The global forklift market is experiencing steady expansion, driven by rising demand for material handling equipment across logistics, manufacturing, and warehousing sectors. According to Grand View Research, the global forklift truck market size was valued at USD 21.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% from 2024 to 2030. This growth is fueled by increasing automation in supply chains, urbanization, and the booming e-commerce industry, which demands efficient warehouse operations. With electrification trends gaining momentum and a shift toward more sustainable material handling solutions, leading manufacturers are innovating across all forklift classifications—from Class I electric riders to Class V internal combustion trucks. As competition intensifies, a handful of key players are distinguishing themselves through technological advancements, global distribution networks, and strategic partnerships. Based on production capacity, market share, innovation, and global footprint, the following are the top 10 forklift classification manufacturers shaping the industry’s future.

Top 10 Fork Truck Classifications Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Yale Lift Truck Technologies

Domain Est. 1994

Website: yale.com

Key Highlights: Yale’s forklifts and lift trucks are designed to tackle your biggest challenges. Discover how our technology can boost your warehouse productivity!…

#2 ANSI B56.1

Domain Est. 1994

Website: blog.ansi.org

Key Highlights: ANSI B56.1 specifies industrial trucks to promote safety through their design, construction, application, operation, and maintenance….

#3 50 Forklift Manufacturers: The Complete List

Domain Est. 1996

Website: conger.com

Key Highlights: This is the complete list of forklift manufacturers. Learn company histories and what forklifts each company offers….

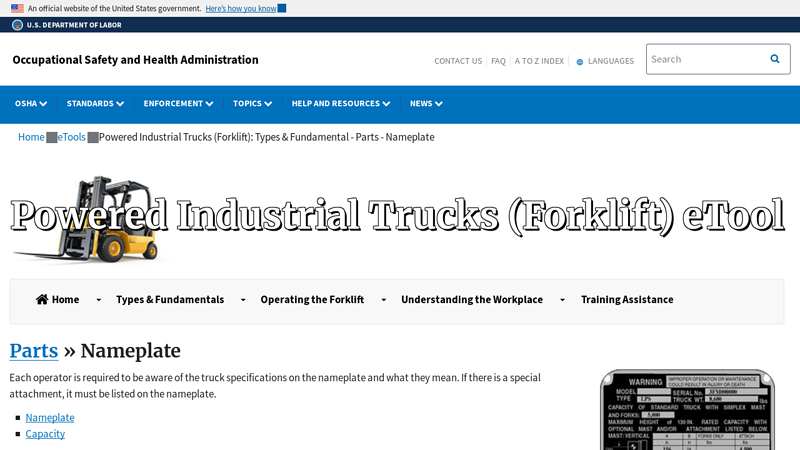

#4 eTool : Powered Industrial Trucks (Forklift)

Domain Est. 1997

Website: osha.gov

Key Highlights: The nameplate (also called the data plate) provides important information for the forklift operator, including the fuel type, forklift weight, and capacity….

#5 Industrial Truck Association

Domain Est. 1997

Website: indtrk.org

Key Highlights: We are ITA. Who We Serve. United States. ITA’s manufacturing Members represent more than 90% of the forklift market in North America….

#6 Cat® Lift Trucks EAME

Domain Est. 1999

Website: catlifttruck.com

Key Highlights: Cat Lift Trucks are one of the leading manufacturers of forklift trucks and materials handling equipment with a network of dealers across Europe, Africa and ……

#7 Forklifts

Domain Est. 1995

Website: komatsu.com

Key Highlights: Enhance your operation with high-quality, durable, high-performing forklifts from Komatsu. We combine our long history of rigorous engineering in construction ……

#8 Understanding Different Forklift Types and Their Applications

Domain Est. 1996

Website: toyotaforklift.com

Key Highlights: What are the Different Forklift Types? · Class I: Electric Motor Rider Forklifts · Class II: Electric Motor Narrow Aisle Forklifts (Reach Trucks, ……

#9 Mitsubishi Forklift Trucks

Domain Est. 1999

Website: mitforklift.com

Key Highlights: Our class-leading diesel and LPG forklifts trucks deliver powerful, efficient and reliable performance. Handling up to 16.0 tonnes….

#10 Taylor Forklifts: Heavy

Domain Est. 2000

Website: taylorforklifts.com

Key Highlights: Explore heavy-duty forklifts and container handling equipment from Taylor. Built for tough industries, backed by expert service, parts, and dealer support….

Expert Sourcing Insights for Fork Truck Classifications

H2: 2026 Market Trends for Forklift Truck Classifications

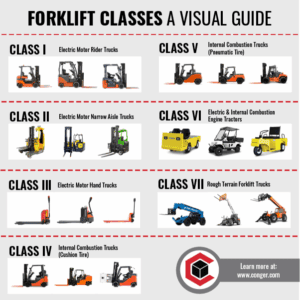

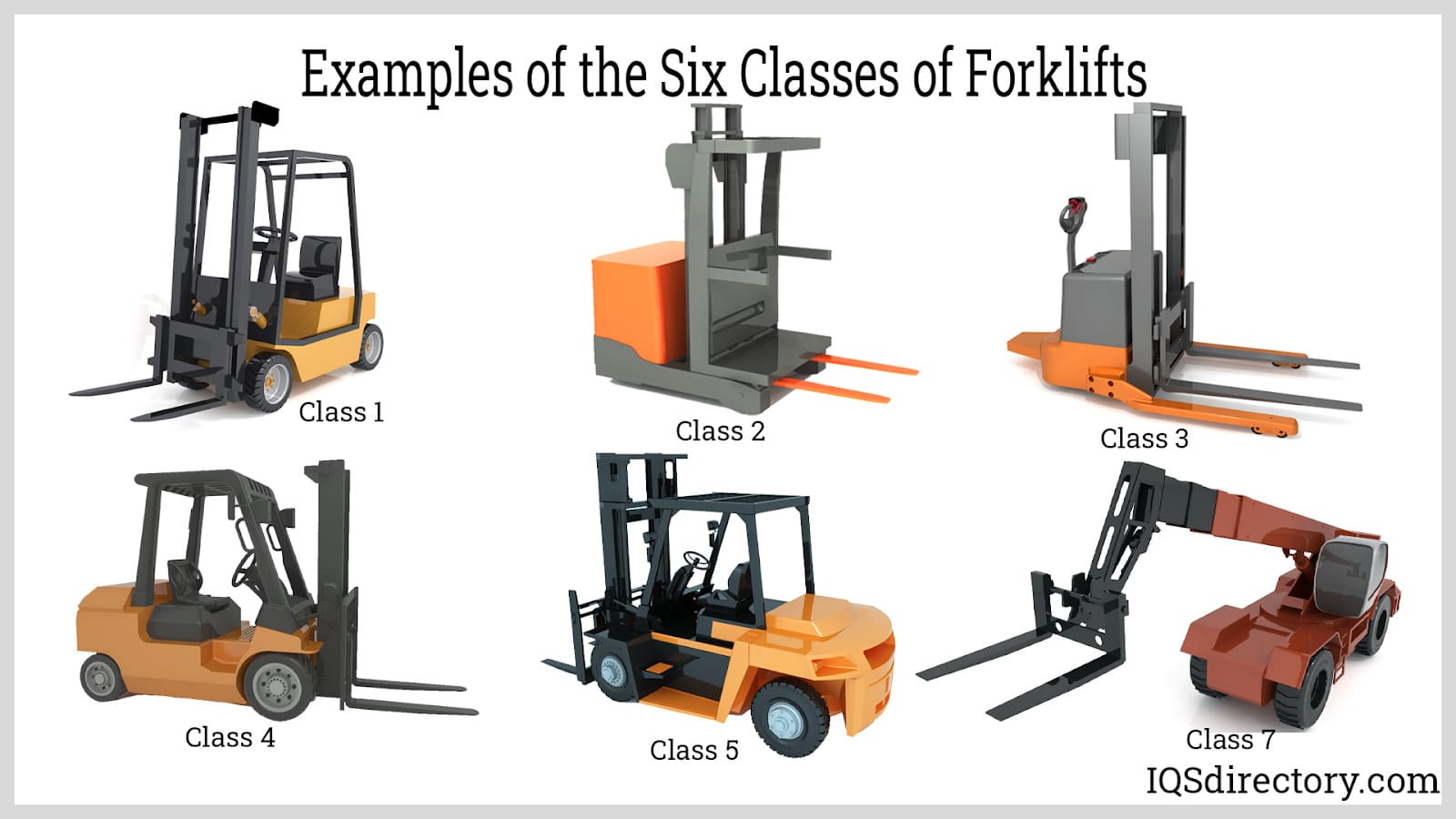

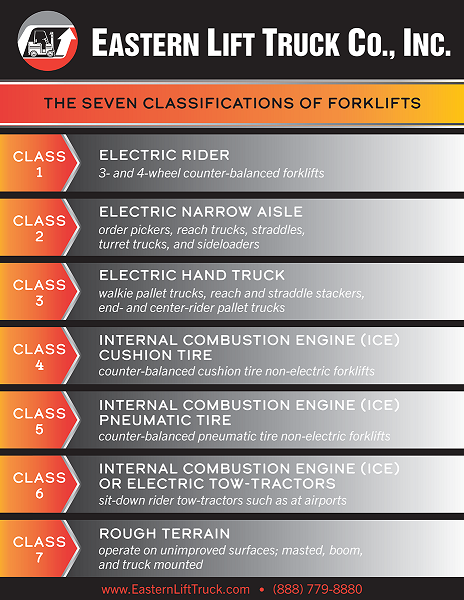

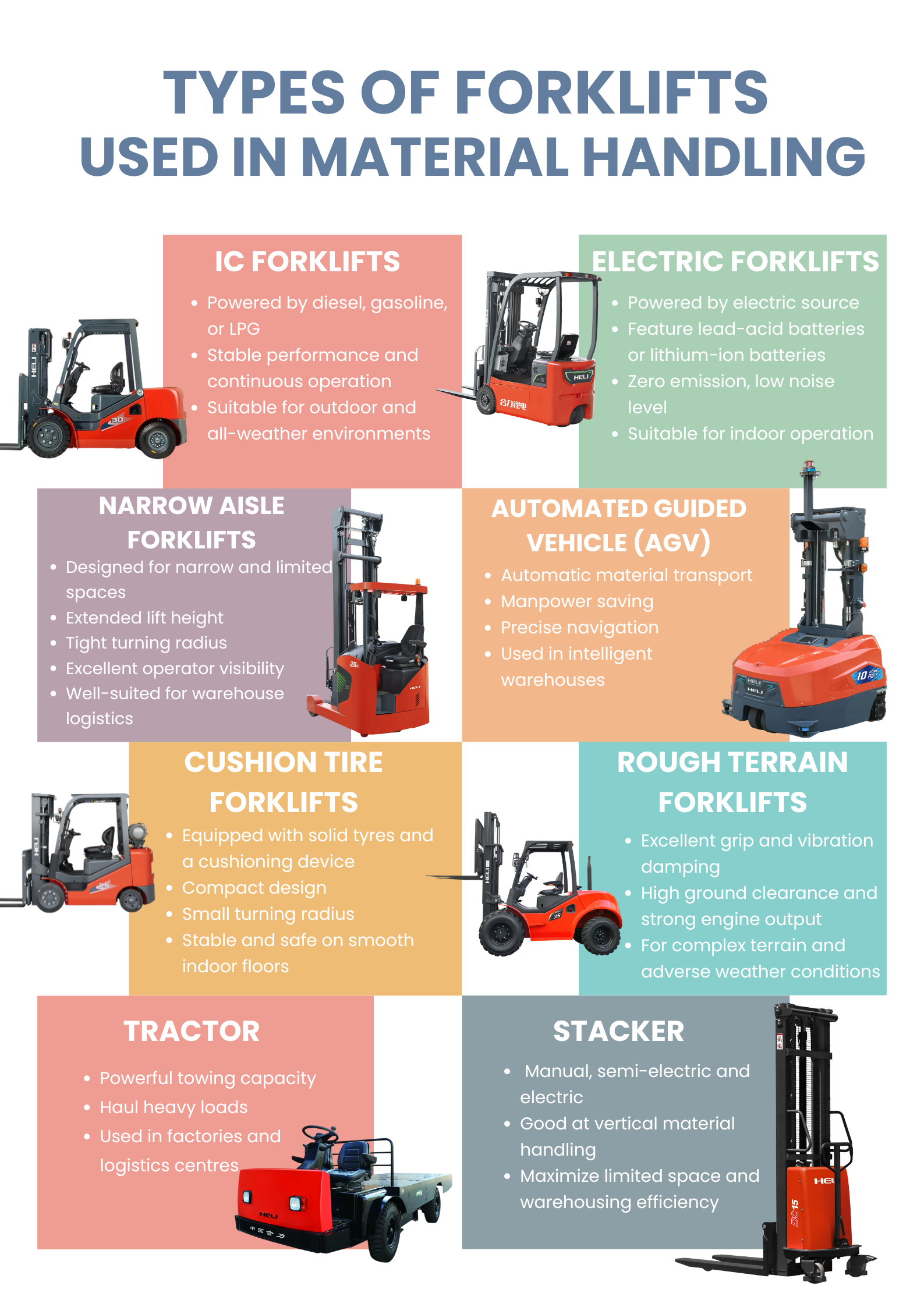

The global forklift truck market is poised for significant transformation by 2026, driven by technological advancements, sustainability mandates, and evolving industrial needs. Each of the seven official forklift classifications—defined by the Industrial Truck Association (ITA)—is expected to experience distinct growth patterns, innovation trends, and regional demand shifts. Below is an analysis of anticipated market trends across forklift classifications through 2026.

Class I: Electric Motor Hand Trucks

Class I forklifts, including walkie stackers and powered hand trucks, are projected to see robust growth due to their suitability for narrow-aisle warehouses and e-commerce fulfillment centers. The trend toward automation and labor efficiency will boost demand for intelligent, operator-assist models equipped with Li-ion batteries and IoT integration. By 2026, increased investment in smart logistics infrastructure will expand the use of Class I units in last-mile delivery hubs and micro-fulfillment centers, particularly in North America and Europe.

Class II: Electric Narrow Aisle Forklifts

Class II equipment, such as reach trucks and very narrow aisle (VNA) trucks, will benefit from the ongoing optimization of warehouse space. Rising urbanization and land scarcity are compelling logistics operators to adopt high-density storage solutions. By 2026, these forklifts will increasingly feature automated guidance systems (AGS), fleet management software, and energy-efficient designs. The Asia-Pacific region, especially China and India, will emerge as high-growth markets due to rapid e-commerce expansion and modernization of cold chain logistics.

Class III: Electric Pallet Trucks, Stackers, and Tow Tractors

Class III forklifts are expected to lead in electrification adoption, with lithium-ion batteries replacing lead-acid systems due to faster charging and longer lifespan. Tow tractors will see growing use in automotive and manufacturing plants where continuous material movement is critical. By 2026, these vehicles will increasingly integrate with warehouse automation platforms, supporting Industry 4.0 initiatives. Demand will be strongest in automated distribution centers, driven by the need for seamless, scalable intralogistics solutions.

Class IV: Internal Combustion Cushion Tire Forklifts

Class IV forklifts, traditionally used in indoor heavy-duty applications, face declining market share due to environmental regulations and the shift toward cleaner alternatives. However, they will still maintain relevance in industries requiring high lifting capacity and durability, such as lumber, metals, and manufacturing. By 2026, manufacturers may focus on hybrid models or cleaner-burning fuels (e.g., propane or hydrogen) to extend the life cycle of cushion tire IC forklifts in niche applications.

Class V: Internal Combustion Pneumatic Tire Forklifts

Class V forklifts dominate outdoor and rough-terrain operations. Demand is expected to remain steady through 2026, particularly in construction, ports, and agriculture. However, emissions standards (e.g., EPA Tier 5 and EU Stage V) will push manufacturers to adopt advanced emission control systems and explore alternative fuels. Hydrogen-powered and hybrid pneumatic forklifts could emerge as viable options, especially in regions with strong green energy incentives.

Class VI: Tow Tractors

Tow tractors will see increased deployment in large-scale manufacturing and airport logistics, where efficient transport of heavy loads over long distances is essential. By 2026, automation and connectivity will play a key role, with autonomous tow tractors being tested in pilot programs across automotive and aerospace sectors. Growth will be fueled by just-in-time (JIT) manufacturing and the need for uninterrupted material flow in smart factories.

Class VII: Rough Terrain Forklifts

Class VII forklifts are expected to experience moderate growth, driven by infrastructure development in emerging economies and renewable energy projects (e.g., wind and solar farms). By 2026, manufacturers will focus on improving fuel efficiency, operator comfort, and telematics integration. Electrification remains a challenge due to power demands, but hybrid and hydrogen-fueled prototypes may begin to enter the market, particularly in environmentally sensitive zones.

Cross-Cutting Trends by 2026

– Electrification Acceleration: All electric forklift classes (I–III) will outpace internal combustion counterparts in growth, supported by falling battery costs and government decarbonization targets.

– Autonomy and IoT: Integration with warehouse management systems (WMS) and autonomous operation capabilities will become standard features in high-end models.

– Sustainability Regulations: Stricter emissions standards will phase down diesel and gasoline forklifts, especially in Europe and California.

– Regional Divergence: North America and Europe will prioritize automation and clean energy, while Asia-Pacific will focus on capacity expansion and cost-effective solutions.

In conclusion, the 2026 forklift market will be characterized by a clear divide between electrified, automated, and data-connected solutions in Classes I–III, and more traditional, rugged IC models in Classes IV–VII adapting to regulatory and operational pressures. Strategic investments in sustainable technologies and digital integration will define market leadership across classifications.

Common Pitfalls in Sourcing Forklift Classifications (Quality, IP)

When sourcing forklifts, understanding and correctly specifying classifications—particularly in terms of quality standards and Ingress Protection (IP) ratings—is critical. Missteps in these areas can lead to safety risks, equipment failure, and costly downtime. Below are common pitfalls to avoid:

Misunderstanding Forklift Classifications and Their Applications

Buyers often confuse forklift classifications (e.g., Class I, II, III for electric forklifts, Class IV–V for internal combustion) with environmental or operational requirements. Each class serves different material handling needs, and selecting the wrong class can result in inefficiency or unsafe operation. For instance, using a Class I pedestrian-operated forklift in a high-throughput warehouse meant for Class IV sit-down counterbalance trucks compromises both productivity and safety.

Overlooking Build Quality and Component Sourcing

Prioritizing initial cost over long-term durability is a frequent error. Low-cost forklifts may use substandard materials, inferior hydraulics, or underpowered motors, leading to frequent breakdowns. It’s essential to evaluate the quality of critical components—such as the mast, forks, and control systems—and verify the manufacturer’s track record. Avoid suppliers who don’t provide transparent information about component origins or lack third-party quality certifications.

Ignoring IP (Ingress Protection) Ratings for Operating Environment

The IP rating defines a forklift’s resistance to dust and moisture, yet it’s often overlooked during procurement. Using a forklift with insufficient IP protection (e.g., IP54 vs. IP67) in wet, dusty, or outdoor environments can lead to electrical failures, sensor malfunctions, or corrosion. For example, a warehouse with frequent washdowns requires higher IP-rated electrical enclosures (e.g., IP65 or above) to prevent short circuits and ensure operator safety.

Assuming All Forklifts Meet International Quality Standards

Not all manufacturers adhere to the same quality benchmarks. Some may claim compliance with ISO or ANSI standards without proper certification. Always verify documentation and request proof of conformity. Sourcing from regions with lax regulatory oversight increases the risk of receiving non-compliant or poorly tested equipment.

Neglecting After-Sales Support and Spare Parts Availability

Even with proper classification and quality, forklift performance depends on maintenance. Choosing a supplier without reliable technical support or readily available spare parts—especially for IP-rated seals or specialized components—can lead to prolonged downtimes. Ensure the supplier offers service networks and warranties that match the intended operational intensity.

Failing to Match IP Ratings with Application Needs

A common mistake is over-specifying or under-specifying IP ratings. Over-specification increases costs unnecessarily, while under-specification risks equipment damage. For example, an IP68 rating may be excessive for an indoor dry warehouse but critical for cold storage or chemical handling facilities. Conduct a site-specific risk assessment before finalizing IP requirements.

Avoiding these pitfalls requires due diligence, clear specifications, and collaboration with reputable suppliers who prioritize safety, quality, and environmental compatibility in their forklift offerings.

Logistics & Compliance Guide for Forklift Classifications

Understanding forklift classifications is essential for ensuring operational efficiency, workplace safety, and regulatory compliance in logistics and warehouse environments. The Industrial Truck Association (ITA), part of the Material Handling Industry (MHI), has established a standardized classification system that categorizes forklifts into seven distinct classes based on their power source, design, and intended application. Adhering to these classifications supports compliance with OSHA (Occupational Safety and Health Administration) standards and helps employers assign appropriate equipment and operator training.

Class I: Electric Motor Rider Trucks

Class I forklifts are electric-powered, rider-operated trucks designed for indoor use. They are ideal for operations requiring precise control and zero emissions, such as in food processing, pharmaceuticals, and clean manufacturing environments. These trucks operate on lead-acid batteries and require designated charging areas that comply with electrical and ventilation safety standards.

Key Compliance Considerations:

– OSHA 1910.178 requires operator certification for all powered industrial trucks.

– Battery charging stations must be well-ventilated and equipped with emergency eyewash stations and spill containment.

– Regular maintenance logs must be kept to ensure electrical systems are in safe working condition.

Class II: Electric Motor Narrow Aisle Trucks

Class II trucks are also electric-powered but specifically engineered for narrow aisle operations, such as very narrow aisle (VNA) racking systems. This category includes reach trucks, turret trucks, and order pickers, allowing high-density storage and improved warehouse space utilization.

Key Compliance Considerations:

– Operators must be trained on the unique handling characteristics of narrow aisle equipment.

– Aisles must meet minimum width requirements based on truck specifications to prevent collisions.

– Fall protection and overhead guard requirements under OSHA must be strictly enforced, especially for elevated order-picking models.

Class III: Electric Motor Hand or Hand-Rider Trucks

Class III encompasses powered hand trucks and hand-rider trucks, often used for moving loads over short distances or in tight spaces. These are commonly used in retail, loading docks, and assembly lines. They can be walk-behind or allow the operator to ride when traveling longer distances.

Key Compliance Considerations:

– Operators must be trained even for low-lift walkies due to pinch point and pedestrian interaction hazards.

– Speed limits and pedestrian right-of-way must be clearly posted and enforced.

– Equipment must include emergency disconnects and reliable braking systems.

Class IV: Internal Combustion Engine Trucks—Cushion Tires

Class IV forklifts are powered by internal combustion (IC) engines—typically fueled by gasoline, liquid petroleum gas (LPG), or diesel—and feature cushion (solid) tires. Designed primarily for indoor use on smooth surfaces, they offer high capacity and durability.

Key Compliance Considerations:

– LPG-fueled trucks require safe cylinder exchange procedures and proper ventilation to prevent carbon monoxide buildup.

– Fire extinguishers must be onboard and inspected monthly.

– Operators must be trained on fuel handling and refueling safety per OSHA and NFPA standards.

Class V: Internal Combustion Engine Trucks—Pneumatic Tires

Class V trucks are IC engine-powered with pneumatic (air-filled) tires, making them suitable for both indoor and outdoor use on rough or uneven terrain. Commonly used in construction, lumber yards, and shipping docks, these forklifts offer enhanced traction and load stability.

Key Compliance Considerations:

– Equipment must be rated for outdoor use and equipped with appropriate lighting if used in low-light conditions.

– Operators must be trained for outdoor hazards such as slopes, mud, and weather conditions.

– Regular inspection of tires, hydraulic systems, and exhaust components is required to prevent failures.

Class VI: Tow Tractors

Class VI includes tow tractors used to pull loaded carts or trailers, commonly found in assembly lines, airports, and large distribution centers. These can be electric or internal combustion-powered and are designed for continuous towing rather than lifting.

Key Compliance Considerations:

– Tow trains must have proper coupling mechanisms and braking systems.

– Load trains must not exceed manufacturer-rated capacity or site-specific safety limits.

– Operators must be trained on coupling/uncoupling procedures and safe travel routes.

Class VII: Rough Terrain Forklift Trucks

Class VII forklifts are heavy-duty, IC engine-powered machines built for outdoor use on rough, uneven terrain. Featuring large pneumatic tires and reinforced frames, these are commonly used in construction, agriculture, and lumber operations.

Key Compliance Considerations:

– These trucks are excluded from OSHA’s general powered industrial truck standards under 1910.178 but still require operator training and safe operating procedures.

– ROPS (Rollover Protective Structures) and seat belts must be used whenever available.

– Pre-operational inspections are critical due to harsh operating environments.

Compliance Best Practices Across All Classes

- Operator Training & Certification: All forklift operators must be trained and certified per OSHA 1910.178, including classroom instruction, hands-on training, and periodic evaluations.

- Daily Inspections: Operators must perform pre-shift inspections (visual checks, fluid levels, tire condition, horn, lights) and document findings.

- Maintenance Logs: Maintain detailed service records to demonstrate compliance during audits or incident investigations.

- Site-Specific Safety Plans: Develop traffic management plans, load capacity signage, and restricted zones based on forklift class and usage.

- Environmental Controls: Ensure proper ventilation in charging or fueling areas and implement spill response procedures.

By aligning logistics operations with the correct forklift classifications and adhering to compliance requirements, organizations can enhance safety, reduce liability, and optimize material handling efficiency.

Conclusion on Sourcing Forklift Classifications

When sourcing forklifts, understanding and properly classifying the different types of forklifts is essential to ensuring operational efficiency, safety, and cost-effectiveness. Forklift classifications—commonly defined by organizations such as the Industrial Truck Association (ITA) into Classes I through VII—provide a standardized framework that helps organizations select the right equipment based on power source, application, and environment.

Each class serves distinct purposes, from electric warehouse models (Class I–III) ideal for indoor use, to heavy-duty internal combustion engine forklifts (Classes IV–VII) suited for outdoor and high-capacity tasks. Proper classification enables buyers to match equipment capabilities with specific material handling needs, reducing operational bottlenecks and maintenance costs.

Moreover, considering factors such as battery charging infrastructure, emissions regulations, maneuverability, and load capacity within the appropriate class ensures long-term value and compliance. As automation and sustainability become increasingly important, understanding these classifications also supports the integration of advanced technologies like electric and automated guided vehicles (AGVs).

In conclusion, a strategic approach to sourcing forklifts—rooted in accurate classification—empowers businesses to make informed procurement decisions that enhance productivity, ensure workplace safety, and align with both current and future operational demands.