The global forklift market is experiencing robust growth, driven by rising demand for material handling equipment across logistics, manufacturing, and warehousing sectors. According to a report by Mordor Intelligence, the global forklift trucks market was valued at USD 74.5 billion in 2023 and is projected to grow at a CAGR of over 5.8% from 2024 to 2029. A significant segment of this growth is attributed to pneumatic forklifts, which are preferred for their durability, superior traction, and performance in outdoor and rough-terrain applications. With industries increasingly prioritizing operational efficiency and equipment reliability, the demand for high-performance pneumatic forklifts continues to surge. As a result, leading manufacturers are investing heavily in innovation, fuel efficiency, and sustainable technologies to capture expanding market opportunities. In this evolving landscape, the following nine companies have emerged as key players shaping the future of pneumatic forklift manufacturing worldwide.

Top 9 Forklift Pneumatic Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Toyota Forklifts

Domain Est. 1996

Website: toyotaforklift.com

Key Highlights: Toyota Forklifts is the leader in material handling and industrial lift trucks and equipment. Learn about our solutions to maximize your warehouse ……

#2 UniCarriers Forklifts

Domain Est. 2020

Website: logisnextamericas.com

Key Highlights: UniCarriers manufactures a full line of IC and electric-powered, cushion and pneumatic tire forklifts that set the standard for reliability and uptime….

#3 Forklifts

Domain Est. 1995

Website: komatsu.com

Key Highlights: Enhance your operation with high-quality, durable, high-performing forklifts from Komatsu. We combine our long history of rigorous engineering in construction ……

#4 CLARK Material Handling Company

Domain Est. 1996

Website: clarkmhc.com

Key Highlights: CLARK offers products in all five classes, including powered pallet jacks, electric standup forklifts, narrow aisle forklifts, walkie pallet stackers, order ……

#5 Internal Combustion Pneumatic Tire Forklifts

Domain Est. 1996

Website: hyster.com

Key Highlights: Hyster’s pneumatic tire forklifts offer unmatched strength. Choose from our diesel lift truck range for superior performance in heavy-duty tasks….

#6 IC Pneumatic Tire Forklifts & Lift Trucks

Domain Est. 1997

Website: bobcat.com

Key Highlights: Explore the Bobcat diesel and LPG (Liquid Propane Gas) powered IC pneumatic tire forklift lineup of 3000 – 55000 lb. capacity for your material handling ……

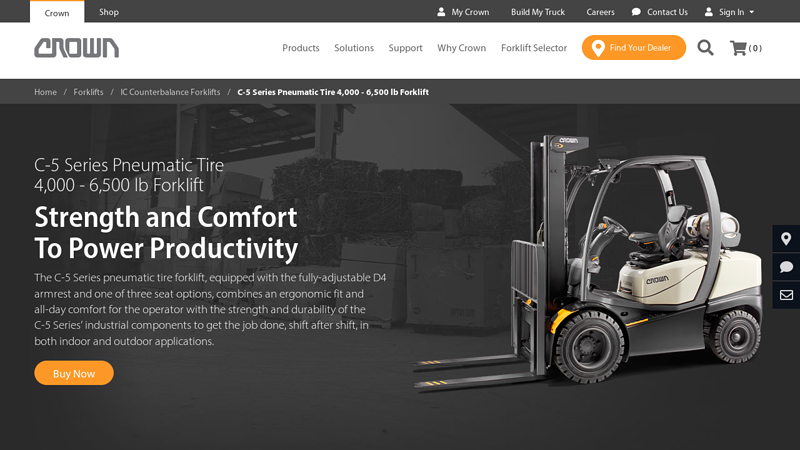

#7 C-5 Internal Combustion Pneumatic Tire Forklift

Domain Est. 1998

Website: crown.com

Key Highlights: The Crown C-5 4000 – 6000 lb pneumatic tire forklifts are available in Diesel and LPG models. This indoor and outdoor forklift is equipped with a ……

#8 Taylor Forklifts: Heavy

Domain Est. 2000

Website: taylorforklifts.com

Key Highlights: Explore heavy-duty forklifts and container handling equipment from Taylor. Built for tough industries, backed by expert service, parts, and dealer support….

#9 Linde Material Handling

Domain Est. 2008

Website: linde-mh.us

Key Highlights: Linde Material Handling is celebrating its 40th year of manufacturing in America by launching the next generation of forklifts, the HT25T-HT35T….

Expert Sourcing Insights for Forklift Pneumatic

2026 Market Trends for Forklift Pneumatic Tires

The global market for forklift pneumatic tires is poised for significant evolution by 2026, driven by shifting industrial demands, technological advancements, and sustainability imperatives. Key trends shaping this sector include:

Accelerated Demand in Emerging Economies

Rapid industrialization and infrastructure development across Southeast Asia, India, and parts of Africa are fueling warehouse and logistics expansion. This growth directly increases the need for material handling equipment, particularly pneumatic forklifts suited for rough outdoor terrain. As construction, agriculture, and port operations scale up, demand for durable, high-traction pneumatic tires is expected to rise steadily through 2026.

Technological Innovation in Tire Materials and Design

Manufacturers are investing heavily in next-generation rubber compounds and reinforced sidewalls to enhance durability, puncture resistance, and load-bearing capacity. Non-marking and low-rolling-resistance compounds are gaining traction in indoor-outdoor hybrid environments. Additionally, airless or semi-pneumatic hybrid designs are being refined to combine the cushioning of traditional pneumatic tires with the maintenance-free benefits of solid tires, particularly appealing to operations seeking reduced downtime.

Sustainability and Circular Economy Pressures

Environmental regulations and corporate ESG goals are pushing the industry toward greener solutions. Tire manufacturers are exploring bio-based and recyclable materials, while retreading programs are being revitalized to extend tire life and reduce waste. By 2026, end-of-life tire management and carbon footprint reduction will become key differentiators among suppliers, influencing procurement decisions in environmentally conscious sectors.

Integration with Fleet Management Systems

The rise of smart forklifts and IoT-enabled fleet management systems is extending to tire monitoring. Sensors embedded in or near pneumatic tires can track pressure, temperature, and wear in real time, enabling predictive maintenance and reducing unexpected failures. This trend supports operational efficiency and safety, particularly in large-scale logistics centers where downtime is costly.

Supply Chain Resilience and Localization

Ongoing global supply chain volatility is prompting buyers and manufacturers to prioritize regional sourcing and inventory resilience. By 2026, we expect increased localization of tire production and distribution networks to mitigate risks and ensure faster delivery times. This shift may favor suppliers with diversified manufacturing bases and strong regional partnerships.

In summary, the forklift pneumatic tire market in 2026 will be characterized by innovation in materials, a growing emphasis on sustainability, and deeper integration with digital fleet ecosystems. Companies that adapt to these trends will be well-positioned to capture value in an increasingly competitive and dynamic landscape.

Common Pitfalls Sourcing Forklift Pneumatic Tires (Quality, IP)

Sourcing forklift pneumatic tires requires careful evaluation to ensure durability, performance, and safety in industrial environments. However, several common pitfalls can compromise quality and suitability—particularly when assessing material integrity, load capacity, and Ingress Protection (IP) ratings where relevant. Below are key challenges buyers often encounter.

1. Overlooking Material Quality and Durability

One of the most frequent mistakes is selecting tires made from inferior rubber compounds. Low-quality materials wear out quickly, crack under UV exposure, or degrade when exposed to oils and chemicals. Always verify the tire’s composition—premium-grade rubber with anti-abrasion and anti-aging properties is essential for longevity, especially in demanding environments like construction sites or lumber yards.

2. Ignoring Load Capacity and Application Mismatch

Buyers sometimes choose tires based on price or availability without matching the tire’s load rating to the forklift’s operating weight and usage. Using under-rated tires leads to premature failure, blowouts, or safety hazards. Always cross-reference the forklift manufacturer’s specifications and ensure the pneumatic tire is rated for both static and dynamic load requirements.

3. Confusing IP Ratings with Pneumatic Tires

A common misconception is applying IP (Ingress Protection) ratings to pneumatic tires. IP ratings pertain to electrical enclosures and indicate protection against solids and liquids—they do not apply to tires. While some may mistakenly look for “IP-rated” tires for wet or dusty environments, the real focus should be on tread design, sidewall protection, and resistance to punctures. Clarifying this avoids confusion and ensures proper selection based on environmental conditions.

4. Neglecting Terrain and Environmental Conditions

Pneumatic tires vary significantly in tread pattern and flexibility. Using smooth-tread tires on rough, outdoor terrain increases slippage and wear. Conversely, deep-tread off-road tires on smooth warehouse floors create excessive vibration and noise. Assessing the operating environment—indoor, outdoor, uneven ground, debris—is critical to choosing the right tread profile and tire construction.

5. Sourcing from Unverified Suppliers

Procuring tires from unverified or non-specialist suppliers increases the risk of counterfeit or re-treaded products misrepresented as new. These tires often lack proper certifications, fail under stress, and void forklift warranties. Always source from reputable suppliers with documented quality standards (e.g., ISO certification) and request test reports or compliance documentation.

6. Failing to Consider Puncture Resistance

Standard pneumatic tires are prone to flats when operating in environments with nails, metal shavings, or sharp debris. Some buyers overlook options like solid-filled or non-marking puncture-resistant variants. While not fully pneumatic, hybrid solutions may be more appropriate in high-risk areas. Evaluate the trade-offs between ride comfort and durability based on site conditions.

7. Inadequate Maintenance Planning

Even high-quality pneumatic tires require regular pressure checks and inspections. Buyers who neglect maintenance protocols risk uneven wear, reduced efficiency, and increased downtime. Factor in ease of maintenance and availability of service support when sourcing—some suppliers offer maintenance programs or training.

By addressing these pitfalls proactively, businesses can ensure reliable performance, extended tire life, and improved safety in material handling operations.

Logistics & Compliance Guide for Forklift Pneumatic Tires

Overview of Pneumatic Tires in Material Handling

Pneumatic forklift tires, typically inflated with compressed air, are designed for outdoor and rough-terrain applications. They provide superior shock absorption, traction, and durability on uneven surfaces such as gravel, dirt, and construction sites. Understanding the logistics and compliance requirements associated with their use, transportation, and maintenance is critical for operational efficiency and regulatory adherence.

Transportation and Storage Logistics

When transporting or storing pneumatic forklift tires, ensure they are stored upright in a cool, dry, and well-ventilated environment away from direct sunlight, ozone sources (e.g., electric motors), and hydrocarbons. Tires should not be stacked excessively high to prevent deformation. During transport, secure tires to prevent rolling or shifting. For international shipping, comply with IATA or IMDG regulations if tires are mounted on rims with residual air pressure.

Regulatory Compliance Standards

Pneumatic forklift tires must comply with regional safety and environmental standards. In the U.S., OSHA 29 CFR 1910.178 outlines safe operation of industrial trucks, including tire inspection and maintenance. The European Union requires CE marking under the Machinery Directive (2006/42/EC), ensuring tires meet essential health and safety requirements. Additionally, REACH and RoHS regulations may apply to chemical components used in tire manufacturing.

Maintenance and Inspection Requirements

Regular inspection of pneumatic tires is essential for compliance and safety. Check for cuts, cracks, bulges, tread wear, and proper inflation pressure according to manufacturer specifications. Underinflated tires increase fuel consumption and risk of blowouts, while overinflation reduces traction and ride comfort. Document inspections as part of a preventive maintenance program to meet OSHA and insurance requirements.

Environmental and Disposal Considerations

Used pneumatic tires are classified as waste under environmental regulations such as the U.S. EPA’s Solid Waste Disposal Act and the EU End-of-Life Vehicles (ELV) and Waste Framework Directives. Facilities must use licensed tire recyclers or processors to ensure proper disposal or retreading. Onsite storage of used tires is regulated to prevent fire hazards and pest breeding; accumulation limits and fire prevention measures are often mandated.

Operator Safety and Training

Ensure all forklift operators are trained per OSHA 1910.178(l) on the specific handling characteristics of vehicles equipped with pneumatic tires, which may differ from cushion-tire forklifts due to larger size and bounce. Training should include recognizing tire damage, understanding load capacity impacts based on tire condition, and procedures for reporting defects.

Procurement and Supplier Compliance

When sourcing pneumatic tires, verify that suppliers provide certifications for ISO 9001 (quality management) and, where applicable, ISO 14001 (environmental management). Confirm that tires meet load index and speed rating specifications for your forklift models. Maintain records of tire origin, specifications, and compliance documentation for audit purposes.

Incident Reporting and Recordkeeping

In the event of tire-related incidents—such as blowouts leading to accidents or near misses—document the event and conduct a root cause analysis. Maintain records of tire replacements, repairs, inspections, and training for a minimum of three years to comply with OSHA and insurance standards.

Conclusion

Adhering to logistics and compliance protocols for pneumatic forklift tires ensures workplace safety, regulatory conformity, and operational reliability. A proactive approach to tire management supports compliance with OSHA, EPA, EU directives, and industry best practices, reducing downtime and liability risks.

Conclusion: Sourcing Forklift Pneumatic Tires

Sourcing forklift pneumatic tires requires a strategic approach that balances quality, durability, cost, and supplier reliability. Pneumatic tires are essential for ensuring optimal forklift performance, especially in outdoor or rough-terrain environments where impact resistance and traction are critical. When selecting suppliers, it is important to consider factors such as tire specifications (size, load capacity, tread pattern), material quality (solid vs. air-filled), and compliance with industry standards.

Establishing relationships with reputable manufacturers or distributors can lead to long-term cost savings, consistent supply, and technical support. Additionally, evaluating total cost of ownership—factoring in lifespan, maintenance, and downtime—helps in making a more informed decision beyond initial purchase price.

In conclusion, effective sourcing of forklift pneumatic tires involves thorough market research, clear understanding of operational needs, and a focus on sustainability and service support. By prioritizing quality and supplier partnership, organizations can enhance equipment efficiency, improve workplace safety, and reduce operational disruptions.