The U.S. footwear manufacturing industry is experiencing steady transformation driven by shifting consumer preferences, advancements in sustainable production, and growing domestic demand for high-performance and specialty footwear. According to a 2023 report by Grand View Research, the U.S. footwear market was valued at approximately $75.8 billion and is projected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is fueled by rising demand in athletic, outdoor, and lifestyle segments, alongside increased investments in localized supply chains and innovation in materials. Mordor Intelligence further supports this trend, projecting a CAGR of around 4.1% over the same period, highlighting resilience amid global supply chain disruptions and a renewed emphasis on ‘Made in USA’ products. As demand for quality, durability, and ethically produced footwear rises, a new wave of domestic manufacturers is emerging—combining craftsmanship with cutting-edge technology. In this report, we spotlight the top 10 footwear manufacturers in the U.S. that are shaping the future of American-made shoes through innovation, sustainability, and scalable production.

Top 10 Footwear In Usa Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 SAS Shoes

Domain Est. 2003

Website: sasshoes.com

Key Highlights: San Antonio Shoe, Inc. 1717 SAS Drive San Antonio, TX 78224 Customer Service Line: 1-877-727-7463…

#2 Weinbrenner Shoe Company

Domain Est. 1996

Website: weinbrennerusa.com

Key Highlights: For more than 125 years, Weinbrenner Shoe Company has been a leading US manufacturer of footwear for uniform, work, safety & outdoor….

#3 United States Footwear Manufacturers Association (USFMA)

Domain Est. 2019

Website: usfma.org

Key Highlights: The USFMA is the heart of the domestic footwear industry – it is the hub for innovation, networking and collaborative between manufacturers and suppliers….

#4 NYC Shoe Factory

Website: nycshoefactory.com

Key Highlights: NYC SHOE FACTORY’s Footwear Development and Production. Create Your Custom Shoe Line. USA Based Manufacturing & Sampling. In an era when fashion production has ……

#5 Alden Shoes

Domain Est. 1998

Website: aldenshoe.com

Key Highlights: Stores · Product Information · History · Accessories · Restoration. Alden Shoe Company – 1 Taunton Street, Middleborough, MA 02346 508-947-3926 online@aldenshoe ……

#6 Original Footwear

Domain Est. 1999

Website: originalfootwear.com

Key Highlights: Original Footwear Co. builds footwear engineered for the grind—lightweight tactical boots for speed and support and slip resistant boots that hold firm on ……

#7 Footwear Unlimited

Domain Est. 2001

Website: footwearunlimited.com

Key Highlights: We aim to deliver a fair and consistent profit to our customers while developing and marketing the best footwear brands in North America….

#8 West Coast Shoe Company

Domain Est. 2003

Website: builder.wescoboots.com

Key Highlights: Custom orders are taking about 10-11 months to manufacture. My Account · Shopping Cart · ABOUT WESCO. CUSTOM FITTING. CUSTOM BOOTS. STOCK BOOTS. BOOT…

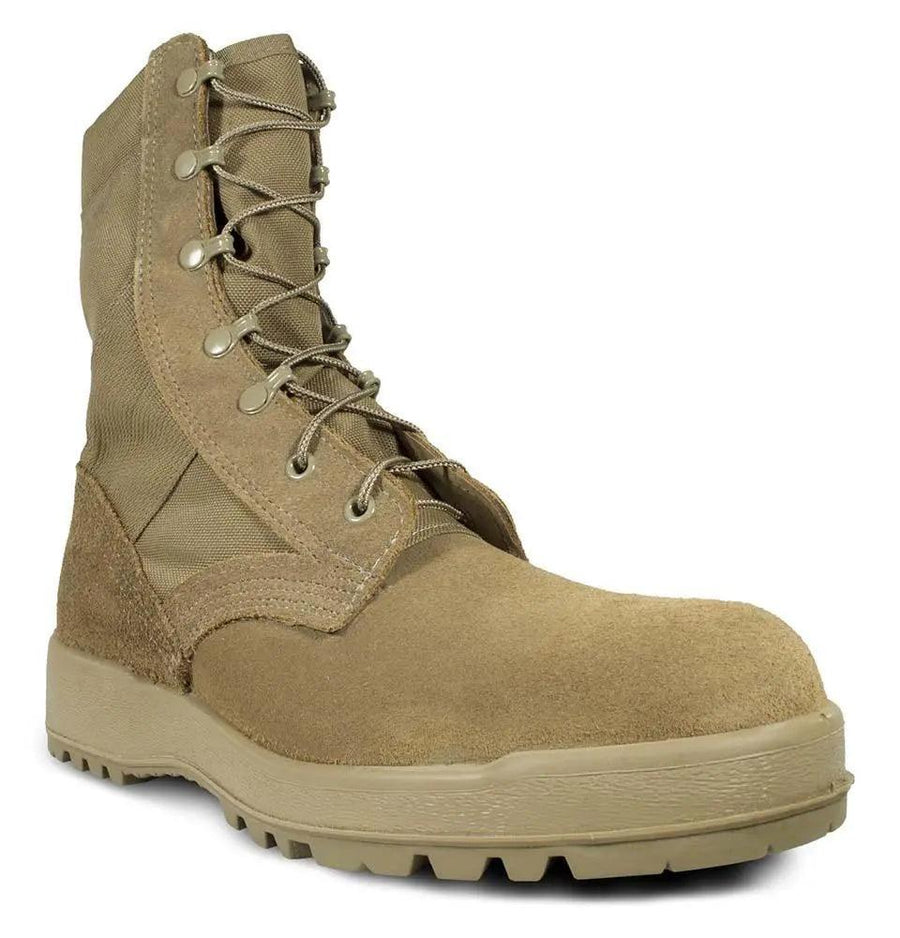

#9 McRae Footwear

Domain Est. 2009

Website: mcraefootwear.com

Key Highlights: McRae Footwear manufactures military footwear for the United States Department of Defense, and for individual customers….

#10 Warson Brands

Domain Est. 2009

Website: warsonbrands.com

Key Highlights: 800+ styles across 8 brands with online ordering 24x7x365; Every type of work shoe for every type of worker and every type of job site; Over 350 years of ……

Expert Sourcing Insights for Footwear In Usa

2026 Market Trends for Footwear in the USA

The U.S. footwear market in 2026 is poised for dynamic shifts driven by evolving consumer behaviors, technological advancements, and heightened emphasis on sustainability. As the industry rebounds and adapts post-pandemic, several key trends are expected to shape the landscape over the next few years.

Sustainability and Eco-Conscious Materials

Environmental responsibility is becoming a non-negotiable factor for consumers. By 2026, demand for footwear made from recycled plastics, bio-based materials (like algae foam and mushroom leather), and other sustainable alternatives will surge. Major brands are investing heavily in circular fashion models, offering repair programs, take-back initiatives, and transparent supply chains. Retailers and manufacturers emphasizing carbon neutrality and ethical labor practices will gain a competitive edge.

Rise of Direct-to-Consumer (DTC) and Digital Shopping

E-commerce will continue to dominate footwear sales, with brands strengthening their DTC channels to build customer loyalty and gather first-party data. Augmented reality (AR) try-on tools, AI-powered sizing recommendations, and personalized shopping experiences will enhance online conversions. Social commerce platforms like Instagram and TikShop will play a crucial role in discovery and impulse buying, particularly among Gen Z and millennial consumers.

Athleisure and Performance Hybridization

The blurring line between athletic and casual footwear will intensify. Consumers seek versatile shoes that transition seamlessly from gym to work to social settings. Innovations in comfort technology—such as adaptive cushioning, breathable knits, and lightweight soles—will be central to product development. Brands will focus on “performance comfort” even in non-athletic categories, integrating biomechanical design for everyday wear.

Customization and Personalization

Mass customization is emerging as a key differentiator. By 2026, more brands will offer made-to-order or customizable options—allowing consumers to choose colors, materials, and even fit modifications. 3D printing and on-demand manufacturing will reduce waste and inventory costs while meeting the growing desire for unique, personalized products.

Inflation and Value-Conscious Spending

Economic uncertainty and inflation will influence purchasing decisions. While premium and luxury footwear will maintain a niche, there will be increased demand for value-oriented options, including refurbished or gently used shoes via resale platforms. Brands that balance quality, durability, and affordability will thrive. Private-label footwear from retailers like Amazon, Target, and Walmart will gain market share.

Health and Wellness Integration

Footwear will increasingly be marketed as part of holistic health regimens. Smart shoes with embedded sensors to monitor gait, posture, or activity levels will gain traction, especially among fitness enthusiasts and aging populations. Orthopedic and podiatrist-approved designs will appeal to consumers prioritizing long-term foot health.

Inclusive Sizing and Design

Diversity and inclusivity will extend beyond marketing into product design. Brands are expanding size ranges to include more widths, half sizes, and gender-neutral options. Adaptive footwear for people with disabilities—featuring easy closures and accessible designs—will become more mainstream, driven by both social responsibility and untapped market potential.

In summary, the U.S. footwear market in 2026 will be defined by innovation, sustainability, and consumer-centricity. Brands that embrace digital transformation, prioritize ethical practices, and respond to diverse consumer needs will lead the market in the coming years.

Common Pitfalls Sourcing Footwear in the USA (Quality, IP)

Sourcing footwear in the USA offers advantages such as shorter lead times, better oversight, and support for local manufacturing. However, brands and retailers can still encounter significant challenges, particularly concerning quality control and intellectual property (IP) protection. Being aware of these pitfalls is essential for a successful sourcing strategy.

Quality Inconsistencies Due to Small-Batch Production

Many domestic footwear manufacturers operate on a smaller scale, often specializing in artisanal or custom production. While this supports craftsmanship, it can lead to inconsistencies in materials, stitching, and overall finish between production runs. Without standardized processes or rigorous quality assurance systems, each batch may vary, impacting brand reputation and customer satisfaction. Brands must implement clear quality benchmarks and conduct regular inspections.

Limited Scalability and Capacity Constraints

U.S. footwear factories typically have lower production capacities compared to overseas counterparts. This limitation can become a major pitfall when demand spikes, leading to delays or inability to fulfill large orders. Relying on a single domestic supplier without contingency planning can disrupt supply chains. Diversifying suppliers or negotiating volume commitments in advance is crucial to mitigate this risk.

Higher Production Costs Impacting Margins

Domestic manufacturing generally comes with higher labor and material costs. While this often correlates with better quality, it can squeeze profit margins, especially for budget-conscious brands. Cutting corners to reduce costs—such as using lower-grade materials or reducing oversight—can compromise product integrity. Balancing cost efficiency with quality standards requires careful vendor selection and transparent pricing models.

Intellectual Property Vulnerability in Collaborative Design

When working closely with U.S. manufacturers on custom designs, there’s a risk of IP exposure. Without proper legal agreements, manufacturers may inadvertently or intentionally replicate unique designs, logos, or proprietary technologies for other clients. This is particularly concerning in a competitive market where design differentiation is key. Always use Non-Disclosure Agreements (NDAs) and clearly define IP ownership in manufacturing contracts.

Lack of IP Enforcement Awareness

Even within the U.S., not all manufacturers fully understand or prioritize IP rights. Some may source materials or components (e.g., branded soles, textiles) without proper licensing, unknowingly exposing the brand to infringement claims. Brands must vet suppliers for compliance and ensure all components used are legally sourced and do not violate trademarks or patents.

Inadequate Documentation and Traceability

Smaller manufacturers may lack robust systems for recording material sources, production processes, or compliance certifications. This absence of traceability can become a liability during quality audits or recalls and complicates efforts to prove IP originality or ethical sourcing. Insist on detailed documentation and consider third-party verification for critical product lines.

Avoiding these pitfalls requires proactive management, thorough due diligence, and strong legal protections. By prioritizing quality standards and safeguarding intellectual property, brands can successfully leverage U.S. footwear manufacturing to build trustworthy, innovative product offerings.

Logistics & Compliance Guide for Footwear in the USA

Import Regulations and Documentation

To legally import footwear into the United States, businesses must comply with regulations set by U.S. Customs and Border Protection (CBP) and other federal agencies. The following documentation is required:

- Commercial Invoice: Must include seller/buyer details, product description, value, currency, and terms of sale (e.g., FOB, CIF).

- Packing List: Details the contents of each package, including weight, dimensions, and quantity.

- Bill of Lading (B/L) or Air Waybill (AWB): Serves as the contract between the shipper and carrier and proof of shipment.

- Entry Documents (CBP Form 7501): Filed by a licensed customs broker to declare goods to CBP.

- Importer Security Filing (ISF or “10+2”): Required for ocean shipments, to be submitted 24 hours before cargo is loaded abroad.

Harmonized Tariff Schedule (HTS) Classification

Footwear is classified under Chapter 64 of the HTSUS (Harmonized Tariff Schedule of the United States). Accurate classification determines duty rates and eligibility for trade programs. Key examples include:

- 6403: Footwear with outer soles and uppers of rubber or plastics

- 6404: Textile footwear

- 6405: Other footwear (e.g., canvas, combinations)

- 6406: Parts of footwear (e.g., soles, heels)

Duty rates vary widely—from 0% to over 30%—depending on material, use (e.g., athletic vs. dress), and country of origin.

Country of Origin Labeling

All imported footwear must be permanently and legibly marked with the country of origin. Common compliant methods include:

- Heat-stamped labels inside the tongue or sole

- Embossed or molded markings on non-removable parts

Markings must use English and follow the format: “Made in [Country]” or “Product of [Country]”.

Safety and Regulatory Compliance

Certain types of footwear must meet U.S. safety standards administered by:

- Consumer Product Safety Commission (CPSC): Regulates children’s footwear for hazards like lead, phthalates, and small parts.

- Occupational Safety and Health Administration (OSHA): Requires safety footwear (e.g., steel-toe boots) to meet ASTM F2413 standards.

- Federal Trade Commission (FTC): Enforces labeling requirements for fiber content in textile footwear.

Anti-Dumping and Countervailing Duties

Footwear from certain countries (e.g., China, Vietnam) may be subject to anti-dumping (AD) or countervailing duties (CVD). Importers should:

- Review current AD/CVD orders from the U.S. Department of Commerce (DOC).

- Work with a customs broker to determine additional duty liabilities.

- Maintain records to support duty assessments.

Customs Valuation

The declared value of footwear must reflect the transaction value, which includes:

- Price paid for the goods

- Packing costs

- Selling commissions

- Assists (e.g., molds, tooling provided to manufacturer)

CBP may audit valuations, so documentation must be complete and accurate.

Logistics and Distribution

Efficient logistics involve:

- Port Selection: Major ports for footwear include Los Angeles, Long Beach, New York/New Jersey, and Savannah.

- Warehousing: Use of bonded warehouses or Foreign Trade Zones (FTZs) can defer or reduce duties.

- Last-Mile Delivery: Partner with reliable domestic carriers (e.g., UPS, FedEx, USPS) for timely distribution.

- Inventory Management: Implement software to track stock levels, expiration (for materials), and compliance status.

Recordkeeping and Audits

Importers must retain records for five years, including:

- Invoices and packing lists

- Customs entries and duty payment records

- Certificates of origin

- Test reports for safety compliance

CBP may conduct audits to verify compliance.

Trade Programs and Duty Savings

Explore opportunities to reduce costs:

- Generalized System of Preferences (GSP): Duty-free treatment for eligible products from designated developing countries.

- U.S.-Mexico-Canada Agreement (USMCA): Duty-free entry if footwear meets rules of origin.

- Duty Drawback: Refund of duties on imported components used in exported goods.

Best Practices for Compliance

- Engage a Licensed Customs Broker to ensure accurate filings.

- Verify HTS Codes with CBP’s ruling database or binding rulings.

- Conduct Supplier Audits to confirm origin and compliance.

- Stay Updated on changes in trade policy, tariffs, and regulations.

By following this guide, footwear importers can navigate U.S. logistics and compliance efficiently, minimizing delays, penalties, and costs.

In conclusion, sourcing footwear manufacturers in the USA offers numerous advantages, including higher quality control, shorter lead times, greater transparency, and support for ethical labor practices. Domestic manufacturing enables brands to respond quickly to market trends, reduce shipping costs and carbon footprint, and maintain better oversight throughout the production process. While costs may be higher compared to offshore manufacturing, the long-term benefits—such as enhanced brand reputation, reduced inventory risks, and the ability to market “Made in the USA”—can provide a strong competitive edge. For businesses prioritizing sustainability, craftsmanship, and supply chain resilience, partnering with American footwear manufacturers is a strategic and increasingly viable choice in today’s conscious consumer market.