifications, training logs, and waste disposal manifests are retained for a minimum of seven years. Internal audits are conducted quarterly to verify adherence to policies and prepare for external regulatory inspections.

Customer Data Privacy

Customer information collected during service is protected under applicable privacy laws, including the California Consumer Privacy Act (CCPA) where applicable. Data is encrypted and access is restricted to authorized personnel only. Third-party vendors are vetted for data security compliance.

Conclusion for Sourcing Grease Trap Plumbing Supplies:

Sourcing the right grease trap plumbing components is essential for ensuring efficient wastewater management, regulatory compliance, and long-term system performance in commercial kitchens and food service operations. By selecting high-quality materials, partnering with reliable suppliers, and considering factors such as durability, local code requirements, and ease of maintenance, businesses can minimize blockages, reduce costly repairs, and prevent environmental contamination. A strategic sourcing approach that balances cost-effectiveness with sustainability and performance will ultimately support operational efficiency and compliance with health and safety standards. Regular evaluation of suppliers and staying informed about industry advancements can further enhance the reliability and effectiveness of grease plumbing systems.