The global sandpaper market, inclusive of specialized products like glass sandpaper, has seen consistent expansion in recent years, driven by growing demand across automotive, construction, and DIY sectors. According to a report by Mordor Intelligence, the abrasive market was valued at USD 39.5 billion in 2023 and is projected to grow at a CAGR of over 4.8% from 2024 to 2029. This expansion is fueled by technological advancements in abrasive materials and increasing consumer preference for high-precision finishing tools. Glass sandpaper, known for its fine grit uniformity and durability in wet and dry applications, represents a niche yet growing segment within this landscape. As industrial applications demand higher performance and consistency, leading manufacturers are investing in innovation and scalable production. Based on market presence, product quality, and global reach, the following nine companies have emerged as key players in the glass sandpaper manufacturing space.

Top 9 Glass Sandpaper Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 INDASA Abrasives

Domain Est. 2013 | Founded: 1979

Website: indasa-abrasives.com

Key Highlights: Founded in 1979, INDASA Abrasives is now one of Europe’s leading manufacturers of high performance coated abrasive technology….

#2 Mirka

Domain Est. 1997

Website: mirka.com

Key Highlights: Mirka Ltd is a world leader in surface finishing technology and offers a broad range of ground-breaking sanding solutions including abrasives, sandpaper,……

#3 Maverick Abrasives: #1 Abrasives Manufacturer

Domain Est. 1997

Website: maverickabrasives.com

Key Highlights: Maverick abrasives is a premium manufacturer of sanding belts, sanding discs, buffing wheels & buffing compounds. We are a family run business that thrives ……

#4 Apex Abrasives – Sandpaper

Domain Est. 2020

Website: apex-abrasives.com

Key Highlights: Leading manufacturer and supplier of silicon carbide sandpaper … To fabricate sandpaper & polishing abrasives that can make any task that involves sanding Glass ……

#5 CRL

Domain Est. 1995

Website: crlaurence.com

Key Highlights: The leading full-service provider of architectural metals, glass fittings & professional-grade glazing supplies. Shop CRL’s architectural hardware today….

#6 SurfacePrep

Domain Est. 1995

Website: surfaceprep.com

Key Highlights: SurfacePrep is the largest national network of regional distributors of high-quality abrasive products, specialty ceramics and surface finishing equipment….

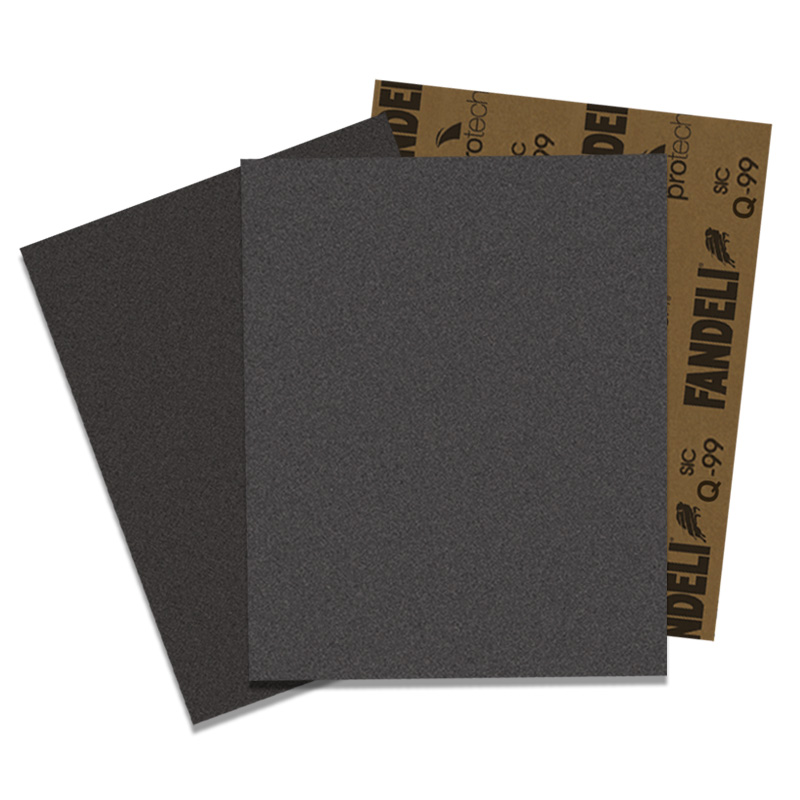

#7 Sandpaper for metal and glass Q

Domain Est. 1999

Website: fandeli.com

Key Highlights: Sandpaper for metal and glass Q-99 · Better finishing processes. · For finishing, polishing and microfinishing operations, both in dry and wet applications….

#8 sia Abrasives Industries AG

Domain Est. 2005

Website: siaabrasives.com

Key Highlights: Bonded and flexible abrasives, foam and fleece abrasive solutions and sandpaper for automotive, wood and metal applications….

#9 Saint-Gobain North America

Domain Est. 2008

Website: saint-gobain-northamerica.com

Key Highlights: Saint-Gobain North America, a leader in sustainable construction, offers 160+ locations with manufacturing career jobs, engineering & more….

Expert Sourcing Insights for Glass Sandpaper

H2: 2026 Market Trends for Glass Sandpaper

The global glass sandpaper market is poised for notable transformation by 2026, driven by advancements in abrasive technology, increasing demand from key end-use industries, and growing emphasis on sustainable manufacturing practices. As a specialized abrasive product, glass sandpaper—typically made from recycled glass particles bonded to paper or cloth backings—offers an eco-friendly alternative to traditional silicon carbide or aluminum oxide sandpapers. The following trends are expected to shape the market landscape in 2026:

-

Rising Demand for Eco-Friendly Abrasives

Environmental regulations and corporate sustainability goals are accelerating the shift toward green manufacturing. Glass sandpaper, often composed of up to 80% recycled glass, aligns with circular economy principles. By 2026, industries such as automotive refinishing, woodworking, and metal fabrication are expected to increase adoption of glass-based abrasives to reduce environmental impact and comply with stricter emissions and waste disposal standards. -

Growth in Construction and Renovation Activities

Expanding infrastructure projects and residential renovations, particularly in emerging economies in Asia-Pacific and Latin America, are boosting demand for surface preparation tools. Glass sandpaper is gaining traction due to its durability, consistent particle structure, and lower dust emission, making it suitable for both manual and power sanding applications in construction and restoration projects. -

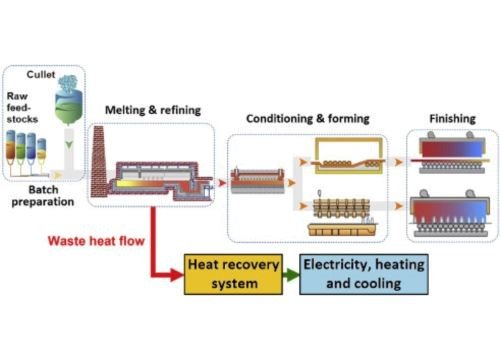

Technological Advancements in Coating and Bonding

Innovations in resin bonding systems and coating techniques are enhancing the performance and lifespan of glass sandpaper. Manufacturers are investing in precision grain alignment and anti-clogging technologies to improve cutting efficiency and reduce waste. By 2026, smart abrasives with real-time wear indicators or IoT-enabled performance tracking could begin entering niche markets. -

Shift Toward Customized and Industrial-Grade Solutions

End-users in aerospace, marine, and precision engineering are demanding tailored abrasive solutions. Glass sandpaper with variable grit sizes, flexible backings, and enhanced heat resistance are being developed to meet specific surface finishing requirements. This trend is pushing manufacturers to offer modular product lines and collaborative R&D with industrial clients. -

Supply Chain Optimization and Regional Manufacturing

Geopolitical uncertainties and logistics disruptions have prompted companies to localize production. By 2026, regional manufacturing hubs in India, Southeast Asia, and Eastern Europe are expected to expand, reducing dependency on imports and enabling faster response to market demands. This shift also supports cost efficiency and faster time-to-market for new glass sandpaper formulations. -

Competition from Alternative Sustainable Abrasives

While glass sandpaper holds a strong position in the eco-abrasive segment, it faces competition from bio-based backings, ceramic grains, and other recycled material composites. Continued investment in R&D will be critical for glass sandpaper producers to maintain a competitive edge through superior performance and cost-effectiveness.

In conclusion, the 2026 outlook for the glass sandpaper market is positive, underpinned by environmental imperatives, industrial modernization, and technological innovation. Companies that prioritize sustainability, product differentiation, and regional adaptability are likely to capture significant market share in the evolving abrasive tools sector.

Common Pitfalls When Sourcing Glass Sandpaper: Quality and Intellectual Property Issues

Sourcing glass sandpaper—especially for industrial or high-precision applications—can be fraught with challenges, particularly concerning material quality and intellectual property (IP) risks. Buyers, manufacturers, and distributors often encounter avoidable setbacks due to lack of due diligence. Below are some of the most common pitfalls in these two critical areas.

Quality-Related Pitfalls

1. Inconsistent Grit Size and Adhesion

One of the most frequent quality issues with sourced glass sandpaper is inconsistency in grit size distribution. Poorly manufactured products may have uneven abrasive particle sizes, leading to inconsistent surface finishing. Additionally, weak adhesive bonding can cause premature shedding of abrasive grains, reducing tool life and potentially contaminating the workpiece.

2. Substandard Backing Material

The glass fiber or paper backing must be durable and resistant to heat, moisture, and tearing. Low-cost suppliers may use inferior backing materials that delaminate or tear during use, compromising performance and safety.

3. Lack of Performance Testing and Certification

Reputable suppliers provide performance data and certifications (e.g., ISO standards, ANSI grit classification). Sourcing from vendors without verifiable test reports increases the risk of receiving non-compliant or underperforming products.

4. Mislabeling of Grit Grades

Some suppliers misrepresent grit coarseness (e.g., labeling a 120-grit product as 80-grit). This can lead to incorrect material removal rates and unsatisfactory surface finishes, especially in precision applications.

5. Poor Packaging and Storage Conditions

Glass sandpaper is sensitive to humidity and physical damage. Improper packaging or storage during transit can degrade the adhesive and cause clumping or warping, reducing usability upon arrival.

Intellectual Property (IP) Risks

1. Copying Branded Product Designs

Some suppliers replicate the design, packaging, or labeling of well-known branded glass sandpaper without authorization. Sourcing such products—even unknowingly—can expose buyers to legal liability for contributory infringement or trademark violations.

2. Unauthorized Use of Patented Technology

Advanced glass sandpaper may incorporate patented abrasive formulations, coating techniques, or backing technologies. Sourcing from manufacturers who use these protected methods without licensing can lead to IP disputes, shipment seizures, or supply chain disruptions.

3. Lack of Transparency in Manufacturing Origin

Suppliers may obscure the true origin of the product or falsely claim proprietary technology. This opacity makes it difficult to verify whether IP rights are being respected and increases the risk of inadvertently sourcing counterfeit or infringing goods.

4. Private Labeling Without IP Clearance

Buyers who private-label glass sandpaper must ensure that the product design, branding, and technical features do not infringe existing patents or trademarks. Failing to conduct an IP clearance search can result in costly legal challenges.

5. Inadequate Supplier Agreements on IP Indemnification

Many sourcing contracts fail to include clauses that hold suppliers accountable for IP violations. Without proper indemnification, the buyer may bear the financial and legal burden if an infringement claim arises.

Conclusion

To mitigate these risks, buyers should conduct thorough supplier audits, request material test reports, verify compliance with industry standards, and perform IP due diligence—especially when sourcing proprietary or high-performance glass sandpaper. Engaging legal counsel for contract review and IP assessment can further safeguard the supply chain.

Logistics & Compliance Guide for Glass Sandpaper

Product Classification and Regulatory Overview

Glass sandpaper, commonly used for smoothing or etching glass surfaces, typically consists of abrasive materials (such as aluminum oxide or silicon carbide) bonded to a paper or cloth backing. While generally considered a low-risk industrial consumable, it may still be subject to various transportation, labeling, and safety regulations depending on composition, packaging, and destination.

Hazard Classification and Safety Data Sheets (SDS)

Glass sandpaper is generally not classified as hazardous under major regulatory frameworks (e.g., GHS, OSHA, CLP) when in its finished form. However, the dust generated during use may contain respirable crystalline silica (especially if silicon carbide is used), which is a known carcinogen. Ensure that a current Safety Data Sheet (SDS) compliant with local regulations (e.g., OSHA HazCom 2012 in the U.S., EU REACH/CLP) is available and provided to customers. The SDS should address potential inhalation hazards, proper handling, and disposal.

Packaging and Labeling Requirements

Glass sandpaper should be packed in sturdy, moisture-resistant materials to prevent damage during transit. Individual sheets or rolls may be shrink-wrapped or boxed, with master cartons secured on pallets for bulk shipments. Labels must include:

– Product name and specifications

– Manufacturer or supplier information

– Lot or batch number (for traceability)

– Net quantity

– Any applicable safety warnings (e.g., “Avoid breathing dust,” “Use with adequate ventilation”)

– GHS pictograms if required by SDS classification

Transportation and Shipping Regulations

Glass sandpaper is typically non-regulated for transport under IATA, IMDG, or 49 CFR (DOT), as it is not flammable, corrosive, or otherwise hazardous in its packaged form. It may be shipped as a general industrial good via air, sea, or ground without special handling. However, ensure that packaging meets carrier requirements for durability and stackability. For international shipments, verify that no specific national restrictions apply to abrasive products.

Import/Export Compliance

For cross-border shipments, classify glass sandpaper under the appropriate Harmonized System (HS) code. A common code is 6805.20 (“Sandpaper and other paper, woven cloth or felt, with an abrasive surface”), though this may vary by country. Confirm the correct tariff code with local customs authorities. No export licenses are typically required for glass sandpaper under EAR (U.S. Commerce) or similar regimes, but verify based on destination and volume.

Environmental and Disposal Considerations

Used glass sandpaper may be contaminated with glass particles or metal residues. Dispose of according to local waste regulations. If contaminated with hazardous materials, it may be classified as hazardous waste. Recommend recycling where possible and provide disposal guidance in product documentation.

Storage and Handling Best Practices

Store in a dry, cool environment to prevent moisture damage and degradation of the adhesive. Keep away from direct sunlight and extreme temperatures. During handling, minimize dust generation and use appropriate PPE (e.g., gloves, masks) when cutting or sanding. Provide user instructions emphasizing safe work practices.

Regulatory Updates and Recordkeeping

Stay informed about changes in chemical safety regulations (e.g., updates to silica exposure limits by OSHA or EU-OSHA). Maintain records of SDS versions, shipping documentation, and compliance certifications for a minimum of five years, or as required by jurisdiction.

In conclusion, sourcing glass sandpaper requires careful consideration of several key factors including grit type and coarseness, backing material durability, bonding quality, and the specific application requirements—whether for industrial manufacturing, automotive restoration, glass etching, or artistic projects. It is essential to identify reliable suppliers that offer consistent quality, competitive pricing, and compliance with safety and environmental standards. Additionally, evaluating options based on proven performance, customer reviews, and availability of technical support can significantly impact efficiency and end-product quality. By prioritizing quality, suitability, and supplier reliability, businesses and individuals can ensure optimal results in glass surface preparation and finishing while minimizing waste and rework.