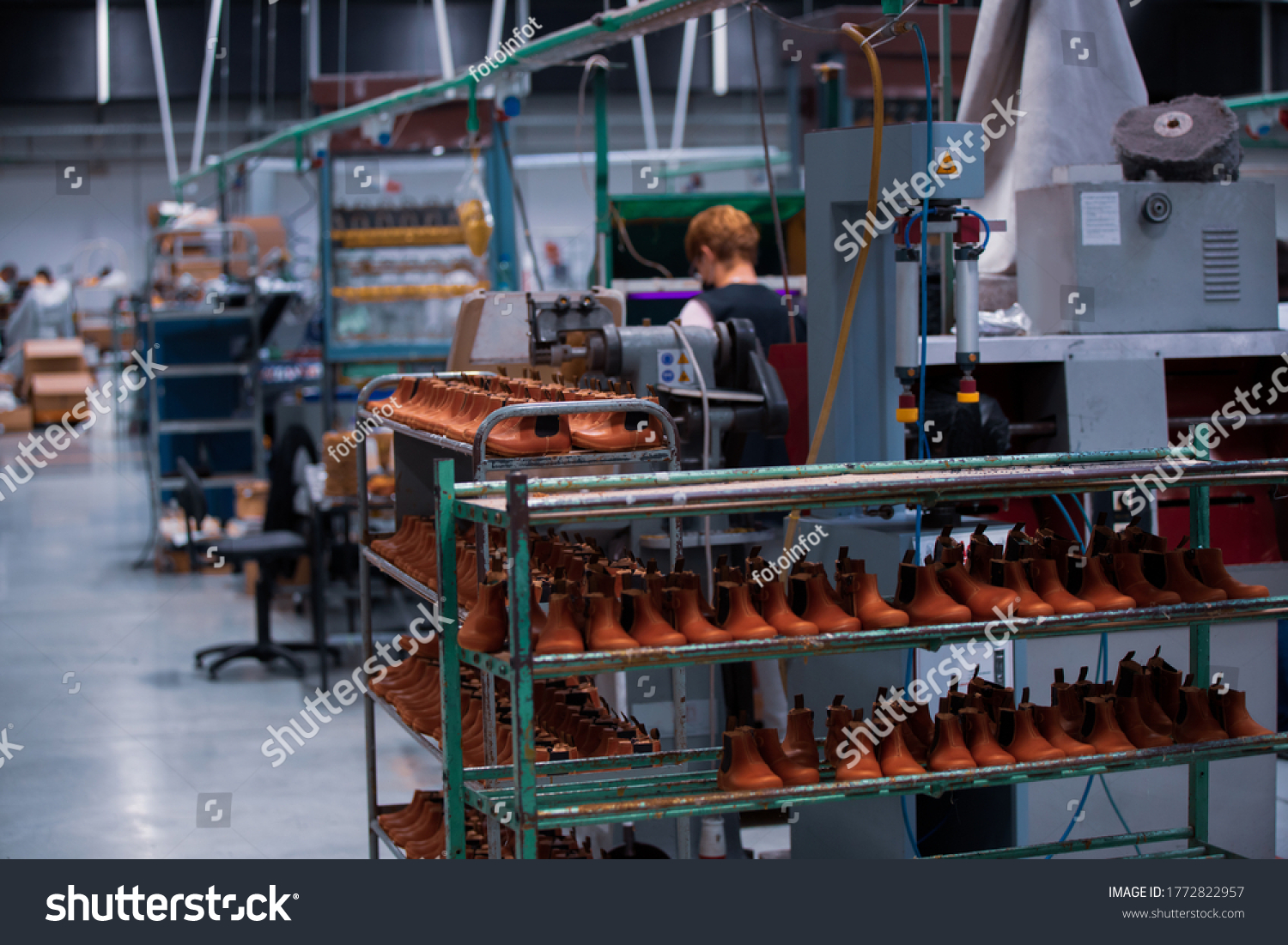

The global footwear manufacturing market is experiencing steady growth, driven by rising consumer demand for both athletic and casual footwear, as well as increasing automation in production processes. According to Mordor Intelligence, the footwear market was valued at USD 365.5 billion in 2023 and is projected to grow at a CAGR of 5.8% through 2029. This expansion is mirrored in the rising demand for advanced footwear making tools, as manufacturers focus on precision, efficiency, and scalability. Supporting this trend, Grand View Research highlights that innovations in molding, cutting, and stitching technologies are becoming critical differentiators in footwear production. As the industry evolves, the role of specialized tooling manufacturers becomes increasingly vital. The following list highlights the top nine footwear making tool manufacturers that are shaping the future of footwear production through technological innovation and reliable performance.

Top 9 Footwear Making Tools Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

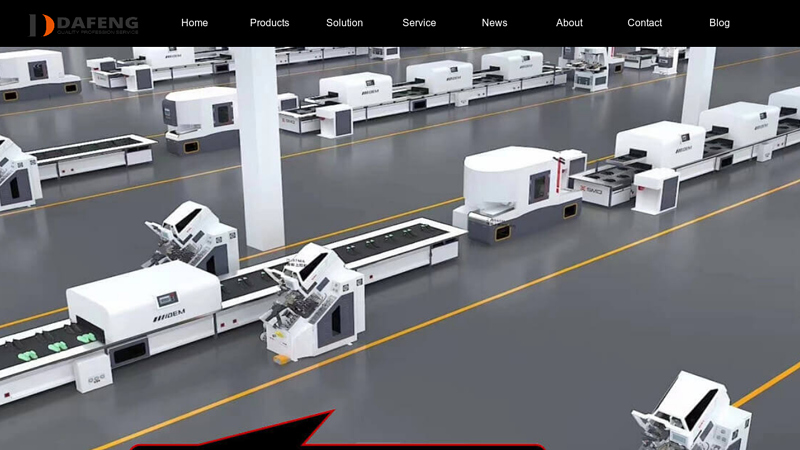

#1 Shoes Making Machine Manufacturer Factory,Toe Lasting Machine …

Domain Est. 2022

Website: shoes-machine.com

Key Highlights: Our engineers’ team serve to produce the most productive solution to fit your plant and equipment based on a thorough understanding of your production needs….

#2 Boot & Shoe Repair Supplies

Domain Est. 2000

Website: montanaleather.com

Key Highlights: Free delivery over $150 30-day returnsWe carry a wide range of supplies for various types of footwear, including shoemaking leather supplies, such as full leather shoe soles, half …

#3 Tecnica Group

Domain Est. 2003

Website: tecnicagroup.com

Key Highlights: Tecnica Group is a leading sport equipment manufacturer in the market of footwear and winter sports equipment….

#4 Machinery for shoemaking

Domain Est. 2013

Website: shoemakingcoursesonline.com

Key Highlights: Machinery for shoemaking. Shoemaking machinery encompasses a range of specialized equipment designed to streamline and enhance the shoe production process….

#5 Tools

Domain Est. 2014

Website: shoetechnik.com

Key Highlights: 1–4 day deliveryTools and instruments for shoemakers and designers. Cutting tools, pliers, hammers and everything concerning with hand-making….

#6 Shoe Materials and Shoe Repair Supplies

Domain Est. 1998

Website: algeos.com

Key Highlights: Shoe Making Supplies from Algeos provides everything needed to create, repair, and customise high-quality footwear. From premium materials to specialised tools, ……

#7 Kaufman Shoe Repair Supplies

Domain Est. 1999

Website: kaufmanshoe.com

Key Highlights: New York’s Largest Wholesaler of Shoe Repair Supplies. 621 Sackett Street,. Brooklyn, NY 11217. 212-777-1700. Directions & Hours · Flyer · Shoe Making Supplies ……

#8 Wholesale Cobbler & Shoe Repair Supplies

Domain Est. 2006

Website: tcolledgeandson.com

Key Highlights: Serving Cobblers based in the UK, TColledgeandson are suppliers of shoe care and shoe repair products and materials in the following categories at competitive ……

#9 Weaver Leather Supply

Domain Est. 2013

Website: weaverleathersupply.com

Key Highlights: Start your next leather crafting project with top quality leather, leatherworking tools, machinery and hardware from Weaver Leather Supply….

Expert Sourcing Insights for Footwear Making Tools

2026 Market Trends for Footwear Making Tools

The global footwear making tools market is poised for significant transformation by 2026, driven by technological advancements, shifting consumer demands, and evolving manufacturing strategies. Key trends shaping the landscape include:

H2: Rising Demand for Automation and Smart Manufacturing Tools

The integration of automation, robotics, and AI-driven solutions in footwear production will accelerate. By 2026, manufacturers will increasingly adopt automated cutting machines, robotic last handling systems, and smart stitching tools to enhance precision, reduce labor costs, and improve production speed. This trend is particularly strong in regions like China, Vietnam, and India, where rising wages and labor shortages are pushing brands toward Industry 4.0 adoption.

H2: Growth in Sustainable and Eco-Friendly Tooling Solutions

Sustainability will remain a core driver, influencing both materials and processes. Footwear making tools designed for use with recycled materials, waterless dyeing systems, and energy-efficient operations will gain traction. Tools compatible with bio-based adhesives and low-impact manufacturing techniques will be in higher demand as brands strive to meet ESG goals and regulatory requirements in Europe and North America.

H2: Expansion of Customization and On-Demand Production Tools

The consumer shift toward personalized footwear will fuel demand for flexible, modular tools that support small-batch and made-to-order production. Digital design software, 3D printing for molds and lasts, and adaptable assembly tools will enable faster prototyping and customization, especially in premium and athletic footwear segments.

H2: Increased Investment in Digital Twin and Simulation Technologies

By 2026, digital twin technology—virtual replicas of physical production lines—will become more widespread. These systems allow manufacturers to simulate and optimize tool performance, predict maintenance needs, and reduce downtime. This digital integration enhances operational efficiency and reduces material waste during the footwear development process.

H2: Regional Shifts and Localization of Supply Chains

Geopolitical factors and supply chain resilience concerns will drive localized footwear production in North America, Europe, and parts of Southeast Asia. This shift will increase regional demand for advanced footwear making tools, supporting nearshoring initiatives and reducing dependency on distant manufacturing hubs.

H2: Advancement in Material-Specific Tooling

As new materials like mushroom leather, algae-based foams, and recycled synthetics enter mainstream use, specialized tools tailored to their unique processing requirements will emerge. Tool manufacturers will need to innovate rapidly to support these novel materials without compromising durability or efficiency.

In summary, the 2026 footwear making tools market will be defined by smarter, greener, and more flexible technologies, enabling manufacturers to meet the dual demands of sustainability and customization in a competitive global landscape.

Common Pitfalls When Sourcing Footwear Making Tools: Quality and Intellectual Property Risks

Sourcing footwear making tools—ranging from lasts and molds to cutting dies and stitching equipment—requires careful due diligence. Overlooking critical factors can lead to production delays, compromised product quality, legal disputes, and reputational damage. Below are two major pitfalls businesses often encounter, centered on quality inconsistencies and intellectual property (IP) risks.

Quality Inconsistencies Due to Poor Supplier Vetting

One of the most frequent issues in sourcing footwear tools is receiving substandard equipment that fails to meet technical or durability standards. Many suppliers, particularly in low-cost regions, may offer competitive pricing but lack the precision engineering required for consistent tool performance. For example, poorly machined shoe lasts can result in misshapen footwear, while inaccurate cutting dies lead to material waste and assembly problems. These inconsistencies often stem from inadequate quality control processes, use of inferior materials, or limited experience in producing tools for high-volume or premium footwear manufacturing. Without on-site audits, sample testing, and clear technical specifications, buyers risk integrating flawed tools into their production line, leading to rework, delays, and increased costs.

Intellectual Property Infringement and Unauthorized Replication

Footwear making tools—especially lasts, molds, and design-specific jigs—are often based on proprietary designs protected by intellectual property rights. A critical pitfall arises when suppliers replicate branded or patented tooling without authorization. Some manufacturers may copy designs from competitors or reverse-engineer tools provided by other clients, exposing the buyer to legal liability for IP infringement. This risk is heightened when sourcing from regions with weak IP enforcement. Additionally, lack of contractual safeguards—such as non-disclosure agreements (NDAs) or IP ownership clauses—can result in the supplier retaining rights to or reselling custom tooling to competitors. This not only undermines product differentiation but can also damage brand integrity and lead to costly litigation.

To mitigate these risks, businesses should conduct thorough supplier due diligence, insist on quality certifications, perform prototype validation, and establish clear IP agreements before production begins.

Logistics & Compliance Guide for Footwear Making Tools

Overview

This guide outlines key logistics and compliance considerations for the international trade of footwear making tools. These tools—such as lasts, lasts-making machines, cutting dies, stitching machines, sole attaching equipment, and pattern-making software—must meet regulatory, customs, and transportation standards to ensure smooth supply chain operations.

Classification & Tariff Codes (HS Codes)

Correct classification is essential for customs clearance and determining import duties. Footwear making tools generally fall under HS Chapter 84 (Nuclear reactors, boilers, machinery and mechanical appliances) or Chapter 82 (Tools of base metal). Examples include:

- 84.65: Machines for working wood, cork, bone, or similar hard materials (includes pattern-cutting and last-shaping machines).

- 84.52: Sewing machines and sewing machine heads (used in upper stitching).

- 82.05: Other hand tools (e.g., lasts, cutting knives, edge trimmers).

- 84.79: Other special-purpose machinery (e.g., sole pressing, cementing, or lasting machines).

Always verify country-specific tariff schedules, as sub-classifications may differ.

Import/Export Regulations

- Export Controls: Some advanced manufacturing tools (e.g., CNC-based machinery) may be subject to export control regulations (e.g., U.S. EAR, EU Dual-Use Regulations) if they incorporate sensitive technology.

- Import Requirements: Check destination country rules for machinery imports. Some countries require conformity assessment, registration, or local agent representation.

- Restricted Materials: Tools containing certain metals, lubricants, or electronic components may require special documentation or be restricted.

Product Safety & Standards Compliance

- CE Marking (EU): Machinery must comply with the EU Machinery Directive (2006/42/EC), requiring risk assessments, technical documentation, and conformity declarations.

- UL/ETL Listing (USA): Electrical components must meet safety standards set by OSHA-recognized Nationally Recognized Testing Laboratories (NRTLs).

- RoHS & REACH (EU): Ensure compliance with restrictions on hazardous substances (e.g., lead, cadmium, phthalates) in electrical and mechanical components.

- EAC Certification (Eurasian Economic Union): Required for machinery sold in Russia, Belarus, Kazakhstan, etc.

Packaging & Shipping Requirements

- Secure Packaging: Use robust, shock-resistant packaging for fragile components (e.g., lasts, precision dies). Include foam inserts and moisture barriers.

- Labeling: Clearly label packages with:

- HS code

- Net and gross weight

- Country of origin

- “Fragile” and “This Side Up” indicators

- Handling instructions (e.g., “Do Not Stack”)

- Palletization: Secure tools on wooden or plastic pallets compliant with ISPM 15 (for wood packaging material).

- Shipping Modes: Choose air freight for urgent, high-value tools; ocean freight for bulk shipments. Consider multimodal options for inland transport.

Documentation

Accurate documentation is critical for customs clearance. Required documents include:

– Commercial Invoice (with detailed descriptions, unit values, and Incoterms)

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin

– Export Declaration (e.g., AES for U.S. exports)

– Conformity Certificates (CE, UL, etc.)

– Import License (if required by destination country)

Incoterms Selection

Choose appropriate Incoterms based on responsibility and risk:

– EXW (Ex Works): Buyer manages all logistics from seller’s facility.

– FCA (Free Carrier): Seller delivers goods to a carrier nominated by buyer.

– CIP (Carriage and Insurance Paid To): Seller arranges transport and insurance to a named destination.

– DAP (Delivered at Place): Seller bears all risks until goods are ready for unloading at destination.

Customs Clearance & Duties

- Engage a licensed customs broker in the destination country.

- Be prepared for inspections, especially for machinery with moving parts or electrical components.

- Calculate duties based on HS code, country of origin, and trade agreements (e.g., USMCA, RCEP).

- Consider bonded warehouses or temporary admission for tools used in manufacturing under export processing zones.

Environmental & Sustainability Compliance

- WEEE (EU): If tools contain electrical components, producers may be responsible for take-back and recycling.

- Battery Regulations: Tools with batteries must comply with transport (e.g., IATA for air) and disposal regulations.

- Carbon Reporting: Some countries require emissions data for imported goods (e.g., France’s carbon footprint labeling).

Risk Management

- Insurance: Cover tools against loss, damage, or delay during transit (All-Risk cargo insurance).

- Supplier Audits: Verify compliance of manufacturers with international standards.

- Contingency Planning: Identify alternate shipping routes and backup suppliers.

Conclusion

Navigating the logistics and compliance landscape for footwear making tools requires attention to classification, regulatory standards, documentation, and risk mitigation. Partnering with experienced freight forwarders, customs brokers, and compliance consultants ensures efficient global distribution while minimizing delays and penalties.

In conclusion, sourcing footwear making tools requires a strategic approach that balances quality, cost, reliability, and long-term sustainability. It is essential to thoroughly evaluate suppliers based on their product range, manufacturing standards, delivery timelines, and after-sales support. Whether sourcing locally or internationally, building strong relationships with reputable suppliers ensures consistent access to durable and precise tools that enhance production efficiency and product quality. Additionally, considering factors such as tool durability, technological advancements, and compatibility with existing manufacturing processes contributes to improved craftsmanship and competitiveness in the footwear industry. Ultimately, a well-executed sourcing strategy not only reduces operational costs but also supports innovation and growth in footwear production.