The global grain analyser market is experiencing robust growth, driven by increasing demand for food quality assurance, stringent regulatory standards, and advancements in analytical technologies. According to a report by Grand View Research, the global grain analyser market was valued at USD 865.2 million in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This growth is further fueled by rising investments in agricultural technology and the need for precise, real-time grain quality assessment across the supply chain—from harvest to processing and trade. As food safety becomes a top priority and automation gains traction in agri-tech, manufacturers of grain analysers are innovating rapidly in spectroscopy, moisture detection, and protein analysis. In this evolving landscape, nine key players have emerged as leaders, combining technological precision, global reach, and data-driven solutions to meet the demands of modern agriculture and food production industries.

Top 9 Grain Analyser Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 GrainSense

Domain Est. 2012

Website: grainsense.com

Key Highlights: The GrainSense solution is tailored for industrial, trading, research, and farming customers, providing instant grain quality analysis….

#2 The Leader in Portable Grain Analyzers

Domain Est. 1996

Website: zeltex.com

Key Highlights: The Zeltex line of Whole Grain Analyzers has proven their mettle. Wheat, Corn, Soybeans, Barley and Rice as well as Seeds in the research environment….

#3 Whole Grain Analyzers

Domain Est. 1998

Website: perkinelmer.com

Key Highlights: Our whole-grain analyzer portfolio can help you get accurate results for moisture, protein, oil, test weight/hectoliter weight, and temperature in grains….

#4 ChemWiz

Domain Est. 2002

Website: stellarnet.us

Key Highlights: Our portable Grain Analyzer can help improve consistency and efficiency of many grain processing applications as well as provide rapid on-site analysis ……

#5 Moisture Tester

Domain Est. 2015

Website: grainmoisture.com

Key Highlights: DICKEY-john Moisture Tester analyzes grain moisture and test weight. Authorized sales and service….

#6 Grain solutions

Domain Est. 2016

Website: fossanalytics.com

Key Highlights: オイル粉砕プロセスに完全な信頼を提供する高度な分析. Where can you analyse. ラボや過酷な製造現場でのアットライン. What can you analyse….

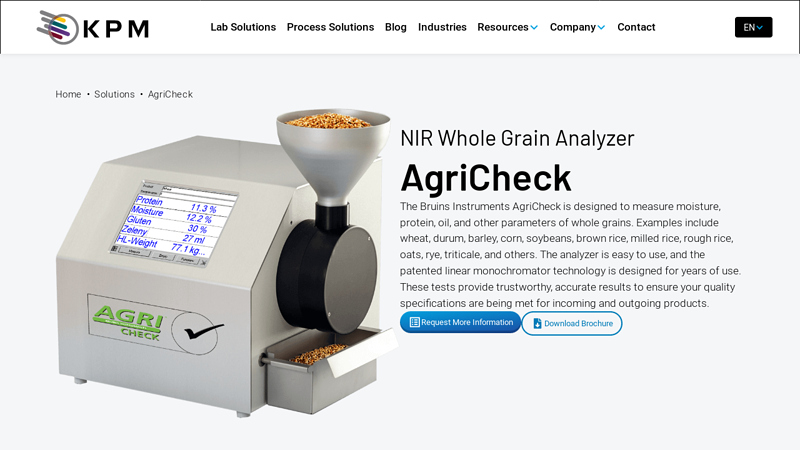

#7 AgriCheck NIR Grain Analyzer

Domain Est. 2016

Website: kpmanalytics.com

Key Highlights: The AgriCheck analyzer measures whole grains through transmission analysis. Common products include: Wheat; Durum; Barley; Corn; Soybeans; Rapeseed (Canola) ……

#8 Infracont grain analysers

Domain Est. 2017

Website: infracont.com

Key Highlights: Infracont Instruments has many decades of experience and knowledge in developing, manufacturing and servicing Near Infrared grain analysers….

#9 Grain Analyser

Domain Est. 2020

Website: grainanalyser.com

Key Highlights: GrainAnalyser offers Food Grain Trade services model backed by Operation Efficiency, Trade Facilitation, Quality Analytics and Traceability….

Expert Sourcing Insights for Grain Analyser

H2 2026 Market Trends Analysis for Grain Analyzers

The grain analyzer market in H2 2026 is poised for significant evolution, driven by technological advancements, shifting agricultural demands, and heightened global focus on food security and sustainability. Here’s a breakdown of the key trends:

1. Dominance of AI and Machine Learning Integration:

* Predictive Analytics: Grain analyzers are moving beyond basic composition measurement (moisture, protein, oil, starch) to incorporate AI-driven predictive models. These models use historical and real-time data to forecast grain quality degradation during storage, optimize drying processes, and predict market value based on subtle compositional markers.

* Enhanced Accuracy & Speed: ML algorithms continuously learn from vast datasets, improving the accuracy of NIR (Near-Infrared) and other spectroscopic readings, especially for complex or non-standard grain types. This reduces calibration needs and speeds up analysis.

* Anomaly Detection: AI enables real-time identification of contaminants (e.g., mycotoxins, foreign materials) or adulteration with unprecedented sensitivity, crucial for food safety compliance.

2. Miniaturization and On-Site/Point-of-Need Testing:

* Portable & Handheld Devices: Demand for rugged, battery-powered analyzers for use directly at farms, grain elevators, trucks, and delivery points is surging. This enables immediate quality assessment, faster trading decisions (“farm-gate pricing”), and reduced logistics costs for samples.

* Integration with Harvesters & Handling Equipment: Real-time analyzers are being increasingly integrated directly into combines and conveyor systems, providing instantaneous feedback on harvest quality and enabling automated sorting or blending decisions on the go.

* Blockchain Integration: Data from these on-site analyzers is increasingly fed directly into blockchain platforms, enhancing traceability and providing immutable quality records from field to end-user.

3. Focus on Sustainability and Carbon Footprint Monitoring:

* “Green Grain” Certification: Analyzers are evolving to measure parameters linked to sustainability, such as nitrogen use efficiency (NUE) markers in grain, indirectly assessing fertilizer application impact. This supports certification schemes demanding lower environmental footprints.

* Optimizing Resource Use: Precise protein and moisture data allows for optimized blending, reducing waste and energy consumption in downstream processing (e.g., milling, malting, biofuel production). Analyzers are key tools for demonstrating resource efficiency.

* Demand for Low-Carbon Inputs: Mills and processors are seeking grains with verifiable lower embedded carbon. Analyzers providing data correlating with sustainable farming practices will gain value.

4. Expansion Beyond Traditional Cereals:

* Pulse & Oilseed Focus: Demand for accurate analysis of pulses (lentils, chickpeas, peas) and oilseeds (soy, canola, sunflower) is growing rapidly due to rising plant-based protein demand. Analyzers are being specifically calibrated and adapted for these diverse matrices.

* Specialty & Ancient Grains: The market for quinoa, teff, spelt, and other specialty grains requires analyzers capable of handling their unique compositions and often smaller batch sizes. Custom calibrations are becoming essential.

5. Data Integration and Cloud-Based Platforms:

* Centralized Data Hubs: Grain analyzer data (from lab, portable, and inline systems) is increasingly aggregated on cloud platforms. This allows for:

* Supply Chain Visibility: Real-time tracking of quality across the entire chain.

* Predictive Modeling: Large-scale analysis of quality trends, yield predictions, and market forecasting.

* Remote Monitoring & Support: Manufacturers can monitor instrument performance and provide proactive maintenance.

* API-Driven Ecosystems: Open APIs allow seamless integration of analyzer data into farm management software (FMS), enterprise resource planning (ERP) systems, and commodity trading platforms.

6. Regulatory Pressure and Food Safety:

* Stricter Mycotoxin Limits: Global regulations (e.g., EU, China) continue to tighten limits for aflatoxins, deoxynivalenol (DON), and other mycotoxins. This drives demand for analyzers with highly sensitive, rapid, and reliable detection capabilities, often requiring advanced sample preparation or specific calibration.

* Traceability Mandates: Regulations like FSMA (US) and the EU’s “Farm to Fork” strategy demand robust traceability. Grain analyzers providing digital, timestamped, and location-tagged quality data are critical for compliance.

7. Competitive Landscape Shifts:

* Consolidation: Larger instrumentation companies are acquiring specialized grain analysis firms to expand their agri-tech portfolios.

* New Entrants: Tech startups focusing on AI, hyperspectral imaging, or novel sensing technologies (e.g., Raman spectroscopy) are entering the market, challenging incumbents.

* Focus on Total Cost of Ownership (TCO): Buyers are increasingly evaluating analyzers based on long-term TCO, including calibration stability, service costs, data management capabilities, and integration ease, not just upfront price.

Conclusion for H2 2026:

The grain analyzer market in H2 2026 is characterized by intelligence, connectivity, and sustainability. Success will belong to providers offering:

* AI-powered, highly accurate instruments with predictive capabilities.

* Flexible solutions (lab, portable, inline) with seamless cloud integration.

* Specialized calibrations for diverse grains and critical safety parameters (especially mycotoxins).

* Data platforms enabling actionable insights for optimization and sustainability reporting.

* Robust support for integration into complex agricultural and supply chain ecosystems.

Manufacturers who embrace these trends and move from being hardware suppliers to data and insights partners will gain significant competitive advantage in the evolving H2 2026 landscape. The focus is firmly on delivering value beyond simple measurement – enabling smarter decisions, enhanced sustainability, and greater supply chain resilience.

Common Pitfalls Sourcing a Grain Analyser (Quality, IP)

Sourcing a grain analyser for quality and intellectual property (IP) purposes involves significant technical, legal, and operational considerations. Failure to address key pitfalls can result in inaccurate data, IP infringement, regulatory non-compliance, and financial loss. Below are the most common pitfalls to avoid:

Inadequate Specification of Analytical Requirements

Organisations often fail to clearly define the required analytical capabilities—such as moisture, protein, oil, starch, or contaminant detection—leading to the procurement of equipment that cannot meet specific quality control needs. Without precise specifications aligned with industry standards (e.g., ISO, AOAC), the analyser may deliver inconsistent or unusable data.

Overlooking Intellectual Property (IP) Ownership and Licensing

A critical oversight is neglecting to clarify IP rights related to calibration models, software algorithms, or proprietary methods embedded in the analyser. Some suppliers retain full IP ownership, restricting the buyer’s ability to modify, transfer, or share data. This can hinder internal R&D, create dependency on the vendor, or lead to legal disputes.

Insufficient Validation and Calibration Support

Purchasing analysers without access to proper calibration standards or validation protocols compromises data reliability. Grain composition varies by region and season, so analysers must be calibrated accordingly. Vendors that do not provide ongoing calibration support or transparent methodologies risk delivering inaccurate quality assessments.

Vendor Lock-In Through Proprietary Software or Consumables

Many suppliers use closed software ecosystems or proprietary consumables (e.g., sample cells, reagents), limiting interoperability and increasing long-term costs. This restricts the ability to integrate the analyser into existing laboratory information systems (LIMS) or switch service providers, undermining operational flexibility.

Neglecting Data Security and Compliance

Grain quality data can be commercially sensitive, especially in breeding or contract farming. Sourcing analysers without robust data security features or compliance with data protection regulations (e.g., GDPR) exposes organisations to IP theft or unauthorised data sharing, particularly with cloud-connected devices.

Underestimating Training and Technical Support Needs

Even advanced analysers require skilled operators. Failing to secure comprehensive training and responsive technical support from the supplier can result in misuse, downtime, or misinterpretation of results—jeopardising quality assurance and breeding programme integrity.

Inadequate Due Diligence on Supplier Reputation and Longevity

Choosing suppliers based solely on price or speed without evaluating their track record, R&D investment, or financial stability risks acquiring obsolete or unsupported technology. Suppliers may discontinue models or go out of business, leaving buyers without spare parts or software updates.

Avoiding these pitfalls requires a structured sourcing strategy that balances technical performance, IP rights, long-term support, and compliance—ensuring the grain analyser delivers reliable, defensible, and secure quality data.

Logistics & Compliance Guide for Grain Analyser

This guide outlines the essential logistics and compliance considerations for the safe, efficient, and legally compliant handling, transportation, installation, and operation of Grain Analyser equipment.

Equipment Handling and Transportation

Ensure all Grain Analyser units are securely packaged in manufacturer-recommended crates or containers to prevent damage during transit. Use appropriate lifting equipment (e.g., forklifts with padded forks) when moving the analyser, and always follow the center of gravity guidelines provided in the user manual. Avoid tilting or dropping the unit. For international shipments, comply with ISPM 15 regulations for wooden packaging materials. Maintain a clean, dry, and temperature-stable environment during transport to protect sensitive optical and electronic components.

Import and Export Compliance

Verify all export controls and import regulations applicable to the destination country. Grain Analysers may contain electronic components or measurement technologies subject to export licensing requirements (e.g., under EAR or ITAR, if applicable). Ensure proper Harmonized System (HS) code classification (typically under 9027 for instruments for physical or chemical analysis) and provide accurate commercial invoices, packing lists, and certificates of origin. Confirm compliance with local metrology or standards authority requirements (e.g., MID certification in the EU, NTEP in the US) if the analyser is used for trade purposes.

Installation Site Preparation

Prepare an installation site that meets the manufacturer’s environmental specifications, including stable temperature (typically 15–30°C), low humidity (<80% non-condensing), and protection from dust, vibration, and direct sunlight. Ensure a clean, level surface with adequate space for operation, maintenance, and ventilation. Provide a stable electrical supply matching the analyser’s voltage and frequency requirements (e.g., 100–240 VAC, 50/60 Hz) with surge protection. For hazardous locations, confirm compliance with ATEX or IECEx standards if applicable.

Regulatory and Safety Compliance

Operate the Grain Analyser in accordance with local occupational health and safety regulations. Ensure all operators are trained on safe usage, emergency shutdown procedures, and handling of sample materials. Comply with electrical safety standards such as IEC 61010. If the analyser uses lasers or other radiation sources, adhere to relevant radiation safety regulations (e.g., IEC 60825 for laser safety). Maintain up-to-date documentation, including CE marking (EU), FCC (US), or other regional conformity marks as required.

Calibration and Metrological Traceability

Implement a regular calibration schedule as specified by the manufacturer or required by regulatory bodies. Use certified reference materials (CRMs) traceable to national or international standards (e.g., NIST, PTB). Keep detailed records of all calibrations, including dates, results, and personnel responsible. For legal-for-trade applications, ensure the device is verified and sealed by an authorized metrology body where required (e.g., weights and measures authorities).

Data Integrity and Cybersecurity

Protect data generated by the Grain Analyser in compliance with data protection laws (e.g., GDPR, CCPA). Enable password protection and user access controls on the device. Secure data transfers using encrypted protocols and ensure regular backups. For network-connected units, follow cybersecurity best practices, including firmware updates and firewall protection, to prevent unauthorized access.

End-of-Life and Environmental Compliance

Dispose of obsolete or damaged Grain Analysers in accordance with WEEE (Waste Electrical and Electronic Equipment) directives or local e-waste regulations. Coordinate with certified electronic waste recyclers to ensure proper handling of components containing hazardous substances (e.g., lead, mercury). Return or recycle packaging materials responsibly.

Documentation and Record Keeping

Maintain a complete compliance file including: user manuals, calibration certificates, import/export documentation, safety data sheets (if applicable), training records, maintenance logs, and regulatory approvals. Ensure all documentation is accessible for audit purposes and retained for the minimum period required by local regulations (typically 5–7 years).

Adhering to this guide ensures reliable operation of the Grain Analyser while meeting global logistics and regulatory requirements.

Conclusion for Sourcing a Grain Analyzer

In conclusion, sourcing a grain analyzer is a strategic investment that significantly enhances the efficiency, accuracy, and consistency of grain quality assessment across agricultural and processing operations. The selection of an appropriate grain analyzer should be guided by specific operational requirements, including the types of grains processed, key quality parameters (such as moisture, protein, oil, and starch content), throughput needs, and desired level of automation.

After evaluating various options, factors such as measurement technology (e.g., NIR spectroscopy), ease of use, calibration flexibility, data management capabilities, and after-sales support are critical in making an informed decision. Opting for a reliable, high-precision analyzer not only ensures compliance with quality standards but also supports better pricing, improved processing yields, and enhanced traceability throughout the supply chain.

Ultimately, the right grain analyzer contributes to improved decision-making, cost savings, and increased competitiveness in the grain market. By carefully aligning technical specifications with business objectives, stakeholders can ensure a successful long-term return on investment and maintain the highest standards of grain quality and safety.