The global furniture manufacturing market is experiencing steady expansion, driven by rising urbanization, increasing disposable incomes, and evolving consumer preferences for customized and sustainable furnishings. According to Grand View Research, the global furniture market size was valued at USD 593.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. This growth directly fuels demand for high-performance, precision-driven tools essential in modern furniture production. As manufacturers seek to enhance efficiency, reduce waste, and adapt to automation, investments in advanced woodworking machinery and equipment are surging. With the global woodworking machinery market also projected to expand significantly—Mordor Intelligence forecasts a CAGR of approximately 5.2% over the next five years—the role of leading furniture making tools manufacturers becomes increasingly critical. These companies are at the forefront of innovation, delivering solutions that combine smart technology, durability, and precision to meet the evolving needs of furniture makers worldwide. Here, we spotlight the top 10 manufacturers shaping the future of furniture production through cutting-edge tooling systems and machinery.

Top 10 Furniture Making Tools Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Furniture Making CNC Machines

Domain Est. 1996

Website: lagunatools.com

Key Highlights: Laguna Tools offers both Industrial and Automated CNC Machines to meet the demands of modern furniture makers….

#2 Milwaukee® Tool

Domain Est. 2000

Website: milwaukeetool.com

Key Highlights: Milwaukee Tool is the most respected manufacturer of heavy-duty power tools, hand tools, instruments, and accessories….

#3 Handler Manufacturing LLC.

Domain Est. 1996

#4 Tools

Domain Est. 1998

Website: montanafurniture.com

Key Highlights: This page showcases our collection of digital tools developed to help you design with Montana. Tools that range from interior design software to 3d-files, ……

#5 to Kreg Tool

Domain Est. 1999

Website: kregtool.com

Key Highlights: Save up to $100 on the Kreg Rebel™, Adaptive Cutting System, pocket-hole jigs, hardware jigs, Kreg Academy woodworking lessons, and more. Don’t miss winter ……

#6 Festool United States

Domain Est. 2004

Website: festoolusa.com

Key Highlights: Festool USA: German-engineered power tools and accessories for the toughest demands, such as plunge-cut saws, circular saws, jigsaws, cordless drills, ……

#7 ToughBuilt: Sawhorses

Domain Est. 2004

Website: toughbuilt.com

Key Highlights: Professional-Grade Sawhorses, Tool Pouches and Knee Pads for work by ToughBuilt. Strictly for construction workers and electricians who need the best for ……

#8 Offerman Woodshop

Domain Est. 2005

Website: offermanwoodshop.com

Key Highlights: Founded by Nick Offerman, we are a Los Angeles based woodworking collective specialising in Custom Fine Furniture, Live-Edge Slabs, Canoes and bespoke projects ……

#9 Stanley Black & Decker Homepage

Domain Est. 2009

Website: stanleyblackanddecker.com

Key Highlights: Headquartered in the USA, Stanley Black & Decker is the world’s largest tool company with 50 manufacturing American facilities and more than 100 worldwide….

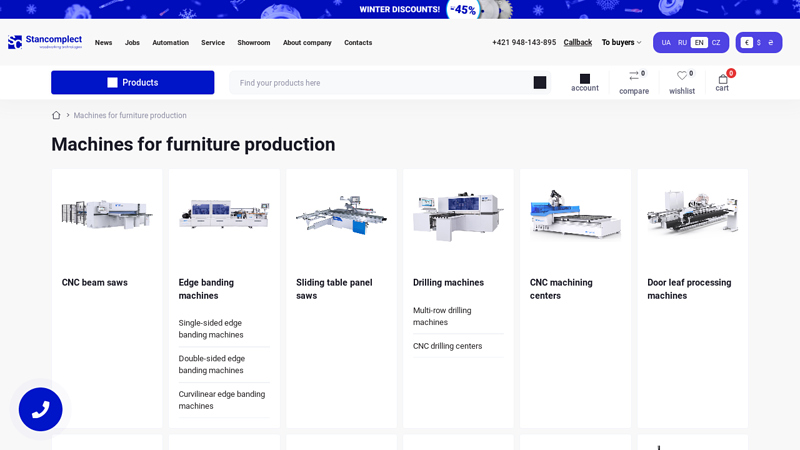

#10 Machines for furniture production

Domain Est. 2022

Website: stancomplect.com

Key Highlights: Rating 5.0 (5) Furniture machines at affordable prices ➤ Buy equipment for the production of wooden furniture ✔️ Spare parts warehouse ⭐ Warranty and service….

Expert Sourcing Insights for Furniture Making Tools

2026 Market Trends for Furniture Making Tools

The furniture making tools market is poised for significant transformation by 2026, driven by technological innovation, evolving consumer demands, and shifts in manufacturing practices. Key trends are expected to reshape how tools are designed, used, and purchased, impacting both professional artisans and hobbyists.

Advancements in Smart and Connected Tools

By 2026, smart tools equipped with IoT (Internet of Things) capabilities will become increasingly mainstream. Tools such as CNC routers, table saws, and sanders will feature embedded sensors, real-time performance monitoring, and connectivity to cloud-based platforms. These features enable predictive maintenance, usage analytics, and remote diagnostics, enhancing productivity and reducing downtime. Integration with digital design software will allow seamless workflow from concept to creation, especially in custom and small-batch furniture production.

Rise of Automation and Robotics in Workshops

Automation will extend beyond large-scale factories into mid-sized and specialized workshops. Robotic arms for sanding, finishing, and assembly, coupled with adaptive tooling systems, will improve precision and reduce labor costs. This trend supports the growing demand for high-quality, consistent finishes and complex designs, particularly in modular and bespoke furniture segments.

Sustainable and Ergonomic Tool Design

Sustainability will influence not only furniture materials but also the tools used to make them. Manufacturers will prioritize energy-efficient motors, recyclable materials in tool construction, and longer product lifecycles. Additionally, ergonomic design will be a key differentiator, with tools engineered to reduce user fatigue and prevent injury—critical for artisans engaged in repetitive tasks. Lightweight composites and vibration-dampening technologies will be standard features.

Growth in Portable and Multi-Functional Tools

The rise of remote and mobile craftsmanship, including urban makerspaces and home-based businesses, will drive demand for compact, portable, and multi-functional tools. Battery-powered tools with extended life and quick-charging capabilities will dominate, enabling greater flexibility. Tools that combine functions—such as a drill-driver-sander combo—will appeal to DIY enthusiasts and small-scale producers seeking space and cost efficiency.

Expansion of E-Commerce and Digital Marketplaces

By 2026, online platforms will be the primary channel for purchasing furniture making tools. Enhanced AR (augmented reality) features will allow users to visualize tools in their workspace before buying, while AI-driven recommendation engines will personalize product suggestions based on skill level and project type. Subscription models for tool access and digital design libraries may emerge, offering flexible solutions for occasional users.

Emphasis on Skill Development and Digital Literacy

As tools become more sophisticated, demand for training and digital literacy will grow. Tool manufacturers and industry associations will invest in online tutorials, certification programs, and community platforms. This trend supports a new generation of furniture makers who blend traditional craftsmanship with digital fabrication techniques like 3D modeling and CAM (Computer-Aided Manufacturing).

Regional Market Diversification

While North America and Europe remain strong markets due to high DIY engagement and advanced manufacturing, Asia-Pacific—particularly China, India, and Southeast Asia—will see accelerated growth. Rising disposable incomes, urbanization, and government support for vocational training in woodworking will expand the consumer and professional base for furniture tools.

In conclusion, the 2026 furniture making tools market will be defined by intelligence, connectivity, sustainability, and accessibility. Companies that embrace digital integration, user-centric design, and eco-conscious practices will lead the industry, empowering makers at all levels to innovate with greater efficiency and creativity.

Common Pitfalls When Sourcing Furniture Making Tools (Quality and Intellectual Property)

Sourcing furniture making tools—whether for a workshop, manufacturing operation, or retail—can be riddled with challenges, especially concerning tool quality and intellectual property (IP) concerns. Overlooking these pitfalls can lead to subpar performance, legal risks, and reputational damage. Below are key issues to avoid.

Poor Quality Control and Inconsistent Tool Performance

One of the most frequent issues when sourcing furniture making tools is receiving products that fail to meet expected standards. This is especially common when purchasing from low-cost suppliers or unfamiliar manufacturers. Tools may have inconsistent materials, imprecise tolerances, or poor heat treatment, resulting in premature wear, breakage, or inaccurate cuts. For example, a poorly tempered chisel may chip during use, while a misaligned table saw blade can compromise safety and craftsmanship. Always verify certifications, request samples, and conduct third-party inspections to ensure consistency and durability.

Counterfeit or Misrepresented Brand Tools

The furniture tool market is rife with counterfeit products that mimic well-known brands such as Festool, DeWalt, or Lie-Nielsen. These knockoffs often use similar logos, packaging, or model names to deceive buyers. Purchasing counterfeit tools not only risks poor performance but can also expose buyers to liability, especially if the tools fail and cause injury. Additionally, reselling counterfeit goods can lead to legal action for trademark infringement. Always source from authorized distributors and verify authenticity through official brand channels.

Intellectual Property Infringement in Tool Design

Some manufacturers, particularly in regions with lax IP enforcement, produce tools that closely replicate patented designs or trade secrets of established brands. While the tool may function similarly, using or distributing such products can expose the buyer to IP litigation. For instance, a dovetail jig or a specialized router bit design might be protected by design patents. Sourcing tools that infringe on these rights—even unknowingly—can result in cease-and-desist letters, product seizures, or financial penalties.

Lack of Traceability and Compliance Documentation

Many furniture making tools, especially power tools, are subject to safety and environmental regulations (e.g., CE, UL, or RoHS certifications). Sourcing from suppliers who cannot provide compliance documentation increases the risk of regulatory non-compliance. Moreover, without traceable manufacturing records, it becomes difficult to address quality issues or recalls effectively. Insist on full compliance paperwork and audit supplier manufacturing practices when possible.

Overlooking Long-Term Support and Spare Parts Availability

Low-cost tools may seem appealing initially, but if the supplier does not offer spare parts, technical support, or repair services, long-term ownership costs can soar. This is particularly critical for CNC routers or multi-component jigs. Sourcing tools without considering after-sales support can lead to downtime and reduced productivity. Evaluate the supplier’s service network and parts availability before making a purchase.

Avoiding these pitfalls requires due diligence, supplier vetting, and a clear understanding of both product quality standards and intellectual property rights. Investing time upfront can save significant cost and risk down the line.

Logistics & Compliance Guide for Furniture Making Tools

Product Classification and Tariff Codes

Identify accurate Harmonized System (HS) codes for furniture making tools (e.g., hand tools, power tools, jigs, and fixtures) based on material, function, and mechanism. Proper classification ensures correct duty rates and compliance with customs authorities in both origin and destination countries. Consult local trade databases or a customs broker to determine applicable codes—common categories may fall under HS 8205 (hand tools), 8467 (machines for working wood), or related subheadings.

Import/Export Regulations

Comply with import and export controls in all involved jurisdictions. Some power tools may be subject to export licensing requirements under dual-use or security-related regulations (e.g., U.S. EAR or EU Dual-Use Regulation). Verify whether tools containing motors, batteries, or advanced electronics require special documentation or permits before shipment. Ensure adherence to anti-dumping or countervailing duties if sourcing from specific countries.

Safety and Technical Standards

Furniture making tools must meet safety standards in the destination market. In the EU, tools must comply with the Machinery Directive (2006/42/EC) and carry CE marking. In the U.S., tools should meet OSHA and ANSI standards, and UL certification may be required for electrical tools. Include required technical documentation, user manuals in the local language, and safety warnings to avoid customs delays or product recalls.

Packaging and Labeling Requirements

Use durable, secure packaging suitable for international shipping, especially for heavy or sharp tools. Label packages with proper handling instructions (e.g., “Fragile,” “This Side Up”) and include all required regulatory markings (e.g., CE, EAC, UKCA). Product labels must display manufacturer information, model numbers, voltage ratings, and compliance marks. Avoid misleading claims or unverified certifications.

Restricted Materials and Substances

Ensure tools do not contain restricted substances such as lead, cadmium, or hazardous chemicals beyond permitted levels. Comply with regulations like the EU’s RoHS (Restriction of Hazardous Substances) for electrical components and REACH for chemical content. Suppliers should provide Material Declarations or Certificates of Compliance (CoC) for key components.

Transportation and Freight Considerations

Choose appropriate freight modes (air, sea, or ground) based on tool size, weight, urgency, and cost. Power tools with lithium-ion batteries are subject to IATA Dangerous Goods Regulations for air transport—packaging must meet UN 38.3 testing standards, and proper shipping labels and documentation (e.g., Shipper’s Declaration) are required. Declare batteries correctly on air waybills.

Customs Documentation

Prepare complete documentation for smooth customs clearance, including:

– Commercial Invoice (with detailed descriptions, quantities, and values)

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin

– Safety and Compliance Certifications

– Export/Import Licenses (if applicable)

Ensure invoice values reflect actual transaction value to avoid customs audits or penalties.

Duty and Tax Optimization

Leverage Free Trade Agreements (FTAs) where applicable (e.g., USMCA, RCEP, or EU-South Korea FTA) to reduce or eliminate tariffs. Maintain proof of origin documentation to claim preferential treatment. Account for Value Added Tax (VAT), Goods and Services Tax (GST), or other import taxes in pricing and logistics planning.

End-Use and Ethical Compliance

Verify that tools are not destined for prohibited end-uses (e.g., military applications, illegal logging, or forced labor operations). Adhere to conflict minerals regulations (e.g., U.S. Dodd-Frank Act Section 1502) if sourcing components from high-risk regions. Maintain supply chain transparency and conduct due diligence on suppliers.

Returns and Warranty Logistics

Establish a clear process for handling returns, repairs, or warranty claims across borders. Consider regional service centers to reduce shipping costs and turnaround time. Ensure spare parts shipments comply with import rules and include proper documentation to avoid classification as new commercial imports.

Recordkeeping and Audits

Retain all logistics and compliance records (e.g., shipping documents, certifications, declarations) for a minimum of 5–7 years, depending on jurisdiction. Conduct periodic internal audits to ensure ongoing compliance with trade laws and prepare for potential customs inspections or regulatory inquiries.

In conclusion, sourcing furniture making tools requires a careful balance between quality, cost, durability, and specific project requirements. Whether purchasing hand tools, power tools, or workshop machinery, it is essential to assess reliability, brand reputation, and long-term value. Sourcing from reputable suppliers—locally or internationally—ensures access to authentic products, warranties, and after-sales support. Additionally, considering factors such as tool ergonomics, compatibility with materials, and future scalability of operations contributes to a more efficient and productive workshop. By conducting thorough research, comparing options, and prioritizing tools that offer precision and longevity, furniture makers can build a reliable toolkit that enhances craftsmanship and supports sustainable business growth.