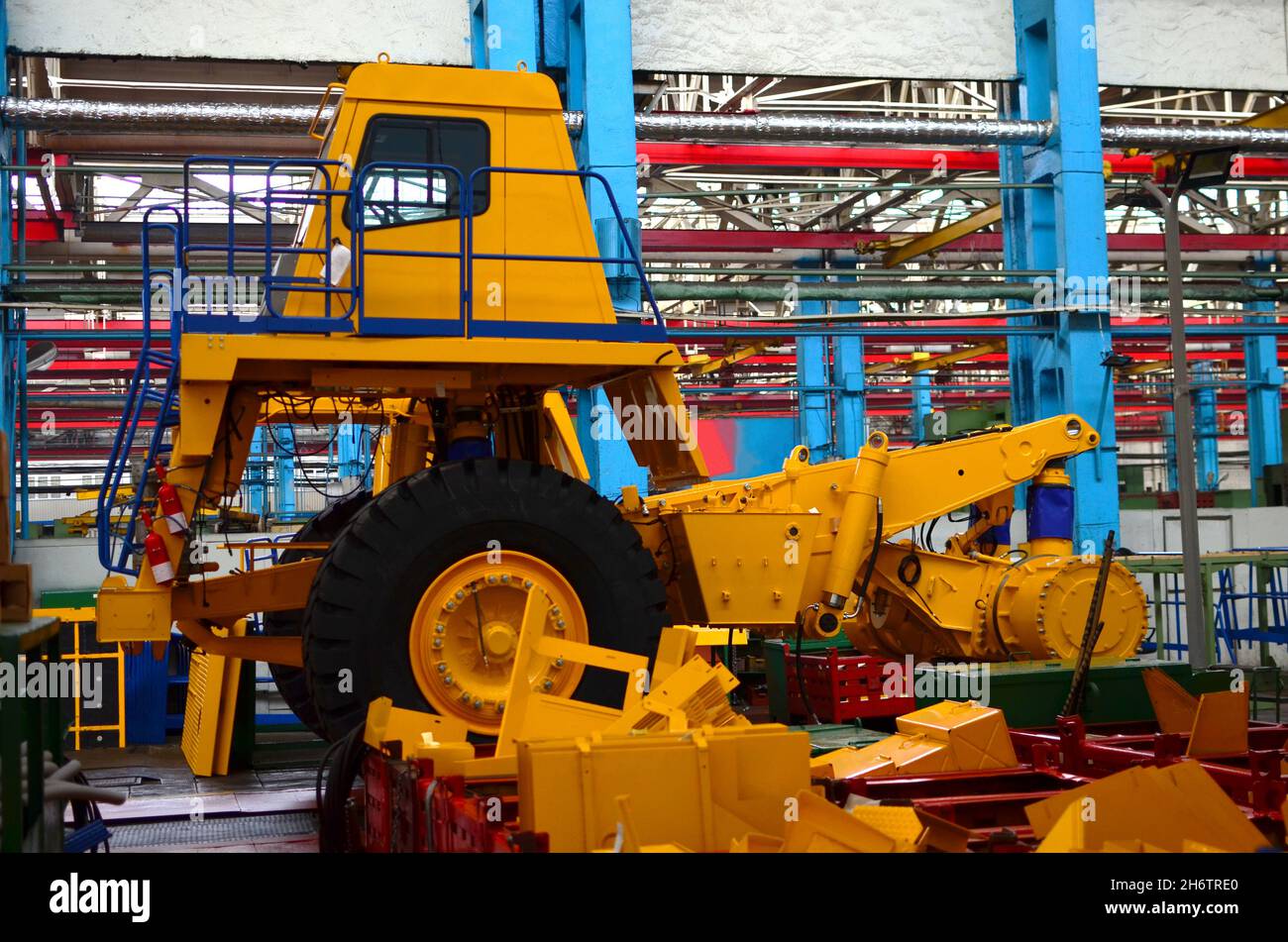

The global construction equipment market is experiencing robust growth, driven by rising infrastructure development and urbanization—particularly in emerging economies. According to Grand View Research, the global construction equipment market size was valued at USD 165.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. As demand for efficient material transport solutions increases, gravel trucks—specialized for hauling aggregate materials in quarry, mining, and road construction operations—have become critical assets. This growth trajectory, supported by increasing investments in transportation infrastructure and mining activities, has intensified competition among manufacturers to deliver durable, high-capacity, and fuel-efficient gravel hauling solutions. Against this backdrop, the following list highlights the top 10 gravel truck manufacturers leading innovation, market share, and operational performance in the heavy-duty hauling segment.

Top 10 Gravel Truck Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Rugby Manufacturing

Domain Est. 1997

Website: rugbymfg.com

Key Highlights: Rugby is North America’s leading designer and manufacturer of Class 3 – 7 dump truck bodies, landscape bodies, platform bodies, truck and trailer hoists….

#2 Off-Road Dump Truck

Domain Est. 2024

Website: mine-trucks.com

Key Highlights: As a professional off-road dump truck manufacturer with 20 years of experience, we offer four flagship products: off-road dump trucks, mining dump trucks, ……

#3 Articulated Dump Trucks

Domain Est. 1990

Website: deere.com

Key Highlights: Whether it’s 26 ton, 31 ton, 41 ton, or 46 ton, our ADTs deliver impressive power and torque for exceptional power-to-weight ratios and fast cycles….

#4 Off-Highway Trucks

Domain Est. 1993

Website: cat.com

Key Highlights: Rugged Cat® off-highway trucks and mining trucks have worked in the harsh conditions of mines, construction projects and quarries around the world….

#5 Mack Trucks

Domain Est. 1995

Website: macktrucks.com

Key Highlights: Mack creates durable, purpose-built trucks like the Mack Anthem® and Pioneer™, offering advanced uptime and driving progress for tough jobs worldwide….

#6 Peterbilt Work Trucks

Domain Est. 1996

Website: peterbilt.com

Key Highlights: Find the right Peterbilt truck model for on-highway, medium duty, vocational and electric applications. Every Peterbilt truck delivers unparalleled ……

#7 Western Star: Explore Our Heavy

Domain Est. 1996

Website: westernstartrucks.com

Key Highlights: Western Star offers a range of premium Class 8 trucks designed to meet your specific needs for highway, vocational and off-road applications….

#8 Commercial Trucks, Buses, Engines & Parts

Domain Est. 1998

Website: international.com

Key Highlights: Proud makers of trucks, buses, engines, parts, and history. … International trucks parked on gravel. SERVICES. From financing and warranties ……

#9 Some build trucks. We custom engineer severe duty tools.

Domain Est. 2001

Website: autocartruck.com

Key Highlights: Find the right truck to fit your severe-duty vocational needs. Find out how we can custom build a tool to your specifications….

#10 Rokbak

Domain Est. 2020

Website: rokbak.com

Key Highlights: Articulated haulers that pull their weight. Tough and tougher. At Rokbak, our reliability comes in two sizes: with payloads of 28 and 38 metric tonnes….

Expert Sourcing Insights for Gravel Truck

H2: 2026 Market Trends for Gravel Trucks

The gravel truck segment—a critical component of construction, mining, and infrastructure development—is poised for significant transformation by 2026. Driven by regulatory shifts, technological innovation, and evolving market demands, the industry is moving toward greater efficiency, sustainability, and operational intelligence. Below are the key trends expected to shape the gravel truck market in 2026.

1. Accelerated Electrification and Alternative Fuels

By 2026, electrification will gain substantial momentum in the gravel truck sector, especially for short-haul and urban operations. Major manufacturers—including Volvo, Daimler (via Freightliner), and Tesla—are expected to offer purpose-built electric dump and rigid haul trucks capable of handling gravel transport with zero tailpipe emissions. Additionally, hydrogen fuel cell and renewable natural gas (RNG)-powered trucks will emerge as viable options for longer hauls or regions with limited charging infrastructure. Government incentives and tightening emissions regulations (e.g., EPA Phase 3, EU Euro VII) will accelerate adoption.

2. Increased Automation and Telematics Integration

Autonomous and semi-autonomous technologies will become more prevalent in controlled environments such as quarries and large-scale construction sites. By 2026, gravel trucks equipped with advanced driver assistance systems (ADAS), GPS-guided hauling, and remote monitoring will improve safety and productivity. Telematics platforms will enable real-time tracking of payload, fuel efficiency, maintenance needs, and route optimization, allowing fleet operators to reduce downtime and operational costs.

3. Demand Driven by Infrastructure Investment

Global infrastructure spending—particularly in North America (via the U.S. Infrastructure Investment and Jobs Act), Europe (via the Green Deal), and parts of Asia—will drive demand for gravel and, consequently, gravel trucks. Public and private investments in roads, bridges, and renewable energy projects (e.g., wind farms, solar installations) will sustain high demand for aggregate transport, supporting steady market growth.

4. Focus on Durability and Total Cost of Ownership (TCO)

Fleet operators will increasingly prioritize trucks designed for rugged environments with enhanced durability, corrosion resistance, and ease of maintenance. Manufacturers will emphasize TCO models that factor in fuel efficiency, maintenance intervals, and resale value. Modular designs allowing for easy upgrades (e.g., battery swaps in electric models) will become more common.

5. Sustainability and ESG Compliance

Environmental, Social, and Governance (ESG) criteria will influence procurement decisions. Contractors and municipalities will favor suppliers using low-emission or zero-emission gravel trucks. This shift will encourage leasing models and partnerships with green-certified haulers. Additionally, use of recycled materials in truck manufacturing and sustainable quarrying practices will gain importance.

6. Growth in Rental and Fleet-as-a-Service Models

To manage capital expenditure and adapt to project-based demand, more companies will turn to rental services and “trucks-as-a-service” models. These offerings—often bundled with maintenance, training, and telematics—will be especially attractive for small-to-medium contractors and temporary infrastructure projects.

7. Regional Market Diversification

While North America and Europe lead in adopting advanced gravel truck technologies, emerging markets in Southeast Asia, Africa, and Latin America will see rising demand due to urbanization and industrialization. However, affordability and fuel availability will keep internal combustion engine (ICE) trucks dominant in these regions, albeit with newer, cleaner engine technologies.

Conclusion:

By 2026, the gravel truck market will be characterized by a dual trajectory: technological advancement in developed markets and volume growth in emerging economies. Electrification, connectivity, and sustainability will define innovation, while infrastructure spending and fleet efficiency will drive demand. Companies that adapt to these trends—through strategic investment in green technologies and digital solutions—will gain a competitive edge in the evolving landscape.

Common Pitfalls When Sourcing a Gravel Truck (Quality & Intellectual Property)

Sourcing a gravel truck—especially from international or non-traditional suppliers—can present significant challenges related to both quality assurance and intellectual property (IP) protection. Overlooking these areas can lead to operational inefficiencies, legal risks, and financial losses.

Poor Build Quality and Substandard Components

Many suppliers, particularly low-cost manufacturers, may use inferior materials or cut corners in manufacturing to reduce costs. This can result in premature wear, frequent breakdowns, and reduced payload capacity. Common issues include weak axles, under-rated suspensions, and poorly welded chassis frames that fail under heavy loads or rough terrain typical in gravel operations.

Inadequate Testing and Certification

Some sourced trucks lack proper third-party testing or compliance with regional safety and emissions standards (e.g., EPA, CE, or GB standards). Without verifiable certifications, buyers risk acquiring vehicles that cannot legally operate in their target market or fail under real-world conditions.

Misrepresentation of Specifications

Suppliers may exaggerate performance metrics such as engine power, fuel efficiency, or load capacity. This misrepresentation can lead to mismatched equipment that underperforms, increasing operational costs and downtime. Always verify technical data with independent testing or trusted inspection agencies.

Lack of After-Sales Support and Spare Parts Availability

Low-cost suppliers may not offer reliable maintenance networks or sufficient spare parts inventory. This can result in extended downtime when repairs are needed. Ensure the supplier provides a clear service roadmap and access to genuine replacement components.

Intellectual Property Infringement

Some manufacturers produce trucks that closely mimic patented designs, engines, or proprietary technologies from established brands (e.g., copying Volvo, Caterpillar, or Komatsu components). Purchasing such trucks may expose the buyer to legal liability, especially if the vehicle is imported into jurisdictions with strict IP enforcement.

Use of Counterfeit or Unlicensed Parts

To cut costs, some suppliers integrate counterfeit engines, transmissions, or hydraulic systems bearing fake branding. These components not only violate IP laws but also pose safety risks and typically offer poor reliability and support.

Absence of Licensing Agreements

Reputable manufacturers license their technology and designs legally. When sourcing gravel trucks, verify whether the supplier has proper licensing for any branded components. Lack of documentation may indicate IP violations and jeopardize resale value or customs clearance.

Insufficient Documentation and Traceability

Poor record-keeping or missing technical documentation (e.g., design schematics, compliance reports, or IP licenses) can hinder quality audits and expose buyers to regulatory penalties. Always request full traceability of critical components.

Recommendations to Mitigate Risks

- Conduct factory audits and third-party quality inspections.

- Require certification documents and validate compliance.

- Include IP warranty clauses in procurement contracts.

- Source from suppliers with transparent supply chains and verifiable partnerships.

- Consult legal experts on IP regulations in both the sourcing and operating countries.

Avoiding these pitfalls ensures long-term reliability, legal compliance, and optimal return on investment when sourcing gravel trucks.

Logistics & Compliance Guide for Gravel Truck Operations

Vehicle Specifications and Requirements

Gravel trucks, typically rear dump or transfer dump models, must meet strict federal and state size, weight, and safety standards. Common configurations include 6×4 axle setups with GVWRs (Gross Vehicle Weight Ratings) ranging from 60,000 to 80,000 lbs. Ensure your truck complies with FMCSA (Federal Motor Carrier Safety Administration) standards, including proper lighting, brake systems, tires, and mud flaps. Confirm state-specific regulations on trailer length, height, and tarping requirements to prevent spillage.

Licensing and Driver Credentials

Operators must possess a valid Commercial Driver’s License (CDL) with appropriate endorsements—typically Class A or B, depending on vehicle weight. A DOT medical certificate is mandatory, and drivers should maintain clean driving records. Employers must conduct pre-employment and random drug and alcohol testing per FMCSA regulations. Additional training in load securement and defensive driving is highly recommended.

Weight Limits and Axle Configurations

Adhere to federal bridge formula regulations governing weight distribution across axles. The federal maximum gross weight on interstate highways is 80,000 lbs, with limits of 20,000 lbs on single axles and 34,000 lbs on tandem axles. Overweight permits may be required for non-divisible loads and vary by state. Use certified scales for pre-trip and post-delivery weigh-ins to avoid fines and road closures.

Load Securement and Tarping Compliance

Gravel must be fully contained and covered during transit to comply with state and local anti-spillage laws. Use durable, properly fitted tarps that fully enclose the load. Tarps must be secured with straps or chains to prevent loosening. Failure to comply can result in citations, fines, and environmental penalties. Inspect tarps regularly for wear and replace as needed.

Route Planning and Road Restrictions

Plan routes carefully to avoid roads with weight restrictions, low bridges, or residential zones where gravel trucks may be prohibited. Use GPS systems designed for commercial vehicles to identify legal routes. Coordinate with municipalities for permits if entering restricted areas. Consider road conditions and weather to minimize wear and environmental impact.

Permits and Documentation

Maintain up-to-date operating authority (MC number), DOT number, and state-specific permits such as intrastate authority or overweight/oversize permits. Carry bills of lading, scale tickets, and equipment registration during transit. Digital logging devices (ELDs) must be installed and operational to record hours of service (HOS) in compliance with FMCSA rules.

Environmental and Local Regulations

Follow local ordinances regarding operating hours, noise, and dust control. Some jurisdictions require dust suppression systems or washed tires to prevent tracking. Comply with stormwater regulations under the Clean Water Act—avoid dumping gravel near waterways or drainage systems. Report any spills immediately and follow cleanup protocols.

Safety Protocols and Inspections

Conduct pre-trip and post-trip vehicle inspections using DVIR (Driver Vehicle Inspection Report) forms. Address any defects before operating. Equip trucks with high-visibility markings, reflective tape, and emergency warning devices. Train drivers in safe dumping procedures, especially on uneven terrain or near utilities.

Recordkeeping and Audit Readiness

Retain records for at least six months (or longer as required), including driver logs, inspection reports, maintenance records, and proof of insurance. Regular internal audits help ensure compliance and prepare for DOT inspections. Use fleet management software to streamline documentation and track compliance metrics.

Emergency Response and Incident Reporting

Establish procedures for accidents, spills, or mechanical failures. Drivers should know how to secure the scene, contact supervisors, and report incidents to authorities when required. Maintain emergency contact lists and ensure all drivers have access to spill kits and first aid supplies.

Conclusion for Sourcing a Gravel Truck

After a thorough evaluation of available options, it is clear that sourcing a gravel truck requires a strategic balance between cost-efficiency, reliability, and long-term operational needs. Whether purchasing new or used, leasing, or hiring from a third-party contractor, each option presents distinct advantages and limitations. A new truck offers advanced features, better fuel efficiency, and lower maintenance costs, but comes with a higher initial investment. Used trucks can significantly reduce upfront expenses but may entail greater repair and downtime risks. Leasing provides flexibility and includes maintenance support, making it ideal for short-term or seasonal projects.

The decision should align with the project’s scale, duration, budget constraints, and in-house maintenance capabilities. Additionally, factors such as terrain, hauling distance, payload requirements, and environmental regulations must be carefully considered to ensure optimal performance and compliance. Partnering with reputable suppliers or contractors who provide reliable after-sales service and warranty options further enhances operational continuity.

In conclusion, a well-informed sourcing strategy—based on comprehensive research, life-cycle cost analysis, and alignment with project goals—will ensure that the gravel truck selected maximizes productivity, minimizes downtime, and supports efficient and cost-effective operations in the long run.