The global oil level gauge market is experiencing steady growth, driven by rising demand across automotive, industrial, and aerospace sectors. According to a report by Mordor Intelligence, the Oil Level Sensor Market was valued at USD 1.27 billion in 2023 and is projected to reach USD 1.84 billion by 2029, growing at a CAGR of approximately 6.3% during the forecast period. This expansion is fueled by increasing vehicle production, stricter regulatory standards for fuel efficiency, and the integration of advanced diagnostics in modern engines. Parallel insights from Grand View Research highlight the ongoing shift toward precision monitoring systems in industrial machinery and commercial vehicles, further bolstering market momentum. As demand for reliable fluid level measurement intensifies, several manufacturers have emerged as leaders in innovation, quality, and global reach. Below are the top 8 gauge oil level manufacturers shaping the industry’s future.

Top 8 Gauge Oil Level Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Custom Level Indicator Manufacturer

Domain Est. 1999

Website: ksentry.com

Key Highlights: For over 75 years we have manufactured over three million liquid-level gauges. We provide high-quality custom tank gauges for a variety of industries and ……

#2 Tank Gauges

Domain Est. 1992

Website: husky.com

Key Highlights: Oil Filter Crushers Tank Gauges Tank Monitors & Alarms Gauges/Monitor Accessories … Red Fox® 99” Liquid Level Gauge Horizontal Float in Retail Packaging. Part ……

#3 Oil Level Gauges On The Timken Company

Domain Est. 1994

Website: cad.timken.com

Key Highlights: Browse Oil Level Gauges in the The Timken Company catalog including Part Number,Item Name,Description ,Thread G,Weight,Dimension B,Dimension C,Type….

#4 Oil Level & Flow Indicators

Domain Est. 1997

Website: qualitrolcorp.com

Key Highlights: Oil Level & Flow Indicators · Direct Oil Level Indicators (Magnetic) · Flow Indicators · Remote Oil Level Indicator….

#5 Liquid Level Gauges

Domain Est. 1997

Website: gitsmfg.com

Key Highlights: Explore a wide range of innovative liquid level gauges by Gits Manufacturing….

#6 Oil level indicator

Domain Est. 1998

Website: reinhausen.com

Key Highlights: Our oil level gauges are suited for various applications and, depending on the model, come equipped with floats, direct displays or magnetic flaps….

#7 Oil level gauges, polyamide

Domain Est. 2012

Website: kippusa.com

Key Highlights: 3-day delivery 30-day returnsOil level gauges, polyamide ✓ Made in Germany ✓ Highest quality ✓ Fast delivery ✓ Customer-specific solutions ✓ Download CAD data ✓ Wide range with 750…

#8 Homepage

Domain Est. 2020

Website: rochestersensors.com

Key Highlights: Rochester Sensors is a global organization with the expertise, resources and capabilities to solve any challenge related to liquid level measurement….

Expert Sourcing Insights for Gauge Oil Level

H2: Projected 2026 Market Trends for Gauge Oil Level

The global market for oil level gauges is poised for notable transformation by 2026, driven by evolving industrial demands, technological advancements, and a growing emphasis on automation and predictive maintenance. As industries across automotive, energy, marine, and manufacturing continue to prioritize system efficiency and safety, the demand for accurate and reliable oil level monitoring solutions is expected to rise significantly.

1. Increased Adoption of Smart and Digital Oil Level Gauges

A key trend shaping the 2026 landscape is the shift from traditional mechanical gauges to digital and smart oil level sensors. Integrated with IoT platforms, these advanced gauges enable real-time monitoring, remote diagnostics, and predictive analytics. This transition is particularly pronounced in the automotive and industrial sectors, where connected systems enhance operational efficiency and reduce downtime.

2. Growth in Automotive and Electric Vehicle (EV) Applications

Despite the rise of electric vehicles (EVs), which require less lubrication than internal combustion engines, oil level gauges remain essential in hybrid vehicles and EV transmissions, gearboxes, and cooling systems. Furthermore, the continued dominance of internal combustion engine (ICE) vehicles in emerging markets ensures sustained demand. The integration of oil monitoring systems into advanced driver assistance systems (ADAS) is also expected to boost market growth.

3. Expansion in Industrial and Energy Sectors

The oil and gas, power generation, and heavy machinery industries are investing in condition-based monitoring systems, increasing the need for durable and accurate oil level gauges. In offshore and remote operations, wireless and explosion-proof gauge solutions are gaining traction, aligning with safety and reliability standards.

4. Regional Market Dynamics

Asia-Pacific is projected to lead market growth by 2026, fueled by rapid industrialization in China, India, and Southeast Asia, along with expanding automotive production. North America and Europe will see steady growth, driven by regulatory standards for equipment safety and the retrofitting of legacy systems with smart monitoring technologies.

5. Sustainability and Regulatory Influences

Environmental regulations promoting energy efficiency and reduced emissions are encouraging the development of low-maintenance and longer-lasting oil monitoring systems. Standards from bodies such as ISO and API are pushing manufacturers to adopt non-invasive, corrosion-resistant, and leak-proof gauge designs.

6. Competitive Landscape and Innovation

Market consolidation and strategic partnerships are expected to intensify, with key players focusing on R&D to differentiate products through features like self-calibration, wireless connectivity, and AI-based anomaly detection. Companies such as WIKA, Bosch, and Gems Sensors are likely to expand their portfolios to include integrated fluid monitoring systems.

Conclusion

By 2026, the oil level gauge market will be characterized by digitalization, integration, and intelligence. While traditional applications remain relevant, innovation in sensor technology and connectivity will redefine the value proposition of oil level monitoring systems. Stakeholders who align with these trends—particularly in smart sensing and sustainability—are well-positioned to capture emerging opportunities.

Common Pitfalls in Sourcing Gauge Oil Level (Quality, IP)

Sourcing Gauge Oil Level components—particularly those involving critical quality standards and intellectual property (IP) considerations—can present significant challenges. Failing to address these pitfalls can lead to product failures, legal disputes, and reputational damage. Below are the most common issues encountered:

Poor Quality Control and Non-Compliance with Standards

One of the primary risks when sourcing gauge oil level sensors or indicators is receiving substandard components that do not meet required performance or safety standards. Many suppliers, especially in low-cost manufacturing regions, may lack robust quality assurance processes. Components may fail under real-world conditions such as temperature fluctuations, vibration, or exposure to aggressive fluids. Additionally, products may not comply with international standards like ISO 9001, IATF 16949 (for automotive), or ATEX (for hazardous environments), leading to integration issues or regulatory non-compliance.

Mitigation: Conduct thorough supplier audits, require third-party certifications, and implement incoming inspection protocols with sample testing for key performance metrics (e.g., accuracy, durability, sealing integrity).

Inadequate IP Protection and Risk of Counterfeiting

Gauge oil level technologies often incorporate proprietary designs, calibration methods, or embedded software. When sourcing from third parties—especially contract manufacturers—there is a significant risk of intellectual property (IP) theft or unauthorized replication. Suppliers may reverse-engineer designs or sell identical components to competitors. Additionally, counterfeit or cloned products may enter the supply chain, especially if sourcing through indirect distributors or gray market channels.

Mitigation: Use legally binding non-disclosure agreements (NDAs) and IP assignment clauses in contracts. Limit technical documentation access and consider patent or design registration in key jurisdictions. Audit supplier facilities and monitor for unauthorized production.

Lack of Traceability and Material Certification

Oil level gauges used in industries such as automotive, aerospace, or industrial machinery require full traceability of materials and manufacturing processes. Sourcing components without proper material certifications (e.g., RoHS, REACH, or specific polymer resistance data) can result in compatibility issues with oils or environmental conditions. Poor traceability also complicates root cause analysis during failure investigations and may violate regulatory requirements.

Mitigation: Require suppliers to provide material declarations, batch traceability, and certificates of conformance (CoC). Include traceability requirements in procurement contracts.

Inconsistent Calibration and Measurement Accuracy

Oil level gauges must deliver precise and repeatable measurements. However, sourced components may exhibit calibration drift or inconsistent output due to variations in manufacturing tolerances or lack of standardized testing. This is especially problematic when integrating gauges into digital monitoring systems where accuracy impacts overall system reliability.

Mitigation: Define clear calibration specifications and verify performance through functional testing. Require suppliers to perform end-of-line testing and provide calibration data for each unit or batch.

Hidden Costs Due to Poor Communication and Misaligned Specifications

Ambiguous or incomplete technical specifications can lead to misinterpretations by suppliers, resulting in non-conforming parts. Differences in units, tolerances, or interface requirements (e.g., mounting dimensions, electrical connectors) often emerge only during integration, leading to costly redesigns or delays.

Mitigation: Provide detailed technical drawings, 3D models, and performance specifications. Engage in regular technical reviews with suppliers and use design for manufacturing (DFM) input early in the sourcing process.

By proactively addressing these common pitfalls, organizations can ensure the reliable, compliant, and secure sourcing of gauge oil level components while protecting both product quality and intellectual property.

Logistics & Compliance Guide for Gauge Oil Level

Overview of Gauge Oil Level

Gauge Oil Level refers to the measurement and monitoring of oil levels in tanks, reservoirs, or machinery using level gauges. Proper logistics and compliance management are essential to ensure safety, regulatory adherence, and operational efficiency during the transportation, storage, and use of oil in conjunction with level gauges.

Regulatory Compliance Requirements

All operations involving Gauge Oil Level systems must comply with relevant local, national, and international regulations. Key compliance frameworks include:

– OSHA (Occupational Safety and Health Administration) – Standards for workplace safety, including handling of hazardous materials and confined space entry.

– EPA (Environmental Protection Agency) – Regulations on spill prevention, containment, and reporting (e.g., SPCC – Spill Prevention, Control, and Countermeasure).

– API Standards (American Petroleum Institute) – Guidelines for tank and gauge installation, maintenance, and inspection (e.g., API 18.2, API 2350).

– ATEX/IECEx – For operations in potentially explosive atmospheres, ensuring that level gauges are certified for use in hazardous locations.

Ensure all personnel are trained and documentation is maintained to demonstrate compliance during audits.

Transportation & Handling Procedures

Proper logistics protocols must be followed when transporting oil and level gauge equipment:

– Use DOT-compliant containers and vehicles for oil transport.

– Secure level gauges during transit to prevent damage; use protective packaging.

– Label all containers with appropriate hazard symbols (e.g., flammable liquids).

– Maintain manifests and shipping papers in accordance with hazardous materials regulations (49 CFR in the U.S.).

– Conduct pre-transport inspections to verify container integrity and gauge functionality.

Storage & Inventory Management

Safe storage of oil and level gauges is critical for operational and environmental safety:

– Store oil in approved, labeled containers in well-ventilated, fire-resistant areas away from ignition sources.

– Implement a first-in, first-out (FIFO) inventory system to prevent oil degradation.

– Conduct regular inspections of storage tanks and gauges for leaks, corrosion, or malfunction.

– Maintain digital or physical logs of oil levels, gauge readings, and maintenance activities.

Installation & Operational Safety

Installation of oil level gauges must follow manufacturer specifications and safety standards:

– Use certified technicians for installation in compliance with NFPA 70 (NEC) and API standards.

– Ensure proper grounding and bonding to prevent static discharge.

– Calibrate gauges regularly to maintain accuracy and prevent overfilling.

– Install secondary containment systems where required (e.g., dikes, bunds).

Environmental & Spill Response

Prepare for potential oil spills involving level gauge systems:

– Maintain a site-specific Spill Prevention, Control, and Countermeasure (SPCC) plan.

– Equip storage areas with spill kits, absorbents, and containment booms.

– Train personnel on spill response procedures and emergency shutdown protocols.

– Report spills exceeding regulatory thresholds to appropriate authorities promptly.

Documentation & Recordkeeping

Accurate documentation supports compliance and operational continuity:

– Keep records of gauge calibration, maintenance, and repair.

– Maintain training logs for personnel handling oil and gauges.

– Store inspection reports, compliance audits, and incident reports for a minimum of 5 years (or as required by regulation).

– Use digital management systems to track oil levels, shipments, and compliance status.

Training & Personnel Requirements

All personnel involved in Gauge Oil Level operations must receive comprehensive training:

– Hazard communication (HazCom) and GHS labeling.

– Safe handling of oil and use of personal protective equipment (PPE).

– Operation and interpretation of level gauges.

– Emergency response and evacuation procedures.

Training must be reviewed annually and updated with changes in equipment or regulations.

Audit & Continuous Improvement

Regular internal and external audits ensure ongoing compliance and identify areas for improvement:

– Conduct quarterly compliance checks on storage, labeling, and documentation.

– Perform annual third-party audits for regulatory alignment.

– Implement corrective actions promptly based on audit findings.

– Update the logistics and compliance guide annually or as regulations evolve.

Conclusion for Sourcing Gauge Oil Level:

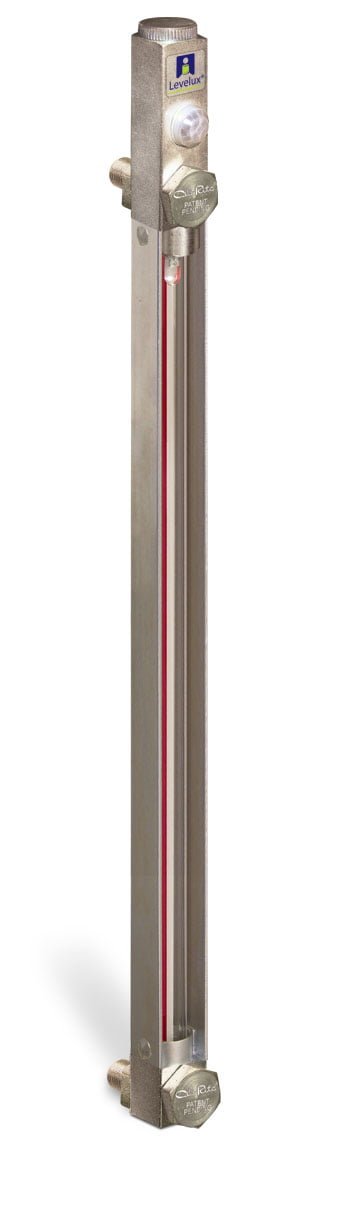

In conclusion, the accurate sourcing and selection of a gauge for oil level measurement is critical to ensuring operational efficiency, equipment safety, and longevity across various industrial and mechanical applications. The choice of oil level gauge should be based on factors such as application requirements, environmental conditions, fluid type, temperature, pressure, and desired accuracy. Common options such as sight glass gauges, float gauges, magnetic level indicators, and electronic sensors each offer unique advantages depending on the use case.

Proper sourcing involves verifying compatibility with system specifications, ensuring compliance with industry standards, and selecting reliable suppliers to maintain quality and durability. Additionally, ease of maintenance, readability, and integration with control systems should be considered to support real-time monitoring and prevent failures due to overfilling or low oil conditions.

Ultimately, investing in the right oil level gauge through careful sourcing not only enhances system performance but also reduces downtime and maintenance costs, contributing to safer and more efficient operations.