The global market for fracture strength testing equipment is experiencing steady growth, driven by increasing demand for quality assurance across industries such as aerospace, automotive, construction, and biomedical. According to Grand View Research, the global materials testing equipment market size was valued at USD 4.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. This growth is fueled by stringent regulatory standards and rising R&D investments in material durability and performance. As manufacturers prioritize precision and compliance, the need for reliable fracture strength solutions has become critical. In this landscape, leading manufacturers distinguish themselves through innovation, accuracy, and advanced testing technologies. Below is a data-driven overview of the top 10 fracture strength equipment manufacturers shaping the industry.

Top 10 Fracture Strength Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Fracture Strength Of All

Domain Est. 1986

Website: digitalcommons.library.uab.edu

Key Highlights: Fracture strength of monolithic and bilayered LAVA and e. max lower molar crowns after load cycling was measured and compared….

#2 Fatigue Standards and Fracture Standards

Domain Est. 1994

Website: store.astm.org

Key Highlights: ASTM’s fatigue and fracture standards provide the appropriate procedures for carrying out fatigue, fracture, and other related tests on specified materials….

#3 Etching process effects on surface structure, fracture strength, and …

Domain Est. 1997

Website: nist.gov

Key Highlights: The etching processes used to produce microelectromechanical systems (MEMS) leave residual surface features that typically limit device ……

#4 Fracture strength of silicon solar cells

Domain Est. 1997

Website: ntrs.nasa.gov

Key Highlights: A test program was developed to determine the nature and source of the flaw controlling the fracture of silicon solar cells….

#5 Fracture strength test of digitally produced ceramic

Domain Est. 1997

Website: pmc.ncbi.nlm.nih.gov

Key Highlights: Purpose of this study was to investigate the mechanical efficiency of 3D-printed permanent and provisional implant cemented fixed bridges produced via ……

#6 Strength, plasticity, fracture and fatigue behaviour controlled by …

Domain Est. 2007

Website: european-mrs.com

Key Highlights: The combination of advanced testing techniques and simulation methods will improve the knowledge related to strength, fatigue and fracture of surfaces, ……

#7 Fracture Toughness determination (ISO 17281) now available

Domain Est. 2009

Website: impact-solutions.co.uk

Key Highlights: Impact labs are equipped for fast fracture testing with their new IFWI tester, adding fracture toughness determination to list of tests….

#8 SIGN Products

Domain Est. 2011

Website: signfracturecare.org

Key Highlights: We design, manufacture, and distribute orthopaedic instruments and implants from our facility in Richland, WA….

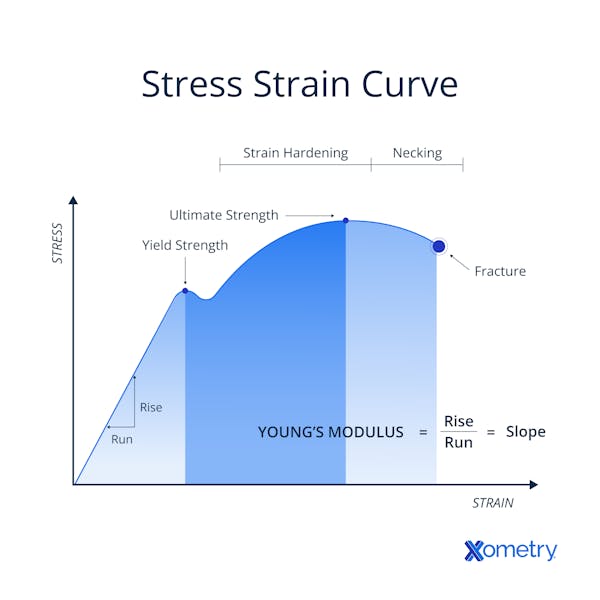

#9 Fracture Strength: What it is and How It Works

Domain Est. 2015

Website: xometry.com

Key Highlights: A material’s fracture strength defines the maximum stress or load it can withstand before a fracture occurs. Learn more about it here….

#10 China Understanding Fracture Strength

Domain Est. 2022

Website: dtgplasticmolding.com

Key Highlights: Fracture strength refers to the maximum amount of stress or force a material can endure before experiencing catastrophic failure, characterized by fracture….

Expert Sourcing Insights for Fracture Strength

H2: Fracture Strength Market Trends in 2026

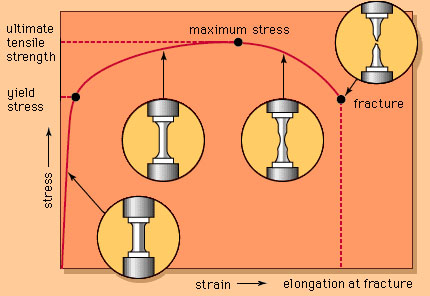

By 2026, the fracture strength market—primarily driven by advancements in materials science, structural engineering, and quality assurance across industries—is expected to experience significant transformation due to technological innovation, regulatory developments, and evolving industry demands. Fracture strength, a critical mechanical property measuring a material’s resistance to crack propagation under stress, remains a key performance indicator in sectors such as aerospace, automotive, construction, energy, and biomedical engineering.

1. Increased Demand in High-Performance Industries

The aerospace and defense sectors continue to demand materials with superior fracture strength to ensure the safety and longevity of components under extreme conditions. By 2026, the adoption of advanced composites, high-strength alloys (e.g., titanium aluminides and nickel-based superalloys), and ceramic matrix composites (CMCs) is expected to grow significantly. These materials offer high fracture toughness and resistance to fatigue, aligning with the need for lightweight, durable structures in next-generation aircraft and spacecraft.

2. Growth in Additive Manufacturing (3D Printing)

Additive manufacturing is revolutionizing how components with complex geometries are produced. However, inconsistencies in material microstructure and residual stresses in 3D-printed parts can compromise fracture strength. By 2026, there will be a strong market focus on process optimization, in-situ monitoring, and post-processing techniques (e.g., hot isostatic pressing) to enhance the fracture performance of additively manufactured components. This trend is especially prominent in medical implants and aerospace applications.

3. Smart Materials and Self-Healing Technologies

The integration of smart materials capable of self-diagnosis or self-repair is gaining traction. By 2026, materials embedded with microvascular networks or shape-memory polymers that can autonomously repair microcracks are expected to enter commercial applications. These innovations directly influence fracture strength by mitigating crack initiation and propagation, thereby extending the service life of critical components.

4. Rise in Predictive Analytics and Digital Twins

Digital twin technology and AI-driven predictive modeling are becoming essential tools for assessing fracture strength in real time. By 2026, industries will increasingly rely on simulation platforms that integrate finite element analysis (FEA) and machine learning to predict failure points and optimize designs before physical prototyping. This reduces R&D costs and accelerates time-to-market for high-integrity components.

5. Sustainability and Recycled Materials

With global emphasis on sustainability, the use of recycled metals and composites is rising. However, recycled materials often exhibit variable fracture strength due to impurities and microstructural inconsistencies. By 2026, advancements in material sorting, purification, and non-destructive testing (NDT) will improve the reliability of recycled materials, enabling broader adoption in structural applications without compromising safety.

6. Regulatory and Standardization Developments

As materials and manufacturing methods evolve, international standards (e.g., ASTM, ISO) will be updated to address fracture toughness testing for new material classes. By 2026, stricter regulatory requirements—especially in transportation and energy sectors—are expected to drive investment in accurate fracture strength evaluation and certification processes.

7. Emerging Applications in Renewable Energy

The renewable energy sector, particularly wind and nuclear power, demands materials with high fracture resistance to withstand cyclic loading and harsh environments. By 2026, turbine blades, reactor vessels, and offshore platforms will increasingly utilize fracture-resistant materials, supported by advanced monitoring systems to detect crack growth early.

Conclusion

The 2026 fracture strength market is characterized by innovation, digitization, and sustainability. Growth will be fueled by cross-industry demand for safer, lighter, and more durable materials. Companies investing in advanced testing methodologies, predictive modeling, and next-generation materials are poised to lead in this evolving landscape. As fracture strength becomes increasingly predictive and integrated into the design lifecycle, it will remain a cornerstone of material performance and structural integrity.

Common Pitfalls in Sourcing Fracture Strength Data (Quality, IP)

When sourcing fracture strength data—especially for critical applications—organizations often encounter challenges related to data quality and intellectual property (IP) considerations. Overlooking these aspects can lead to flawed designs, compliance issues, or legal risks. Below are key pitfalls to avoid:

Poor Data Quality and Inconsistencies

Fracture strength values can vary significantly based on testing methods, environmental conditions, and material batches. Sourcing data from unreliable or non-standardized sources may result in measurements that are not reproducible or representative. Common issues include missing metadata (e.g., temperature, strain rate, specimen geometry), lack of traceability to recognized standards (e.g., ASTM, ISO), and use of outdated or non-peer-reviewed publications. Without rigorous validation, such data can compromise structural integrity predictions.

Lack of Contextual Relevance

Fracture strength is highly dependent on material microstructure, processing history, and service conditions. Sourcing generic values without understanding the specific context—such as heat treatment, surface finish, or loading mode—can lead to inappropriate material selection. Data from one alloy or composite formulation may not apply to a slightly different variant, making direct comparisons misleading.

Intellectual Property (IP) Infringement Risks

Using fracture strength data obtained from proprietary databases, technical reports, or unpublished research without proper authorization may violate IP rights. Many organizations generate and protect mechanical property data as trade secrets or copyrighted content. Unauthorized use, especially in commercial product development or publications, can expose users to legal liability and damage business relationships.

Overreliance on Public or Open-Source Databases

While public databases (e.g., NIST, MatWeb) are valuable resources, they may contain unverified entries, aggregated data without attribution, or values extracted without permission from copyrighted sources. Users may mistakenly assume these data are free to use commercially, potentially leading to IP violations or quality issues due to lack of curation.

Failure to Document Data Provenance

Inadequate record-keeping regarding the origin, testing methodology, and limitations of sourced fracture strength data undermines traceability and accountability. This is especially problematic in regulated industries (e.g., aerospace, medical devices), where auditors require full documentation to ensure compliance with safety and quality standards.

Inadequate Licensing Agreements

When sourcing data from third-party vendors or research institutions, failing to secure proper licensing for intended use (e.g., internal R&D vs. product certification) can result in restricted usage or unexpected costs. Some licenses prohibit redistribution or commercial application, which may limit downstream innovation or product development.

Avoiding these pitfalls requires due diligence: verify data sources, ensure methodological transparency, confirm usage rights, and maintain clear documentation to support both technical reliability and legal compliance.

Logistics & Compliance Guide for Fracture Strength

This guide outlines the essential logistics and regulatory compliance considerations for managing, handling, and distributing Fracture Strength—a hypothetical or proprietary product requiring careful oversight due to its nature, intended use, or composition. Always verify specific requirements based on actual product classification and regional regulations.

Regulatory Classification and Documentation

Identify the precise regulatory classification of Fracture Strength (e.g., pharmaceutical, medical device, industrial chemical, dietary supplement) to determine applicable compliance frameworks. Maintain up-to-date documentation including Certificates of Analysis (CoA), Safety Data Sheets (SDS), and regulatory approvals (e.g., FDA, EMA, REACH). Ensure all labeling complies with jurisdiction-specific requirements for content, language, and hazard communication.

Storage and Environmental Controls

Store Fracture Strength under controlled conditions as specified by the manufacturer. Typical requirements may include temperature (e.g., 15–25°C), humidity, and protection from light. Use dedicated, secure storage areas with monitoring systems to log environmental data continuously. Segregate incompatible materials and ensure proper ventilation in storage facilities.

Transportation and Shipment Protocols

Use certified carriers experienced in handling regulated goods. Package Fracture Strength in UN-certified containers with appropriate cushioning and tamper-evident seals. Clearly label shipments with handling instructions, hazard symbols (if applicable), and tracking identifiers. Comply with international transport regulations such as IATA (air), IMDG (sea), or ADR (road), including required declarations and permits.

Import/Export Compliance

Verify export control classifications (e.g., ECCN) and obtain necessary licenses for cross-border shipments. Ensure adherence to destination country regulations, including import permits, customs documentation, and product registration. Maintain records of all export transactions for audit and traceability purposes.

Quality Assurance and Traceability

Implement a robust quality management system (e.g., ISO 9001, GMP) to oversee logistics operations. Utilize batch or serial tracking to enable full traceability from manufacturing to end-user. Conduct regular audits of logistics partners to ensure consistent compliance with internal and regulatory standards.

Incident Response and Recall Procedures

Establish a documented response plan for logistics-related incidents (e.g., shipment damage, temperature excursions, theft). Define clear escalation paths and communication protocols with regulatory bodies, customers, and internal stakeholders. Maintain a recall procedure that enables rapid product retrieval and reporting within mandated timeframes.

Training and Personnel Compliance

Provide regular training for logistics and warehouse personnel on handling procedures, safety protocols, and regulatory requirements. Ensure staff are certified where necessary (e.g., hazardous materials handling). Maintain training records and enforce strict access controls to inventory areas.

Sustainability and Waste Management

Dispose of expired or damaged Fracture Strength in accordance with environmental regulations (e.g., RCRA, WEEE). Partner with licensed waste handlers and document all disposal activities. Optimize packaging and transportation to minimize environmental impact and support sustainability goals.

For the most accurate guidance, consult the product’s technical dossier and engage with regulatory experts familiar with the target markets.

Conclusion for Sourcing Fracture Strength:

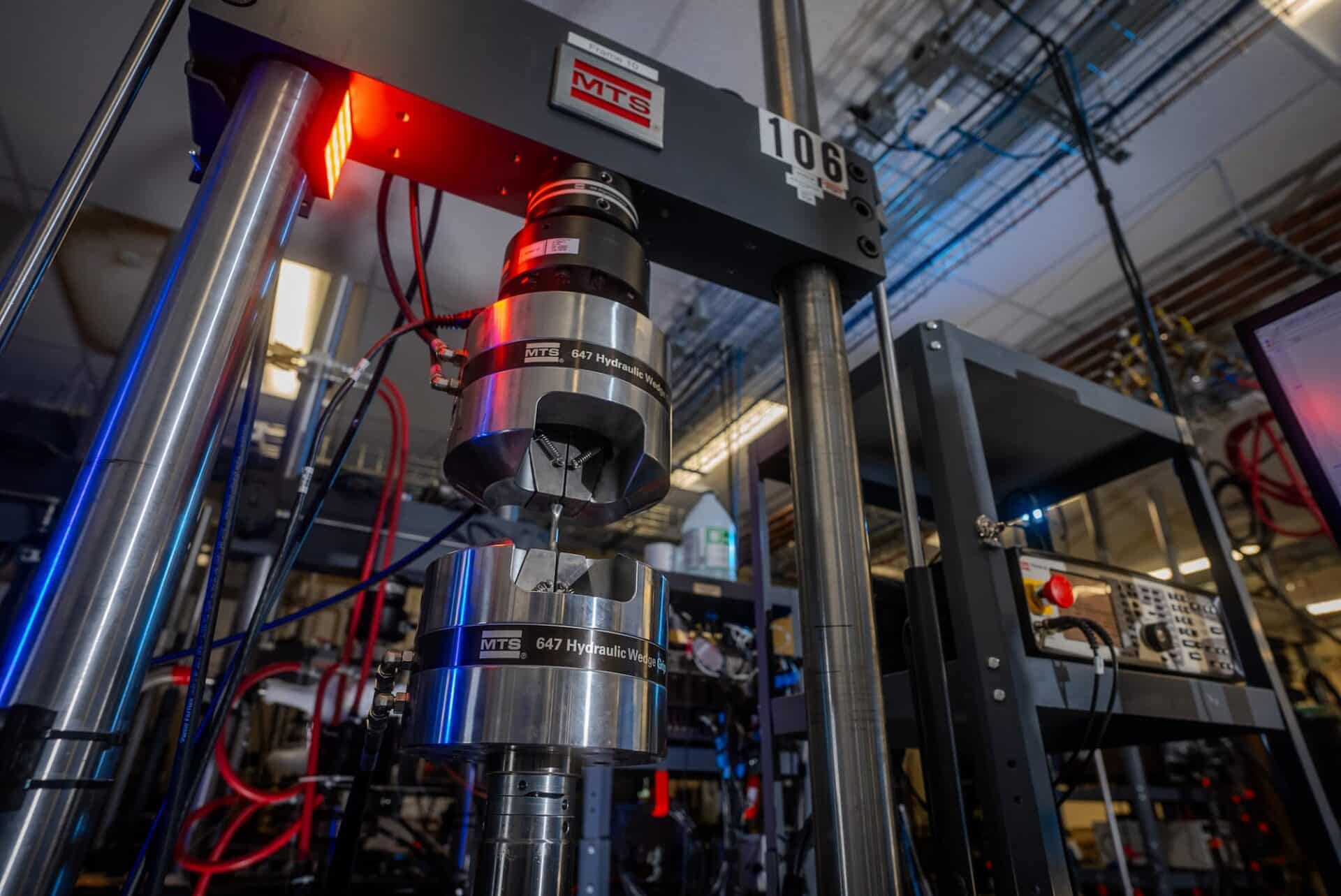

The fracture strength of a material is a critical mechanical property that determines its reliability and performance under stress, particularly in structural and engineering applications. Sourcing accurate and representative fracture strength data requires a comprehensive approach, combining empirical testing (such as tensile, bend, or fracture toughness tests), consideration of material microstructure, environmental conditions, and loading rates. Reliable sources include peer-reviewed literature, standardized test methods (e.g., ASTM, ISO), and material datasheets from reputable manufacturers. It is essential to account for variability due to manufacturing processes, defects, and service conditions when selecting fracture strength values for design purposes. Ultimately, a conservative and well-documented approach to sourcing fracture strength ensures structural integrity, safety, and long-term durability of engineered components and systems.