The global market for internal combustion engines, including gas-powered vertical shaft engines, continues to expand, driven by rising demand in agricultural machinery, construction equipment, and power generation applications. According to Grand View Research, the global small gasoline engine market was valued at USD 12.3 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030. This growth is fueled by increasing mechanization in developing economies, rising adoption of lawn and garden equipment, and the critical need for reliable off-grid power solutions. Vertical shaft gas engines, in particular, are favored in applications requiring compact design and direct coupling to equipment such as pumps, mowers, and industrial fans. With North America and Asia Pacific leading in production and consumption, key manufacturers are investing in fuel-efficient, low-emission technologies to meet regulatory standards and evolving customer demands. Against this backdrop, the following analysis highlights the top seven manufacturers excelling in innovation, market reach, and vertical shaft engine performance.

Top 7 Gas Engine Vertical Shaft Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 GX Commercial Series Engines

Domain Est. 1989

Website: engines.honda.com

Key Highlights: Honda GX series commercial grade engines are legendary. For reliable, easy-starting, fuel efficient performance, insist on a Honda GX Series Engine….

#2 Vertical Shaft Mower & Utility Engines

Domain Est. 1996

Website: briggsandstratton.com

Key Highlights: Briggs & Stratton offers a complete line of easy-starting engines with the power to cut tall, thick grass. Learn more here!…

#3 Honda Engines Vertical Shaft Replacement Engines

Domain Est. 1998

#4 Vertical Shaft V-Twin Engines

Domain Est. 2001

Website: vanguardpower.com

Key Highlights: Vanguard® vertical shaft gas engines are built to work as hard as you do. See our full vertical shaft engine line, from Small Block V-Twin to 810cc V-Twin….

#5 Briggs Vertical Shaft Engines

Domain Est. 2002

#6 WEG

Domain Est. 2004

Website: weg.net

Key Highlights: WEG provides global solutions for electric motors, variable frequency drives, soft starters, controls, panels, transformers, and generators….

#7 Small Vertical & Horizontal Shaft Engine Sizes

Domain Est. 2005

Website: carrollstream.com

Key Highlights: Free delivery over $100Browse horizontal and vertical shaft sizes for different small engines. Small gas engine shaft sizes by diameter for sale. Everything from Kohler, Kawasaki, …

Expert Sourcing Insights for Gas Engine Vertical Shaft

H2: 2026 Market Trends for Gas Engine Vertical Shaft

The global market for gas engine vertical shafts is expected to experience notable transformations by 2026, driven by evolving energy demands, technological advancements, and regional industrial dynamics. As industries continue shifting toward cleaner and more efficient power sources, natural gas-powered engines—particularly those utilizing vertical shaft configurations—are gaining traction across multiple sectors.

1. Increasing Demand in Power Generation and Cogeneration

By 2026, gas engine vertical shafts are projected to see heightened adoption in distributed power generation and combined heat and power (CHP) systems. With governments pushing for reduced carbon emissions, natural gas—being cleaner than coal or diesel—is becoming a preferred fuel for decentralized energy solutions. Vertical shaft engines, known for their compact design and ease of integration into modular systems, are especially suitable for small to medium-scale power plants, driving demand in both developed and emerging economies.

2. Growth in Industrial and Agricultural Applications

Vertical shaft gas engines are widely used in agricultural machinery (e.g., irrigation pumps, grain handling systems) and industrial equipment (e.g., compressors, generators). The expansion of mechanized farming in Asia-Pacific and Africa, coupled with infrastructure development, is expected to boost demand. These engines offer reliability and lower operational costs compared to diesel alternatives, making them ideal for remote or off-grid applications.

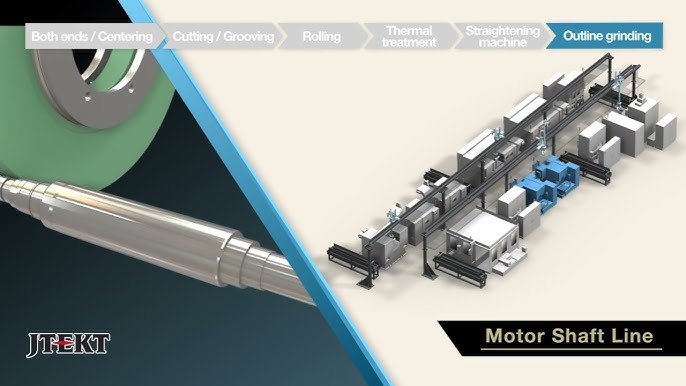

3. Technological Improvements and Efficiency Optimization

By 2026, manufacturers are anticipated to focus on enhancing engine efficiency, emissions control, and durability. Innovations such as electronic fuel injection (EFI), advanced combustion systems, and integration with IoT-based monitoring systems will improve performance and reduce maintenance costs. These advancements will make vertical shaft gas engines more competitive against electric and diesel counterparts, especially in hybrid setups.

4. Regional Market Dynamics

North America and Europe will remain key markets due to supportive environmental regulations and investments in natural gas infrastructure. Meanwhile, the Asia-Pacific region—led by China, India, and Southeast Asian countries—is expected to witness the highest growth rate, fueled by industrialization, urbanization, and rising energy needs. Local manufacturing and government incentives for clean energy adoption will further accelerate market penetration.

5. Challenges and Competitive Landscape

Despite growth, the market faces challenges such as fluctuating natural gas prices, competition from electric motors, and the long-term transition toward renewable energy. However, the transitional role of natural gas in decarbonization strategies ensures continued relevance for gas engine vertical shafts through 2026. Leading manufacturers are likely to focus on product diversification, aftermarket services, and strategic partnerships to maintain a competitive edge.

Conclusion

The 2026 outlook for gas engine vertical shafts is positive, with steady growth driven by energy transition trends, industrial demand, and technological innovation. While long-term sustainability will depend on integration with renewable systems and further emissions reductions, these engines are expected to play a critical role in the global shift toward cleaner, decentralized power solutions.

H2: Common Pitfalls in Sourcing Gas Engine Vertical Shaft (Quality & IP Risks)

Sourcing a Gas Engine Vertical Shaft involves critical technical specifications and significant intellectual property (IP) considerations. Overlooking key pitfalls can lead to performance failures, safety hazards, legal disputes, and costly delays. Here are the major risks to avoid:

H3: Quality-Related Pitfalls

-

Inadequate Material Specification & Verification:

- Pitfall: Accepting shafts made from substandard or incorrect grade steel (e.g., wrong alloy, insufficient hardness, poor heat treatment). This leads to premature wear, cracking, or catastrophic failure under torque and thermal stress.

- Mitigation: Define precise material specs (e.g., SAE 4140, AISI 4340, specific hardness HRC range, heat treatment process – quench & temper). Require material test reports (MTRs) and conduct independent hardness testing upon receipt.

-

Poor Dimensional Accuracy & Tolerances:

- Pitfall: Shafts out of tolerance for critical dimensions (diameter, length, keyway width/depth, runout, concentricity). Causes misalignment, excessive vibration, bearing premature failure, and reduced engine efficiency.

- Mitigation: Provide detailed engineering drawings with strict GD&T (Geometric Dimensioning and Tolerancing). Require First Article Inspection Reports (FAIR) and implement incoming inspection using calibrated CMMs or optical comparators.

-

Substandard Surface Finish & Machining:

- Pitfall: Rough surface finish (especially on bearing journals, seal areas, splines) accelerates wear, causes seal leakage, and creates stress risers initiating cracks.

- Mitigation: Specify exact surface finish requirements (Ra value) for all functional surfaces. Visually inspect and use profilometers for spot checks on critical areas.

-

Insufficient Fatigue & Dynamic Strength:

- Pitfall: Shafts failing under cyclic loading due to poor design, material flaws, or inadequate heat treatment. Gas engines impose significant torsional and bending stresses.

- Mitigation: Require design validation (FEA reports if possible) and proof of proper heat treatment. Specify minimum fatigue strength requirements if applicable. Source from suppliers with proven experience in high-stress rotating components.

-

Lack of Traceability & Process Control:

- Pitfall: Inability to trace material batch, heat treatment batch, or manufacturing process for a specific shaft. Makes root cause analysis impossible during failures.

- Mitigation: Demand full batch traceability (material mill certs, heat treat batch numbers, machine operator logs). Audit supplier quality management systems (ISO 9001).

H3: Intellectual Property (IP) Pitfalls

-

Unauthorized Copying / Reverse Engineering:

- Pitfall: Supplier produces a shaft based on reverse-engineering an OEM or competitor’s design without a valid license, infringing on patents or design rights. You become liable for using/stocking infringing parts.

- Mitigation: Crucial: Only source from suppliers who can provide documented proof of their right to manufacture (e.g., valid license agreement, design is non-protected or expired patents). Conduct IP due diligence on the design itself.

-

Ambiguous or Weak IP Clauses in Contracts:

- Pitfall: Contracts lack clear terms on ownership of designs, tooling, modifications, and background IP. Supplier claims ownership of improvements, or your proprietary design details are not protected.

- Mitigation: Use robust contracts with explicit clauses: Define background IP ownership, assign ownership of new IP developed for you to you, include strong confidentiality (NDA) and non-use provisions, and require warranties of non-infringement from the supplier.

-

Supplier Using Your Design Without Authorization:

- Pitfall: Supplier uses your provided drawings/specifications to manufacture and sell identical shafts to your competitors.

- Mitigation: Implement strict access controls to design data. Use NDAs. Include specific “sole sourcing” or “no third-party sales” clauses in the contract. Conduct regular audits.

-

Failure to Verify Patent Landscape:

- Pitfall: Sourcing a shaft design that is actively patented by another company, leading to cease-and-desist letters, injunctions, or damages.

- Mitigation: Conduct a Freedom-to-Operate (FTO) analysis before finalizing the design and sourcing strategy, especially for non-OEM parts. Consult IP counsel.

-

Overlooking Trade Secrets:

- Pitfall: Sharing proprietary manufacturing processes, heat treatment parameters, or material blends with the supplier without adequate protection.

- Mitigation: Clearly mark information as “Confidential” or “Trade Secret.” Ensure NDAs explicitly cover trade secrets and define obligations for safeguarding.

Key Takeaway: Successful sourcing requires rigorous technical validation and proactive IP management. Prioritize suppliers with strong quality systems, proven technical capability, and transparent IP practices. Never compromise on material specs, tolerances, and contractual IP protections.

Logistics & Compliance Guide for Gas Engine Vertical Shaft

Overview

This guide outlines the essential logistics and compliance considerations for the transportation, handling, storage, and regulatory adherence related to Gas Engine Vertical Shafts. These components are critical in power generation, industrial machinery, and oil & gas applications. Proper management ensures safety, regulatory compliance, and operational efficiency.

1. Product Classification and Identification

1.1 Product Description

A Gas Engine Vertical Shaft is a precision-engineered rotating component designed to transmit torque from a gas engine to driven equipment (e.g., pumps, compressors, generators). It is typically constructed from high-strength alloy steel and undergoes heat treatment for durability.

1.2 HTS Code (Harmonized Tariff Schedule)

- HTS Code (US): 8483.40.60 – Transmission shafts (including camshafts and crankshafts) for internal combustion engines

- Note: Verify country-specific codes for international shipments (e.g., EU TARIC, Canada HS Code).

1.3 UN Number and Hazard Classification

- UN Number: Not applicable (non-hazardous mechanical part)

- Hazard Class: Non-dangerous goods (unless contaminated with lubricants/oils)

2. Packaging and Handling Requirements

2.1 Packaging Standards

- Use wooden crates or heavy-duty cardboard with internal foam or corrugated dividers to prevent movement.

- Apply rust-inhibiting VCI (Vapor Corrosion Inhibitor) paper for long-term storage or humid environments.

- Seal packaging in moisture-resistant plastic if transporting through high-humidity regions.

2.2 Handling Instructions

- Use mechanical lifting equipment (e.g., forklifts, cranes with soft slings) for units over 25 kg.

- Avoid direct contact with bare hands; use gloves to prevent oil transfer and corrosion.

- Mark “Fragile,” “This Side Up,” and “Do Not Stack” on external packaging.

3. Storage Conditions

3.1 Environmental Controls

- Temperature: Store between 5°C and 40°C (41°F to 104°F)

- Humidity: Maintain below 60% RH to prevent corrosion

- Ventilation: Ensure dry, well-ventilated area; avoid exposure to salt spray or chemical fumes

3.2 Shelf Life and Rotation

- Inspect stored shafts every 6 months for corrosion or packaging degradation.

- Apply fresh protective coating if stored beyond 12 months.

- Use First-In, First-Out (FIFO) inventory method.

4. Transportation Logistics

4.1 Domestic Shipping (e.g., USA, EU)

- Mode: Truck or rail preferred for heavy components

- Secure loads using straps and anti-slip mats

- Comply with national freight regulations (e.g., FMCSA in the U.S.)

4.2 International Shipping

- Incoterms: Clearly define terms (e.g., FOB, DDP) in contracts

- Documentation Required:

- Commercial Invoice

- Packing List

- Certificate of Origin

- Bill of Lading (BOL) or Air Waybill (AWB)

4.3 Customs Clearance

- Ensure accurate product description and HTS code on customs forms.

- Provide manufacturer’s specifications if requested.

- Be prepared for potential inspections—maintain traceability records.

5. Regulatory and Compliance Requirements

5.1 Export Controls

- EAR (Export Administration Regulations – USA):

- Check Commerce Control List (CCL) – ECCN likely 9A991 (components for engines not controlled for nuclear, missile, etc.)

- License exceptions may apply (e.g., LVS, GBS) depending on destination and value

- Sanctioned Countries: Avoid export to embargoed nations (e.g., Iran, North Korea) without authorization

5.2 Environmental and Safety Standards

- REACH (EU): Confirm no restricted substances in coatings or lubricants

- RoHS Compliance: Not typically applicable, but verify if electronic sensors are integrated

- OSHA/WHMIS: Training required for handling large components to prevent injury

5.3 Industry-Specific Certifications

- ISO 9001:2015 (Quality Management)

- API Spec Q1 (for oil & gas applications)

- ISO 1940 (Balance quality requirements for shafts)

6. Import Considerations by Region

| Region | Key Requirements |

|——–|——————|

| USA | CBP entry filing, HTS classification, anti-dumping checks if applicable |

| EU | CE marking not required for standalone shafts, but traceability under MDR may apply |

| Canada | CBSA documentation, possible duties based on origin |

| Australia | Comply with Biosecurity import conditions (wooden packaging must be ISPM 15 treated) |

7. Risk Mitigation and Best Practices

- Insurance: Cover cargo for full replacement value during transit

- Traceability: Assign serial numbers and track with ERP or SCM systems

- Supplier Audits: Ensure manufacturing partners meet ISO and export compliance standards

- Labeling: Include part number, weight, country of origin, and handling symbols

8. Emergency and Non-Compliance Response

- Damage in Transit: Document with photos, file carrier claim, and initiate replacement process

- Customs Hold: Provide requested documentation promptly; engage customs broker if needed

- Regulatory Violation: Conduct internal audit, report to relevant authority if required, and revise compliance procedures

Conclusion

Proper logistics and compliance management for Gas Engine Vertical Shafts ensures uninterrupted supply chains and legal adherence. By following this guide, stakeholders can mitigate risks, reduce delays, and maintain quality and safety standards across the product lifecycle. Regular review of regulations and carrier performance is recommended to stay current with evolving requirements.

Conclusion for Sourcing Gas Engine Vertical Shaft:

In conclusion, sourcing a gas engine with a vertical shaft requires careful consideration of application requirements, equipment compatibility, fuel availability, maintenance needs, and total cost of ownership. Vertical shaft gas engines are ideal for a range of stationary and industrial applications—such as pumps, generators, compressors, and agricultural machinery—where space efficiency and direct power transmission are critical. After evaluating key suppliers, engine specifications, performance metrics, and support services, it is essential to select a reliable provider that offers durable, fuel-efficient, and emissions-compliant equipment. Additionally, incorporating lifecycle analysis and after-sales support into the sourcing decision ensures long-term reliability and operational efficiency. With the right approach, sourcing a vertical shaft gas engine can provide a robust and cost-effective power solution tailored to specific operational demands.