The global gelatine market, particularly bovine-derived gelatine, continues to expand on the back of rising demand from the food & beverage, pharmaceutical, and nutraceutical industries. According to a 2023 report by Mordor Intelligence, the global gelatine market is projected to grow at a CAGR of approximately 5.3% from 2023 to 2028, driven by increasing consumer preference for natural hydrocolloids and protein-based ingredients. Bovine gelatine remains a key segment due to its superior gelling properties, widespread regulatory acceptance, and established supply chains. With emerging applications in dietary supplements, medical capsules, and functional foods, manufacturers specializing in bovine gelatine are strategically scaling production and investing in traceability and sustainability. As the market evolves, a select group of global leaders stands out for their technical expertise, extensive product portfolios, and adherence to stringent quality standards—positioning them at the forefront of this growth trajectory.

Top 9 Gelatine Bovine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 World-leading Gelatin & Collagen Solutions Manufacturer

Domain Est. 2003

Website: pbleiner.com

Key Highlights: PB Leiner is one of the world’s leading manufacturers of high quality gelatins and collagen peptides solutions….

#2 SelJel Jelatin

Domain Est. 2010 | Founded: 1961

Website: seljel.com

Key Highlights: Seljel Jelatin Sanayi ve Ticaret AS, has been founded in 1961 as glue/technical gelatine producer from bovine hides….

#3 HALAL GELATIN

Domain Est. 2013 | Founded: 2002

Website: gulfoodmanufacturing.com

Key Highlights: Halal Gelatin (Pvt) Ltd., established in 2002 and headquartered at 12 KM G.T. Road, Shahdara, Lahore, Pakistan, is a leading manufacturer of Halal-Certified ……

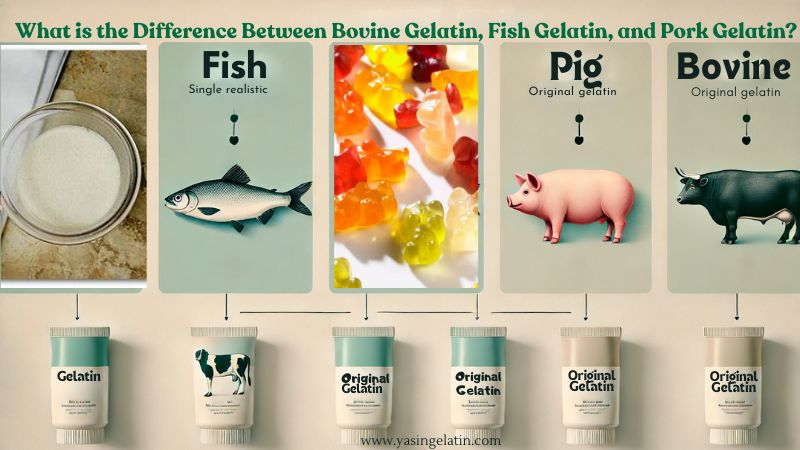

#4 Your Professional Gelatin & Collagen Manufacturer in China

Domain Est. 2023

Website: yasingelatin.com

Key Highlights: As an expert in gelatin and collagen manufacturing and among the top 5 exporters in China, Yasin Gelatin offers high-quality gelatin and collagen products….

#5 ASAHI GELATINE INDUSTRIAL Co.,Ltd.

Website: asahi-gelatine.co.jp

Key Highlights: Top-class manufacturing and sales of gelatine and collagen peptides. With a focus on producing high quality, we have maintained a feelings toward a technique….

#6 Gelatin Ingredients

Domain Est. 1996

Website: nitta-gelatin.com

Key Highlights: Offering specialized gelatin ingredients for food, pharmaceutical, and dietary supplement applications. Kosher and Halal gelatins available upon request….

#7 GME

Domain Est. 1997

Website: gelatine.org

Key Highlights: There is a five-step manufacturing process to make gelatine. Only high-quality raw-materials from the meat industry are used….

#8 FIT Gelatins

Domain Est. 2001

Website: fitgelatins.com

Key Highlights: Provider of Kosher Gelatin & Collagen. All products are Pareve & OU Certified. Kosher Bovine Gelatin & Collagen, Kosher Marine Gelatin & Collagen….

#9

Website: ewaldgelatine.de

Key Highlights: EWALD-GELATINE GmbH is a highly modern and flexible company in the production of leaf gelatine and powder gelatine. It uses the most up-to-date technologies….

Expert Sourcing Insights for Gelatine Bovine

H2: Market Trends for Bovine Gelatin in 2026

The global bovine gelatin market is expected to experience moderate growth and transformation by 2026, driven by evolving consumer preferences, regulatory developments, and advancements in alternative sourcing. Below are key trends anticipated to shape the bovine gelatin market in 2026:

1. Steady Demand in Pharmaceuticals and Capsules

Bovine gelatin remains a critical excipient in the pharmaceutical industry, particularly in hard and soft gelatin capsules. With ongoing investments in drug delivery systems and an aging global population, demand from the pharma sector is projected to remain stable through 2026. Stringent quality standards for pharmaceutical-grade gelatin will continue to favor certified bovine sources, especially in regulated markets like North America and Europe.

2. Regulatory and Safety Concerns Continue to Influence Market Dynamics

Concerns related to bovine spongiform encephalopathy (BSE) persist, prompting strict sourcing and traceability requirements. By 2026, manufacturers are expected to enhance transparency in supply chains, with widespread adoption of certifications (e.g., Halal, Kosher, BSE-free) to reassure consumers and comply with international regulations. This will particularly influence trade flows, with increased preference for gelatin sourced from low-risk countries.

3. Competition from Alternatives on the Rise

The rise of plant-based and marine gelatin alternatives (e.g., from fish, algae, or microbial fermentation) is expected to challenge bovine gelatin’s dominance, especially in the food and confectionery sectors. Vegan consumerism and clean-label trends are pushing food manufacturers to explore substitutes. However, bovine gelatin’s superior gelling, textural, and thermal properties ensure it retains a strong foothold in high-performance applications.

4. Geographical Shifts in Production and Consumption

While Europe and North America remain significant consumers, particularly for pharmaceutical-grade gelatin, production is increasingly shifting to South America (e.g., Brazil, Argentina) and parts of Asia due to lower costs and favorable raw material availability. By 2026, these regions are expected to account for a growing share of global bovine gelatin exports.

5. Sustainability and Ethical Sourcing Pressures

Environmental and ethical concerns surrounding animal agriculture are prompting companies to adopt more sustainable practices. By 2026, leading bovine gelatin producers are likely to emphasize by-product utilization (using hides and bones from the meat industry), reducing waste and improving lifecycle sustainability metrics to appeal to ESG-conscious buyers.

6. Innovation in High-Purity and Functional Grades

There is growing demand for specialized bovine gelatin grades—such as Type A (acid-processed) and higher Bloom strength variants—used in advanced applications like nutraceuticals, 3D bioprinting, and functional foods. Manufacturers investing in purification technologies and product differentiation are expected to capture premium market segments by 2026.

Conclusion

While facing competition from alternatives and evolving consumer sentiment, the bovine gelatin market is poised for steady, niche-driven growth in 2026. Its irreplaceable role in pharmaceuticals and high-end food applications, coupled with improved safety standards and sustainability initiatives, will sustain its relevance. Success in the market will depend on traceability, innovation, and strategic positioning amid a dynamic competitive landscape.

Common Pitfalls When Sourcing Bovine Gelatin (Quality and Intellectual Property)

Sourcing bovine gelatin requires careful consideration of both quality and intellectual property (IP) concerns. Failing to address these aspects can lead to regulatory, reputational, and legal risks. Below are common pitfalls to avoid:

Quality-Related Pitfalls

1. Inadequate Traceability and Sourcing Transparency

A major risk in sourcing bovine gelatin is the lack of traceability from raw material to finished product. Without clear origin tracking—especially regarding the animal source, country of slaughter, and processing facility—buyers risk exposure to diseases like Bovine Spongiform Encephalopathy (BSE). Always ensure suppliers comply with BSE-free country certifications (e.g., from the OIE or FDA) and provide full documentation.

2. Inconsistent Gel Strength and Bloom Values

Gelatin quality is often measured by Bloom strength, which affects functionality in end applications (e.g., gelling, texture). Sourcing from unreliable suppliers may result in inconsistent Bloom values, leading to product performance issues. Establish strict quality specifications and require third-party lab testing.

3. Poor Processing Standards and Contamination Risks

Low-cost suppliers may cut corners in processing, increasing risks of microbial contamination, residual chemicals (e.g., chromium from tanning), or cross-contamination with non-halal or non-kosher materials. Verify Good Manufacturing Practice (GMP) compliance and conduct supplier audits.

4. Mislabeling of Grades (Food, Pharma, Technical)

Bovine gelatin is available in food-grade, pharmaceutical-grade, and technical-grade forms. Using lower-grade material in high-spec applications (e.g., pharmaceutical capsules) can lead to regulatory non-compliance. Ensure proper certification (e.g., USP, EP, or food-grade compliance) based on intended use.

Intellectual Property-Related Pitfalls

1. Unlicensed Use of Proprietary Processes

Some advanced gelatin production methods—such as enzymatic extraction or low-temperature hydrolysis—are protected by patents. Sourcing from suppliers using such patented technologies without proper licensing may expose downstream users to IP infringement claims, especially in regulated industries like pharmaceuticals.

2. Infringement on Formulation or Application Patents

Even if the gelatin itself is not patented, its use in specific formulations (e.g., in a patented drug delivery system or vegan-alternative hybrid product) may be protected. Buyers must assess freedom-to-operate (FTO) when integrating bovine gelatin into innovative applications.

3. Lack of IP Clarity in Supplier Agreements

Many sourcing contracts fail to address IP ownership, especially when co-developing custom gelatin solutions. Without clear clauses on background IP, improvements, and confidentiality, disputes may arise over proprietary know-how or process innovations.

4. Counterfeit or Grey Market Products

Unverified suppliers may offer branded or patented gelatin products at suspiciously low prices, indicating counterfeit or diverted goods. These pose both quality and IP risks. Always source through authorized distributors and validate product authenticity.

Conclusion

To mitigate risks, conduct due diligence on suppliers, demand full documentation, and consult legal experts on IP matters. Prioritize transparency, compliance, and contractual clarity to ensure safe, lawful, and high-quality sourcing of bovine gelatin.

Logistics & Compliance Guide for Bovine Gelatine

Overview of Bovine Gelatine

Bovine gelatine is a protein derived from collagen found in the skin, bones, and connective tissues of cattle. It is widely used in the food, pharmaceutical, and cosmetic industries due to its gelling, stabilizing, and emulsifying properties. Ensuring proper logistics and regulatory compliance is essential to maintain product quality, safety, and market access.

Regulatory Compliance Requirements

Food Safety Standards

Bovine gelatine intended for food use must comply with food safety regulations in the target market. Key regulatory bodies include:

– FDA (U.S. Food and Drug Administration): Requires adherence to Current Good Manufacturing Practices (cGMPs) under 21 CFR Part 110. Gelatine must be produced from USDA-inspected, disease-free cattle.

– EFSA & EU Regulations (European Union): Regulated under Regulation (EC) No 853/2004 and No 1069/2009. Only gelatine from cattle not affected by transmissible spongiform encephalopathies (TSEs), including BSE (Bovine Spongiform Encephalopathy), is permitted. Certified BSE-free status is mandatory.

– Codex Alimentarius Standard for Gelatine (CODEX STAN 235-2001): Provides international guidelines on quality, purity, and labeling.

Pharmaceutical and Cosmetic Use

For non-food applications:

– Pharmaceutical Grade: Must comply with pharmacopeial standards such as USP (United States Pharmacopeia) or Ph. Eur. (European Pharmacopoeia), including microbial limits and traceability.

– Cosmetic Grade: Subject to regulations such as the EU Cosmetic Regulation (EC) No 1223/2009, which mandates safety assessments and ingredient labeling (INCI name: Gelatin).

Religious and Ethical Certification

- Halal Certification: Requires sourcing from animals slaughtered according to Islamic law and processing in certified facilities. Issued by recognized bodies such as JAKIM, MUIS, or HFA.

- Kosher Certification: Must be processed in accordance with Jewish dietary laws, certified by agencies like OU, OK, or Kof-K.

- Non-GMO and Allergen Declarations: Required in many markets; bovine gelatine must be declared as an allergen in food products under labeling laws (e.g., EU FIC Regulation 1169/2011).

Sourcing and Traceability

Raw Material Origin

- Source bovine raw materials only from countries recognized as BSE negligible or controlled risk by the World Organisation for Animal Health (WOAH).

- Maintain full traceability from slaughterhouse to finished product using documented supply chain records.

- Obtain health certifications and veterinary attestations for each consignment.

Supplier Qualification

- Audit suppliers for compliance with food safety (e.g., FSSC 22000, BRCGS) and ethical standards.

- Require documentation including Certificates of Analysis (CoA), Certificates of Origin, and BSE compliance statements.

Manufacturing and Processing Controls

Production Facility Standards

- Operate in facilities compliant with GMP and HACCP principles.

- Segregate processing lines for Halal/Kosher/non-Halal products to avoid cross-contamination.

- Implement allergen control programs and cleaning validation procedures.

Processing Methods

- Acid (Type A) or alkaline (Type B) hydrolysis must follow validated processes to ensure safety and consistency.

- Monitor critical parameters (pH, temperature, time) and conduct microbial testing (e.g., total plate count, Salmonella, E. coli).

Packaging and Labeling

Packaging Requirements

- Use food-grade, moisture-resistant packaging (e.g., multi-layer polyethylene bags inside fiber drums).

- Ensure packaging prevents contamination and maintains integrity during transport and storage.

Labeling Compliance

- Clearly indicate product name, batch number, manufacturing and expiry dates, storage conditions, and allergen information.

- Include regulatory status (e.g., “For Food Use,” “Pharmaceutical Grade”) and certifications (e.g., Halal, Kosher, BSE-Free).

- Comply with local language and regulatory requirements in destination markets.

Storage and Shelf Life

Storage Conditions

- Store in a cool, dry, well-ventilated area. Ideal conditions: 15–25°C (59–77°F) and relative humidity <60%.

- Protect from direct sunlight, moisture, and strong odors.

- Use first-in, first-out (FIFO) inventory management.

Shelf Life

- Typically 2–3 years when stored properly. Monitor and validate shelf life through stability testing.

- Re-test after extended storage if near expiry.

Transportation and Logistics

Mode of Transport

- Use clean, dry, and pest-free containers or vehicles.

- For international shipments, ensure compliance with ISPM 15 for wooden packaging.

Temperature Control

- Ambient transport is generally acceptable; avoid extreme temperatures that may cause clumping or microbial growth.

- Monitor temperature during long-haul or intercontinental transit if required by customer specification.

Documentation for International Trade

- Provide commercial invoice, packing list, bill of lading, and certificate of origin.

- Include health certificate, BSE declaration, and any required import permits.

- Ensure compliance with customs regulations in destination countries (e.g., FDA Prior Notice for U.S. imports).

Quality Assurance and Testing

Incoming and Finished Product Testing

- Test raw materials and finished gelatine for:

- Microbiological safety (Salmonella, E. coli, total aerobic count)

- Heavy metals (lead, arsenic, cadmium)

- Physical properties (bloom strength, viscosity, color, odor)

- Residual solvents (if applicable)

- Maintain sample retention (minimum 6 months beyond expiry).

Third-Party Audits and Certifications

- Undergo regular audits by certification bodies for ISO 22000, FSSC 22000, Halal, Kosher, or other relevant schemes.

- Provide audit summaries and certificates to customers upon request.

Risk Management and Contingency Planning

BSE Risk Mitigation

- Exclude specified risk materials (SRMs) such as brain and spinal cord from raw material sourcing.

- Monitor global BSE status updates and adjust sourcing strategies accordingly.

Recall Preparedness

- Establish a product traceability and recall system capable of tracking lot numbers through the supply chain.

- Conduct periodic mock recalls to verify effectiveness.

Supply Chain Disruptions

- Maintain alternative suppliers in approved BSE-compliant regions.

- Monitor geopolitical, climatic, and regulatory changes that may impact availability.

Conclusion

Proper logistics and compliance management for bovine gelatine ensures product safety, regulatory acceptance, and consumer trust. Adherence to international standards, rigorous documentation, and proactive risk mitigation are critical across sourcing, manufacturing, and distribution stages. Regular training and audits further strengthen compliance and operational excellence.

In conclusion, sourcing bovine gelatine requires careful consideration of multiple factors to ensure quality, safety, and compliance with regulatory and ethical standards. Key aspects include selecting reputable suppliers who adhere to Good Manufacturing Practices (GMP) and provide full traceability from approved, healthy cattle sources. It is essential to verify that the raw materials come from countries recognized as low-risk for bovine spongiform encephalopathy (BSE) and that processing facilities comply with international food safety standards, such as those set by the FDA, EFSA, or HALAL and KOSHER certification bodies where applicable.

Additionally, companies must evaluate the gelatine’s physical and functional properties—such as bloom strength, viscosity, and setting temperature—based on their specific application needs in food, pharmaceuticals, or technical industries. Sustainability and ethical sourcing practices are also becoming increasingly important to consumers and stakeholders, making it advantageous to engage with suppliers committed to environmental responsibility and animal welfare.

Ultimately, a strategic and due diligence-driven approach to sourcing bovine gelatine not only ensures product consistency and regulatory compliance but also supports brand integrity and long-term supply chain resilience.