The global automotive brake system market is experiencing steady growth, driven by increasing vehicle production, rising safety regulations, and growing demand for high-performance components. According to a report by Mordor Intelligence, the brake system market was valued at USD 26.8 billion in 2023 and is projected to grow at a CAGR of over 4.5% from 2024 to 2029. With Ford vehicles accounting for a significant portion of the North American automotive fleet—over 6 million F-Series trucks sold in the U.S. alone in 2023—original equipment and aftermarket brake manufacturers play a critical role in maintaining vehicle safety and performance. As fleet longevity increases and consumer expectations for braking efficiency rise, three manufacturers have emerged as leaders in supplying reliable, high-quality brake components for Ford vehicles.

Top 3 Ford Brake Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Ford® Drums, Rotors, and Hubs

Domain Est. 1988

Website: ford.com

Key Highlights: Shop Drums, Rotors, and Hubs from the official Ford® Accessories store. View your favorite products. Filter by category, brand, price & color….

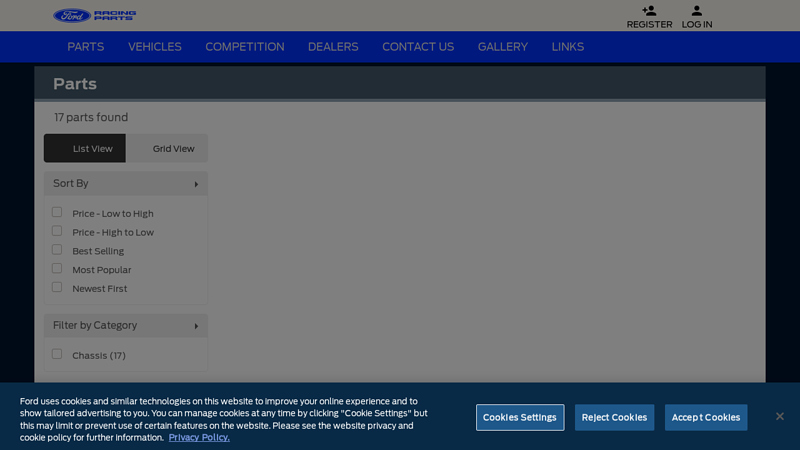

#2 Brake Kits / Components

Domain Est. 1988

#3 TBM Brakes

Domain Est. 2012

Website: tbmbrakes.com

Key Highlights: 6–7 day delivery 30-day returnsHigh Quality racing brakes, Made in the USA, for drag racing, road racing, sprint car, late model, top fuel, circle track, monster trucks and much mo…

Expert Sourcing Insights for Ford Brake

H2: 2026 Market Trends for Ford Brake Systems

As the automotive industry continues to evolve toward electrification, advanced safety systems, and sustainability, Ford’s brake technology and market positioning are expected to undergo significant transformation by 2026. Several key trends will shape the demand, development, and competitive landscape for Ford brake systems in the coming years.

-

Electrification Driving Regenerative Braking Adoption

With Ford accelerating its electric vehicle (EV) lineup—including models like the F-150 Lightning and Mustang Mach-E—regenerative braking systems will become increasingly central to brake design. By 2026, the majority of Ford’s new EVs and hybrids will rely on blended braking systems that combine regenerative and friction braking. This shift reduces wear on traditional brake components, altering aftermarket demand and maintenance cycles for conventional brake pads and rotors. -

Increased Integration with ADAS and Autonomous Driving

Advanced Driver Assistance Systems (ADAS), such as automatic emergency braking (AEB), adaptive cruise control, and lane-keeping assist, require highly responsive and precise brake actuators. Ford is investing heavily in brake-by-wire technology, which replaces mechanical linkages with electronic controls. By 2026, Ford is expected to deploy more brake-by-wire systems, particularly in higher-end and autonomous-capable models, improving integration with AI-driven safety features and enabling faster response times. -

Lightweight and Sustainable Materials

To improve vehicle efficiency and reduce emissions, Ford is expected to adopt more lightweight, durable materials in brake components by 2026. Ceramic matrix composites (CMCs) and aluminum-based calipers may see increased use, particularly in performance and electric models. Additionally, sustainability initiatives will push Ford toward recyclable and low-dust brake pad formulations, aligning with stricter environmental regulations in North America and Europe. -

Growth in Aftermarket and Service Demand

While EVs reduce mechanical brake usage due to regenerative systems, the overall vehicle parc (total number of Ford vehicles on the road) will sustain demand for brake services. Older internal combustion engine (ICE) models will continue to require traditional brake maintenance, creating a dual-market dynamic. Ford Motorcraft and its dealer network are likely to expand service offerings tailored to both traditional and high-tech brake systems, including diagnostics for electronic braking components. -

Competitive Pressure and Supply Chain Resilience

Global supply chain volatility and semiconductor shortages have underscored the need for resilient sourcing. By 2026, Ford may strengthen partnerships with Tier 1 brake suppliers like Bosch, ZF, and Continental while also investing in vertical integration for critical braking components. Competition from aftermarket and third-party brake manufacturers will also intensify, especially as consumers seek cost-effective alternatives for high-mileage ICE vehicles. -

Data-Driven Maintenance and Predictive Diagnostics

Ford’s connected vehicle platforms, including Ford Power-Up over-the-air (OTA) updates, will enable predictive brake maintenance. By 2026, onboard sensors and telematics will monitor brake wear, temperature, and performance in real time, alerting drivers and service centers before failures occur. This trend will enhance customer safety and loyalty while creating new revenue streams through data-driven service subscriptions.

Conclusion

By 2026, Ford’s brake systems will be more integrated, intelligent, and efficient than ever before. The transition to electrification and autonomy will redefine the role of brakes—from simple stopping mechanisms to key components in energy recovery and vehicle safety. Ford’s success in this evolving landscape will depend on innovation in materials, partnerships, and digital integration, positioning the company at the forefront of next-generation braking technology.

Common Pitfalls Sourcing Ford Brakes (Quality, IP)

Sourcing Ford brake components—whether for replacement, repair, or aftermarket use—can be fraught with challenges, especially concerning quality consistency and intellectual property (IP) concerns. Being aware of these pitfalls is crucial for maintaining vehicle safety, performance, and legal compliance.

Quality Inconsistencies in Aftermarket and Replica Parts

One of the most significant risks when sourcing Ford brake parts is encountering inconsistent quality, particularly with non-OEM (Original Equipment Manufacturer) or aftermarket components. Many suppliers offer cheaper alternatives that may mimic the appearance of genuine Ford brakes but fall short in critical performance areas.

- Substandard Materials: Lower-tier manufacturers may use inferior-grade friction materials or metallurgy in brake pads and rotors. This can lead to excessive wear, reduced stopping power, increased brake fade under load, and higher dust output.

- Poor Manufacturing Tolerances: Inconsistent machining or casting can result in warped rotors, uneven pad wear, brake vibrations, or noise (squealing, grinding). These issues compromise safety and driver comfort.

- Lack of Rigorous Testing: Genuine Ford brakes undergo extensive testing for durability, heat dissipation, and performance across diverse conditions. Aftermarket alternatives often skip or minimize such testing, increasing the risk of premature failure.

Risk of Counterfeit or Unlicensed Ford-Branded Components

Sourcing brake parts labeled as “Ford” or bearing Ford logos carries a high risk of encountering counterfeit or IP-infringing products.

- Trademark and IP Violations: Using Ford’s branding, part numbers, or logos without authorization constitutes intellectual property infringement. Distributors and installers of counterfeit parts may face legal liability, including fines or injunctions.

- Deceptive Packaging: Counterfeit parts often use packaging that closely resembles genuine Ford packaging, making it difficult for buyers to distinguish fakes without close inspection or verification through official channels.

- Traceability and Warranty Issues: Genuine Ford parts come with traceability and warranty support. Counterfeit or unlicensed parts typically offer no warranty and cannot be traced back to a legitimate manufacturer, leaving users without recourse in case of failure.

Supply Chain Transparency and Certification Gaps

Many suppliers, especially in global markets, lack transparency in their sourcing and manufacturing processes, increasing the risk of receiving subpar or non-compliant brake components.

- Unverified Suppliers: Sourcing from third-party vendors or online marketplaces without proper vetting increases exposure to counterfeit or low-quality products.

- Missing Certifications: Genuine Ford brake components typically meet or exceed OEM specifications and may carry certifications such as ISO 9001, IATF 16949, or compliance with FMVSS (Federal Motor Vehicle Safety Standards). Aftermarket parts often lack these certifications, making compliance uncertain.

Recommendations to Mitigate Risks

- Source from Authorized Ford Dealers or Licensed Distributors: Ensure parts are procured through Ford’s official distribution channels or certified aftermarket partners.

- Verify Part Numbers and Packaging: Cross-check part numbers with Ford’s official catalogs and inspect packaging for security features or signs of tampering.

- Request Documentation: Ask for material certifications, test reports, and warranty information before purchase.

- Avoid “Too Good to Be True” Pricing: Significantly lower prices often indicate compromised quality or counterfeit goods.

By recognizing these pitfalls and implementing strict sourcing protocols, businesses and consumers can ensure they receive safe, reliable, and legally compliant brake components for Ford vehicles.

Logistics & Compliance Guide for Ford Brake

This guide outlines the essential logistics and compliance procedures for handling, transporting, storing, and documenting Ford Brake components to ensure operational efficiency, regulatory adherence, and quality assurance.

Supply Chain Coordination

Maintain seamless communication with Ford-approved suppliers and internal teams to ensure timely delivery of raw materials and finished brake components. Utilize Ford’s designated supply chain management platforms (e.g., SYNC, EDI systems) for order tracking, inventory updates, and demand forecasting. All logistics partners must be certified under Ford’s Supplier Quality Excellence Process (SQEP).

Transportation Requirements

All brake components must be shipped using climate-controlled, secure, and Ford-authorized carriers. Packaging must meet Ford’s Engineering Material Specification (e.g., WSS-M4D750-A) for moisture, shock, and vibration resistance. Hazardous materials (e.g., brake fluids) must comply with DOT, IATA, and ADR regulations, including proper labeling, documentation, and segregation during transit.

Warehousing & Storage Protocols

Store brake assemblies in dry, temperature-regulated environments (10°C–30°C) with humidity below 60%. Use first-in, first-out (FIFO) inventory practices and conduct quarterly stock audits. Clearly label all items with Ford part numbers, batch codes, and expiration dates. Ensure warehouse facilities are ISO 9001 and IATF 16949 certified.

Regulatory Compliance

Adhere to all local, national, and international regulations, including:

– U.S. DOT Federal Motor Vehicle Safety Standards (FMVSS)

– EU Regulation (EU) 2018/858 for vehicle type approval

– REACH and RoHS for chemical substance restrictions

– EPA and EU end-of-life vehicle (ELV) directives

Maintain up-to-date compliance documentation, including Certificates of Conformance (CoC), Safety Data Sheets (SDS), and Restricted Substances Declarations.

Documentation & Traceability

Implement full traceability from raw material sourcing to final delivery using Ford’s Global Product Development System (GPDS) and Bar Code/RFID tagging. Retain shipping logs, inspection reports, and non-conformance records for a minimum of 15 years. All export shipments require accurate commercial invoices, packing lists, and Harmonized System (HS) code classification.

Quality & Audit Preparedness

Conduct routine internal audits aligned with Ford’s Q1 Quality Certification requirements. Prepare for unannounced supplier audits by maintaining organized records and trained personnel. Report any non-conformances immediately through Ford’s Problem Reporting and Corrective Action System (PRCAS).

Environmental & Safety Standards

Ensure all logistics operations comply with Ford’s World Excellence Environmental (WEE) standards. Implement waste reduction, recycling programs, and spill containment measures. Train staff in OSHA and local workplace safety regulations, with special emphasis on handling heavy components and chemical substances.

Continuous Improvement

Participate in Ford’s Logistics Excellence Program (LEP) by submitting performance metrics (on-time delivery, damage rates, inventory accuracy) and engaging in continuous improvement initiatives such as Lean Six Sigma and Kaizen events.

In conclusion, sourcing Ford brakes requires careful consideration of compatibility, quality, supplier reliability, and cost-effectiveness. Whether sourcing original equipment manufacturer (OEM) parts directly from Ford or opting for high-quality aftermarket alternatives, it is essential to ensure that the components meet the required safety and performance standards. Evaluating authorized distributors, reputable online platforms, and verified suppliers helps minimize the risk of counterfeit or substandard parts. Additionally, considering factors such as vehicle model, year, and specific braking system requirements ensures optimal fit and function. By adopting a strategic and informed sourcing approach, businesses and consumers can secure reliable Ford brake components that enhance vehicle safety, performance, and longevity.