The global wholesale motor manufacturing market is experiencing robust growth, driven by rising demand for energy-efficient motors across industrial, automotive, and consumer electronics sectors. According to Grand View Research, the global electric motor market was valued at USD 154.7 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030. Similarly, Mordor Intelligence forecasts a CAGR of over 6.8% during the period 2024–2029, underpinned by increasing automation, advancements in motor technology, and supportive regulatory frameworks promoting energy efficiency. In this expanding landscape, three leading manufacturers have emerged as dominant players in the global wholesale segment—combining scale, innovation, and extensive distribution networks to meet escalating demand across international markets.

Top 3 Global Wholesale Motor Company Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ACDelco: OEM & Aftermarket Auto Parts

Domain Est. 1996

Website: gmparts.com

Key Highlights: ACDelco offers the only aftermarket parts backed by GM. ACDelco’s Gold and Silver lines of premium aftermarket parts offer a precise fit for GM vehicles….

#2 Global Wholesale Motor Co INC. Homepage

Domain Est. 2007

Website: globalmotorco.com

Key Highlights: Global Wholesale Motor Co INC. Selling Used Cars in Fort Myers, FL….

#3 Global Partners LP

Domain Est. 1996

Website: globalp.com

Key Highlights: Global Partners is a leading independent owner, supplier, and operator of liquid energy terminals, fueling locations, and retail experiences….

Expert Sourcing Insights for Global Wholesale Motor Company

H2: Global Market Trends Shaping the Automotive Wholesale Industry in 2026

As the automotive industry undergoes a transformative shift, the Global Wholesale Motor Company (GWMC) is poised to face both challenges and opportunities in 2026. Driven by technological innovation, evolving consumer preferences, regulatory pressures, and macroeconomic dynamics, the global wholesale automotive market is expected to experience significant changes over the next few years. Below is a detailed analysis of key trends expected to influence GWMC’s operations and strategic positioning in 2026.

-

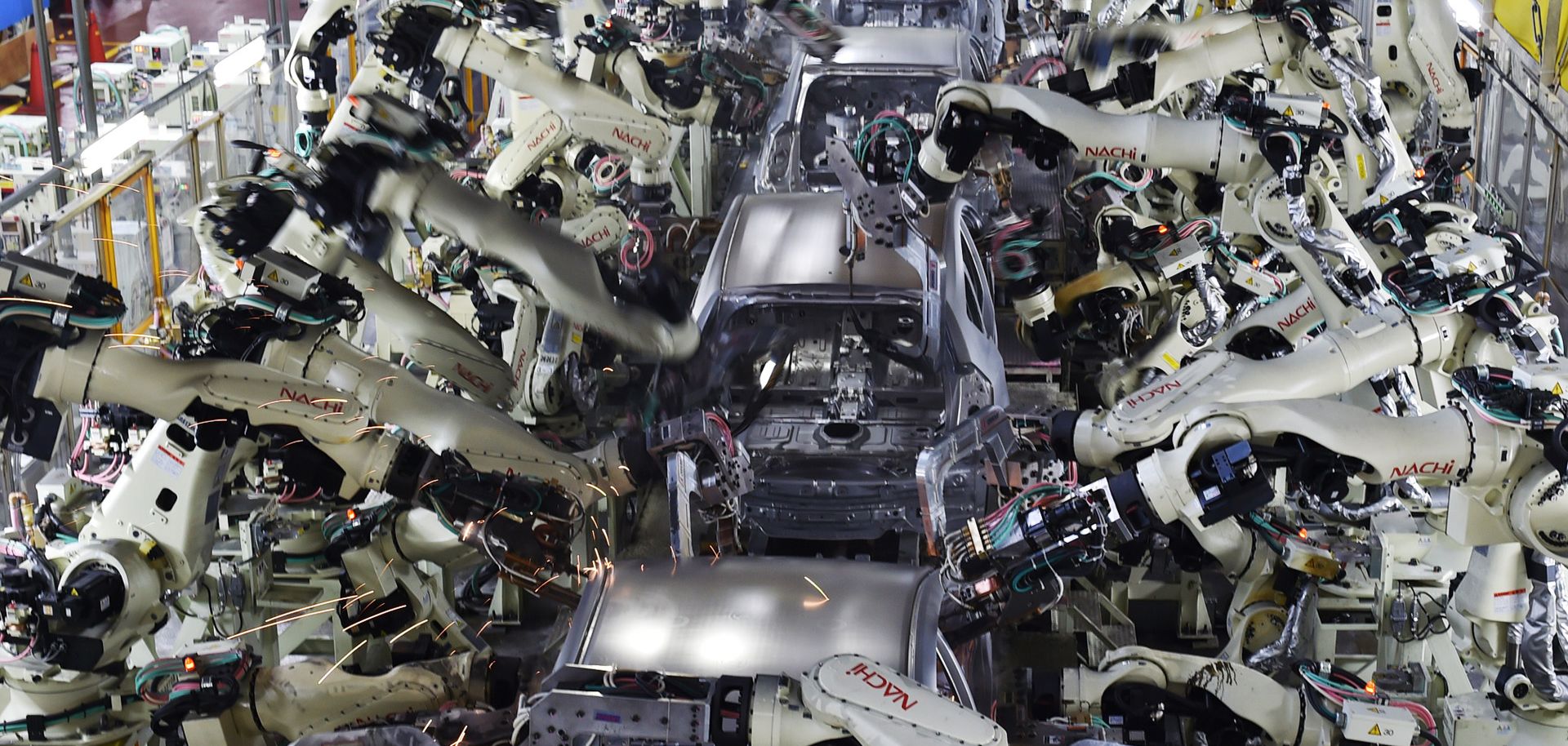

Accelerated Electrification and EV Adoption

By 2026, electric vehicle (EV) penetration is projected to reach approximately 30–35% of new vehicle sales globally, according to BloombergNEF and IEA forecasts. This shift is fueled by tightening emissions regulations in the EU, North America, and China, alongside declining battery costs and expanded charging infrastructure. For GWMC, this means a growing need to diversify inventory to include a broader range of EVs, including wholesale lots from OEMs scaling up production. Partnerships with EV manufacturers and investment in EV logistics (e.g., battery handling and transport compliance) will be critical. -

Digital Transformation in Wholesale Marketplaces

Online vehicle auction platforms and digital wholesale exchanges (e.g., ACV Auctions, Manheim Digital) are gaining dominance. By 2026, over 70% of wholesale vehicle transactions are expected to occur via digital channels, up from around 50% in 2023. GWMC must enhance its digital presence, integrate AI-driven pricing tools, and leverage data analytics to optimize bidding strategies, inventory turnover, and regional demand forecasting. Blockchain-based vehicle history verification may also increase transaction transparency and trust. -

Supply Chain Resilience and Localization

Ongoing geopolitical tensions, semiconductor shortages, and logistical bottlenecks have underscored the need for resilient supply chains. OEMs and distributors are increasingly adopting regional manufacturing and inventory models (“nearshoring”). GWMC will benefit from establishing regional distribution hubs in key markets (e.g., North America, Europe, Southeast Asia) to reduce lead times and mitigate disruption risks. This trend supports just-in-time inventory models and dynamic fleet reallocation. -

Rising Demand for Used and Certified Pre-Owned (CPO) Vehicles

With high new vehicle prices and economic uncertainty in several regions, the used vehicle market is expected to remain robust in 2026. Wholesale demand for reliable, high-mileage CPO units is increasing, especially in emerging markets. GWMC can capitalize on this by strengthening its reconditioning partnerships, expanding inspection standards, and offering value-added services such as extended warranties or digital vehicle passports. -

Sustainability and ESG Integration

Investors and regulators are placing greater emphasis on environmental, social, and governance (ESG) metrics. By 2026, compliance with carbon reporting standards (e.g., CSRD in the EU) will be mandatory for large enterprises. GWMC will need to measure and reduce the carbon footprint of its logistics operations, transition to electric or hybrid fleet vehicles, and ensure ethical labor practices across its supply chain. Sustainability certifications could become a competitive differentiator in B2B relationships. -

Economic and Regulatory Uncertainty

Inflationary pressures, fluctuating interest rates, and trade policy shifts (e.g., potential new tariffs on Chinese EVs) could impact vehicle pricing and cross-border trade. GWMC must adopt agile pricing models and maintain diversified sourcing to hedge against regional volatility. Additionally, evolving safety and data privacy regulations (e.g., EU’s Type Approval Framework) will require close monitoring to ensure compliance across markets. -

Growth in Fleet and Commercial Vehicle Wholesale

Commercial fleets, including last-mile delivery vans and light-duty trucks, are experiencing strong demand due to e-commerce expansion. Electrification of fleets is also accelerating, with companies like Amazon and UPS committing to zero-emission vehicles. GWMC can tap into this trend by developing specialized wholesale channels for commercial EVs and offering bundled services such as fleet management software integration and charging infrastructure support.

Conclusion

In 2026, the Global Wholesale Motor Company will operate in a more digital, sustainable, and electrified marketplace. Success will depend on strategic agility—embracing digital platforms, adapting to EV demand, enhancing supply chain resilience, and aligning with global ESG standards. By proactively addressing these trends, GWMC can strengthen its position as a leader in the global automotive wholesale ecosystem.

Common Pitfalls When Sourcing from Global Wholesale Motor Company (Quality, IP)

Sourcing from Global Wholesale Motor Company (GWMC) or similar large-scale international suppliers can offer cost advantages, but it also presents significant risks—particularly regarding product quality and intellectual property (IP) protection. Being aware of these common pitfalls is essential for mitigating risk and ensuring long-term business success.

Quality Inconsistencies and Lack of Oversight

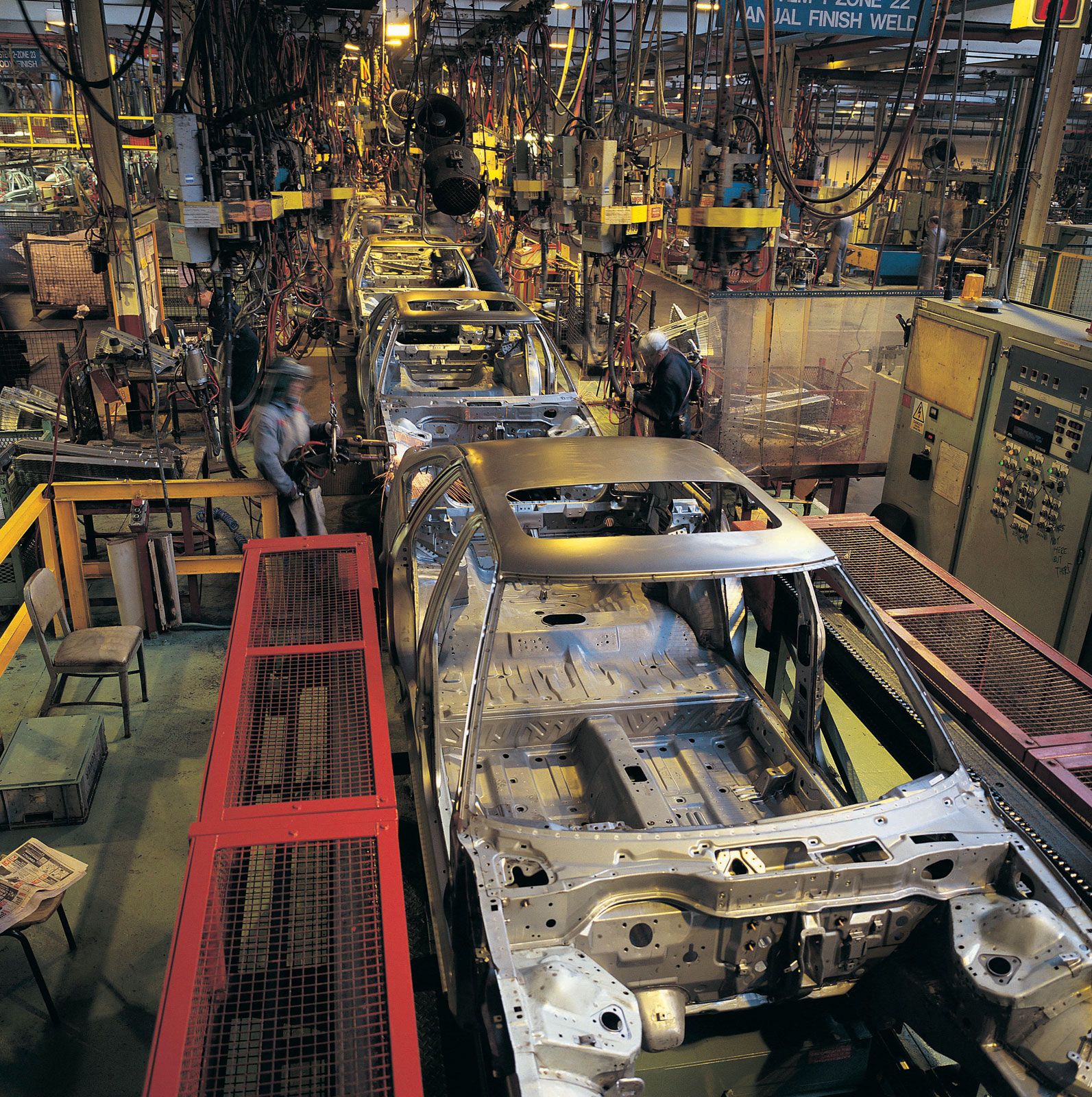

One of the most frequent issues when sourcing from GWMC is inconsistent product quality. While initial samples may meet specifications, mass production often reveals deviations in materials, tolerances, or workmanship. This inconsistency stems from decentralized manufacturing, variable subcontractor standards, and limited third-party quality control. Buyers may discover defective motors only after shipment, leading to costly recalls, downtime, or customer dissatisfaction.

Inadequate Quality Assurance Processes

GWMC may lack robust quality assurance (QA) protocols or fail to provide transparent access to QA documentation. Without access to detailed inspection reports, material certifications, or production line audits, buyers have little visibility into how products are made. This opacity increases the risk of receiving substandard components that do not meet industry or safety standards.

Intellectual Property Infringement Risks

Sourcing from GWMC can expose companies to intellectual property (IP) violations. There is a risk that the motors supplied may incorporate patented designs, proprietary technology, or copyrighted materials without proper licensing. If your company distributes such products, you could face legal liability, import seizures, or reputational damage—even if the infringement was unintentional.

Limited IP Protection Agreements

Many transactions with GWMC occur without formal IP protection agreements. Without non-disclosure agreements (NDAs), IP ownership clauses, or design confidentiality terms, your proprietary modifications or custom motor designs may be replicated and sold to competitors. Once IP is compromised, enforcement across international jurisdictions is often difficult and expensive.

Supply Chain Opacity and Counterfeit Components

The complex, multi-tiered supply chain used by GWMC can obscure the origin of components. Subcontractors may use counterfeit or recycled parts to cut costs, especially in critical areas like bearings, wiring, or magnets. These components may pass basic inspections but fail prematurely in the field, undermining product reliability and brand trust.

Difficulty in Enforcement and Recourse

When quality failures or IP breaches occur, pursuing remedies with GWMC can be challenging. Legal jurisdiction, language barriers, and the cost of international litigation often deter enforcement. Dispute resolution processes may be slow, and contractual terms may favor the supplier, leaving buyers with limited recourse.

Conclusion: Mitigation Is Key

To avoid these pitfalls, businesses must conduct thorough due diligence, demand transparency in manufacturing and sourcing, implement rigorous QA protocols, and establish strong legal protections for intellectual property. Regular audits, clear contracts, and third-party verification can help safeguard both product quality and IP integrity when sourcing from Global Wholesale Motor Company.

Logistics & Compliance Guide for Global Wholesale Motor Company

This guide outlines the essential logistics and compliance procedures for Global Wholesale Motor Company to ensure efficient operations, regulatory adherence, and risk mitigation across international markets.

Supply Chain Management

- Establish standardized procurement protocols for sourcing vehicle inventory and spare parts globally.

- Maintain relationships with approved suppliers meeting ISO and industry-specific quality standards.

- Implement vendor performance tracking systems to monitor delivery reliability and quality compliance.

International Shipping & Transportation

- Utilize multimodal transport strategies (sea, air, rail, road) based on cost, urgency, and destination.

- Partner with certified freight forwarders experienced in automotive logistics.

- Ensure all shipments comply with Incoterms 2020 agreements to clarify responsibilities and liabilities.

Customs Clearance Procedures

- Prepare accurate commercial invoices, packing lists, and bills of lading for each shipment.

- Classify vehicles and parts using correct HS codes to prevent delays and penalties.

- Appoint local customs brokers in key markets to manage import documentation and duties.

Regulatory Compliance

- Adhere to import/export regulations, including U.S. ITAR, EU REACH, and country-specific automotive standards.

- Maintain up-to-date knowledge of emissions, safety, and labeling requirements in target markets.

- Conduct regular compliance audits to verify adherence to international trade laws.

Vehicle Certification & Homologation

- Ensure all vehicles meet destination country safety, environmental, and technical standards (e.g., FMVSS, ECE).

- Secure necessary type approvals and certifications prior to shipment.

- Retain documentation proving compliance for inspection purposes.

Documentation Management

- Centralize digital records of titles, registration documents, export certificates, and conformity certificates.

- Implement a document control system with version tracking and access controls.

- Retain all compliance-related records for a minimum of seven years.

Trade Sanctions & Embargoes

- Screen all customers, suppliers, and shipping routes against OFAC, EU, and UN sanctions lists.

- Prohibit transactions with restricted entities or embargoed countries.

- Conduct annual training for staff on sanctions compliance.

Risk Management & Insurance

- Obtain comprehensive cargo insurance covering transit, loading/unloading, and temporary storage.

- Assess geopolitical, logistical, and financial risks for each market.

- Develop contingency plans for port disruptions, customs delays, or supply chain interruptions.

Environmental & Sustainability Compliance

- Follow proper disposal procedures for hazardous materials (e.g., batteries, oils, fluids).

- Comply with regulations on vehicle recycling (e.g., EU End-of-Life Vehicles Directive).

- Report carbon emissions from transportation activities as required by local laws.

Internal Training & Monitoring

- Provide mandatory training for logistics and compliance staff on international trade regulations.

- Assign a Compliance Officer responsible for policy enforcement and updates.

- Conduct bi-annual reviews of logistics processes and compliance performance.

All employees involved in logistics and trade operations must adhere to this guide. Non-compliance may result in legal penalties, shipment delays, or termination of employment.

Conclusion: Sourcing from a Global Wholesale Motor Company

Sourcing motors from a global wholesale motor company offers significant advantages in terms of cost-efficiency, scalability, and access to diverse product ranges. By partnering with a reputable international supplier, businesses can benefit from standardized quality, technological innovation, and reliable production capacity to meet fluctuating market demands. Additionally, global sourcing enhances supply chain resilience by diversifying supplier bases and reducing dependency on local manufacturers.

However, successful sourcing requires careful due diligence—evaluating supplier credibility, compliance with international standards (e.g., ISO, CE), logistics capabilities, lead times, and after-sales support. Currency fluctuations, geopolitical risks, and communication barriers must also be proactively managed.

In conclusion, with strategic planning and strong supplier relationships, sourcing from a global wholesale motor company can drive operational efficiency, support growth, and provide a competitive edge in today’s interconnected marketplace. The key lies in balancing cost benefits with quality assurance and supply chain stability to ensure long-term success.