The global gearbox market is experiencing robust growth, driven by rising industrial automation, increasing demand from end-use sectors such as automotive, aerospace, and renewable energy, and the expansion of manufacturing activities in emerging economies. According to a report by Mordor Intelligence, the global gearbox market was valued at USD 77.9 billion in 2023 and is projected to grow at a CAGR of over 5.6% from 2024 to 2029. Similarly, Grand View Research estimates that the market size reached USD 82.8 billion in 2023 and is expected to expand at a CAGR of 5.8% through 2030. This growth trajectory is further bolstered by technological advancements in gear design, rising adoption of wind energy systems requiring high-performance gearboxes, and the integration of Industry 4.0 practices in production processes. As demand intensifies, a select group of manufacturers have emerged as leaders in innovation, reliability, and global reach. Here’s a data-driven look at the top 10 gearbox manufacturers shaping the future of mechanical power transmission.

Top 10 Gearbox Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 STOBER

Domain Est. 1996

Website: stober.com

Key Highlights: STOBER is one of the world’s leading industrial gearbox manufacturers, and for good reason. Click here to learn more about our solutions….

#2 RJ Link International, Inc.

Domain Est. 1998

Website: rjlink.com

Key Highlights: Rj Link is the go-to solution for custom gearboxes. From free-standing speed reducers, speed increasers, transfer cases, creep drives, and planetary drives….

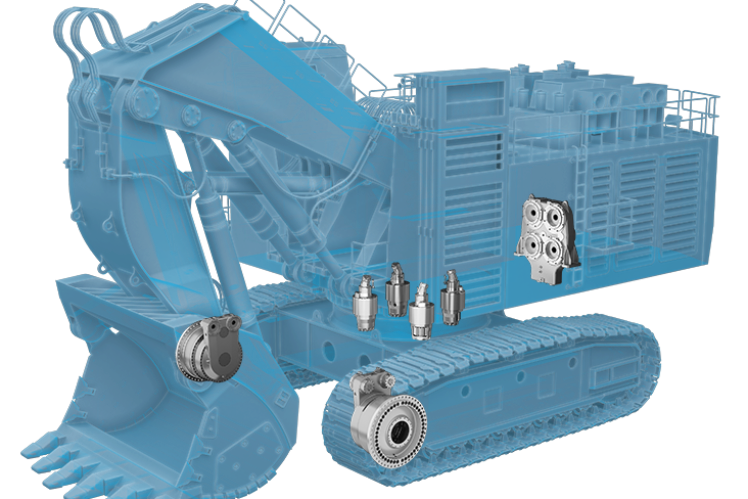

#3 ZF Product Range Industrial Gearboxes

Domain Est. 1996

Website: zf.com

Key Highlights: ZF offers a complete range of planetary transmissions for a wide scope of applications and always perfectly matched to the intended purpose….

#4 Philadelphia Gear

Domain Est. 1996

Website: philagear.com

Key Highlights: Philadelphia Gear operates at the core of critical applications, providing a complete range of custom-engineered gearbox products and gear services….

#5 Horsburgh & Scott

Domain Est. 1996

Website: horsburgh-scott.com

Key Highlights: Horsburgh & Scott engineers and manufactures a wide range of small to large gears and gearboxes, then supports them with value-added services….

#6 Neugart

Domain Est. 1997

Website: neugart.com

Key Highlights: Discover the high-quality planetary and custom gearboxes from Neugart GmbH. As one of the leading gearbox manufacturers, we offer innovative drive solutions ……

#7 Planetary Gearbox Manufacturer

Domain Est. 2003

Website: apexdynamicsusa.com

Key Highlights: Apex Dynamics is a worldwide name in planetary gearbox manufacturing with over 20 years of accumulated experience producing high-quality components….

#8 Quality Gearboxes & Gear Motors

Domain Est. 2019

Website: sitipowertransmission.com

Key Highlights: SITI Power Transmission is a manufacturer of gearboxes, geared motors and electro-mechanical drive technologies. We are located in Littleton, Massachusetts ……

#9 Gears and gearboxes made in Germany

Domain Est. 2017

Website: tandler-gearboxes.com

Key Highlights: We have been manufacturing gears and gear parts of the highest quality for 70 years now. We manufacture individually or in series entirely in Germany….

#10 Gearbox Group

Domain Est. 2018

Website: gearboxcompanies.com

Key Highlights: Gearbox manufactures OE and aftermarket automotive blanking, paper and friction components under the Raybestos Powertrain, Steel Parts and Allomatic brands….

Expert Sourcing Insights for Gearbox

H2 2026 Market Trends Analysis for Gearbox

As we look toward the second half of 2026, the market landscape for gearboxes—particularly within industrial automation, renewable energy, electric vehicles (EVs), and aerospace—is undergoing significant transformation. Driven by technological advancements, sustainability mandates, and evolving supply chain dynamics, several key trends are shaping the gearbox industry.

1. Increased Demand in Renewable Energy Sectors

The global push toward carbon neutrality continues to fuel growth in wind energy, especially offshore wind farms. Gearboxes remain a critical component in wind turbine drivetrains, particularly in medium-speed and multi-megawatt turbines. By H2 2026, demand is expected to rise due to large-scale renewable infrastructure projects in Europe, North America, and parts of Asia. Manufacturers are focusing on developing high-efficiency, low-maintenance gearboxes with improved reliability to reduce lifetime operational costs.

2. Electrification and the Shift in Automotive Applications

While traditional internal combustion engine (ICE) vehicles rely heavily on complex gearbox systems, the rise of EVs—especially in passenger and commercial fleets—is altering demand patterns. EVs typically use single-speed reduction gearboxes, reducing overall gearbox complexity and volume per vehicle. However, H2 2026 will see increased innovation in high-performance EV gearboxes, including integrated e-axles and multi-speed designs for trucks and performance vehicles. Gearbox makers are pivoting toward hybrid solutions and e-drive systems to capture value in this evolving market.

3. Smart Gearboxes and Predictive Maintenance

Digitalization is accelerating in industrial applications. By H2 2026, smart gearboxes equipped with embedded sensors, IoT connectivity, and AI-driven analytics are becoming standard in sectors like manufacturing, mining, and rail. These intelligent systems enable real-time monitoring of vibration, temperature, and lubrication, allowing for predictive maintenance and reduced downtime. Companies investing in digital twins and condition-monitoring platforms are gaining competitive advantage through improved service offerings and customer retention.

4. Supply Chain Resilience and Localization

Geopolitical tensions and past disruptions have led OEMs and gearbox suppliers to reevaluate global supply chains. In H2 2026, we see a continued trend toward regionalization—particularly in North America and the EU—where nearshoring and onshoring of gearbox production are being incentivized through industrial policy and green subsidies. This shift supports faster delivery times, reduced logistics costs, and greater control over quality and sustainability standards.

5. Focus on Sustainability and Lightweight Materials

Environmental regulations and ESG (Environmental, Social, and Governance) goals are pushing gearbox manufacturers to adopt sustainable practices. H2 2026 marks increased use of recyclable materials, energy-efficient manufacturing processes, and lightweight composite or advanced alloy gears—especially in aerospace and mobility applications. Additionally, gearbox designs are being optimized for longer service life and remanufacturability to support circular economy models.

6. Consolidation and Strategic Partnerships

Market competition and R&D costs are driving consolidation among gearbox suppliers. In H2 2026, we observe more mergers, acquisitions, and joint ventures—particularly between traditional gearbox firms and technology providers specializing in digital controls, electrification, or advanced materials. These partnerships enable faster innovation and broader market reach, especially in high-growth emerging markets.

Conclusion

The gearbox market in H2 2026 is characterized by adaptation and innovation. While traditional applications in heavy industry remain vital, growth is increasingly driven by green energy, digital integration, and electrified mobility. Leading companies are those that embrace modular design, smart technologies, and sustainable manufacturing, positioning themselves at the intersection of mechanical engineering and digital transformation.

Common Pitfalls in Sourcing Gearboxes: Quality and Intellectual Property (IP) Concerns

Sourcing gearboxes, especially from international or low-cost suppliers, presents several risks that can impact product performance, reliability, and legal compliance. Two of the most critical areas of concern are quality inconsistencies and intellectual property (IP) infringement. Understanding these pitfalls is essential for mitigating risk in procurement.

Quality-Related Pitfalls

Inconsistent Manufacturing Standards

One of the most frequent issues is the lack of adherence to international quality standards such as ISO 9001 or AGMA (American Gear Manufacturers Association) specifications. Suppliers may claim compliance without proper certification or rigorous quality control, leading to gearboxes with poor tolerances, misaligned gears, or substandard materials that result in premature failure.

Use of Substandard Materials

To reduce costs, some suppliers use inferior-grade steel, improper heat treatment, or low-quality lubricants. This compromises the gearbox’s durability, load capacity, and operational lifespan. Without material certifications or third-party testing, these shortcomings may not be evident until after integration and deployment.

Lack of Testing and Validation

Reliable gearboxes require performance testing under simulated load, temperature, and environmental conditions. Many suppliers, particularly smaller or non-reputable ones, skip rigorous testing protocols. This increases the risk of field failures, unplanned downtime, and safety hazards.

Inadequate Documentation and Traceability

Poor documentation—including missing assembly records, material traceability, or test reports—makes it difficult to diagnose failures or ensure consistency across batches. This is especially problematic in regulated industries like aerospace, defense, or medical equipment.

Intellectual Property (IP) Risks

Counterfeit or Reverse-Engineered Designs

A significant risk when sourcing gearboxes, particularly from certain regions, is receiving products that infringe on patented designs. Some suppliers produce near-identical copies of well-known gearbox models without licensing. Purchasing such products can expose your company to legal liability, customs seizures, and reputational damage.

Unclear IP Ownership in Custom Designs

When developing a custom gearbox with a supplier, failure to clearly define IP ownership in contracts can lead to disputes. Suppliers may claim partial rights or reuse the design for other clients, undermining your competitive advantage and potentially violating confidentiality agreements.

Lack of Legal Recourse

If IP infringement occurs, especially with overseas suppliers, enforcing rights can be costly and complex due to jurisdictional challenges. Weak legal frameworks in some countries make it difficult to pursue claims, leaving companies vulnerable to ongoing IP theft.

Supply Chain Transparency Gaps

Without visibility into the supplier’s sub-tier vendors and manufacturing processes, it’s difficult to verify whether components are legitimately sourced or involve unauthorized replication. This opacity increases the risk of inadvertently incorporating infringing parts into your products.

Mitigation Strategies

To avoid these pitfalls, companies should:

– Conduct thorough supplier audits and request certifications.

– Require material test reports and performance validation data.

– Use independent third-party inspections.

– Include explicit IP clauses in contracts, specifying ownership and usage rights.

– Partner with reputable suppliers with proven track records and legal compliance.

– Perform due diligence on design origins, especially for off-brand or “compatible” models.

By proactively addressing quality and IP concerns, organizations can ensure reliable performance, protect innovation, and reduce long-term operational and legal risks in gearbox sourcing.

Logistics & Compliance Guide for Gearbox

This guide outlines the essential logistics and compliance procedures for Gearbox to ensure efficient operations, regulatory adherence, and risk mitigation across supply chain activities.

Supply Chain Overview

Gearbox’s logistics framework supports the timely delivery of goods and services across regional and international markets. This includes procurement, warehousing, transportation, inventory management, and last-mile distribution. All operations must align with internal policies and external regulatory requirements.

Regulatory Compliance Requirements

Gearbox must comply with all applicable laws and regulations, including but not limited to:

– International Trade Regulations: Adherence to export controls (e.g., ITAR, EAR), customs regulations (e.g., CBP, HMRC), and trade sanctions (OFAC, UN).

– Import/Export Documentation: Accurate preparation of commercial invoices, packing lists, bills of lading, and certificates of origin.

– Product Standards: Compliance with regional safety, labeling, and environmental standards (e.g., CE, FCC, RoHS).

– Data Privacy: Compliance with GDPR, CCPA, and other data protection laws when handling customer or shipment data.

Transportation & Carrier Management

All shipments must use approved, vetted carriers that meet Gearbox’s service level and compliance standards.

– Mode Selection: Optimize between air, sea, road, and rail based on cost, speed, and environmental impact.

– Freight Documentation: Ensure all required shipping documents are complete and retained for audit purposes.

– Insurance: Confirm all high-value shipments are adequately insured against loss or damage.

Warehousing & Inventory Control

Gearbox warehouses must maintain accurate inventory records and ensure proper storage conditions.

– Inventory Audits: Conduct regular cycle counts and annual physical inventories.

– Storage Conditions: Maintain appropriate handling standards for sensitive or hazardous materials.

– Labeling & Tracking: Use barcode or RFID systems to track inventory in real time.

Customs Clearance Procedures

All cross-border shipments require timely and accurate customs clearance.

– Harmonized System (HS) Codes: Assign correct HS codes to all products for proper tariff classification.

– Duties & Taxes: Calculate and remit applicable duties, VAT, or GST in accordance with local regulations.

– Authorized Representatives: Use licensed customs brokers where required.

Risk Management & Contingency Planning

Gearbox must identify and mitigate logistics-related risks.

– Supply Chain Disruptions: Develop contingency plans for events such as port closures, natural disasters, or geopolitical issues.

– Compliance Audits: Conduct internal audits annually to verify adherence to policies and regulations.

– Incident Reporting: Establish a protocol for reporting compliance violations or shipment discrepancies.

Training & Accountability

All personnel involved in logistics and compliance must receive regular training.

– Role-Specific Training: Provide updates on regulatory changes, documentation procedures, and security protocols.

– Compliance Officers: Appoint designated staff to oversee adherence and serve as points of contact for audits or inquiries.

Record Retention & Documentation

Maintain all logistics and compliance records for the legally required period (typically 5–7 years).

– Digital Archiving: Store electronic copies of shipping documents, customs filings, and audit reports.

– Access Controls: Restrict access to sensitive compliance data based on role-based permissions.

Adherence to this guide ensures Gearbox operates efficiently, avoids penalties, and maintains trust with partners and regulators.

Conclusion for Sourcing Gearbox Manufacturer:

After a comprehensive evaluation of potential gearbox manufacturers, it is recommended to partner with [Manufacturer X] based on key criteria such as product quality, technical expertise, production capacity, cost competitiveness, industry certifications, and proven track record in the target application sector. This supplier demonstrates strong capabilities in R&D, consistent quality control, timely delivery, and responsive after-sales support, aligning well with our project requirements and long-term operational goals.

Additionally, their compliance with international standards (e.g., ISO, CE) and flexibility in customization ensures reliability and scalability. Conducting on-site audits and reviewing client references further confirmed their suitability. To mitigate risks, a phased supply agreement with performance benchmarks is advised, allowing for ongoing assessment and assurance of quality.

In conclusion, sourcing gearboxes from [Manufacturer X] offers a balanced combination of quality, reliability, and value, positioning them as the optimal strategic supplier for our needs.