The global glove fabric market is experiencing robust growth, driven by rising demand across healthcare, industrial safety, and consumer sectors. According to Grand View Research, the global disposable gloves market was valued at USD 9.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.1% from 2023 to 2030. This surge is fueled by heightened hygiene awareness, stringent workplace safety regulations, and sustained demand in emerging economies. Meanwhile, Mordor Intelligence projects a CAGR of 9.5% over the same period, citing increased healthcare infrastructure investments and pandemic-driven consumption patterns as key accelerants. In this expanding landscape, glove fabric manufacturers are pivotal, supplying performance-driven materials such as nitrile, latex, polyethylene, and chloroprene. These materials are engineered for durability, comfort, and protection, meeting evolving industry standards. As demand continues to grow, innovation and scalability are differentiating leaders in the market. Below, we examine the top 10 glove fabric manufacturers shaping the industry through advanced production capabilities, global reach, and consistent quality.

Top 10 Glove Fabric Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

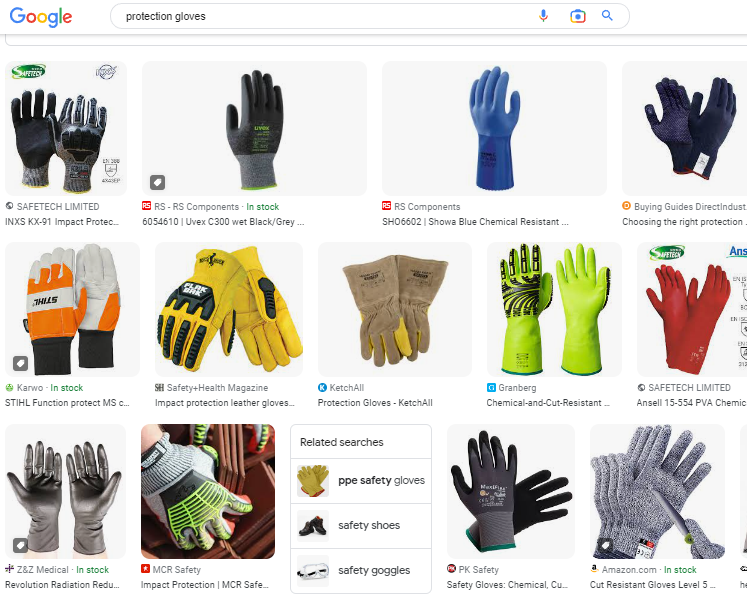

#1 Protective gloves (PPE) for medical and industry use

Domain Est. 2014

Website: showagroup.com

Key Highlights: SHOWA is a fully integrated manufacturer of industrial PPE hand protection. We work with the very latest in technological advancements….

#2 Mechanix Wear

Domain Est. 1997

Website: mechanix.com

Key Highlights: Mechanix Wear uses technology to bring you the best in all work, safety, and tactical gloves. Whether that is the durability of Durahide leather gloves; ……

#3 US Glove Products

Domain Est. 1998

Website: usglove.com

Key Highlights: 8-day delivery 30-day returnsUS Glove Products – US Glove is the proud manufacturer of Tiger Paws Wrist Supports and other leading gymnastics supplies….

#4 United Glove

Domain Est. 2003

Website: unitedglove.com

Key Highlights: United Glove is a wholesale glove manufacturer of machine-knit terry cloth and string-knit work gloves, as well as an importer….

#5 Boss Gloves

Domain Est. 2013

Website: us.pipglobal.com

Key Highlights: Crafted from the most advanced materials and engineered to provide maximum protection and productivity for workers in tough Industrial ……

#6 About us

Domain Est. 1996 | Founded: 1910

Website: superiorglove.com

Key Highlights: Superior Glove is a leading innovator in the design and manufacture of safety gloves and sleeves. Since 1910, we have been protecting workers across the globe….

#7 Saranac Glove: Premium Winter Gloves & Mitts

Domain Est. 1998

Website: saranacglove.com

Key Highlights: Cold Weather Gloves for Outdoor Adventures. Engineered for the elements, built for durability, and designed for hands that never stop moving….

#8 Stauffer Glove & Safety

Domain Est. 1999 | Founded: 1907

Website: stauffersafety.com

Key Highlights: Stauffer Glove & Safety provides the products & expertise that workers need to stay safe. Family-owned since 1907….

#9 to Gloveworks. Make Your Own Glove and Bring It !

Domain Est. 2014

Website: gloveworks.net

Key Highlights: At Gloveworks we take pride in creating you a custom, one-of-a-kind glove with the highest quality materials and the finest craftsmanship in the industry….

#10 Knoxville Glove Company

Domain Est. 2015

Website: knoxvilleglove.net

Key Highlights: Our Products · Leather Palm Gloves · Kevlar® Gloves · Sleeves · “Wear-Tested” on millions of hands over 100 years and are Made in the USA!…

Expert Sourcing Insights for Glove Fabric

H2: Market Trends for Glove Fabric in 2026

The global glove fabric market is poised for significant transformation by 2026, driven by evolving end-user demands, technological advancements, and heightened regulatory and environmental considerations. This analysis outlines key market trends expected to shape the glove fabric industry in 2026 under the H2 framework, focusing on Health, Hygiene, High-Performance Materials, and Human-Centric Design.

1. Health (H1): Rising Demand in Medical and Healthcare Sectors

By 2026, the healthcare sector will remain the largest consumer of glove fabrics, with continued demand for sterile, hypoallergenic, and antimicrobial textiles. The post-pandemic normalization has instilled permanent changes in hygiene protocols, increasing glove usage in hospitals, clinics, and home healthcare settings. Innovations such as biodegradable nitrile and latex-free glove fabrics will gain traction to address latex allergies and support patient safety. Additionally, smart glove fabrics embedded with sensors for vital sign monitoring are expected to enter commercial healthcare applications, particularly in telemedicine and elder care.

2. Hygiene (H2): Expansion in Food Service and Consumer Use

Hygiene consciousness will extend beyond healthcare into food processing, retail, and everyday consumer use. Glove fabrics designed for single-use or repeated washing—such as antimicrobial knitted nylon and poly-cotton blends—will see increased adoption in food handling, delivery services, and household cleaning. Regulatory emphasis on food safety (e.g., FDA and EFSA guidelines) will drive demand for certified, low-lint, and powder-free glove materials. Disposable glove fabrics with enhanced grip and breathability will dominate the home-use segment, supported by e-commerce growth and direct-to-consumer branding.

3. High-Performance Materials (H3): Innovation in Durability and Protection

The industrial and occupational safety segment will demand advanced glove fabrics offering cut, heat, chemical, and puncture resistance. By 2026, high-performance materials such as Dyneema®, Kevlar®, and engineered composites will dominate premium glove production. Manufacturers will increasingly adopt nano-coated textiles and composite yarns that combine strength with flexibility. Additionally, sustainability-focused innovations—like bio-based polyurethane coatings and recycled aramid fibers—will align performance with environmental goals, appealing to corporate ESG commitments.

4. Human-Centric Design (H4): Focus on Comfort, Ergonomics, and Sustainability

User experience will be a differentiating factor in glove fabric adoption. In 2026, ergonomic designs using 3D-knitted seamless fabrics will be mainstream, offering improved dexterity, reduced hand fatigue, and customizable fit. Breathable, moisture-wicking fabrics (e.g., Coolmax® blends) will be critical in hot environments and long-duration wear scenarios. Alongside comfort, circular economy principles will influence material sourcing: brands will prioritize recyclable, compostable, or mono-material glove fabrics to minimize waste. Transparency in supply chains—enabled by blockchain and QR-coded traceability—will become a competitive advantage.

Conclusion: Strategic Outlook for 2026

By 2026, the glove fabric market will be shaped by the convergence of health awareness, hygiene standards, material innovation, and human-centered design. Leading manufacturers will invest in R&D to create multifunctional, sustainable, and smart textile solutions. Regional markets in Asia-Pacific and Latin America will witness accelerated growth due to industrialization and healthcare expansion. Companies that align with H2 trends—Health, Hygiene, High-Performance Materials, and Human-Centric Design—will be best positioned to capture value in an increasingly competitive and regulated global landscape.

Common Pitfalls Sourcing Glove Fabric (Quality, IP)

Sourcing glove fabric involves more than just finding a low price—overlooking key quality and intellectual property (IP) factors can lead to product failures, legal disputes, and reputational damage. Below are critical pitfalls to avoid:

Poor Material Quality and Inconsistent Performance

Low-cost glove fabrics may appear suitable initially but often fail under real-world conditions. Common issues include inconsistent thickness, poor tensile strength, inadequate abrasion resistance, or inconsistent coating adhesion (in coated fabrics). These deficiencies result in premature wear, reduced protection, and customer dissatisfaction. Always request physical samples, conduct third-party testing, and audit supplier production processes to ensure consistency and compliance with performance standards (e.g., EN, ASTM).

Lack of Traceability and Certification

Many suppliers cannot provide documentation for fiber origin, chemical treatments, or compliance with environmental and safety regulations (e.g., REACH, OEKO-TEX®). Without traceability, brands risk non-compliance, especially in regulated industries like medical, food handling, or PPE. Ensure suppliers offer full material disclosure and relevant certifications to mitigate regulatory and reputational risks.

Intellectual Property Infringement

Using patented fabric technologies—such as specific knit structures, moisture-wicking treatments, or antimicrobial finishes—without proper licensing can lead to costly IP litigation. Some suppliers may unknowingly or deliberately offer “copy” fabrics that infringe on existing patents. Conduct due diligence by reviewing patent databases and requiring suppliers to warrant that their products do not violate third-party IP rights.

Hidden Minimum Order Quantities (MOQs) and Long Lead Times

While unit prices may seem attractive, hidden MOQs or extended lead times can disrupt supply chains and increase inventory costs. Clarify MOQs, production capacity, and delivery timelines upfront. Flexible suppliers with scalable output reduce the risk of overstocking or stockouts.

Inadequate Testing for End-Use Conditions

Glove fabrics must perform under specific environmental and mechanical stresses. Sourcing based on generic specs without application-specific testing—such as flex durability, chemical resistance, or thermal stability—can result in field failures. Collaborate with suppliers to simulate real-use scenarios and validate performance before bulk orders.

Supplier Misrepresentation and Lack of Transparency

Some suppliers exaggerate capabilities or provide misleading claims about fabric performance or exclusivity. Verify technical claims through independent labs and conduct on-site audits when possible. Building long-term relationships with transparent, technically capable partners reduces the risk of misrepresentation.

Avoiding these pitfalls requires a proactive sourcing strategy focused on quality validation, legal compliance, and supplier accountability—ensuring reliable, defensible glove fabric supply chains.

Logistics & Compliance Guide for Glove Fabric

This guide outlines the key logistics and compliance considerations for the international trade and handling of glove fabric, a critical material used in the production of protective gloves across medical, industrial, and consumer sectors.

Regulatory Compliance

Adhering to regulatory standards is essential to ensure safety, quality, and market access. Glove fabric may be subject to various regulations depending on its end-use and destination.

Material Safety & Chemical Restrictions

Glove fabrics, particularly those used in medical or food-handling applications, must comply with chemical safety standards. Key regulations include:

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals. Ensure no restricted substances (e.g., phthalates, certain azo dyes) are present.

– RoHS (EU): Applies if fabric contains electronic components (e.g., conductive threads in ESD gloves).

– Proposition 65 (California, USA): Requires warning labels if fabric contains listed carcinogens or reproductive toxins.

– OEKO-TEX® Standard 100: Voluntary certification confirming absence of harmful levels of toxic substances.

Medical-Grade Fabric Regulations

For fabrics intended for medical gloves:

– FDA 21 CFR (USA): May classify the fabric as a medical device component. Ensure compliance with Good Manufacturing Practices (GMP) and biocompatibility standards (e.g., ISO 10993).

– EU MDR (Medical Device Regulation 2017/745): Requires CE marking and conformity assessment if fabric is part of a medical device.

Textile Labeling & Fiber Content

Comply with destination country labeling laws:

– USA (FTC Textile Rules): Accurate fiber content labeling (e.g., “100% Nitrile-Coated Polyester Knit”).

– EU Textile Regulation (EU No 1007/2011): Mandates fiber composition labeling in all member states.

Import & Export Requirements

Proper documentation and adherence to trade regulations are critical for smooth cross-border movement.

Harmonized System (HS) Codes

Correct classification ensures accurate duties and regulatory treatment. Common HS codes for glove fabric include:

– 5903.90: Textile fabrics impregnated, coated, or covered with plastics (e.g., PVC, PU-coated knits).

– 5806.32 / 5806.39: Narrow woven fabrics of synthetic fibers, potentially used as glove trim or wristbands.

– 6216.00: Complete gloves – while not fabric per se, classification may influence fabric duties if imported as part of a finished product.

Country-Specific Import Regulations

– USA: CBP (Customs and Border Protection) requires entry documents (e.g., commercial invoice, packing list, bill of lading). Textiles may be subject to quota restrictions under USMCA or AGOA.

– EU: Importers must register in the EU Import Control System (ICS2) and provide Prior Notification of Arrival (PNA). Proof of origin may be required for preferential tariffs.

– China: Requires CCC mark if fabric is part of a certified product; strict customs inspections apply.

Trade Agreements & Tariff Preferences

Leverage free trade agreements (e.g., USMCA, RCEP, AfCFTA) to reduce or eliminate tariffs. Ensure compliance with Rules of Origin (ROO) to qualify for preferential treatment.

Packaging & Labeling

Proper packaging ensures product integrity and regulatory compliance throughout the supply chain.

Packaging Standards

– Use moisture-resistant, durable materials to prevent contamination or damage.

– Clearly label rolls or bundles with SKU, weight, color, batch number, and production date.

– For medical-grade fabric, maintain sterile or clean-room packaging as required.

Labeling Requirements

– Include required information: fiber composition, country of origin, care instructions (if applicable), and safety warnings.

– Comply with language requirements (e.g., French in Canada, Spanish in Mexico).

– Use standardized barcodes and RFID tags for traceability.

Transportation & Handling

Safe and efficient logistics depend on appropriate handling, storage, and transport methods.

Mode of Transport

– Ocean Freight: Most cost-effective for bulk shipments. Use dry containers; consider desiccants for humidity control.

– Air Freight: Suitable for urgent or high-value orders. Monitor temperature and humidity.

– Land Transport: Use enclosed, clean trailers to prevent contamination.

Storage Conditions

– Store in clean, dry, temperature-controlled environments (ideally 15–25°C, <60% RH).

– Keep away from direct sunlight, ozone sources, and sharp objects.

– Rotate stock using FIFO (First In, First Out) to prevent aging.

Hazardous Considerations

– Most glove fabrics are non-hazardous, but solvent-based coatings (e.g., neoprene, latex) may require hazardous material declarations (e.g., UN 3082).

– Follow IATA, IMDG, or ADR regulations if transporting flammable or reactive materials.

Sustainability & Environmental Compliance

Environmental regulations and corporate sustainability goals are increasingly important.

Waste & Disposal

– Comply with local waste management laws. Coated fabrics may require special disposal due to non-biodegradable components.

– Implement recycling programs for fabric scraps (e.g., repurposing into insulation or padding).

Carbon Footprint & Reporting

– Track emissions from transport and production for ESG reporting.

– Consider low-carbon shipping options and eco-certified materials (e.g., recycled polyester knit).

Certifications

– GRS (Global Recycled Standard): For fabrics containing recycled content.

– Bluesign®: Ensures sustainable and safe textile production.

– ISO 14001: Environmental management system certification for suppliers.

Quality Assurance & Traceability

Maintain consistent quality and enable rapid response to compliance issues.

Inspection & Testing

– Conduct pre-shipment inspections for weight, width, coating thickness, and defects.

– Perform periodic lab testing for tensile strength, chemical resistance, and compliance with safety standards.

Batch Traceability

– Assign unique batch/lot numbers to each production run.

– Maintain records of raw materials, production dates, and test results for at least 5 years (longer for medical applications).

By adhering to this logistics and compliance guide, manufacturers, suppliers, and distributors can ensure the safe, legal, and efficient movement of glove fabric across global markets. Regular updates to regulatory requirements and proactive risk management are essential for long-term success.

Conclusion on Sourcing Glove Fabric:

Sourcing the right glove fabric is a critical step in ensuring product quality, functionality, and market competitiveness. After evaluating various materials—such as cotton, polyester, nylon, spandex, leather, and specialized technical fabrics like neoprene or cut-resistant fibers—the optimal choice depends on the intended application, performance requirements, comfort, durability, and cost considerations.

Key takeaways include the importance of balancing performance attributes (e.g., dexterity, grip, thermal regulation, abrasion resistance) with sustainability and ethical sourcing practices. Building strong relationships with reliable suppliers, conducting thorough quality testing, and staying informed about innovative textile technologies can significantly enhance sourcing efficiency and end-product value.

Ultimately, a strategic and well-researched approach to glove fabric sourcing enables manufacturers to meet customer expectations, comply with industry standards, and maintain a competitive edge in an evolving marketplace.