The global gearbox market is experiencing robust growth, driven by rising demand across industrial automation, automotive, renewable energy, and heavy machinery sectors. According to a report by Mordor Intelligence, the global gearbox market was valued at USD 95.2 billion in 2023 and is projected to reach USD 138.6 billion by 2029, growing at a CAGR of 6.3% during the forecast period. This expansion is fueled by increasing adoption of wind energy systems—where gearboxes are critical components in turbine operations—and the ongoing modernization of manufacturing infrastructure worldwide. Additionally, Grand View Research highlights that the industrial gearbox segment alone held a dominant share in 2022, underscoring the sector’s reliance on efficient power transmission solutions. As automation and precision engineering become strategic imperatives, leading gearbox manufacturers are scaling innovation in durability, efficiency, and smart integration. In this evolving landscape, identifying the top performers becomes crucial for OEMs, EPCs, and procurement leaders aiming to optimize performance and reliability. Here’s a data-backed look at the top 10 gearbox manufacturers shaping the future of motion control and mechanical power transmission.

Top 10 Gearbox Maker Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 STOBER

Domain Est. 1996

Website: stober.com

Key Highlights: Right Angle Geared Motors. From helical gearboxes to planetary gearboxes, STOBER has geared motor options that fit your requirements….

#2 Custom Gearbox Manufacturers

Domain Est. 1999

Website: turnerunidrive.com

Key Highlights: Turner Uni-Drive has been a leading custom gearbox manufacturer providing quality multi-speed industrial gearboxes and transmissions….

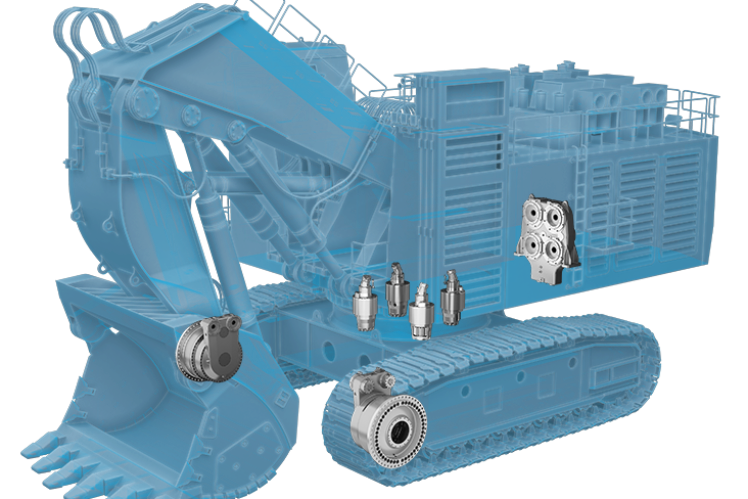

#3 ZF Product Range Industrial Gearboxes

Domain Est. 1996

Website: zf.com

Key Highlights: ZF drive, swing and winch gearboxes take up the heaviest loads, they are extremely compact and facilitate precise machine control with high power transmission….

#4 Philadelphia Gear

Domain Est. 1996

Website: philagear.com

Key Highlights: Philadelphia Gear is your one stop for new gearboxes, replacement gear drives, gear parts, gearbox repair and gear service….

#5 Neugart

Domain Est. 1997

Website: neugart.com

Key Highlights: Discover the high-quality planetary and custom gearboxes from Neugart GmbH. As one of the leading gearbox manufacturers, we offer innovative drive solutions ……

#6

Domain Est. 1998

Website: clevelandgear.com

Key Highlights: Cleveland Gear is recognized as the leader in gearing and enclosed gear drives. We provide solutions for a wide variety of critical industrial applications….

#7 Planetary Gearbox Manufacturer

Domain Est. 2003

Website: apexdynamicsusa.com

Key Highlights: Apex Dynamics is a worldwide name in planetary gearbox manufacturing with over 20 years of accumulated experience producing high-quality components….

#8 Gears and gearboxes made in Germany

Domain Est. 2017

Website: tandler-gearboxes.com

Key Highlights: We have been manufacturing gears and gear parts of the highest quality for 70 years now. We manufacture individually or in series entirely in Germany….

#9 Gearbox Group

Domain Est. 2018

Website: gearboxcompanies.com

Key Highlights: Gearbox manufactures OE and aftermarket automotive blanking, paper and friction components under the Raybestos Powertrain, Steel Parts and Allomatic brands….

#10 Quality Gearboxes & Gear Motors

Domain Est. 2019

Website: sitipowertransmission.com

Key Highlights: SITI manufactures custom gearboxes to meet unique application challenges. Our engineering team offers complete support from inception to completion….

Expert Sourcing Insights for Gearbox Maker

H2: 2026 Market Trends Analysis for Gearbox Makers

The global gearbox manufacturing industry is poised for significant transformation in 2026, driven by technological innovation, regulatory shifts, and evolving end-user demands. Key trends shaping the market include the acceleration of electrification, increased demand for energy efficiency, digitalization, and supply chain resilience. Below is a comprehensive analysis of these trends and their implications for gearbox makers.

1. Electrification and Hybridization in Mobility and Industry

The shift toward electric vehicles (EVs) and hybrid machinery is redefining the role of gearboxes. While traditional multi-speed gearboxes are less critical in pure EVs, precision single- or two-speed gearboxes for e-axles are in rising demand. In 2026, gearbox makers are adapting by:

– Developing compact, high-torque density gear systems optimized for electric motors.

– Partnering with EV and e-mobility OEMs to co-design integrated e-drive units.

– Expanding into off-highway and industrial EV applications (e.g., electric construction equipment, AGVs).

Implication: Traditional automotive gearbox suppliers must pivot toward electrified drivetrains or risk market erosion.

2. Energy Efficiency and Sustainability Regulations

Global carbon reduction targets (e.g., EU Green Deal, U.S. Inflation Reduction Act) are pushing industries to adopt high-efficiency mechanical drives. Gearbox makers are responding by:

– Launching IE4 and IE5-compliant gearmotors with reduced friction and optimized lubrication.

– Using lightweight materials (e.g., advanced composites, aluminum alloys) to improve efficiency.

– Offering remanufactured and reconditioned gearboxes to support circular economy goals.

Implication: Regulatory pressure will favor manufacturers with certified energy-efficient product lines and lifecycle sustainability reporting.

3. Digitalization and Predictive Maintenance

In 2026, smart gearboxes equipped with embedded sensors and IoT connectivity are becoming standard in industrial automation, wind energy, and process industries. Key developments include:

– Integration with Industrial IoT platforms for real-time condition monitoring.

– AI-driven predictive maintenance solutions to reduce downtime and extend gearbox life.

– Digital twins enabling performance simulation and design optimization.

Implication: Gearbox makers must evolve into solution providers, offering value-added digital services alongside hardware.

4. Growth in Renewable Energy and Wind Power

The wind energy sector remains a major growth driver, with offshore wind projects expanding globally. Gearbox demand is sustained by:

– Continued reliance on medium- and high-speed gearboxes in multi-megawatt turbines.

– Demand for reliability and durability in harsh offshore environments.

– Increased service and retrofitting contracts as early-generation turbines age.

Implication: Specialization in high-reliability, service-intensive gearbox systems will differentiate leading players.

5. Supply Chain Localization and Resilience

Geopolitical tensions and post-pandemic disruptions have accelerated the trend toward regionalization. In 2026:

– Gearbox makers are investing in nearshoring and regional manufacturing hubs (e.g., North America, Eastern Europe, Southeast Asia).

– Emphasis on dual-sourcing critical components (e.g., bearings, gears) to mitigate risk.

– Adoption of advanced manufacturing (e.g., additive manufacturing, automation) to reduce lead times.

Implication: Agility and supply chain transparency will be competitive advantages.

6. Consolidation and Strategic Partnerships

The market is seeing increased M&A activity as companies seek scale, technology access, and market diversification. In 2026:

– Larger players are acquiring niche innovators in e-drive or digital solutions.

– Cross-sector collaborations (e.g., gearbox makers with software firms) are enabling integrated offerings.

– Joint ventures to enter emerging markets (e.g., India, Brazil) with localized production.

Implication: Scale and ecosystem integration will be critical for long-term competitiveness.

Conclusion

By 2026, gearbox makers must transition from component suppliers to integrated mobility and industrial solutions providers. Success will depend on embracing electrification, digitalization, sustainability, and resilient operations. Companies that innovate rapidly and align with global decarbonization and automation trends will capture market share, while laggards risk obsolescence. Strategic agility, R&D investment, and customer-centric service models will define industry leaders in the coming year.

Common Pitfalls When Sourcing a Gearbox Maker: Quality and Intellectual Property Risks

Sourcing a gearbox maker involves complex technical and legal considerations. Overlooking key risks—especially in quality control and intellectual property (IP) protection—can lead to costly failures, delays, and legal disputes. Below are critical pitfalls to avoid.

Quality-Related Pitfalls

Inadequate Supplier Qualification

Failing to thoroughly vet a gearbox manufacturer’s capabilities, certifications (e.g., ISO 9001, ISO 13485), and track record can result in substandard products. Many suppliers may claim expertise but lack the infrastructure or experience to meet tight tolerances, durability requirements, or industry-specific standards.

Poor Material and Process Control

Gearboxes are highly sensitive to material quality and manufacturing processes. Sourcing from makers who use inconsistent raw materials or outdated heat treatment and gear grinding techniques can lead to premature wear, noise, or catastrophic failure in the field.

Lack of Rigorous Testing and Validation

Some suppliers skip or minimize performance testing (e.g., load testing, endurance runs, vibration analysis). Without documented test results and validation reports, buyers assume all risk for performance and reliability.

Inconsistent Quality Across Production Runs

Even if initial samples meet specifications, volume production may drift due to poor process controls or lack of in-line quality checks. Without clear quality assurance protocols and regular audits, product consistency cannot be guaranteed.

Insufficient Documentation and Traceability

Gearbox failures are difficult to diagnose without detailed manufacturing records, material certifications, and traceability by batch or serial number. Suppliers who do not maintain robust documentation hinder root cause analysis and regulatory compliance.

Intellectual Property-Related Pitfalls

Unclear Ownership of Design IP

A common oversight is assuming that paying for a custom gearbox design automatically transfers IP rights. Without a clear agreement, the manufacturer may retain rights to the design, limiting your ability to reproduce, modify, or source elsewhere.

Risk of Design Theft or Unauthorized Use

Low-cost regions may have weaker IP enforcement. A gearbox maker could reverse-engineer your design and sell it to competitors or create knock-offs under another brand. Non-disclosure agreements (NDAs) and robust contracts are essential but often poorly enforced.

Use of Infringing Third-Party IP

Some manufacturers incorporate patented technologies (e.g., gear profiles, lubrication systems) without proper licensing. Buyers may unknowingly become liable for IP infringement claims, especially in export markets.

Inadequate Protection in Joint Development

When co-developing a gearbox, unclear agreements on IP contributions and ownership can lead to disputes. Without defining who owns improvements or derivatives, future innovation and supply flexibility may be compromised.

Weak Contractual Safeguards

Many sourcing agreements lack specific clauses on IP indemnification, design confidentiality, and post-contract usage restrictions. Generic terms may not hold up in court, leaving buyers exposed to legal and financial risk.

Mitigation Strategies

To avoid these pitfalls:

– Conduct thorough due diligence on potential gearbox makers, including site audits and reference checks.

– Require detailed quality plans, inspection reports, and certification documentation.

– Use legally reviewed contracts that explicitly assign IP ownership to the buyer.

– Include strong confidentiality, non-compete, and infringement indemnity clauses.

– Consider engaging IP counsel to assess jurisdiction-specific risks, especially when sourcing internationally.

Proactive management of quality and IP concerns ensures reliable performance, protects innovation, and secures long-term supply chain integrity.

Logistics & Compliance Guide for Gearbox Maker

Supply Chain Management

Establish reliable relationships with raw material suppliers (e.g., steel, aluminum, lubricants) and component vendors (e.g., bearings, seals). Implement just-in-time (JIT) or vendor-managed inventory (VMI) systems to reduce holding costs while ensuring production continuity. Conduct regular supplier audits to verify quality and delivery performance.

International Shipping & Freight Coordination

Coordinate the transportation of raw materials and finished gearboxes via air, sea, or land freight based on cost, lead time, and customer requirements. Use freight forwarders experienced in industrial machinery shipments. Ensure proper packaging, labeling, and documentation (commercial invoices, packing lists, certificates of origin) for export compliance.

Customs Compliance

Adhere to import/export regulations in all operating regions. Classify gearboxes accurately using Harmonized System (HS) codes to determine tariffs and restrictions. Maintain records for customs audits and ensure adherence to rules of origin, especially under trade agreements like USMCA or EU regulations.

Regulatory Standards & Certifications

Ensure all gearboxes meet relevant international standards such as ISO 9001 (quality management), ISO 14001 (environmental), and ISO 45001 (safety). Comply with industry-specific requirements like CE marking (EU), UL listing (North America), or ATEX for explosive environments. Regularly update product certifications as standards evolve.

Product Labeling & Documentation

Clearly label gearboxes with essential information: model number, serial number, power ratings, rotation direction, lubrication requirements, and safety warnings. Provide multilingual operation and maintenance manuals. Include material declarations (e.g., RoHS, REACH) where applicable.

Environmental & Hazardous Materials Compliance

Properly manage and document the use of lubricants, coolants, and coatings that may be classified as hazardous. Follow EPA (USA), ECHA (EU), or equivalent local regulations for handling, storage, and disposal. Implement a waste reduction and recycling program aligned with environmental compliance goals.

Import/Export Licensing

Obtain necessary licenses or permits for shipping controlled technologies, especially if gearboxes are used in defense, aerospace, or energy sectors. Monitor changes in export control lists (e.g., EAR, ITAR) to avoid unauthorized shipments.

Quality Control & Traceability

Implement a traceability system to track raw materials, production batches, and finished units. Conduct in-process and final inspections to ensure compliance with engineering specifications. Maintain quality records for audits and warranty support.

After-Sales Logistics & Spare Parts Management

Establish a spare parts distribution network to support maintenance and repairs. Use warehouse management systems (WMS) to optimize inventory levels and delivery times. Offer reverse logistics for returns, refurbishment, or recycling of old gearboxes.

Risk Management & Business Continuity

Develop contingency plans for supply chain disruptions (e.g., port delays, geopolitical issues). Diversify supplier base and maintain safety stock for critical components. Insure shipments and facilities against loss or damage.

Conclusion for Sourcing Gearbox Maker

After a comprehensive evaluation of potential gearbox suppliers, including assessments of technical capabilities, product quality, manufacturing capacity, cost competitiveness, lead times, and after-sales support, we conclude that [Insert Chosen Supplier Name] is the most suitable sourcing partner for our gearbox requirements.

This supplier demonstrates strong engineering expertise, consistent quality control processes, and a proven track record in delivering reliable gearboxes for similar applications. Their alignment with our production timelines, willingness to collaborate on customization, and compliance with industry standards (e.g., ISO,AGMA) further strengthen their position as the preferred vendor.

Moving forward, we recommend initiating a formal agreement with [Supplier Name], accompanied by ongoing performance monitoring to ensure continued quality and delivery consistency. Establishing a long-term partnership will not only enhance supply chain stability but also support future scalability and innovation in our product offerings.