The generator market in Nigeria has experienced robust growth over the past decade, driven by persistent power supply challenges and increasing demand for reliable backup energy solutions across residential, commercial, and industrial sectors. According to Mordor Intelligence, the Nigeria Generators Market is projected to grow at a CAGR of over 6.8% from 2024 to 2029, underpinned by rising urbanization, infrastructural development, and limited grid reliability. With over 90 million households and businesses reliant on alternative power sources, Nigeria has become one of the largest generator markets in Africa. This surge in demand has attracted both local and international manufacturers, fostering competition and innovation in product offerings and pricing. As consumers become more price- and efficiency-conscious, understanding the leading generator manufacturers and their pricing landscape is crucial for informed purchasing decisions. This analysis explores the top 9 generator manufacturers in Nigeria, evaluating their market presence, product range, and competitive pricing strategies to provide a comprehensive overview of the current industry dynamics.

Top 9 Generator Price In Nigeria Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Buy power generators Online in Nigeria from GZ Industrial Supplies

Domain Est. 2014

Website: gz-supplies.com

Key Highlights: Our power generators range from the small 3 KVA to large size industrial generators, we carry brands such as Honda, A-ipower, Maxmech, ……

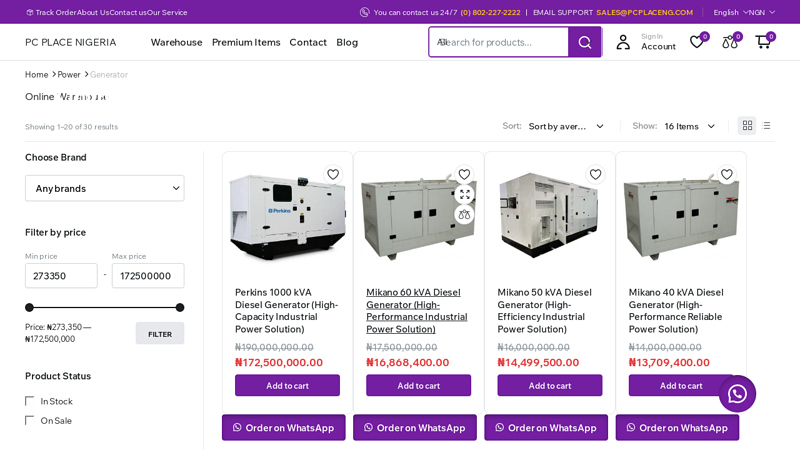

#2 Buy Power generators in Nigeria

Domain Est. 2019

Website: tikweld.com

Key Highlights: 30-day returnsOur power generators range from the small 3 KVA to large size industrial generators, we carry brands such as Honda, AI-power,Ingco….

#3 EcoFlow DELTA 3 Solar Generator

Domain Est. 1998

Website: ng.ecoflow.com

Key Highlights: Out of stockEcoFlow DELTA 3 Solar Generator. Regular price ₦860,499.00 NGN. Sale price ₦860,499.00 NGN Regular price ₦899,999.00. -₦39,500. Sale Sold out. Save up to ₦ ……

#4

Domain Est. 2003

Website: jmglimited.com

Key Highlights: Visit JMG Limited Nigeria for superior electro-mechanical solutions, including state-of-the-art generators, efficient power systems, and cutting-edge HVAC ……

#5 Generator

Domain Est. 2016

#6 Buy Reliable Generators Online

Website: electromart.com.ng

Key Highlights: BRUHM 2.2KVA, GASOLINE GENERATOR, MANUAL START,FULL COPPER WINDING ALTERNATOR, BGG-22MR,. ₦ 431,988.00 Original price was: ₦ 431,988.00. ₦ 339,990.00 ……

#7 Generators & Portable Power

Website: jumia.com.ng

Key Highlights: 4.4 53 Shop for quality generators at the best prices online on Jumia Nigeria. Find quality generators from top brands like Haier Thermocool, Senwei, ……

#8 Buy Generator Online in Nigeria @ Best Price with Same day Delivery

Domain Est. 2020

Website: alabamart.com

Key Highlights: Shop Generators online from alabamart.com and enjoy amazing discount and products. Our Maxi Generator comes with 3 months warranty as well as Doorstep ……

#9 Buy Sumec Firman Generator At Best Price

Website: kara.com.ng

Key Highlights: Sumec Generator is one of the best gasoline generators to buy online in Nigeria. With the best firman diesel generator price in Nigeria, you will get the deal….

Expert Sourcing Insights for Generator Price In Nigeria

2026 Market Trends for Generator Prices in Nigeria

The Nigerian generator market in 2026 is expected to be shaped by a complex interplay of persistent energy deficits, evolving economic conditions, technological advancements, and shifting consumer preferences. While precise price forecasts remain challenging, several key trends are likely to influence generator pricing across segments.

Persistent Power Supply Gaps Driving Demand

Despite government initiatives, Nigeria’s national grid remains unreliable, with frequent outages affecting both urban and rural areas. By 2026, this chronic power deficit will continue to fuel strong demand for backup power solutions. Households, small businesses, commercial enterprises, and industrial users will remain heavily reliant on generators, underpinning sustained market activity and limiting any significant downward pressure on prices due to weak demand.

Inflation and Currency Volatility Impacting Costs

The Nigerian Naira’s exchange rate volatility and ongoing inflation will significantly influence generator prices in 2026. Most generators and their components are imported, making pricing highly sensitive to foreign exchange fluctuations. If the Naira depreciates against major currencies (especially the USD), the cost of importing generators will rise, directly pushing retail prices higher. Additionally, inflation-driven increases in logistics, distribution, and operational costs will further contribute to price escalations, particularly for established international brands.

Growth of Alternative Energy and Hybrid Solutions

A notable trend by 2026 will be the increasing adoption of solar hybrid and inverter generator systems. As solar panel and battery storage prices continue to decline globally, more Nigerian consumers will consider hybrid systems that combine solar energy with a smaller, more efficient generator as a backup. This shift could moderate demand for large, traditional diesel/petrol generators, potentially stabilizing or slightly reducing prices in the high-capacity segment, while boosting prices and competition in the mid-range inverter and hybrid categories.

Rise of Local Assembly and Chinese Imports

Local assembly of generators—particularly by Chinese and Indian manufacturers setting up operations in Nigeria—may gain traction by 2026. This could help mitigate some import costs and foreign exchange pressures, potentially leading to more competitively priced models. However, the extent of price reduction will depend on the scale of local content, availability of raw materials, and government policies on import duties and tariffs. Meanwhile, Chinese-made generators will likely dominate the lower and mid-price segments, keeping entry-level prices relatively stable or increasing at a slower rate than premium brands.

Fuel Costs and Regulatory Pressures

Fluctuations in global and domestic fuel prices (petrol and diesel) will affect consumer operating costs, indirectly influencing generator choice. High fuel prices may push buyers toward more fuel-efficient inverter generators or hybrid systems. Furthermore, potential government regulations on noise, emissions, or energy efficiency by 2026 could phase out older, less efficient models, affecting the availability and pricing of compliant units, possibly increasing costs for eco-friendly models in the short term.

Conclusion

In summary, generator prices in Nigeria in 2026 are expected to face upward pressure from macroeconomic factors such as inflation and currency instability, while demand remains robust due to inadequate grid power. However, the rise of solar-hybrid systems, local assembly, and competitive imports may offer some balance, particularly in the mid-to-lower price ranges. Consumers are likely to see a bifurcated market: premium, efficient, and eco-friendly models commanding higher prices, while budget-friendly and hybrid options gain popularity. Overall, prices may increase moderately in Naira terms, though real affordability will depend heavily on economic stability and exchange rate performance.

Common Pitfalls When Sourcing Generator Prices in Nigeria (Quality and IP)

Sourcing generators in Nigeria can be a complex process, especially when balancing cost, quality, and intellectual property (IP) considerations. While attractive price points may seem appealing, several pitfalls can undermine the value and reliability of the purchase. Below are key issues to watch out for.

1. Prioritizing Low Price Over Quality

One of the most common mistakes is focusing solely on the generator price in Nigeria while neglecting quality. Cheap generators often use substandard materials, leading to:

- Frequent breakdowns and high maintenance costs

- Reduced lifespan and inefficient fuel consumption

- Poor voltage regulation, which can damage connected appliances

Always verify build quality, component sourcing, and performance metrics before making a purchase.

2. Lack of Genuine Brand Verification

Many imported generators sold in Nigeria are counterfeit or rebranded. Unscrupulous suppliers may:

- Repackage used or refurbished units as new

- Use fake branding to mimic reputable manufacturers (e.g., Honda, Yamaha, Pramac)

- Sell clones that infringe on intellectual property rights

Always request proof of authenticity, including original invoices, serial numbers, and manufacturer warranties.

3. Ignoring Intellectual Property (IP) Risks

Purchasing counterfeit or IP-infringing generators exposes businesses and individuals to legal and reputational risks, including:

- Potential seizure of goods by customs or regulatory bodies

- Liability for distributing or using pirated technology

- Damage to brand reputation if used in commercial operations

Ensure suppliers are authorized distributors and that products comply with local IP laws.

4. Inadequate After-Sales Support

Low-priced generators often come from suppliers with limited or no after-sales service. This can result in:

- Unavailability of spare parts

- Long downtimes during repairs

- Poor technical support and lack of maintenance guidance

Choose suppliers with established service networks and reliable customer support.

5. Misleading Specifications and False Ratings

Some generators are advertised with inflated power ratings (e.g., “5kVA” when actual output is much lower). This misrepresentation can lead to:

- Overloading and system failures

- Inability to power required equipment

- Safety hazards due to overheating

Always verify technical specifications with independent testing or trusted third-party certifications.

6. Poor Compliance with Nigerian Standards

Many imported generators do not meet SON (Standard Organization of Nigeria) or NEMSA (Energy Management Services Agency) requirements. Non-compliant units may:

- Fail safety inspections

- Be banned from commercial use

- Pose fire or electrocution risks

Ensure the generator has the necessary certifications (e.g., SONCAP) before purchase.

Conclusion

While sourcing generators based on price is understandable in Nigeria’s cost-sensitive market, overlooking quality and IP concerns can lead to long-term expenses and legal complications. Conduct due diligence, verify supplier credentials, and prioritize certified, genuine products for reliable and compliant power solutions.

Generator Price In Nigeria: Logistics & Compliance Guide

When importing or distributing generators in Nigeria, understanding the logistics and compliance requirements is crucial for cost efficiency, legality, and smooth operations. Generator prices are significantly influenced by these factors. Below is a comprehensive guide to help businesses navigate the process.

Understanding Market Demand and Generator Types

Before delving into logistics and compliance, it’s essential to recognize that generator prices in Nigeria vary based on type, capacity, brand, and fuel type (petrol, diesel, or inverter). High demand due to erratic power supply drives a competitive but regulated market. Knowing the target segment—residential, commercial, or industrial—helps determine the logistics and compliance strategy.

Importation Logistics for Generators

Importing generators into Nigeria involves a series of logistical considerations that directly impact the final price.

Shipping and Freight Options

- Sea Freight (FCL/LCL): Most cost-effective for bulk imports. Full Container Load (FCL) is ideal for large orders, while Less than Container Load (LCL) suits smaller quantities. Transit time ranges from 4 to 6 weeks from major ports like China or India.

- Air Freight: Faster (5–10 days) but significantly more expensive; used for urgent or high-value units.

- Inland Haulage: After arrival at ports (Lagos Apapa or Tin Can Island), transport to warehouses or distribution centers via road. Factor in congestion, fuel costs, and security risks.

Warehousing and Inventory Management

- Secure storage facilities are needed near ports or distribution hubs to reduce delivery times.

- Proper inventory tracking helps manage demand fluctuations and avoid overstocking, which increases holding costs.

Distribution Network

- Last-mile delivery to urban and rural areas requires partnerships with reliable logistics firms.

- Pricing must include transport costs, especially to remote regions with poor road infrastructure.

Regulatory and Compliance Requirements

Compliance with Nigerian regulations is non-negotiable and directly affects the landed cost and legality of generator imports.

Nigerian Customs Procedures

- Classification & Tariff Codes: Generators fall under HS Code 8502 (electrical generating sets). Accurate classification ensures correct duty application.

- Customs Duties and Taxes:

- Import Duty: Typically 5%–35% depending on generator type and origin.

- Value Added Tax (VAT): 7.5% (as of 2023) applied on CIF value + duty.

- Importation VAT and other levies (e.g., NCC Levy, ARISE fees) may apply.

- Documentation Required:

- Bill of Lading

- Commercial Invoice

- Packing List

- Certificate of Origin

- Pre-shipment Inspection Certificate (from SONCAP-accredited agencies)

SONCAP Certification (Standards Organisation of Nigeria Conformity Assessment Programme)

- Mandatory for all electrical products, including generators.

- Requires product testing and certification before shipment.

- Non-compliance results in shipment rejection or fines, increasing costs and delays.

NEMSA Certification

- The Nigerian Electricity Management Services Agency (NEMSA) requires safety certification for electrical equipment.

- Generators must meet technical and safety standards to be legally sold and used.

- Engage accredited testing labs for certification prior to import.

Environmental and Noise Regulations

- Diesel generators must comply with emissions standards.

- Urban areas may have noise level restrictions; inverter generators are often preferred in residential zones.

- Ensure product specifications meet local environmental guidelines.

Price Implications of Logistics and Compliance

All logistics and compliance factors directly contribute to the final generator price in Nigeria:

– Freight & Insurance (10–20% of product cost)

– Customs Duties & VAT (15–40% depending on product type)

– Certification & Testing Fees (5–10%)

– Warehousing & Distribution (5–15%)

Transparent pricing models should reflect these components to avoid losses and ensure competitiveness.

Tips for Cost-Effective and Compliant Operations

- Partner with Reputable Freight Forwarders: Choose agents experienced in Nigerian customs clearance.

- Pre-arrange Certifications: Complete SONCAP and NEMSA processes before shipment to avoid port delays.

- Consolidate Shipments: Reduce per-unit logistics costs through bulk imports.

- Leverage Trade Agreements: Explore duty concessions under AfCFTA or country-specific agreements where applicable.

- Stay Updated on Policy Changes: Nigerian import regulations and tax rates can change; monitor updates from FIRS, SON, and NEMSA.

Conclusion

Generator pricing in Nigeria is more than just the manufacturer’s cost—it’s a reflection of complex logistics and strict compliance demands. By mastering shipping, customs, and certification processes, businesses can optimize costs, ensure legal operations, and deliver competitively priced products to a high-demand market.

In conclusion, sourcing generator prices in Nigeria requires careful consideration of several factors including brand, power capacity, fuel type, and point of purchase. Prices vary significantly across cities such as Lagos, Abuja, and Port Harcourt due to differences in demand, availability, and transportation costs. While imported generators often offer higher reliability, locally assembled models provide more affordable options. Additionally, the fluctuating exchange rate and high cost of foreign exchange continue to impact generator pricing, making it essential for buyers to compare options from multiple suppliers, authorized dealers, and online platforms. Engaging in proper market research, verifying product authenticity, and considering after-sales services can help buyers secure the best value for their investment. Ultimately, understanding the price dynamics and supply chain intricacies in Nigeria’s generator market enables more informed and cost-effective purchasing decisions.