The global fuel pressure regulator sensor market is experiencing steady growth, driven by rising automotive production, stringent emission regulations, and the increasing adoption of advanced fuel injection systems. According to Grand View Research, the global automotive sensors market—encompassing fuel pressure regulators—was valued at USD 24.2 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. Similarly, Mordor Intelligence forecasts a robust CAGR of over 6.8% for the automotive sensors market during the forecast period of 2023–2028, citing enhanced vehicle electrification and demand for improved fuel efficiency as key growth catalysts. As fuel pressure regulator sensors play a critical role in optimizing combustion efficiency and ensuring engine performance, leading manufacturers are investing heavily in precision engineering and miniaturized sensor technologies. Against this backdrop, we spotlight the top 10 companies pioneering innovation and market leadership in fuel pressure regulator sensor manufacturing.

Top 10 Fuel Pressure Regulator Sensor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Fuel Pressure Regulators: OEM, High

Domain Est. 2007

Website: highflowfuel.com

Key Highlights: 3-day deliveryShop OEM-spec, high-performance, & inline fuel pressure regulators to maintain the perfect fuel pressure level in your fuel system….

#2 SSI Technologies, LLC

Domain Est. 2011

Website: ssi-sensors.com

Key Highlights: SSI’s family of pressure sensors use piezoresistive technology for its sensor signal processing to measure pressure. SSI Technologies, LLC full line of ……

#3 PCB Piezotronics

Domain Est. 1992

Website: pcb.com

Key Highlights: PCB® manufactures sensors used by design engineers and predictive maintenance professionals to test and measure vibration, pressure, force, acoustics, load, and ……

#4 TESCOM

Domain Est. 1995

Website: discreteautomation.emerson.com

Key Highlights: TESCOM designs and manufactures a wide range of standard and custom engineered pressure control regulator and valve solutions for a diverse, global market….

#5 Fuel Pressure Regulators

Domain Est. 1997

Website: walkerproducts.com

Key Highlights: Fuel Pressure Regulators (FPR) maintain the correct pressure in the fuel rail for proper injector fuel delivery….

#6 Precision Fuel Pressure Regulators for a Wide Variety of Applications

Domain Est. 1997

Website: aeromotiveinc.com

Key Highlights: Free delivery 90-day returnsAeromotive’s Fuel Pressure Regulators are built to perform at any speed, angle, or condition, embodying our commitment to excellence in automotive fuel …

#7 Fuel Pressure Sensor

Domain Est. 2000

Website: standardbrand.com

Key Highlights: Standard provides top coverage and quality for fuel pressure sensors that monitor the pressure in the fuel system to detect evaporative leaks….

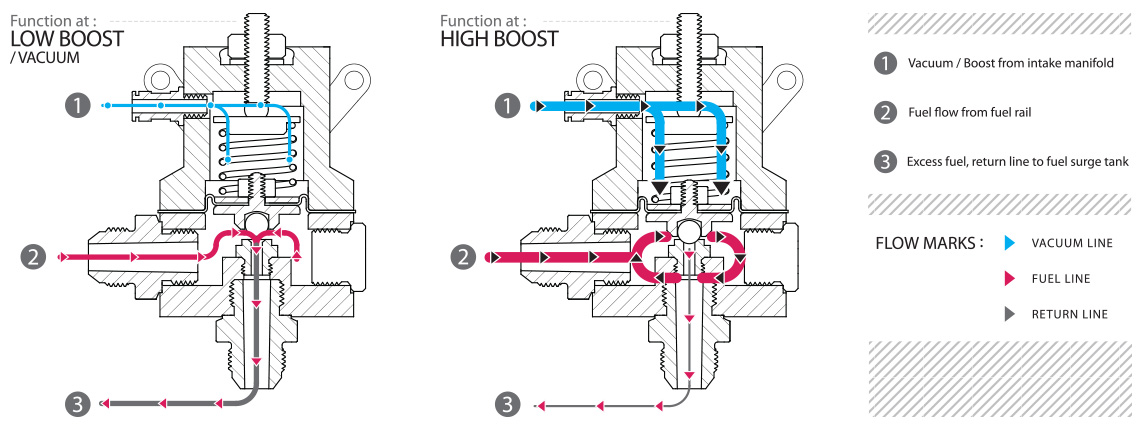

#8 How does a Fuel Pressure Regulator work?

Domain Est. 2005

Website: nukeperformance.com

Key Highlights: Like most regulators our FPR provide a convenient pressure port for attaching a fuel pressure gauge or alternatively, a fuel pressure sensor for digital output….

#9 Fuel Pressure Regulator

Domain Est. 2010

#10 Fuel Pressure Regulator

Domain Est. 2012

Website: delphiautoparts.com

Key Highlights: A fuel pressure regulator works to maintain proper and consistent pressure for the injectors during a variety of driving conditions….

Expert Sourcing Insights for Fuel Pressure Regulator Sensor

H2: 2026 Market Trends for Fuel Pressure Regulator Sensor

The global market for fuel pressure regulator sensors is poised for significant evolution by 2026, driven by advancements in automotive technology, tightening emissions regulations, and the ongoing shift toward fuel-efficient and hybrid propulsion systems. Below are the key trends shaping the fuel pressure regulator sensor market in 2026:

-

Increased Demand for Precision and Reliability

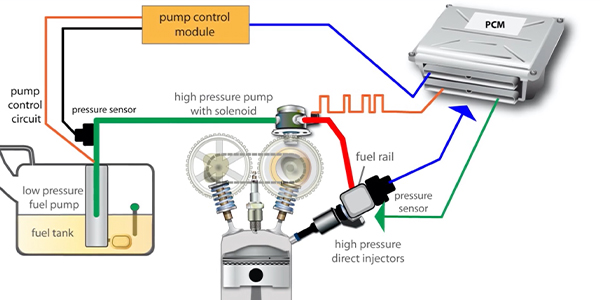

With stricter emissions standards—such as Euro 7 in Europe and Tier 4 in North America—automotive manufacturers are prioritizing precise fuel delivery systems. Fuel pressure regulator sensors are critical in maintaining optimal fuel pressure in direct injection engines, ensuring efficient combustion and reduced emissions. In 2026, demand is rising for high-accuracy, durable sensors capable of operating under extreme temperature and pressure conditions. -

Growth in Gasoline Direct Injection (GDI) Engines

The proliferation of GDI engines in passenger vehicles continues to drive market expansion. These engines rely heavily on advanced fuel pressure regulator sensors to maintain high fuel rail pressures (up to 350 bar). As GDI penetration increases in emerging markets like India, Southeast Asia, and Latin America, sensor demand is expected to grow steadily through 2026. -

Integration with Advanced Engine Control Units (ECUs)

Modern fuel pressure regulator sensors are increasingly integrated with sophisticated ECUs that use real-time data for adaptive fuel management. In 2026, sensor-to-ECU communication is becoming faster and more intelligent, supporting predictive maintenance and improved engine performance. The trend toward software-defined vehicles is enhancing the value proposition of smart sensors. -

Rise of Hybrid Electric Vehicles (HEVs)

While full electric vehicles (EVs) do not require fuel pressure sensors, HEVs still rely on internal combustion engines (ICEs) and thus continue to use fuel pressure regulation systems. As HEVs act as a transitional technology in many regions, especially in Asia and Eastern Europe, they sustain demand for fuel pressure regulator sensors. Manufacturers are developing compact, lightweight sensors tailored for hybrid powertrains. -

Adoption of Advanced Materials and Miniaturization

To meet automotive OEMs’ demands for smaller, lighter, and more robust components, sensor manufacturers are leveraging MEMS (Micro-Electro-Mechanical Systems) technology and advanced materials like silicon carbide and ceramic substrates. By 2026, miniaturized sensors with enhanced thermal stability and resistance to fuel contaminants are becoming standard. -

Regional Market Shifts

Asia-Pacific, particularly China and India, is emerging as the fastest-growing market due to rising vehicle production and government initiatives promoting cleaner engines. Meanwhile, North America and Europe remain key markets driven by retrofitting programs and stringent fuel economy standards. Localized production and supply chain resilience are influencing manufacturing strategies. -

Sustainability and Circular Economy Considerations

In response to environmental concerns, sensor manufacturers are focusing on recyclable materials and energy-efficient production processes. By 2026, sustainability certifications and eco-design principles are becoming competitive differentiators in procurement decisions by major automakers. -

Technological Convergence and Data Integration

Fuel pressure regulator sensors are increasingly part of broader vehicle health monitoring systems. In 2026, data from these sensors is being aggregated with other powertrain diagnostics via cloud platforms, enabling fleet operators and service centers to optimize maintenance schedules and reduce downtime.

In conclusion, the fuel pressure regulator sensor market in 2026 is characterized by technological sophistication, regulatory pressure, and integration within smarter, cleaner vehicle ecosystems. While the long-term outlook may be affected by the rise of full electrification, the intermediate-term demand remains robust, especially in hybrid and high-efficiency ICE applications.

Common Pitfalls When Sourcing a Fuel Pressure Regulator Sensor (Quality, IP)

Sourcing a Fuel Pressure Regulator Sensor (FPRS) requires careful attention to avoid critical issues related to quality and intellectual property (IP). Overlooking these aspects can lead to system failures, safety hazards, legal disputes, and reputational damage. Below are the key pitfalls to watch for:

1. Compromised Component Quality

Pitfall: Selecting low-cost sensors from suppliers lacking robust quality control processes or certifications.

- Risk: Substandard materials, inconsistent calibration, or poor sealing can lead to inaccurate fuel pressure readings, engine performance issues, increased emissions, or even fuel leaks.

- Example: Sensors failing prematurely under high-temperature or vibration conditions common in engine bays.

- Mitigation: Require ISO/TS 16949 (or IATF 16949) certification, conduct on-site audits, and demand full traceability and batch testing reports.

2. Inadequate Environmental Protection (IP Rating)

Pitfall: Overlooking the Ingress Protection (IP) rating required for the sensor’s operating environment.

- Risk: Sensors with insufficient IP ratings (e.g., below IP6K9K for under-hood applications) may allow moisture, dust, or chemical ingress, causing short circuits or sensor drift.

- Example: A sensor rated IP54 may fail in high-pressure wash environments or high-humidity zones, leading to premature failure.

- Mitigation: Specify exact IP requirements based on installation location and environmental exposure; verify test reports from suppliers.

3. Counterfeit or Non-OEM-Compliant Components

Pitfall: Sourcing from unauthorized channels increases the risk of counterfeit sensors that mimic genuine parts but lack performance and safety standards.

- Risk: Poor calibration accuracy, use of non-approved materials, and potential violations of OEM specifications.

- Example: Counterfeit sensors may pass initial inspection but fail under real-world conditions, leading to warranty claims.

- Mitigation: Source only through authorized distributors or direct OEM partnerships; implement anti-counterfeit verification protocols.

4. Intellectual Property Infringement

Pitfall: Unknowingly procuring sensors that infringe on patented designs, circuitry, or calibration algorithms.

- Risk: Legal liability, product recalls, import bans, and damage to brand reputation.

- Example: A cloned FPRS based on a competitor’s patented pressure transducer design could trigger infringement lawsuits.

- Mitigation: Conduct IP due diligence; require suppliers to provide IP indemnification clauses in contracts; verify freedom-to-operate.

5. Lack of Calibration and Traceability Documentation

Pitfall: Accepting sensors without full calibration certificates or traceable serial numbers.

- Risk: Inconsistent performance across units, difficulty in root-cause analysis during failures, and non-compliance with regulatory standards (e.g., EPA, Euro 6).

- Mitigation: Enforce requirements for NIST-traceable calibration and digital part traceability throughout the supply chain.

6. Insufficient Long-Term Supply and Support

Pitfall: Choosing suppliers without a proven history of long-term availability and technical support.

- Risk: Production halts due to discontinued parts, lack of firmware updates, or unavailable failure analysis.

- Mitigation: Evaluate supplier stability, lifecycle management policies, and obsolescence planning during selection.

By proactively addressing these pitfalls—focusing on certified quality, correct IP ratings, authenticity, IP compliance, and full documentation—procurement teams can ensure reliable, safe, and legally compliant sourcing of Fuel Pressure Regulator Sensors.

H2: Logistics & Compliance Guide for Fuel Pressure Regulator Sensor

This guide outlines the critical logistics and compliance considerations for the safe, legal, and efficient handling, transportation, storage, and documentation of Fuel Pressure Regulator Sensors (FPRS) throughout the supply chain.

H3: Regulatory Classification & Documentation

- Product Classification: FPRS are typically classified as automotive parts (HS Code 8708.29 or 8533.10, country-specific). They may also fall under electronic components due to integrated sensors. Verify exact HS codes with the destination country’s customs authority.

- Material Safety Data Sheet (MSDS/SDS): While generally non-hazardous, an SDS must be available. It should confirm the absence of significant hazardous substances (e.g., lead, mercury, cadmium above RoHS limits, specific phthalates) and detail composition (metals, plastics, elastomers). Crucially, it must state if the sensor contains any pressurized components or residual flammable liquids. If pressurized, specific hazardous goods regulations apply.

- Certificate of Conformity (CoC): Required documentation proving the sensor meets relevant safety and performance standards in the target market (e.g., ISO 9001, IATF 16949 for quality; specific OEM specifications).

- RoHS/REACH Compliance: Mandatory for EU and many other markets. Provide formal declarations confirming compliance with restrictions on hazardous substances (RoHS) and registration of chemical substances (REACH).

- Conflict Minerals Reporting: If applicable (especially for US customers), be prepared to provide data on the sourcing of Tin, Tantalum, Tungsten, and Gold (3TG) to comply with regulations like the Dodd-Frank Act.

- Warranty & Traceability: Maintain batch/lot traceability records for quality control and recall management. Include warranty terms in commercial documentation.

H3: Packaging & Labeling Requirements

- Primary Packaging: Protect sensors from physical damage (shock, vibration, bending pins), contamination (dust, moisture, oils), and electrostatic discharge (ESD). Use:

- Rigid plastic clamshells or trays.

- Anti-static bags (pink or black poly) for ESD-sensitive components.

- Desiccant packs if moisture sensitivity is a concern.

- Secondary Packaging: Secure primary packaging within strong, double-walled corrugated cardboard boxes. Use void fill (bubble wrap, foam inserts, molded pulp) to prevent movement. Boxes must withstand stacking.

- Labeling: Each package must be clearly labeled with:

- Product Name & Part Number (P/N).

- Quantity.

- Lot/Batch Number.

- Manufacturer/OEM Name.

- “Fragile” and “Handle with Care” markings.

- “This Way Up” arrows.

- ESD Warning Symbol (if applicable).

- Country of Origin.

- Barcodes (e.g., SSCC, UPC, or customer-specific).

- Hazardous Goods Label (ONLY if pressurized/residual fluid – see SDS): UN number, proper shipping name, hazard class (e.g., Class 2.1 Flammable Gas, Class 3 Flammable Liquid), packing group, GHS pictograms. This triggers full ADR/IMDG/IATA compliance.

H3: Storage Conditions

- Environment: Store in a clean, dry, temperature-controlled environment. Avoid extreme temperatures (typically -10°C to +40°C / 14°F to 104°F) and high humidity (ideally <60% RH).

- Location: Store on pallets or shelves off the floor. Protect from direct sunlight, dust, and chemical fumes.

- Handling: Practice FIFO (First-In, First-Out) inventory management. Avoid stacking packages excessively high to prevent crushing. Handle with care to prevent damage to connectors and housings.

- ESD Control (if applicable): Store ESD-sensitive sensors within designated ESD-protected areas (EPAs) using grounded work surfaces and appropriate packaging.

H3: Transportation Modes & Handling

- General Handling: Treat as fragile goods. Use appropriate material handling equipment (MHE). Avoid dropping, rolling, or dragging packages. Protect from weather during loading/unloading.

- Road Freight (Truck): Secure loads properly on pallets using stretch wrap or straps. Ensure even weight distribution. Use temperature-controlled vehicles if required by specifications or long transit times through extreme climates. Comply with regional road transport regulations (e.g., ADR only if hazardous).

- Air Freight: Subject to IATA Dangerous Goods Regulations ONLY if classified as hazardous (pressurized/fluid). Non-hazardous sensors must still comply with general aviation safety and security requirements (e.g., TSA/FAA). Use sturdy packaging suitable for air pressure changes. Shipper’s Declaration for Dangerous Goods (DGD) is mandatory for hazardous shipments.

- Ocean Freight (Container): Protect from salt air and condensation (container desiccants recommended). Secure cargo within the container to prevent shifting. Comply with IMDG Code ONLY if hazardous. Ensure ventilation if non-hazardous but sensitive to moisture.

- Rail Freight: Similar precautions to road freight regarding securing loads and environmental protection.

H3: Key Compliance Regulations (Examples)

- Non-Hazardous: Focus on customs (HS Codes, CoC, RoHS/REACH), packaging standards (ISTA, ASTM), and general safety.

- Hazardous (Pressurized/Residual Fluid): STRICT adherence to:

- Globally: UN Recommendations on the Transport of Dangerous Goods (Model Regulations).

- Air: IATA Dangerous Goods Regulations (DGR).

- Sea: IMDG Code (International Maritime Dangerous Goods).

- Road (Europe): ADR (European Agreement).

- Road (North America): 49 CFR (US DOT) / TDG (Canada).

- Rail (North America): 49 CFR / TDG.

- Environmental: WEEE (Waste Electrical and Electronic Equipment) – Ensure end-of-life disposal/recycling pathways are considered and communicated where required (especially EU).

H3: Risk Mitigation & Best Practices

- Verify SDS: Always obtain and review the current SDS before shipping. The presence or absence of hazardous materials dictates the entire compliance regime.

- Accurate Classification: Invest in expert dangerous goods classification if there’s any doubt about pressurization or fluid content.

- Training: Ensure all personnel involved in handling, packaging, and documentation (especially for hazardous goods) are properly trained and certified.

- Carrier Selection: Use carriers experienced in handling automotive parts and, critically, certified to transport dangerous goods if applicable. Provide them with complete, accurate documentation.

- Insurance: Ensure adequate cargo insurance covers the full value and any specific risks (e.g., temperature damage, hazardous goods incidents).

- Audits: Conduct regular audits of packaging, storage, and compliance procedures.

- Customer Requirements: Always confirm specific packaging, labeling, and documentation requirements with the receiving customer or OEM.

Disclaimer: Regulations are complex and subject to change. This guide provides general best practices. Always consult the specific product SDS, relevant regulatory authorities (e.g., DOT, ECHA, IATA, IMDG), and qualified logistics/compliance professionals for definitive requirements based on the exact sensor model, origin, destination, and transport mode.

In conclusion, sourcing a fuel pressure regulator sensor requires careful consideration of compatibility, quality, supplier reliability, and cost-effectiveness. It is essential to ensure the sensor matches the specifications of the vehicle’s engine management system, including correct pressure ratings, electrical connections, and physical dimensions. Opting for OEM or reputable aftermarket brands helps guarantee durability and accurate performance. Additionally, purchasing from trusted suppliers with proper certifications and customer support minimizes the risk of receiving counterfeit or substandard parts. By conducting thorough research and due diligence, one can source a fuel pressure regulator sensor that ensures optimal engine performance, fuel efficiency, and long-term reliability.