The global automotive frame manufacturing market is experiencing steady growth, driven by increasing vehicle production, rising demand for lightweight materials, and advances in modular chassis design. According to Mordor Intelligence, the automotive chassis market was valued at USD 139.5 billion in 2023 and is projected to grow at a CAGR of over 4.8% from 2024 to 2029. This expansion is fueled by OEMs’ focus on enhancing vehicle safety, fuel efficiency, and performance—key factors where the frame plays a critical structural role. As demand for both conventional and electric four-wheelers rises across North America, Europe, and Asia-Pacific, frame manufacturers are investing heavily in high-strength steel, aluminum alloys, and composite materials to meet evolving regulatory and performance standards. In this competitive landscape, nine key players have emerged as leaders in innovation, scalability, and technological integration, setting the benchmark for quality and reliability in four-wheeler frame production.

Top 9 Four Wheeler Frame Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Chassis Systems

Domain Est. 1991

Website: magna.com

Key Highlights: Magna has produced full frames for mid-size, full-size and heavy-duty pick-ups and SUVs for over 20 years. Frames are the main supporting structure of the ……

#2 High Lifter

Domain Est. 1997

Website: highlifter.com

Key Highlights: Free delivery · 30-day returnsHigh Lifter is the industry’s leading source for ATV & UTV portals, axles, lift kits, control arms, springs, shocks, snorkels, doors & performance pa…

#3 TOMCAR

Domain Est. 1998

Website: tomcar.com

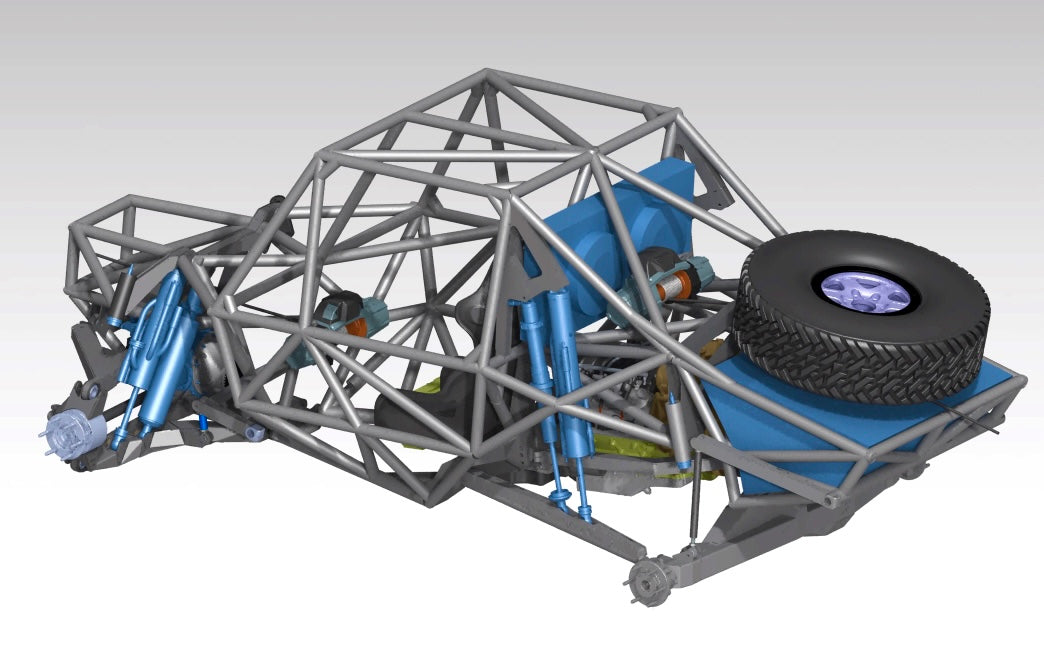

Key Highlights: TOMCAR has combined all of the best aspects of commercial and consumer-grade ATVs, UTVs, and other off-road vehicles into one turn-key package….

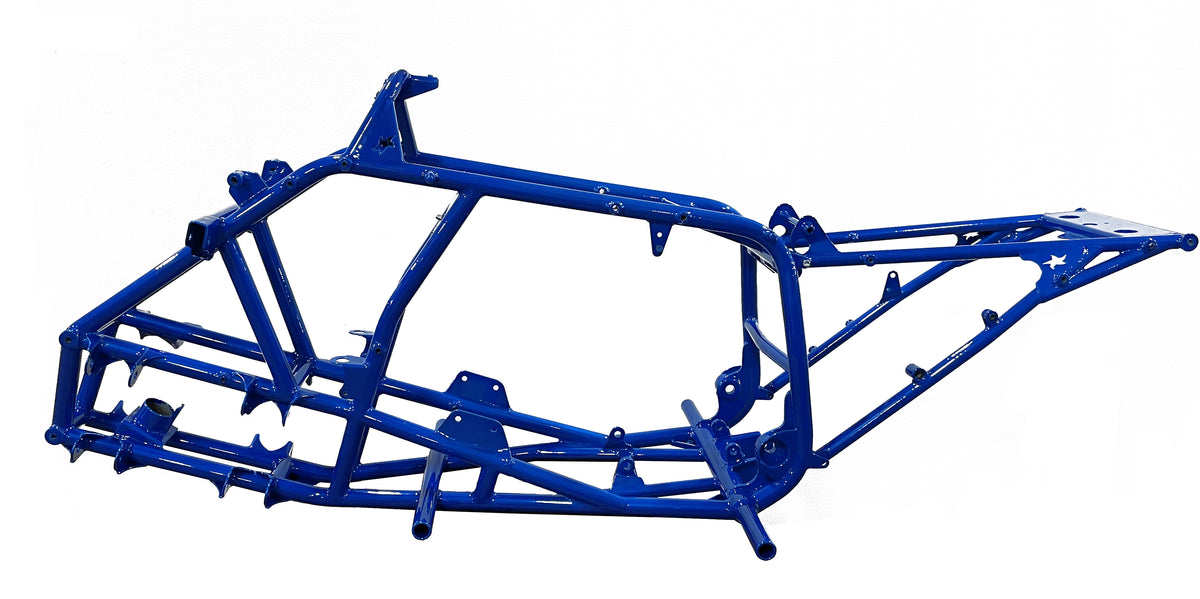

#4 Lonestar Racing

Domain Est. 1999

Website: lsracing.com

Key Highlights: Full Tube 4130 chromoly tig welded race chassis. Chassis is 4” wider in the belly in order to comfortably fit a 34 gallon center mounted fuel cell….

#5 Fab Fours: Premium Truck and SUV Parts

Domain Est. 2004

Website: fabfours.com

Key Highlights: For over 10 years, Fab Fours has been designing, developing and delivering premium steel products made right here the USA….

#6 TMR Customs: 4×4 Off Road Parts

Domain Est. 2008

Website: tmrcustoms.com

Key Highlights: For 4×4 off-road parts, TMR Customs has some of the highest-quality products in the market. Customize your vehicle, get outside and start off-roading today!…

#7 ATV TEK: Off Road Accessories For ATV/UTV

Domain Est. 2009

Website: atv-tek.com

Key Highlights: Get UTV Mirrors, rack systems, four wheeler accessories, off road accessories, towing utility, hunting products, and much more from ATV TEK….

#8 Autokiniton

Domain Est. 2014

Website: autokiniton.com

Key Highlights: We manufacture full body-frame structural assemblies that provide state-of-the-art lightweighting and structural benefits.Missing: four wheeler…

#9 NDR Auto Components: Seating Systems for Four

Domain Est. 2020

Website: ndrauto.com

Key Highlights: NDR Auto Components is manufacturing complete seating systems under one roof catering to the four-wheeler, two-wheeler and surface transport segments….

Expert Sourcing Insights for Four Wheeler Frame

H2: 2026 Market Trends for Four Wheeler Frames

As the automotive industry evolves toward electrification, sustainability, and advanced materials, the market for four wheeler frames—encompassing SUVs, trucks, and off-road vehicles—is expected to undergo significant transformation by 2026. Key trends shaping this sector include material innovation, lightweighting demands, integration with electric powertrains, regional market dynamics, and regulatory influences.

-

Shift Toward Lightweight and High-Strength Materials

By 2026, aluminum and high-strength steel (HSS) are projected to dominate frame construction in four wheelers, replacing traditional mild steel. Automakers are increasingly adopting hydroformed steel and aluminum alloys to reduce vehicle weight and improve fuel efficiency—critical for meeting global emissions standards. Additionally, the use of advanced composites in non-structural frame components is expected to grow, especially in premium off-road and performance models. -

Electrification and Frame Architecture Redesign

The rise of electric SUVs and trucks is driving a shift from body-on-frame to unibody and modular skateboard platforms. However, body-on-frame designs will persist in heavy-duty trucks and off-road vehicles, with adaptations to accommodate large battery packs, electric motors, and lower centers of gravity. OEMs are developing reinforced frames with integrated battery protection and thermal management systems, influencing frame design complexity and manufacturing processes. -

Increased Demand for Off-Road and Adventure Vehicles

Consumer interest in adventure tourism and outdoor recreation continues to fuel demand for rugged four wheelers. This trend supports sustained investment in durable, off-road-optimized frame designs, including ladder frames with enhanced torsional rigidity and modular mounting points for aftermarket accessories. Markets in North America, Australia, and parts of Asia-Pacific are leading this demand. -

Regional Manufacturing and Supply Chain Shifts

By 2026, localized production of four wheeler frames is expected to rise due to trade policies, supply chain resilience concerns, and incentives for domestic EV manufacturing (e.g., U.S. Inflation Reduction Act). Countries like India, Mexico, and Vietnam are emerging as key manufacturing hubs, influencing cost structures and material sourcing strategies. -

Sustainability and Circular Economy Pressures

Environmental regulations and ESG (Environmental, Social, Governance) goals are pushing automakers to adopt recyclable materials and energy-efficient production methods. Frame manufacturers are investing in closed-loop recycling systems, especially for aluminum, and exploring low-carbon steel production techniques to reduce the carbon footprint of frame manufacturing. -

Smart Frames and Integration with ADAS

While still in early stages, the integration of sensors and communication modules into vehicle frames is gaining traction. By 2026, expect limited deployment of “smart frames” with embedded strain gauges and connectivity features to monitor structural health, particularly in commercial and fleet-oriented four wheelers.

In conclusion, the 2026 market for four wheeler frames will be defined by innovation in materials, adaptation to electrification, and responsiveness to consumer and regulatory demands. Manufacturers that prioritize flexibility, sustainability, and technological integration will be best positioned to lead in this evolving landscape.

Common Pitfalls When Sourcing Four Wheeler Frames (Quality, IP)

Sourcing four wheeler frames—especially for off-road or heavy-duty applications—requires careful attention to both quality assurance and intellectual property (IP) considerations. Overlooking these aspects can lead to product failures, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Quality-Related Pitfalls

Inadequate Material Specifications

Using substandard steel or aluminum alloys can compromise frame durability, leading to cracking, warping, or failure under stress. Ensure suppliers adhere to recognized material standards (e.g., ASTM, ISO) and provide mill test certificates.

Poor Welding and Fabrication Practices

Inconsistent or improper welding techniques weaken structural integrity. Look for suppliers with certified welders (e.g., AWS D1.1), proper weld inspection protocols (e.g., X-ray or ultrasonic testing), and documented quality control processes.

Lack of Rigorous Testing and Validation

Frames that haven’t undergone load, torsion, or fatigue testing are prone to field failures. Demand proof of performance testing, including FEA (Finite Element Analysis) simulations and physical prototype validation under real-world conditions.

Inconsistent Tolerances and Fitment Issues

Poor dimensional control leads to misalignment with other vehicle components. Verify that suppliers use precision tooling and conduct regular dimensional inspections to ensure compatibility with suspension, drivetrain, and body systems.

Insufficient Corrosion Protection

Frames exposed to harsh environments require robust anti-corrosion treatments like powder coating, galvanization, or e-coating. Avoid suppliers who cut corners on surface preparation or coating thickness.

Intellectual Property (IP)-Related Pitfalls

Unlicensed Use of Proprietary Designs

Sourcing frames that copy patented or trademarked designs (e.g., OEM ladder frames or modular architectures) can result in infringement lawsuits. Always verify that the design is either original, licensed, or in the public domain.

Lack of Design Ownership Clarity

Ambiguity over who owns the IP for custom frame designs can lead to disputes. Ensure contracts explicitly state that design rights transfer to your company or are jointly owned, especially when funding development.

Counterfeit or Gray Market Components

Purchasing from unauthorized distributors risks receiving knock-offs that mimic branded frames. These may lack quality control and infringe on IP. Source only from authorized or vetted manufacturers with traceable supply chains.

Inadequate Documentation for Compliance

Missing design records, CAD files, or IP disclaimers can hinder regulatory compliance and future innovation. Require full documentation packages, including design intent, revision history, and freedom-to-operate (FTO) analyses.

Failure to Conduct IP Due Diligence

Neglecting a pre-sourcing IP audit increases the risk of adopting infringing technology. Engage legal experts to perform clearance searches before finalizing suppliers or designs.

By proactively addressing these quality and IP pitfalls, companies can ensure reliable performance, mitigate legal risks, and protect their brand when sourcing four wheeler frames.

Logistics & Compliance Guide for Four Wheeler Frame

This guide outlines the essential logistics and compliance considerations for the transportation, handling, and regulatory adherence related to four wheeler frames—critical structural components in automotive manufacturing and distribution.

Transportation & Handling

Proper logistics planning ensures that four wheeler frames reach their destination safely and efficiently.

Packaging Requirements

Frames must be securely packaged to prevent damage during transit. Use custom crating, protective wraps, and anti-corrosion materials. Wooden skids or steel racks are recommended for stability during loading and unloading.

Loading & Securing

When transporting via truck, rail, or container, frames should be evenly distributed and firmly secured using straps, chains, or load locks. Overhang and shifting must be avoided to comply with road safety regulations.

Mode of Transport

Choose transport mode based on distance, volume, and urgency:

– Road: Ideal for regional distribution; ensure compliance with vehicle load limits.

– Rail: Cost-effective for high-volume, long-distance shipments.

– Ocean Freight: Used for international exports; frames must meet containerization standards (e.g., ISO container dimensions).

Handling Equipment

Use forklifts, overhead cranes, or automated guided vehicles (AGVs) designed for heavy loads. Operators must be trained and certified per OSHA (or local equivalent) standards.

Regulatory Compliance

Adherence to international, national, and industry-specific regulations is mandatory.

Vehicle Safety Standards

Frames must comply with structural integrity and crashworthiness standards such as:

– FMVSS (Federal Motor Vehicle Safety Standards) – U.S.

– ECE Regulations – Europe

– INSD (Indian Standards for Automotive Safety) – India

Ensure frame design and materials meet relevant crash test and durability requirements.

Material & Environmental Regulations

Verify that raw materials (e.g., steel, aluminum) comply with environmental directives:

– REACH (EU): Registration, evaluation, and authorization of chemicals.

– RoHS: Restriction of hazardous substances in electrical and electronic components (if applicable).

– ELV Directive (End-of-Life Vehicles): Design for recyclability.

Customs & Import/Export Compliance

For cross-border shipments:

– Classify frames under the correct HS Code (e.g., 8707 for motor vehicle parts).

– Provide accurate Commercial Invoices, Packing Lists, and Certificates of Origin.

– Comply with ITAR/EAR if frames incorporate controlled technology (rare, but verify).

– Adhere to C-TPAT (U.S.) or AEO (EU) security programs if applicable.

Documentation & Traceability

Maintain a full audit trail:

– Batch/Serial Numbers: Track frame production and shipment.

– Certificates of Conformity (CoC): Required for customs and quality assurance.

– Bill of Materials (BOM): For compliance verification and recalls.

Quality Assurance & Inspection

Implement checks at key logistics stages.

Pre-Shipment Inspection

Conduct visual and dimensional inspections to verify frame integrity, absence of warping, and correct labeling.

In-Transit Monitoring

Use IoT sensors to monitor shock, tilt, and humidity during transport—especially for high-value or prototype frames.

Receiving Inspection

Upon delivery, inspect for damage and verify quantities. Report discrepancies immediately to the carrier and supplier.

Storage & Inventory Management

Warehouse Conditions

Store frames in dry, covered areas to prevent rust and contamination. Use first-in, first-out (FIFO) inventory rotation.

Stacking Limits

Follow manufacturer guidelines for maximum stacking height to avoid deformation.

Labeling

Clearly label each frame or batch with part number, date, and compliance marks (e.g., ISO, DOT).

Sustainability & Reverse Logistics

Recycling & Disposal

Scrap frames should be processed through certified metal recyclers. Maintain records for environmental reporting.

Return Processes

Establish protocols for defective or excess frames, including return authorization (RMA), packaging, and transport.

By following this logistics and compliance guide, manufacturers, distributors, and logistics providers can ensure the safe, legal, and efficient handling of four wheeler frames across the supply chain.

Conclusion for Sourcing a Four-Wheeler Frame:

In conclusion, sourcing a four-wheeler (ATV or quad) frame requires a thorough evaluation of quality, material strength, compatibility, and supplier reliability. The frame serves as the structural backbone of the vehicle, directly influencing safety, performance, and durability. After comparing options from OEMs, aftermarket manufacturers, and potential international suppliers, it is evident that selecting a frame made from high-grade steel or aluminum alloy—designed to meet or exceed industry standards—is critical. Additionally, considerations such as certification, warranty, lead times, and cost-effectiveness play a vital role in making the right procurement decision. Ultimately, partnering with reputable suppliers who provide traceability, technical support, and consistent quality control ensures long-term reliability and operational efficiency. A well-sourced frame not only enhances vehicle performance but also reduces maintenance costs and downtime, contributing to overall customer satisfaction and safety.