The global furnace fuel market is experiencing steady growth, driven by rising industrial energy demands and advancements in fuel efficiency technologies. According to Grand View Research, the global industrial fuel market was valued at USD 1.87 trillion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. Meanwhile, Mordor Intelligence projects a CAGR of approximately 4.1% over the forecast period (2024–2029), citing increasing adoption in manufacturing, metal processing, and petrochemical sectors. With energy security and cost-efficiency becoming pivotal for industrial operations, furnace fuel manufacturers are innovating to meet stricter emissions standards and provide reliable, high-calorific-value fuels. In this evolving landscape, a select group of leading manufacturers are shaping supply chains, advancing cleaner combustion technologies, and capturing significant market share—making them key players to watch in the global furnace fuel industry.

Top 10 Furnace Fuel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 The Nabertherm furnace world

Domain Est. 1999

Website: nabertherm.com

Key Highlights: As a manufacturer of industrial furnaces Nabertherm does not only offer the widest range of standard furnaces. Professional engineering in combination with ……

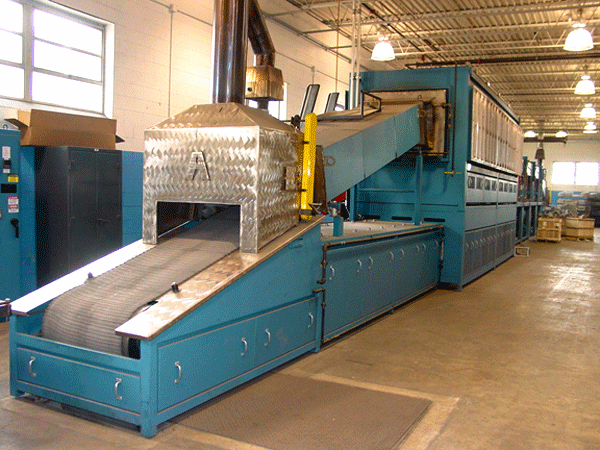

#2 Abbott Furnace

Domain Est. 1999

Website: abbottfurnace.com

Key Highlights: Abbott Furnace is an industrial furnace manufacturer who designs and manufactures some of the industry’s most high performing continuous belt furnaces….

#3 Industrial furnace manufacturer

Domain Est. 2010

Website: ecm-furnaces.com

Key Highlights: As a world leader for low pressure carburizing industrial furnaces, we design and manufacture innovative heat treating solutions….

#4 Nordyne

Domain Est. 1996

Website: nordyne.com

Key Highlights: As the most trusted worldwide HVAC manufacturer, Nordyne manufactures top-tier heating and cooling equipment that distributors, contractors, and customers love….

#5 Rheem Manufacturing Company

Domain Est. 1995

Website: rheem.com

Key Highlights: Learn about Rheem’s innovative and efficient heating, cooling, and water heating solutions for homes and businesses….

#6 Irving Oil

Domain Est. 1996

Website: irvingoil.com

Key Highlights: Irving Energy has been delivering heating oil, diesel and propane for more than 90 years. Our local service reps and drivers provide customer service you can ……

#7 – Thermo Pride

Domain Est. 1997

Website: thermopride.com

Key Highlights: Thermo Pride provides a full range of Energy Saving heating & cooling products to meet your every need, from residential spaces to commercial facilities….

#8 Heat treatment furnaces by SECO/WARWICK GROUP

Domain Est. 1998

Website: secowarwick.com

Key Highlights: SECO/WARWICK GROUP is the leader in technologies: atmosphere, aluminum and vacuum furnaces, controlled atmosphere brazing and vacuum melting systems….

#9 Dornback Manufacturing

Domain Est. 2004

Website: dornbackfurnace.com

Key Highlights: Dornback UNI-PAK Waste Oil Heaters available from 75,000 BTU/HR to 500,000 BTU/HR and 150,000 BTU/HR Portable Units . Burns crankcase and gear oil, ……

#10 Top Renewable Bioheat, Propane & Heating Oil Delivery, Furnace …

Domain Est. 2015

Website: genesee-energy.com

Key Highlights: Genesee Energy is a full service heating, cooling, and fuel delivery company. We specialize in heating oil and bioheat delivery, propane delivery, and furnace ……

Expert Sourcing Insights for Furnace Fuel

As of now, projecting market trends for furnace fuel by 2026—specifically using hydrogen (H₂) as a fuel—requires analyzing current technological, regulatory, economic, and environmental developments. While H₂ is not yet a dominant furnace fuel globally, its role is expected to expand significantly by 2026 due to decarbonization efforts, especially in heavy industries like steel, cement, and chemicals. Below is a comprehensive analysis of 2026 market trends for furnace fuel with a focus on hydrogen (H₂):

1. Drivers of H₂ Adoption in Furnace Applications (2020–2026)

a. Decarbonization Policies and Net-Zero Targets

Many countries (EU, UK, Japan, South Korea, Canada, and parts of the U.S.) have committed to net-zero emissions by 2050, with interim targets for 2030. By 2026, regulations will require heavy industries—major users of high-temperature furnaces—to reduce carbon emissions. Hydrogen, especially green H₂ (produced via electrolysis using renewable electricity), offers a near-zero-emission alternative to fossil fuels like natural gas or coal.

b. Industrial Heat Decarbonization Challenges

Furnaces in industries such as steelmaking (e.g., reheating furnaces) and glass manufacturing require temperatures above 1,000°C. Electrification is often not feasible at such scales, making H₂ a promising substitute. By 2026, pilot projects and early commercial adoptions of H₂-fueled furnaces will likely scale up.

c. Green Hydrogen Cost Reduction

The cost of green hydrogen is expected to decline from ~$4–6/kg in 2023 to $2–3/kg by 2026 due to:

– Falling renewable electricity prices (solar PV, onshore wind).

– Scaling up of electrolyzer manufacturing (e.g., PEM and alkaline).

– Government subsidies (e.g., U.S. Inflation Reduction Act’s $3/kg H₂ tax credit).

Lower H₂ costs improve the economic viability of using it as furnace fuel.

2. Market Trends for H₂ in Furnace Fuel by 2026

a. Regional Adoption Patterns

-

Europe: Leading the transition due to the EU Green Deal and Carbon Border Adjustment Mechanism (CBAM). German and Scandinavian steelmakers (e.g., SSAB, ThyssenKrupp) are testing H₂ in blast furnaces and reheating processes. By 2026, several EU-based industrial furnaces may operate on H₂ blends or pure H₂.

-

North America: Driven by the U.S. Inflation Reduction Act (IRA), which provides strong incentives for clean hydrogen production. Projects like HyStEP in California and H₂ hubs in the Gulf Coast will support H₂ supply for industrial use, including furnaces.

-

Asia-Pacific: Japan and South Korea are investing heavily in hydrogen supply chains (e.g., Australia–Japan H₂ pipeline projects). China is focusing on coal-to-H₂ with CCS (blue H₂), with some pilot H₂ furnace trials in steel mills.

b. Technology Readiness and Blending

- By 2026, most industrial furnaces will use H₂-natural gas blends (up to 30% H₂ by volume) rather than 100% H₂. Retrofitting existing furnaces for higher H₂ content is ongoing, but full conversion requires significant capital investment.

- Pure H₂ furnaces will be limited to demonstration and niche applications (e.g., specialty metals, pilot green steel plants like HYBRIT in Sweden).

c. Infrastructure Development

- Hydrogen pipelines and storage (e.g., salt caverns) are being expanded, especially in industrial clusters (e.g., Rotterdam, Houston, North Rhine-Westphalia).

- On-site H₂ generation via electrolysis may become more common for secure supply.

d. Supply Chain Growth

- Electrolyzer capacity is projected to exceed 100 GW globally by 2026 (up from ~1 GW in 2022).

- Green H₂ production is expected to reach 5–10 million tonnes/year by 2026, with growing share dedicated to industrial heat.

3. Challenges and Barriers (as of 2026 Outlook)

- High Cost: Even with falling prices, H₂ remains more expensive than natural gas (~$2–3/MMBtu) unless subsidized.

- Energy Density and Storage: H₂ has lower volumetric energy density, requiring larger storage and modifications to burner systems.

- Safety and Regulation: Handling high-pressure H₂ requires updated safety codes and workforce training.

- Material Compatibility: H₂ embrittlement can damage existing furnace components (e.g., steel pipes), necessitating upgrades.

4. Competitive Landscape

- Incumbents: Natural gas will still dominate furnace fuel use in 2026 due to infrastructure and cost.

- Alternatives: Biomass, electrification (resistive or induction heating), and carbon capture (for fossil fuels) compete with H₂, but each has limitations at high temperatures.

- H₂ Advantage: Only H₂ offers deep decarbonization at high-temperature industrial scale.

5. Market Projections (2026 Estimates)

| Metric | 2026 Projection |

|——–|—————–|

| Global green H₂ production | 8–12 million tonnes/year |

| H₂ used in industrial heating | 0.5–1.5 million tonnes/year |

| % of industrial furnaces using H₂ (blended or pure) | 5–10% (mostly <30% blend) |

| Key sectors adopting H₂ furnaces | Steel, glass, chemicals |

| Major markets | EU, U.S., Japan, South Korea |

6. Strategic Implications for Stakeholders

- Industrial Users: Begin pilot programs; assess furnace retrofits; secure H₂ supply agreements.

- Energy Providers: Invest in H₂ production and distribution infrastructure.

- Policy Makers: Expand carbon pricing, fund R&D, and support early adopters.

- Technology Providers: Scale up H₂-compatible burners, monitoring systems, and safety solutions.

Conclusion

By 2026, hydrogen (H₂) will emerge as a strategic furnace fuel in the global push to decarbonize industrial heat. While it won’t dominate the market, H₂ use in furnaces will grow significantly—from pilot projects to early commercial deployment—driven by policy, falling costs, and corporate net-zero commitments. The primary applications will be in steel, glass, and chemical industries, with Europe and North America leading adoption. However, widespread use of pure H₂ in furnaces will likely remain limited until after 2026 due to technical and economic hurdles.

Bottom Line: H₂ is on a clear growth trajectory for furnace fuel use by 2026, serving as a critical enabler of industrial decarbonization, but it will coexist with natural gas and other transitional solutions.

When sourcing furnace fuel and considering hydrogen (H₂) as an alternative, there are several common pitfalls related to fuel quality and intellectual property (IP) that organizations should be aware of. Below is a breakdown of these pitfalls, with a focus on hydrogen:

1. Fuel Quality Pitfalls with Hydrogen (H₂)

Hydrogen offers clean combustion (emitting only water vapor), but its quality and specifications are critical for safe and efficient operation. Key pitfalls include:

a. Purity Requirements

- Pitfall: Impurities in hydrogen (e.g., CO, CO₂, H₂S, ammonia, hydrocarbons, or moisture) can damage furnace components, reduce efficiency, or contaminate end products (especially in high-purity industries like glass or electronics).

- Mitigation: Specify strict purity standards (e.g., ≥99.97% for industrial use, ≥99.999% for sensitive processes). Use gas chromatography or sensors for real-time monitoring.

b. Variability in Supply Source

- Pitfall: Hydrogen can be produced via various methods (grey, blue, green), resulting in differing impurity profiles and energy content.

- Mitigation: Define source specifications in contracts (e.g., green H₂ from electrolysis with renewable energy). Conduct regular supplier audits.

c. Moisture and Dew Point Control

- Pitfall: Wet hydrogen can lead to corrosion, flame instability, or ice formation in valves and regulators.

- Mitigation: Ensure proper drying (e.g., desiccant dryers) and monitor dew point (e.g., < -40°C).

d. Calorific Value and Flame Characteristics

- Pitfall: Hydrogen has a lower volumetric energy density (~3x less than natural gas) and higher flame speed, which can cause flashback or overheating if not managed.

- Mitigation: Retrofit burners and control systems for H₂ compatibility. Adjust air-to-fuel ratios and use flame arrestors.

e. Embrittlement of Materials

- Pitfall: Hydrogen embrittlement can weaken steel pipelines and storage tanks, leading to leaks or failures.

- Mitigation: Use H₂-compatible materials (e.g., stainless steel 316L, polymers) and conduct regular integrity testing.

2. Intellectual Property (IP) Pitfalls

Adopting H₂ as furnace fuel often involves new technologies and processes, creating IP-related risks.

a. Unlicensed Use of Proprietary Technologies

- Pitfall: Using patented burner designs, control systems, or H₂ blending methods without proper licensing can lead to infringement lawsuits.

- Mitigation: Conduct freedom-to-operate (FTO) analyses before deployment. License essential IP or design around patents.

b. Joint Development & IP Ownership

- Pitfall: Collaborating with suppliers or research institutions without clear IP agreements can result in disputes over ownership of innovations.

- Mitigation: Define IP ownership, usage rights, and data sharing in contracts upfront (e.g., via joint development agreements).

c. Reverse Engineering Risks

- Pitfall: Attempting to reverse engineer H₂-compatible furnace components may violate trade secrets or patents.

- Mitigation: Focus on open innovation or licensed technology transfer.

d. Trade Secret Exposure

- Pitfall: Sharing process parameters (e.g., optimal H₂/air mix ratios, temperature profiles) with third-party vendors may expose proprietary know-how.

- Mitigation: Use non-disclosure agreements (NDAs) and limit data sharing to what’s necessary.

e. Export Controls and Compliance

- Pitfall: Certain H₂ technologies (e.g., high-efficiency electrolyzers, fuel cells) may be subject to export control regulations (e.g., ITAR, EAR).

- Mitigation: Classify technology under relevant control lists and obtain required licenses.

Best Practices Summary

| Area | Recommendation |

|——|—————-|

| Fuel Quality | Enforce strict H₂ purity specs, monitor moisture, use compatible materials, adapt burners |

| Supply Chain | Vet suppliers, define production method (green/blue/grey), ensure traceability |

| IP Management | Conduct FTO searches, use clear IP agreements, protect trade secrets |

| Regulatory | Comply with safety (e.g., ISO 19880, NFPA 2), environmental, and export regulations |

Conclusion

Switching to hydrogen as furnace fuel offers decarbonization benefits but introduces unique quality and IP challenges. Proactive management of hydrogen purity, material compatibility, and intellectual property rights is essential to avoid operational failures, legal disputes, and compliance risks. A cross-functional team (engineering, procurement, legal, IP) should be involved from the outset.

Logistics & Compliance Guide for Furnace Fuel Using Hydrogen (H₂)

Version 1.0 | Focus: Industrial Furnace Applications

1. Introduction

Hydrogen (H₂) is emerging as a clean and efficient fuel for high-temperature industrial furnaces, particularly in sectors such as steel, glass, cement, and ceramics. This guide outlines the logistics, safety, regulatory compliance, and operational best practices for using hydrogen as a furnace fuel.

2. Hydrogen Fuel Properties

| Property | Value / Description |

|—————————–|———————|

| Energy Content (LHV) | 120 MJ/kg (~3x natural gas) |

| Flame Temperature (in air) | ~2,000°C (3,632°F) |

| Ignition Energy | Low (0.02 mJ) – highly flammable |

| Flammability Range (in air) | 4% – 75% by volume |

| Buoyancy | 14x lighter than air – rises rapidly |

| Zero Carbon Combustion | Produces only H₂O when combusted (no CO₂, NOx minimized with proper controls) |

Note: High flame speed and wide flammability range require careful burner and furnace design.

3. Supply Chain & Logistics

3.1 Hydrogen Sources

- Green H₂: Electrolysis using renewable electricity (preferred for sustainability).

- Blue H₂: Natural gas with carbon capture and storage (CCS).

- Grey H₂: Steam methane reforming (SMR) without CCS – not recommended for decarbonization goals.

3.2 Delivery Methods

| Method | Suitability for Furnace Use | Notes |

|———————-|—————————–|——-|

| On-Site Electrolysis | High | Ideal for continuous operations; high CAPEX, low OPEX over time. Requires water, power, and space. |

| Compressed Gas (CGH₂) | Medium | Delivered via tube trailers (200–500 bar). Suitable for medium-scale users. Requires compression and storage. |

| Liquid Hydrogen (LH₂) | Low-Medium | Cryogenic (-253°C). High energy cost for liquefaction. Risk of boil-off. Best for high-volume, continuous use. |

| Pipeline H₂ | High (if available) | Most efficient for large industrial clusters. Limited infrastructure currently. |

3.3 Storage

- Compressed Gas Storage: Use high-pressure tanks (350–700 bar) with Type III/IV composite vessels.

- Cryogenic Storage: For LH₂; double-walled vacuum-insulated tanks.

- Duration: Design for 3–7 days of buffer storage depending on supply reliability.

- Location: Outdoors, elevated, well-ventilated, at least 15 meters from ignition sources.

3.4 Piping & Distribution

- Use stainless steel (SS316L) or approved H₂-compatible materials.

- Avoid galvanized steel (risk of hydrogen embrittlement).

- Ensure all joints are welded or double-ferrule compression fittings.

- Install automatic shutoff valves and leak detection systems.

4. Furnace Integration & Combustion

4.1 Burner Design

- Use hydrogen-specific burners with:

- Flame speed management

- NOx suppression (staged combustion, flue gas recirculation)

- Flashback prevention

- Retrofit existing natural gas burners only with OEM approval.

4.2 Combustion Byproducts

- Primary: H₂O vapor (visible as steam).

- Secondary: NOx – minimized via:

- Ultra-low NOx burners

- Preheated air control

- Flue gas recirculation (FGR)

- No SOx or particulates.

4.3 Control Systems

- Integrate with PLC/SCADA for:

- H₂ flow monitoring

- Flame detection

- Emergency shutdown (ESD)

- O₂ trim control for efficiency

5. Safety Management

5.1 Hazard Mitigation

- Leak Detection: Install H₂ sensors (ppm level) at low points (H₂ rises, but can accumulate in confined spaces).

- Ventilation: Natural or forced ventilation in enclosed areas; >1 m/s airflow.

- Explosion Prevention: Use explosion-proof equipment (ATEX/IECEx Zone 1 or 2).

- Flame Detection: UV/IR sensors for rapid response.

5.2 Emergency Procedures

- Leak Response:

- Isolate supply

- Evacuate area

- Ventilate

- No ignition sources

- Fire Response:

- H₂ flames are nearly invisible in daylight – use thermal imaging.

- Do not extinguish unless supply can be cut (risk of re-ignition).

- Cool surrounding equipment.

5.3 PPE

- Flame-resistant clothing

- Safety goggles

- Gas detection badges

- No spark-producing tools in hazardous zones

6. Regulatory & Compliance Framework

6.1 International Standards

- ISO 19880 (Gaseous hydrogen fueling) – Covers storage, piping, nozzles

- ISO 22734 – On-site hydrogen generators

- NFPA 2 (Hydrogen Technologies Code) – U.S. standard for production, storage, use

- EN 17124 – European standard for gaseous hydrogen systems

6.2 Regional Regulations

| Region | Key Regulations |

|————–|—————–|

| USA | OSHA 29 CFR 1910, NFPA 2, EPA Clean Air Act (GHG reporting) |

| EU | ATEX Directive, PED, SEVESO III, RED III (Renewable Energy Directive) |

| UK | COMAH, Health and Safety at Work Act, HSG279 (H₂ safety guidance) |

| Asia | Varies; Japan JIS B 8265, China GB/T 34542 |

6.3 Environmental & Carbon Compliance

- Carbon Accounting: H₂ combustion emits zero CO₂ → eligible for Scope 1 emissions reduction.

- Reporting: Under GHG Protocol, EU ETS, or equivalent.

- Certification: Obtain Guarantee of Origin (GoO) for green H₂ to claim carbon-free status.

7. Training & Documentation

7.1 Personnel Training

- Mandatory training for:

- H₂ properties and risks

- Leak and fire response

- Equipment operation

- Emergency shutdown

- Certification required for operators.

7.2 Documentation

- Hydrogen Safety Data Sheet (SDS) – Section 2: GHS classification

- Process Hazard Analysis (PHA) / HAZOP study

- Operating Procedures (SOPs)

- Maintenance logs (valves, sensors, piping)

8. Monitoring & Maintenance

- Daily: Leak checks, sensor calibration, pressure readings

- Monthly: Inspect piping for embrittlement, burner nozzle wear

- Annual: Full system audit, third-party safety review

- Use predictive maintenance with IoT sensors (vibration, temperature, H₂ concentration)

9. Sustainability & Incentives

- Eligible for:

- U.S. 45V Clean Hydrogen PTC ($3/kg H₂ max)

- EU Innovation Fund, IPCEI Hy2Tech

- Carbon credits (e.g., CORSIA, voluntary markets)

- Lifecycle Assessment (LCA): Required to verify carbon intensity (e.g., <4 kg CO₂e/kg H₂ for green H₂)

10. Conclusion

Hydrogen is a viable, zero-carbon furnace fuel with growing infrastructure and regulatory support. Success requires:

– Proper logistics planning

– Compliance with safety and environmental standards

– Investment in hydrogen-ready equipment

– Continuous training and monitoring

With strategic implementation, H₂ can decarbonize high-heat industrial processes while maintaining efficiency and reliability.

Prepared by: [Your Organization] – Energy & Compliance Division

Contact: [email protected]

Last Updated: April 2024

Disclaimer: This guide is for informational purposes. Always consult local authorities and certified engineers before implementation.

Conclusion for Sourcing Furnace Fuel

In conclusion, selecting the appropriate fuel source for furnace operations requires a careful evaluation of energy efficiency, cost-effectiveness, environmental impact, availability, and compatibility with existing systems. Common fuel options such as natural gas, propane, fuel oil, coal, biomass, and electricity each present unique advantages and challenges. Natural gas often emerges as a preferred choice due to its clean combustion, widespread availability, and lower emissions, while renewable options like biomass support sustainability goals despite potential logistical and handling complexities.

Ultimately, the optimal fuel choice depends on regional resource availability, regulatory requirements, long-term energy pricing trends, and organizational sustainability objectives. A comprehensive assessment, including lifecycle cost analysis and environmental considerations, ensures a reliable, efficient, and responsible fuel sourcing strategy. Diversifying fuel sources or investing in hybrid systems may also enhance energy security and operational resilience in the face of market volatility and evolving environmental standards.