The global forklift market is undergoing robust expansion, fueled by rising industrial automation, e-commerce logistics demand, and infrastructure development. According to Mordor Intelligence, the forklift market was valued at USD 73.7 billion in 2023 and is projected to grow at a CAGR of over 6.5% through 2029, with gas-powered forklifts maintaining a significant share, particularly in regions prioritizing outdoor operations and quick refueling cycles. Gas forklifts—commonly powered by liquefied petroleum gas (LPG) or compressed natural gas (CNG)—offer a reliable alternative to electric models in environments where continuous operation and performance in variable weather conditions are critical. As industries from warehousing to construction seek efficient material handling solutions, leading manufacturers are innovating to improve fuel efficiency, reduce emissions, and integrate smart technology. This growing demand underscores the importance of identifying the top players shaping the gas forklift segment. Based on market presence, technological advancement, and global reach, the following are the top 10 gas forklift manufacturers driving the industry forward.

Top 10 Gas Forklift Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Leading Forklift Manufacturer

Domain Est. 1996

Website: hyster.com

Key Highlights: Hyster is a global forklift manufacturer known for award-winning designs, industrial-strength components, and high-tech manufacturing….

#2 Yale Lift Truck Technologies

Domain Est. 1994

Website: yale.com

Key Highlights: Yale’s forklifts and lift trucks are designed to tackle your biggest challenges. Discover how our technology can boost your warehouse productivity!…

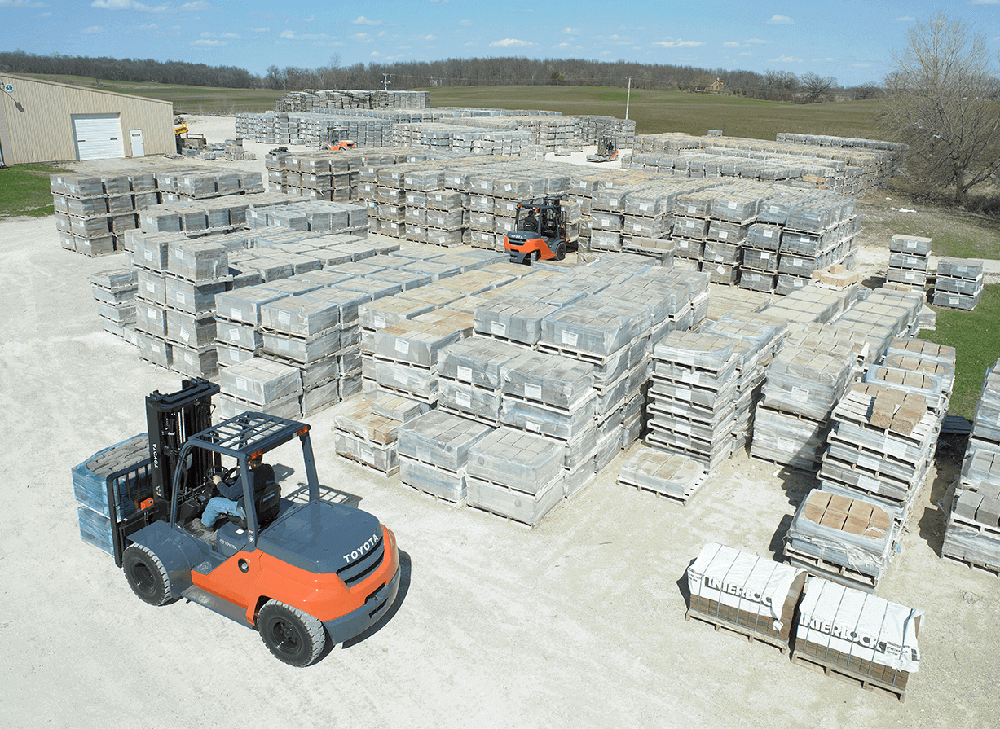

#3 Toyota Forklifts

Domain Est. 1996

Website: toyotaforklift.com

Key Highlights: Toyota Forklifts is the leader in material handling and industrial lift trucks and equipment. Learn about our solutions to maximize your warehouse ……

#4 Cat® Lift Trucks EAME

Domain Est. 1999

Website: catlifttruck.com

Key Highlights: Cat® Lift Trucks are one of the leading manufacturers of forklift trucks and materials handling equipment with a network of dealers across Europe, Africa and ……

#5 Forklifts

Domain Est. 1995

Website: komatsu.com

Key Highlights: Enhance your operation with high-quality, durable, high-performing forklifts from Komatsu. We combine our long history of rigorous engineering in construction ……

#6 CLARK Material Handling Company

Domain Est. 1996

Website: clarkmhc.com

Key Highlights: CLARK offers products in all five classes, including powered pallet jacks, electric standup forklifts, narrow aisle forklifts, walkie pallet stackers, order ……

#7 Forklifts & Lift Trucks

Domain Est. 1997

Website: bobcat.com

Key Highlights: As a complete material handling solutions provider, Bobcat offers a full range of IC, LPG and electric forklifts, with capacities ranging from 3,000 to ……

#8 Mitsubishi Forklift Trucks

Domain Est. 1999

Website: mitforklift.com

Key Highlights: Our class-leading diesel and LPG forklifts trucks deliver powerful, efficient and reliable performance. Handling up to 16.0 tonnes….

#9 Lightest, fastest, versatile truck-mounted forklift

Domain Est. 2000

Website: donkeyforklift.com

Key Highlights: Donkey Forklifts are engineered for speed, simplicity, and serious performance — giving your customers the edge on every job site. When you carry Donkey, you’re ……

#10 Gas Forklifts

Domain Est. 2001

Website: linde-mh.com

Key Highlights: Gas forklifts from Linde with load capacities from 1.4 to 8 tonnes ✓ Efficient ✓ Powerful ✓ Versatile ▻ Discover all models here….

Expert Sourcing Insights for Gas Forklift

2026 Market Trends for Gas Forklifts: A Strategic Outlook

As the material handling industry evolves, gas-powered forklifts—primarily those running on liquefied petroleum gas (LPG) and, to a lesser extent, gasoline—face both persistent demand and mounting challenges by 2026. While electrification continues to accelerate, gas forklifts retain strategic relevance in specific sectors and geographies. Here are the key trends shaping the gas forklift market in 2026:

1. Resilient Niche Demand Amid Electrification Pressure

Despite the strong growth trajectory of electric forklifts, gas forklifts remain indispensable in applications requiring high power, rapid refueling, and outdoor/indoor flexibility. By 2026, industries such as construction, lumber, waste management, and cold storage (where battery performance dips) will continue to rely on LPG units. Their ability to operate continuously with quick fuel swaps supports multi-shift operations where battery charging downtime is prohibitive.

2. Geographic and Regional Market Divergence

The demand for gas forklifts in 2026 will be regionally segmented. Mature markets like North America and parts of Europe will see gradual declines as electrification incentives and stricter emissions regulations (e.g., EU Stage V) take effect. Conversely, emerging economies in Asia-Pacific, Latin America, and parts of Africa will sustain demand due to lower upfront costs, underdeveloped charging infrastructure, and established LPG distribution networks.

3. Integration of Advanced Emission Control Technologies

To comply with tightening environmental standards, OEMs will continue enhancing gas forklift engines with advanced emission control systems. By 2026, expect widespread adoption of three-way catalysts, closed-loop fuel management, and improved combustion efficiency. These upgrades ensure gas forklifts meet regulatory thresholds while maintaining performance—particularly crucial in regions enforcing low-emission zones.

4. Hybridization and Fuel Diversification Exploration

While not yet mainstream, some manufacturers are exploring hybrid gas-electric systems or alternative gaseous fuels (e.g., renewable propane, biogas) to future-proof their offerings. These innovations aim to reduce carbon footprints and align with sustainability goals, potentially extending the lifecycle of gas-powered platforms in a greener logistics ecosystem.

5. Focus on Total Cost of Ownership (TCO) Advantages

Gas forklifts will maintain a competitive edge in TCO for certain operations. Lower initial acquisition costs, established maintenance networks, and minimal investment in charging infrastructure make them attractive for SMEs and rental fleets. In 2026, vendors will emphasize lifecycle cost models that highlight these benefits, particularly in markets where capital expenditure constraints are significant.

6. Rental and Fleet Flexibility Drivers

The rental market will remain a stronghold for gas forklifts. Their versatility across indoor/outdoor settings, ease of refueling, and suitability for temporary or seasonal work make them ideal for rental fleets. In 2026, rental companies will continue to stock LPG models to meet diverse customer needs, especially in construction and event logistics.

In summary, while the long-term direction of the forklift industry leans toward electrification, gas forklifts will hold a resilient, purpose-driven position in 2026. Success will depend on targeting high-value niches, leveraging regional market dynamics, and enhancing sustainability through technological upgrades.

Common Pitfalls Sourcing Gas Forklifts (Quality, IP)

Sourcing gas forklifts, especially from international suppliers or unfamiliar manufacturers, carries significant risks related to both product quality and intellectual property (IP). Failing to address these pitfalls can lead to operational downtime, safety hazards, financial loss, and legal complications.

Quality-Related Pitfalls

-

Inadequate Safety & Regulatory Compliance:

- Risk: Forklifts failing to meet critical safety standards (e.g., OSHA in the US, CE in Europe, AS/NZS in Australia/NZ, GB standards in China). This includes issues with structural integrity, braking systems, load capacity verification, operator protection (ROPS/FOPS), and gas system safety (leak detection, ventilation).

- Consequence: Increased risk of accidents, injuries, fatalities, and severe regulatory fines. Equipment may be impounded or banned from use on site.

- Mitigation: Demand and verify original, valid certifications (e.g., CE Declaration of Conformity, UL listing, local market approvals) from accredited testing bodies. Conduct independent third-party inspections (pre-shipment inspection – PSI) focusing on safety-critical components.

-

Substandard Component Quality & Workmanship:

- Risk: Use of inferior materials (thin steel for masts, weak castings), low-quality engines/ transmissions (prone to overheating, premature failure), cheap hydraulic components (leaks, inconsistent performance), and poor welding/construction.

- Consequence: Frequent breakdowns, high repair costs, reduced lifespan, decreased productivity, and potential safety failures during lifting.

- Mitigation: Audit the manufacturer’s facility if possible. Review component supplier lists and specifications. Require detailed technical specifications and material certifications. PSI should include rigorous checks on materials, welds, and component authenticity.

-

Inaccurate or Inflated Specifications:

- Risk: Suppliers overstating lift capacity, lift height, engine power, or fuel efficiency. Real-world performance falls significantly short.

- Consequence: Forklift is unsuitable for required tasks, leading to operational inefficiency, safety risks when overloaded, and inability to meet production demands.

- Mitigation: Insist on test reports from independent labs (e.g., TUV, SGS) verifying key performance metrics under standardized conditions (e.g., ISO 5083, ISO 5084). Conduct performance testing upon delivery.

-

Poor Emissions Compliance:

- Risk: Engines failing to meet local or international emissions standards (e.g., EPA Tier 4 Final, EU Stage V). Using older, dirtier engines.

- Consequence: Inability to operate legally in regulated areas (warehouses, ports, cities), environmental fines, and damage to corporate sustainability goals.

- Mitigation: Require proof of specific emissions certification (e.g., EPA Certificate of Conformity, EU Type Approval) matching the exact engine model and application. Verify certification numbers with the issuing authority.

-

Inadequate After-Sales Support & Spare Parts:

- Risk: Unreliable or non-existent service network, long lead times for critical spare parts, lack of trained technicians, or parts quality issues.

- Consequence: Extended downtime during breakdowns, high operational costs, and premature abandonment of the fleet.

- Mitigation: Evaluate the supplier’s global service network before purchase. Negotiate service level agreements (SLAs) and warranty terms. Verify the availability and lead times for common spare parts. Consider stocking critical spares.

Intellectual Property (IP) – Related Pitfalls

-

Counterfeit or “Knock-off” Equipment:

- Risk: Sourcing forklifts that are illegal copies of reputable brands (e.g., mimicking Toyota, Hyster, Jungheinrich styling and naming). These are often built with inferior components and lack genuine engineering.

- Consequence: Severe quality and safety risks, potential legal action from the IP rights holder against both the manufacturer and the buyer for infringement, immediate seizure of equipment, reputational damage.

- Mitigation: Deal only with authorized distributors or the OEM directly. Be extremely wary of prices significantly below market. Verify the manufacturer’s identity and branding legitimacy. Research the supplier thoroughly. Insist on proof of genuine brand authorization if applicable.

-

“OEM” Misrepresentation:

- Risk: Suppliers falsely claiming to be the “Original Equipment Manufacturer” (OEM) when they are merely assemblers or resellers of generic or unbranded equipment, or when they build for a different major brand.

- Consequence: Lack of true engineering control, inconsistent quality, difficulty obtaining genuine support, potential IP confusion.

- Mitigation: Verify the supplier’s actual role and manufacturing capability. Request documentation proving their relationship with any brand they claim to represent. Distinguish between true OEMs and ODMs (Original Design Manufacturers) or assemblers.

-

Use of Stolen or Copied Design/Technology:

- Risk: The forklift incorporates design elements, control systems, or proprietary technology (e.g., specific mast designs, electronic control units) copied without license from a major manufacturer.

- Consequence: While the immediate risk might seem lower than counterfeit, the equipment can still be subject to IP infringement claims and seizure. Quality and reliability of copied technology are often poor.

- Mitigation: Choose reputable suppliers with transparent supply chains. Be cautious of designs that look too similar to market leaders. Include IP warranty clauses in contracts stating the supplier indemnifies the buyer against IP infringement claims.

-

Weak or Absent IP Protection in Contracts:

- Risk: Failure to secure clear contractual guarantees regarding the authenticity of the product and freedom from IP infringement.

- Consequence: No legal recourse if the equipment is seized due to IP violations. Financial losses borne solely by the buyer.

- Mitigation: Include explicit IP indemnity clauses in the purchase contract. The supplier must warrant the equipment is genuine, not infringing, and agree to defend and compensate the buyer for any resulting losses (fines, seizure costs, downtime).

Conclusion: Sourcing gas forklifts requires diligent due diligence focused on both tangible quality attributes and intangible IP legitimacy. Prioritize suppliers with proven track records, verifiable certifications, robust quality systems, transparent operations, and clear IP standing. Invest in pre-shipment inspections and legal protections to mitigate the significant risks associated with poor quality and IP violations.

Logistics & Compliance Guide for Gas Forklifts

Introduction to Gas Forklift Operations

Gas-powered forklifts, including those running on liquefied petroleum gas (LPG), compressed natural gas (CNG), or gasoline, are widely used in material handling due to their power, versatility, and outdoor suitability. However, their operation, transportation, and maintenance involve specific logistical and compliance requirements to ensure safety, regulatory adherence, and operational efficiency.

Regulatory Compliance Overview

Gas forklifts are subject to various national and international regulations concerning emissions, workplace safety, and fuel handling. Key standards include:

– OSHA (Occupational Safety and Health Administration): Governs forklift operator training, workplace safety, and fueling procedures in the U.S.

– EPA (Environmental Protection Agency): Regulates emissions standards for non-road engines, including gas forklifts.

– NFPA 58 (National Fire Protection Association): Provides guidelines for the safe storage and handling of LPG.

– DOT (Department of Transportation): Regulates the transportation of gas cylinders and fueled equipment.

– ANSI/ITSDF B56.1: Safety standard for low- and high-lift trucks, including design and operational requirements.

Operator Training and Certification

All operators must be trained and certified in accordance with OSHA 29 CFR 1910.178. Training must include:

– Pre-operational inspection procedures

– Safe fueling practices (especially for LPG systems)

– Understanding load capacity and center of gravity

– Emergency response for gas leaks or fires

– Refresher training every three years or after incidents

Fuel Handling and Storage

Proper fuel management is critical for safety and compliance:

– LPG Cylinders: Must be stored upright in well-ventilated, designated areas away from ignition sources.

– DOT Compliance: Cylinders must be DOT-approved and regularly inspected (requalified every 5–10 years).

– Ventilation: Indoor use requires adequate ventilation to prevent gas accumulation.

– Leak Detection: Use of leak-detection solutions or electronic sensors during fuel changes.

Pre-Operation Inspection Requirements

Daily pre-use inspections are mandatory and should include:

– Checking for fuel leaks in hoses, fittings, and connections

– Verifying cylinder security and valve integrity

– Inspecting exhaust system condition

– Confirming proper operation of warning devices and safety systems

– Ensuring the fire extinguisher is present and charged

Transportation and Logistics

When transporting gas forklifts:

– LPG Cylinders: Must be disconnected and transported separately in approved containers if required by DOT regulations.

– Securing Equipment: Forklifts must be immobilized on trailers using wheel chocks and straps.

– Ventilation: Enclosed transport vehicles must allow for ventilation to prevent gas buildup.

– Documentation: Maintain records of cylinder inspections, maintenance, and operator certifications.

Maintenance and Servicing

Scheduled maintenance ensures compliance and extends equipment life:

– Follow manufacturer-recommended service intervals

– Use only qualified technicians for fuel system repairs

– Keep detailed maintenance logs for audits and compliance checks

– Replace worn hoses, valves, and regulators promptly

Emissions and Environmental Compliance

Gas forklifts contribute to air pollution and must meet EPA Tier 4 or equivalent emissions standards:

– Use certified low-emission engines where applicable

– Perform regular emissions testing if required by local regulations

– Implement idle-reduction policies to minimize exhaust output

– Consider transitioning to cleaner alternatives (e.g., electric) in enclosed or urban environments

Incident Reporting and Emergency Procedures

Establish clear protocols for emergencies:

– Immediate shutdown procedures for gas leaks or fires

– Evacuation plans and fire suppression systems in fueling areas

– Reporting incidents to OSHA if they result in injury, hospitalization, or significant damage

– Regular drills for spill response and fire evacuation

Recordkeeping and Audits

Maintain comprehensive documentation to demonstrate compliance:

– Operator training certificates

– Equipment inspection logs (daily, monthly, annual)

– Maintenance and repair records

– Fuel cylinder inspection and requalification dates

– Incident reports and corrective actions taken

Conclusion and Best Practices

Ensuring safe and compliant operation of gas forklifts requires a proactive approach to logistics, training, and regulatory adherence. By implementing structured procedures, conducting regular audits, and fostering a culture of safety, organizations can minimize risks, avoid penalties, and maintain efficient material handling operations. Regularly review regulations and update internal policies to reflect changes in standards or technology.

Conclusion for Sourcing a Gas Forklift:

After evaluating operational needs, cost considerations, environmental impact, and long-term sustainability, sourcing a gas-powered forklift proves to be a practical and reliable solution for many material handling applications—particularly in environments where indoor air quality standards allow for their use and where electric charging infrastructure may be limited.

Gas forklifts offer strong performance, rapid refueling capabilities, and consistent power output, making them ideal for high-intensity operations and outdoor use. They are also generally more affordable upfront compared to electric models and require less downtime, which can enhance productivity in demanding work settings.

However, ongoing fuel and maintenance costs, emissions, and noise levels are important factors that must be managed responsibly. As sustainability and regulatory compliance become increasingly important, businesses should also consider future transition options toward cleaner technologies.

In conclusion, sourcing a gas forklift is a viable and efficient choice for operations requiring robust, flexible lifting equipment—provided that the total cost of ownership, environmental impact, and long-term operational goals are carefully balanced. Organizations should continue monitoring advancements in alternative fuel technologies to ensure long-term competitiveness and sustainability.