The global stainless steel market is experiencing robust growth, driven by increasing demand across industries such as construction, automotive, food processing, and pharmaceuticals. According to Grand View Research, the global stainless steel market size was valued at USD 135.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. A significant contributor to this expansion is the rising preference for Grade 304 stainless steel—the most widely used austenitic stainless steel—due to its excellent corrosion resistance, durability, and ease of fabrication. Mordor Intelligence projects a similar trajectory, highlighting that growing infrastructure investments and industrialization in emerging economies are key demand accelerators. As applications for 304 stainless steel continue to proliferate, the manufacturers leading innovation, production capacity, and quality assurance are becoming increasingly pivotal in shaping the future of the industry. Here’s a data-driven look at the top 10 Grade 304 stainless steel manufacturers at the forefront of this growth.

Top 10 Grade 304 Stainless Steel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 North American Stainless

Domain Est. 1999 | Founded: 1990

Website: northamericanstainless.com

Key Highlights: Founded in 1990, North American Stainless (NAS) has undertaken several phases of expansion to become the largest, fully integrated stainless steel producer in ……

#2 304 Stainless Steel Grade

Domain Est. 1996

Website: alro.com

Key Highlights: Alro stocks 304 stainless steel in many shapes including: tubing, angles, beams, bars, channels, coils, pipes, plates, tubing, and sheets. Comparing Types of ……

#3 STAINLESS

Domain Est. 1996

Website: castlemetals.com

Key Highlights: Castle markets a vast array of stainless steel products and grades, working closely with customers to provide highly engineered and custom solutions….

#4 Stainless Steel Grades

Domain Est. 1999

Website: jindalstainless.com

Key Highlights: Stainless Steel 304 is a versatile austenitic alloy renowned for its remarkable corrosion resistance and durability. Its versatility shines in applications ……

#5 304 Stainless Steel

Domain Est. 1999

Website: pennstainless.com

Key Highlights: Explore 304 stainless steel from Penn Stainless. Learn about 304 vs 316 differences, food-grade applications, rust resistance, magnetic properties, ……

#6 of stainless steels

Domain Est. 2000

Website: worldstainless.org

Key Highlights: worldstainless.org is the most comprehensive site for anyone interested in stainless steels. You will find documentation on the properties, ……

#7 Stainless Steel 304

Domain Est. 2000

Website: remingtonindustries.com

Key Highlights: Free delivery 120-day returnsBrowse our stainless steel 304 flat bars and round rods, or scroll to the bottom of the page for more information on 304 grade stainless steel. Read Mo…

#8 North American Steel Products

Domain Est. 2004

Website: clevelandcliffs.com

Key Highlights: We offer flat-rolled carbon steel, stainless, electrical, plate, long steel products, carbon and stainless steel tubing, and hot and cold stamping and tooling….

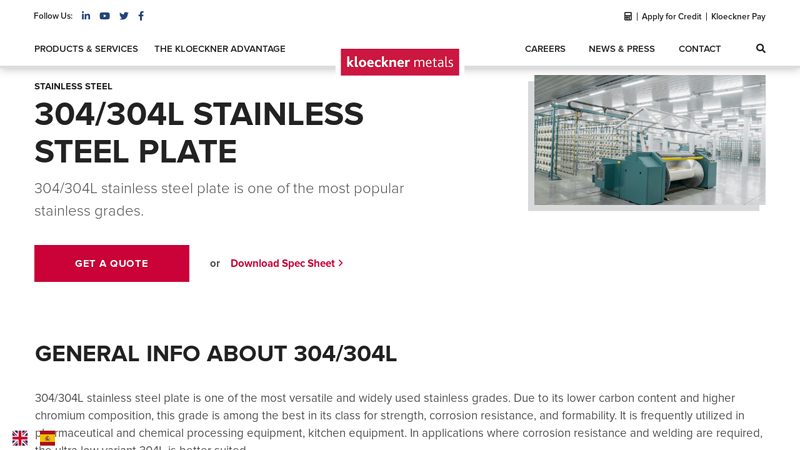

#9 304/304L Stainless Steel Plate

Domain Est. 2011

Website: kloecknermetals.com

Key Highlights: 304/304L stainless steel plate is one of the most popular stainless grades, supplied nationwide across our network of 55+ branches….

#10 Stainless Steel 304

Domain Est. 2017

Website: thyssenkrupp-materials.co.uk

Key Highlights: Type 304 stainless steel is an austenitic grade that can be severely deep drawn. This property has resulted in 304 being the dominant grade used in applications ……

Expert Sourcing Insights for Grade 304 Stainless Steel

2026 Market Trends for Grade 304 Stainless Steel

Grade 304 stainless steel, the most widely used austenitic stainless steel alloy, is expected to experience notable shifts in market dynamics by 2026. Driven by global industrial demand, supply chain evolution, sustainability mandates, and raw material price fluctuations, the 304 stainless steel market is poised for moderate growth with region-specific variations.

Market Growth and Demand Forecast

The global demand for Grade 304 stainless steel is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2026, reaching an estimated market value of USD 89 billion by 2026, according to industry reports. This growth is primarily fueled by increasing applications in construction, automotive, food processing, and consumer goods industries.

Asia-Pacific remains the dominant consumer and producer region, with China, India, and Southeast Asia driving demand due to rapid urbanization and infrastructure development. In contrast, North America and Europe are witnessing steady but slower growth, supported by modernization of industrial infrastructure and the adoption of energy-efficient appliances.

Influence of Raw Material Costs

The price volatility of key raw materials—particularly nickel and chromium—will continue to impact the 304 stainless steel market in 2026. Nickel, which constitutes 8–10.5% of Grade 304, has experienced fluctuating prices due to geopolitical tensions in major producing countries such as Indonesia and the Philippines.

Indonesia’s export restrictions on nickel ore and investment in downstream processing are expected to tighten global supply, potentially increasing production costs. However, advancements in recycling technologies and increased scrap utilization may help mitigate raw material price pressures. By 2026, recycled stainless steel is projected to account for over 40% of total feedstock, reducing dependency on virgin materials.

Sustainability and Regulatory Pressures

Environmental regulations are becoming a key driver in the stainless steel industry. The European Union’s Green Deal and similar initiatives in North America and Japan are pushing manufacturers to reduce carbon emissions and improve energy efficiency. As a result, producers are increasingly investing in electric arc furnaces (EAFs) and hydrogen-based reduction technologies.

Grade 304 stainless steel benefits from its high recyclability and long service life, positioning it favorably in green building standards and circular economy frameworks. By 2026, ESG (Environmental, Social, and Governance) compliance is expected to be a prerequisite for major procurement contracts, influencing purchasing decisions in construction and infrastructure projects.

Technological and Industrial Shifts

In the automotive sector, electric vehicle (EV) production is creating new demand patterns. While EVs use less stainless steel than traditional vehicles, the shift toward high-efficiency motors and battery enclosures is increasing the use of corrosion-resistant materials like 304 in auxiliary systems and charging infrastructure.

Additionally, the food and beverage industry continues to rely heavily on Grade 304 due to its non-reactive properties and ease of sanitation. The expansion of cold chain logistics and smart kitchen appliances in emerging markets is expected to boost demand.

Competitive Landscape and Supply Chain Resilience

The 304 stainless steel market remains highly competitive, with major players such as Outokumpu (Finland), Acerinox (Spain), Nippon Steel (Japan), and Tsingshan Holding Group (China) dominating production. In response to trade barriers and supply chain disruptions—such as those seen during the pandemic—companies are diversifying sourcing and increasing regional production.

Nearshoring and regionalization trends, especially in North America and Europe, are leading to new investments in local stainless steel capacity. This shift aims to reduce dependency on Asian imports and improve supply chain resilience by 2026.

Conclusion

By 2026, the Grade 304 stainless steel market will be shaped by a confluence of rising industrial demand, raw material volatility, sustainability imperatives, and technological innovation. While challenges remain in cost management and supply chain stability, the alloy’s versatility and durability ensure its continued prominence across key sectors. Producers who adapt to ESG standards, invest in recycling, and diversify supply chains are likely to gain competitive advantage in the evolving global landscape.

Common Pitfalls When Sourcing Grade 304 Stainless Steel (Quality & Integrity)

Sourcing Grade 304 stainless steel requires careful attention to quality and integrity to ensure performance, safety, and regulatory compliance. Failing to verify these aspects can lead to material failures, project delays, safety hazards, and financial losses. Below are the most common pitfalls encountered:

Inadequate Material Certification and Documentation

One of the most frequent issues is accepting stainless steel without proper, traceable certification. Buyers may receive mill test certificates (MTCs) that are incomplete, generic, or even falsified. The absence of a valid EN 10204 3.1 or 3.2 certificate undermines material traceability and makes it difficult to verify compliance with ASTM A240 or equivalent standards. Without full chemical and mechanical test data, there is no assurance that the material meets the required chromium (18–20%), nickel (8–10.5%), and carbon (<0.08%) composition.

Substitution with Inferior Grades (e.g., 200-Series or 301)

Suppliers, particularly in competitive or low-cost markets, may substitute genuine 304 stainless steel with lower-cost alternatives like 201 or 301. These grades contain less nickel and may include manganese or nitrogen as substitutes, reducing corrosion resistance and mechanical performance. Such substitutions are often hidden through misleading labeling or forged documentation. This is especially problematic in corrosive environments where true 304 performance is expected.

Inconsistent or Poor Surface Finish and Tolerances

Grade 304 is often selected for both functional and aesthetic reasons. However, sourced material may exhibit inconsistent surface finishes (e.g., variation in #4 brushed finish) or dimensional tolerances outside ASTM or ISO specifications. Poor surface quality not only affects appearance but can also compromise corrosion resistance by increasing surface roughness and harboring contaminants.

Lack of Third-Party Verification and Testing

Relying solely on supplier-provided data without independent verification is a critical oversight. Reputable buyers conduct third-party material testing, including positive material identification (PMI) using portable XRF analyzers, to confirm alloy composition. Skipping PMI or mechanical testing (e.g., tensile strength, hardness) increases the risk of receiving non-conforming or counterfeit material.

Supply Chain Transparency and Traceability Gaps

Complex supply chains, especially involving multiple intermediaries or offshore sourcing, can obscure the origin of the material. Without clear traceability from the original mill, there is increased risk of contamination, improper heat treatment, or mixing of heats. This lack of transparency makes it difficult to investigate issues or assign accountability in case of failure.

Inadequate Quality Management Systems in Suppliers

Sourcing from suppliers without certified quality management systems (e.g., ISO 9001) heightens the risk of inconsistent quality. Such suppliers may lack proper internal controls, inspection protocols, or documentation practices, leading to variability in material properties and increased defect rates.

Failure to Specify Requirements Clearly in Procurement

Ambiguous purchase specifications—such as omitting required standards, finishes, tolerances, or testing protocols—leave room for interpretation and non-compliance. Suppliers may deliver material that technically meets a generic “304” label but fails to satisfy the project’s actual performance requirements.

Avoiding these pitfalls requires robust supplier qualification, clear technical specifications, independent verification, and a commitment to material integrity throughout the sourcing process.

Logistics & Compliance Guide for Grade 304 Stainless Steel

Overview of Grade 304 Stainless Steel

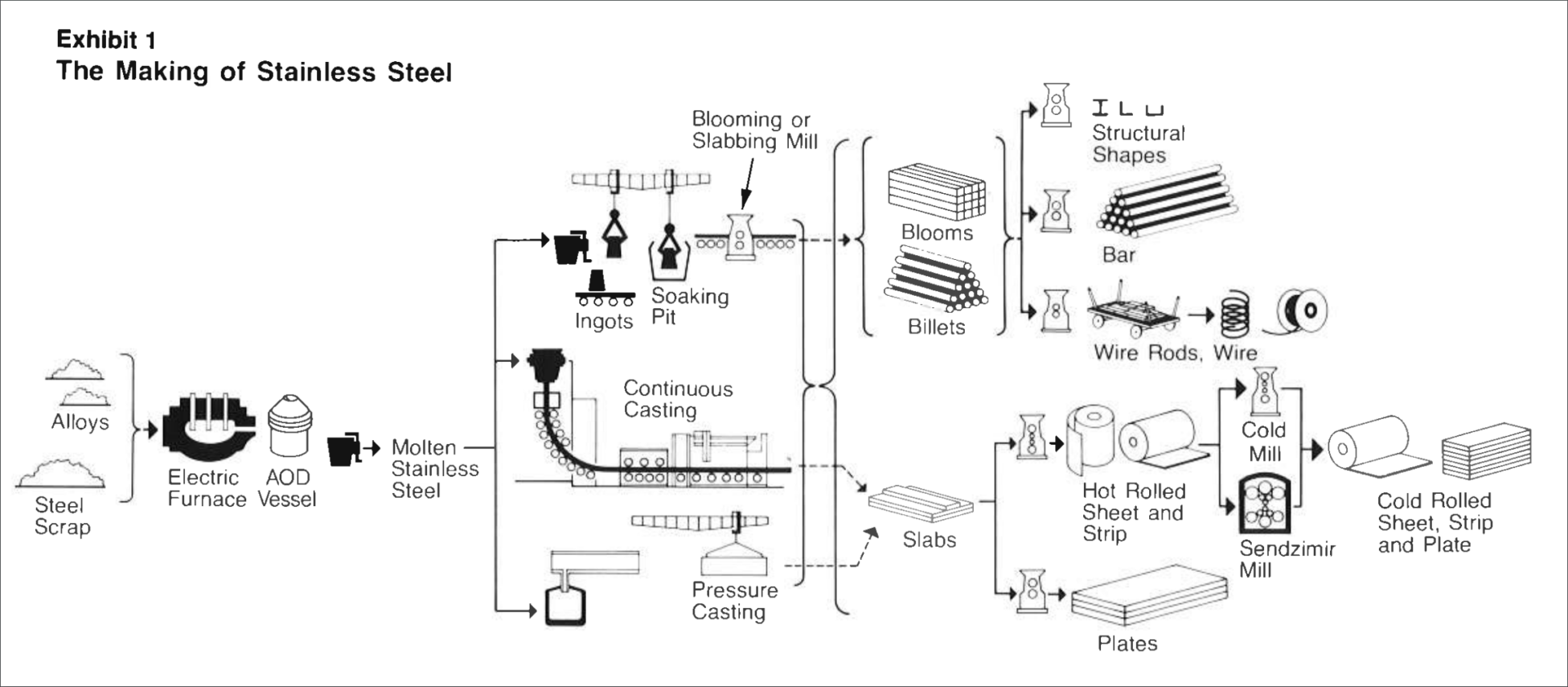

Grade 304 stainless steel is an austenitic chromium-nickel alloy known for its excellent corrosion resistance, formability, weldability, and durability. It is the most widely used stainless steel grade in industries such as food processing, architecture, chemical containers, and consumer goods. Composed primarily of 18% chromium and 8% nickel (18/8 stainless), it performs well in a variety of environments but is not recommended for prolonged exposure to saltwater or chloride-rich conditions without protective measures.

International Trade Classification (HS Code)

For global shipping and customs declaration, Grade 304 stainless steel is categorized under the Harmonized System (HS) Code framework. The specific code may vary slightly by country, but common classifications include:

- HS Code 7219.32: Stainless steel flat-rolled products, of width ≥ 600 mm, cold-rolled, not clad, plated, or coated, containing by weight ≥ 1.2% but < 6% nickel (typical for 304).

- HS Code 7219.33: Stainless steel flat-rolled products, of width ≥ 600 mm, cold-rolled, not clad, plated, or coated, containing by weight ≥ 6% nickel (also applicable for 304 depending on exact Ni content).

- HS Code 7219.90: Other flat-rolled stainless steel products.

- HS Code 7220.20: Stainless steel flat-rolled products, of width < 600 mm.

- HS Code 7222.20: Stainless steel bars and rods.

Note: Accurate classification is essential for customs clearance and tariff assessment. Confirm the exact HS code with the importing country’s customs authority and provide detailed product specifications (e.g., form, dimensions, finish, chemical composition).

Packaging and Handling Requirements

Proper packaging and handling prevent surface damage, corrosion, and contamination during transit and storage.

- Packaging:

- Flat sheets and coils: Wrapped in moisture-resistant paper or plastic film, secured on wooden pallets with corner protectors.

- Bars, tubes, and pipes: Bundled with steel or plastic strapping, ends capped to prevent dents.

- Use desiccants when packaging for long-term or maritime transport to prevent condensation.

-

Avoid direct contact with carbon steel to prevent cross-contamination and rust staining (‘rouging’).

-

Handling:

- Use non-magnetic lifting equipment (e.g., slings, clamps) designed for stainless steel to avoid surface damage.

- Keep material dry and store off the ground on pallets or racks.

- Separate from chloride sources, acidic materials, and carbon steel during storage and transport.

Transportation and Shipping

Grade 304 stainless steel can be transported via sea, rail, or road, but certain precautions ensure product integrity.

- Marine Transport:

- Use covered containers (dry van or refrigerated if humidity control is needed).

- Avoid exposure to salt spray; ensure containers are sealed and moisture-controlled.

-

Include humidity indicators in packaging for long voyages.

-

Land and Rail Transport:

- Secure loads to prevent shifting; use protective padding between layers.

-

Cover with waterproof tarpaulins if transported in open railcars or trucks.

-

Temperature Considerations:

- Grade 304 performs well across a broad temperature range (–200°C to 870°C), but avoid prolonged exposure to temperatures between 425–860°C (sensitization range) during transport or storage near heat sources.

Regulatory and Compliance Standards

Compliance with international and regional standards ensures material quality, safety, and market access.

- Material Certification:

- Provide Mill Test Certificates (MTC) per EN 10204 Type 3.1 or 3.2, confirming chemical composition and mechanical properties.

-

Standard specifications include:

- ASTM A240/A240M (for plate, sheet, and strip)

- ASTM A276 (for bars and shapes)

- ASTM A312 (for seamless and welded tubes)

- EN 10088-2 (European standard for stainless steel plates and sheets)

-

Environmental and Safety Compliance:

- REACH (EU): Grade 304 contains nickel and chromium, which are regulated substances. Ensure compliance with SVHC (Substances of Very High Concern) declarations.

- RoHS (EU): Not directly applicable to raw materials but relevant for finished electrical/electronic components made from 304.

- OSHA & WHMIS (US/Canada): Provide Safety Data Sheets (SDS) for handling metal dust during cutting or grinding operations.

-

TSCA (US): Confirm that the material and manufacturing process comply with Toxic Substances Control Act requirements.

-

Customs and Import Regulations:

- Anti-dumping or countervailing duties may apply depending on the country of origin.

- Example: The U.S. imposes anti-dumping duties on certain stainless steel flat products from specific countries (e.g., India, South Korea).

- Accurate origin declaration (Certificate of Origin) may be required for preferential tariff treatment under trade agreements (e.g., USMCA, EU-FTA).

Quality Assurance and Traceability

- Maintain full traceability from melt batch to final product using heat numbers.

- Conduct periodic inspections for surface defects, dimensional accuracy, and chemical verification (e.g., PMI – Positive Material Identification).

- Third-party inspection (e.g., SGS, Bureau Veritas) may be required for high-value or critical applications.

End-of-Life and Recycling Compliance

- Grade 304 is 100% recyclable; ensure end-of-life management aligns with local recycling regulations.

- Report recycling rates where required (e.g., under EU Circular Economy Action Plan).

Summary

Successful logistics and compliance for Grade 304 stainless steel require attention to accurate classification, protective packaging, contamination control, and adherence to international standards. By maintaining proper documentation, handling procedures, and regulatory awareness, companies can ensure smooth global trade and product integrity throughout the supply chain.

Conclusion for Sourcing Grade 304 Stainless Steel:

After a comprehensive evaluation of supply options, quality standards, pricing, and logistical considerations, sourcing Grade 304 stainless steel proves to be a reliable and cost-effective choice for a wide range of industrial, commercial, and construction applications. Its excellent corrosion resistance, durability, formability, and aesthetic appeal make it one of the most versatile and widely used stainless steel grades globally.

Sourcing Grade 304 from reputable suppliers who adhere to international standards (such as ASTM A240, AISI, or JIS) ensures consistent material quality and performance. Conducting thorough due diligence—including mill certifications, material testing, and supply chain transparency—minimizes risks related to counterfeit or substandard products.

Additionally, considering both domestic and international suppliers provides opportunities for competitive pricing and supply stability, especially when factoring in lead times, freight costs, and trade regulations. Establishing long-term partnerships with qualified vendors can further enhance supply continuity and enable volume-based cost benefits.

In conclusion, with proper supplier vetting and quality assurance processes in place, sourcing Grade 304 stainless steel supports long-term project success, structural integrity, and compliance with industry requirements. It remains a preferred material solution where performance, value, and reliability are critical.