The global fluorescent lamp starters market continues to hold a niche yet steady position within the broader lighting industry, despite the rising adoption of LED technology. According to Grand View Research, the global fluorescent lamp market was valued at USD 6.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.1% from 2023 to 2030, driven by ongoing demand in commercial and industrial applications, particularly in developing regions. Similarly, Mordor Intelligence projects moderate but sustained growth in fluorescent lighting components, attributing this resilience to retrofitting projects, cost-effective maintenance solutions, and the extended lifecycle of existing fluorescent installations. As a critical component ensuring efficient lamp ignition, fluorescent starters remain essential in these systems. This enduring demand supports a competitive manufacturing landscape, with several key players leading in innovation, reliability, and global supply. Below are the top seven fluorescent lamp starter manufacturers shaping the market today.

Top 7 Fluorescent Lamp Starters Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 S2786 FS2 STARTER W/CONDENSOR

Domain Est. 1996

Website: satco.com

Key Highlights: SATCO® is a leading supplier of lighting products, offering solutions for commercial, residential, and industrial markets. Read more About us. Our Company….

#2 Fluorescent Starters

Domain Est. 1998

Website: normanlamps.com

Key Highlights: $3.85 delivery 30-day returnsFluorescent Starter for 115W & 140W Lamps, Sunstarter 80W/100W/140W, Turn and Lock Base (Brass.. Contact for Price. Add to Cart. FSU-220V (Universal) ….

#3 Fluorescent lamps and starters

Domain Est. 1987

Website: usa.lighting.philips.com

Key Highlights: Free delivery · 30-day returns…

#4 Starters for fluorescent lamps

Domain Est. 1996

Website: signify.com

Key Highlights: The fluorescent starters are easy to install and eco-friendly, suitable for all types of fluorescent lamps and fluorescent tubes with conventional ……

#5 Fluorescent Lamp Starters

Domain Est. 1996

Website: crescentelectric.com

Key Highlights: 3–9 day delivery 60-day returnsFluorescent Lamp Starters … Environmentally Responsible Lamps Sustainable lighting solution – Reduces the impact on the environment.;Warranty Perio…

#6 Sylvania

Domain Est. 1999

Website: reynoldsonline.com

Key Highlights: Sylvania GLOSTAT FS-2/42812 Fluorescent Starter, Fluorescent Lamp, 120 VAC. MFG Part #:42812. Call for Pricing. Compare. Add to List. QTY. Add to Cart….

#7 Legrand US

Domain Est. 2004

Website: legrand.us

Key Highlights: We deliver access to power, light and data. From designer switches and outlets that will improve the aesthetics and capabilities of your home….

Expert Sourcing Insights for Fluorescent Lamp Starters

H2: Market Trends for Fluorescent Lamp Starters in 2026

As the global lighting industry continues its transition toward energy-efficient and sustainable technologies, the market for fluorescent lamp starters is expected to experience a marked decline by 2026. Once a critical component in fluorescent lighting systems—facilitating the initial voltage surge needed to ignite gas within the tube—starters are becoming increasingly obsolete due to the widespread adoption of LED (Light Emitting Diode) lighting and advancements in electronic ballast technologies.

-

Declining Demand Due to LED Replacement

By 2026, LED lighting is projected to dominate over 60% of the global lighting market, according to industry forecasts. LEDs require no starters or ballasts, operate at lower energy consumption, and offer significantly longer lifespans (typically 25,000–50,000 hours compared to 8,000–15,000 for fluorescents). This shift is driven by government regulations phasing out inefficient lighting (e.g., EU Ecodesign Directive, U.S. DOE standards) and cost reductions in LED manufacturing, making retrofitting fluorescent systems economically favorable. -

Regional Market Variations

While the demand for fluorescent lamp starters is shrinking globally, residual demand will persist in developing regions such as parts of Africa, South Asia, and Southeast Asia. These areas may continue using fluorescent fixtures due to lower upfront costs and existing infrastructure. However, even in these markets, international aid programs and local energy efficiency initiatives are accelerating LED adoption, thereby limiting long-term growth for starter components. -

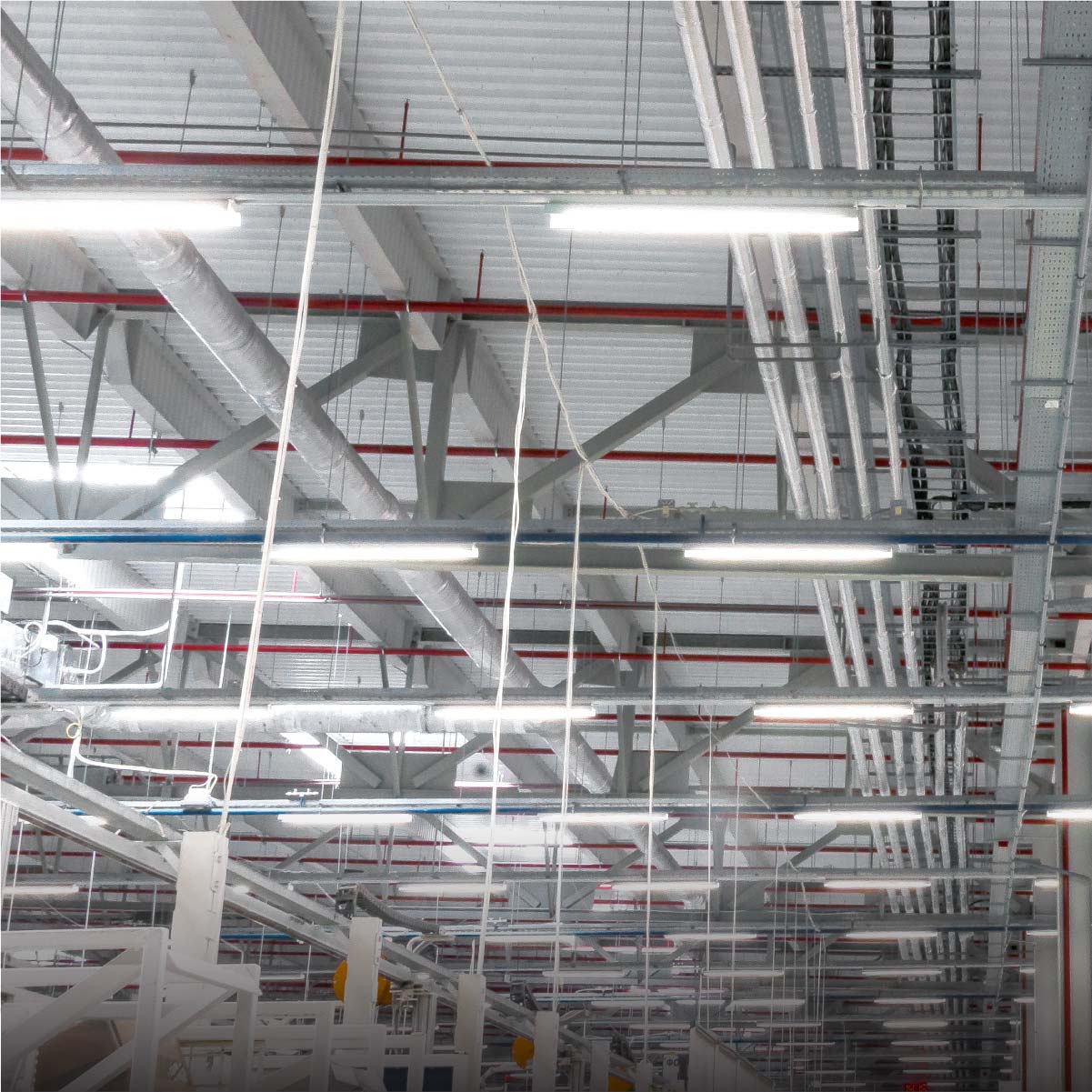

Niche and Retrofit Applications

The fluorescent starter market in 2026 will largely be confined to niche applications, including legacy industrial facilities, older commercial buildings undergoing gradual upgrades, and specific environments where fluorescent lighting remains in use (e.g., cold storage, certain laboratory settings). Additionally, the aftermarket for replacement starters will shrink but not disappear entirely, as maintenance of existing fluorescent systems will continue for several more years. -

Manufacturing and Supply Chain Shifts

Many manufacturers that once specialized in fluorescent components are pivoting toward LED driver technologies and smart lighting controls. By 2026, the production of traditional glow-type starters (e.g., FS-U, FS-2) is expected to be limited to a few regional suppliers, with reduced economies of scale driving consolidation in the supply chain. -

Environmental and Regulatory Pressures

Growing emphasis on reducing mercury use—fluorescent lamps contain small amounts—will further dampen demand. Initiatives like the Minamata Convention on Mercury are prompting countries to phase out mercury-containing products, indirectly affecting the fluorescent ecosystem, including starters.

In summary, by 2026, the fluorescent lamp starter market will be a shrinking segment of the broader lighting industry, sustained only by legacy system maintenance and transitional applications. The long-term outlook points to obsolescence, with market activity focused on replacement parts rather than new installations. Companies still involved in this space will need to adapt by diversifying into LED-compatible components or exiting the segment altogether.

Common Pitfalls Sourcing Fluorescent Lamp Starters (Quality, IP)

Sourcing fluorescent lamp starters may seem straightforward, but several critical pitfalls related to quality and intellectual property (IP) can lead to performance issues, safety risks, and legal complications. Being aware of these issues is essential for procurement professionals, lighting distributors, and facility managers.

Poor Quality Components and Construction

One of the most prevalent issues when sourcing fluorescent lamp starters—especially from low-cost suppliers—is substandard quality. Many generic or unbranded starters use inferior materials and lack rigorous quality control.

- Inconsistent Bimetal Switch Performance: Low-quality starters often feature poorly calibrated bimetal switches that fail to open and close reliably. This leads to flickering lamps, failure to start, or shortened lamp life.

- Low-Grade Encapsulation: The plastic housing may be brittle or non-flame-retardant, increasing the risk of cracking, overheating, or even fire in high-temperature environments.

- Short Lifespan: Cheap starters may fail after only a few hundred start cycles, necessitating frequent replacements and increasing long-term costs despite lower initial prices.

Lack of Safety Certifications and Non-Compliance

Reputable fluorescent starters carry safety certifications such as UL (USA), CE (Europe), or CCC (China). However, many low-cost suppliers sell uncertified or counterfeit products.

- False Certification Claims: Some suppliers falsely claim compliance with safety standards. Always verify certifications through official databases.

- Non-Compliance with Local Regulations: Using non-certified starters can violate electrical codes, void insurance coverage, and expose organizations to liability in the event of equipment failure or fires.

Intellectual Property (IP) Infringement Risks

Fluorescent starter designs, especially from established brands like Philips, Osram, or Sylvania, are often protected by patents, trademarks, and design rights.

- Counterfeit Products: Some suppliers offer replicas that mimic branded packaging and logos. These infringe on trademarks and may mislead buyers into believing they are purchasing authentic products.

- Patent Infringement: Copying patented internal mechanisms (e.g., specific bimetal switch configurations or gas discharge designs) without authorization can expose buyers and distributors to legal action, especially in markets with strong IP enforcement.

- Supply Chain Liability: Distributors and integrators who unknowingly sell or install IP-infringing products may face legal consequences, including fines, product recalls, or reputational damage.

Inadequate IP Protection in Supplier Contracts

When sourcing from manufacturers—particularly in regions with weaker IP enforcement—buyers often fail to secure proper contractual protections.

- No IP Warranty: Supplier agreements may lack clauses guaranteeing that products do not infringe third-party IP rights.

- Limited Recourse: Without clear indemnification terms, buyers may bear the cost of legal disputes or product seizures.

Inconsistent Performance Across Batches

Due to lax quality control, performance can vary significantly between production batches, even from the same supplier.

- Intermittent Failures: Some starters in a batch may work initially but degrade quickly, leading to unpredictable maintenance needs.

- Compatibility Issues: Poorly manufactured starters may not be compatible with certain ballast types or lamp configurations, causing operational failures.

Recommendations to Avoid Pitfalls

- Source from Reputable Suppliers: Prioritize suppliers with verifiable track records and official distribution agreements.

- Verify Certifications: Request and validate safety certifications through independent sources.

- Conduct Sample Testing: Test products under real-world conditions before large-scale procurement.

- Review Contracts for IP Clauses: Ensure supplier agreements include IP warranties and indemnification provisions.

- Avoid “Too Good to Be True” Pricing: Extremely low prices are often indicative of compromised quality or IP violations.

By addressing these quality and IP-related pitfalls, organizations can ensure reliable lighting performance, regulatory compliance, and reduced legal risk when sourcing fluorescent lamp starters.

Logistics & Compliance Guide for Fluorescent Lamp Starters

Product Overview and Classification

Fluorescent lamp starters are small electrical components used in conjunction with magnetic ballasts in older fluorescent lighting systems to initiate the arc within the lamp. They are typically categorized as electrical accessories and may fall under specific regulatory frameworks due to their electrical nature and potential environmental impact.

Regulatory Compliance

Electrical Safety Standards

- IEC 60969: This international standard applies to self-ballasted lamps for general lighting services with integral control gear, but components like starters must comply with relevant parts of IEC 61195 and IEC 61184.

- IEC 61184: Specifically covers lamp caps and holders, including requirements for fluorescent lamp starters. Compliance ensures mechanical and electrical safety in operation.

- UL 935 (U.S.): Standard for Electric Discharge Lighting Equipment, including auxiliary devices such as starters. Products sold in North America must meet UL or ETL certification requirements.

- CE Marking (EU): Requires compliance with the Low Voltage Directive (2014/35/EU) and RoHS Directive (2011/65/EU). CE certification is mandatory for market access in the European Economic Area.

Environmental and Chemical Compliance

- RoHS (EU): Restricts the use of hazardous substances such as lead, mercury, cadmium, and hexavalent chromium. While fluorescent starters themselves typically contain minimal or no mercury, they must still comply with RoHS limits for restricted materials.

- REACH (EU): Requires declaration of Substances of Very High Concern (SVHC). Manufacturers must ensure no banned or reportable substances are used above threshold levels.

- WEEE Directive (EU): Fluorescent lamp starters are classified as electrical and electronic equipment (EEE), requiring proper end-of-life handling and recycling. Producers may need to register and contribute to take-back schemes.

Country-Specific Requirements

- UKCA Marking: Post-Brexit, products placed on the UK market may require UKCA marking, with alignment to UK versions of CE directives (e.g., UK RoHS, UK WEEE).

- CCC Mark (China): Required for certain categories of electrical components; verify if fluorescent starters fall under mandatory CCC certification.

- PSE Mark (Japan): Required for electrical appliances under the DENAN Law. Class A (specified electrical appliances) may apply depending on product specifications.

Packaging and Labeling Requirements

Mandatory Markings

- Manufacturer or authorized representative name and address

- Product designation and model number

- Rated voltage and current

- Compliance marks (e.g., CE, UKCA, UL, PSE)

- RoHS compliance symbol (e.g., “RoHS compliant” or “Lead-free”)

- WEEE symbol (crossed-out wheeled bin) if applicable

Packaging

- Use anti-static packaging if components are sensitive to electrostatic discharge (ESD).

- Include bilingual labeling where required (e.g., English and local language in EU countries).

- Provide user instructions or safety warnings, particularly regarding installation and disposal.

Transportation and Logistics

Domestic and International Shipping

- UN Number and Hazard Classification: Fluorescent lamp starters are generally not classified as hazardous for transport if they contain no hazardous materials (e.g., mercury-free). However, verify composition with the manufacturer.

- IATA/IMDG/ADR Compliance: If no hazardous substances are present, standard non-hazardous shipment rules apply. Always confirm with Safety Data Sheet (SDS).

- Packaging Standards: Use durable packaging to prevent crushing or damage during transit. Consider moisture-resistant materials for sea freight.

Storage Conditions

- Store in a dry, temperature-controlled environment (typically 5°C to 40°C).

- Avoid direct sunlight and high humidity to prevent corrosion or insulation degradation.

- Keep away from flammable materials and strong electromagnetic fields.

Import and Customs Considerations

HS Code Classification

- Common HS Code: 8536.69 – “Other apparatus for protecting electrical circuits” or 8537.10 – “Boards, panels, etc., for electrical control”.

- Confirm with local customs authority; some countries may classify under 9405.40 (parts of lighting fittings).

Required Documentation

- Commercial invoice

- Packing list

- Certificate of Conformity (e.g., CE, UL)

- Bill of Lading or Air Waybill

- Import licenses (if required by destination country)

- SDS (Safety Data Sheet) – recommended even if non-hazardous

Duties and Tariffs

- Duty rates vary by country. Check local tariff databases (e.g., US Harmonized Tariff Schedule, EU TARIC).

- Preferential treatment may apply under trade agreements (e.g., USMCA, EU-South Korea FTA) if rules of origin are met.

End-of-Life and Sustainability

- Recycling: Coordinate with certified e-waste recyclers. Do not dispose of in general waste.

- Producer Responsibility: In the EU and other regions, suppliers may be obligated to finance recycling through producer compliance schemes (e.g., EAR in Germany, Eco-systèmes in France).

- Sustainability Trends: Consider offering take-back programs or transitioning to electronic starters with longer life and RoHS-compliant materials.

Summary Checklist for Compliance and Logistics

| Requirement | Action Item |

|———————————-|————-|

| Electrical Safety Certification | Obtain CE, UL, or local equivalent |

| RoHS/REACH Compliance | Confirm material declarations |

| WEEE Registration (if applicable)| Register in EU/UK and report volumes |

| Proper Labeling & Packaging | Apply required marks and use ESD-safe packaging |

| Accurate HS Code | Verify with customs broker |

| SDS Availability | Prepare and provide upon request |

| Non-Hazardous Transport | Classify correctly; avoid misdeclaration |

| Import Documentation | Prepare complete customs package |

Adhering to this guide ensures legal market access, safe handling, and responsible lifecycle management of fluorescent lamp starters. Always consult local regulators or compliance experts for jurisdiction-specific updates.

In conclusion, sourcing fluorescent lamp starters requires careful consideration of factors such as compatibility with existing lighting systems, quality standards, supplier reliability, and cost-effectiveness. Due to the gradual global shift towards energy-efficient LED lighting, the availability of fluorescent starters may decline over time, making it essential to identify dependable suppliers and possibly consider stocking spares for maintenance purposes. Additionally, evaluating environmental regulations and end-of-life disposal options is important for sustainable sourcing. Where feasible, organizations should also explore transitioning to modern lighting technologies to reduce long-term dependency on obsolete components. A strategic sourcing approach will ensure continuity in operations while preparing for future upgrades in lighting infrastructure.