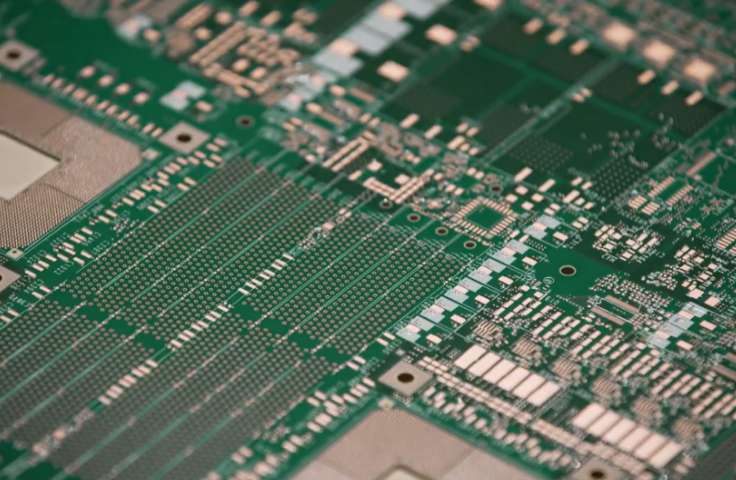

The global printed circuit board (PCB) market, including specialized variants like glass circuit boards, is experiencing robust growth driven by advancements in electronics, miniaturization, and the rise of high-performance computing and optoelectronic devices. According to a 2024 report by Mordor Intelligence, the PCB market is projected to grow at a CAGR of 5.2% from 2024 to 2029, reaching a value of over USD 87 billion by the end of the forecast period. This expansion is fueled by increasing demand in consumer electronics, telecommunications, automotive, and aerospace sectors—applications where glass-based substrates are gaining traction due to their superior thermal stability, low dielectric loss, and dimensional accuracy. As manufacturers push the boundaries of circuit density and signal integrity, glass circuit boards are emerging as a critical enabler for next-generation technologies. In this evolving landscape, a select group of eight leading manufacturers are setting the pace through innovation, precision engineering, and strategic R&D investments.

Top 8 Glass Circuit Board Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Thin-Film Circuit Boards

Domain Est. 1993

Website: global.kyocera.com

Key Highlights: Thin-film circuit boards are manufactured using vacuum deposition technology to form thin-film conductive and insulating layers on the surface of the substrate, ……

#2 LPKF PCB Prototype Technology & Laser Material Processing

Domain Est. 1995

Website: lpkf.com

Key Highlights: As a leading provider of laser manufacturing solutions, LPKF Laser & Electronics helps to create more powerful electronic systems and increase functionality ……

#3 EI Microcircuits

Domain Est. 1998

Website: eimicro.com

Key Highlights: Custom PCB manufacturing with precision and reliability. EI Microcircuits delivers high-quality electronic solutions tailored to your needs….

#4 Glass Composite Circuit Board Materials

Domain Est. 1990

Website: industrial.panasonic.com

Key Highlights: Circuit board materials which realize safety performance of the industry-leading and excellent cost performance by size-free manufacturing method….

#5 Experct PCB Manufacturing & Assembly Services at OnBoard

Domain Est. 2002

Website: onboardcircuits.com

Key Highlights: Find expert PCB manufacturing and assembly services at OnBoard Circuits. We specialize in quality PCB services to meet your requirements. Call now!…

#6 FICT LIMITED

Domain Est. 2021

Website: fict-g.com

Key Highlights: We develop highly reliable, high-performance semiconductor packaging substrates and multilayer printed circuit boards (PCBs) for a wide variety of applications….

#7 Excellent Quality Glass PCB from PCBTok

Domain Est. 2022

Website: pcbtok.com

Key Highlights: PCBTok is the most reliable and professional glass PCB supplier in China! An experienced company with over 10 years of experience in manufacturing and exporting ……

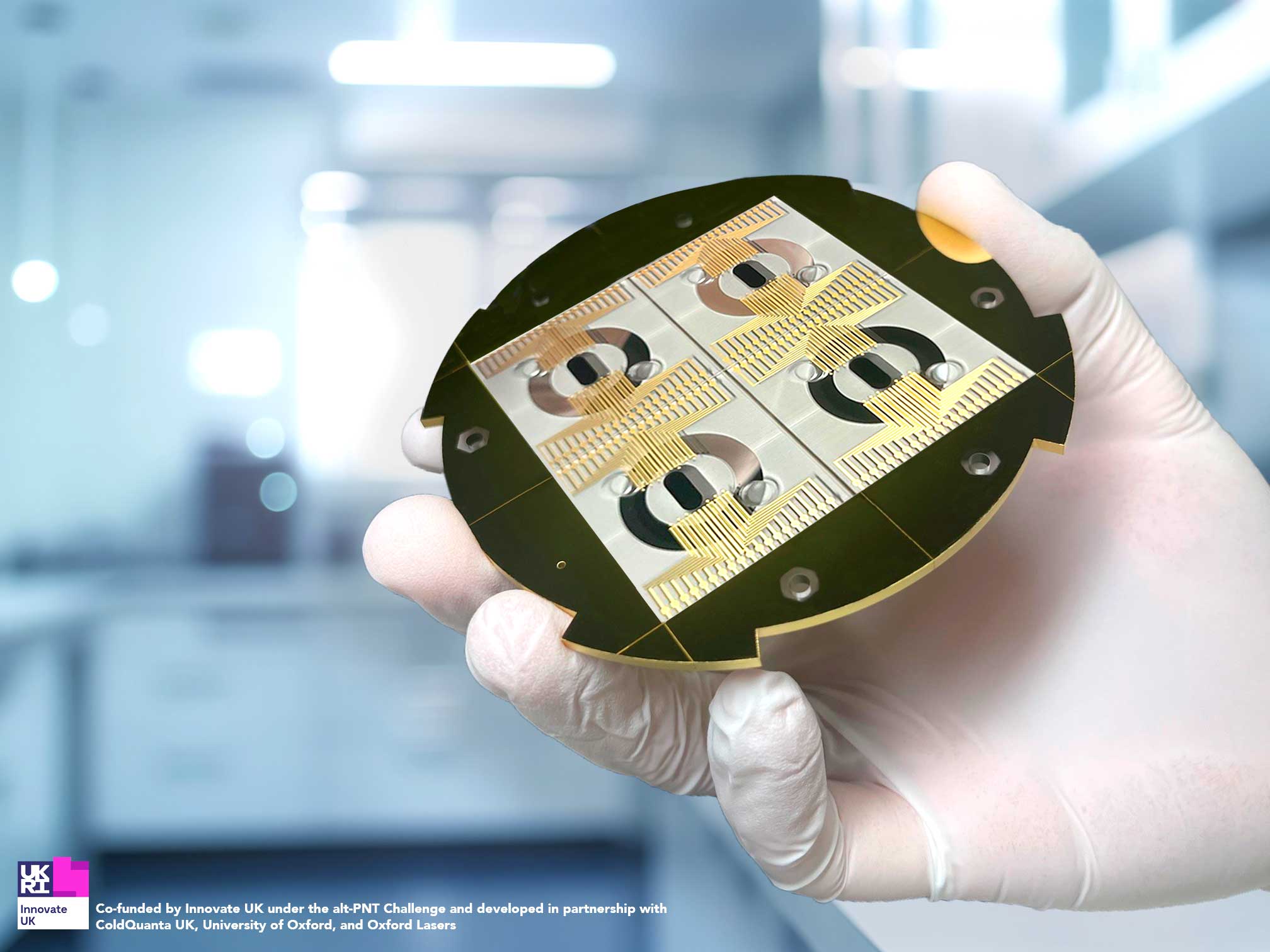

#8 Glass PCB for Quantum & Photonics

Website: femtoprint.ch

Key Highlights: A Glass PCB (Printed Circuit Board) is a circuit board fabricated using glass or glass-ceramic substrates instead of standard composite materials like FR4….

Expert Sourcing Insights for Glass Circuit Board

H2: 2026 Market Trends for Glass Circuit Boards

By 2026, the Glass Circuit Board (GCB) market is poised for significant transformation, driven by the relentless demand for higher performance, miniaturization, and thermal management in next-generation electronics. While still an emerging technology compared to traditional organic substrates (like FR-4) and established alternatives like silicon interposers, GCBs are expected to gain substantial traction, particularly in high-value, performance-critical applications. Key trends shaping the market include:

1. Accelerated Adoption in High-Performance Computing (HPC) and AI/ML:

* Primary Driver: The insatiable need for bandwidth, reduced latency, and power efficiency in data centers, AI accelerators, and advanced GPUs will be the single largest catalyst. Glass substrates offer superior electrical properties (lower signal loss, higher bandwidth density) compared to organic materials, enabling finer pitch interconnects and higher I/O densities required for chiplets and 3D packaging.

* Trend: Major semiconductor companies (Intel, AMD, NVIDIA) and OSATs (like ASE, Amkor) are heavily investing in glass core substrate R&D and pilot production. By 2026, widespread commercial deployment in flagship HPC and AI chips is highly probable, moving beyond prototypes.

2. Advancements in Manufacturing Scalability and Yield:

* Critical Challenge & Trend: Historically, the high cost and complexity of processing large, thin glass panels have been barriers. The 2026 outlook hinges on overcoming these.

* Trend: Expect significant progress in:

* Panel Size Scaling: Transition from smaller panels (e.g., 510x515mm) towards larger Gen 2.5 or Gen 3 sizes (e.g., 600x600mm or larger), improving throughput and reducing cost per unit area.

* Through-Glass Via (TGV) Technology: Refinement of processes like laser drilling, plasma etching, and metallization for TGVs will be crucial. Improved uniformity, aspect ratio capabilities, and yield are key goals.

* Handling & Warpage Control: Development of robust support carriers and processes to handle large, thin glass panels without breakage or excessive warpage during processing (especially during plating and lamination).

* Cost Reduction: Economies of scale, improved process yields, and optimized materials will drive down costs, making GCBs more competitive against high-end organic substrates and silicon interposers for specific applications.

3. Expansion into Advanced Packaging Platforms:

* Beyond Interposers: While initial focus is on high-end interposers, GCBs are expected to expand into other advanced packaging schemes by 2026:

* Fan-Out Glass Substrates (FO-GS): Offering better warpage control, flatter surfaces, and potentially finer lines/spaces than fan-out on organic substrates, attractive for high-performance mobile and networking chips.

* System-in-Package (SiP) & Heterogeneous Integration: Glass’s dimensional stability and thermal properties make it ideal for integrating diverse components (logic, memory, RF, photonics) with minimal stress and high reliability.

* Hybrid Bonding: Glass’s atomic-level flatness is highly compatible with direct copper-copper hybrid bonding, enabling ultra-fine pitch interconnects essential for 3D stacking.

4. Intensifying Competition and Ecosystem Development:

* Trend: The ecosystem will mature significantly by 2026.

* Material Suppliers: Companies like Corning, AGC, Nippon Electric Glass (NEG), and SCHOTT will expand their offerings of specialized glass compositions (different CTEs, mechanical properties) optimized for circuit board applications.

* Equipment Manufacturers: Vendors for lithography, etching, plating, and inspection tools will develop and commercialize solutions specifically tailored for glass processing challenges.

* OSATs & IDMs: Increased capacity investment in glass substrate production lines will be evident, leading to greater supply stability.

* Competition: While glass gains ground, competition will remain fierce from high-performance organic substrates (e.g., ABF films from Hitachi) and silicon interposers, each vying for share in the high-bandwidth, high-density market.

5. Focus on Reliability and Standardization:

* Trend: As GCBs move into commercial products, rigorous reliability testing (thermal cycling, drop test, moisture resistance) and the establishment of industry standards (for materials, processes, and testing) will become paramount. Addressing concerns about long-term mechanical robustness (especially drop/shock for mobile) and hermeticity will be critical for wider adoption beyond data centers.

6. Niche Growth in RF, mmWave, and Photonics:

* Trend: Glass’s inherent low dielectric loss and stable Dk/Df properties across frequency make it highly attractive for high-frequency RF front-ends, 5G/6G infrastructure, and emerging integrated photonics. Expect targeted growth in these specialized segments by 2026.

Conclusion for 2026:

The glass circuit board market in 2026 will transition from a promising technology to a commercially established solution, primarily fueled by the AI/HPC boom. While not replacing organic substrates broadly, GCBs will capture a significant and growing share of the high-performance, high-value segment. Success will depend on continued breakthroughs in manufacturing scalability, cost reduction, and yield improvement. The ecosystem will be more robust, with multiple players across the supply chain. Expect GCBs to be a key enabler for the most advanced semiconductor packages powering next-generation computing, setting the stage for broader adoption in subsequent years.

Common Pitfalls When Sourcing Glass Circuit Boards: Quality and Intellectual Property Concerns

Sourcing Glass Circuit Boards (GCBs), an emerging technology offering advantages in high-frequency performance, thermal management, and miniaturization, comes with unique challenges. Two major areas of risk are quality inconsistencies and intellectual property (IP) vulnerabilities. Failing to address these pitfalls can lead to project delays, product failures, and legal exposure.

Quality-Related Pitfalls

Glass Circuit Boards are manufactured using specialized processes that differ significantly from traditional FR-4 or even high-performance laminates. This introduces several potential quality issues:

-

Lack of Standardized Specifications: Unlike established PCB materials, GCBs often lack universally accepted industry standards for performance metrics (e.g., dielectric constant, loss tangent, thermal expansion). Suppliers may use proprietary formulations, making comparison and qualification difficult.

-

Fragility and Handling Damage: Glass substrates are inherently more brittle than conventional PCB materials. Poor handling during manufacturing, shipping, or assembly can result in micro-cracks or breakage, which may not be immediately visible but compromise long-term reliability.

-

Inconsistent Material Properties: Variations in glass composition, lamination processes, or metallization techniques between production batches can lead to inconsistent electrical and mechanical performance. This is especially critical in high-frequency applications where signal integrity depends on uniform dielectric properties.

-

Limited Supplier Experience: The GCB market is still maturing, and many suppliers may have limited production scale or experience. This increases the risk of process variability, yield issues, and inadequate quality control protocols such as insufficient testing for delamination or thermal cycling performance.

-

Adhesion and Reliability Issues: Ensuring strong adhesion between the glass substrate and copper layers (or other conductive materials) is challenging. Poor adhesion can lead to peeling, blistering, or via failures under thermal stress, reducing product lifespan.

Intellectual Property (IP) Risks

The novelty and competitive advantage of GCB technology make IP protection a significant concern during sourcing:

-

Unprotected Design and Process IP: Sharing detailed design files or fabrication requirements with potential suppliers—especially those in regions with weaker IP enforcement—risks unauthorized replication or reverse engineering of proprietary technologies.

-

Ambiguous IP Ownership Agreements: Without clear contractual terms, the ownership of jointly developed processes, custom tooling, or design improvements can become disputed. Suppliers may claim rights to innovations developed during the manufacturing process.

-

Reverse Engineering Vulnerabilities: Physical samples provided for prototyping or testing can be analyzed to extract material compositions, layer stack-ups, or circuit layouts. Competitors or unscrupulous suppliers may exploit this information.

-

Use of Third-Party Patented Technologies: Some GCB manufacturing processes may incorporate patented technologies (e.g., laser drilling, thin-film deposition). Sourcing from a supplier using such methods without proper licensing could expose the buyer to infringement claims.

-

Inadequate NDAs and Compliance: Relying on weak or poorly enforced non-disclosure agreements (NDAs) increases the risk of IP leakage. Additionally, suppliers may not comply with international IP regulations or export controls, especially when subcontracting parts of the process.

To mitigate these risks, companies should conduct thorough due diligence on suppliers, establish strong IP agreements, require detailed quality certifications, and consider working with trusted partners in jurisdictions with robust IP protections.

Logistics & Compliance Guide for Glass Circuit Boards

Glass Circuit Boards (GCBs) are advanced electronic substrates used in high-frequency, high-reliability applications such as 5G infrastructure, aerospace, and medical devices. Due to their fragile nature and specialized materials, handling, transportation, and regulatory compliance require careful planning. This guide outlines key logistics and compliance considerations for the safe and legal movement of Glass Circuit Boards across the supply chain.

Material Classification & Regulatory Compliance

Glass Circuit Boards may contain materials subject to environmental, safety, and trade regulations. Key compliance areas include:

- RoHS (Restriction of Hazardous Substances): Ensure GCBs comply with EU Directive 2011/65/EU, which restricts substances such as lead, mercury, and cadmium. Provide RoHS compliance certificates upon request.

- REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Confirm that all chemical components used in GCB manufacturing are registered under EU REACH regulations.

- Conflict Minerals (Dodd-Frank Act, Section 1502): If GCBs contain tin, tantalum, tungsten, or gold (3TG), conduct due diligence and report sourcing in accordance with U.S. SEC requirements.

- Export Controls (ITAR/EAR): Some high-frequency or aerospace-grade GCBs may be subject to export restrictions under the U.S. Export Administration Regulations (EAR) or International Traffic in Arms Regulations (ITAR). Verify classification (e.g., ECCN) before international shipment.

Packaging & Handling Requirements

Due to the brittleness of glass substrates, proper packaging is critical to prevent cracking, chipping, or delamination.

- ESD-Safe Packaging: Use static-dissipative or conductive packaging materials to prevent electrostatic discharge damage to integrated circuits or fine traces.

- Rigid Enclosures: Ship GCBs in rigid clamshell containers or custom die-cut trays with foam or corrugated dividers to immobilize boards during transit.

- Moisture Protection: Include desiccant packs and moisture barrier bags (MBBs) if GCBs are sensitive to humidity, especially in tropical climates.

- Labeling: Clearly label packages with “Fragile,” “This Side Up,” “ESD Sensitive,” and handling instructions. Use barcodes or RFID tags for traceability.

Storage Conditions

Proper storage ensures long-term reliability and performance:

- Temperature: Store in a climate-controlled environment between 15°C and 25°C (59°F to 77°F).

- Humidity: Maintain relative humidity between 30% and 60% to prevent moisture absorption and condensation.

- Shelving: Store boards vertically in static-safe cabinets to avoid warping or mechanical stress.

Transportation & Shipping

- Domestic & International Regulations: Comply with IATA, IMDG, or ADR regulations if hazardous materials (e.g., lead-free solder flux residues) are present.

- Carrier Selection: Use carriers experienced in handling high-value, fragile electronics. Consider temperature- and shock-monitored shipping options.

- Insurance: Insure shipments for full replacement value, especially for high-density or custom GCBs.

- Customs Documentation: Provide accurate commercial invoices, packing lists, certificates of origin, and compliance declarations (e.g., RoHS, REACH) to avoid delays.

Quality & Traceability

- Serial Number Tracking: Assign unique serial numbers or batch codes to enable full traceability from manufacturing to end-use.

- Inspection Protocols: Conduct pre-shipment inspections for defects, and document handling conditions (e.g., shock, temperature logs).

- Compliance Records: Maintain up-to-date technical files, test reports, and conformity declarations for audit purposes.

End-of-Life & Recycling

- WEEE Compliance (EU): Register with national WEEE authorities if placing GCBs on the European market. Provide take-back and recycling information.

- Recycling Partners: Partner with certified e-waste recyclers to responsibly manage end-of-life boards, especially those containing precious metals or regulated materials.

Adhering to this logistics and compliance framework ensures the safe, sustainable, and legally compliant movement of Glass Circuit Boards across global markets. Regular audits and updates to regulatory standards are recommended to maintain alignment with evolving requirements.

Conclusion for Sourcing Glass Circuit Boards

In conclusion, sourcing glass circuit boards presents a promising solution for high-frequency, high-speed, and miniaturized electronic applications where superior electrical performance, dimensional stability, and thermal properties are critical. While glass substrates offer advantages such as low signal loss, high insulation, and compatibility with advanced packaging technologies like chip-on-glass (COG) and glass core substrates (GCS), their adoption must be carefully evaluated against challenges including higher manufacturing costs, brittleness, and limited supplier availability compared to traditional FR-4 or even high-performance organic laminates.

Successful sourcing requires a strategic approach—identifying reliable suppliers with proven expertise in glass substrate fabrication, evaluating material specifications (e.g., coefficient of thermal expansion, dielectric constant, thickness tolerance), and ensuring compatibility with existing assembly processes such as photolithography, thin-film deposition, and solder reflow.

Furthermore, collaboration with material scientists, design engineers, and suppliers from the early stages of product development is essential to mitigate risks and optimize performance. As demand grows for advanced electronics in 5G, AI, and IoT devices, glass circuit boards are poised to play a pivotal role. Therefore, establishing a robust, scalable, and quality-focused supply chain for glass-based interposers and substrates will be a strategic advantage for innovators in next-generation electronics.