The global gas turbine air filters market is experiencing robust growth, driven by increasing energy demand, expanding power generation infrastructure, and the critical need for turbine efficiency and longevity. According to Grand View Research, the market was valued at USD 1.2 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Similarly, Mordor Intelligence forecasts steady growth, citing rising investments in combined-cycle power plants and retrofitting of older turbines as key drivers. With air filtration directly impacting turbine performance—reducing fouling, minimizing maintenance downtime, and improving output—operators are prioritizing high-efficiency filtration solutions. This growing demand has elevated the role of specialized manufacturers, leading to technological advancements in filtration media, design, and contaminant removal. As the market becomes more competitive, identifying top-tier suppliers capable of delivering reliability and innovation is essential for operators across power generation, oil & gas, and industrial sectors. Below, we present the top 9 gas turbine air filters manufacturers shaping the industry with proven performance, global reach, and data-backed market presence.

Top 9 Gas Turbine Air Filters Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Engine and Industrial Air, Oil and Liquid Filtration

Domain Est. 1995

Website: donaldson.com

Key Highlights: Donaldson Company, Inc. is a global leader in providing engine and industrial air, oil and liquid filtration solutions….

#2 Industrial Gas Turbine Filters & Separator Solutions

Domain Est. 1997

Website: gravertech.com

Key Highlights: At Graver Technologies, we offer reliable and durable gas turbine filters that ensure superior air quality for turbine operations. These gas turbine air filter ……

#3 Gas Turbine Filters

Domain Est. 1995

Website: pall.com

Key Highlights: Pall turbine filters provide users with effective and economic removal of critically sized particulate contaminants in lubrication oil….

#4 Filter cartridges

Domain Est. 1996

Website: hengst.com

Key Highlights: Filter cartridges are critical for protecting gas turbines and turbomachinery from airborne contaminants to ensure their efficient operation and extend their ……

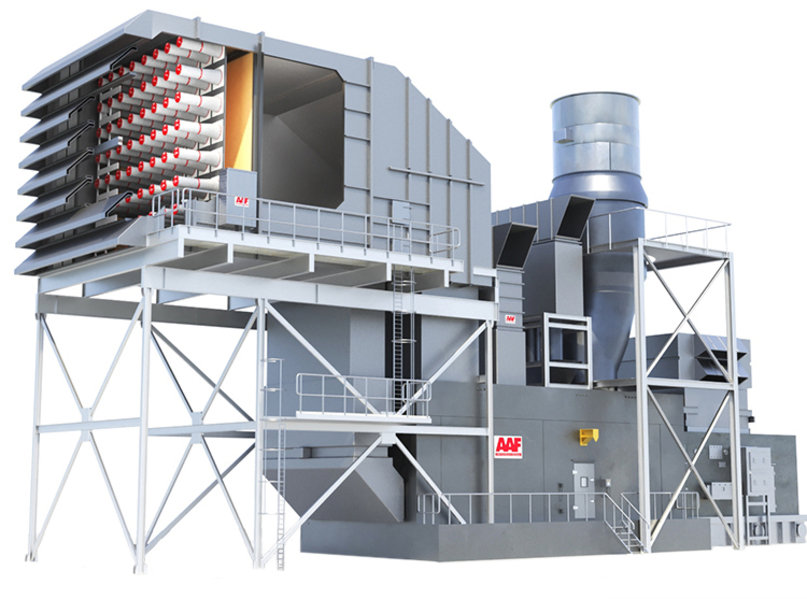

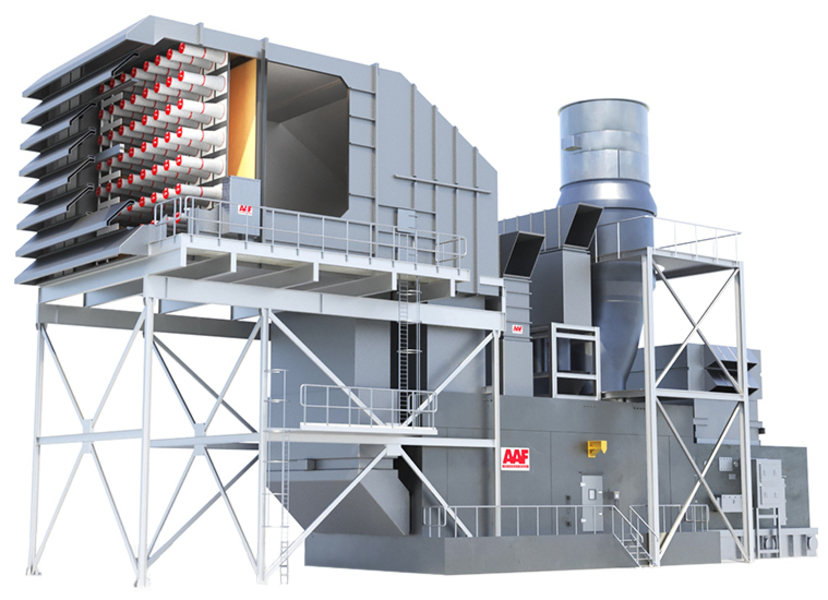

#5 Gas Turbine Air Filtration Solutions

Domain Est. 1997

Website: aafintl.com

Key Highlights: Maximize gas turbine efficiency with AAF’s proven air filtration systems with 50+ years expertise protecting turbines worldwide….

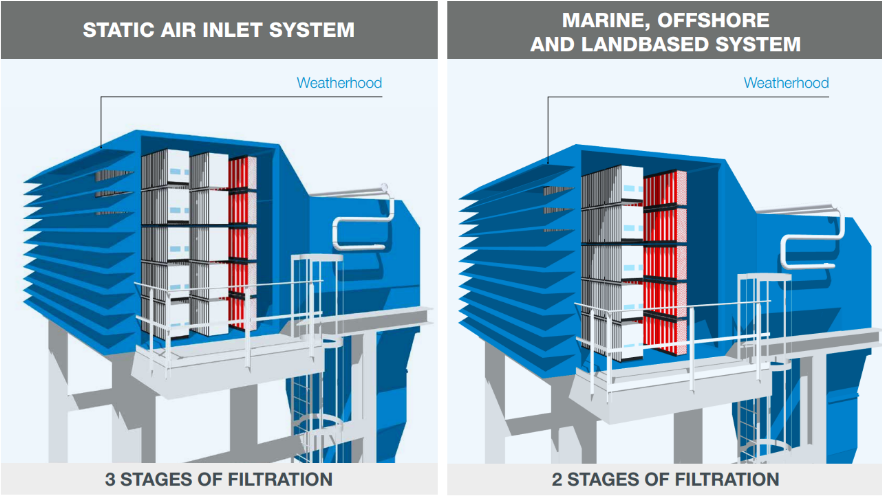

#6 Gas Turbine Air Filters & Solutions

Domain Est. 1998

Website: camfil.com

Key Highlights: Maximize gas turbine efficiency with Camfil’s advanced air intake systems. Protect your turbomachinery from contaminants and ensure optimal performance….

#7 Gas Turbine Intake Filter Systems

Domain Est. 1998

Website: airfiltration.mann-hummel.com

Key Highlights: Explore our selection of filters for gas turbine intake filter systems applications ✓ VB4 Ultra ✓ ProCell Plus MIF ✓ Separation and Filtration ✓ Filters….

#8 Gas Turbine Inlet Air Filtration

Domain Est. 2015

Website: nedermanmikropul.com

Key Highlights: Nederman Pneumafil designs and manufactures inlet air filtration systems which ensure turbines continually operate at maximum output efficiency….

#9 Performance Upgrade For Gas Turbines

Website: emw.de

Key Highlights: We can upgrade your gas turbines’ performance with expertly engineered systems and solutions made up of our coalescers, pocket filters, filter cells, (H)EPA ……

Expert Sourcing Insights for Gas Turbine Air Filters

H2: Projected Market Trends for Gas Turbine Air Filters in 2026

The global gas turbine air filter market is poised for significant evolution by 2026, driven by increasing energy demands, stricter environmental regulations, and advancements in filtration technologies. As industries continue to prioritize operational efficiency and emissions reduction, the role of high-performance air filtration systems in gas turbines has become increasingly critical. This analysis identifies key trends expected to shape the gas turbine air filter market in 2026 under the H2 framework—highlighting Hydrogen Readiness, High-Efficiency Filtration, and Hybrid Monitoring Systems.

1. Hydrogen Readiness (H2 as Fuel Transition)

With the global push toward decarbonization, hydrogen (H2) is emerging as a pivotal clean energy carrier. By 2026, many gas turbine manufacturers are expected to transition toward hydrogen-compatible turbines, capable of burning blends of natural gas and hydrogen (up to 100% H2 in pilot projects). This shift necessitates re-engineering of air intake systems, as hydrogen combustion alters airflow dynamics and increases sensitivity to particulate contamination. Gas turbine air filters will need to meet new standards for moisture resistance, particulate capture efficiency, and compatibility with higher flow rates associated with hydrogen-fueled operations. Suppliers investing in H2-ready filtration solutions—such as hydrophobic media and enhanced coalescing filters—are likely to gain a competitive edge.

2. High-Efficiency Filtration (H2 as Performance Standard)

The demand for high-efficiency particulate air (HEPA) and ultra-low penetration air (ULPA) filtration in gas turbines will grow by 2026, particularly in regions with high levels of airborne contaminants—such as coastal, desert, and industrial zones. Advanced synthetic media, nanofiber coatings, and multi-stage filtration systems are expected to dominate the market, offering improved dust-holding capacity, reduced pressure drop, and longer service life. Regulatory standards, such as ISO 16890, will drive adoption of performance-based filtration solutions. Additionally, combined cycle power plants and data center backup generators will increasingly prioritize filter efficiency to protect turbine blades and maintain optimal performance, reducing maintenance costs and unplanned downtime.

3. Hybrid Monitoring Systems (H2 as Smart Integration)

By 2026, digitalization will play a central role in air filter management through the integration of hybrid monitoring systems. These systems combine IoT-enabled sensors, predictive analytics, and cloud-based platforms to monitor filter performance in real time—tracking differential pressure, humidity, particulate loading, and remaining service life. This “smart filtration” approach enables predictive maintenance, reduces operational risks, and improves energy efficiency. Hybrid systems may also integrate with turbine control systems to dynamically adjust airflow or trigger filter replacement alerts. As digital twin technology matures, operators will simulate filter performance under various environmental conditions, optimizing selection and deployment strategies.

Conclusion

The 2026 gas turbine air filter market will be shaped by the convergence of clean energy transitions (H2 fuel), performance demands (high-efficiency filtration), and digital innovation (hybrid monitoring). Manufacturers and end-users who align with these H2-driven trends—Hydrogen Readiness, High-Efficiency Filtration, and Hybrid Monitoring Systems—will be best positioned to meet the evolving requirements of power generation, aerospace, and industrial sectors in a more sustainable and technologically advanced landscape.

H2: Common Pitfalls When Sourcing Gas Turbine Air Filters (Quality & Intellectual Property)

Sourcing gas turbine air filters involves more than just finding the lowest price—critical factors such as filter quality and intellectual property (IP) compliance can significantly impact turbine performance, longevity, and operational safety. Below are the most common pitfalls to avoid:

1. Prioritizing Cost Over Quality

One of the most frequent mistakes is selecting filters based solely on cost. Low-cost filters may use inferior media, substandard structural materials, or inconsistent manufacturing processes. This can result in:

– Reduced filtration efficiency, allowing harmful particulates into the turbine.

– Shorter service life, increasing maintenance frequency and downtime.

– Higher pressure drop, reducing turbine efficiency and power output.

2. Lack of Compliance with OEM Specifications

Many operators unknowingly purchase filters that deviate from Original Equipment Manufacturer (OEM) specifications. Even minor differences in dimensions, media type, or sealing mechanisms can lead to:

– Poor fitment and air bypass.

– Voided turbine warranties.

– Decreased performance or damage to compressor blades.

Always verify that filters meet OEM performance standards (e.g., ISO 29463, ASHRAE 52.2) and are tested under real-world conditions.

3. Inadequate Documentation and Traceability

Reputable suppliers provide full documentation, including test reports, material certifications, and performance data. Pitfalls arise when:

– Suppliers cannot provide evidence of filter testing (e.g., efficiency, dust holding capacity, fire resistance).

– There is no batch traceability, making root-cause analysis difficult during failures.

Ensure full transparency in the supply chain and demand complete technical dossiers.

4. Intellectual Property (IP) Infringement Risks

Using or sourcing “OEM-equivalent” or “pattern” filters can expose organizations to legal risk if:

– The design copies patented filter geometry, pleating patterns, or sealing technologies.

– Trademarks or branding are mimicked, leading to potential infringement claims.

Always confirm that third-party filters are reverse-engineered legally and do not violate IP rights. Consider suppliers who license technology or design their own proprietary solutions.

5. Insufficient Environmental Adaptation

Gas turbines operate in diverse environments (desert, coastal, industrial). A common pitfall is using generic filters not designed for specific conditions, leading to:

– Rapid clogging in high-dust environments.

– Corrosion in saline or high-humidity areas.

– Poor performance during seasonal changes (e.g., pollen, sandstorms).

Choose filters engineered for your site’s environmental profile, including appropriate pre-filters, hydrophobic coatings, or anti-static properties.

6. Unverified Supplier Credibility

Not all suppliers have the technical expertise or manufacturing control to produce reliable turbine filters. Red flags include:

– No in-house R&D or testing facilities.

– Inconsistent lead times or quality variances between batches.

– Lack of industry certifications (e.g., ISO 9001, ISO 14001).

Conduct due diligence on suppliers through audits, references, and sample testing before committing to large orders.

Conclusion

To avoid compromising gas turbine reliability and efficiency, prioritize quality assurance, OEM compatibility, and IP compliance when sourcing air filters. Partner with technically capable, transparent suppliers who provide documented performance data and respect intellectual property rights.

Logistics & Compliance Guide for Gas Turbine Air Filters

Overview of Gas Turbine Air Filter Requirements

Gas turbine air filters are critical components in power generation, oil & gas, and industrial applications, protecting turbines from particulate contaminants that can cause erosion, fouling, and reduced efficiency. Due to their specialized function, the logistics and compliance requirements for these filters are stringent, involving careful handling, storage, transportation, and adherence to international and industry-specific regulations.

Classification and Regulatory Framework

Gas turbine air filters are typically classified under Harmonized System (HS) Code 8421.39 (parts for air filtering machinery). Depending on materials (e.g., synthetic media, metal housings), additional classifications may apply. Key regulatory frameworks include:

– ISO 16890: Global standard for air filter classification based on particle size efficiency (ePM1, ePM2.5, ePM10).

– EN 779 (legacy)/ISO 16890 (current): European standards for filter performance.

– ASME PCC-10: Guidelines for gas turbine inlet systems, including filtration.

– ATEX Directive 2014/34/EU: Required if filters are used in explosive atmospheres (e.g., offshore platforms).

– REACH and RoHS: Compliance needed if filters contain restricted substances (e.g., certain flame retardants or heavy metals).

Export controls may apply if filters are used in military or dual-use applications (e.g., ITAR or EAR regulations in the U.S.).

Packaging and Handling Specifications

Proper packaging is essential to maintain filter integrity:

– Use moisture-resistant, crush-proof packaging with internal supports to prevent deformation.

– Seal filters in vapor corrosion inhibitors (VCI) or vacuum bags if stored in humid environments.

– Label packages with orientation arrows, “Fragile,” and “Do Not Stack” warnings.

– Protect pleated media from compression and punctures during handling.

For oversized or custom filters, crating with wooden frames may be required.

Storage Conditions and Shelf Life

- Store filters in a clean, dry, temperature-controlled environment (15°C–30°C / 59°F–86°F).

- Relative humidity should not exceed 70% to prevent media degradation or microbial growth.

- Avoid direct sunlight and exposure to ozone or chemical fumes.

- Shelf life typically ranges from 2 to 5 years, depending on media type; inspect seals and packaging before installation.

- Rotate stock using FIFO (First In, First Out) inventory management.

Transportation and Shipping Logistics

- Use enclosed, climate-controlled trucks or containers for long-distance or international shipments.

- Secure filters to prevent movement; avoid stacking heavy items on top.

- For air freight, ensure compliance with IATA Dangerous Goods Regulations if filters contain treated media (e.g., oil-impregnated or antimicrobial coatings).

- Provide detailed shipping documentation including:

- Commercial invoice

- Packing list with weights and dimensions

- Certificate of Conformance (COC) to ISO 16890 or project-specific specs

- Material Safety Data Sheet (MSDS), if applicable

Cold chain logistics may be needed in extreme climates.

Import/Export Documentation and Clearance

Key documents for international trade include:

– Bill of Lading / Air Waybill

– Certificate of Origin (preferential or non-preferential)

– Import licenses (if required by destination country)

– Customs valuation declaration

Be aware of country-specific requirements:

– U.S. Customs: May require EPA or DOT documentation if filters involve hazardous materials.

– GCC Countries: Conformity assessment programs like SASO may apply.

– China: Requires CCC mark if part of a larger regulated system.

Engage a customs broker familiar with industrial components.

Quality Assurance and Traceability

- Each filter batch should have a unique serial or batch number for traceability.

- Maintain quality records including:

- Test reports (efficiency, pressure drop, dust holding capacity)

- Raw material certifications

- Manufacturing date and location

- Implement a documented quality management system (e.g., ISO 9001).

End-users often require full audit trails for compliance with operational safety standards.

Disposal and Environmental Compliance

Used gas turbine air filters may be classified as industrial waste and require proper disposal:

– Assess for hazardous content (e.g., oil, heavy metals, bioaerosols).

– Follow local regulations (e.g., EPA RCRA in the U.S., WEEE or ELV directives in the EU).

– Partner with certified waste management providers for recycling or incineration.

– Document disposal for environmental compliance audits.

Some media types (e.g., cellulose-based) are biodegradable and may be processed accordingly.

Best Practices for Supply Chain Management

- Partner with certified suppliers who adhere to international standards.

- Conduct periodic supplier audits for quality and compliance.

- Use digital tracking (e.g., barcodes, RFID) for real-time inventory visibility.

- Maintain safety stock for critical spares to prevent turbine downtime.

- Train logistics personnel on filter-specific handling and regulatory requirements.

Adhering to this guide ensures reliable performance, regulatory compliance, and operational continuity in gas turbine operations.

Conclusion for Sourcing Gas Turbine Air Filters

Sourcing the right gas turbine air filters is a critical factor in ensuring optimal performance, reliability, and longevity of gas turbine operations. High-quality air filters protect the turbine from harmful contaminants such as dust, moisture, oil, and particulate matter, which can lead to erosion, fouling, and reduced efficiency. When selecting air filters, it is essential to consider factors such as filtration efficiency, environmental conditions (e.g., coastal, desert, or industrial areas), differential pressure, service life, and compatibility with the turbine model.

A strategic sourcing approach should involve evaluating reputable suppliers offering certified, OEM-approved, or equivalent filters that meet industry standards (such as ISO 5011 or ASHRAE). Total cost of ownership—not just initial purchase price—should guide decisions, as superior filters can reduce maintenance downtime, lower fuel consumption, and extend time between overhauls.

Furthermore, implementing a robust supply chain with reliable lead times and inventory management helps prevent unplanned outages. Partnering with suppliers who provide technical support, field testing, and customized filtration solutions can significantly enhance operational efficiency.

In conclusion, investing in high-performance, well-sourced air filters is a proactive measure that delivers long-term operational and financial benefits. It ensures maximum turbine efficiency, reduces lifecycle costs, and supports uninterrupted power generation or industrial processes in demanding environments.