The global grated metal market is experiencing steady growth, driven by rising demand across construction, industrial safety, and infrastructure sectors. According to Grand View Research, the global metal flooring market—of which grated metal is a key component—was valued at USD 7.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by increasing urbanization, stringent safety regulations in industrial environments, and the material’s durability and anti-slip properties. Similarly, Mordor Intelligence projects continued expansion in metal grating applications, particularly in oil & gas, water treatment, and renewable energy infrastructure, with Asia-Pacific emerging as a high-growth region due to rapid industrialization and infrastructure development. As demand intensifies, identifying leading grated metal manufacturers becomes critical for sourcing reliable, high-performance products. Below is a data-informed overview of the top 10 grated metal manufacturers shaping the industry through innovation, global reach, and robust production capabilities.

Top 10 Grated Metal Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Ohio Gratings

Domain Est. 1996

Website: ohiogratings.com

Key Highlights: Ohio Gratings, Inc. is a premier metal bar grating supplier, specializing in industrial and commercial grating design, manufacturing, and custom fabrication ……

#2 Industrial Metals

Domain Est. 2014

Website: amicoglobal.com

Key Highlights: Amico metal, Amico metals, industrial metals. The world’s largest manufacturer of industrial bar grating, expanded metal and perforated metal….

#3 Miner Grating Systems

Domain Est. 2019

Website: minergrating.com

Key Highlights: Miner Grating is North America’s leading manufacturer and fabricator of bar grating, diamond safety grating, and round hole safety grating products….

#4 IKG

Domain Est. 1995

Website: ikg.com

Key Highlights: America’s first and leading steel grating manufacturer. ……

#5 Nucor Steel Grating

Domain Est. 1997

Website: nucor.com

Key Highlights: Vulcraft Grating is a leading North American producer of bar grating products. Our grating products are manufactured at modern plants using specially designed ……

#6 Bar Grating Supplier

Domain Est. 1997

Website: sss-steel.com

Key Highlights: At Triple-S Steel®, we specialize in supplying top-quality steel and aluminum bar grating for a wide range of industrial and architectural applications….

#7 Vulcraft Grating

Domain Est. 1997

Website: vulcraft.com

Key Highlights: Steel bar grating from Vulcraft-standard, heavy-duty, and stair treads. Custom fabrication, fast delivery, and expert support for all your grating needs….

#8 Steel and Metal Grating

Domain Est. 1997

Website: metalsusa.com

Key Highlights: Metals USA stocks a variety of bar grating sizes in carbon steel and aluminum, including galvanized, painted, and serrated options….

#9 Grating Pacific

Domain Est. 1997

Website: gratingpacific.com

Key Highlights: Grating Pacific is the Western States’ leading fabricator and supplier of metal bar grating, aluminum, and fiberglass grating, woven and welded wire mesh ……

#10 Neenah Foundry

Domain Est. 2000

Website: neenahfoundry.com

Key Highlights: Neenah Foundry has been a consistent leader in delivering durable and highly engineered, structural, and sustainable casting solutions for customers….

Expert Sourcing Insights for Grated Metal

H2: Projected Market Trends for Grated Metal in 2026

The grated metal market is poised for significant evolution by 2026, driven by advancements in industrial applications, sustainability mandates, and expanding infrastructure development globally. As industries prioritize durability, safety, and material efficiency, grated metal—encompassing steel, aluminum, and fiberglass variants—continues to gain traction across construction, transportation, energy, and municipal sectors.

1. Growth in Infrastructure and Urbanization

Accelerated urban development, particularly in emerging economies across Asia-Pacific, Africa, and Latin America, will be a primary driver for grated metal demand in 2026. Governments are investing heavily in smart cities, sewage systems, pedestrian walkways, and public transit, where grated metal is essential for drainage, safety grating, and architectural design. The global push for resilient infrastructure under climate adaptation strategies will further boost demand for corrosion-resistant aluminum and stainless steel gratings.

2. Sustainability and Green Building Standards

Environmental regulations and green building certifications (e.g., LEED, BREEAM) are shaping material selection. Grated metal, especially recycled steel and aluminum variants, aligns with circular economy goals due to its high recyclability and long service life. By 2026, manufacturers are expected to emphasize low-carbon production methods and transparent supply chains to meet ESG (Environmental, Social, and Governance) criteria, influencing procurement decisions in both public and private sectors.

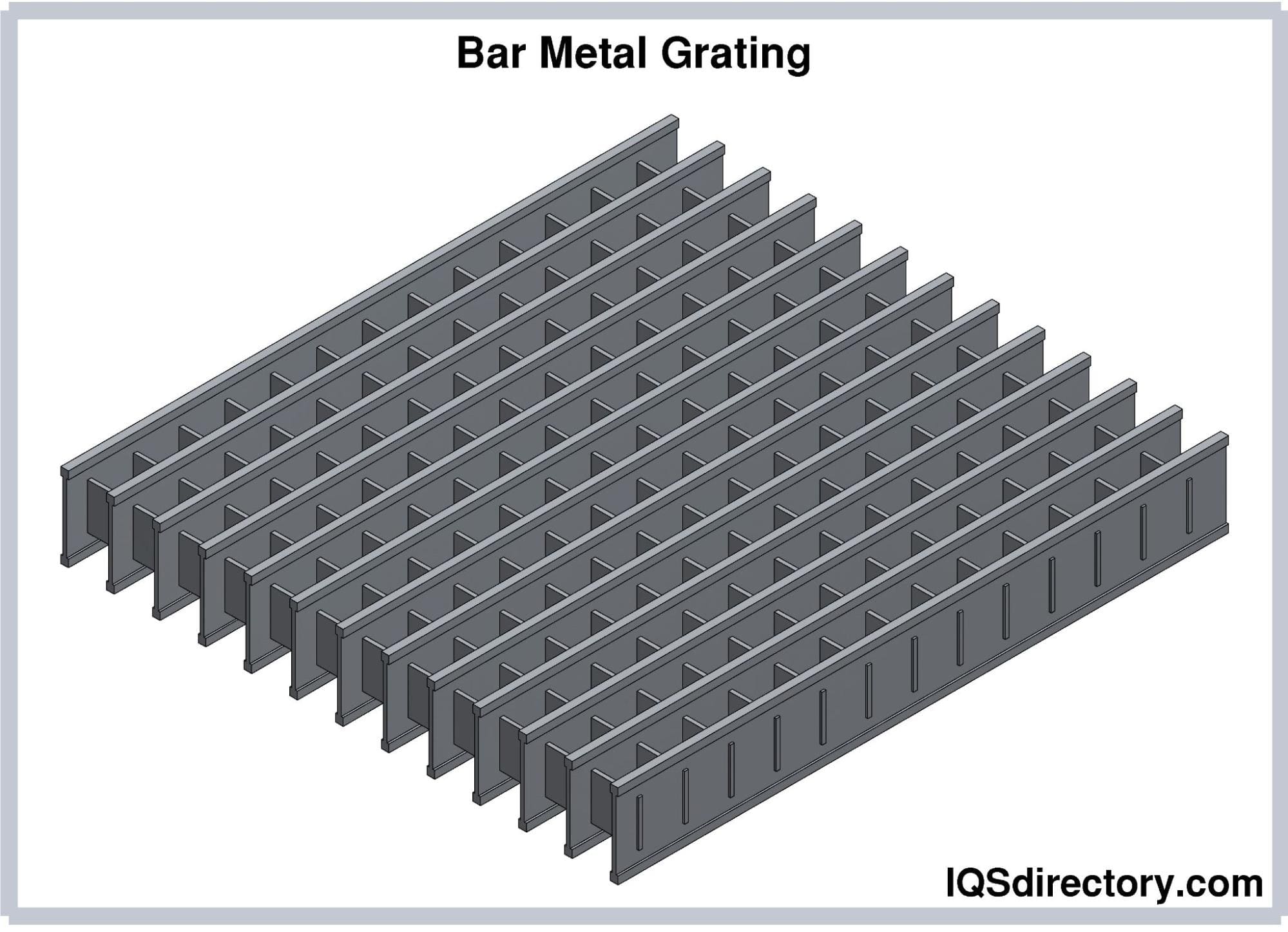

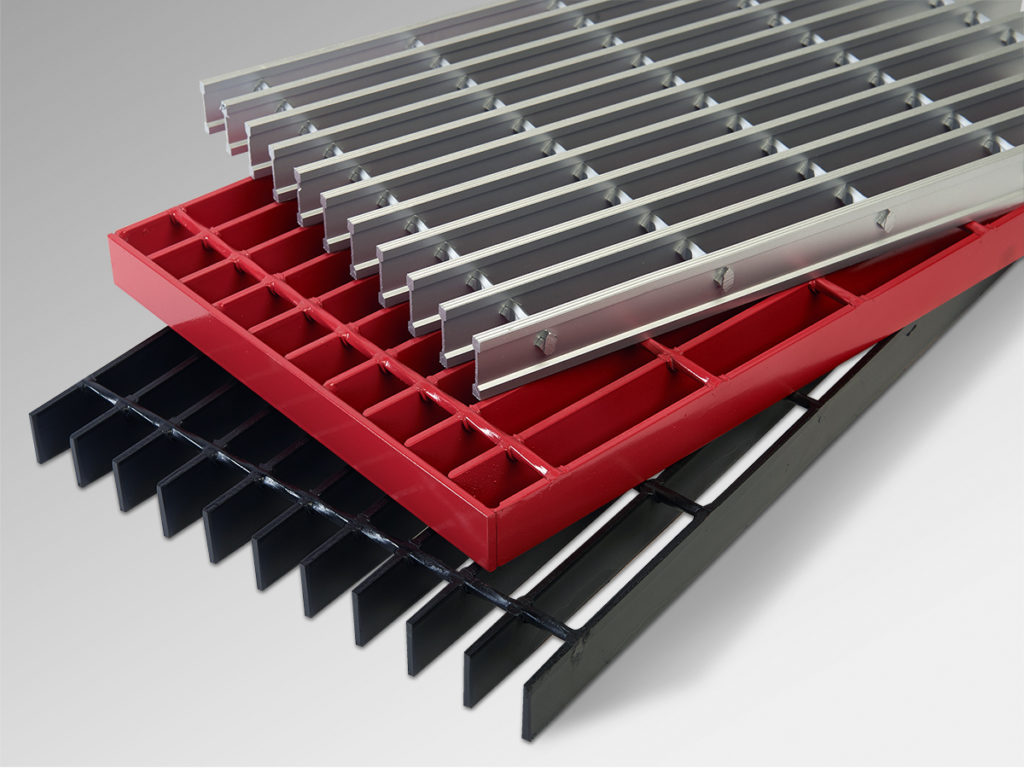

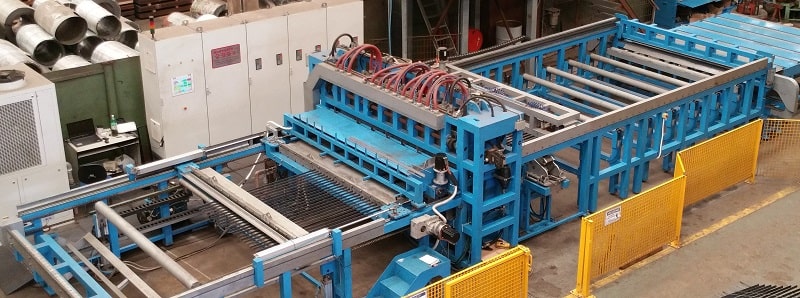

3. Technological Advancements and Customization

Innovations in manufacturing, such as laser cutting, modular design, and 3D modeling integration, are enabling greater customization and precision in grated metal products. This trend supports architectural creativity and performance optimization in applications like façades, stair treads, and platform flooring. The rise of Industry 4.0 technologies will also enhance production efficiency and supply chain responsiveness, reducing lead times and costs.

4. Expansion in Renewable Energy and Industrial Applications

The global shift toward renewable energy—particularly offshore wind, solar farms, and hydroelectric plants—requires durable grated metal for walkways, platforms, and access structures. These environments demand high corrosion resistance, spurring demand for aluminum and stainless steel gratings. Similarly, oil & gas, mining, and wastewater treatment facilities continue to rely on grated metal for safety and functionality, supporting steady industrial demand.

5. Regional Market Dynamics

Asia-Pacific is expected to dominate the grated metal market in 2026, led by China, India, and Southeast Asian nations undergoing rapid industrialization. North America and Europe will see moderate growth, driven by infrastructure renewal projects and retrofitting of aging facilities. Meanwhile, the Middle East’s focus on megaprojects (e.g., NEOM, UAE urban expansions) will create niche opportunities for high-performance grated solutions.

6. Price Volatility and Supply Chain Resilience

Fluctuations in raw material prices—especially steel and aluminum—remain a challenge. Geopolitical tensions and trade policies may affect supply chains, prompting companies to diversify sourcing and increase localized production. By 2026, strategic partnerships and vertical integration are likely to become more common among key market players to mitigate risks.

Conclusion

The grated metal market in 2026 will be characterized by innovation, sustainability, and regional diversification. As demand grows across infrastructure, energy, and industrial sectors, manufacturers who invest in eco-friendly production, advanced engineering, and resilient supply chains will be best positioned to capitalize on emerging opportunities.

Common Pitfalls When Sourcing Grated Metal: Quality and Intellectual Property (IP) Concerns

Sourcing grated metal for industrial, architectural, or engineering applications requires careful evaluation to avoid critical issues related to quality and intellectual property (IP). Below are the most common pitfalls in these two areas.

Quality-Related Pitfalls

Inconsistent Material Composition

One of the most frequent quality issues is receiving grated metal with inconsistent alloy composition. Suppliers may substitute lower-grade materials (e.g., using mild steel instead of stainless steel) to cut costs, leading to reduced corrosion resistance, structural weakness, and premature failure in demanding environments.

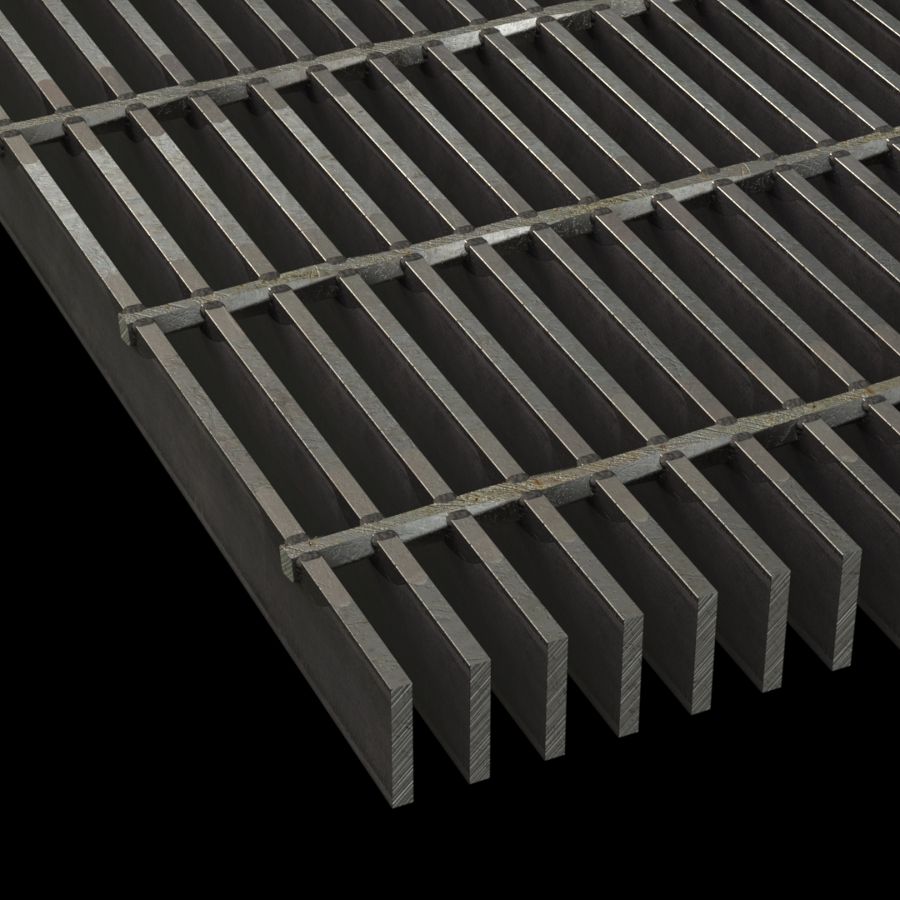

Poor Dimensional Accuracy

Grated metal must meet precise dimensional tolerances for proper fit and load-bearing capacity. Inaccurate bar spacing, uneven cross-rod placement, or warping during manufacturing can compromise safety and performance, especially in walkways, flooring, or drainage systems.

Substandard Welding or Assembly

For welded grating, weak or inconsistent welds can significantly reduce strength and durability. Poor fusion, burn-through, or misaligned joints may not be immediately visible but can lead to structural failure under load or vibration.

Inadequate Surface Finish and Coating

Improper or uneven galvanization, powder coating, or anti-slip treatments expose the metal to accelerated wear and corrosion. Some suppliers may apply insufficient zinc coating or skip post-treatment processes altogether, reducing the product’s lifespan.

Lack of Certification and Testing Documentation

Reputable suppliers provide mill test certificates (MTCs), load charts, and third-party inspection reports. Sourcing without these documents increases the risk of non-compliance with industry standards such as ANSI, ISO, or ASTM.

Intellectual Property (IP) Pitfalls

Infringement of Patented Grating Designs

Certain grated metal patterns, especially those with specialized load distribution or anti-slip features, may be protected by patents. Sourcing from manufacturers who replicate patented designs without licensing exposes the buyer to legal liability and potential supply chain disruptions.

Use of Copycat or Reverse-Engineered Products

Some suppliers produce grating that mimics proprietary designs from well-known brands. While these may appear identical, they often lack the engineering validation and performance guarantees of the original, posing both IP and safety risks.

Insufficient IP Due Diligence in Contracts

Purchase agreements that fail to include IP indemnification clauses leave buyers vulnerable. If a supplier delivers infringing products, the buyer—not the supplier—may face litigation, fines, or recall obligations.

Sourcing from Unverified or Unauthorized Distributors

Third-party vendors may claim to offer branded grated metal but distribute counterfeit or unauthorized copies. Without verifying authorized distribution channels, buyers risk purchasing IP-infringing products and compromising project integrity.

Mitigating these pitfalls requires thorough supplier vetting, clear technical specifications, rigorous quality inspections, and legal review of IP rights—especially when using specialized or branded grated metal designs.

Logistics & Compliance Guide for Grated Metal

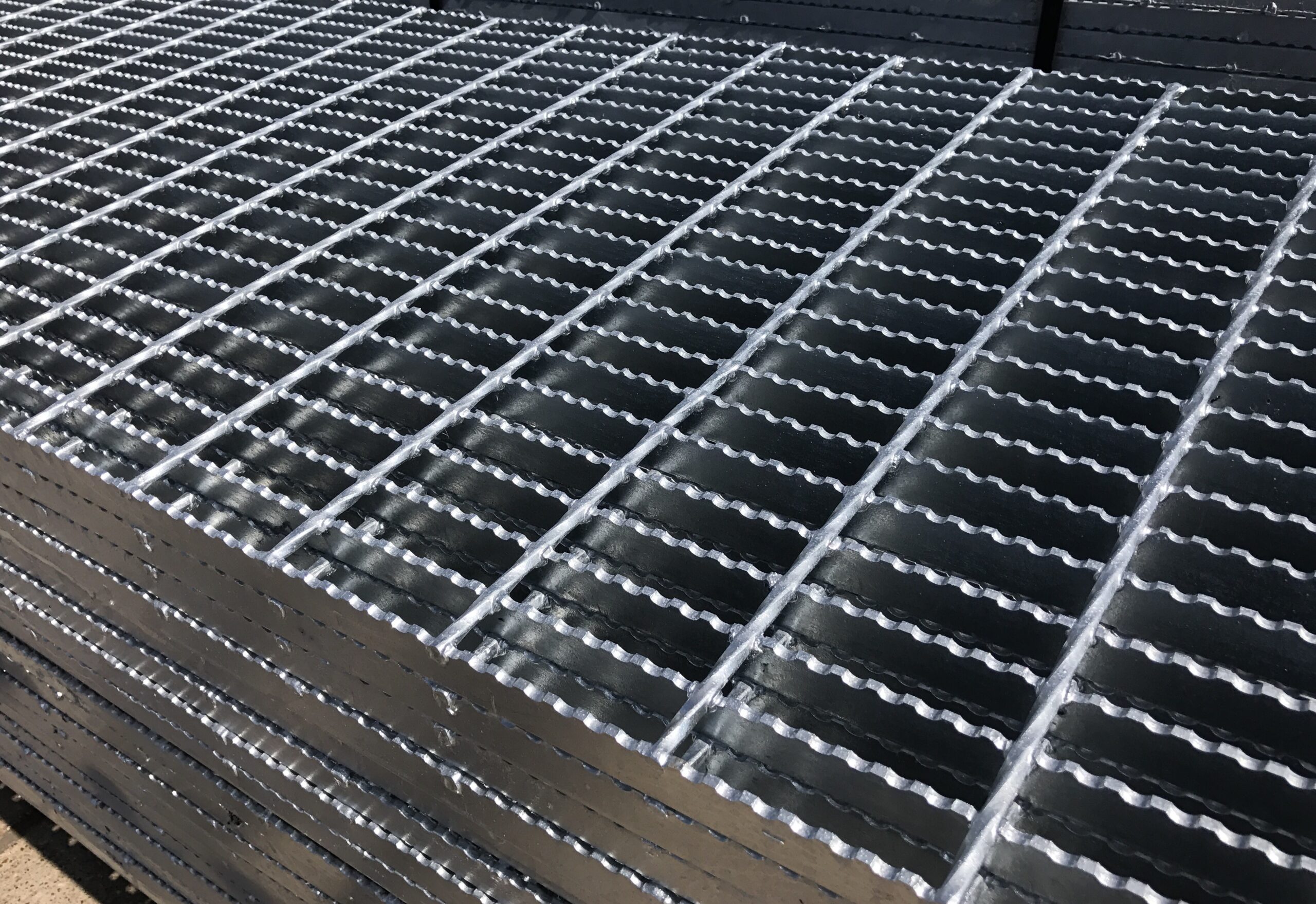

Overview of Grated Metal Products

Grated metal refers to metal sheets or panels with a pattern of openings, commonly made from steel, aluminum, or stainless steel. These products are widely used in construction, industrial flooring, walkways, drainage systems, and architectural applications due to their strength, durability, and slip-resistant properties. Proper logistics and compliance practices are essential to ensure safe handling, transportation, and regulatory adherence throughout the supply chain.

Material Classification and HS Code

Grated metal is typically classified under the Harmonized System (HS) Code 7310.89 or 7315.82, depending on composition (e.g., iron/steel vs. other metals) and form. Accurate classification is critical for international shipping, customs clearance, and tariff determination. Always confirm the specific HS code based on material type, coating, and intended use to avoid delays or penalties.

Packaging and Handling Requirements

Grated metal should be securely bundled using steel straps or shrink-wrapped to prevent shifting during transport. Wooden skids or pallets are recommended for stability. Edges must be protected to avoid damage and injury. Handling requires forklifts or cranes equipped with appropriate lifting gear, and personnel should use protective equipment due to sharp edges. Mark packages with load capacity, orientation arrows, and handling instructions.

Transportation Considerations

Transport grated metal via flatbed trucks, shipping containers, or open-top containers depending on volume and destination. Secure loads with tie-downs to prevent movement. For international shipments, ensure compatibility with container dimensions and weight limits. Oversized loads may require special permits. Monitor environmental exposure during transit—especially moisture—to prevent corrosion, particularly for carbon steel variants.

Storage Guidelines

Store grated metal indoors whenever possible, on elevated, level surfaces to prevent ground moisture absorption. Keep materials covered or under shelter if stored outdoors. Separate different metal types (e.g., aluminum from steel) to avoid galvanic corrosion. Maintain clear aisles for safe access and ensure stacking does not exceed safe load limits to prevent collapse or deformation.

Regulatory Compliance

Ensure grated metal products meet relevant standards such as ASTM A766 (steel grating), ANSI/NAAMM (MBG 531), or ISO 14122-4 for industrial safety. For export, comply with destination country regulations, including CE marking for Europe or OSHA standards for the U.S. Provide Material Safety Data Sheets (MSDS) if coatings or treatments (e.g., galvanization) are applied.

Environmental and Safety Regulations

Galvanized grated metal may be subject to REACH and RoHS regulations in the EU due to zinc content. Control dust and fumes during cutting or welding in accordance with OSHA or local occupational health standards. Recycle scrap metal in compliance with environmental laws—many jurisdictions require certified recycling for metal waste.

Documentation and Traceability

Maintain accurate shipping documents, including packing lists, commercial invoices, and certificates of origin. Include mill test reports or material certifications when required. For traceability, label batches with production date, material grade, and heat number. Digital tracking systems can enhance supply chain visibility and compliance audits.

Import and Export Procedures

Verify import restrictions, duties, and anti-dumping measures in the destination country. Some nations impose safeguards on steel products. Use licensed freight forwarders experienced in metal goods. Prepare for customs inspections by ensuring all documentation is complete, accurate, and readily available.

Risk Mitigation and Insurance

Insure shipments against damage, theft, and delays. Address risks such as corrosion, buckling, or impact during transit with appropriate packaging and handling protocols. Conduct regular supplier audits to ensure compliance with quality and safety standards, reducing liability across the logistics chain.

Conclusion for Sourcing Grated Metal:

Sourcing grated metal requires a strategic approach that balances quality, cost, supplier reliability, and sustainability. After evaluating available suppliers, material specifications, processing methods, and market conditions, it is essential to establish strong partnerships with vendors who adhere to industry standards and can consistently deliver the required grade and form of grated metal. Factors such as corrosion resistance, dimensional accuracy, and intended application must guide the selection process. Additionally, considering logistical aspects like lead times, transportation costs, and supply chain resilience will contribute to long-term operational efficiency. By implementing a well-structured sourcing strategy, businesses can ensure a reliable supply of high-quality grated metal while optimizing costs and supporting sustainability goals.