The global gravity irrigation systems market is witnessing steady growth, driven by rising water scarcity, increasing demand for sustainable agricultural practices, and supportive government initiatives promoting efficient water use in farming. According to Mordor Intelligence, the irrigation systems market is projected to grow at a CAGR of over 10.5% from 2024 to 2029, with gravity-based methods maintaining a strong foothold—particularly in developing regions due to their low cost and minimal energy requirements. Gravity irrigation, which leverages natural elevation gradients to distribute water across fields, accounts for a significant share of traditional irrigation practices, especially in rice cultivation and surface irrigation applications. As the agriculture sector increasingly adopts cost-effective and energy-efficient solutions, manufacturers specializing in gravity irrigation systems are expanding production, enhancing distribution, and innovating designs to improve uniformity and water-use efficiency. This list highlights the top 10 gravity irrigation system manufacturers shaping this evolving landscape, selected based on market presence, product range, geographic reach, and technological advancements.

Top 10 Gravity Irrigation System Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Drip Irrigation System & Technology

Domain Est. 2000

Website: netafimusa.com

Key Highlights: Netafim is the world’s leading drip irrigation technology company supplying multiple industries with smart drip irrigation systems that help to fight food ……

#2 Rubicon Water

Domain Est. 2009

Website: rubiconwater.com

Key Highlights: Rubicon Water delivers advanced technology to optimize gravity irrigation management systems through automated gates and precise water accounting software….

#3 N

Domain Est. 2018

Website: ndrip.com

Key Highlights: A disruptive technology that provides precise irrigation, produces higher yields while saving water, without adding energy or needing water filtration….

#4 Low Energy

Domain Est. 1996

Website: netafim.com

Key Highlights: An all-in-one modular irrigation system, powered by gravity, that doesn’t require any pumping or filters, and incurs no energy expenses….

#5 Blumat

Domain Est. 1998

Website: blumat.com

Key Highlights: Tropf-Blumat is an automatic watering system for plants all around the house. From flowering plants to your own vegetables, Tropf-Blumat is a needs-based system ……

#6 Hit Products Corp

Domain Est. 1999

Website: hitproductscorp.com

Key Highlights: Manufacturing a wide variety of items for your irrigation needs. Agriculture. Over 40 years of proven products to fill you irrigation needs….

#7 SWAN Systems

Domain Est. 1999

Website: swansystems.com

Key Highlights: Chaffin Farms in Blythe, California is modernizing gravity-fed irrigation through a collaboration with Rubicon Water and SWAN Systems. By ……

#8 Drip Irrigation Systems

Domain Est. 2010

Website: rivulis.com

Key Highlights: Discover Rivulis’s advanced drip irrigation systems. Our solutions help you save water, increase yield, and improve crop quality….

#9 Power Free, Indoor & Outdoor Irrigation

Domain Est. 2012

#10 Metzer

Domain Est. 2016

Website: metzer-group.com

Key Highlights: Innovative drip irrigation & infrastructure solutions for every field. Boost your yield with Metzer – explore our smart systems today….

Expert Sourcing Insights for Gravity Irrigation System

H2: 2026 Market Trends for Gravity Irrigation Systems

As of 2026, the gravity irrigation system market is undergoing a period of strategic evolution, shaped by intensifying water scarcity, climate volatility, and the growing imperative for sustainable agriculture. While facing competition from pressurized systems like drip and sprinkler, gravity irrigation—particularly in its modernized forms—remains a cornerstone of global food production, especially in developing regions and large-scale row crop farming. Key market trends for 2026 include:

1. Resurgence Through Modernization and Efficiency Upgrades:

Far from being obsolete, traditional gravity systems (e.g., furrow, basin, border irrigation) are experiencing a renaissance driven by cost-effective modernization. The dominant trend is the integration of precision technologies. Laser land leveling, now more accessible, is widespread to ensure optimal water distribution and minimize runoff. Coupled with automated gated pipe systems, surge valves, and real-time soil moisture sensors, farmers are significantly improving application efficiency (reaching 60-70%, up from traditional 30-50%). This “smart gravity” approach offers a lower-cost alternative to full drip systems, making it highly attractive for water-stressed but cost-sensitive regions.

2. Dominance in Staple Crop Production & Emerging Markets:

Gravity irrigation continues to dominate in the cultivation of water-intensive staple crops like rice, wheat, maize, and sugarcane, particularly in South Asia (India, Bangladesh), Southeast Asia, Sub-Saharan Africa, and parts of Latin America. Government subsidies and national food security policies in these regions actively promote gravity systems due to their lower initial investment and suitability for vast, flat terrains. In 2026, market growth is heavily concentrated in these emerging economies, driven by population growth and the need to boost agricultural output with limited capital.

3. Water Scarcity as a Double-Edged Sword:

Intensifying water stress is the most significant market driver and challenge. On one hand, it fuels demand for efficiency upgrades (as noted in trend 1) and reinforces the need for any irrigation where rainfed agriculture fails. On the other, it accelerates the shift towards more efficient pressurized systems (drip, sprinkler) in high-value crops and water-critical areas. Gravity systems are increasingly scrutinized for their higher water losses (evaporation, deep percolation, runoff). Their market share is thus contracting in water-scarce developed regions (e.g., parts of the US, Australia, Southern Europe) but holding or growing in regions with relatively abundant surface water or strong policy support.

4. Sustainability & Environmental Regulations:

Environmental concerns are reshaping the market. Regulations targeting nutrient runoff and groundwater depletion are pushing farmers to adopt best management practices (BMPs) with gravity systems. This includes controlled drainage, tailwater recovery systems, and precise scheduling based on evapotranspiration data. Systems incorporating these features are gaining favor. Additionally, gravity irrigation powered by gravity-fed canals (avoiding energy-intensive pumps) aligns with carbon footprint reduction goals, enhancing its sustainability credentials in specific contexts.

5. Competitive Dynamics & Technological Convergence:

The market is seeing increased competition from hybrid systems and advanced alternatives. While drip irrigation dominates high-value horticulture, low-pressure drip (LPD) and subsurface drip are encroaching on traditional gravity crop domains. However, the significant cost gap remains a major barrier to full displacement. The 2026 landscape features convergence, where gravity systems increasingly incorporate components and data analytics from precision agriculture (e.g., using satellite imagery for scheduling, IoT sensors for monitoring), blurring the lines between “traditional” and “advanced” irrigation.

6. Supply Chain & Investment Focus:

Investment in 2026 is flowing towards efficiency-enhancing components rather than basic infrastructure. Key growth areas include automated flow control devices, durable and efficient gated pipe systems, laser leveling equipment, and integrated monitoring platforms. Supply chains are adapting to meet demand in emerging markets, with local manufacturing hubs expanding in Asia and Africa to reduce costs and improve accessibility. International development agencies continue to fund large-scale modernization projects, particularly in public canal networks.

Conclusion:

In 2026, the gravity irrigation market is characterized by adaptive resilience. It is not disappearing but is transforming. Its future lies in embracing precision technologies to become more efficient and sustainable, particularly in water-abundant or policy-supported regions focused on staple food security. While facing pressure from more efficient alternatives in water-scarce zones, its low operational energy requirements and significantly lower capital cost ensure it remains a vital, evolving component of the global irrigation landscape, especially for large-scale, lower-value-per-acre agriculture. Success hinges on continuous innovation in efficiency and integration with digital agriculture tools.

Common Pitfalls in Sourcing Gravity Irrigation Systems (Quality and Intellectual Property)

Sourcing Gravity Irrigation Systems can offer cost-effective and sustainable water management solutions, especially in remote or off-grid areas. However, organizations and individuals often encounter significant challenges related to product quality and intellectual property (IP) issues. Being aware of these pitfalls is crucial to ensure long-term system performance, cost efficiency, and legal compliance.

Poor Product Quality and Material Durability

One of the most frequent issues when sourcing gravity irrigation systems—especially from low-cost suppliers—is substandard product quality. Components such as drip lines, emitters, filters, and connectors may be made from inferior plastics or low-grade materials that degrade quickly under UV exposure, temperature fluctuations, or water pressure variations. This leads to frequent clogging, leaks, and premature system failure, undermining the reliability and efficiency of the irrigation setup. Buyers may also receive inconsistent flow rates across emitters due to poor manufacturing tolerances, resulting in uneven water distribution and reduced crop yields.

Lack of Certification and Performance Testing

Many suppliers, particularly in unregulated markets, do not provide third-party certification for their irrigation products. Without certifications such as ISO, ASTM, or IAPMO, there is no guarantee that the system components meet international quality and performance standards. Buyers may assume compatibility and durability based on product descriptions, only to discover that the system fails under field conditions. This lack of verified testing significantly increases the risk of operational inefficiencies and financial loss.

Counterfeit or Copycat Products

The gravity irrigation market, especially for drip irrigation technology, is rife with counterfeit or imitation products that mimic well-known branded systems. These copies often replicate the appearance of patented designs but use inferior materials and engineering. While they may appear cost-effective initially, they typically underperform and fail sooner than genuine products. Sourcing such items can lead to reduced agricultural productivity and increased maintenance costs.

Intellectual Property Infringement Risks

Purchasing or distributing irrigation components that infringe on existing patents, trademarks, or designs can expose buyers and resellers to legal liability. Many gravity irrigation technologies—especially efficient emitter designs, filtration systems, and pressure-compensating driplines—are protected by intellectual property rights. Sourcing from manufacturers that do not respect these IP rights can result in legal disputes, shipment seizures, or reputational damage. It is essential to verify that suppliers have legitimate rights to produce and sell the technology they offer.

Inadequate Technical Support and Documentation

Low-cost suppliers may lack the technical expertise to provide adequate installation guidance, maintenance protocols, or troubleshooting support. This is particularly problematic in gravity-fed systems, where proper slope, elevation, and filtration are critical for optimal function. Without reliable documentation or engineering support, end users may install systems incorrectly, leading to inefficiencies or complete system failure.

Hidden Costs from System Incompatibility

Sourcing components from multiple unvetted suppliers can result in parts that are not compatible with each other. For example, barbed connectors may not seal properly with certain tubing diameters, or filters may not integrate with specific manifold designs. This incompatibility leads to leaks, pressure loss, and the need for additional adapters or replacements—adding unexpected costs and delays.

Conclusion

To avoid these pitfalls, buyers should prioritize suppliers with verifiable quality standards, transparent manufacturing processes, and respect for intellectual property. Conducting due diligence—including requesting test reports, checking for certifications, and verifying IP compliance—can prevent costly failures and legal complications. Investing in higher-quality, legitimate systems ultimately ensures better agricultural outcomes and long-term sustainability.

Logistics & Compliance Guide for Gravity Irrigation System

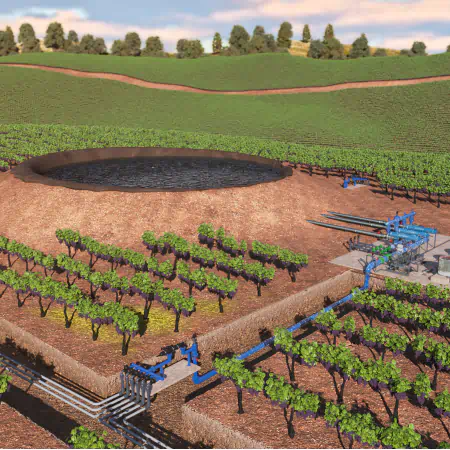

System Overview

A gravity irrigation system utilizes elevation differences to deliver water from a source (e.g., reservoir, stream, or tank) to agricultural fields without mechanical pumps. Proper logistics and compliance ensure efficient, sustainable, and legally compliant operation.

Site Assessment & Design Logistics

- Conduct topographic surveys to confirm sufficient elevation drop for adequate water flow.

- Map water source location, distribution network, and field layout.

- Design pipeline routes to minimize length and elevation fluctuations.

- Select piping materials (e.g., HDPE, PVC) based on terrain, pressure requirements, and durability.

- Include sediment traps or filters at intake points to prevent clogging.

Equipment & Material Procurement

- Source pipes, valves, filters, emitters/driplines, and fittings from certified suppliers.

- Verify material specifications meet national or international standards (e.g., ISO, ASTM).

- Ensure availability of spare parts and tools for maintenance.

- Arrange transportation to remote or rugged areas; plan for off-road access if needed.

Installation & Construction Logistics

- Schedule installation during dry seasons to avoid waterlogged terrain.

- Coordinate labor, machinery (if trenching is required), and material delivery timelines.

- Follow engineering plans for proper slope alignment and secure anchoring of pipes.

- Install air vents and flush valves at high and low points to prevent airlocks and sediment buildup.

Water Rights & Regulatory Compliance

- Verify legal access to water source; obtain necessary permits (e.g., water abstraction licenses).

- Comply with local, state, and national water use regulations (e.g., Clean Water Act, regional water boards).

- Adhere to environmental protection rules—avoid altering natural watercourses or impacting aquatic habitats.

- Document water usage for reporting requirements, if applicable.

Environmental & Land Use Compliance

- Conduct an environmental impact assessment (EIA) if the system affects protected areas or endangered species.

- Implement erosion and sediment control measures during construction.

- Avoid deforestation or significant land disturbance; restore vegetation post-installation.

- Comply with agricultural runoff regulations—prevent chemical leaching into water sources.

Health & Safety Standards

- Train personnel on safe trenching, pipe handling, and working at heights.

- Use personal protective equipment (PPE) during installation.

- Mark underground utilities before digging to prevent accidents.

- Ensure all electrical components (e.g., monitoring sensors) meet safety codes.

Operational & Maintenance Compliance

- Establish a routine maintenance schedule: inspect for leaks, clean filters, and flush lines.

- Monitor water flow and pressure to detect system inefficiencies.

- Keep records of maintenance, water usage, and repairs for audits or compliance checks.

- Comply with agricultural sustainability standards (e.g., ISO 14001, local farm certification programs).

Monitoring & Reporting

- Install flow meters and pressure gauges for performance tracking.

- Report water usage data to regulatory bodies as required.

- Conduct periodic audits to ensure ongoing compliance with environmental and safety standards.

- Update system design documentation if modifications are made.

Decommissioning & End-of-Life Compliance

- Plan for responsible disposal or recycling of pipes and components.

- Restore the land to its original or improved condition.

- Surrender water rights or permits if the system is no longer in use.

- Follow local waste management and environmental regulations for dismantling.

By adhering to this logistics and compliance guide, gravity irrigation systems can operate efficiently, sustainably, and in full alignment with legal and environmental requirements.

In conclusion, sourcing a gravity irrigation system presents a sustainable, cost-effective, and low-maintenance solution for agricultural water management, particularly in regions with limited access to electricity and mechanical resources. By leveraging natural elevation to deliver water, gravity irrigation reduces energy consumption and operational costs while promoting equitable water distribution across fields. Careful sourcing—considering quality materials, site-specific design, local environmental conditions, and community needs—ensures long-term efficiency and system durability. When properly implemented, gravity irrigation supports improved crop yields, water conservation, and enhanced resilience for smallholder farmers, contributing to food security and sustainable rural development. Therefore, investing in well-sourced, appropriately designed gravity irrigation systems is a strategic step toward climate-smart and inclusive agricultural practices.