The global stainless steel kitchen sink market, which includes galvanized variants, is experiencing steady growth driven by rising construction activity, urbanization, and increasing consumer preference for durable, corrosion-resistant kitchen fixtures. According to Grand View Research, the global stainless steel kitchen sinks market size was valued at USD 3.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is further amplified by trends in residential renovation and the expansion of the hospitality sector, particularly in emerging economies. With demand on the rise, manufacturers are investing in advanced galvanization techniques to enhance product longevity and performance. In this evolving landscape, identifying leading galvanized steel sink manufacturers becomes critical for distributors, retailers, and builders seeking reliable, high-quality suppliers. Based on production capacity, geographic reach, innovation, and market presence, the following nine companies have emerged as key players shaping the future of the galvanized steel sink industry.

Top 9 Galvanized Steel Sink Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Pier & Anchor Manufacturer: New Construction Support

Domain Est. 2004

Website: cantsink.com

Key Highlights: Cantsink is the leading producer of new construction support products. American made helical piles, piers, anchors, and more….

#2 Industrial & Commercial Bathroom Sinks

Domain Est. 1997

Website: globalindustrial.com

Key Highlights: 30-day returnsWe offer a wide variety of wash stations, hand sinks, wash fountains, utility sinks, mop sinks & more for your commercial or industrial facility. Shop now….

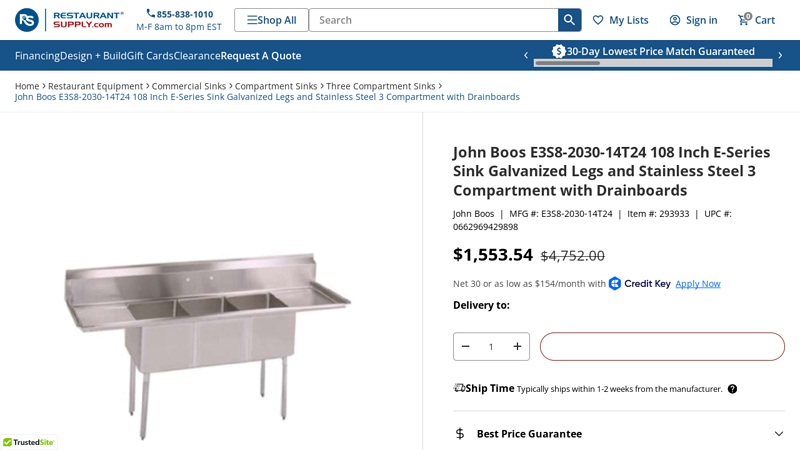

#3 John Boos E3S8

Domain Est. 1998

Website: restaurantsupply.com

Key Highlights: The John Boos E3S8-2030-14T24 E-Series Sink is a commercial-grade three-compartment sink designed for high-volume foodservice environments….

#4 Jones Stephens

Domain Est. 1999

Website: jonesstephens.com

Key Highlights: Galvanized Fittings · Brass Fittings. Back; Air & Drain Cocks · Cast Brass … Kitchen Sink Faucets. Back; Pull Down Faucets · Pull Out Faucets · Side Sprayers ……

#5 GSW

Domain Est. 2001

Website: gsw-usa.com

Key Highlights: GSW is dedicated to manufacture and distribute premium quality standard food service and custom made equipment….

#6 Mainline Collection: Mainline®

Domain Est. 2004

Website: mainlinecollection.com

Key Highlights: Galvanized Fittings · Lead Free* Bronze … Drop-in and stand out with these easy-to-install, classic-style stainless steel kitchen sinks from Mainline….

#7 Sapphire Manufacturing SMS

Domain Est. 2008

Website: culinarydepotinc.com

Key Highlights: In stock $91.92 deliverySapphire Manufacturing SMS-1515D 45″ W 18 Gauge Galvanized Sink. Shop all … Steel 18 Gauge 2-Compartment Sink. $680.97/ Each. Free shipping. Add to cart….

#8 Regency Restaurant Equipment (Storage, Plumbing & More)

Domain Est. 2011

Website: regencyequipment.com

Key Highlights: Find commercial-grade sinks, storage, shelving, plumbing, and more made by Regency to equip your commercial kitchen from top-to-bottom!…

#9 STEEL WORKS STAINLESS

Domain Est. 2021

Website: steelworks-stainless.com

Key Highlights: At Steelworks we only sell top quality 304 Stainless Tables and Sinks. All our offerings are 100% stainless steel never compromising on cheaper galvanized legs ……

Expert Sourcing Insights for Galvanized Steel Sink

2026 Market Trends for Galvanized Steel Sinks

The galvanized steel sink market is poised for notable shifts by 2026, driven by evolving consumer preferences, sustainability demands, and competitive dynamics within the broader kitchen and bathroom fixture industry. While still valued for its durability and cost-effectiveness, galvanized steel faces increasing pressure from alternative materials and changing design aesthetics.

Growing Emphasis on Sustainability and Eco-Friendly Materials

By 2026, sustainability will be a dominant force shaping consumer choices. Galvanized steel, being recyclable and long-lasting, holds an inherent environmental advantage. However, its reputation may be challenged by perceptions around the environmental impact of zinc coating processes and steel production emissions. Manufacturers will need to highlight lifecycle durability and recycling rates to compete against materials like recycled composite or bamboo-enhanced sinks. Transparency in sourcing and production will become critical for market positioning.

Intensifying Competition from Premium and Composite Alternatives

Galvanized steel sinks currently occupy a mid-to-lower tier in the market, particularly in residential applications. By 2026, competition from stainless steel, fireclay, and composite granite sinks is expected to intensify. Stainless steel—offering superior corrosion resistance and a more modern aesthetic—continues to dominate in both residential and commercial spaces. As consumers prioritize longevity and ease of maintenance, galvanized steel’s susceptibility to chipping and rust if damaged may deter buyers, especially in high-end renovations. Composite sinks, which combine durability with design versatility, are gaining traction, further squeezing galvanized steel’s market share.

Niche Applications and Industrial Demand

Despite residential headwinds, galvanized steel sinks will maintain relevance in specific niches. Commercial kitchens, agricultural facilities, workshops, and industrial environments continue to favor galvanized steel for its ruggedness and affordability. In rural or utility-focused homes, these sinks remain a practical choice for laundry rooms, mudrooms, or outdoor kitchens. By 2026, manufacturers may pivot toward specialized, heavy-duty models tailored to these segments, focusing on enhanced coatings and anti-corrosion treatments to extend product life.

Design and Aesthetic Limitations

A key challenge for galvanized steel sinks is their limited design flexibility. They typically come in basic shapes and a metallic gray finish, which clashes with contemporary kitchen trends favoring minimalist, integrated, and customizable designs. By 2026, unless innovations in coating or finish technology allow for more color and styling options, galvanized steel will remain a functional rather than a design-forward choice, limiting its appeal in modern home renovations.

Price Sensitivity and Emerging Markets

In price-sensitive regions and developing markets, galvanized steel sinks will retain strong demand due to their low cost and functional reliability. Economic fluctuations in 2026 could amplify demand in these areas, especially where infrastructure development drives need for affordable plumbing fixtures. However, in mature markets like North America and Western Europe, declining residential adoption may offset growth elsewhere.

In conclusion, the 2026 outlook for galvanized steel sinks is one of gradual market contraction in premium and residential segments, balanced by resilience in industrial and cost-conscious applications. Success will depend on innovation in corrosion protection, clearer sustainability messaging, and strategic targeting of niche markets where durability and value outweigh aesthetic considerations.

Common Pitfalls When Sourcing Galvanized Steel Sinks (Quality & Intellectual Property)

Sourcing galvanized steel sinks can be cost-effective, but it comes with significant risks related to both product quality and intellectual property (IP) infringement. Being aware of these common pitfalls helps ensure you receive durable, compliant products and avoid legal complications.

Poor Galvanization Quality Leading to Premature Corrosion

One of the most frequent quality issues is inadequate or inconsistent galvanization. Low-quality galvanized sinks may have thin, uneven zinc coatings that fail to protect the underlying steel. This results in rust formation, especially in high-moisture kitchen or industrial environments. Look for sinks that meet recognized standards (e.g., ASTM A123 for zinc coating thickness) and request certification. Unreliable suppliers may skip proper surface preparation or use substandard galvanizing processes, drastically reducing the sink’s lifespan.

Use of Substandard Base Steel Material

The quality of the base steel affects structural integrity and longevity. Some suppliers cut costs by using low-grade or improperly coated steel that is prone to warping, denting, or delamination. Thinner gauge steel may also compromise durability. Always verify material specifications such as steel gauge (e.g., 16 or 18 gauge) and ensure the steel is suitable for the intended application (residential, commercial, or industrial).

Inadequate or Missing Quality Certifications

Many suppliers, especially from emerging manufacturing regions, may not provide verifiable quality assurance documentation. Absence of third-party testing reports, ISO certifications, or compliance with regional standards (e.g., CE marking in Europe) increases the risk of receiving non-compliant or unsafe products. Always request and validate quality certifications before placing bulk orders.

Intellectual Property (IP) Infringement Risks

A significant and often overlooked risk is sourcing sinks that copy patented or trademarked designs. Some manufacturers produce look-alike versions of popular branded sinks—replicating shape, finish, or mounting style—without authorization. Purchasing and importing such products may expose your business to legal liability, customs seizures, or forced product recalls. Conduct due diligence by verifying original design rights and requiring suppliers to confirm they do not infringe on existing IP.

Misrepresentation of “Galvanized” vs. “Stainless” or “Coated” Steel

Some suppliers misleadingly label non-galvanized or merely painted steel sinks as “galvanized.” True hot-dip galvanization provides a metallurgically bonded zinc layer; alternatives like electro-galvanizing or paint coatings offer inferior protection. Ensure product descriptions and technical documents clearly specify the galvanization method used.

Lack of Traceability and Supplier Transparency

Unreliable suppliers may be unwilling or unable to provide batch traceability, material test reports, or factory audit access. This opacity makes it difficult to verify quality claims or respond to issues post-shipment. Establish clear communication and vet suppliers through site visits or third-party audits to ensure accountability.

By addressing these pitfalls proactively—through stringent supplier vetting, formal quality agreements, and IP compliance checks—you can mitigate risks and source galvanized steel sinks that meet both performance expectations and legal standards.

Logistics & Compliance Guide for Galvanized Steel Sinks

Product Overview and Classification

Galvanized steel sinks are plumbing fixtures constructed from steel coated with a protective layer of zinc to prevent rust and corrosion. They are commonly used in residential, commercial, and industrial kitchens and utility areas. Proper logistics and compliance handling are essential due to their weight, susceptibility to damage, and international trade requirements.

Harmonized System (HS) Code Classification

The appropriate HS code for galvanized steel sinks is typically 7324.10. This code applies to “Sinks, wash basins, lavatory tanks, baths, shower baths, bidets and similar fixtures, of iron or steel, enamelled or not.” Confirm the exact subcategory based on regional regulations and product specifications, such as whether the sink is enameled or includes additional components.

Packaging and Handling Requirements

Galvanized steel sinks must be securely packaged to prevent scratches, dents, and coating damage during transport. Use corner protectors, corrugated cardboard wrapping, and sturdy wooden pallets or crates. Individual shrink-wrapping is recommended. Avoid stacking without adequate separation. For sea freight, ensure moisture barriers are used to prevent condensation damage.

Transportation and Freight Considerations

Due to their weight and rigid form, galvanized steel sinks are typically shipped via full container load (FCL) or less than container load (LCL) for smaller quantities. Overland transport requires vehicles with sufficient load capacity and secure tie-downs. Use forklifts with padded forks to prevent surface damage during loading and unloading. Air freight is generally cost-prohibitive unless for urgent, small-volume shipments.

Import and Export Documentation

Complete documentation is required for international shipments, including commercial invoice, packing list, bill of lading/air waybill, and certificate of origin. Depending on the destination, additional documents may include a conformity assessment, test reports, or a declaration of materials. Ensure all documents clearly describe the product using the correct HS code and material specifications.

Regulatory Compliance and Standards

Galvanized steel sinks must meet regional plumbing and safety standards. In the U.S., compliance with UPC (Uniform Plumbing Code) or IPC (International Plumbing Code) may be required. In the EU, adherence to EN standards (e.g., EN 10088 for stainless steel, where applicable) and CE marking may apply. Verify zinc coating thickness and corrosion resistance per ASTM A123 or ISO 1461, depending on market requirements.

Environmental and Safety Regulations

Ensure that the galvanization process complies with environmental regulations regarding zinc emissions and waste disposal. In some regions, such as the EU under REACH, restrictions on certain substances must be confirmed. Provide safety data sheets (SDS) if requested, particularly for industrial or bulk shipments, even though the finished product is generally not classified as hazardous.

Customs Clearance and Duties

Prepare for customs inspections by accurately declaring the product value, origin, and material composition. Duty rates vary by country; check the destination’s tariff schedule using HS code 7324.10. Preferential tariffs may apply under free trade agreements if the product meets rules of origin. Factor in anti-dumping or countervailing duties if sourcing from countries under investigation.

Labeling and Marking Requirements

Label each package with handling instructions (e.g., “Fragile,” “This Side Up”), product identification, quantity, weight, and country of origin. The sink itself should bear permanent markings including manufacturer name, model number, material type, and compliance marks as required by destination markets.

Returns and Reverse Logistics

Establish a clear policy for damaged or defective sinks. Use traceable packaging and inspect upon receipt. For returns, ensure proper re-packaging to avoid further damage. Coordinate with freight partners for cost-effective reverse shipping, especially for large or heavy items.

Best Practices for Supply Chain Partners

Collaborate with experienced freight forwarders familiar with metal goods. Conduct regular audits of packaging and handling procedures. Train warehouse and logistics staff on the specific requirements for handling galvanized steel products to minimize damage and ensure compliance throughout the supply chain.

In conclusion, sourcing a galvanized steel sink requires careful consideration of quality, durability, cost, and supplier reliability. While galvanized steel offers strength and resistance to corrosion, it may not be the most common material for sinks—especially in comparison to stainless steel—due to differences in finish, longevity in wet environments, and potential for zinc coating degradation over time. Ensuring the sink is properly coated and suitable for its intended use (e.g., industrial or utility applications) is crucial. Buyers should prioritize reputable suppliers, verify material specifications, and consider long-term maintenance needs. For residential or high-moisture applications, alternative materials like stainless steel may offer better performance. Ultimately, making an informed decision based on application requirements, environmental conditions, and lifecycle cost will lead to a successful sourcing outcome.