The global friction materials market is undergoing significant expansion, driven by rising automotive production, increasing demand for high-performance braking systems, and stringent safety regulations worldwide. According to Mordor Intelligence, the market was valued at USD 24.65 billion in 2023 and is projected to reach USD 33.89 billion by 2029, growing at a CAGR of approximately 5.4% during the forecast period. This growth is further fueled by advancements in material technologies—such as ceramic, semi-metallic, and low-metal formulations—and the rising adoption of electric and hybrid vehicles requiring specialized friction solutions. As demand intensifies, a select group of manufacturers have distinguished themselves through innovation, scale, and global supply chain reach. Below are the top 8 friction material manufacturers shaping the industry’s future with cutting-edge R&D, strategic partnerships, and consistent performance across automotive and industrial applications.

Top 8 Friction Material Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 FMSI.org

Domain Est. 1998

Website: fmsi.org

Key Highlights: The Friction Materials Standards Institute was founded as a trade association of automotive aftermarket friction manufacturers….

#2 TMD Friction

Domain Est. 2000

Website: tmdfriction.com

Key Highlights: TMD Friction designs exceptional brake products for the world’s biggest automotive brands and motorsport. One of the world’s leading friction manufacturers….

#3 Friction Material Manufacturers

Domain Est. 2002

Website: frictionmaterials.com

Key Highlights: We have been working hard for over 3 decades and specialize in the manufacture of high quality friction materials, gear tooth facings, press blocks, and more….

#4 Friction Material Manufacturers

Domain Est. 2007

Website: gmpfriction.com

Key Highlights: To support our customers’ success through collaboration, engineering, and manufacturing of friction materials and system components….

#5 PMA Friction Products

Domain Est. 2009

Website: pmafrictionproducts.com

Key Highlights: PMA Friction Products is a custom manufacturer of non-asbestos brake and clutch friction materials. Our friction materials are formulated from a wide range ……

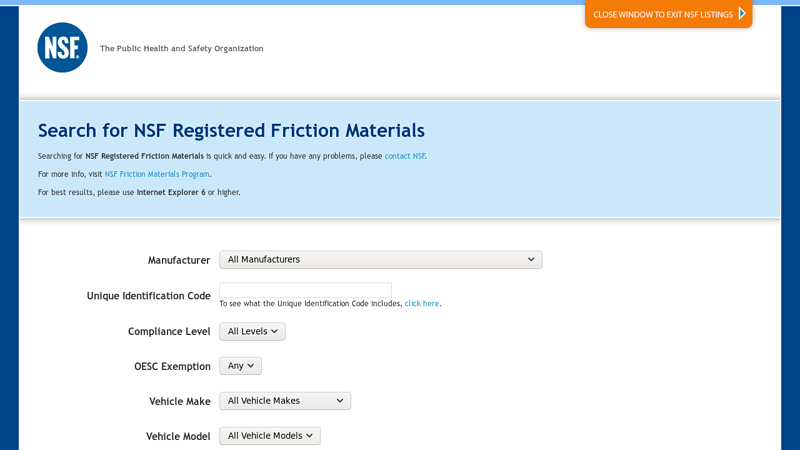

#6 Search for NSF Registered Friction Materials

Domain Est. 1996

Website: info.nsf.org

Key Highlights: Search for NSF Registered Friction Materials. Searching for NSF Registered Friction Materials is quick and easy. If you have any problems, please contact NSF….

#7 Carlisle Brake & Friction

Domain Est. 2011

Website: carlislecbf.com

Key Highlights: Carlisle Brake & Friction is part of CentroMotion, a global manufacturing company specializing in friction products, information and control devices ……

#8 About

Domain Est. 2014

Website: frictionmaster.com

Key Highlights: Headquartered in Chicago, Friction Master is a team of braking experts devoted to the highest quality of service for you….

Expert Sourcing Insights for Friction Material

H2: Market Trends in Friction Materials for 2026

The global friction materials market is poised for significant transformation by 2026, driven by technological advancements, regulatory pressures, and evolving end-user demands. Key trends shaping the industry include the shift toward sustainable and eco-friendly materials, increased demand from the electric vehicle (EV) sector, and the growing emphasis on performance under extreme conditions.

-

Sustainability and Environmental Regulations

Stringent emission standards and environmental regulations, particularly in North America and Europe, are accelerating the adoption of low-metal and asbestos-free friction materials. By 2026, manufacturers are expected to prioritize bio-based, recyclable, and non-hazardous raw materials to comply with laws such as the EU’s REACH and End-of-Life Vehicles Directive. This shift is fostering innovation in organic and ceramic composites that offer reduced particulate emissions and noise. -

Growth in Electric and Hybrid Vehicles

The rise of EVs and hybrid electric vehicles (HEVs) is altering friction material requirements. Regenerative braking systems in EVs reduce mechanical brake usage, but when brakes are applied, they often operate at lower temperatures, requiring materials with stable friction coefficients across a wider range. By 2026, demand is expected to grow for specialized friction formulations optimized for cold-start braking efficiency and wear resistance in low-utilization scenarios. -

Advanced Material Innovation

The integration of nanotechnology, ceramic composites, and carbon-based materials is enhancing thermal stability, wear resistance, and noise reduction. Companies are investing in R&D to develop smart friction materials with embedded sensors for real-time wear monitoring—a trend expected to gain traction by 2026, especially in premium automotive and commercial vehicle segments. -

Expansion in Emerging Markets

Asia-Pacific, particularly China and India, will remain key growth engines due to rising vehicle production and infrastructure development. The demand for cost-effective yet durable friction materials in two-wheelers, commercial vehicles, and railway systems will drive regional market expansion. Localized manufacturing and supply chain optimization will be critical for global players. -

Consolidation and Strategic Partnerships

Market consolidation is anticipated as larger players acquire niche innovators to strengthen their portfolios in eco-friendly and high-performance materials. Strategic collaborations with OEMs and Tier-1 suppliers will be essential to co-develop application-specific solutions and secure long-term contracts.

In summary, by 2026, the friction materials market will be characterized by sustainability-driven innovation, adaptation to electrified mobility, and technological sophistication, positioning advanced composites and intelligent systems at the forefront of industry evolution.

Common Pitfalls Sourcing Friction Material (Quality, IP)

Sourcing friction materials—used in brake pads, clutches, and other high-wear applications—presents unique challenges, particularly concerning quality consistency and intellectual property (IP) protection. Failing to address these areas can lead to product failures, safety risks, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Inadequate Quality Control and Consistency

Friction materials must meet strict performance standards for safety, durability, and reliability. Poor quality control during sourcing can result in inconsistent formulations, variable friction coefficients, and premature wear.

- Unverified Supplier Capabilities: Selecting suppliers without auditing their manufacturing processes, raw material traceability, and testing protocols can lead to substandard materials.

- Lack of Standardized Testing: Failure to require or verify compliance with industry standards (e.g., ISO 6310, SAE J661) increases the risk of inconsistent performance.

- Batch-to-Batch Variability: Without robust quality agreements and incoming inspection processes, minor formulation changes can go undetected, impacting end-product performance.

Intellectual Property Infringement and Misappropriation

Friction material formulations often involve proprietary blends of resins, fibers, and fillers developed through significant R&D investment. Sourcing from unreliable partners heightens the risk of IP theft or unintentional infringement.

- Use of Copycat or Reverse-Engineered Formulations: Some suppliers may offer “equivalent” materials that mimic patented compositions, exposing the buyer to legal liability.

- Weak IP Clauses in Contracts: Failure to include clear ownership, confidentiality, and non-disclosure agreements (NDAs) can result in loss of trade secrets or unauthorized use of formulations.

- Lack of Supply Chain Transparency: When sourcing through intermediaries or multi-tier suppliers, it becomes harder to ensure that the material does not incorporate infringing technologies.

Overlooking Regulatory and Environmental Compliance

Friction materials are subject to evolving environmental regulations (e.g., EU’s ELV Directive, U.S. copper-free brake laws). Sourcing non-compliant materials can lead to product recalls or market access restrictions.

- Failure to Verify Compliance Documentation: Assuming compliance without proper certification or test reports can result in regulatory penalties.

- Use of Restricted Substances: Unintentional inclusion of banned materials (e.g., asbestos, heavy metals) due to poor supplier oversight poses serious health and legal risks.

Insufficient Technical Collaboration and Support

Effective friction material performance depends on system-level integration with hardware (e.g., rotors, calipers). Sourcing without technical engagement can lead to compatibility issues.

- Treating Friction Material as a Commodity: Viewing the material as interchangeable without considering application-specific requirements (e.g., temperature range, noise performance) can result in field failures.

- Lack of Co-Development Agreements: Missing opportunities to collaborate on formulation tuning can limit performance optimization and innovation.

Conclusion

To mitigate these pitfalls, companies should conduct thorough due diligence on suppliers, enforce strong IP protections, require rigorous quality documentation, and maintain close technical collaboration. Establishing long-term partnerships with reputable, transparent suppliers is essential for ensuring both quality and IP integrity in friction material sourcing.

Logistics & Compliance Guide for Friction Material

Friction materials—including brake pads, clutch facings, and brake linings—are essential safety components in automotive and industrial applications. Due to their composition (often containing asbestos-free organic, ceramic, or metallic compounds), their handling, transportation, and regulatory compliance require specific attention. This guide outlines key logistics and compliance considerations for the safe and legal management of friction materials throughout the supply chain.

Regulatory Classification and Compliance

Friction materials may contain regulated substances such as heavy metals (e.g., copper, antimony) or historically contained asbestos. Even asbestos-free products must comply with evolving environmental and safety regulations. Key compliance frameworks include:

- REACH (EU): Registration, Evaluation, Authorisation and Restriction of Chemicals. Manufacturers and importers must ensure that substances in friction materials (e.g., zinc, lead compounds) are registered and do not exceed restricted substance thresholds.

- RoHS (EU): Restriction of Hazardous Substances. Applies to electrical and electronic components in vehicles; indirect implications for friction material formulations.

- TSCA (USA): Toxic Substances Control Act. Requires reporting of chemical substances, especially if legacy asbestos was used or if new compounds are introduced.

- Proposition 65 (California): Requires warnings if products contain chemicals known to cause cancer or reproductive harm—common in certain friction dust emissions.

Always obtain and maintain Safety Data Sheets (SDS) compliant with GHS standards to document composition and hazards.

Packaging and Handling Requirements

Proper packaging ensures product integrity and worker safety during storage and transit.

- Use durable, moisture-resistant packaging to prevent contamination or degradation.

- Clearly label packages with contents, batch numbers, and handling instructions (e.g., “Fragile,” “Keep Dry”).

- Avoid open containers to minimize dust generation, which may contain fine particulate matter regulated under air quality standards.

- Implement dust control measures during loading/unloading to protect personnel and comply with OSHA or equivalent occupational safety regulations.

Transportation and Shipping

Transport regulations are generally not strict for non-hazardous friction materials, but compliance is essential when materials contain regulated substances.

- Non-Hazardous Classification: Most modern friction materials are shipped as non-hazardous goods under IATA, IMDG, or ADR regulations—provided they contain no asbestos or other dangerous substances.

- Asbestos-Containing Materials (ACM): If handling legacy or non-compliant products containing asbestos, strict hazardous material protocols apply:

- Classify as Class 9 (Miscellaneous Dangerous Goods).

- Use leak-proof, labeled packaging with proper hazard markings.

- Provide shipping documents and emergency response information.

- Use enclosed vehicles to prevent loss, contamination, and dust dispersion during transit.

- Maintain chain-of-custody documentation for traceability, especially for OEM or regulated industry shipments.

Storage and Inventory Management

- Store in dry, well-ventilated areas away from direct sunlight and extreme temperatures.

- Elevate pallets off the floor to prevent moisture absorption.

- Segregate old or recalled batches to prevent accidental shipment.

- Implement FIFO (First In, First Out) inventory practices to avoid degradation over time.

- Monitor for physical damage or packaging breaches that could compromise material integrity.

Environmental and Disposal Considerations

Used or scrap friction materials are often classified as industrial waste due to metal and composite content.

- Do not dispose of in regular landfill if local regulations prohibit it (e.g., due to heavy metal leaching).

- Partner with certified waste handlers for proper recycling or disposal.

- Dust residue from manufacturing or maintenance may be subject to air emission controls (e.g., EPA NESHAP in the U.S.).

Documentation and Traceability

Maintain comprehensive records to support compliance audits and recalls:

- Batch-specific SDS and compliance certificates (e.g., REACH, RoHS).

- Certificates of Conformance (CoC) for raw materials and finished goods.

- Shipping logs, customs declarations, and import/export documentation.

- Proof of proper disposal or recycling for end-of-life materials.

Training and Worker Safety

Ensure personnel are trained in:

- Safe handling practices to minimize dust inhalation.

- Proper use of PPE (gloves, masks, eye protection).

- Emergency procedures for spills or exposure.

- Regulatory requirements specific to their region and role.

By adhering to these logistics and compliance guidelines, companies can ensure the safe, legal, and efficient handling of friction materials while minimizing environmental impact and legal risk.

Conclusion for Sourcing Friction Material:

Sourcing friction material requires a strategic approach that balances performance, cost, regulatory compliance, and supply chain reliability. The selection of the right friction material is critical to ensuring safety, durability, and efficiency in braking and transmission systems across automotive, industrial, and rail applications. Key considerations include material composition (such as organic, semi-metallic, or ceramic), coefficient of friction, heat dissipation properties, wear resistance, and environmental impact.

A successful sourcing strategy involves evaluating suppliers based on quality certifications (e.g., ISO standards), testing and validation capabilities, scalability, and adherence to environmental regulations such as REACH or ROHS. Establishing long-term partnerships with reliable suppliers helps mitigate risks related to material inconsistencies and supply disruptions. Additionally, staying informed about advancements in eco-friendly and next-generation friction materials enables organizations to remain competitive and compliant with evolving industry standards.

In conclusion, effective sourcing of friction material is not merely a procurement decision but a vital component of product performance and safety. By focusing on quality, innovation, and sustainable supply chain practices, companies can secure friction materials that meet technical requirements while supporting long-term operational and strategic goals.