The global gear cutting tools market is experiencing robust growth, driven by rising demand from automotive, aerospace, and industrial machinery sectors. According to Grand View Research, the market was valued at USD 2.17 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. This growth is fueled by increasing automation, precision engineering requirements, and the surge in electric vehicle production, all of which necessitate high-performance gear components. As manufacturers prioritize efficiency, durability, and micron-level accuracy, the role of advanced gear cutting tools has become increasingly critical. In this evolving landscape, leading manufacturers are investing heavily in innovation, including carbide and ceramic tooling, CNC-controlled systems, and digital process integration. Based on market presence, technological capability, and global reach, the following ten companies stand out as the top gear cutting tools manufacturers shaping the future of power transmission systems.

Top 10 Gear Cutting Tools Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Super Tools Corporation

Domain Est. 2019

Website: stcgeartools.com

Key Highlights: We manufacture high-quality gear-cutting tools with over 45 years of experience, with all the latest CNC Machines & Technology….

#2 Gear Motions

Domain Est. 1997

Website: gearmotions.com

Key Highlights: Gear Motions is a leading gear manufacturer specializing in supplying high quality custom cut and ground precision gears made in the USA….

#3 A manufacturer of high quality cutting tools

Domain Est. 1997

Website: carmex.com

Key Highlights: Carmex makes cutting tools, including threading tools for milling and turning, tools for grooving, chamfering, boring, parting, profiling, and more….

#4 Gear Cutting Tools

Domain Est. 2017

Website: est-us.com

Key Highlights: EST is an industry-leading manufacturer of gear cutting tools including hobs, shaper cutters, skives, milling cutters and other specialty cutters….

#5 Gleason Corporation

Domain Est. 1991

Website: gleason.com

Key Highlights: We are a leader in the development and manufacture of production systems for all types of gears including gear and transmission design software, machines, ……

#6 Seco Tools – Cutting Tools solutions company

Domain Est. 1996

Website: secotools.com

Key Highlights: Seco Tools – Cutting Tools solutions company – Seco Tools is one of the world’s largest tooling company and providers of comprehensive metal cutting ……

#7 Gear cutting tools

Domain Est. 1996

Website: liebherr.com

Key Highlights: Liebherr offers a comprehensive range of gear cutting tools, many years of experience in gear manufacturing, and the highest level of product quality down ……

#8 Gear Cutting Machines

Domain Est. 1997

Website: nidec.com

Key Highlights: Gear Cutting Machines · Gear Hobbing Machines · Gear Shaping Machines · Gear Skiving Machines · Gear Shaving Machines · Gear Grinding Machines · Shaving Cutter ……

#9 LMT Homepage

Domain Est. 1997

Website: lmt-tools.com

Key Highlights: LMT Tools with Expanded Gear Cutting Expertise New gear cutting tools, innovative solutions, additional manufacturing capacities, and expanded knowledge ……

#10 Ingersoll Cutting Tools

Domain Est. 2001

Website: ingersoll-imc.com

Key Highlights: A world leader in the design and manufacture of milling, turning, and holemaking tools, an expert in project – focused engineering of special cutting tool ……

Expert Sourcing Insights for Gear Cutting Tools

H2: 2026 Market Trends for Gear Cutting Tools

The global Gear Cutting Tools market in 2026 is poised for significant transformation, driven by technological advancements, shifting industrial demands, and evolving manufacturing paradigms. Key trends shaping the landscape include:

1. Accelerated Adoption of Advanced Materials & Coatings:

Demand for cutting tools made from high-performance materials like polycrystalline diamond (PCD), cubic boron nitride (CBN), and advanced carbide grades will surge. Enhanced coatings (e.g., AlTiN, diamond-like carbon) will be critical to improve tool life, heat resistance, and cutting efficiency—especially for machining hardened steels and non-ferrous alloys in automotive and aerospace sectors.

2. Integration of Industry 4.0 and Smart Tooling:

Gear cutting tools will increasingly incorporate embedded sensors and IoT connectivity for real-time monitoring of wear, temperature, and vibration. This “smart tooling” enables predictive maintenance, reduces downtime, and optimizes machining parameters, aligning with digital manufacturing strategies in large-scale production facilities.

3. Growth in Electric Vehicle (EV) Production:

The expansion of EV manufacturing will drive demand for precision gear cutting tools tailored to high-tolerance components such as transmission gears and e-axles. These applications require micro-precision tools capable of producing quieter, more efficient gears with tighter tolerances than traditional automotive components.

4. Rising Demand for High-Precision and Complex Gear Forms:

As industries demand higher efficiency and performance, there will be increased need for tools capable of producing asymmetric, herringbone, and internal gears with complex tooth profiles. This trend is prominent in robotics, aerospace, and renewable energy (e.g., wind turbine gearboxes).

5. Regional Market Shifts and Localization:

Asia-Pacific, particularly China and India, will remain the fastest-growing regional market due to expanding automotive and industrial machinery sectors. However, geopolitical factors and supply chain resilience concerns will encourage localized production, boosting regional tool manufacturing and aftermarket services in North America and Europe.

6. Sustainability and Circular Economy Initiatives:

Manufacturers will focus on sustainable practices, including tool reconditioning, recycling of carbide substrates, and development of eco-friendly coolants compatible with high-speed gear cutting. Energy-efficient machining processes will also influence tool design and material selection.

7. Consolidation and Strategic Partnerships:

The market may see increased M&A activity and R&D collaborations between tool manufacturers, machine builders, and end-users to co-develop customized solutions, especially for niche applications in aerospace and medical devices.

In summary, the 2026 gear cutting tools market will be defined by innovation, digitization, and responsiveness to high-precision, sustainable manufacturing needs—positioning advanced tooling as a critical enabler of next-generation industrial capabilities.

Common Pitfalls Sourcing Gear Cutting Tools: Quality and Intellectual Property Risks

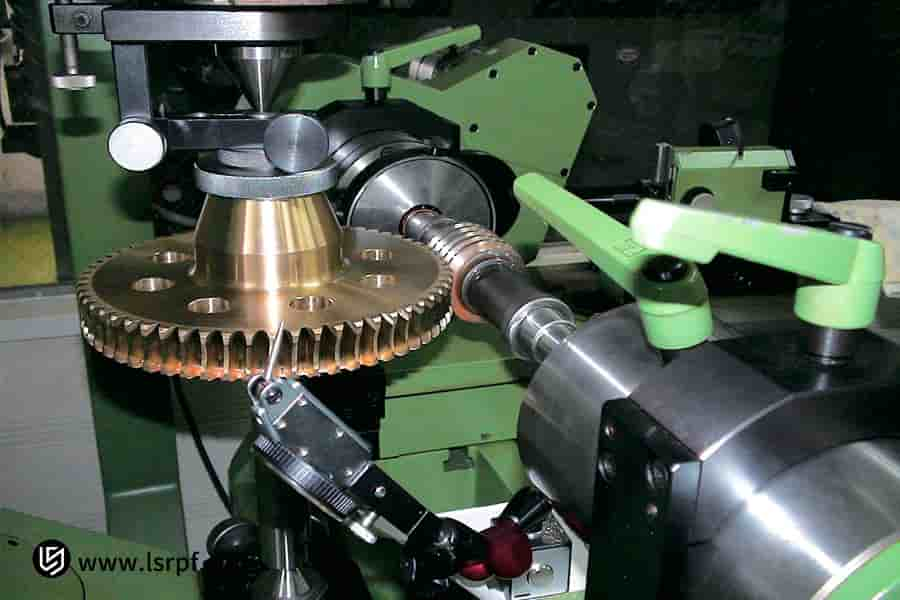

Sourcing gear cutting tools—such as hobs, shapers, broaches, and milling cutters—requires careful evaluation to ensure performance, longevity, and legal compliance. Overlooking key factors can lead to production delays, poor part quality, and intellectual property (IP) issues. Below are common pitfalls related to quality and IP that procurement teams and manufacturers should avoid.

Poor Material and Manufacturing Quality

One of the most frequent issues is receiving tools made from substandard materials or with poor heat treatment. Low-grade high-speed steel (HSS) or carbide can lead to rapid tool wear, chipping, or breakage during use. Inadequate grinding or surface finishing affects cutting precision and surface finish of the gears produced. Always verify supplier certifications (e.g., ISO 9001), request material test reports, and, if possible, conduct sample testing before large-scale procurement.

Inconsistent Tool Geometry and Tolerances

Even minor deviations in tool profile, lead angle, or pitch can result in non-conforming gears, increased noise, and premature gear failure. Some suppliers, especially those offering low-cost alternatives, may not maintain strict tolerances or use outdated design specifications. Ensure tools are manufactured to recognized standards (e.g., DIN, AGMA, ISO) and request inspection reports or coordinate measuring machine (CMM) data for critical dimensions.

Lack of Traceability and Documentation

Reputable gear tool suppliers provide full traceability, including lot numbers, heat treatment records, and inspection data. Sourcing from vendors who do not offer such documentation increases risk—especially in regulated industries (e.g., aerospace, automotive). Without traceability, diagnosing tool failure or addressing quality disputes becomes nearly impossible.

Counterfeit or Reverse-Engineered Tools

A significant IP risk arises when sourcing from suppliers offering “compatible” or “economy” versions of branded tools (e.g., Gleason, Klingelnberg, Sandvik). Some of these tools are reverse-engineered without proper licensing, infringing on patented designs or proprietary geometries. Using such tools may expose your company to legal liability, warranty invalidation, and compatibility issues. Always confirm the supplier’s right to manufacture and sell the tool design.

Unlicensed Use of Proprietary Designs

Many advanced gear cutting tools incorporate patented tooth profiles, rake angles, or coating technologies. Unauthorized replication of these designs constitutes IP infringement. Even if the tool performs adequately, your organization could be implicated in litigation if the tool’s origin is traced back to IP theft. Conduct due diligence by checking patents and requesting proof of licensing from the supplier.

Inadequate Coating and Surface Treatments

Coatings such as TiN, TiAlN, or AlCrN enhance tool life and performance. However, some suppliers apply thin or poorly adhered coatings to cut costs. These may delaminate quickly under high cutting loads, reducing tool life and increasing downtime. Verify coating specifications and, if feasible, perform coating thickness and adhesion tests.

Failure to Consider Application-Specific Requirements

Not all gear cutting tools are suitable for every application. Using a general-purpose hob for precision aerospace gears, for example, can lead to poor surface finish and dimensional inaccuracies. Suppliers may push generic tools to reduce inventory costs, but this compromises performance. Clearly communicate your application requirements—material, gear type, accuracy class (e.g., DIN 3962), and production volume—to ensure the correct tool is sourced.

Overlooking After-Sales Support and Re-Sharpening Services

High-quality gear cutting tools often require periodic re-sharpening to maintain performance. Sourcing from suppliers who don’t offer reconditioning services or lack technical support can lead to extended tool downtime and inconsistent results. Ensure the supplier provides access to sharpening, technical documentation, and application engineering support.

Conclusion

Avoiding these pitfalls requires a strategic sourcing approach that balances cost with quality assurance and legal compliance. Conduct thorough supplier audits, insist on certifications and documentation, and prioritize partners with transparent manufacturing practices and respect for intellectual property. By doing so, you ensure reliable tool performance and protect your organization from operational and legal risks.

Logistics & Compliance Guide for Gear Cutting Tools

Overview

Gear cutting tools—such as hobs, gear shapers, broaches, and mill cutters—are precision instruments used in the manufacturing of gears for automotive, aerospace, industrial machinery, and other high-precision sectors. Due to their specialized nature, high value, and international demand, effective logistics planning and adherence to regulatory compliance are essential to ensure timely delivery, product integrity, and legal conformity.

Packaging and Handling

Proper packaging is critical to prevent damage during transit. Gear cutting tools are typically made from high-speed steel (HSS), carbide, or coated materials and are sensitive to impact, moisture, and corrosion.

– Use anti-corrosion packaging such as VCI (Vapor Corrosion Inhibitor) paper or desiccants.

– Secure tools in rigid containers with foam or molded inserts to prevent movement.

– Clearly label packages with “Fragile,” “This Side Up,” and “Do Not Stack” indicators.

– Avoid exposure to extreme temperatures and humidity during storage and transport.

Domestic and International Shipping

- Choose reliable freight carriers experienced in handling high-value industrial tools.

- For international shipments, use air freight for time-sensitive deliveries and sea freight for bulk orders to reduce costs.

- Ensure accurate shipping documentation, including commercial invoices, packing lists, and certificates of origin.

- Consider shipping insurance to cover loss or damage, especially for high-value tooling.

Regulatory Compliance

Gear cutting tools may be subject to export controls and trade regulations depending on material composition, country of origin, and destination.

– Export Controls: Some tools, particularly those made with tungsten carbide or used in defense-related manufacturing, may be regulated under ITAR (International Traffic in Arms Regulations) or EAR (Export Administration Regulations) in the U.S. Verify classification under the Commerce Control List (CCL).

– Customs Clearance: Provide Harmonized System (HS) codes (e.g., 8207.50 for interchangeable tools for hand tools or machine tools). Accurate classification ensures correct duty rates and avoids delays.

– Sanctions and Embargoes: Screen destination countries and end-users against OFAC (U.S. Office of Foreign Assets Control) and equivalent international sanctions lists.

Import Considerations

- Research import duties, VAT, and local certification requirements in the destination country.

- Some countries require conformity assessment or tool certification (e.g., CE marking in the EU, though not typically applied to cutting tools directly, related machinery may be affected).

- Maintain records of compliance documentation for audit and traceability purposes.

Product Traceability and Certification

- Provide tool identification (part number, serial number, material grade, coating type) on packaging and documentation.

- Maintain quality certifications such as ISO 9001, which may be required by customers or import authorities.

- For aerospace or medical applications, additional certifications (e.g., AS9100, NADCAP) may be necessary.

Environmental and Safety Compliance

- Comply with REACH (EU), RoHS, and other environmental regulations regarding restricted substances in tool materials or coatings.

- Ensure safe handling procedures are documented, especially for coated tools that may release hazardous dust during use.

- Dispose of damaged or end-of-life tools according to local hazardous waste regulations if they contain regulated materials.

Best Practices Summary

- Use tamper-evident, protective packaging with clear labeling.

- Verify export classifications and obtain necessary licenses prior to shipment.

- Partner with customs brokers for complex international logistics.

- Maintain accurate and complete records for compliance audits.

- Train logistics staff on handling requirements and regulatory obligations.

By adhering to this guide, manufacturers and distributors of gear cutting tools can ensure efficient, compliant, and secure delivery across global supply chains.

Conclusion on Sourcing Gear Cutting Tools

Sourcing the right gear cutting tools is a critical factor in ensuring the precision, efficiency, and longevity of gear manufacturing processes. A well-informed procurement strategy should prioritize tool quality, material compatibility, and supplier reliability. Investing in high-performance tools made from advanced materials such as carbide or high-speed steel (HSS), with proper coatings for wear resistance, directly impacts tool life and machining accuracy.

It is essential to partner with reputable suppliers who offer technical support, consistent quality, and timely delivery. Evaluating factors such as tool geometry, customization options, and adherence to international standards (e.g., ISO, DIN) ensures compatibility with existing machinery and production requirements. Additionally, considering total cost of ownership—beyond initial purchase price—incorporates benefits like reduced downtime, lower maintenance, and improved productivity.

In conclusion, effective sourcing of gear cutting tools combines technical evaluation, supplier assessment, and lifecycle cost analysis to enhance manufacturing performance and maintain competitive advantage in precision engineering industries.