The global furniture manufacturing industry has experienced steady expansion over the past decade, fueled by rising urbanization, growth in residential and commercial construction, and increasing consumer demand for ergonomic and aesthetically appealing furnishings. According to a 2023 report by Grand View Research, the global furniture market was valued at USD 681.2 billion and is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2030. This growth is further corroborated by Mordor Intelligence, which highlights that increasing e-commerce penetration and sustainability-driven consumer preferences are reshaping manufacturing strategies worldwide. As competition intensifies, a select group of manufacturers have emerged as leaders through innovation, scale, and supply chain efficiency. The following list highlights the top 10 furniture manufacturers leading this dynamic market, as evaluated by revenue, global reach, production capacity, and market influence.

Top 10 Furniture Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Flexsteel

Domain Est. 1996

Website: flexsteel.com

Key Highlights: Discover exceptional craftsmanship and style with Flexsteel, your premier manufacturer for high-quality furniture. Explore our extensive range of living ……

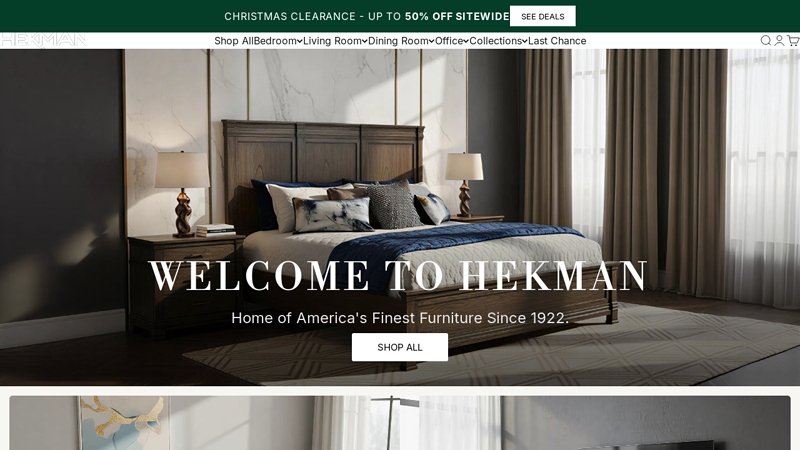

#2 to Hekman Official Web Site

Domain Est. 1996 | Founded: 1922

Website: hekman.com

Key Highlights: Since 1922, Hekman has been one of the leading high-end furniture manufacturers in America. Made with real wood, assembled for you. Contact Us: (616) 748-2699….

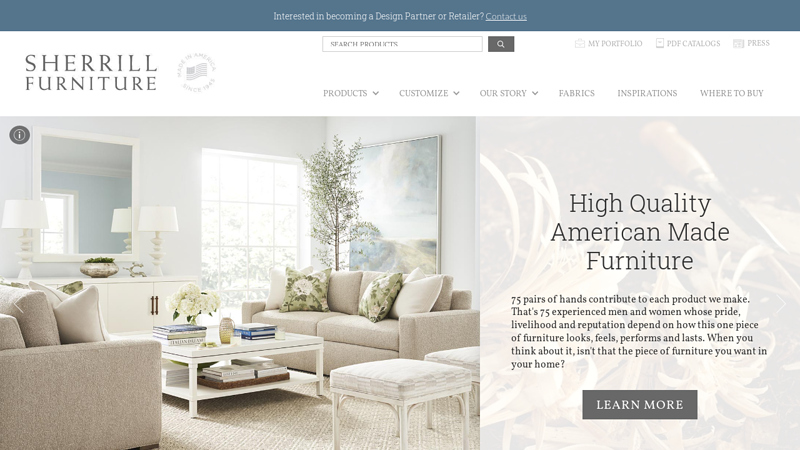

#3 Sherrill Furniture

Domain Est. 1997

Website: sherrillfurniture.com

Key Highlights: Sherrill Furniture manufactures handcrafting high-quality, customized furniture made in the USA. Learn more about our custom upholstery options….

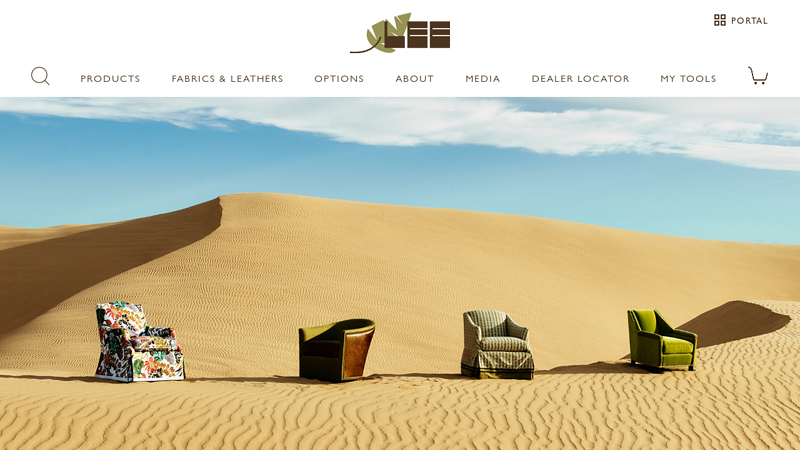

#4 Lee Industries

Domain Est. 1997

Website: leeindustries.com

Key Highlights: HANDCRAFTED IN NORTH CAROLINA · PRODUCTS · fabrics · LEATHERS · INSPIRATION GALLERY · NEW STYLES · LET’S GET SOCIAL….

#5 Smith Brothers Furniture

Domain Est. 2001

Website: smithbrothersfurniture.com

Key Highlights: Smith Brothers of Berne Inc. © 1926-2026. AMERICAN MADE CUSTOM UPHOLSTERY Terms of Use | Privacy Policy · Careers | Dealer Portal · Smith Brothers of Berne, ……

#6 Knoll

Domain Est. 1995

Website: knoll.com

Key Highlights: Knoll uses modern design to connect people with their work, lives and world – browse & shop our entire furniture & textile collection for your home or ……

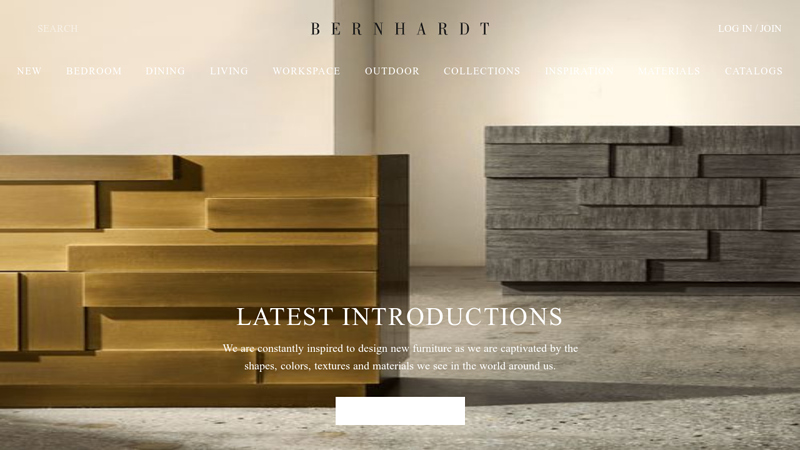

#7 Bernhardt

Domain Est. 1995

Website: bernhardt.com

Key Highlights: Explore Bernhardt’s collection of designer furniture crafted with uniquely beautiful materials and an elevated aesthetic….

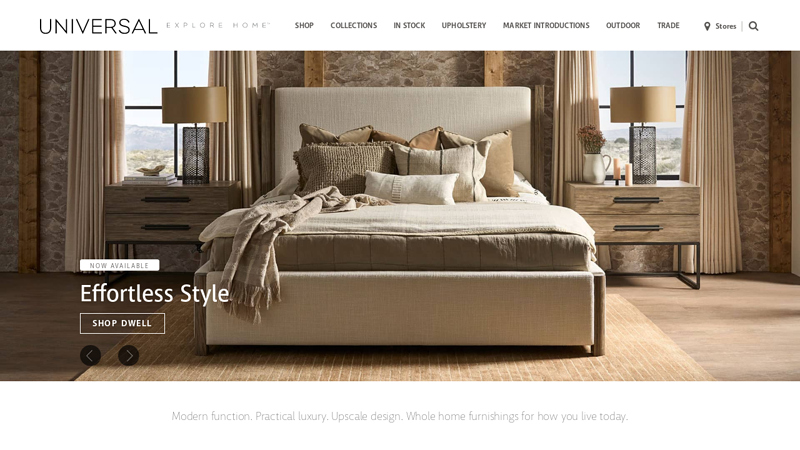

#8 Universal Furniture

Domain Est. 1996

Website: universalfurniture.com

Key Highlights: Universal Furniture creates quality furnishings for the whole home with a focus on function and lifestyle. Universal Explore Home | Explore Home….

#9 HON Office Furniture

Domain Est. 1997

Website: hon.com

Key Highlights: The HON Company designs and manufactures inspiring office furniture including office chairs, desks, tables, filing cabinets, workstations and workplace ……

#10 Copeland Furniture

Domain Est. 1999

Website: copelandfurniture.com

Key Highlights: Copeland Furniture manufactures contemporary, solid hardwood furniture for the bedroom, dining room, and home office in Vermont….

Expert Sourcing Insights for Furniture

H2: Furniture Market Trends in 2026 – Innovation, Sustainability, and Personalization Drive Growth

As we approach 2026, the global furniture market is undergoing a profound transformation, shaped by evolving consumer behaviors, technological advancements, and heightened environmental consciousness. Driven by post-pandemic lifestyle shifts and economic adjustments, the industry is pivoting toward smarter, more sustainable, and highly personalized solutions. Below are the key trends defining the furniture landscape in 2026.

1. Sustainable and Circular Design Takes Center Stage

Environmental responsibility is no longer optional—it’s a market imperative. By 2026, consumers demand furniture made from recycled, upcycled, or rapidly renewable materials such as bamboo, cork, and reclaimed wood. Brands are embracing circular economy principles, offering take-back programs, modular designs for easy repair, and furniture-as-a-service (FaaS) models. Certifications like FSC, Cradle to Cradle, and B Corp are becoming critical differentiators. Expect increased use of biodegradable foams, water-based finishes, and low-carbon manufacturing processes.

2. Smart and Connected Furniture Gains Traction

Technology integration is redefining functionality. By 2026, smart furniture—equipped with built-in wireless charging, IoT connectivity, climate control, and health-monitoring features—is moving from niche to mainstream, especially in urban apartments and co-living spaces. Voice-activated desks, climate-sensitive recliners, and beds with sleep-tracking capabilities are becoming common. Furniture brands are partnering with tech companies to offer seamless, integrated smart home experiences.

3. Hybrid Living Fuels Demand for Multifunctional and Space-Saving Designs

With remote and hybrid work models now entrenched, furniture must serve multiple purposes. Convertible pieces—such as sofa-beds, extendable dining tables, and wall-mounted desks—are in high demand. Compact, modular systems that adapt to changing needs (e.g., from workspace to guest room) dominate urban markets. Micro-apartments and tiny homes are driving innovation in space optimization, including magnetic storage units and furniture with hidden compartments.

4. Personalization and Customization Become Standard

Consumers increasingly reject one-size-fits-all solutions. By 2026, digital platforms enable high levels of customization—from fabric and finish selection to 3D-configurable designs. AI-powered design tools allow customers to visualize furniture in their own space using augmented reality (AR). Mass customization, supported by agile manufacturing and digital supply chains, allows brands to offer bespoke pieces at near-mass-market prices.

5. E-Commerce and Direct-to-Consumer (DTC) Models Reshape Retail

Online furniture shopping continues to grow, fueled by immersive digital experiences. Virtual showrooms, AI stylists, and AR try-before-you-buy features reduce purchase hesitation. DTC brands bypass traditional retail markups, offering better value and greater control over brand experience. However, omnichannel strategies—blending online convenience with physical touchpoints like pop-ups and design studios—are proving most effective.

6. Wellness-Oriented Design Enters the Home

Wellness is extending beyond fitness and nutrition into the home environment. Ergonomic seating, non-toxic materials, and furniture promoting good posture and mental well-being are growing in importance. Biophilic design—incorporating natural elements like wood grain, indoor plants, and organic shapes—is widely adopted to reduce stress and improve air quality. Furniture with built-in air purifiers or circadian lighting support holistic health.

7. Regionalization and Localized Manufacturing

Global supply chain disruptions have accelerated a shift toward regional production. In 2026, more brands are sourcing materials and manufacturing closer to end markets to reduce lead times, carbon emissions, and geopolitical risks. This supports local economies and enables faster response to design trends and customer demands. 3D printing and digital fabrication also enable decentralized, on-demand production.

8. Secondhand and Pre-Owned Furniture Market Expands

The resale market for furniture is booming, driven by sustainability goals and cost-conscious consumers. Platforms offering certified pre-owned, refurbished, or vintage pieces are gaining trust and market share. Brands are launching their own resale programs to retain customer loyalty and extend product life cycles. Refurbished designer furniture, in particular, appeals to younger, eco-aware buyers.

Conclusion

By 2026, the furniture market is more dynamic and consumer-centric than ever. Success will belong to brands that prioritize sustainability, embrace digital innovation, and deliver personalized, adaptable solutions. As homes evolve into multifunctional hubs for work, wellness, and connection, furniture is no longer just functional—it’s an integral part of lifestyle and identity. Companies that align with these H2 trends will lead the next era of design and commerce.

Common Pitfalls Sourcing Furniture: Quality and Intellectual Property Risks

Sourcing furniture, especially from international or unfamiliar suppliers, presents several challenges that can impact both product integrity and legal compliance. Two major areas of concern are quality control and intellectual property (IP) infringement. Overlooking these pitfalls can lead to financial losses, reputational damage, and legal disputes.

Quality Control Issues

One of the most frequent challenges in furniture sourcing is maintaining consistent quality across production batches. Variations in materials, workmanship, and manufacturing standards can result in subpar products that fail to meet customer expectations or safety regulations.

- Inconsistent Materials: Suppliers may substitute lower-grade wood, fabric, or hardware to cut costs, leading to reduced durability and aesthetic appeal.

- Poor Craftsmanship: Inadequate training or oversight can result in misaligned joints, uneven finishes, or structural weaknesses.

- Lack of Standardization: Without clear specifications and quality benchmarks, production can vary significantly between runs.

- Insufficient Testing: Skipping durability, load-bearing, or safety tests increases the risk of product failure and potential liability.

To mitigate these issues, buyers should establish detailed quality control protocols, conduct factory audits, and implement third-party inspections during and post-production.

Intellectual Property Infringement

Furniture designs are often protected by copyrights, design patents, or trademarks. Sourcing replicas or “inspired by” versions of popular designs can expose companies to serious legal consequences.

- Unauthorized Replicas: Many suppliers offer knock-offs of well-known designs (e.g., Eames lounge chairs, Barcelona stools). Distributing these constitutes IP infringement.

- Design Patent Violations: Functional or ornamental designs may be protected, and reproducing them without a license can lead to cease-and-desist orders or lawsuits.

- Copyright Issues: Original artistic elements in furniture (e.g., carvings, patterns) may be protected under copyright law.

- Supplier Misrepresentation: Some suppliers falsely claim designs are “original” or “freely usable,” leaving the buyer liable for infringement.

To avoid IP risks, conduct thorough design due diligence, require suppliers to provide proof of design ownership or licensing, and consider working with legal counsel to review product designs before production or import.

Addressing both quality and IP concerns proactively ensures that sourced furniture meets performance standards and legal requirements, protecting your brand and bottom line.

Logistics & Compliance Guide for Furniture

Understanding Furniture Logistics Challenges

Furniture logistics involve unique challenges due to the size, weight, fragility, and diversity of products. Items such as sofas, tables, and cabinets are often bulky and irregularly shaped, requiring special handling, packaging, and transportation arrangements. Efficient furniture logistics demand careful route planning, proper loading techniques, and coordination across multiple parties, including manufacturers, freight carriers, warehousing providers, and last-mile delivery services.

Packaging and Product Protection

Proper packaging is critical to prevent damage during transit. Furniture should be wrapped in protective materials such as bubble wrap, foam corner guards, and stretch film. Flat-pack furniture must be securely boxed with internal bracing to avoid shifting. For high-value or delicate items like glass-topped tables or handcrafted pieces, custom crates may be necessary. Labels indicating “Fragile,” “This Side Up,” and “Do Not Stack” must be clearly visible to ensure correct handling.

Transportation Modes and Options

Furniture can be shipped via various transportation modes depending on volume, distance, and urgency:

– Less-Than-Truckload (LTL): Ideal for small to medium shipments where space sharing reduces cost.

– Full Truckload (FTL): Best for large orders or oversized items requiring dedicated space.

– Intermodal Shipping: Combines rail and truck transport for long-distance, cost-effective movement.

– Last-Mile Delivery: Final leg from distribution center to customer; often handled by specialized furniture delivery services with white-glove options (in-home assembly, old furniture removal).

Warehousing and Inventory Management

Furniture storage requires spacious, dry, and secure facilities with high ceilings and racking systems designed for bulky items. Inventory management systems should track stock levels, product dimensions, and turnover rates to optimize space utilization. First-In, First-Out (FIFO) principles may apply to prevent material degradation, especially for upholstered or wood-based products sensitive to humidity and temperature.

International Shipping and Customs Compliance

Exporting or importing furniture involves compliance with international trade regulations:

– Harmonized System (HS) Codes: Classify furniture for customs (e.g., 9403.40 for wooden office furniture).

– Import/Export Documentation: Includes commercial invoices, packing lists, bills of lading, and certificates of origin.

– Phytosanitary Certificates: Required for wood products to prevent pest spread; may need heat treatment (ISPM 15 compliance for wooden packaging).

– Duties and Tariffs: Vary by country; must be calculated accurately to avoid delays or fines.

Regulatory and Safety Compliance

Furniture must meet safety and environmental standards in target markets:

– Flammability Standards: Upholstered furniture in the U.S. must comply with California TB 117 or federal regulations.

– Lead and Chemical Restrictions: Products must adhere to limits under CPSIA (U.S.), REACH (EU), and other chemical safety laws.

– Labeling Requirements: Include country of origin, fire retardant content, and compliance marks (e.g., CE mark in Europe).

– Sustainability Regulations: Some regions require disclosure of wood sourcing (e.g., Lacey Act in the U.S.) and adherence to FSC or PEFC certification standards.

Reverse Logistics and Returns Management

Furniture returns are complex due to size and potential damage. A clear return policy, inspection process, and refurbishment or disposal protocol are essential. Return logistics may involve pickup services, restocking fees, and coordination with third-party liquidators or donation programs. Efficient reverse logistics reduce costs and improve customer satisfaction.

Technology and Tracking Solutions

Leveraging technology improves transparency and efficiency:

– Transport Management Systems (TMS): Optimize routes, carrier selection, and freight auditing.

– Real-Time Tracking: GPS and IoT sensors monitor shipment location, temperature, and shock events.

– Barcode/RFID Scanning: Enhances inventory accuracy and reduces handling errors in warehouses.

Best Practices for Furniture Logistics Success

- Partner with experienced freight carriers specializing in oversized goods.

- Standardize packaging where possible to streamline handling.

- Conduct regular compliance audits and staff training.

- Maintain clear communication across the supply chain.

- Invest in scalable logistics technology to support growth.

By adhering to these logistics and compliance guidelines, furniture businesses can ensure safe, efficient, and legally compliant operations across domestic and international markets.

Conclusion: Sourcing Furniture Supplier

After a thorough evaluation of potential furniture suppliers, considering factors such as product quality, pricing, lead times, sustainability practices, certifications, and reliability, Supplier [Insert Name] has been identified as the most suitable partner for our sourcing needs. This supplier consistently demonstrates a strong track record of delivering high-quality, durable furniture while adhering to ethical manufacturing practices and environmental standards. Their competitive pricing structure, flexibility in customization, and reliable delivery timelines align well with our operational requirements and long-term business objectives.

Additionally, their responsive customer service and willingness to collaborate closely with our team provide added assurance of a solid and sustainable partnership. Moving forward, establishing a strategic relationship with this supplier will not only enhance our supply chain efficiency but also support our commitment to quality, sustainability, and customer satisfaction. We recommend proceeding with this supplier and initiating contract negotiations to formalize the collaboration.